October 2019 Housing Market Update

Geoff Green, president of Green Team Realty, welcomed everyone to the October 2019 Housing Market Update. The webinar was held October 14 at 2 p.m. on Facebook Live.

National Housing Market Statistics

RECESSION RECESSION RECESSION

Everyone’s talking about it. Geoff thinks probably the impending 2020 US elections have a lot to do with that as well. The simple fact is that more and more people are starting to think that it will happen. .Because of that, we need to address it. No matter how much less impact we feel this recession would have on the housing market than the last one was, it’s still going to have an impact.

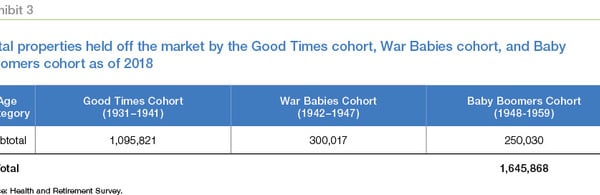

The above charts show a survey of different analysts and influencers in the economic world. Most think the recession will come in 2020. Again, it will be interesting to see the affect that the elections will have. Needless to say, the vast majority believe the recession will start within the next two years, 2020-2021.

Recessions don’t necessarily mean a bad housing market

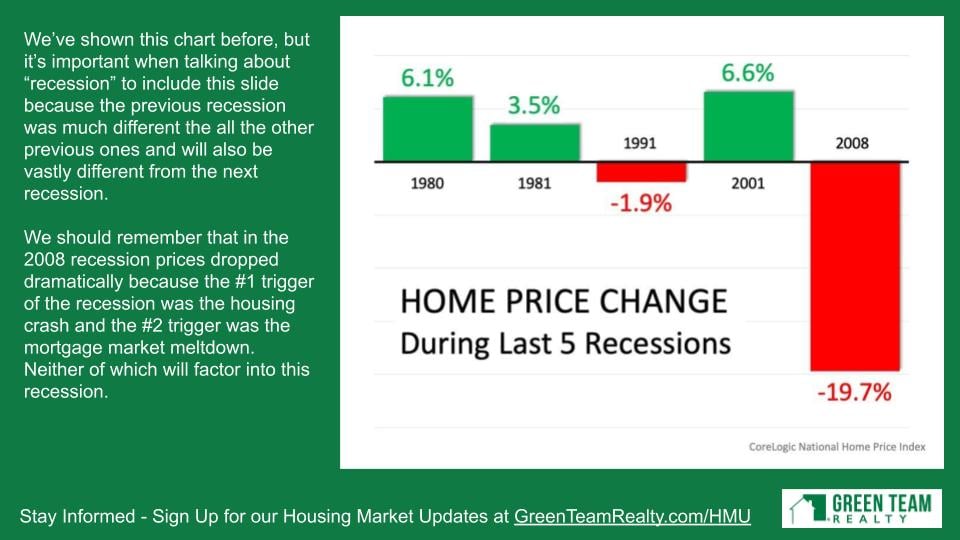

A recession does not mean that there has to be a sharp decline in price. Or an overall reduction in home valuations. The last series of recessions dating back to 1980 and only two of them had negative price appreciation. That’s important to note. Geoff believes that the bottom will not drop out like it did in 2008. That was a very scary time for the real estate industry. There are now a lot of economic fundamentals in place that should lead to a better downturn, if one were to come.

Projected Home Price % Appreciation holding steady

Again, stake holders, influencers in the world of economics are predicting that not only will pricing on a national basis not go down, but it will continue to appreciate. Not at the pace seen in the last few years, but these numbers are probably healthier. The rapid market we were seeing wasn’t going to last forever and could not be sustained. There is nothing wrong with appreciation slowing and growing at a slower pace.

Regional projections

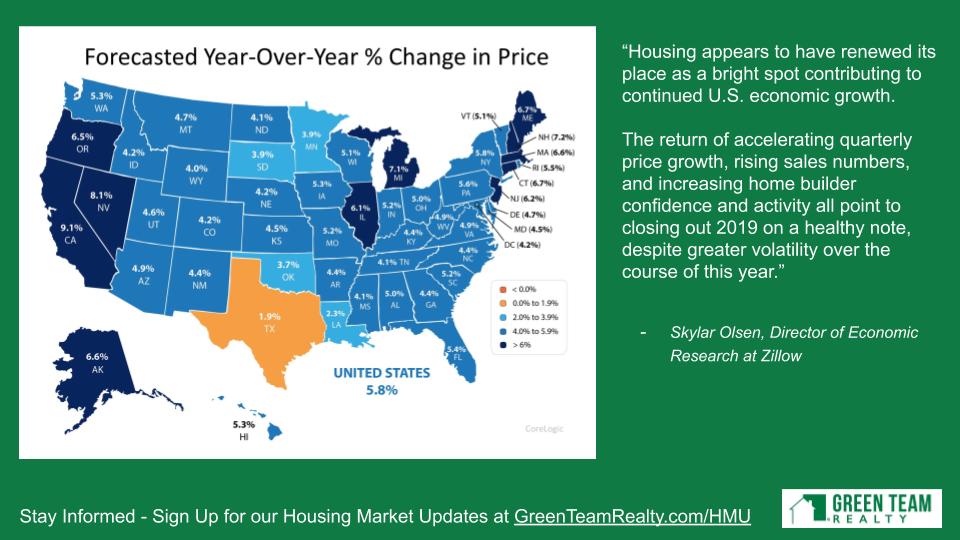

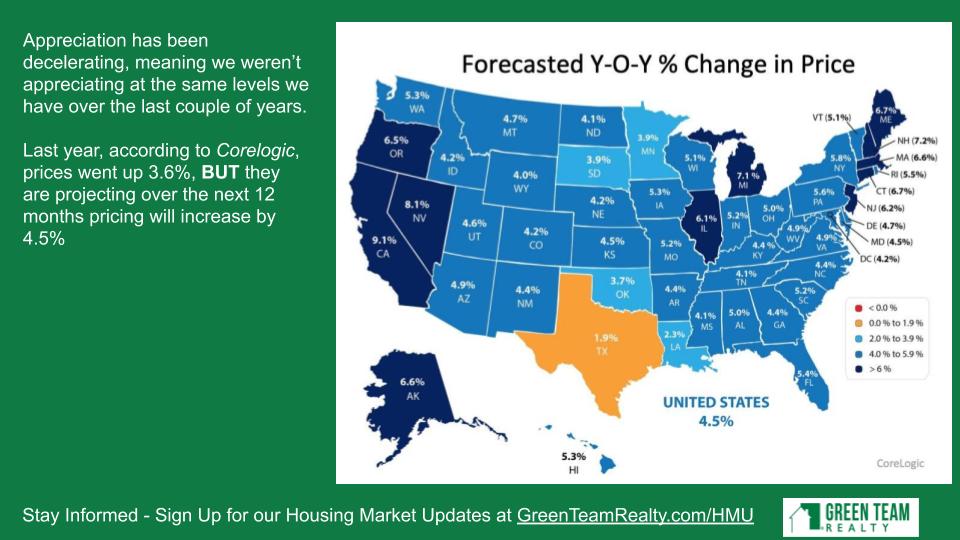

Corelogic shares its forecast for Year-over-Year percentage of change in price, according to markets throughout the U.S. From this it appears the northeast is looking good.

Local Housing Market Statistics

Orange County, New York

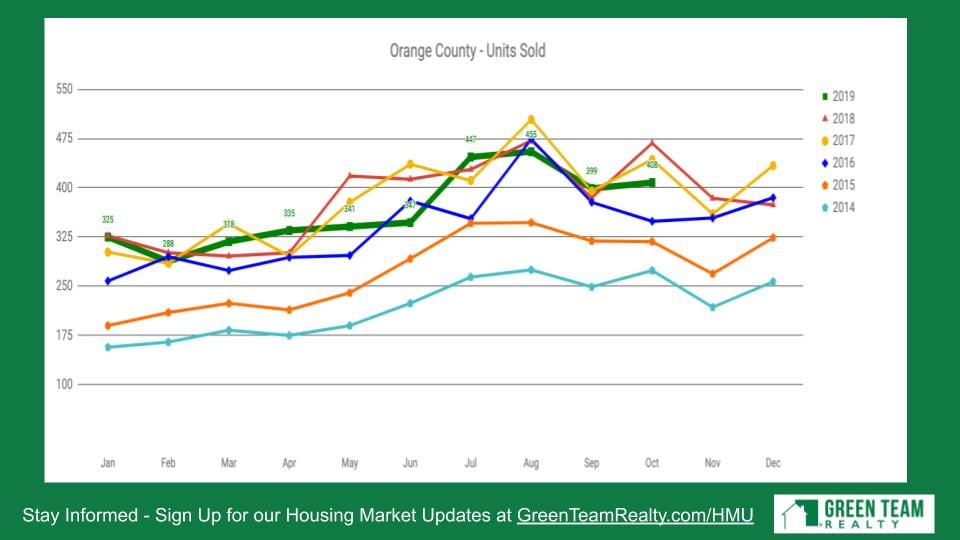

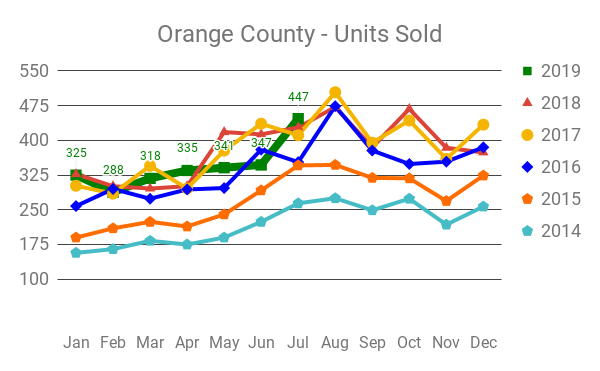

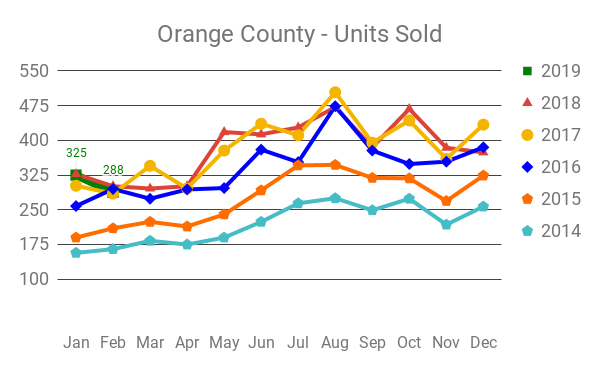

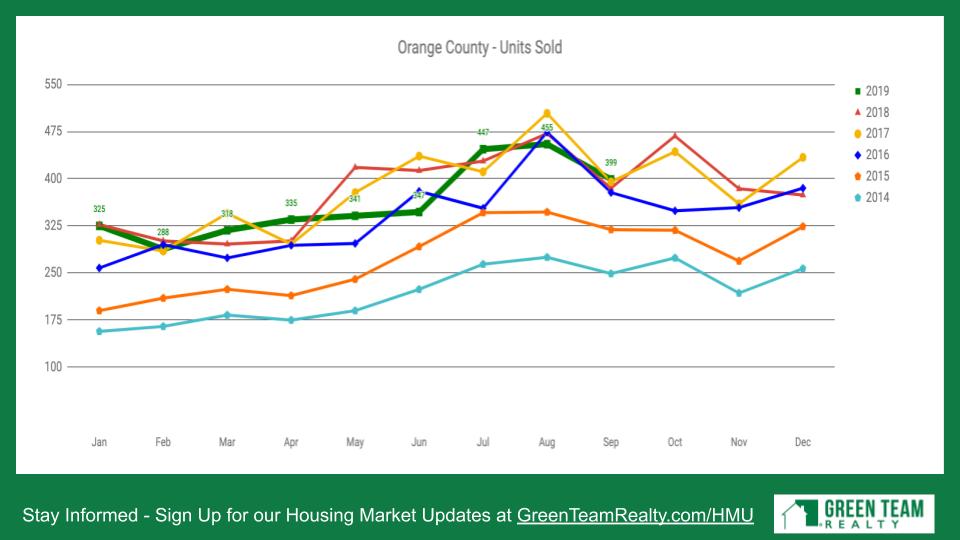

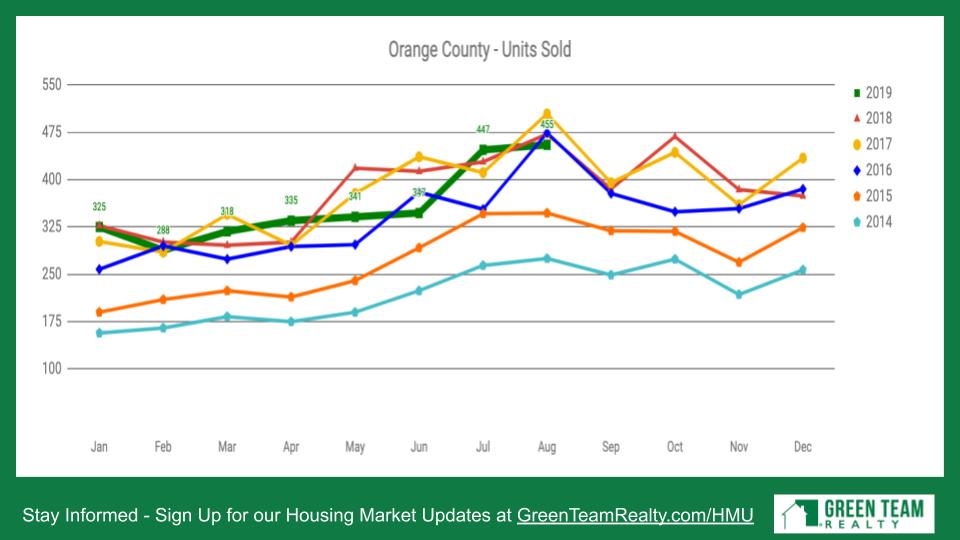

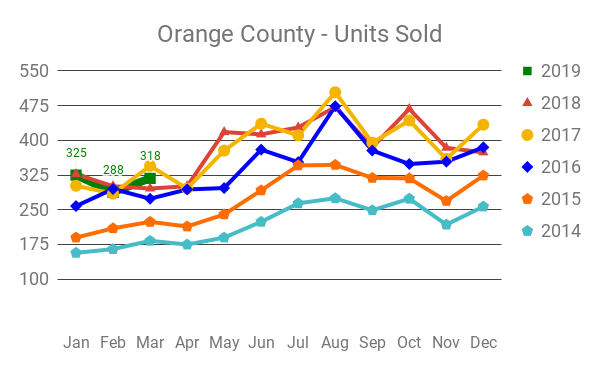

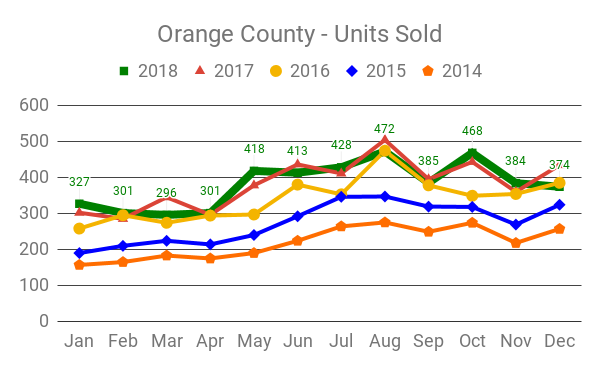

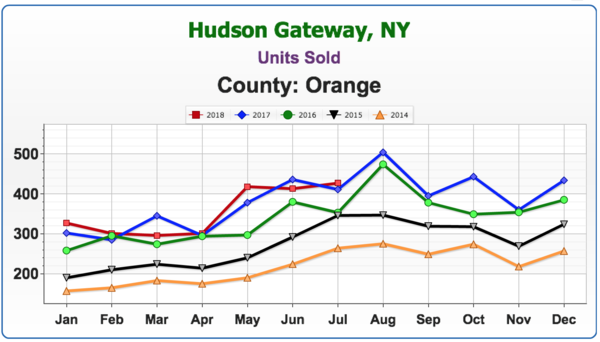

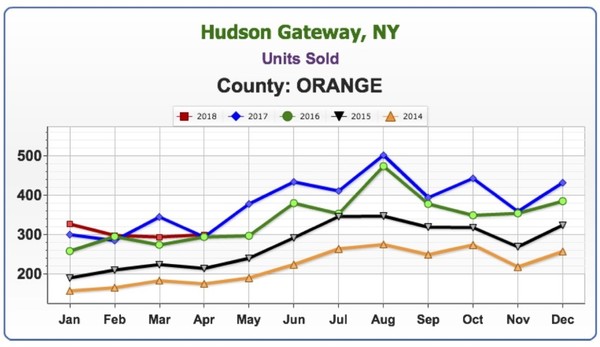

Geoff had expected the green line for units sold to be lower for the third quarter. However, it really held out very well. If you look at July, it was above all previous six years. August was a touch below. And September was even. So it was a good third quarter.

