The August Housing Market Update was held live on Facebook on Tuesday, August 14, at 9 a.m. If you missed the live webinar, you can view it at your convenience by clicking here.

Next month, the Housing Market Update webinar will take place on Tuesday, September 18 at 2 p.m. You can sign up for updates at GreenTeamHQ.com/HMU.

Meet the Panel

Keren Gonen

Patrick Keelin

Jeff Lobb

Geoff Green moderated the webinar and presented statistics for Orange and Sussex Counties. Keren Gonen, of Green Team Real Estate New Jersey and Green Team Home Selling System, gave her perspective on the market from the sales associate’s view. Guest panelists were Patrick Keelin, Branch Manager of Family First Funding’s Warwick office, and Jeff Lobb, Founder and CEO of SparkTank Media. Green Team’s Marketing Director, Melissa Bressette, was on hand to make sure everything ran smoothly.

Housing Market Update – National

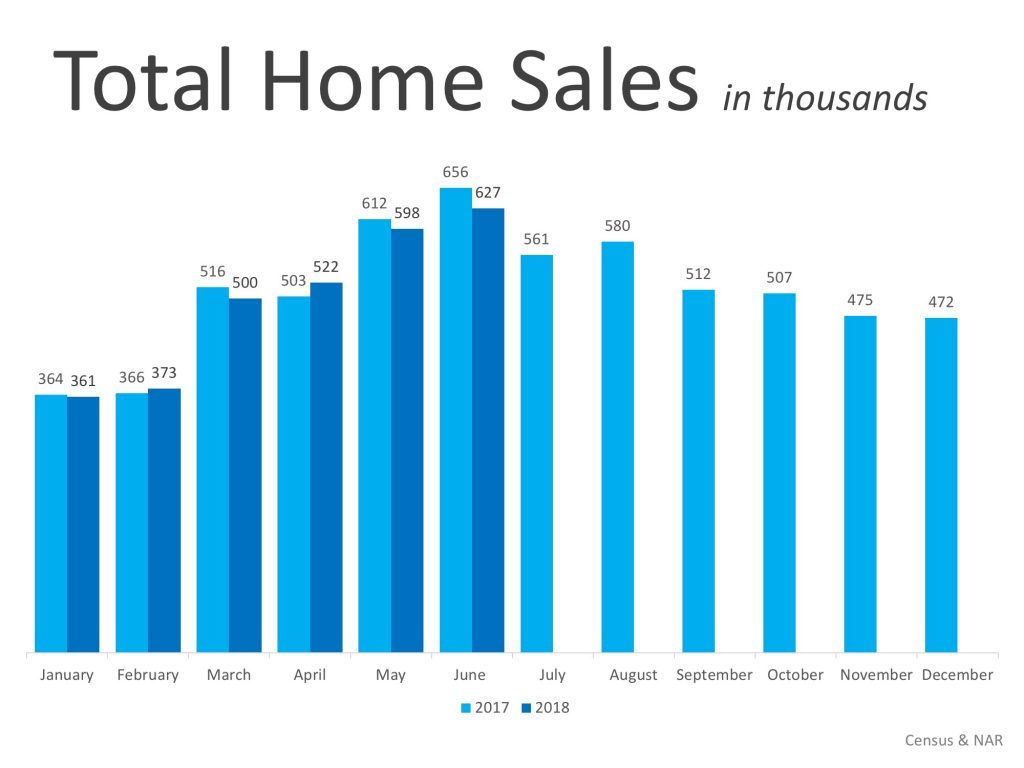

Nationally, for the last two months, the number of homes selling is down slightly from 2017. Earlier in the year it was almost even. There is a mixed bag, not a continued trend. Common knowledge says it’s all about inventory. There are just not enough homes for all the buyers out there.

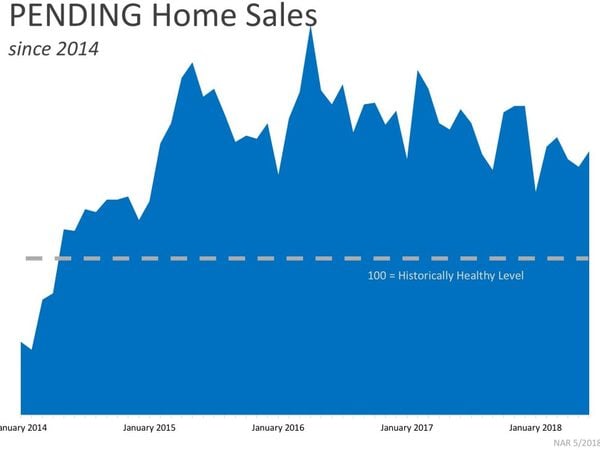

Pending home sales seem to be trending downward nationally.

