August 2019 Housing Market Update

Geoff Green, President of Green Team Realty, welcomed viewers to the August 2019 Housing Market Update. It was held on Tuesday, August 20 at 2 p.m. on Facebook Live.

National Housing Market Statistics

Recession? So what’s the story?

We’ve all keep hearing the word, and the questions… Is it going to happen? Is it not going to happen? In Geoff’s view, that’s always up for debate. We know that at some point it is going to happen. Maybe not right now. However, the question is does a recession lead to a housing crisis?

Based on what he has been hearing from industry experts, Geoff believes that a recession will not lead to a housing crisis. Rather, it appears that the market is normalizing. Over the past three years we’ve been experiencing a super hot seller’s market. Things have been going very quickly. It has not been a normal market, where homes take longer to sell, Prices aren’t dramatically increasing. Things are a little more where we’re headed. Although right now we’re rather hot, looking at numbers and seeing into the future, Geoff does think that things are cooling and we headed towards that more normalized market.

Contrary to the hand-wringing, the U.S. housing market is in fact normalizing, and that is mostly a positive development for the American economy.

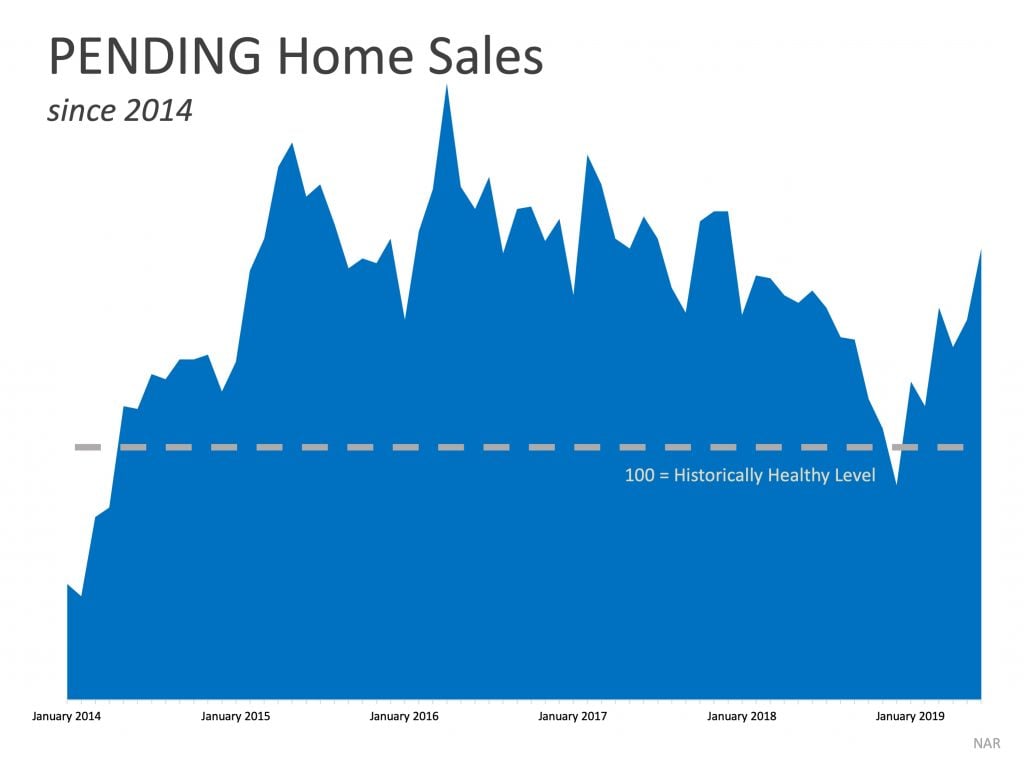

Pending Home Sales

This graphic shows pending home sales on a national basis since 2014. It shows the trends, the ups, and downs, including seasonal fluctuations. Usually, we peak in the 2nd and 3rd quarters of each year, which is where we are right now. However, you can see how low we got nationally as opposed to the last 3 or 4 years. Again, this shows that the number of units selling throughout the country is definitely slowing down.