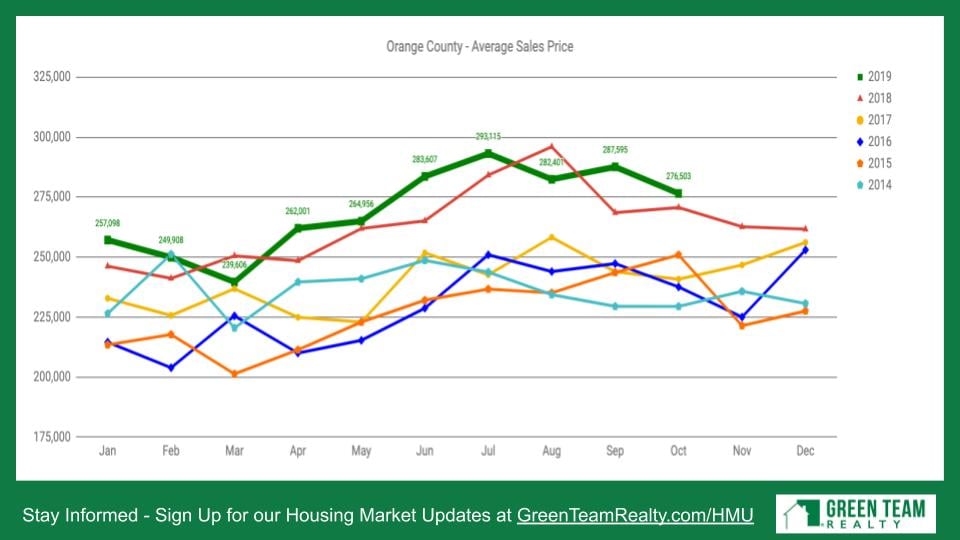

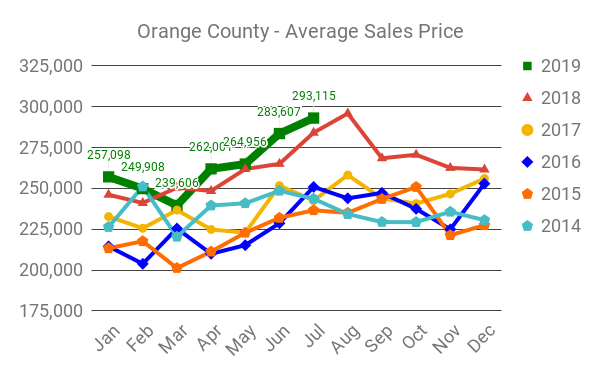

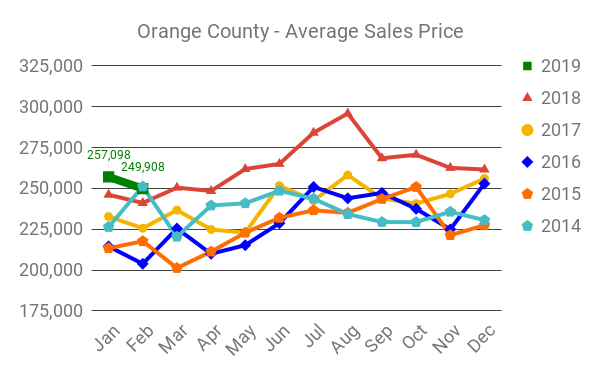

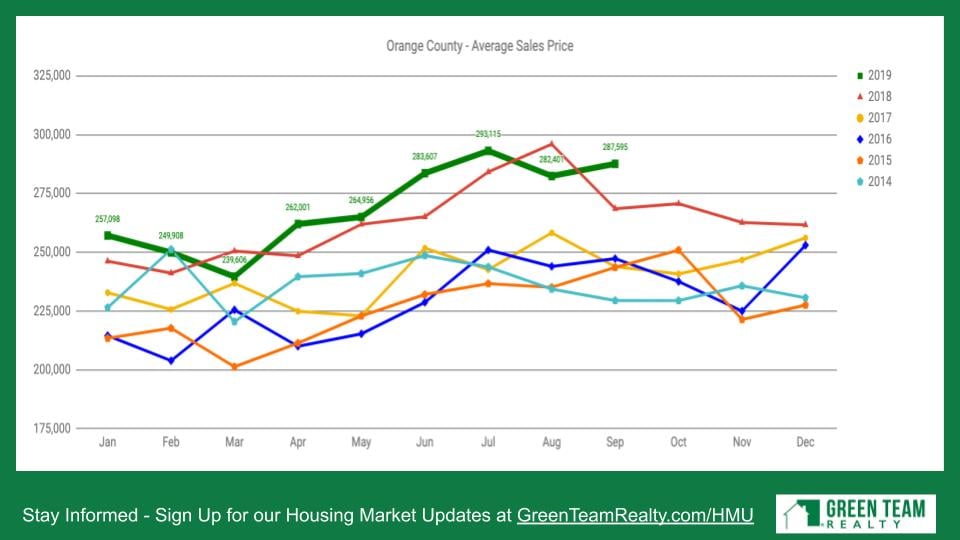

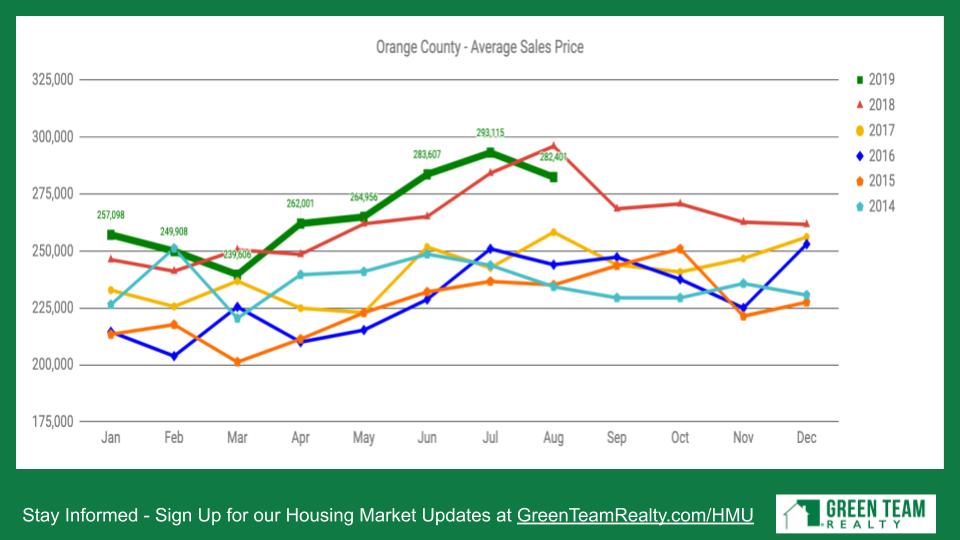

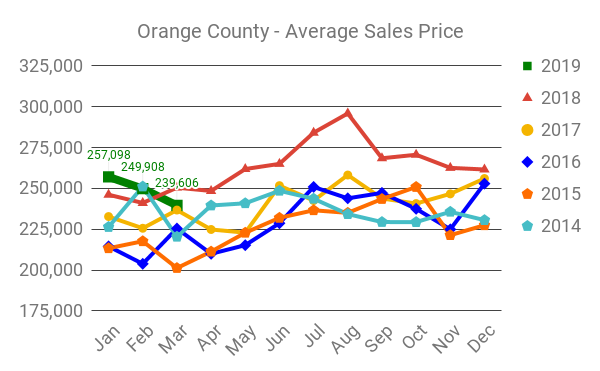

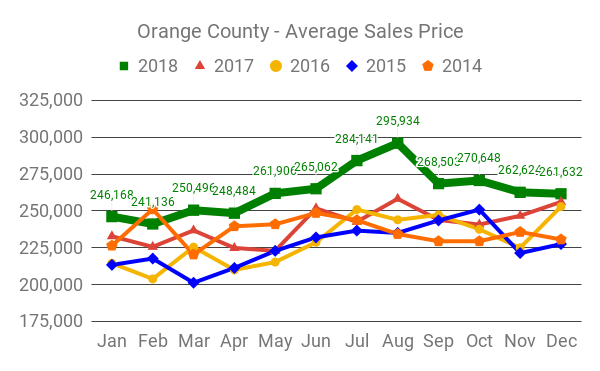

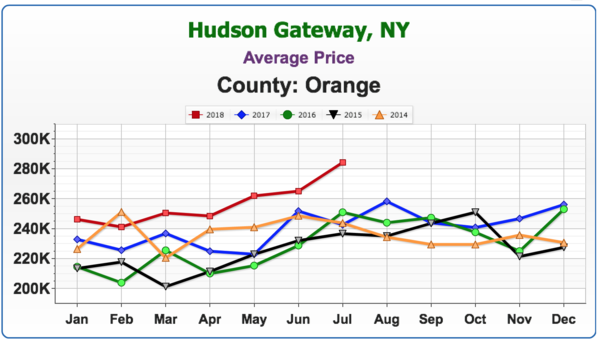

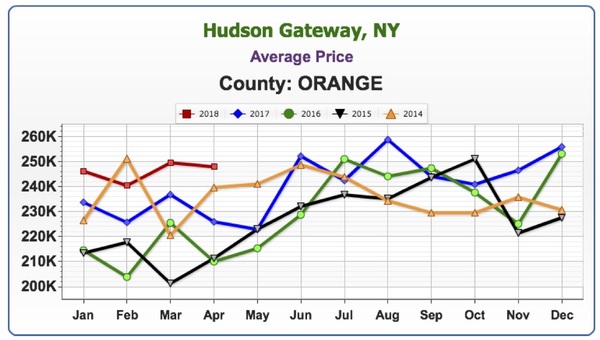

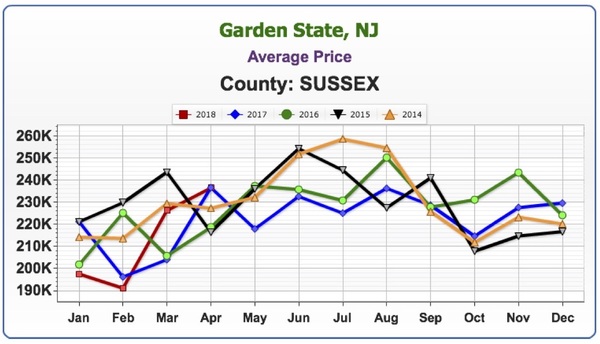

Average Sales Price is doing well. It’s well above where it’s been the last 5 or 6 years.

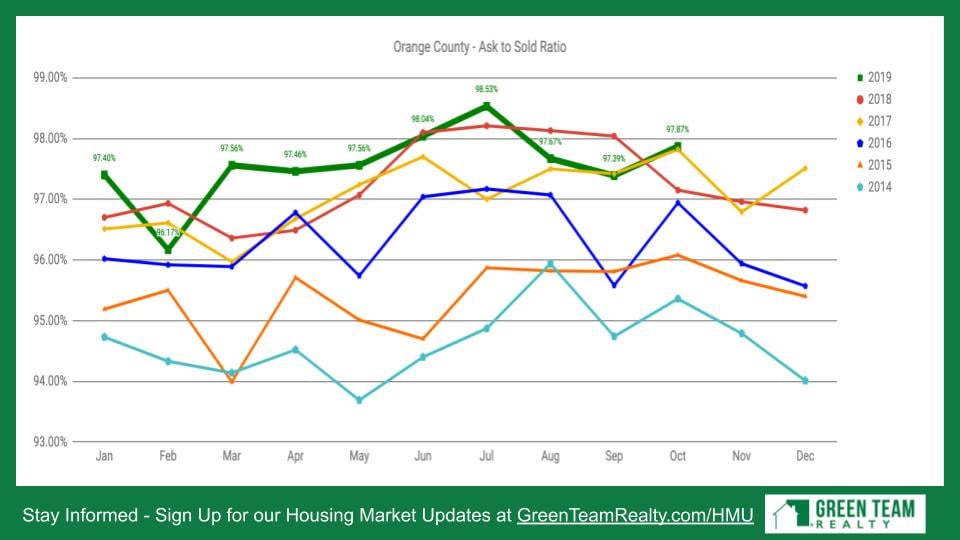

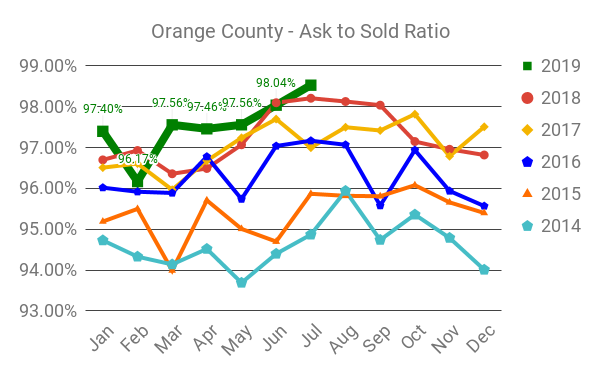

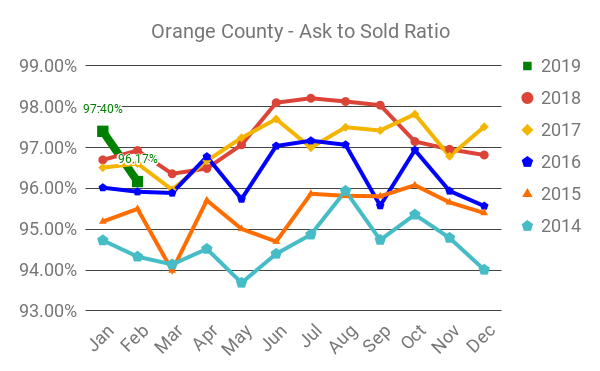

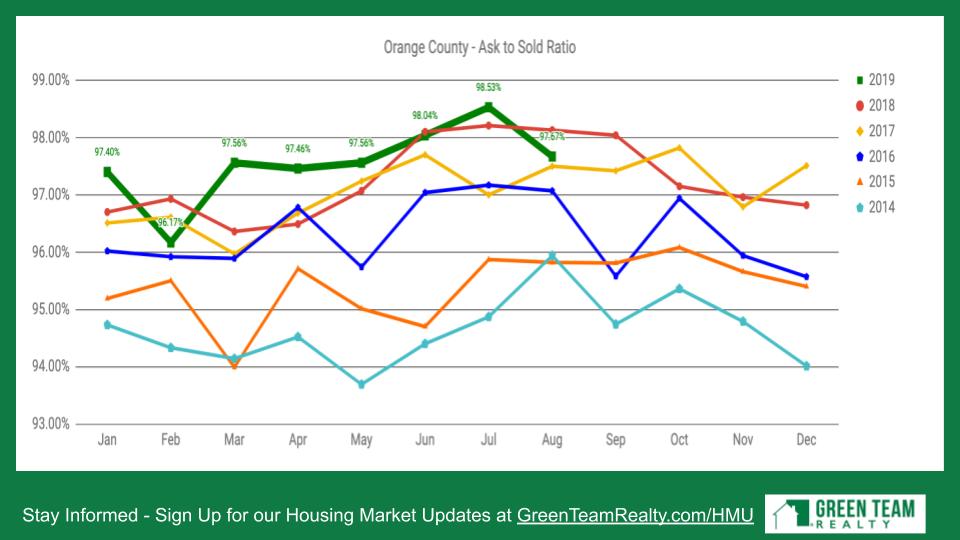

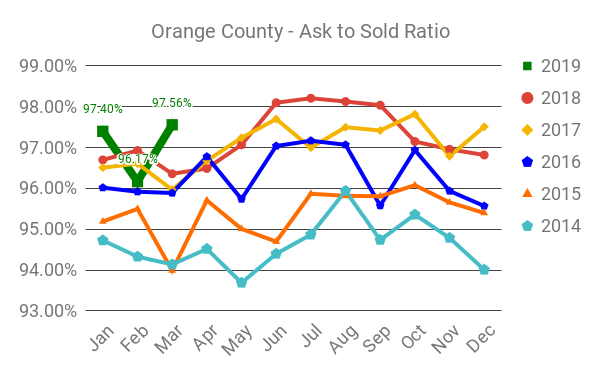

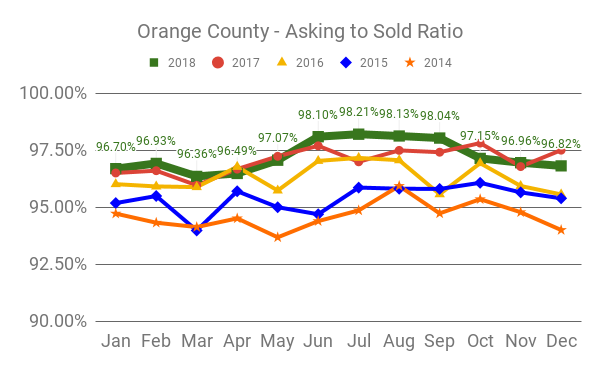

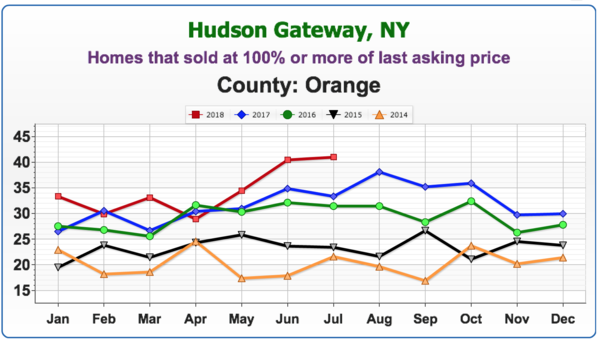

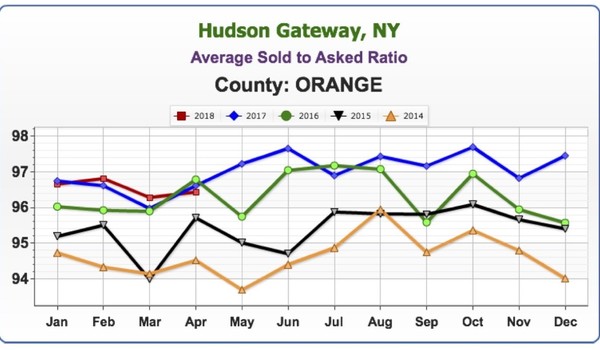

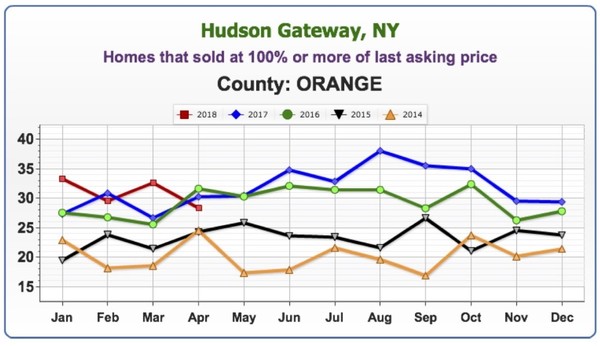

This is the last asking price versus the sales price. The market is becoming a little more competitive. Sellers are having to negotiate a little more off their selling price. Again, as the market is cooling it’s bound to happen. However, we are not seeing a precipitous decline here.

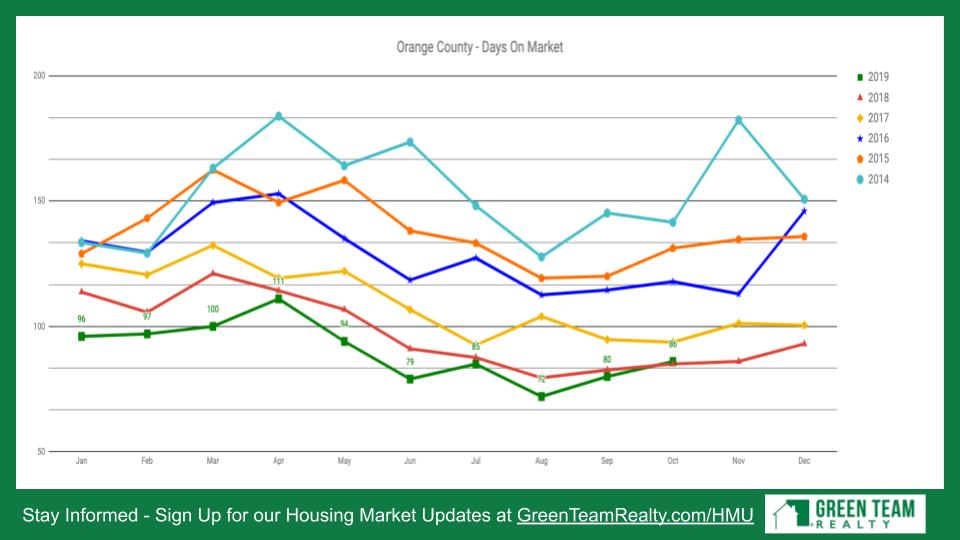

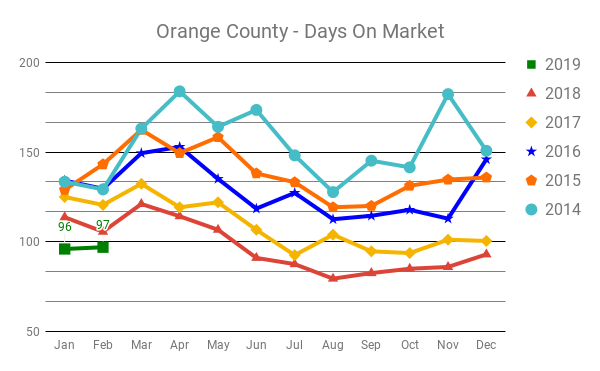

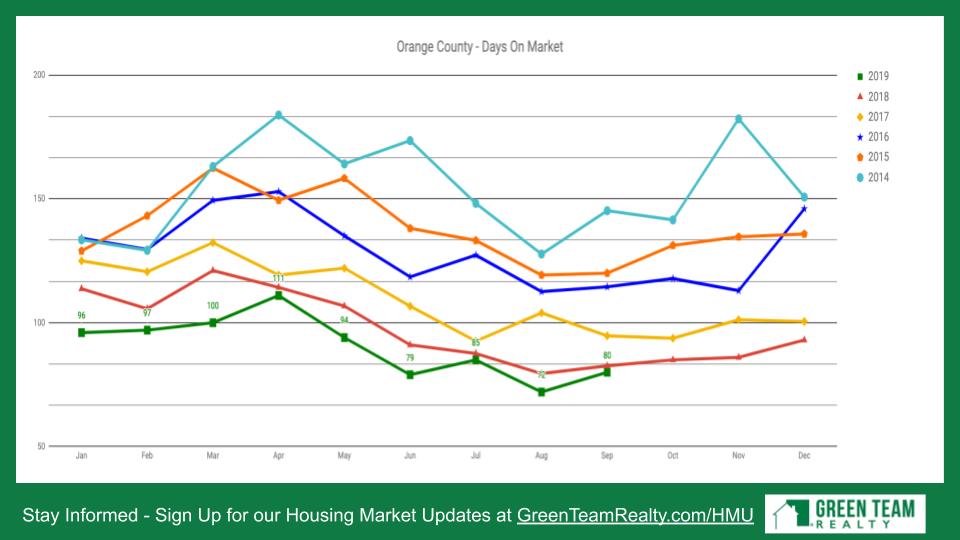

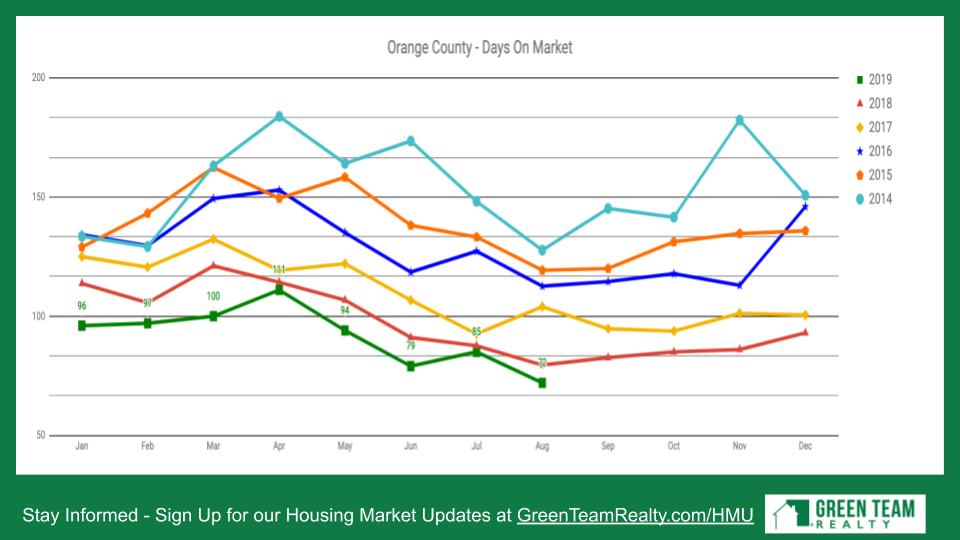

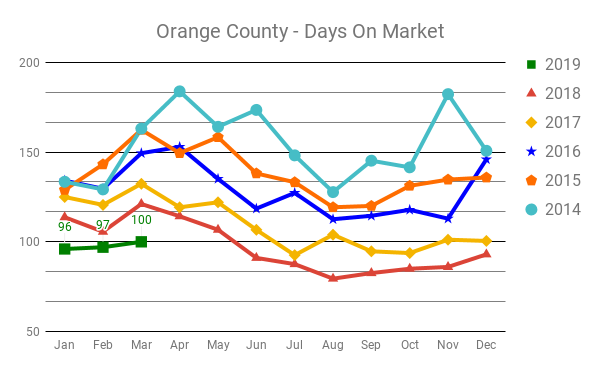

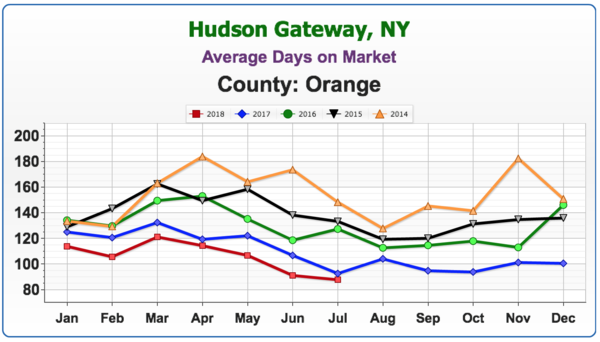

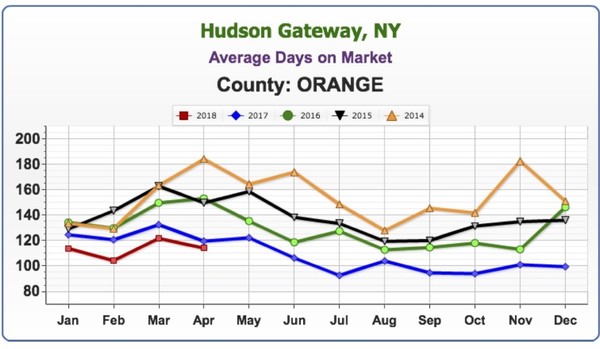

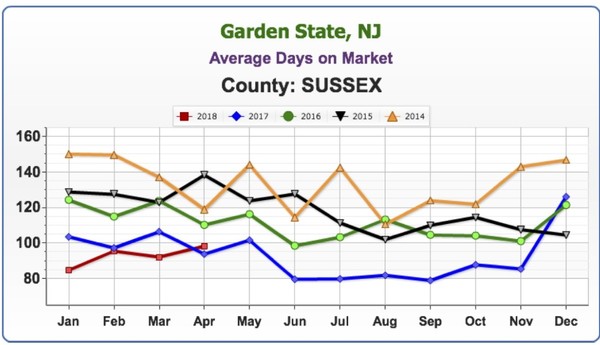

Days on market is still extremely low. Not one month dipped above any of the previous years.