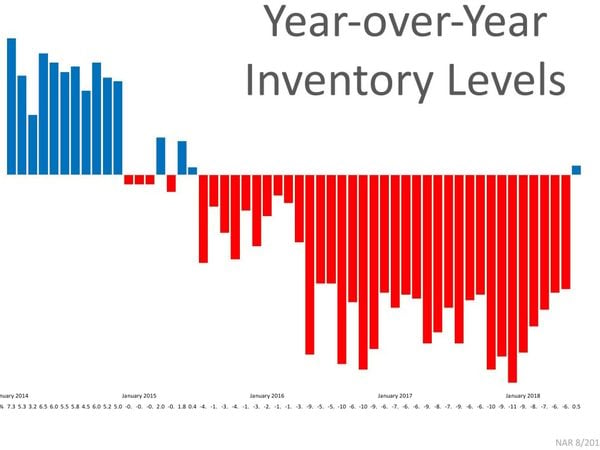

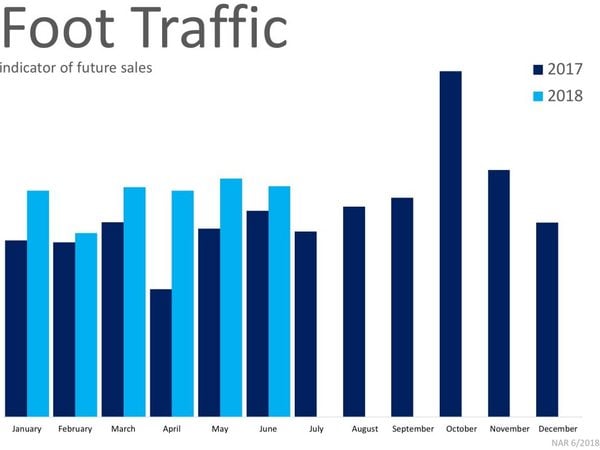

The National Association of Realtors shows year-over-year inventory levels up for the first time in 36 months. It may be a good sign, though it may also be indicative of the market slowing a little. However, foot traffic is up in 2018, compared to 2017. This graphic represents the numbers of people actually in homes, looking to buy. This number has been up consistently all year, though sales are down on a national level. From a national perspective, it’s still a very solid market.

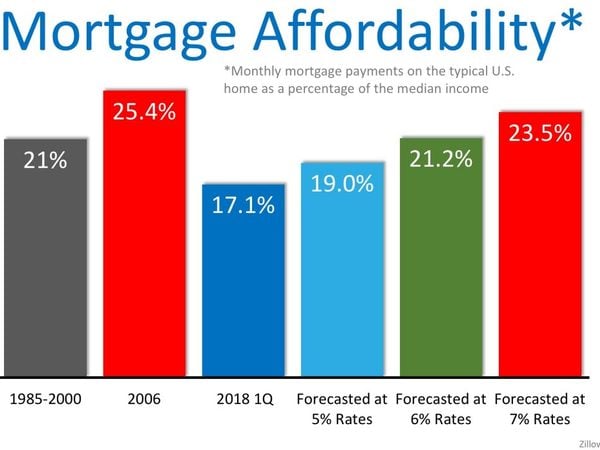

From 1985 to 2000, 21% of household income was dedicated to mortgage payments. In the first quarter of 2018 we’re well below that number. At 17.1%, we’re about 4 points below the historical average over the last 25 years. Therefore, even though prices are rising and inventory is tight, homes are still relatively affordable compared to 1985 to 2000. Even if rates do get to 6% or so, household income dedicated to mortgage payments will be only a few points higher than the 1985 to 2000 average.