Pending home sales – which represent signed contracts on existing homes, and are therefore considered a leading indicator – have advanced to their best level since mid-2017. New-home sales, also representing signed contracts, have been bumpy in recent months but have climbed about 15% so far this year.

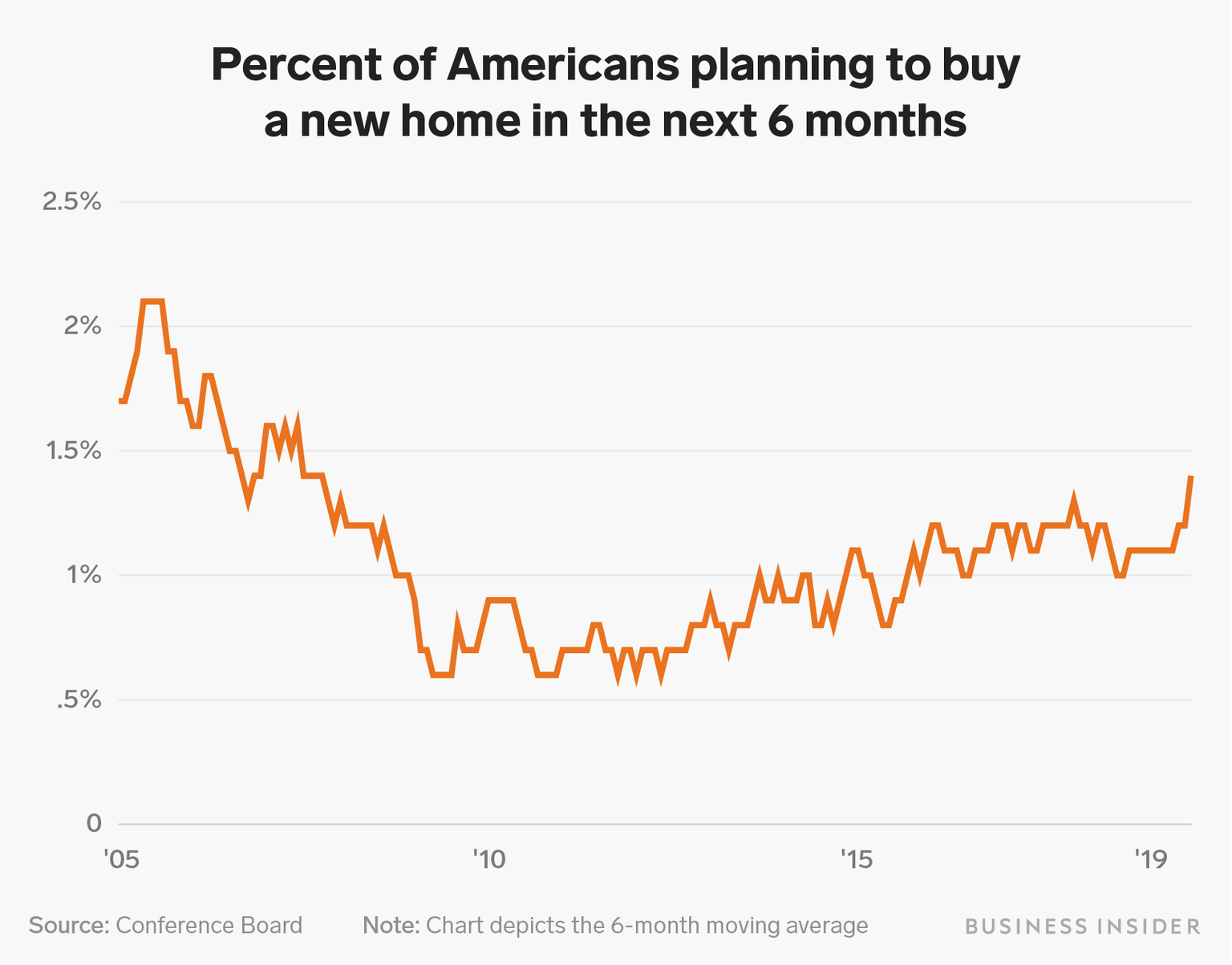

Are Americans planning to buy new homes?