Sussex County, New Jersey

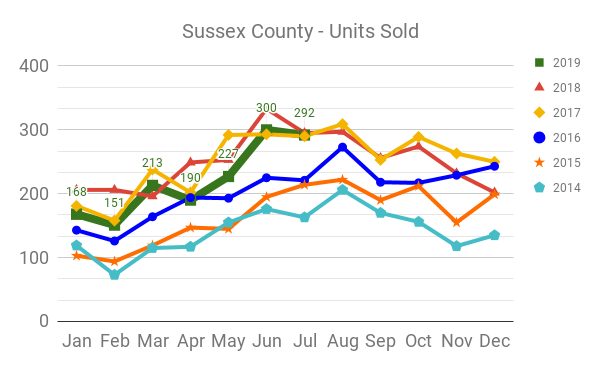

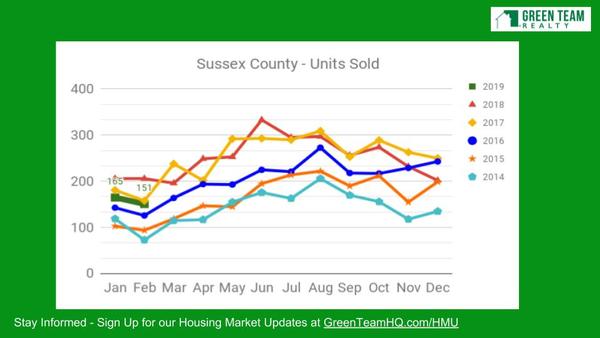

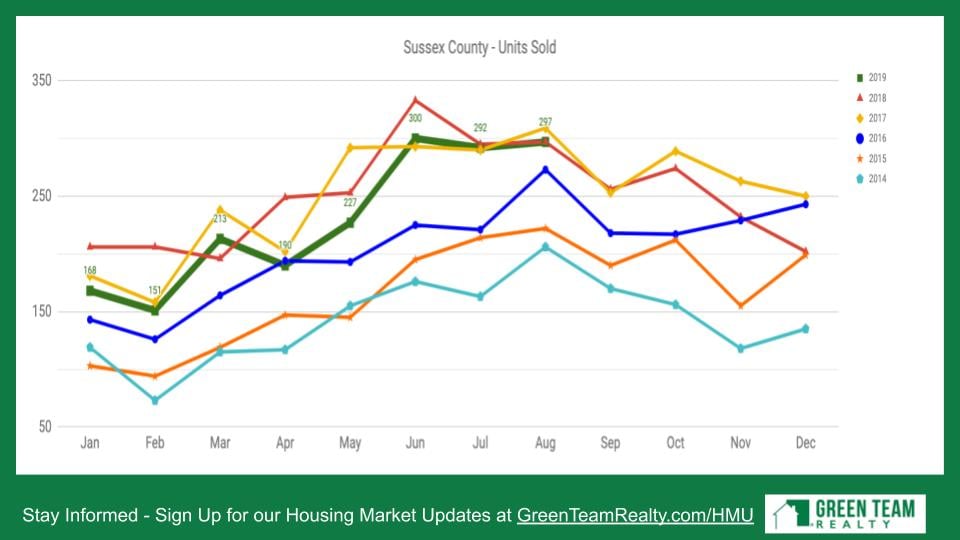

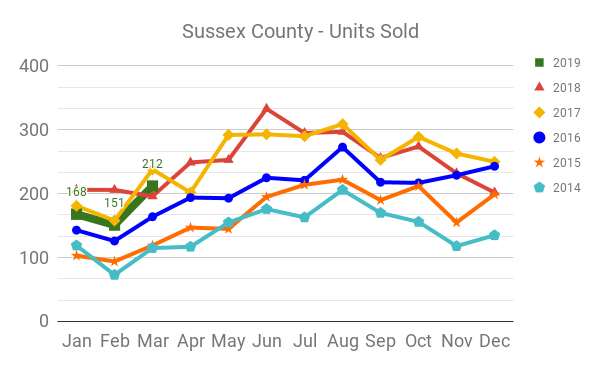

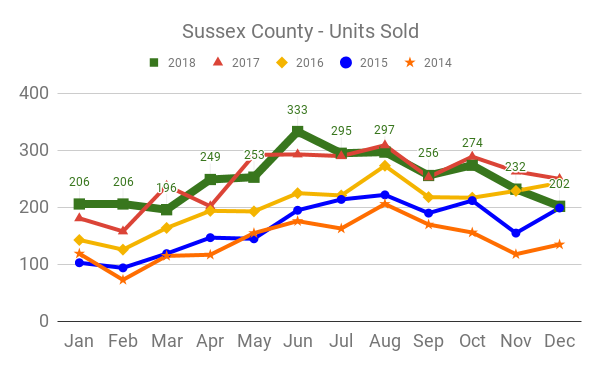

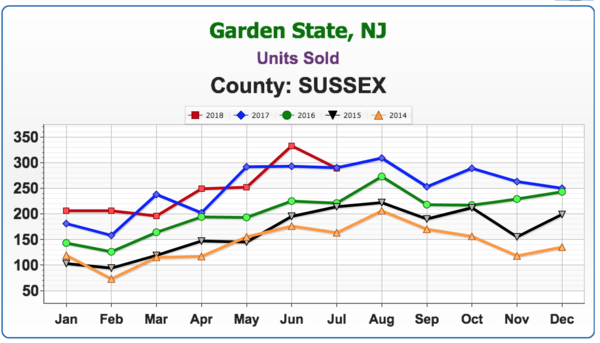

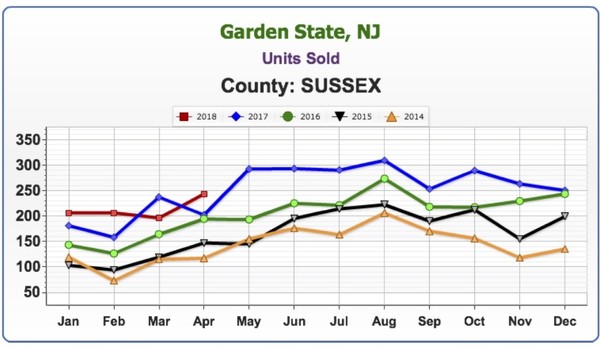

Although the year started out slower in Sussex County, it caught up in the third quarter. The third quarter was strong, which is important.

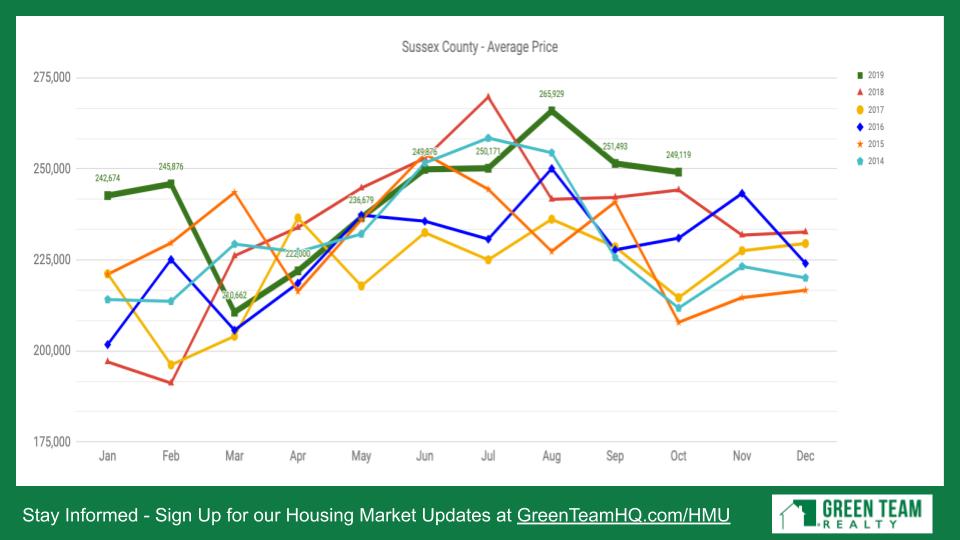

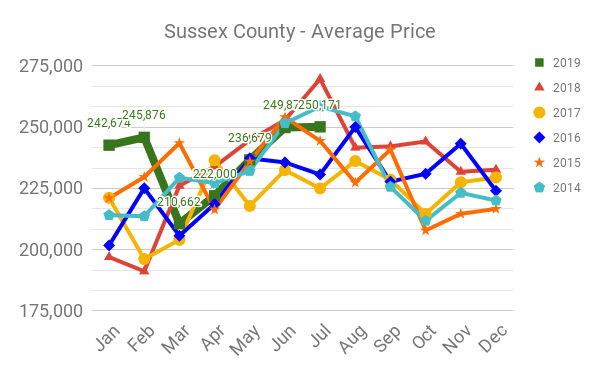

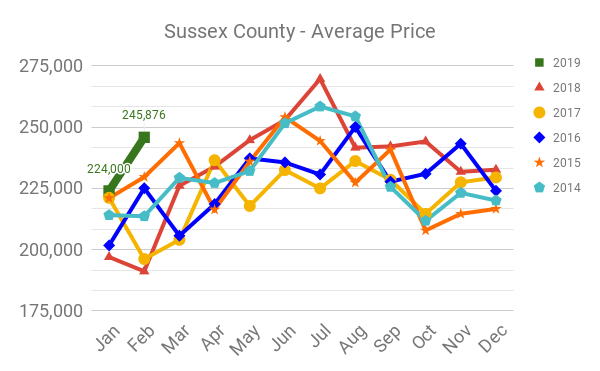

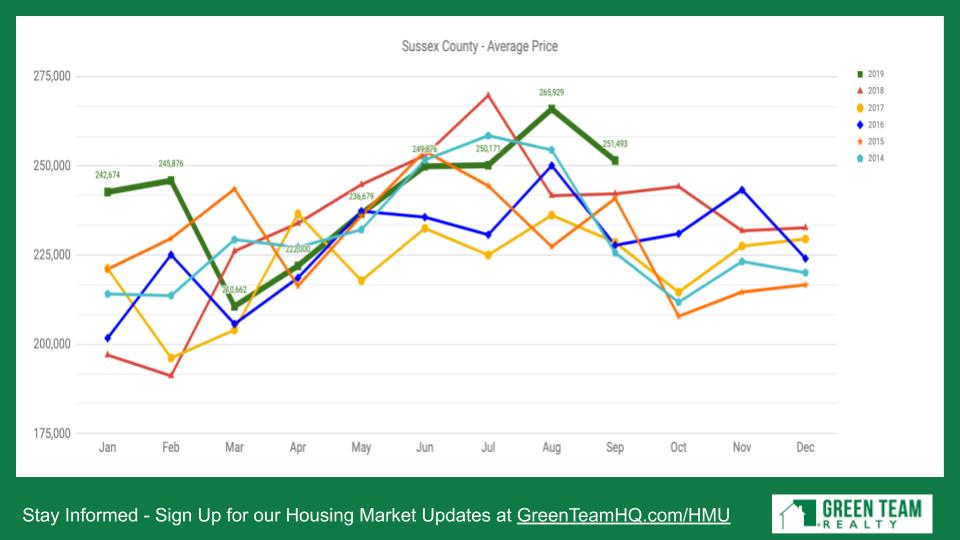

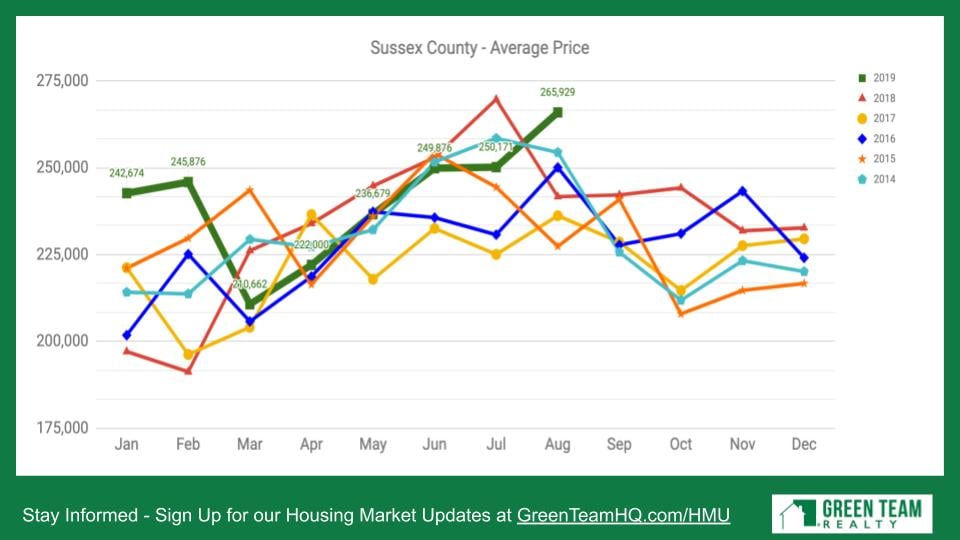

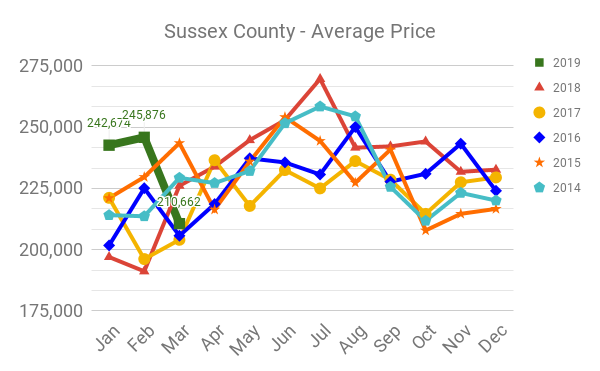

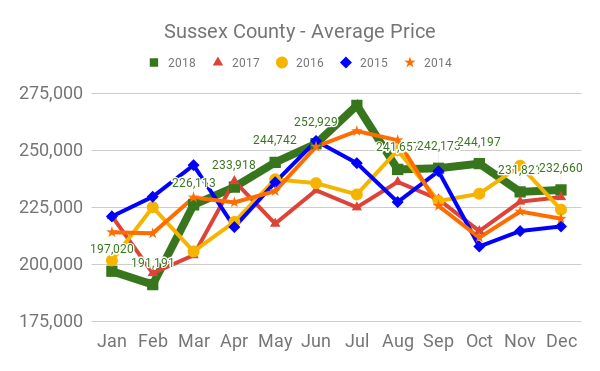

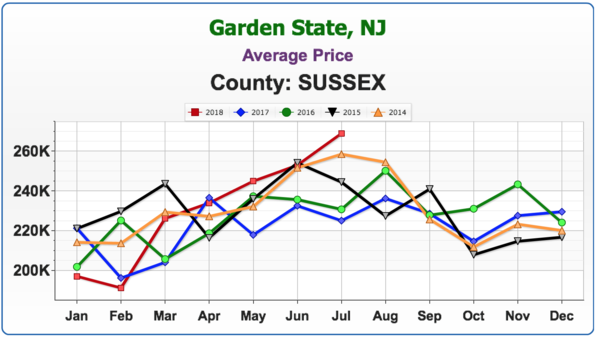

Average price is holding pretty strong.

