Recap

Geoffrey Green, President of Green Team Realty, invited viewers to the Sept 2019 Housing Market Update. The update took place on Sept 17, 2019, 2 p.m. on Facebook Live.

National Housing Market Statistics

Recession Worries

According to Geoff, we’re starting to hear the word recession far more than we did a year ago, far more than six months ago. The big buzz is, are we headed to a recession? If so, when? And how dramatic will it be? The bottom line is most people think we won’t be experiencing anything like we went through from 2008 to around 2016.

“The housing crash during the Great Recession left a lasting impression… But as we look ahead to the next recession, it’s important to recognize how unusual the conditions were that caused the last one, and what is different about the housing market today.” Jeff Tucker, the Zillow Economist

Reasons why housing prices and the real estate market should remain strong

- Many people are in a very strong equity position as far as their home goes. That’s the amount of money that is in the value of the home. If you know the fair market value of your home minus the pay off amount of your mortgage, the difference is the equity. Keren Gonen and our Producer, Melissa Bressette, were discussing that over one-third of US households are free and clear of any mortgage. That is a very strong number. From a balance sheet perspective, we’re doing very well as a nation.

- We’ve had good appreciation over the last few years. It continues and most experts agree that despite the market slowing, appreciation is still going to be something that will continue for the next 12 months at least. The question is really by how much.

- Inventory levels are still relatively low. Days on market are low, bidding wars are still happening.

- Mortgage and interest rates are fantastic. Geoff thinks that if you had asked a lot of mortgage professionals a year ago where rates would be now, they would not have predicted how low rates would be. The low rate environment is continuing to fuel the real estate market.

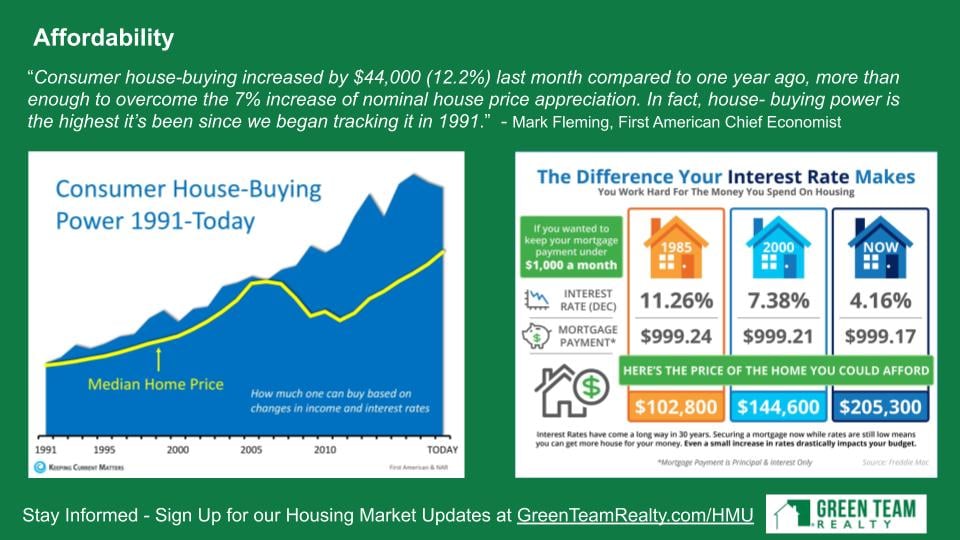

- There is a level of affordability we haven’t seen in a long time. When you package everything together; earnings, mortgage rates, taxes, prices of homes, etc.you get affordability rates that are historically high. That is, how affordable it is for the average American to buy a home.