This not-for-profit organization put together this survey on the percentage of Americans planning on buying a new home in the next six months. What they discovered? Americans are quite bullish on buying homes. In fact, more people are considering buying a home than we saw in 2006, 2007, 2008…

With the numbers gradually increasing, home ownership is still on the forefront of peoples’ minds.

According to the Conference Board, buying intentions for new homes have exploded to levels not seen since before the financial crisis.

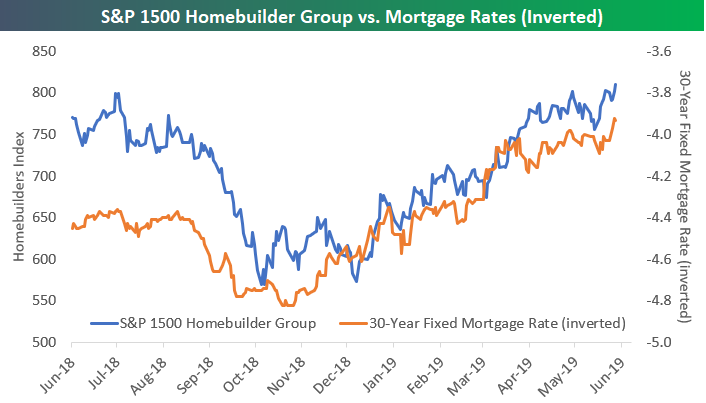

The S&P Homebuilder Group

This consolidated group of stocks were compared from June 2018 to June 2019 (in blue). The 30 year fixed year interest rate is in orange. You can see there is a consistent relation with one another. However, even though rates are still low, confidence in gaining in the stocks in the Homebuilder group. It appears that Wall Street is still seeing opportunity for growth and profit in this sector.

The S&P 1500 Homebuilder group has rallied 35% in 2019 to a new 52-week closing high in mid-June.