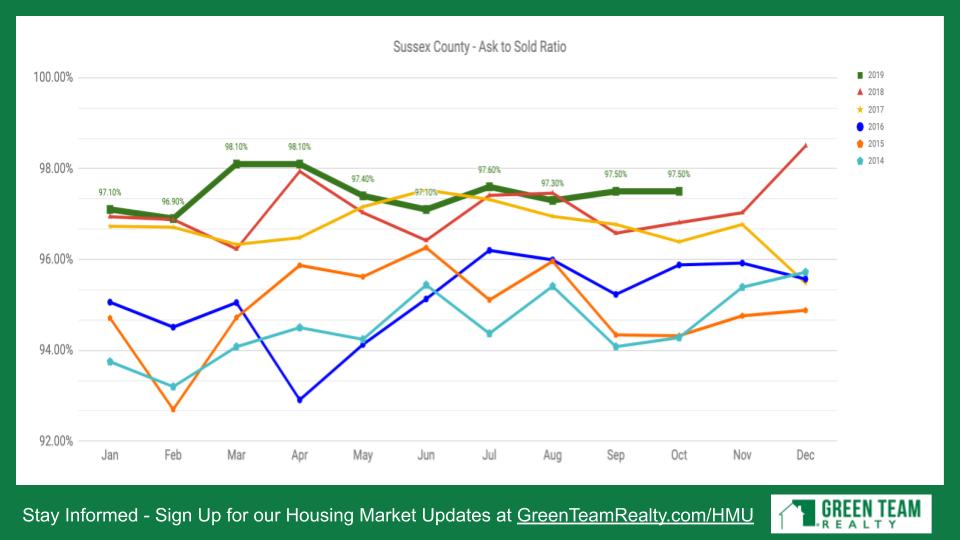

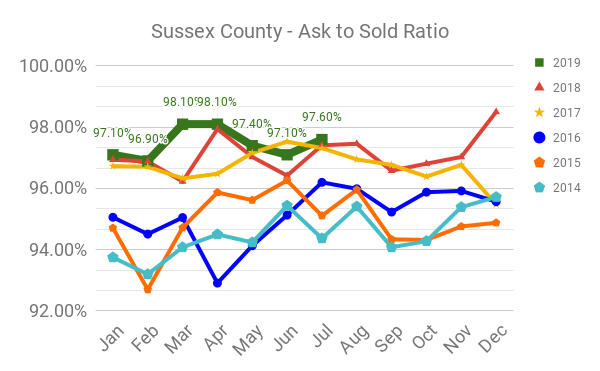

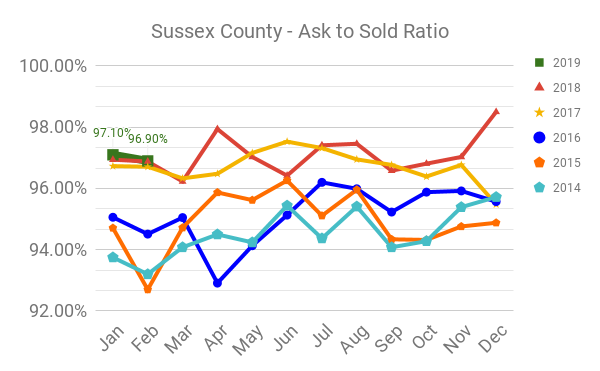

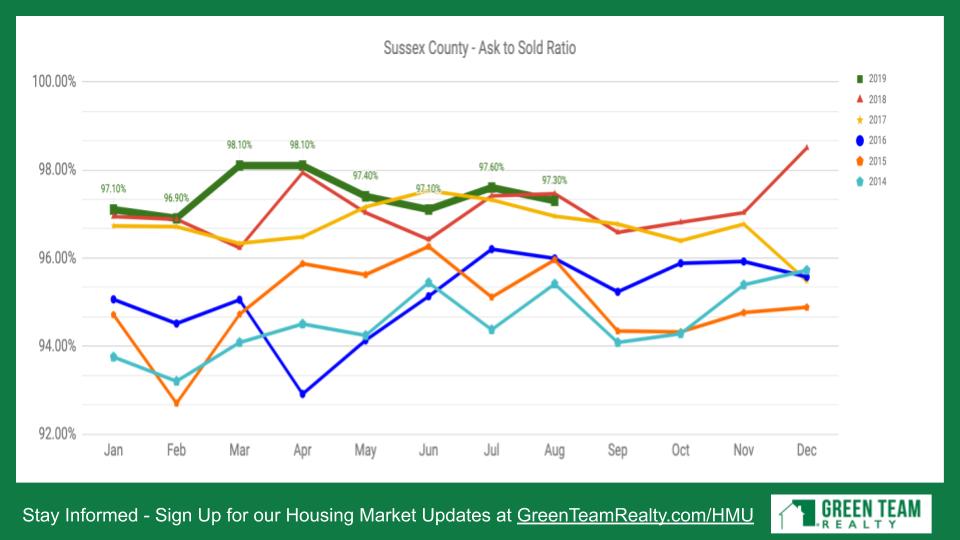

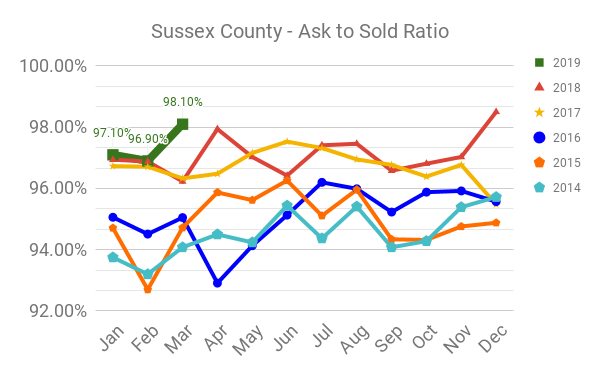

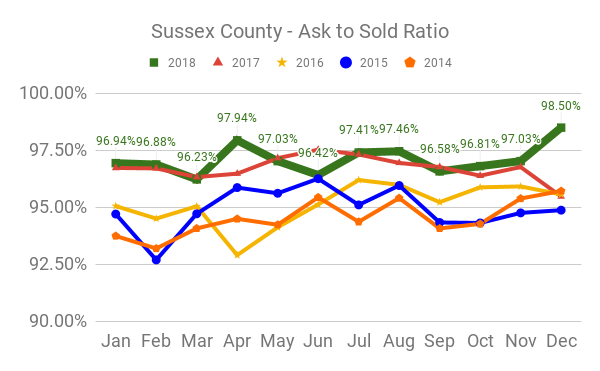

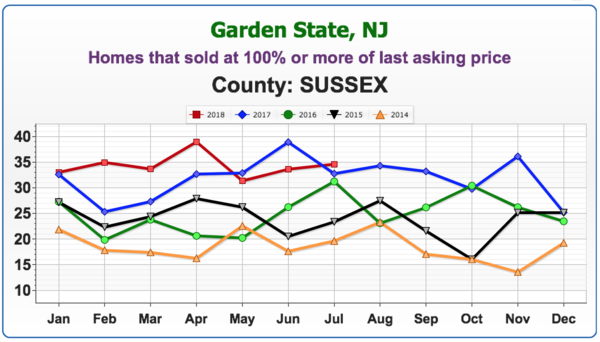

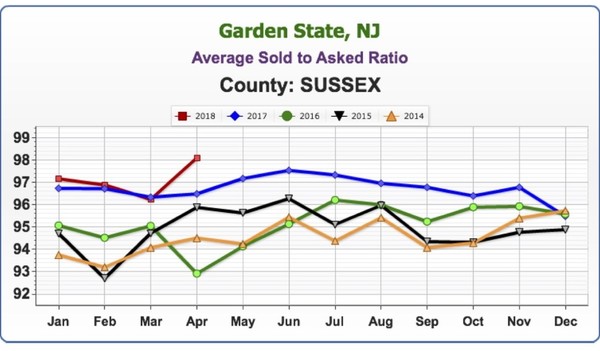

Despite a few dips, Ask to Sold Ratio is remaining at a very high level.

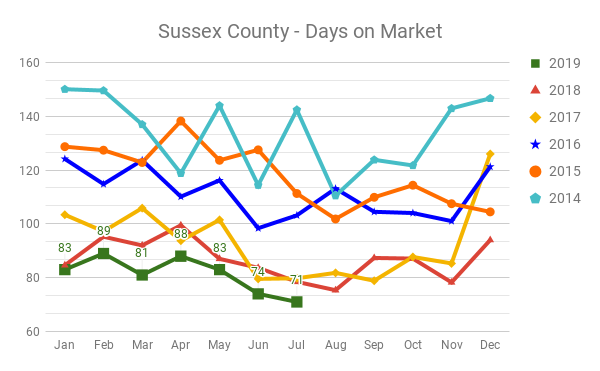

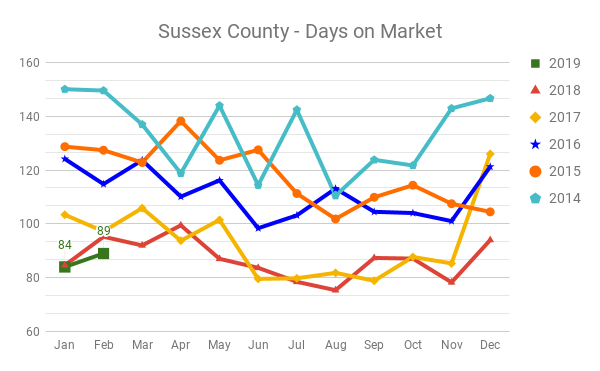

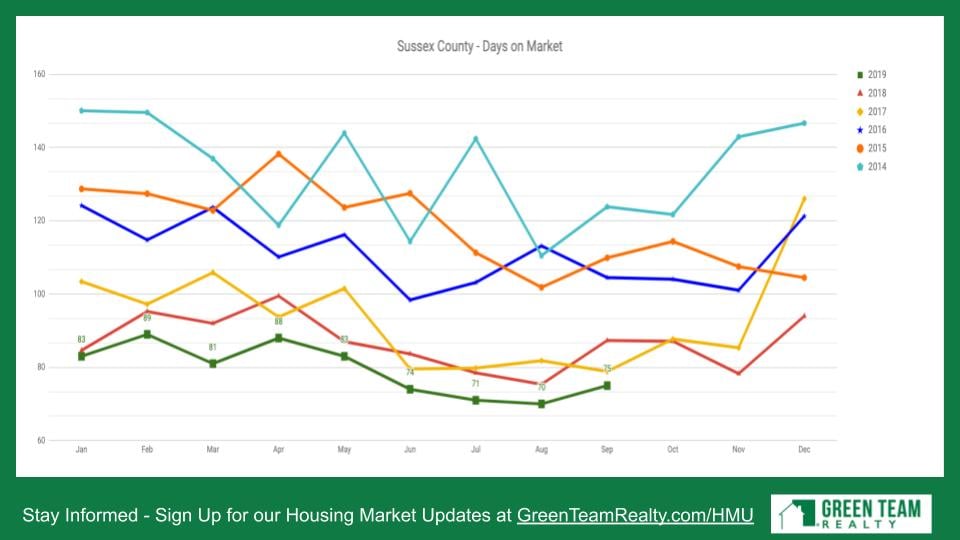

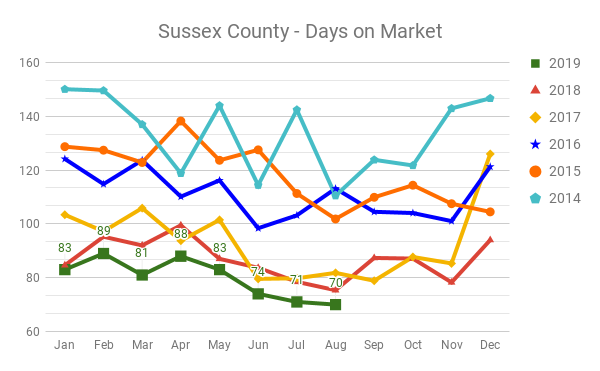

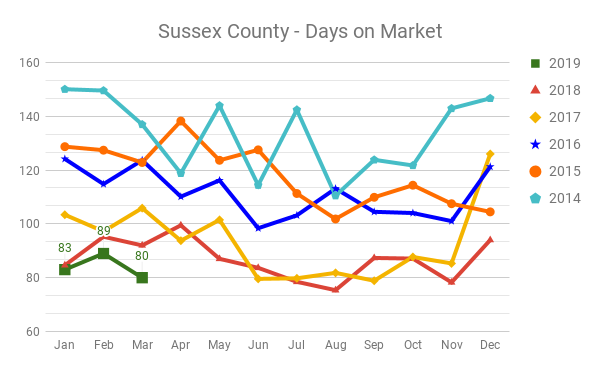

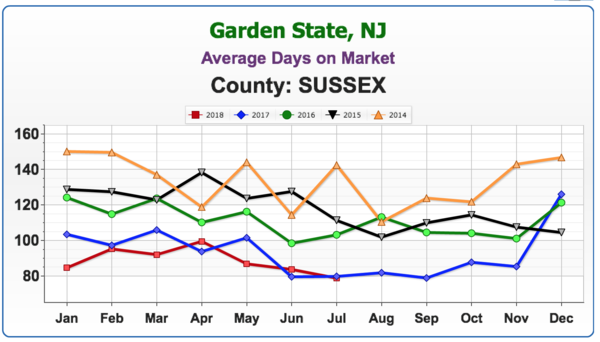

Days on market, not one month has risen above previous years, showing that the market is still strong.

Life events determine buying a home, not market data

Buying a home is based on our life events and where our lives are going. This is good advice. As realtors we want you to find a good home in the place you want to be. If the above three items are all in check, it doesn’t really matter what market you’re in. You’ll make a good decision and you’ll buy a good home.

Housekeeping items

Sign up for Housing Market Updates at GreenTeamRealty.com/HMU. And thank you to our sponsor, REALLY. Join the Real Estate Referral Community for free at REALLYHQ.com.

Meet our Panel

From Left to Right: Toni Kreusch of Green Team New York Realty and Keren Gonen of Green Team New Jersey Realty

The Fear Factor

Geoff started the discussion, asking about the fear factor. Should people be afraid? Should they hesitate? Keren replied that in her experience, people are always afraid of the unknown. That’s one of the reasons people are holding back, whether selling or buying. However, what she did with one of her clients who was buying in Highland Lakes, was advise him to review the previous month’s housing market update. After taking all the information in, that client put an offer on a property and wound up getting the house he wanted. Before learning more about the market, he had been apprehensive about even buying at that time.

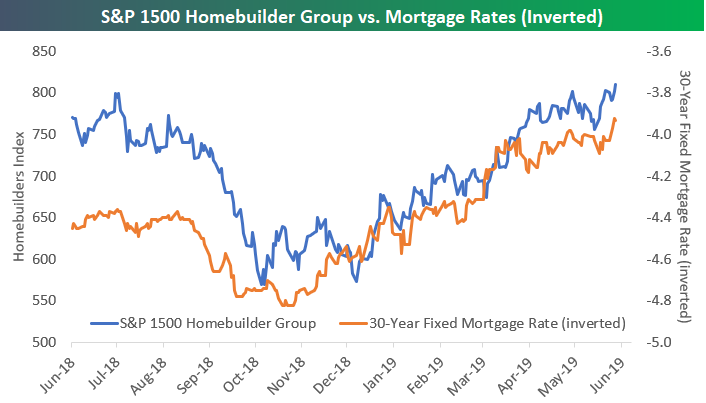

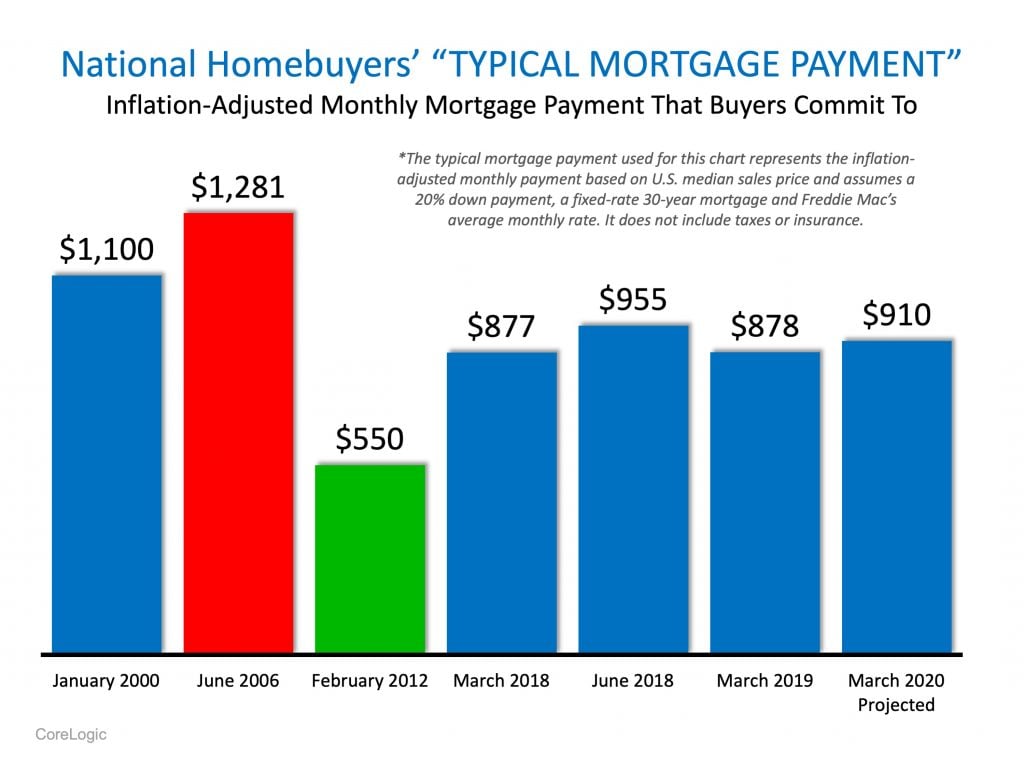

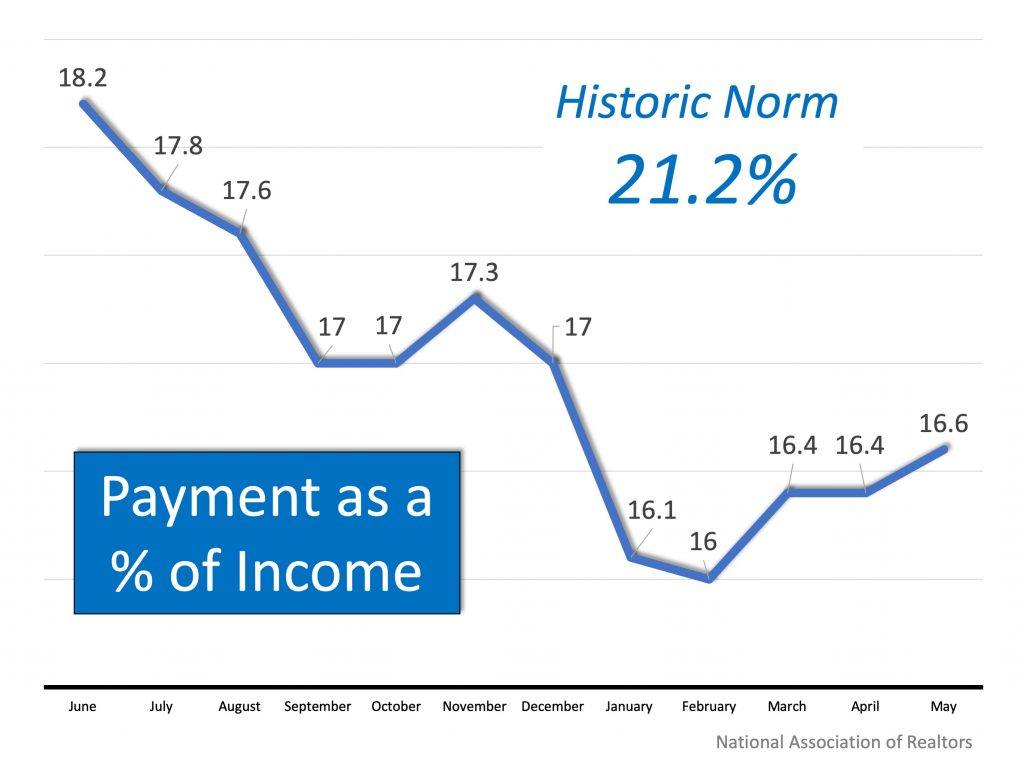

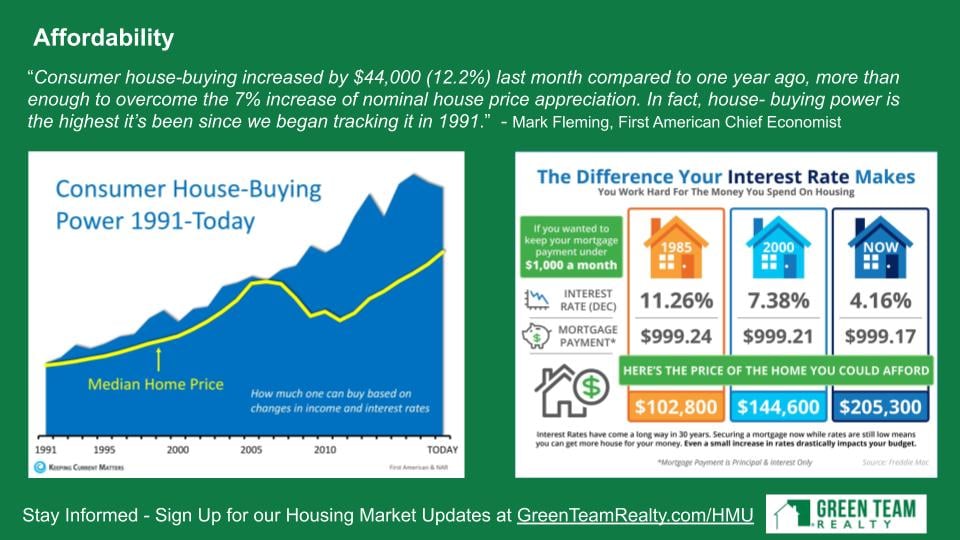

Also, Keren reiterated that interest rates are really low and should be capitalized on. Whether refinancing, buying, downsizing, this is the time to do it. Geoff agreed that rates have been so low it’s remarkable. Especially now, at the end of the day, Geoff’s advice is that it’s all about monthly cash flow. What is it going to cost me each month to live there? And do I have enough income minus my living expenses to be able to pay my mortgage, save for retirement, etc. So, financing really matters.

Toni agrees that people can purchase more house for their money and often pay the same or less if you are currently renting. By owning a home you’re building wealth. What better way to save money as you move into your future?

Would a buyer’s market not be the ideal time to sell?

It’s hard being a broker because there are always two sides to a discussion: there are buyers and there are sellers. One would think if we were in a buyer’s market then it would not be the ideal to sell. There would be lots of inventory, you’d be competing against other people, downward pressure on the price of your home, etc., as opposed to a seller’s market. Geoff believes it is the right time to sell. If you’re someone at or near retirement who has been thinking about getting out it is the right time. Even though we’ll be seeing price appreciation for another few years, even if it goes flat or goes down a little, we’re not going to see a roaring uptick at any point of time in the very near future. Pricing is probably as good as it’s going to get. He asked if Keren and Toni agreed.

Keren agreed. And Toni said we’re experiencing a special time right now, with low-interest rates and low inventory. It’s a great time to buy and sell. From a seller’s perspective, Geoff would advise sellers to put their home on the market now.

Is the Holiday Season not the ideal time to sell?

With Thanksgiving, Christmas, and Hanuka coming, these are low transaction months. Many people put aside their buying regimen during the holidays. Less people are identifying homes in November, December, January. However, one phenomenon Geoff has seen was the buyer who needed to buy a home in December. There wasn’t a lot of inventory and they paid too much for a house because they had to buy. A few months later lots of inventory rolled out and prices were lower. As we head into the holiday season, there are still buyers out there who haven’t found what they wanted yet. They don’t care if it’s December. They’ll still want to look and will buy the right house..

More than most any year that he’s seen since being in the business, Geoff recommends if you are a seller thinking about selling, if your home is ready, put it on the market. Don’t wait until Spring. It’s very busy now. Right now is a very good time. Toni said they still have people calling in and coming into the office who appear to be serious buyers, not just lookers. Keren stated that November has always been her biggest month. People looking in the winter are serious. You’ll probably get less traffic, but the showings are going to be more serious. If it’s priced right, there is enough intensity in the market to get transactions.

This is the time to buy – and the time to sell

Geoff predicted that if someone is going to buy a home and is planning on living there at least a 7-10 year period, they’re fine. Even if the market goes down during that time, it’s going to come back up and re-appreciate. The last downturn lasted a really long time. Looking at it on a hyper-local level, it lasted 8 years regarding pricing. It dropped precipitously in 2008 and did not restabilize until 2016. Eight years of price declines is rare in terms of the history of the housing market. He just does not see that happening this time around. While the market may continue to soften for some time, he doesn’t think it will drop that low. And he believes it will come up relatively soft, compared to the rapid rise the last time. This follows the principles of physics. For every action, there is an equal and opposite reaction. The markets tend to do the same thing.