Housing Market Update – Orange County, NY

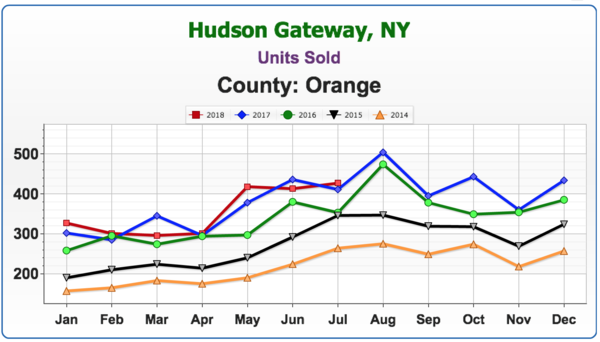

Getting down to local stats, although at a slowing pace, the numbers are still at historical levels. In our area, where the current number of homes selling is the equivalent of 2006 (which was one year after the absolute peak in the market that occurred in 2005), the rate of sales is historically very high. This is a very hot market.

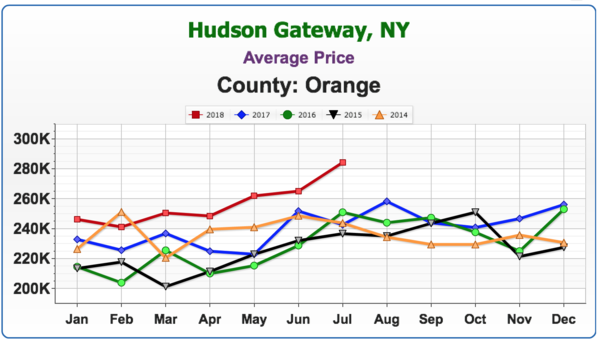

Average price is clearly rising in 2018. Geoff noted that in his experience units sold would increase, but average price didn’t quite get there. Then, units sold would start to decrease but price didn’t follow that trend, with a lag of about 6 months. There was almost a 2-year lag in average price that came after the downturn in the market.

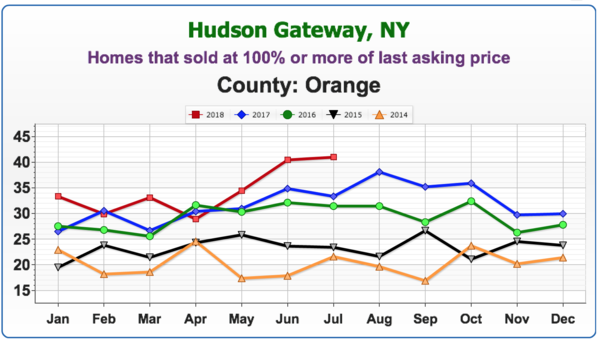

Approximately 40% of homes are selling at 100% or more of their last asking price. There are a lot of bidding wars going on, and this is indicative of how hot the current market is.

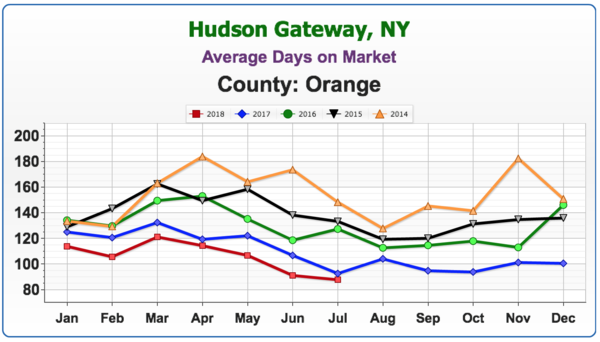

This number continues to decline, another sign that this market is hot.

Housing Market Update – Sussex County, NJ

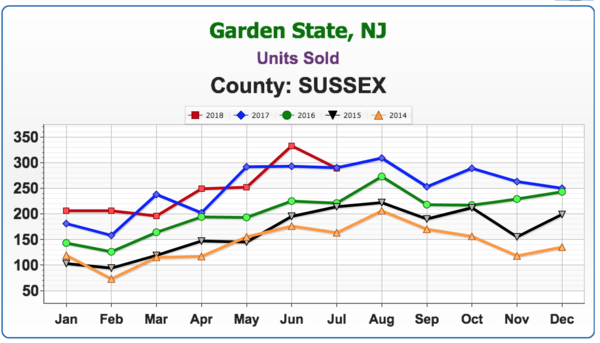

The stats are showing a fluctuation in the number of units sold in Sussex County. It’s a mixed bag – some months below, some months above. No definitive trend has emerged.