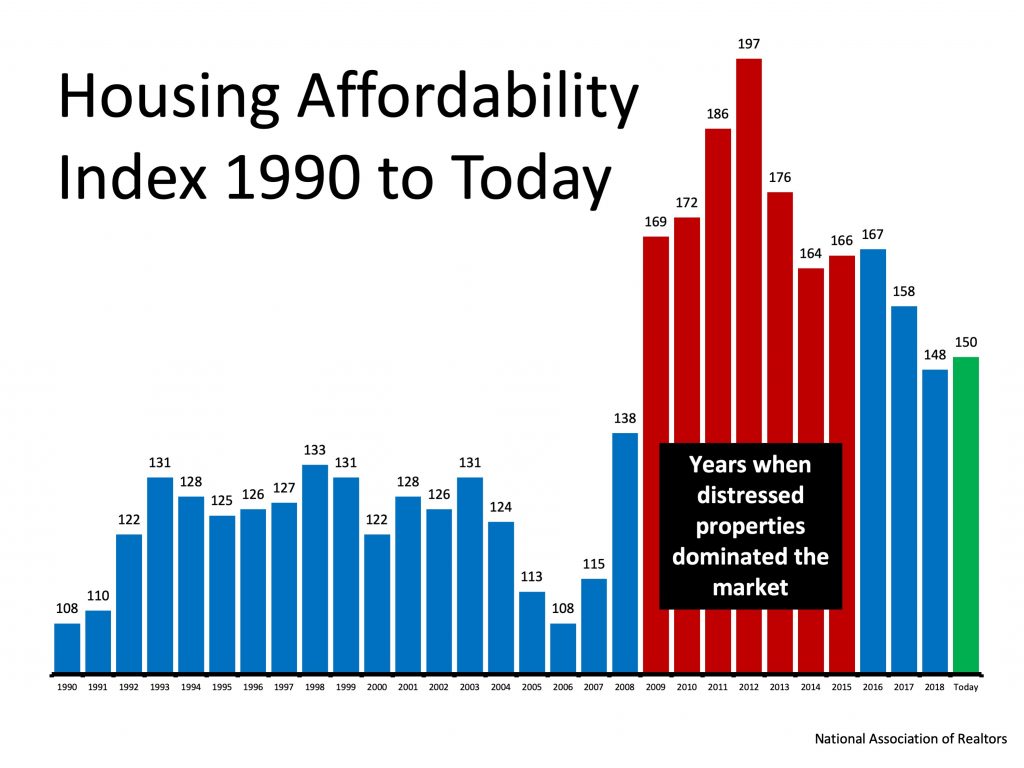

Housing Affordability Index

This chart shows housing affordability from 1999 to 2019. Historically, at least since 2008, 2009, we were at a low level. Homes are very affordable in terms of what people are able to generate in income through their occupations. Although prices have been rising, it’s still a relatively affordable market, and much of that is due to interest rates

The higher the graph, the more affordable homes are.

It’s more affordable than the normal markets that preceded the Boom and Crash.

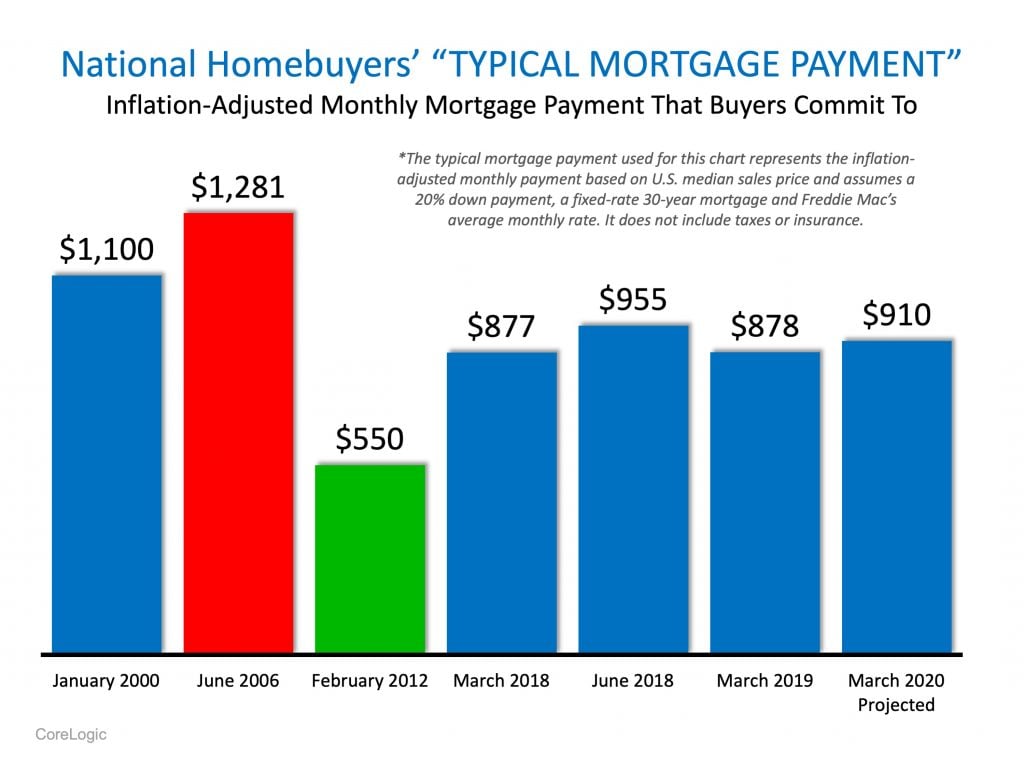

Typical Mortgage Payment

In January 2000, the typical mortgage payment was $1,100 because rates were significantly higher.. Now the typical mortgage payment is $910. Prices nationally are at a much higher level. However people are able to buy people are able to borrow at a lower rate, so their payments are less. Most people in the world have to deal with here and now. “I have to pay my mortgage this month, I have to get my child into camp this month. I’ve got to make college payments this month.” It’s hard for people to look out further than a month or two or three in advance. So this monthly analytic is very important.