Geoff asked Toni and Keren if they agreed with the premise: if a buyer is going to live in a home 7-10 years, they should be just fine in terms of outliving any market turbulence. Keren did agree, and also reiterated that now is the time to sell. If you’re looking to downsize and you’re on the fence, this is it. We have good qualified buyers and low-interest rates but don’t know how long this will last. Like Toni mentioned, sometimes you can purchase with a mortgage less than a rental. That’s important to mention again because it is the time to buy and sell.

Suitable Housing clause

Geoff mentioned that you can structure your listing to make it subject to finding suitable housing. For example, if a retiree worried about finding housing after selling their home a suitable housing clause could be utilized. However, you do have to give buyers reasonable terms on that clause. It is an option to discuss with your Green Team sales associate if this is a concern.

Selling in a bad market

Geoff recounted that a majority of his listings were during a really bad market. Listings would languish and go on and on, very different than the market we’ve been seeing the last 3-5 years here. To those buyers or sellers going through the transaction process, Geoff offers some advice. Sellers may have a home listed and haven’t had any showings, or maybe many showings but no offers, or offers that fell through. Sometimes the reason that sellers are in that place is because the property is priced too high. A lot of people are not willing to admit it, but it is a fact. To those in that situation, what is going to matter most to you when closing is done is not the bottom line on the closing statement. It’s going to be that it’s over and done and you can move on with your life. Far too many people are trying to get an extra $5,000 or $10,000 while they’re spending $1,000 a month on taxes, interest payments, utility costs, maintenance. That all adds up quickly. They’re also not factoring their own well being, factoring in the stress that comes with the whole process. If you’re a seller and you’re thinking of selling, go for it!

Keren’s thoughts

Keren agreed. She stated that sometimes sellers have it in the back of their mind that they are going to get “X” amount of dollars for their listing and they end up being listed for 6, 7, 8 months. As an agent, Keren believes it’s imperative to make clear that we have several different options. If you are looking to sell quickly, this is where we need to be. This is your market value because as realtors, this is what we do day in and day out. For some sellers the home has sentimental value and they are also concerned about the bottom line. There’s a thin line to walk when discussing price.

Toni’s thoughts

Toni said that working with motivated sellers is helpful. So is aggressive marketing, which is done by your agent. And, if your home is not selling, you should certainly consider a price reduction.

Final thoughts

Geoff hoped that this discussion helps people in this position, who may be agonizing over whether to drop their price. Remember, if the house is priced right, you’re going to get a good offer with reasonable terms. Buyers are looking to move on, too. They need a house, need a place for their family.

Reminder: The next Housing Market Update will take place life on Facebook Tuesday, November 19, 2019 at 2 p.m.

To reach our panelists if you’d like to buy or sell a property or learn more about the housing market

Keren Gonen – 551-262-4062

Toni Kreusch – 845-283-2450

Sept 2019 Housing Market Update

Recap

Geoffrey Green, President of Green Team Realty, invited viewers to the Sept 2019 Housing Market Update. The update took place on Sept 17, 2019, 2 p.m. on Facebook Live.

National Housing Market Statistics

Recession Worries

According to Geoff, we’re starting to hear the word recession far more than we did a year ago, far more than six months ago. The big buzz is, are we headed to a recession? If so, when? And how dramatic will it be? The bottom line is most people think we won’t be experiencing anything like we went through from 2008 to around 2016.

“The housing crash during the Great Recession left a lasting impression… But as we look ahead to the next recession, it’s important to recognize how unusual the conditions were that caused the last one, and what is different about the housing market today.” Jeff Tucker, the Zillow Economist

Reasons why housing prices and the real estate market should remain strong

- Many people are in a very strong equity position as far as their home goes. That’s the amount of money that is in the value of the home. If you know the fair market value of your home minus the pay off amount of your mortgage, the difference is the equity. Keren Gonen and our Producer, Melissa Bressette, were discussing that over one-third of US households are free and clear of any mortgage. That is a very strong number. From a balance sheet perspective, we’re doing very well as a nation.

- We’ve had good appreciation over the last few years. It continues and most experts agree that despite the market slowing, appreciation is still going to be something that will continue for the next 12 months at least. The question is really by how much.

- Inventory levels are still relatively low. Days on market are low, bidding wars are still happening.

- Mortgage and interest rates are fantastic. Geoff thinks that if you had asked a lot of mortgage professionals a year ago where rates would be now, they would not have predicted how low rates would be. The low rate environment is continuing to fuel the real estate market.

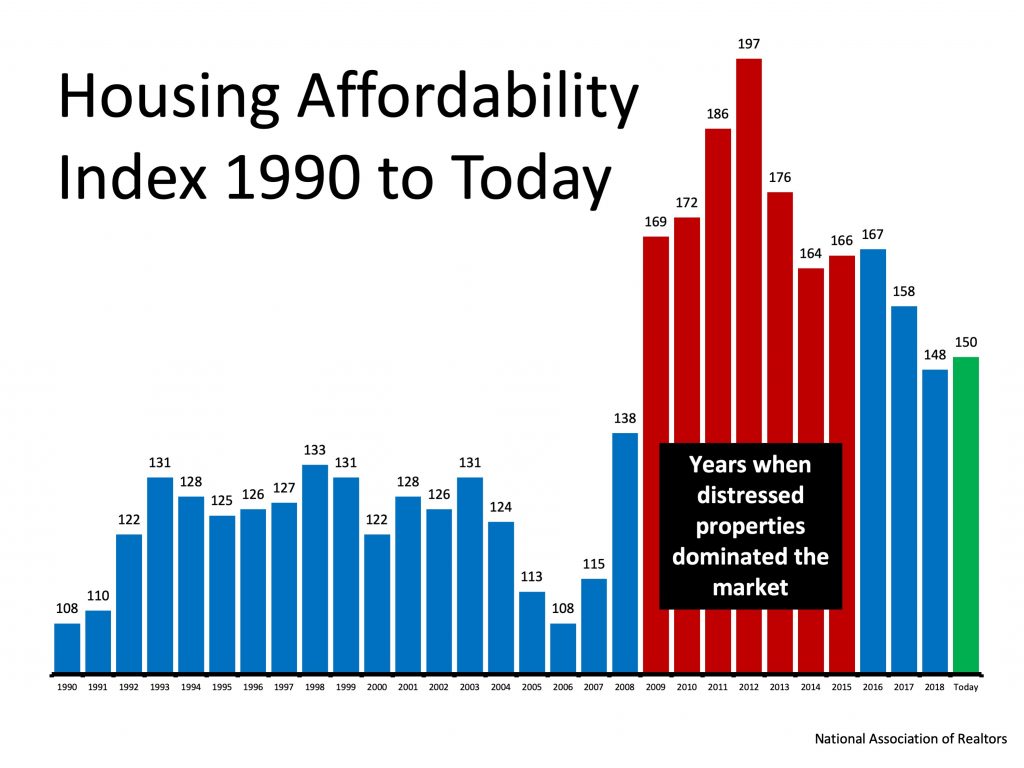

- There is a level of affordability we haven’t seen in a long time. When you package everything together; earnings, mortgage rates, taxes, prices of homes, etc.you get affordability rates that are historically high. That is, how affordable it is for the average American to buy a home.

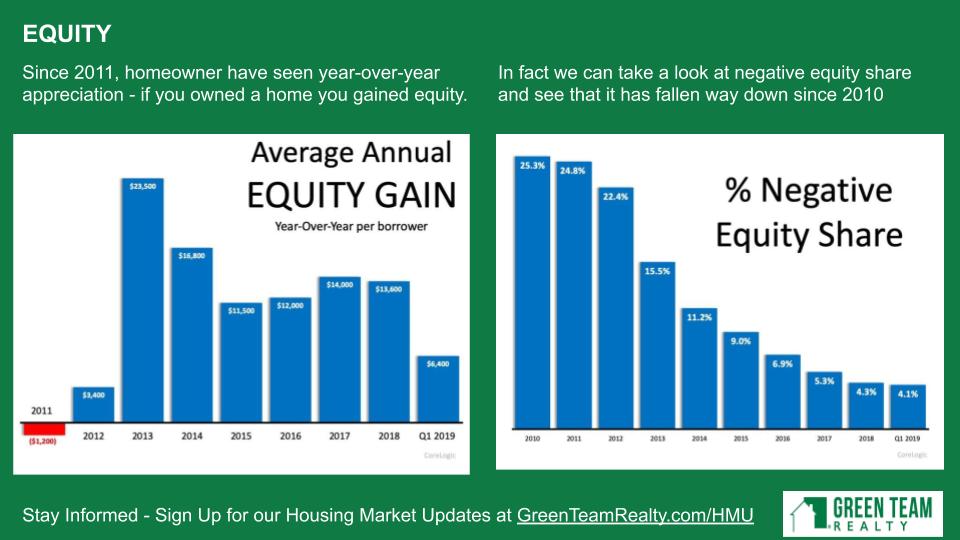

Equity

Here we’re seeing year over year appreciation growth. It is still very strong. Still where it was a couple of years ago. Percent of negative equity share refers to who is in negative equity situation. That occurs when the mortgage payoff is higher than the fair market value of the home. That has been steadily declining since 2010 and we are now at the lowest level since then. Those are very good signs.

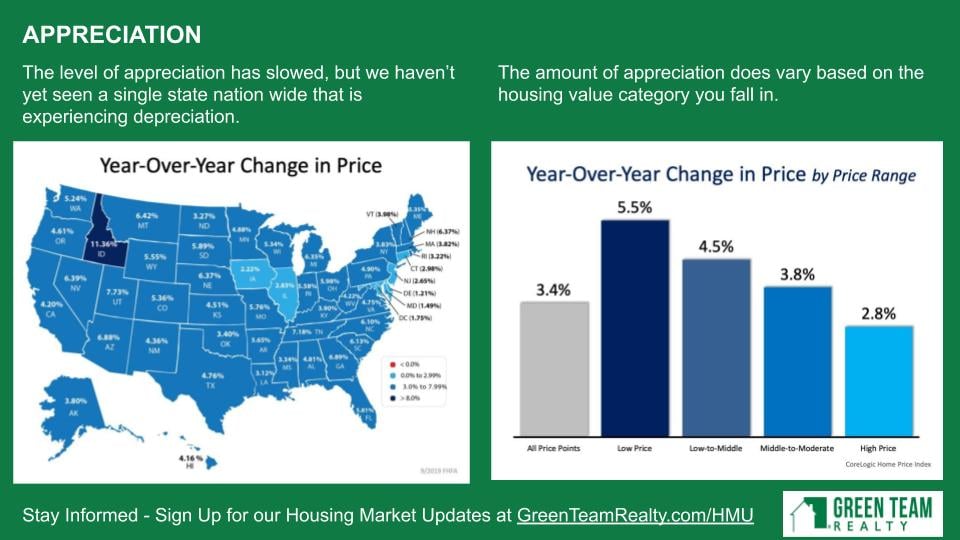

Appreciation

A quick glance at the map of the U.S. on the left side shows nothing is below “0” and everything is still appreciating. Then we review the right side, which examines year-over-year change in price by price range. All price points are in grey. Lower end homes have a bigger market, more demand, which drives up price. However, even the high range homes are experiencing appreciation.

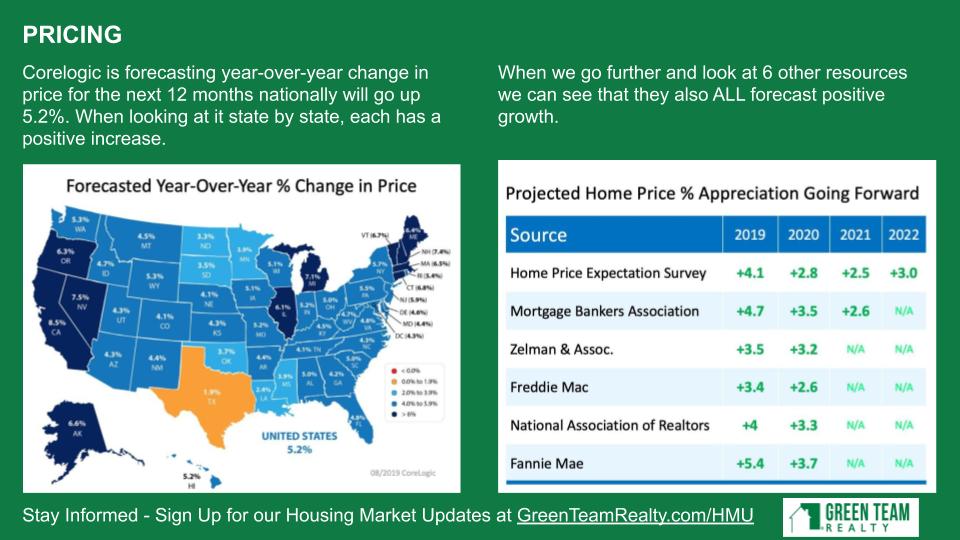

Pricing

Corelogic,a leading provider of statistical data on the housing market is projecting, per the above map, that over the next 12 months the nation will go up another 5.2%. That is a very healthy rate of appreciation. In addition, some other sources, shown here on the right, are predicting a fairly substantial level of appreciation, even into 2021.

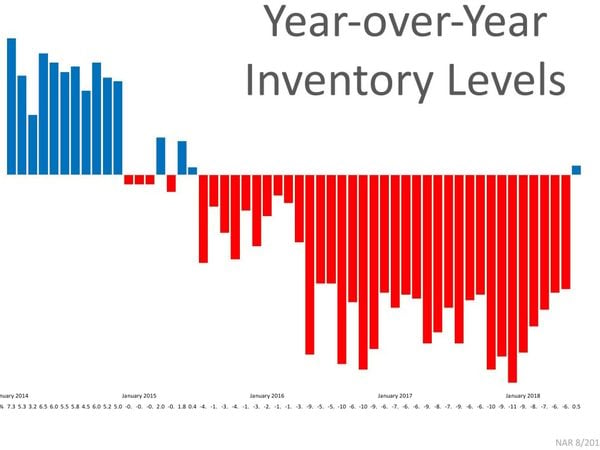

Inventory

Historically, left to right, we are still at a very low level of inventory, which means that pricing should continue to increase. or stay strong year over year. Year-over-year inventory levels, we’ve had a bump at the end of 2018, beginning of 2019. Now we can see inventory starting to tighten up again a little.

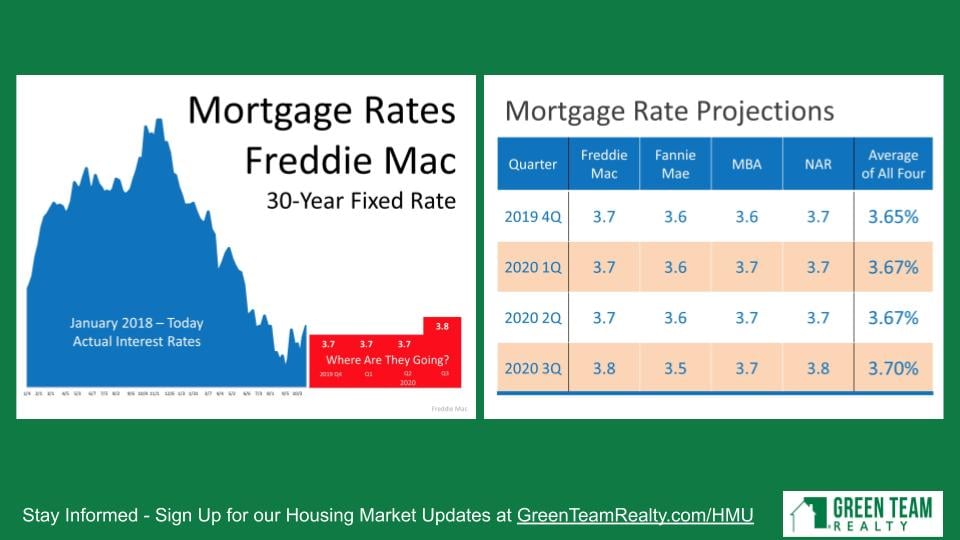

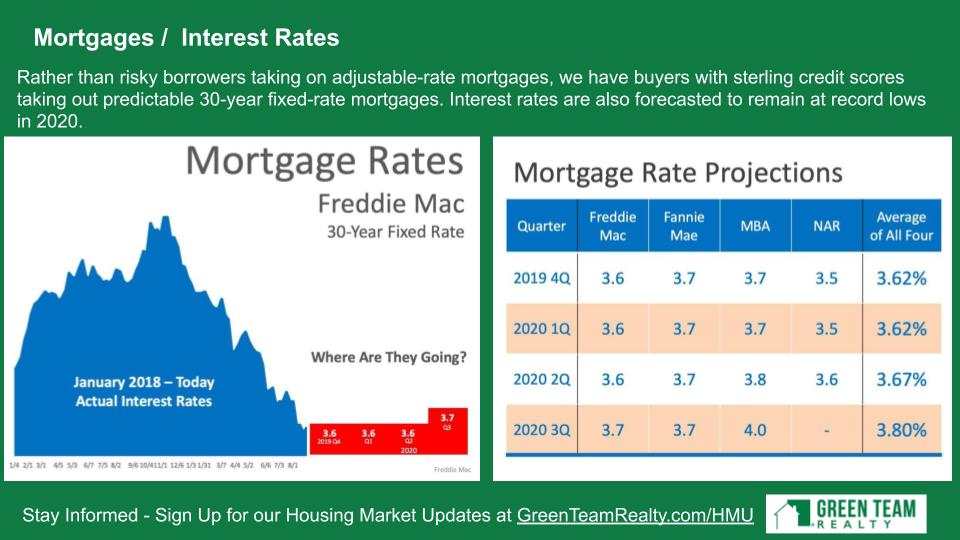

Mortgages/Interest Rates

Where are they headed? Where are they now? We can see from January 2018 to today the rates that could not have been predicted a few years ago to be so low. And we recognize that this is a good spot that we’re in.

Affordability

On the graph to the left, the yellow line represents median home price while the blue represents purchasing power. It’s evident that there is much less of a variance between the two up to 2005, which was the worst period of time. But we’ve stayed strong. During the crash, home prices went down while affordability went up. And it hasn’t really changed. There is still ta good opportunity for people to secure one of the most important assets they ever will own – a home.

Historical Recession Data

Geoff agrees with everyone who believes that this recession will be much shorter than the last one. The housing market is in a better position. We have better fundamentals in place than we did the last time around. There is not nearly as much sub-prime lending as there was. Of the last five recessions, home prices went down in just two. Home prices went up in the other three.

Having gone through the last recession, it can be hard to believe that prices can actually rise. But maybe this one will go that way as well.

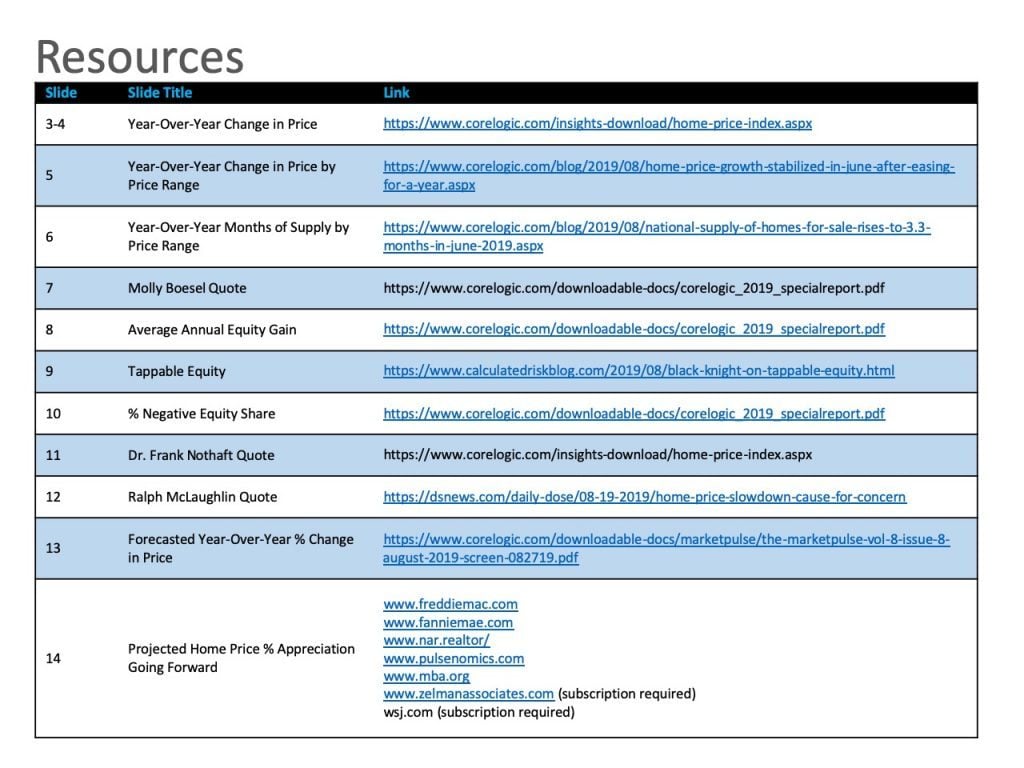

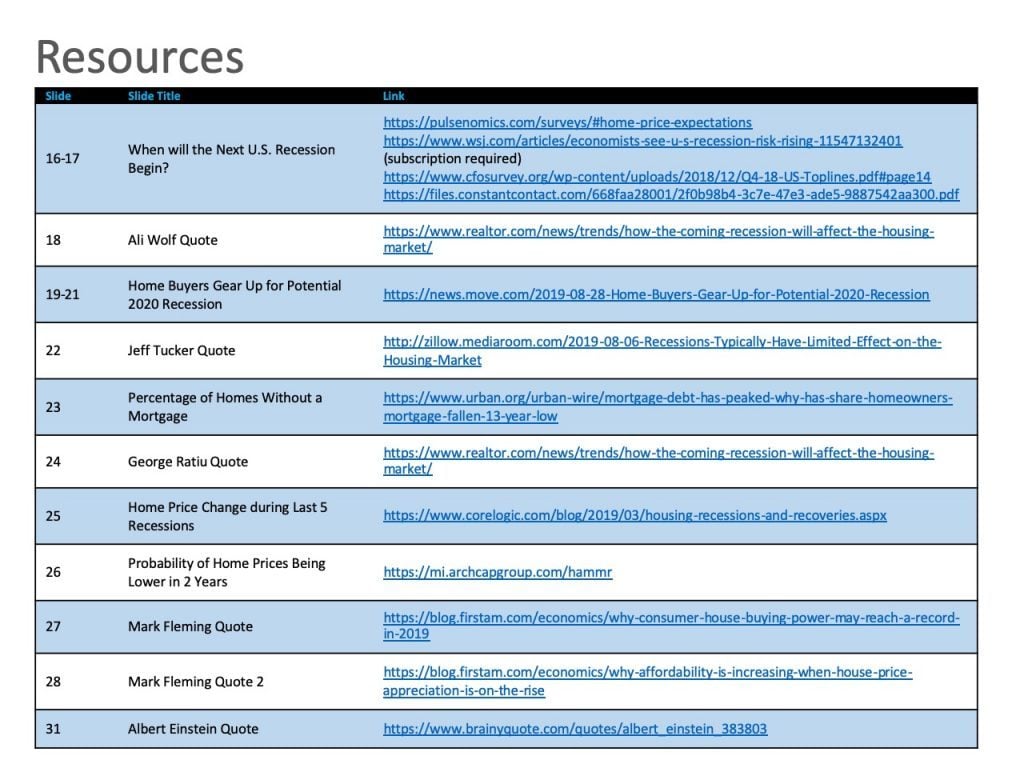

Resource Center

Each month we bring you stats, data and quotes from various trusted industry sources. These resources will now be available to you in our monthly Housing Market Update recap blog post, which can be accessed from GreenTeamRealty.com/hmu/ under Housing Market Recap.