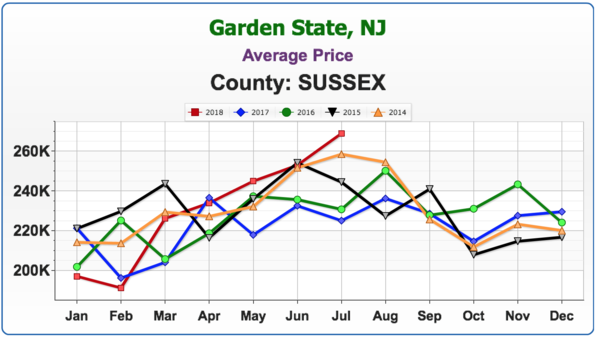

Not quite the lift-off that’s occurring in Orange County, but after the first two months of 2018, there is a definite rise in average price and July is at the highest point of the last five years.

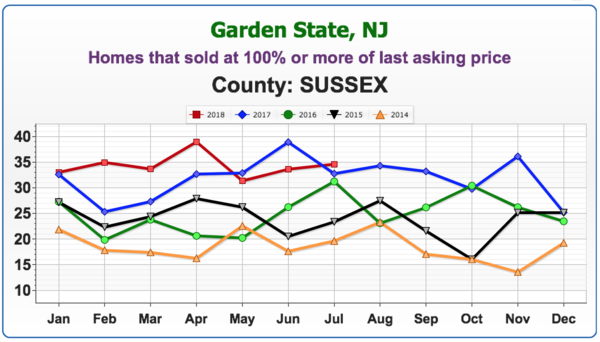

While not quite as high as Orange County, between 30 to 40% of homes are selling at 100% or more of last asking price.

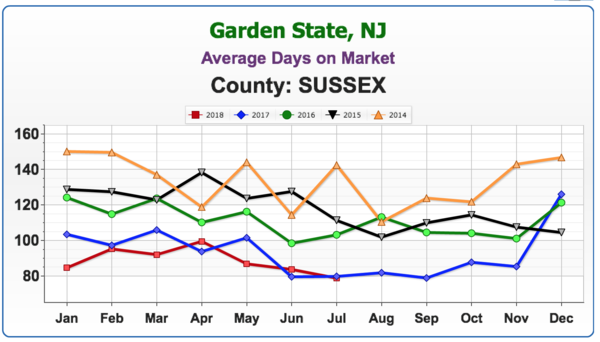

We’re seeing a similar trend to New York, with homes selling at around the 90-day mark.

Keren Goren – A Sales Associate’s Perspective on the Market

Geoff asked Keren Goren, one of Green Team’s top producers, for her thoughts on the current market. Licensed in both New York and New Jersey, Keren finds that there are many prospective buyers for both Orange and Sussex Counties. Lots of bidding wars are going on.

She does feel that some of the flippers in the area are doing less and asking for more. This appears to be a new trend. Keren recalled that flippers used to do a much better job, but many houses on the market now are unfinished and are scaring buyers away as opposed to inviting bids. Therefore, some outdated homes are actually selling for prices higher than they should or would have a few months ago.

Keren sees no sign of the market slowing down. However, she is seeing delays in closings due to issues with some mortgage companies, and with buyers making poor decisions with their finances. Keren did note that her experiences with Family First were extremely positive, and she highly recommended them.

Geoff noted that the current market upturn stands a chance at longevity. Following the downturn, as deep and as long it was, people weren’t moving. Banks have since cleaned up their balance sheets, tightened programs up, and are making money. There are fewer defaults happening. Basically, everything depends on how much money the banks are willing to lend.

PJ Keelin – A Lender’s Perspective

The mortgage industry is doing well, offering a lot more first-time homebuyer programs with as little as 3% down, USDA becoming very popular in Orange and Sussex County areas. Also trending is loosening up a bit and coming up with more portfolio loan products, personal products and using common-sense underwriting and ability to fund when looking at today’s borrowers.

With homes in the $200,000 to $300,000 price range becoming few and far between, they are looking at different programs, such as adjustable rates, less money down, and interest only type payments. However, in these cases, information and education should be given to borrowers upfront. It’s necessary to prepare the borrower for everything that will come together throughout the process. It’s extremely important for borrowers to be aware of what they are getting into with these products and understand how they work.

Geoff noted that with the last downturn, banks were not requiring people to have much “skin in the game.” Zero down, lying about income, jamming loans through. Geoff asked if PJ was seeing any of those practices coming back, or if there remains more oversight. scrutinizing income and the buyer’s comprehensive financial situation, down payments, etc. before loans are going out.