Adjusted for inflation, today’s typical mortgage payment is less than what it was prior to the boom in January 2000.

Part of the reason is wages are up and Interest Rates are still statically low.

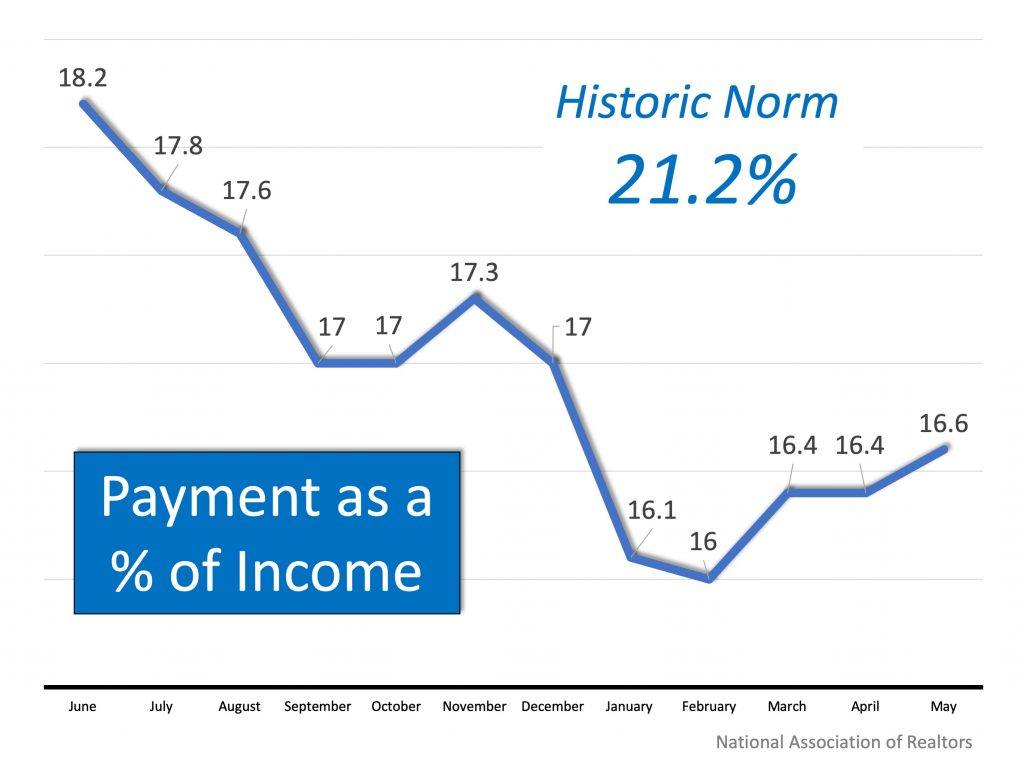

Payment as a Percentage of Income

Per Geoff, there is an old adage in real estate which says, “You name the price, I’ll name the terms!” You want $500,000 for your property? Well, if you are willing to give it to me at a low enough interest rate with a really long amortization term, it will cost me hardly anything to carry on a monthly basis. I can acquire the property, rent it out and achieve much more income that needed to service the debt.

Real Estate is an asset that can be leveraged and therefore the rate at which leverage can be gained is very important. The drop in rates is very significant to this market and where it is headed. If we were in a rising rate atmosphere we would be having a very different conversation.