Local Housing Market Updates

Orange County, New York

Units Sold

It’s been a mixed bag this year. The green line is 2019. It’s fair to say the number of units sold is consistent with 2018. We’re definitely seeing a slowing in the number of transactions. But, it’s still a very high historical level. And it’s still a very strong market. So, yes, it’s cooling, but it’s still a very high rate.

Average Sales Price

The average sales price took a little dip this month.That doesn’t mean that prices will ultimately continue to go down year-over-year over 2018. However, units sold has been slowing. Geoff believes we’ll see a softening of the market, rather than a crash.

Ask to Sold Ratio

The last asking price versus what the house sold for and the ratio thereof. As you an see, this year it’s been high, meaning sellers haven’t had to negotiate much off of their asking price. However, recently we’re seeing a dip, which is worth noting.

Days on Market

The days on market have consistently been lower than the previous 6 years, remaining a strong factor in the market.

Sussex County, New Jersey

Units sold

There is a similar situation here in Sussex County; a mixed bag, up and down. However, it’s clear that in the last 18 months or so, the number of units sold has been slowing.

Average Price

It’s interesting that all through this time period average price in Sussex was kind of languishing. And now we see prices taking off,. almost the highest level of prices in the county in almost 8 years. Only July of 2018 was slightly higher.

Ask to Sold Ratio

The ask to sold ratio is again similar to what we’re seeing in Orange County. at 97, 98%, it’s still a strong market with sellers only having to come down a little bit off their asking price.

Days on Market

Days on market are lowest over last 6 years. The market continues to be strong. Further discussion will take place with our panel.

Thank you to our sponsor

Meet our Panel

Keren Gonen is from Green Team New Jersey Realty and is a regular panelist on our Housing Market Updates.

Geoff asked Keren what’s actually happening in the field; if there are signs of the market taking a downturn.

Keren stated that it’s important to note that there are still people buying. still people selling, and there are still bidding wars due to low inventory. On both sides of the border we’re dealing with a lack of good houses. Now that it’s so easy and affordable to buy a good home, it’s really a question of inventory. Some sellers are on the fence, waiting to hear what will happen in 2020. Agents and Sellers would like more inventory to choose from. However, if agents educate their sellers we’ll see a lot more houses on the market in the coming months.

Geoff asked if Keren has found buyers becoming more picky as time goes on. Keren replied that it’s the opposite; Buyers are rushing to put in offers on the houses that they like. She said we want to make sure that good houses on the market do sell quickly, because that makes everyone look good. Whether it’s the listing agent or selling agent, everyone does better in that type of a market.

From the Seller’s perspective, Geoff asked if Keren agreed that we’re not in a market where they can list at any price and sell. Keren stated that surprisingly all the listings she’s had have either come in on point asking price or a few thousand dollars above asking price due to bidding wars. In addition, they’re going under contract very quickly. Attorneys are moving them along, with attorney review much faster than earlier in the year and last year. She had one listing got out of attorney review in literally 48 hours, which was a first for Keren.

Pricing

Geoff said he was sure that Keren was choosing comparables carefully to make sure the information is accurate and she’s setting a good asking price. She replied, absolutely. That’s the first thing – Listing Agent 101. You want to make sure you do your comps properly so that you don’t sit on the market. Geoff stated that ‘s the message to all Sellers. The hardest conversation to have as realtors is price reduction. It’s kind of like having mud on your face. We’re the ones who bring in the comps, make recommendations on what we feel the fair market is for their home, Many Sellers don’t listen and just want to list at the price they want. But many people do listen. However, sometimes a price reduction is necessary. However, no matter what market you’re in, you have to price it right.

Keren said one of the things she does with all of her Sellers is ask them what their time line is for selling their home. Meaning, are we okay to sit on the market for 3, 4, 5, 6 months? Or are we looking to get an offer within the next month to 2 months. Then, according to what they tell her that’s where she prices the house. She has had clients that tell her they don’t care when they move, the house is paid off and they’re not in a rush. And they want a specific amount for their house. So Keren tells them that’s okay as long as they understand that according to her market analysis, they won’t sell until we reach this price. As long as they understand that, she’s fine with listing it at that price. Ultimately it’s always the Seller’s decision.

The recommendation

Price it right from the beginning. Price it to sell from the get go. You’re likely to get a higher price. There is never a better time to sell your home than when you first list it. It’s new, there are buyers out there waiting for the next house to come out on the market. They’ve been out there looking and haven’t found what they’re looking for yet. Now your home is new and it’s on the market.

Bank Inventory

Geoff asked Keren what she is seeing as far as bank-owned inventory. He considers Keren to be a leading expert in Sussex County on the subject. Keren stated that they are not seeing too much being released by the banks. Whatever was out there was sold. She hasn’t seen anything new that’s affordable for an investor or flipper or someone who wants to take on renovations on their own. It has been quite a few weeks since she’s seen those. She has seen some that are borderline, with a few things missing, but those are priced too high. There really isn’t any new release of inventory from them.

Geoff then asked if Keren is still seeing bank-owned properties continue to be rented, an anomaly that we’re seeing over the last 5-6 years. As far as Keren knows, they are, remarking that it seems banks now want to be landlords as well. Geoff mentioned some clients who rented a bank-owned property and once they got in there was problem after problem. It was discovered that there was a lot of substandard that had been done. Caution people buying inventory to make sure that the renovations have been done correctly. The flips that Keren has seen by banks are usually bid out to the lowest bidder and that reflects in the workmanship.People can get caught up in the moment; the price seems right. And they may think they’re getting a better deal because the property is bank-owned.

Wrapping it up

Geoff has been in the real estate industry for going on 15 years. He has worked a lot of hours every week during those years and developed a great appreciation for agents like Keren, working in the field.The housing market in this country would not be what it is without the hardworking agents. They keep data accurate, make sure clients needs are met. Other market places around the world are not nearly as well run as they are here. We are getting into an age where it may be possible to just buy a home from Zillow offers, etc. However, the expertise, knowledge and support offered by real estate agents cannot be duplicated. Geoff’s final word… Find a Realtor!

Keren Gonen can be reached at: 551-262-4062.

April 2019 Housing Market Update

The April 2019 Housing Market Update was held on Facebook Live Tuesday, April 16 at 2 p.m. If you missed the live webinar, you can view it at your convenience by clicking here. You can also sign up for updates at GreenTeamRealty.com/HMU.

Geoff Green, President of Green Team Realty, began the update with some national statistics. Discussions have been going on for months as to what the 2019 would look like. And, for the most part, it’s roaring. At least that is the case in our area, the northeast.

National Housing Market Statistics

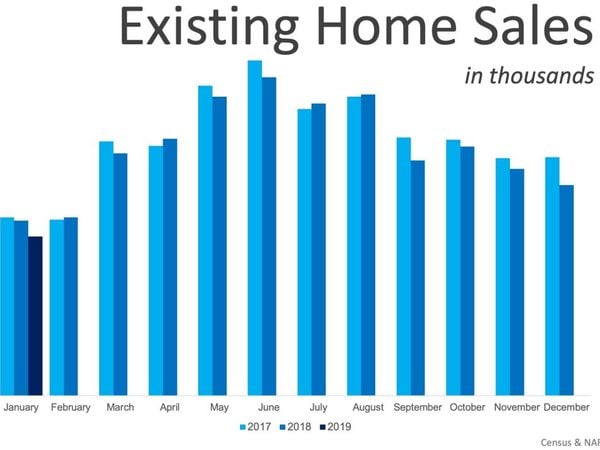

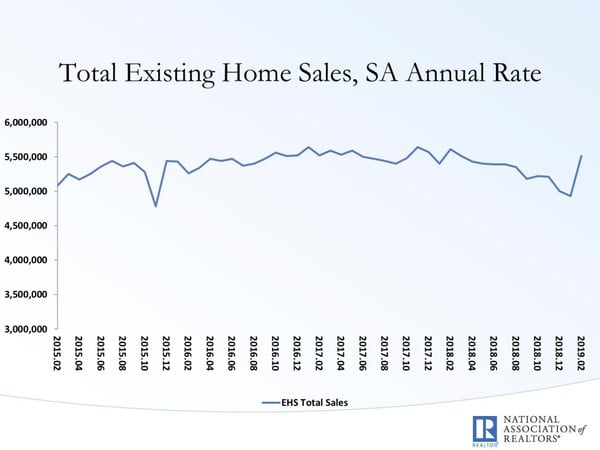

Total Existing Home Sales

This chart shows the total existing home sales for every two months, year over year. There was a dip, with things trending down, from the end of 2017 through 2018 nationally. But there is a bump at the beginning of 2019. And it seems to be busy for everyone right now. The thinking is that this may be another banner year.

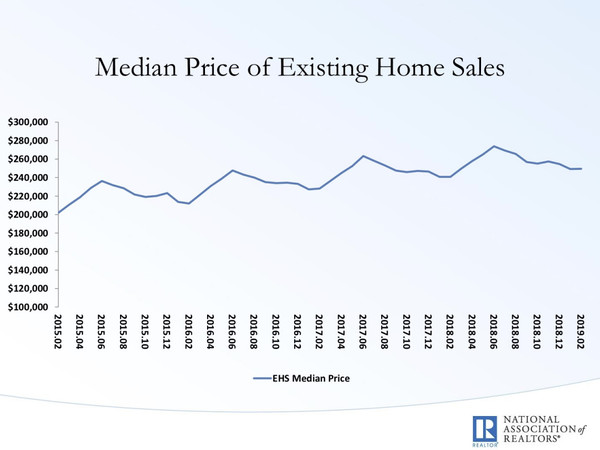

Median Price of Existing Home Sales

Prices have very consistently increased over the last 3 to 4 years. And there doesn’t seem to be a reason to anticipate any change in that trajectory any time soon.

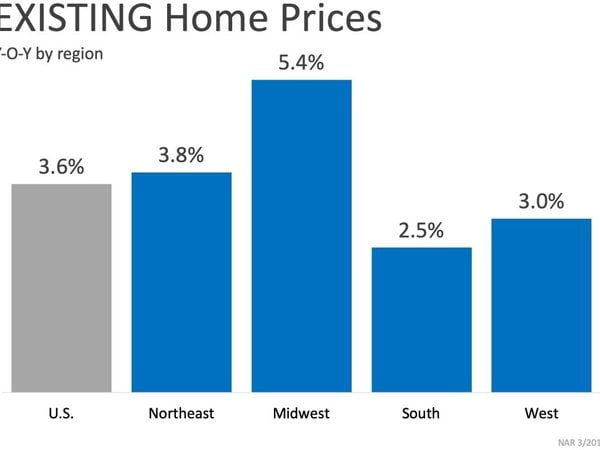

Existing Home Prices by Region

Breaking down existing home prices in terms of regions, this shows where we are now versus last year. The Midwest is leading home prices increases, followed by the Northeast.

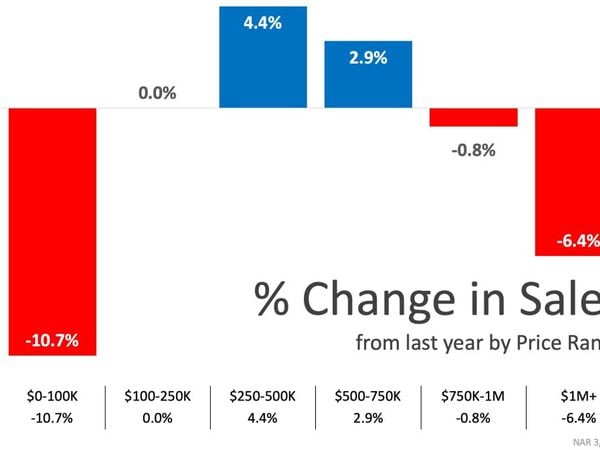

% Change in Sales

As prices have risen, there are fewer homes across the nation in the $0-$100,000 range. This low inventory has resulted in the change in sales for that price range. However, it is also interesting that on the very high end, transactions of $1 Million+ have faltered and slowed down. When you start to get into those metro areas where $1+ Million is not unusual, people may be starting to find it’s a little out of reach.

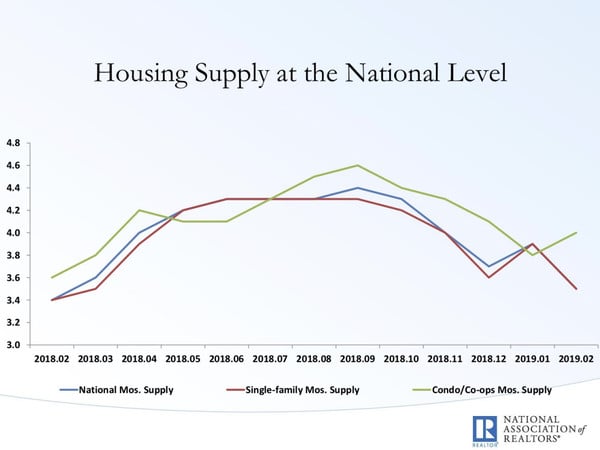

Housing Supply at the National Level

The lack of inventory has been seen as a reason for why the number of transactions was softening for the last 12, 14 months; The supply level peaked in 2018 and then came down towards the end of 2018. But it now looks like it may be coming up again. We really need this to happen to keep the transactions going.

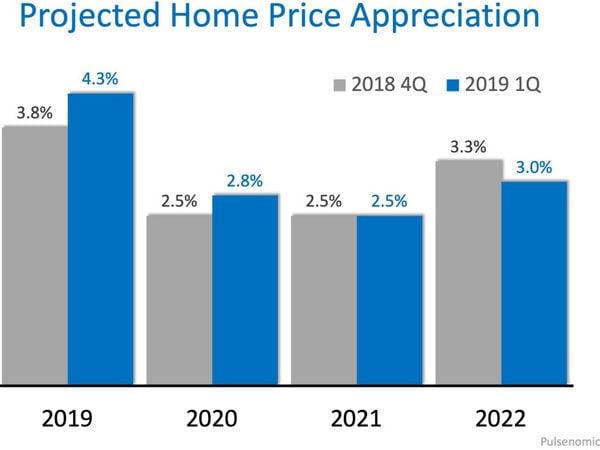

Projected Home Price Appreciation

A panel of over 100 economists, real estate experts and investment and market strategists were interviewed for the most recent Home Price Expectations Survey. These experts have raised the projections they made in the 4th quarter of 2018 for 2019 and 2020. They are anticipating a better year than they first thought.

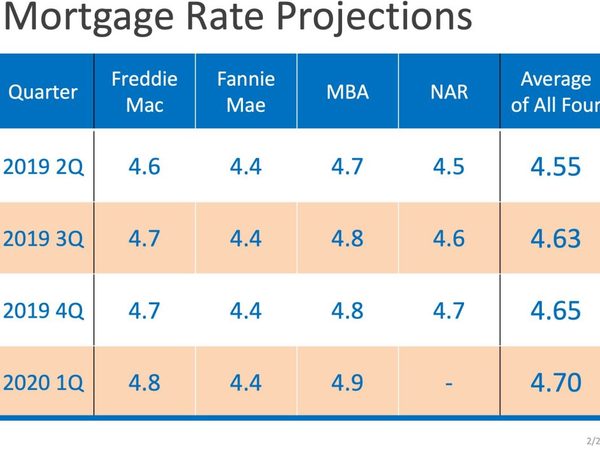

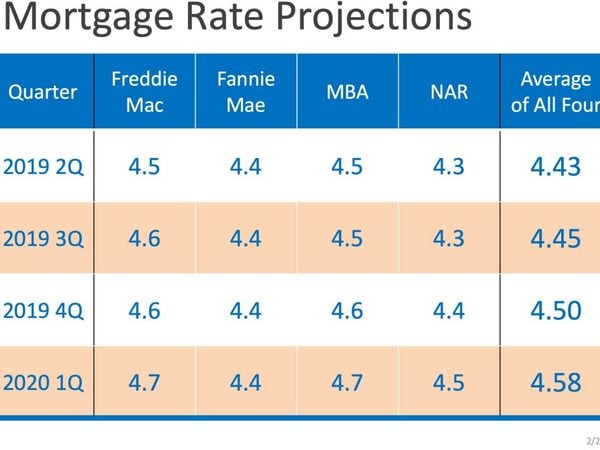

Mortgage Rate Projections

Despite a zooming market and a very solid economy, rates in Geoff’s view are still remaining low. Someone who was looking for a home a year and a half ago may now see rates up a point and think that they are now “high.” However, Geoff says that rates are still historically low.

Local Housing Market Update

Orange County, NY – Units Sold

We seem to be holding even compared to last year. Perhaps a tick better. This is good news.

Orange County, NY – Average Sales Price

So far this year we’re basically even with last year.

Orange County, NY – Ask to Sold Ratio

Ratio at which a home sells versus the last asking price. The ratio seems to be trending higher which means that demand is still very high. People are willing to pay at or near asking, if not over asking. Bidding wars are still continuing.

Orange County, NY – Days on Market

The days on market continue to drop consistently. Homes are still selling fast, selling quicker each year. All signs point to a continued Seller’s Market.

Sussex County, NJ – Units Sold

Units sold in January and February were lower than in 2018. However, in March the number rose, coming in a tick higher than March 2018.

Sussex County, NJ – Average Price

Sales prices in Sussex have been a bit of a conundrum. Price hasn’t taken hold and there has been a significant one month drop from February to March. This will be an interesting analytic to watch as the year goes on.

Sussex County, NJ – Ask to Sold Ratio

Again, the higher the number, the closer things are selling towards the asking price and the less sellers are having to negotiate off those prices. We’re looking at some very strong numbers here.

Sussex County, NJ – Days on Market

Again, here the lower the number the stronger the market. Here was have a steady pattern of fewer days on the market. Homes are selling faster and faster.

Meet our Sponsor

This Webinar is sponsored by REALLY – A real estate referral network for Agents. REALLY Easy Referrals are as Easy as 1, 2, 3…

- Enter your referral in 5 minutes or less

- REALLY notifies you of all willing Agents

- YOU choose the Agent and legally bind with one tap!

The best part – No fees on commissions exchanged between Agents. Join for FREE.

Meet the Panel

Geoffrey Green, Moderator

President, Green Team Realty

Vikki Garby,

Green Team

New York Realty

Keren Gonen,

Green Team

New Jersey Realty

Laura Moritz,

Classic Mortgage

aura Moritz has been with Classic Mortgage for 18 years.

Geoff Green began the panel discussion by asking about the trends they’ve been seeing in the Housing Market Updates and in the market itself. Geoff recalled that the numbers were softening during 2018. Therefore, there was a lot of uncertainty about how the market would be in 2019. However, the numbers seem to be indicating a very good year.