PJ replied that FANNIE and FREDDIE are doing a great job operating more with common sense with people who can have a little more risk, etc. They are requiring more skin in the game. Banks are protecting themselves and borrowers by not letting people put themselves under water.

Where are mortgage rates headed?

Geoff noted that the Fed has been raising short-term interest rates and will probably continue to do so to stifle inflation. He asked PJ where he saw mortgage rates landing over the next 12 to 18 months. PJ answered that he believes rates will be consistently in the 5’s through most programs. The market is being built into where those rates are and is slowly trending. Supply and demand are balancing each other out. Geoff feels that if you buy now, the value of your home won’t drop out like it did 12, 14 years ago. Pricing levels appear to be realistic and should hold for some time in the future. Buyers want to know if the asset they’re buying will be worth at least as much or more than they’re paying now. Even though it is a seller’s market, Geoff and PJ concurred that it is a good time to buy.

Furthermore, PJ stated that appraisers are not allowing appraisal inflation to come above where the market truly should be. It’s better for appraisers to be a little tight because that will keep the longevity of this strong market going on for 12, 18, 24 months. Geoff replied that appraisals have been challenging over the last 3 years. Prior to the upturn, prices were a mixed bag, leaving appraisers unwilling to take a chance as they couldn’t see where the market was going. However, he noted that now some appraisers are more willing to take a chance and make an allowance because of the steady upward-trending market, even though there might not be a comp that can exactly substantiate it. There are fewer appraiser issues, though there are still times when they won’t go along with the offering price. This hurts the seller but protects the buyer. And it’s another way of controlling the market.

Jeff Lobb – A Marketing Expert’s Perspective

Geoff asked Jeff for his views on the future of service providers in the real estate industry in this age of technology. Are realtors going to be the next victims of business models like Amazon? Will technology replace realtors just as retail stores (like ToysRUs) and their employees have been replaced?

Jeff’s view? While buzzwords like “disruption” do sell media, there are things happening at higher levels. However, the real estate agent is not going away anytime soon for one simple reason. There are too many moving parts to a transaction, and emotion is one of those. Technology has not reached the stage where it can handle all these parts.

Disruption occurs with more brands trying to change the way we are doing business, making it faster, more tech, or more niche. New companies are coming into play. Compass, Redfin models, Purple Bricks. And new people are coming into the space trying to change and elevate what we do. At the same time. the industry has seen some large teams leave major brands, saying they can do things better by themselves, without the big brand box.

Taking care of business…

One way to keep track of business is to every day look at local inventory. If there are 500 listings, see how many of those you got. If it’s only 2, there is a lot to be done. The business is a marathon; it’s a competitive race, but not many have enough drive to do the hard work that’s needed. To say the business is slow is not valid. Every day more homes come on the market and more get sold. Someone is getting those listings. And that is where the challenge comes in. It’s about doing the day-to-day work. All the technology that is available can make us work faster and smarter, but we still have to do the work.

Philosophically speaking…

Geoff has a broader perspective as to where realtors stand and what the future holds. As an example, despite all the tools available online there are more travel agents now than in the year 2000. It takes time to do all the research, etc., and many people are finding it more desirable to hire someone to do that work for them.

There has been an explosion of information and technology, but at the end of the day, it’s time. Do most people want to spend the amount of time it takes to properly sell their house or negotiate to buy a home? Most people prefer to hire a real estate professional to handle all the parts of the puzzle. In addition, Geoff believes the housing market is important to the overall US and global economy. The economy is revving. largely because of the housing market healing and coming back. And real estate agents are critical to the health of the economy.

Jeff added, “Will Amazon and Facebook get into the real estate marketplace? Probably!” The big picture is that some companies are coming in trying to acquire agents and market share. Others are trying to change the way technology is driven. However, you still need the people to execute the transactions and deal with the emotional process of a sale.

Geoff’s final analysis? We, humans, are complicated beings, and it takes a human to navigate this process of buying a home. And after much consideration, we should continue to invest in real estate agents and our industry because we’re needed and timeless.

Visit our website, greenteamhq.com/HMU to register for our next Webinar on Tuesday, September 18 at 2 pm. You can also view previous webinars videos and access other recaps like this.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link