According to Mark Fleming, First American’s Chief Economist: The difference between buying a home versus other goods is that we buy them with a mortgage. So, it’s not the actual price that matters, but the price relative to the purchasing power.”

Local Housing Market Statistics

Orange County, New York

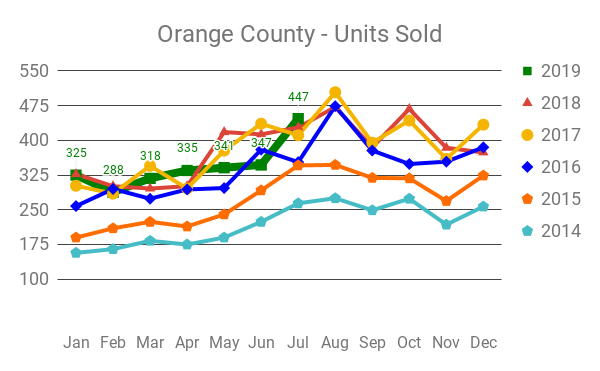

We’re starting to see an upturn in number of units sold in Orange County. July was the best month we’ve seen in a long time. We had been lagging for a while but

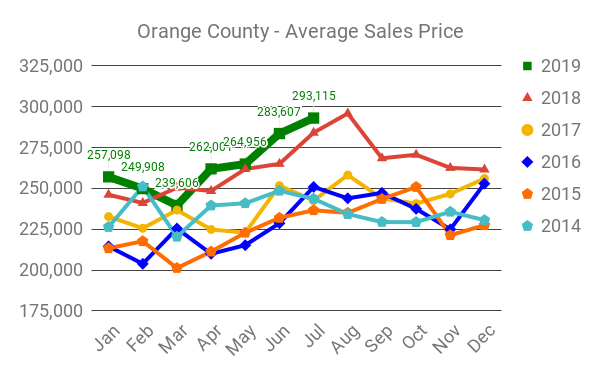

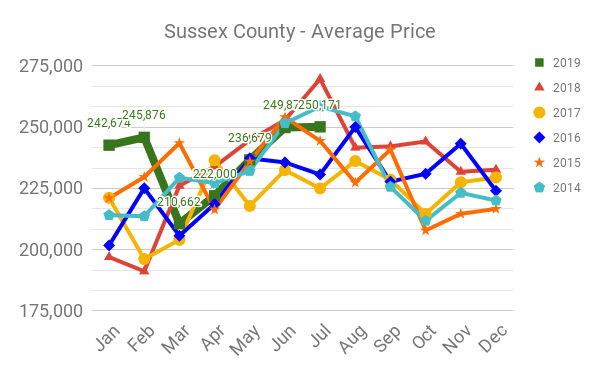

Average sales price continues to increase in Orange County. There had been a cooling-off period for awhile, but over the last three months there has been a steady increase. 2018 showed a definite increase over prior years, and 2019 shows signs of continuing the upward trend.

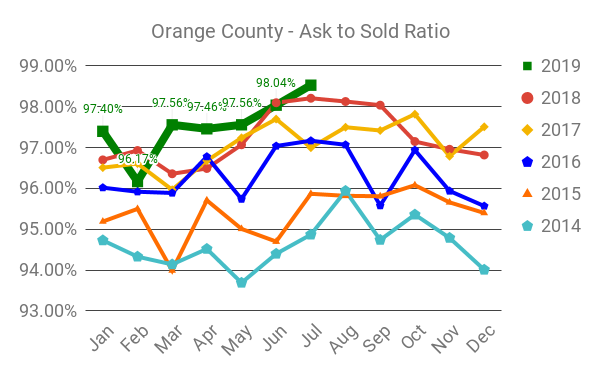

The last asking price versus what homes sold at. 98.53% means Seller are only negotiating 1.47 percent off of their asking price. If you are a Seller whose home is on the market and you’re not getting offers, note that this is the last asking price, not the initial. The key is to having a good, competitive asking price. You can’t put your house out there at just any price and expect these kinds of numbers. However, if a home is priced right, you may hit this ratio.