He asked Vikki and Keren what their experiences were in the field. Vikki said that the general market conditions she sees in Orange County, specifically the Warwick, Goshen, Middletown area, indicate a really strong market. There is still a shortage of inventory, which feeds the demand. She has received several new buyers recently coming from outside the area. Plus, many sellers are staying in the area, adding to the number of prospective buyers.

She has noticed more For Sale by Owner signs lately, and has had buyers request to see some of those. Vikki noted that that’s fine; she’s able to show her clients the homes and guide them through the home purchasing process. She then asked if Keren was seeing the same thing in Sussex County and if it’s a new trend. Keren said they are seeing the same thing in New Jersey. With today’s technology, some sellers are thinking they can do it on their own. And as Vikki mentioned, there are no issues approaching a FSBO and arranging a showing for their buyers.

In regard to home prices plummeting in Sussex, Keren said a new wave of REO’s has been released. This hasn’t happened in a while. They’re also being more logical in their pricing. That may be why we’re seeing that drop. In addition, there is that same problem of inventory. Recently Keren had buyer request to see a newly listed home over the weekend. However that home had an accepted offer on it before her clients could see it 4 days later. It’s still a seller’s market.

New Construction

Geoff agreed that there is clearly an inventory shortage. There is real, organic growth in the market. There are many people who can afford a home, and qualify. Yet there are more prospective buyers like this out there than there are suitable homes. In Warwick, in particular, there is a lot of new construction going on. He wondered if around our local counties there is enough new construction yet. He asked what the panelists were seeing. Had they noticed new subdivisions offering more options for their buyers?

Keren said in Sussex, there was Crystal Springs. A large halted construction site there had just been bought up, and there is new things going up. And there are a lot of people interested in them because there is not that much construction around. They also have those houses that have burnt down and had to be totally gutted. Those houses are getting a lot of activity as well.

Vikki is seeing a lot of new construction in the Warwick area specifically, and also in Goshen, Cornwall. She feels it’s a result of the lack of inventory. Geoff noted that he reads a lot of articles from economists, etc. He received an email from a loan company which urged homeowners to become more reasonable in their pricing. There has also been a lot of talk by economists about the importance of municipalities needing to loosen up their zoning requirements and do what they can to speed up municipalities.

Geoff’s response to these? “Welcome to my world!” Planning boards have gotten tighter and tighter and people are concerned about their communities growing too fast. Regulations have gotten tighter, rather than loosening up. And while Geoff doesn’t believe these things are bad, he’s just saying it’s harder to develop in today’s day and age than it was 50, 60 years ago. There’s just a lot more red tape involved.

Geoff said it will be really interesting to see. America is the place to be. Globally, our economy is far outpacing any other country out there. We’re the “shining city on the hill” again and many people want to be here. Also, many people just don’t want to move.

What’s happening with mortgage financing?

Geoff then asked Laura Moritz where we are with mortgages and where she see rates going, Further, he noted there seems there is a lot of loan of money available, and a lot of loan programs. He doesn’t think that’s the problem. Laura responded that she really doesn’t see a problem at all as far as qualified buyers getting financing. Even a few mortgages were done this month for people with credit scores in the 500’s. Underwriting guidelines have really loosened up. Borrowers may also have what’s called in banking compensating factors = their credit is not so great, but they have other factors, Laura is really not seeing any rejections. She also is not seeing houses not appraising for value. The market has been very steady.

Interest rates are very low now. She has locked in and closed some 30 year loans recently at 4-1/4% with 20% down and good credit. With 15 year loans , you’re looking at high 3’s%.

Geoff mentioned that we’ve talked about the appraisal situation often on the housing market updates. He said it was maybe a year or more that it wasn’t so certain that things would appraise and it was difficult. Now that we have in this steadily increasing medium price market appraisers can buy into the fact that this house is worth more than the one down the street because it’s selling six months later and it’s an increasing market. Where it’s hard on appraisers is on the turn, when the market is on its way up or on its way down.

Laura added that some high end properties with “fluff” amenities may not translate to an appraisal. However, ever her high-end appraisals have been coming in on point because they have the comps.

She doesn’t believe that rates will move in either direction very much over the next 6 to 9 months. However, as we know, one catastrophic event or something in the global economy can shift the bond market and it can change on a dime. It does look like rates will hold steady over the summer months.

Laura closed the discussion by noting that it’s a great time to buy a house. She’s seeing a lot of young people and couples trending towards buying a home before getting married in order to skip the renting stage. She loves hearing from them a few years later that they appreciated $70,000 gain and can now buy their forever home. It’s a great time to buy a home in the Northeast. Geoff added that even speaking to average price we’re still really not back to 2006 levels. As much as it’s a seller’s market now, there is still lots of room for growth in price appreciation in our local markets.

May Housing Market Update

The next Housing Market Update will be held on May 21 at 2 p.m. You can stay informed and sign up for Housing Market Updates. Just click here.

January 2019 Housing Market Update

The Green Team’s January 2019 Housing Market Update was held on Facebook Live Tuesday, January 15 at 2 p.m. If were unable to view the webinar live, you can watch it at your convenience here. You can also sign up for future updates at GreenTeamHQ.com/hmu.

This month’s panelists…

Geoffrey Green, President/Broker of Green Team Realty, moderates the monthly webinars. He also presents national statistics, together with local updates for Orange County, NY and Sussex County, NJ. This month he is joined by Carol Buchanan of Green Team New York Realty, Keren Gonen of Green Team New Jersey Realty and Patrick “PJ” Keelin of Family First Funding.

The National Outlook

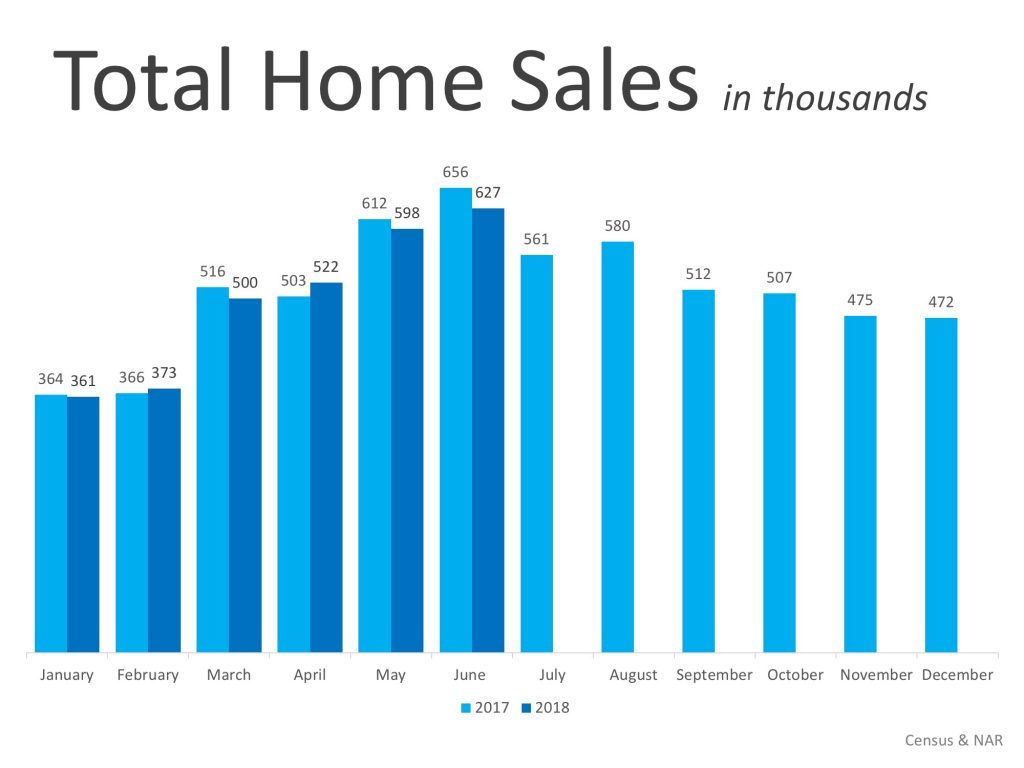

The above charts are raw numbers – the number of homes that were sold from 2014-2018. It appears that things are softening a bit, but it doesn’t appear that it will be drastic.

The analytic showing inventory levels is important. It has been difficult to find homes for buyers over the last few years. However, it appears that inventory levels may be coming back a bit. Lower demand should yield more inventory, but hopefully what some inventory may do is bring some people back into the game who may have been been frustrated previously.

This survey of experts, market analysts, etc. addressed the question, “What Will Home Prices Do in 2019?” 100 people were surveyed and 94% projected that housing prices on a national basis will continue to appreciate. Geoff aligns himself with that 94%. He believes that in 2019 prices will come up again in spite of the fact that activity went down. Price always lags activity.

According to Geoff, this quote from Goldman Sachs is a good one. “Despite the headwinds facing the housing market going into 2019, we expect U.S. house prices to generally achieve a soft landing. We expect national average price appreciation to remain positive.” If this comes true, it’s music to Geoff’s ears. He lived and worked through the last downturn, where 50% of the number of homes that sold went away within a 2-year period of time once the market starting declining. It was a difficult time

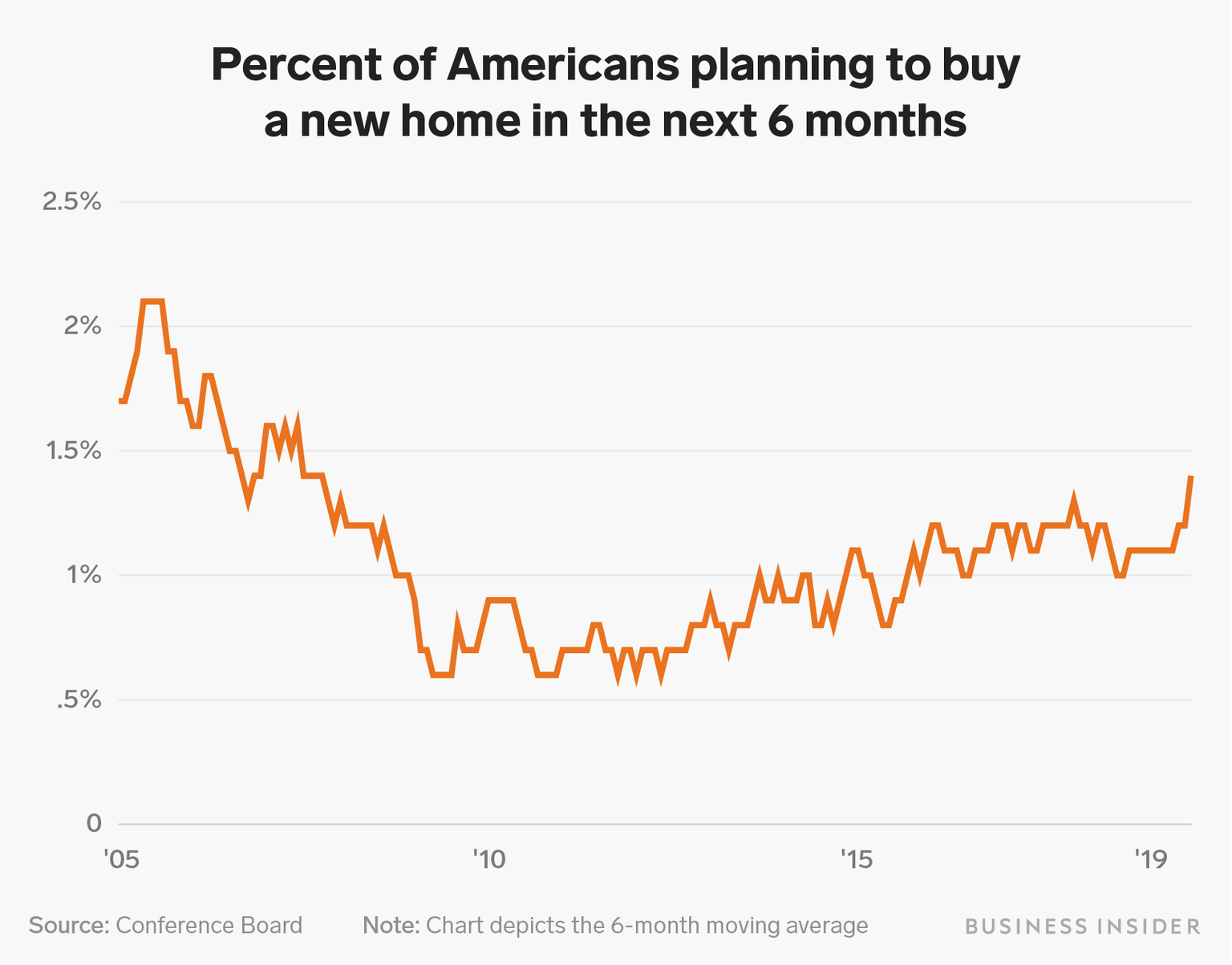

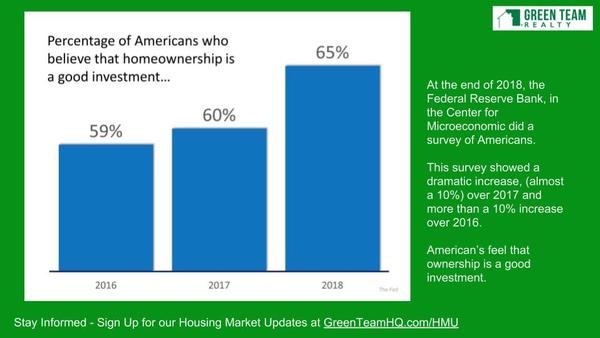

The percentage of Americans who believe homeownership is a good investment continues to increase. The market is at a peak and confidence continues to increase. However, Geoff finds that people tend to buy high and sell low. They should be buying low and selling high. The bottom of the market, 2011, 2012, and 2013 would have been a good time for investment.

However, people are confident that it’s a good time to buy now. And one thing that will never change is that homeownership is a good thing.

January 2019 Local Housing Market Update for Orange and Sussex Counties

Units Sold

Five year look back. The thick green line is 2018 and while it’s been a mixed bag throughout the year, we ended up just a tad bit lower than the past two years.

In Sussex County, Units Sold was also a mixed bag, with one of the lowest totals in almost 4 years.

Average Price

In Orange County, prices were up substantially for a good part of the year. However, there was a cooling-off period towards the end of the year.

Sussex County never saw as much of an appreciation as Orange County did. However, 2018 was still a leading year over the past 5 years.

Asking to Sold Ratio

What price do homes on average sell for versus the last asking price? The higher towards 100% the hotter the market. The numbers have been strong for Orange County throughout the year.

Sussex County was strong in this category throughout the year. However, it hit its highest point in December 2018 with a ratio of 98.50%.

Panel Discussion

Geoff asked Carol Buchanan and Keren Gonen what they think of the market, as it appears a softening is underway. Carol stated that inventory is still low, and January and February are common months for the market to slow down. Carol does believe that 2019 is going to be a very good year. People seem undaunted by higher interest rates. Still a lot of buyers; just not enough homes.

Keren also agrees that 2019 will be a very good year. She thinks that people will start listing homes for sale within the next few months. Right now buyers are looking but there is still not enough inventory. She feels there are sellers sitting on the fence, not sure what to do and just holding out for a few more weeks or months. Geoff commented that the bread and butter of the season is March through August. So it’s natural for many homeowners to wait until March to list their homes.

Talking with Keren regarding foreclosure activity, Geoff asked if she see a decline? Banks are fixing up houses and putting them up at market prices. If the quality of work was good, that would be fine. However banks are bidding jobs out and the resulting work is not necessarily good work. Buyers expect to see good quality and are disappointed with what they’re finding. They often would prefer to pay more for a house that is in good shape. Therefore, many of these homes being sold by the banks are just sitting on the market. Banks are now competing with flippers who, generally speaking, do a better job at fixing up homes than the contractors. Buyers most often prefer paying full price for a home that was “flipped” well than on an REO that was not done well.

Geoff mentioned that this was not the trend in the past. Banks would not fix up their properties and try to sell them for more money. They’d just try to unload them at lower prices and buyers could get a good deal. Over the course of time we’ll see if banks decide to go back to the way they used to handle foreclosures.

Regarding the financing environment, Geoff asked Patrick “PJ” Keelin what we’re looking at for 2019. As Geoff put it, at the end of the day we’re really in the land of the banks, dependent on what they’re willing to do. And how many times the Federal government is willing to let banks leverage their money. PJ indicated that on a global scale, at the end of the year there was talk of the Feds raising the interest rate. That usually indicates a stronger economy; stronger aspects coming from the financing angle and mortgage-backed securities, etc. Unfortunately, at the end of the year there was a huge difference and the Dow dropped significantly. The drop in the Dow affected reports of things they were coming out with. So trends and thoughts of increased interest rates by the end of the year through that New Year boom fizzled out. There are reports that there is potentially going to be a decrease in interest rate for the year 2019. PJ believes that is something being put out there for a little bit of hope.

However, the biggest thing we’re competing with is the lack of inventory and what people will be able to purchase. Looking at an average household income of $60,000 to $70,000, that probably puts a person on average of what they can afford in terms of a property at $1,500 to $1,600 range. That gives them a certain price point that they have to stay in, and with increases in interest rates that is going to affect their eligibility to be able to purchase properties within a certain price range.

Geoff stated that all signs point to Fed raising interest rates. He asked PJ if he thinks that won’t be the case in 2019. PJ replied that there will be a lot less than they were expecting in 2018. They may skip the first interest rate rise. Hopes on the industry side are that there will be a potential interest rate drop. That may push that boom for people who are still sitting on the edge. He sees a stronger trend with the amount of people who are actually motivated in purchasing. They may finally be believing the reports that interest rates are not going to stay historically low and will go up. So many reports are going in different directions that it’s unsure what to make of it. Industry leaders are saying the market is staying relatively steady, but be prepared. There could be a drastic change.

Right the now trend is slow and steady. PJ commented that Geoff is proactive in all that he does; communicating with his sales associates and with the lenders they work with. Because ultimately these transactions need to happen quickly in order for them happen. When they remain open, bigger changes are coming.

Geoff wrapped up, saying that at the end of the day, interest rates are impacted by bond markets. As long as there is no major economic collapse, the housing market should be fine. He predicts a good 2019. PJ agrees, that it will be a good, strong year. People are getting more motivated.

Join us for the next Market Update

The next Housing Market Update will be held on Tuesday, February 12 at 2 p.m., when the Green Team will again be going live on Facebook. Sign up for updates at Greenteamhq.com/hmu.

August Housing Market Update

The August Housing Market Update was held live on Facebook on Tuesday, August 14, at 9 a.m. If you missed the live webinar, you can view it at your convenience by clicking here.

Next month, the Housing Market Update webinar will take place on Tuesday, September 18 at 2 p.m. You can sign up for updates at GreenTeamHQ.com/HMU.

Meet the Panel

Keren Gonen

Patrick Keelin

Jeff Lobb

Geoff Green moderated the webinar and presented statistics for Orange and Sussex Counties. Keren Gonen, of Green Team Real Estate New Jersey and Green Team Home Selling System, gave her perspective on the market from the sales associate’s view. Guest panelists were Patrick Keelin, Branch Manager of Family First Funding’s Warwick office, and Jeff Lobb, Founder and CEO of SparkTank Media. Green Team’s Marketing Director, Melissa Bressette, was on hand to make sure everything ran smoothly.

Housing Market Update – National

Nationally, for the last two months, the number of homes selling is down slightly from 2017. Earlier in the year it was almost even. There is a mixed bag, not a continued trend. Common knowledge says it’s all about inventory. There are just not enough homes for all the buyers out there.