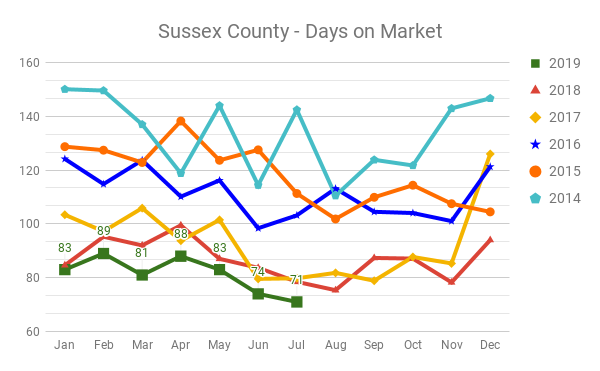

Sussex County, New Jersey

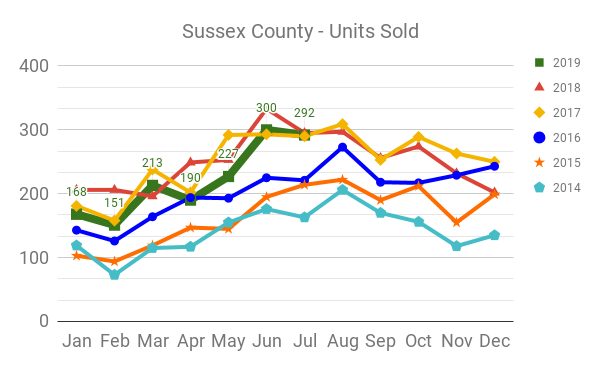

Over the course of a few years we’ve been watching the comparison of the housing market in Sussex County, NY versus Orange County, NY. The numbers are consistently a little lower in Sussex than what we’re seeing in Orange. This is a pretty consistent down trend over 2018 and 2017 and hasn’t gotten above 2018 except for March of this year.

While Geoff does not see this as a steeply declining market, he does think that prices are softening.

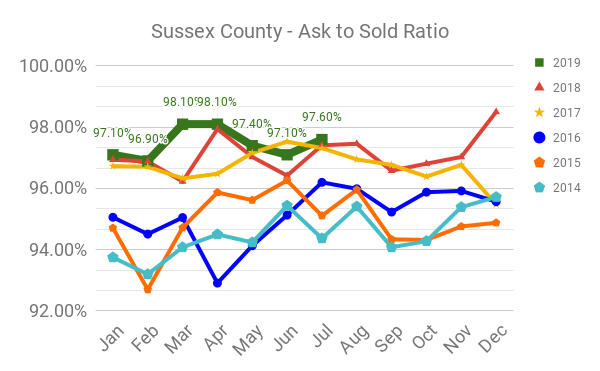

This is a very strong number. While not quite as high as Orange County, it is still a very good number. Only 2.4 percentage points off the asking price, much better than it was a few years ago.

Things are definitely moving in Sussex. There are less days on market than in Orange County. It’s a very robust market in Sussex County.

Thanks to our Webinar Sponsor – REALLY, a real estate referral network for Agents.

REALLY easy referrals are as easy as 1, 2, 3. Enter your referral in 5 minutes or less. REALLY notifies you of all willing Agents. You choose the Agent and legally bind with one tap! The best part is there or no fees on commission exchanges between Agents. Join for free at ReallyHQ.com

Meet our Panel

From left to right, Keren Gonen and Pam Zachowski of Green Team Team New Jersey Realty and Toni Kreusch of Green Team New York Realty.

Geoff opened the discussion to comments from the panelists on the information presented.

Low Interest Rates

Keren Gonen began the conversation by noting that interest rates are so low that a lot more people can qualify for mortgages. When the rates are high, many people just can’t make it on a monthly basis. They can’t afford the house they wanted and pay their other expenses and debts as well. Low interest rates not only allow for buyers to make smarter decisions but also to become eligible for financing. This is also causing low inventory. Even though the market has softened a bit, it’s still a seller’s market. When a good house comes on the market it does not stay there for long. Keren sees bidding wars on a daily basis. She tells clients if they love the house, let’s jump on it. You don’t have to go to asking if the price is ridiculous, but get your foot in the door. The house will not stay. And, when they do not listen, they lose the house.

What is a good house?

Geoff noted that Keren had mentioned “good house.” He went on to describe what he sees as a good house. A house in good condition and well located and there’s a good asking price, it’s going to sell. The old adage is “Location, location, location.” What Keren tells her sellers is to figure out their time line. Do they want to sell right away, or are they willing to let the house sit on the market for a few months? If they want to sell right away, the house needs to be priced to get offers within a week or two. Or do they want to price higher and sit on the market. She leaves the choice to them. Knowing where they stand, what the market is, will help determine what they want to do. Keren believes it is important for agents to educate their sellers and buyers so that they can make the best decisions.

Real Estate – Still a good investment

Pam mentioned she had been listening to Suze Orman in the morning, who was talking about how we were likely going into a recession. However, one thing she pointed out was that real estate was still a good option. She doesn’t anticipate another housing crisis like we had before. She says it’s normalizing and real estate is still a good investment to have. Geoff went on to say that real estate is always a good option. It’s important to make sure you make the right purchase and there’s good logic. If you need a place to live and you’ll be there for at least 3 to 5 years, it doesn’t pay to rent. Even if the market takes a downturn, there are still a lot of advantages to home ownership over renting. He believes that home ownership should be the core of wealth management strategies.

Toni mentioned that for anyone considering buying or selling, home prices are appreciating at a more normal rate right now. And they have been for the last 10 years. With forecasts predicting that with growth continuing at this normal rate and interest rates being low, it is really a great time because you’ll get more money over the life of your loan, and you’ll get more house for your money. Geoff noted that the big takeaway for anyone going to buy a home and planning on living there, you can never really time the market. It’s best to just get in and go for it. Over the course of time your home will appreciate and you will build wealth.

Is low inventory still the major headline for our local markets?

Geoff addressed this question to the panel. Is the lack of inventory a problem for all of the buyers you’re running around, trying to find homes for? Toni agreed that there is a shortage of houses. Geoff asked if it’s mostly the middle range that is so short, or is it the lower or higher end homes that have low inventory? Pam said there is definitely a shortage of homes for investors. She said it is very hard for people to find that house to flip. Also, she feels there are not enough mid-range houses out there. Buyers are looking but just can’t find what they want.

Toni mentioned that first-time home buyers are competing with investors for those lower-end homes. In the higher-priced market, you have the pick of the house. Geoff agreed that the high end has been dragging nationally for some time now. There seems to be a shift in what people want now. They don’t seem to want big homes, higher taxes and big utility bills. People in general are more concerned with smaller footprints. The panelists agreed with Geoff on these points.

Keren mentioned that she is seeing young buyers heading up to Sussex County where they can afford to own a home with a mortgage less than their rent would be in other areas. Geoff agreed. Here in the northern suburbs from New York City there are amazing places to live. It’s a fraction of the cost of living in the City and some of its immediate surrounding areas.

In summary

We’re still in a very strong market. It will be interesting to see what the future holds. Geoff said that many economists are fearful of the possibility of an impending recession within the next 18-24 months. However ,many people feel that the strong housing market is one reason we may not slip into a recession. Even if a recession happens, perhaps the housing market will be okay.

To get in touch with the panelists for your real estate needs:

Keren Gonen – 551-262-4062

Pam Zachowsky – 201-452-0516

Toni Kreusch 845-283-2450

Join us for the next Housing Market Update

September 17th at 2 p.m. Stay informed! Sign up for our Housing Market Updates at: GreenTeamRealty.com/HMU

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link