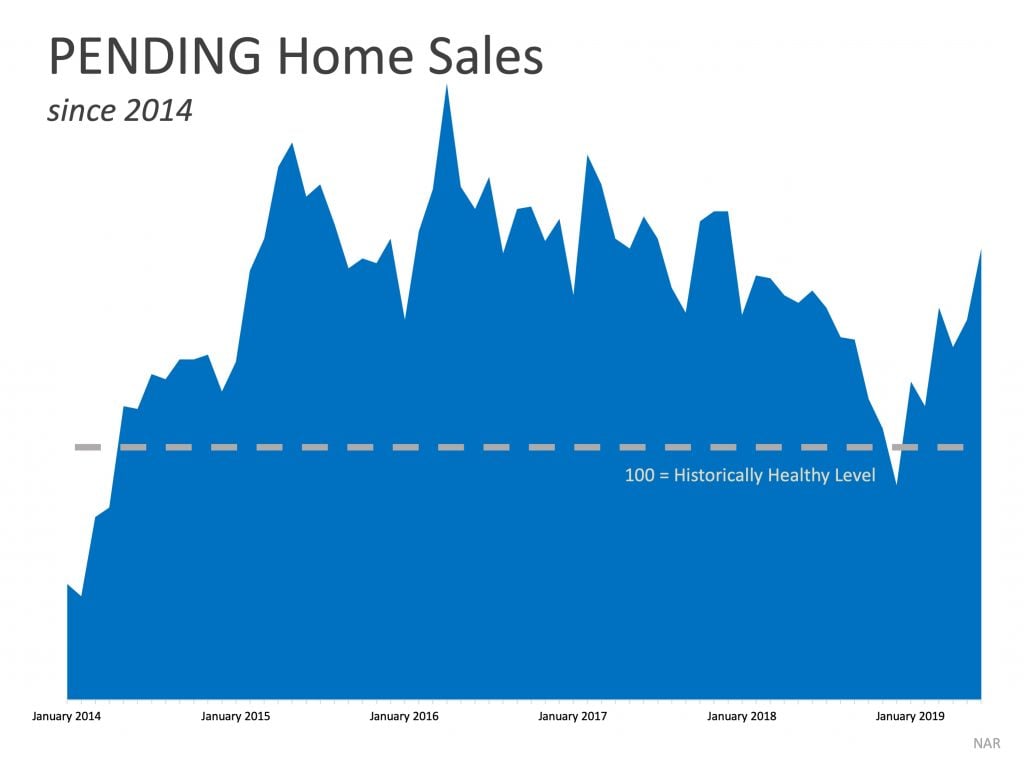

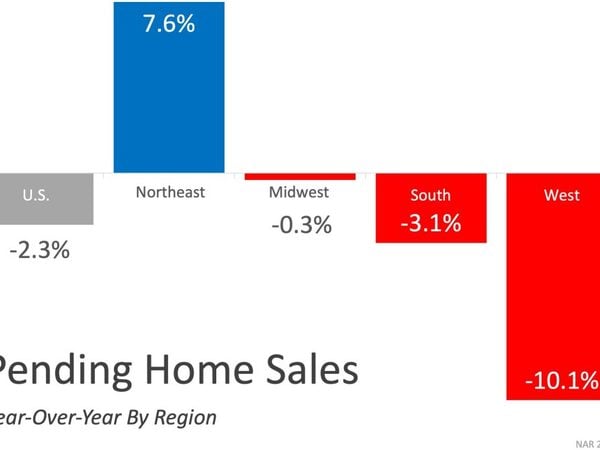

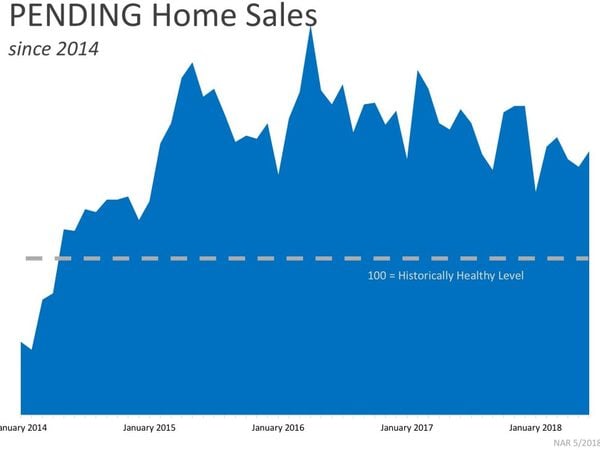

Pending home sales seem to be trending downward nationally.

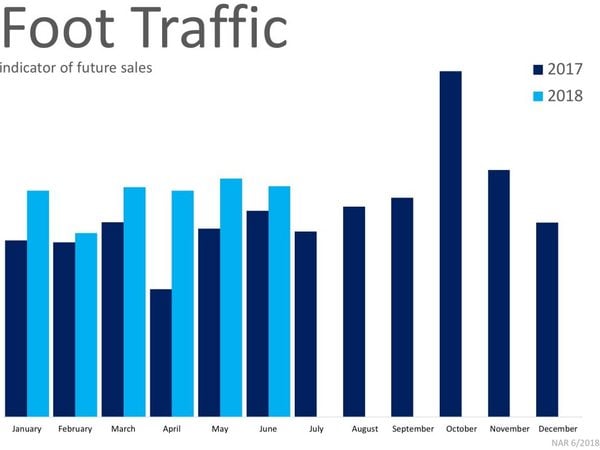

The National Association of Realtors shows year-over-year inventory levels up for the first time in 36 months. It may be a good sign, though it may also be indicative of the market slowing a little. However, foot traffic is up in 2018, compared to 2017. This graphic represents the numbers of people actually in homes, looking to buy. This number has been up consistently all year, though sales are down on a national level. From a national perspective, it’s still a very solid market.

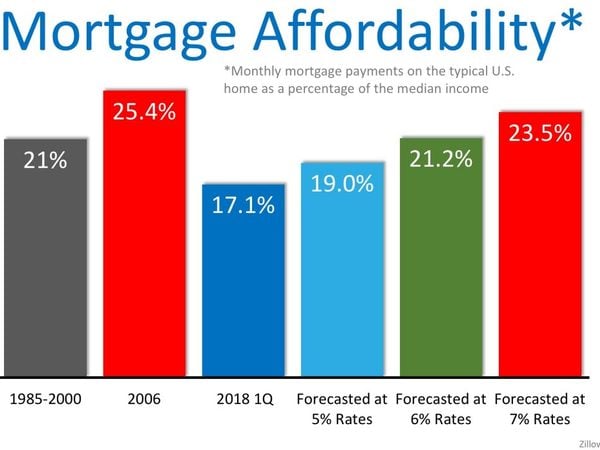

From 1985 to 2000, 21% of household income was dedicated to mortgage payments. In the first quarter of 2018 we’re well below that number. At 17.1%, we’re about 4 points below the historical average over the last 25 years. Therefore, even though prices are rising and inventory is tight, homes are still relatively affordable compared to 1985 to 2000. Even if rates do get to 6% or so, household income dedicated to mortgage payments will be only a few points higher than the 1985 to 2000 average.

Housing Market Update – Orange County, NY

Getting down to local stats, although at a slowing pace, the numbers are still at historical levels. In our area, where the current number of homes selling is the equivalent of 2006 (which was one year after the absolute peak in the market that occurred in 2005), the rate of sales is historically very high. This is a very hot market.

Average price is clearly rising in 2018. Geoff noted that in his experience units sold would increase, but average price didn’t quite get there. Then, units sold would start to decrease but price didn’t follow that trend, with a lag of about 6 months. There was almost a 2-year lag in average price that came after the downturn in the market.

Approximately 40% of homes are selling at 100% or more of their last asking price. There are a lot of bidding wars going on, and this is indicative of how hot the current market is.

This number continues to decline, another sign that this market is hot.

Housing Market Update – Sussex County, NJ

The stats are showing a fluctuation in the number of units sold in Sussex County. It’s a mixed bag – some months below, some months above. No definitive trend has emerged.

Not quite the lift-off that’s occurring in Orange County, but after the first two months of 2018, there is a definite rise in average price and July is at the highest point of the last five years.

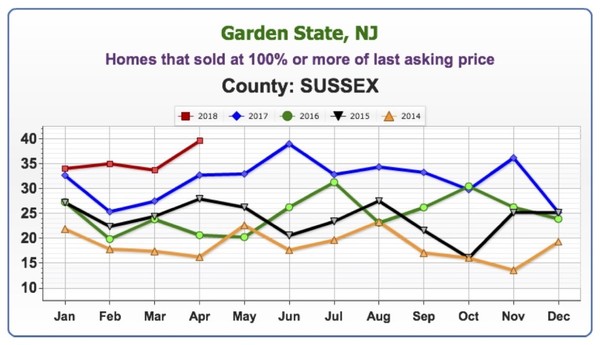

While not quite as high as Orange County, between 30 to 40% of homes are selling at 100% or more of last asking price.

We’re seeing a similar trend to New York, with homes selling at around the 90-day mark.

Keren Goren – A Sales Associate’s Perspective on the Market

Geoff asked Keren Goren, one of Green Team’s top producers, for her thoughts on the current market. Licensed in both New York and New Jersey, Keren finds that there are many prospective buyers for both Orange and Sussex Counties. Lots of bidding wars are going on.

She does feel that some of the flippers in the area are doing less and asking for more. This appears to be a new trend. Keren recalled that flippers used to do a much better job, but many houses on the market now are unfinished and are scaring buyers away as opposed to inviting bids. Therefore, some outdated homes are actually selling for prices higher than they should or would have a few months ago.

Keren sees no sign of the market slowing down. However, she is seeing delays in closings due to issues with some mortgage companies, and with buyers making poor decisions with their finances. Keren did note that her experiences with Family First were extremely positive, and she highly recommended them.

Geoff noted that the current market upturn stands a chance at longevity. Following the downturn, as deep and as long it was, people weren’t moving. Banks have since cleaned up their balance sheets, tightened programs up, and are making money. There are fewer defaults happening. Basically, everything depends on how much money the banks are willing to lend.

PJ Keelin – A Lender’s Perspective

The mortgage industry is doing well, offering a lot more first-time homebuyer programs with as little as 3% down, USDA becoming very popular in Orange and Sussex County areas. Also trending is loosening up a bit and coming up with more portfolio loan products, personal products and using common-sense underwriting and ability to fund when looking at today’s borrowers.

With homes in the $200,000 to $300,000 price range becoming few and far between, they are looking at different programs, such as adjustable rates, less money down, and interest only type payments. However, in these cases, information and education should be given to borrowers upfront. It’s necessary to prepare the borrower for everything that will come together throughout the process. It’s extremely important for borrowers to be aware of what they are getting into with these products and understand how they work.

Geoff noted that with the last downturn, banks were not requiring people to have much “skin in the game.” Zero down, lying about income, jamming loans through. Geoff asked if PJ was seeing any of those practices coming back, or if there remains more oversight. scrutinizing income and the buyer’s comprehensive financial situation, down payments, etc. before loans are going out.

PJ replied that FANNIE and FREDDIE are doing a great job operating more with common sense with people who can have a little more risk, etc. They are requiring more skin in the game. Banks are protecting themselves and borrowers by not letting people put themselves under water.

Where are mortgage rates headed?

Geoff noted that the Fed has been raising short-term interest rates and will probably continue to do so to stifle inflation. He asked PJ where he saw mortgage rates landing over the next 12 to 18 months. PJ answered that he believes rates will be consistently in the 5’s through most programs. The market is being built into where those rates are and is slowly trending. Supply and demand are balancing each other out. Geoff feels that if you buy now, the value of your home won’t drop out like it did 12, 14 years ago. Pricing levels appear to be realistic and should hold for some time in the future. Buyers want to know if the asset they’re buying will be worth at least as much or more than they’re paying now. Even though it is a seller’s market, Geoff and PJ concurred that it is a good time to buy.

Furthermore, PJ stated that appraisers are not allowing appraisal inflation to come above where the market truly should be. It’s better for appraisers to be a little tight because that will keep the longevity of this strong market going on for 12, 18, 24 months. Geoff replied that appraisals have been challenging over the last 3 years. Prior to the upturn, prices were a mixed bag, leaving appraisers unwilling to take a chance as they couldn’t see where the market was going. However, he noted that now some appraisers are more willing to take a chance and make an allowance because of the steady upward-trending market, even though there might not be a comp that can exactly substantiate it. There are fewer appraiser issues, though there are still times when they won’t go along with the offering price. This hurts the seller but protects the buyer. And it’s another way of controlling the market.

Jeff Lobb – A Marketing Expert’s Perspective

Geoff asked Jeff for his views on the future of service providers in the real estate industry in this age of technology. Are realtors going to be the next victims of business models like Amazon? Will technology replace realtors just as retail stores (like ToysRUs) and their employees have been replaced?

Jeff’s view? While buzzwords like “disruption” do sell media, there are things happening at higher levels. However, the real estate agent is not going away anytime soon for one simple reason. There are too many moving parts to a transaction, and emotion is one of those. Technology has not reached the stage where it can handle all these parts.

Disruption occurs with more brands trying to change the way we are doing business, making it faster, more tech, or more niche. New companies are coming into play. Compass, Redfin models, Purple Bricks. And new people are coming into the space trying to change and elevate what we do. At the same time. the industry has seen some large teams leave major brands, saying they can do things better by themselves, without the big brand box.

Taking care of business…

One way to keep track of business is to every day look at local inventory. If there are 500 listings, see how many of those you got. If it’s only 2, there is a lot to be done. The business is a marathon; it’s a competitive race, but not many have enough drive to do the hard work that’s needed. To say the business is slow is not valid. Every day more homes come on the market and more get sold. Someone is getting those listings. And that is where the challenge comes in. It’s about doing the day-to-day work. All the technology that is available can make us work faster and smarter, but we still have to do the work.

Philosophically speaking…

Geoff has a broader perspective as to where realtors stand and what the future holds. As an example, despite all the tools available online there are more travel agents now than in the year 2000. It takes time to do all the research, etc., and many people are finding it more desirable to hire someone to do that work for them.

There has been an explosion of information and technology, but at the end of the day, it’s time. Do most people want to spend the amount of time it takes to properly sell their house or negotiate to buy a home? Most people prefer to hire a real estate professional to handle all the parts of the puzzle. In addition, Geoff believes the housing market is important to the overall US and global economy. The economy is revving. largely because of the housing market healing and coming back. And real estate agents are critical to the health of the economy.

Jeff added, “Will Amazon and Facebook get into the real estate marketplace? Probably!” The big picture is that some companies are coming in trying to acquire agents and market share. Others are trying to change the way technology is driven. However, you still need the people to execute the transactions and deal with the emotional process of a sale.

Geoff’s final analysis? We, humans, are complicated beings, and it takes a human to navigate this process of buying a home. And after much consideration, we should continue to invest in real estate agents and our industry because we’re needed and timeless.

Visit our website, greenteamhq.com/HMU to register for our next Webinar on Tuesday, September 18 at 2 pm. You can also view previous webinars videos and access other recaps like this.

Orange County Real Estate Market Report for May 2018

Green Team Business Review – May 2018

The numbers tell a story all their own. Despite the lack of inventory on the market, despite the specter of rising interest rates, loss of deductions due to new tax laws, etc., the Green Team is doing something very right and finding people buyers for their homes and finding homes for buyers! Both the Warwick and Vernon offices have more than doubled their sales volume from a year ago.

Orange County, NY Real Estate Market Report – April 2018 Results

The May Market Update was held on Tuesday, May 8 on Facebook Live. It was moderated by Geoff Green, Founder of Green Team Home Selling System. Panelists included sales agents Vikki Garby from the Warwick office, Keren Goren of the Vernon office, Michael Giannetto from Residential Home Funding and Ken Ford from Warwick Valley Financial Advisors.

If you missed the original live event, click here to watch. The discussion involved not only the housing market, but also perspectives on the economy. Our guest panelists have a great deal of knowledge and expertise, and the conversation was informative, educational and lively.

You can also sign up for monthly updates by email on the Green Team website.

We were experiencing technical difficulties:

Prior to the update going live, the following discussion took place:

The lack of inventory remains the biggest impediment to home sales, and the panel discussed the various reasons why people are reluctant to sell now. Vikki Garby stated that there were more buyers this winter than last spring, but that there is not a lot to buy. Cash buyers were coming in strong, with some people getting full asking price, or over. Keren Goren stated that many people she spoke to were just hanging on, waiting to see what would happen in the market.

Geoffrey Green told the panel that he is often asked, “Should I wait, because prices are going higher?” According to Vikki, sellers are worried about finding a home! People move up here from other places and swamp the market, and people who want to sell but stay in the area are concerned. Keren said that houses in Sussex are outdated, older than what buyers are looking for. Geoff said, “At the end of the day, if you’re moving and need to sell, try to sell and buy at the same time.”

The conversation turned to “fixer-uppers.” Geoff felt that most buyers don’t have the time, experience, and money to do renovation after buying a home. However, he asked the panel if they were seeing more buyers willing to take on a fixer-upper.

Keren cited a buyer who was willing to take out a loan to put a new roof on a house where everything else had been done. He was willing to go that step. Vikki stated there was not much to choose from and buyers trying to get into the area are having to be more flexible. Mike Giannetto stated that reno loans are now a big product and many people are taking the opportunity to fix up a house, put in new appliances, roof, etc., using equity.

Watch the video for more discussion, including a fascinating look into the world of economics and how the bond market impacts the interest rate that buyers may soon be paying.

Orange County, NY Real Estate Market Report – April 2018 Results

We are pleased to share with you the Housing Market Report for April 2018. We break down local real estate activities and provide you with stats, graphs, and analysis of our local and regional real estate market. In addition, we provide insight from some of the people most familiar with market trends: sales associates, mortgage funding specialists and financial advisers.

Average Days on the Market

The faster homes are selling, the hotter the market. Look for the lowest number on the graph, as opposed to the highest. The calculation in New York State is from the List Date to the Contract Date.

With numbers in for April, the average days on are the lowest they’ve been for this month for 5 years.

Average Price

Here again we’re seeing a trend. Prices are coming in at their highest point for April in 5 years, at an average of $247,849.

Average Sold to Asked Ratio

This is the percentage a house sold for under or over the last asking (not the original) price.

The higher the percentage, the hotter the market. This April the percentage dipped slightly below April 2016 and 2017, but sellers are still negotiating at approximately 3.5 points off the last asking price. As mentioned last month, this is an average of all of Orange County, with some areas having a higher percentage, and some a lower one.

Homes that sold at 100% or more of last asking price

Here again there was a slight dip below April 2016 and 2017, though the numbers remain higher than 2014 and 2015.

Units Sold

Units sold seems to have flat lined; however, more units were sold in April 2018 than in the four preceding years.

We Keep You Informed:

The Green Team Shares this information and more each month during our Live Housing Market Update. Register to join the webinar and hear directly from our participating Green Team Sales Associates who share their personal take on how the marketplace is doing.

Each month we are also joined by industry experts who share insights into the current financing environment as well as broader economic issues affecting the housing market.

Check out our past Housing Market Updates. Then Register to join our next one on June 12th at 9am.

[embedyt] https://www.youtube.com/embed?listType=playlist&list=PL6MEM7EpyL0E5YdU249T_KsDQTukboj8E&v=AQYblgrxmIY[/embedyt]

Sussex County Real Estate Market Report for May 2018

Green Team Business Review – May 2018

The numbers tell a story all their own. Despite the lack of inventory on the market, despite the specter of rising interest rates, loss of deductions due to new tax laws, etc., the Green Team is doing something very right and finding people buyers for their homes and finding homes for buyers! Both the Warwick and Vernon offices have more than doubled their sales volume from a year ago.

Sussex County, NJ Real Estate Market Report – April 2018 Results

The May Market Update was held on Tuesday, May 8 on Facebook Live. It was moderated by Geoff Green, Founder of Green Team Home Selling System. Panelists included sales agents Vikki Garby from the Warwick office, Keren Goren of the Vernon office, Michael Giannetto from Residential Home Funding and Ken Ford from Warwick Valley Financial Advisors.

If you missed the original live event, click here to watch. The discussion involved not only the housing market, but also perspectives on the economy. Our guest panelists have a great deal of knowledge and expertise, and the conversation was informative, educational and lively.

You can also sign up for monthly updates by email on the Green Team website.

We were experiencing technical difficulties:

Prior to the update going live, the following discussion took place:

The lack of inventory remains the biggest impediment to home sales, and the panel discussed the various reasons why people are reluctant to sell now. Vikki Garby stated that there were more buyers this winter than last spring, but that there is not a lot to buy. Cash buyers were coming in strong, with some people getting full asking price, or over. Keren Goren stated that many people she spoke to were just hanging on, waiting to see what would happen in the market.

Geoffrey Green told the panel that he is often asked, “Should I wait, because prices are going higher?” According to Vikki, sellers are worried about finding a home! People move up here from other places and swamp the market, and people who want to sell but stay in the area are concerned. Keren said that houses in Sussex are outdated, older than what buyers are looking for. Geoff said, “At the end of the day, if you’re moving and need to sell, try to sell and buy at the same time.”

The conversation turned to “fixer-uppers.” Geoff felt that most buyers don’t have the time, experience, and money to do renovation after buying a home. However, he asked the panel if they were seeing more buyers willing to take on a fixer-upper.

Keren cited a buyer who was willing to take out a loan to put a new roof on a house where everything else had been done. He was willing to go that step. Vikki stated there was not much to choose from and buyers trying to get into the area are having to be more flexible. Mike Giannetto stated that reno loans are now a big product and many people are taking the opportunity to fix up a house, put in new appliances, roof, etc., using equity.

Watch the video for more discussion, including a fascinating look into the world of economics and how the bond market impacts the interest rate that buyers may soon be paying.

Sussex County, NJ Real Estate Market Report – April 2018 Results

Average Days on the Market

The faster homes are selling, the hotter the market. Look for the lowest number on the graph, as opposed to the highest.

The average days on the market are slightly higher than April of 2017 but are way below the previous three years. The average number of days on the market is 92.57 for the first four months of 2018.

Average Price

The average price is just about where it was this time last year and is above the prior three years.

Average Sold to Asked Ratio

This is the percentage a house sold for under or over the last asking (not the original) price.

There was a jump in this number, with the percentage at 98.98% for this April, the highest point for any month in the past five years. Sellers were negotiating at approximately 2 points off the last asking price.

Homes that sold at 100% or more of last asking price

Here again there was a jump in the numbers, reaching the highest point for any month in the past 5 years.

Units Sold

There was a climb in the numbers here, as well, with April 2018 showing the most units sold for this month over the past four years.

We Keep You Informed:

The Green Team Shares this information and more each month during our Live Housing Market Update. Register to join the webinar and hear directly from our participating Green Team Sales Associates who share their personal take on how the marketplace is doing.

Each month we are also joined by industry experts who share insights into the current financing environment as well as broader economic issues affecting the housing market.

Check out our past Housing Market Updates. Then Register to join our next one on June 12th at 9am.

[embedyt] https://www.youtube.com/embed?listType=playlist&list=PL6MEM7EpyL0E5YdU249T_KsDQTukboj8E&v=AQYblgrxmIY[/embedyt]

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link