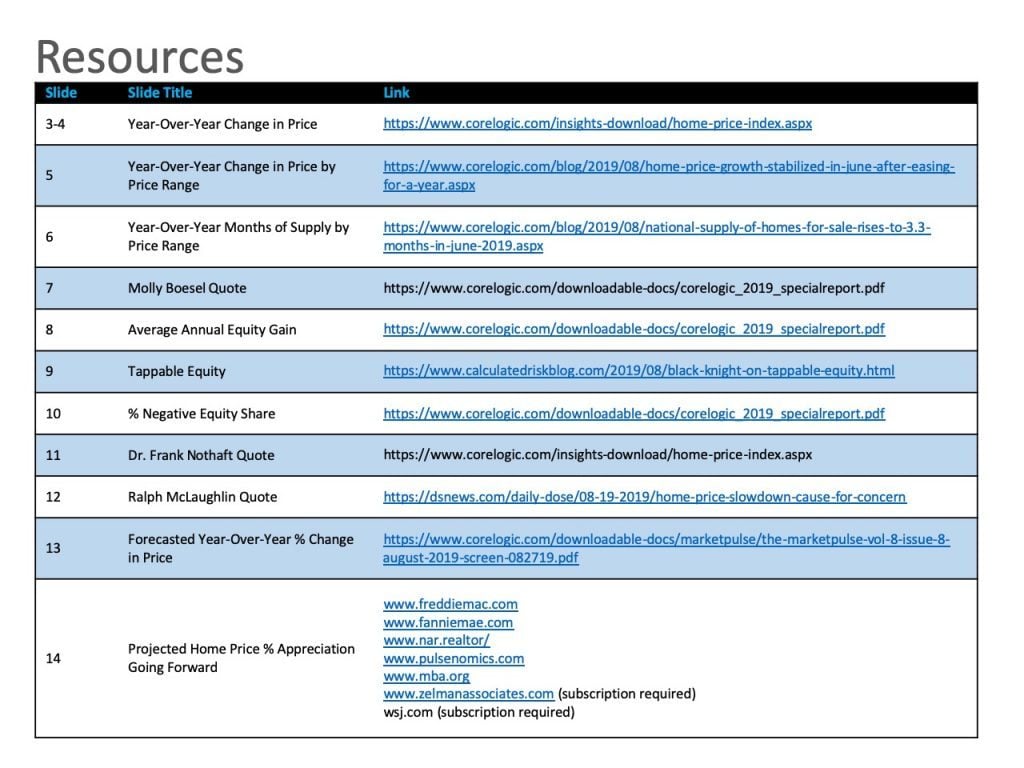

Equity

Here we’re seeing year over year appreciation growth. It is still very strong. Still where it was a couple of years ago. Percent of negative equity share refers to who is in negative equity situation. That occurs when the mortgage payoff is higher than the fair market value of the home. That has been steadily declining since 2010 and we are now at the lowest level since then. Those are very good signs.

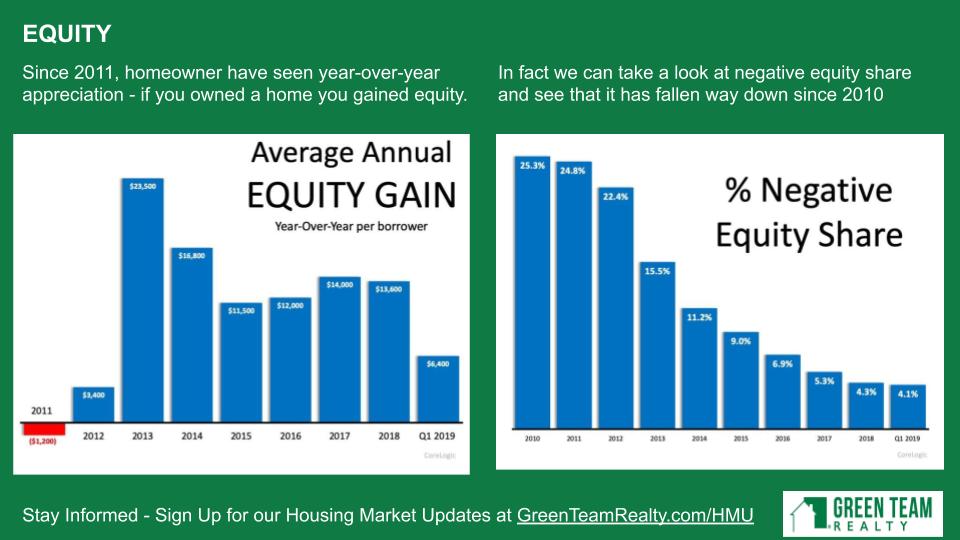

Appreciation

A quick glance at the map of the U.S. on the left side shows nothing is below “0” and everything is still appreciating. Then we review the right side, which examines year-over-year change in price by price range. All price points are in grey. Lower end homes have a bigger market, more demand, which drives up price. However, even the high range homes are experiencing appreciation.

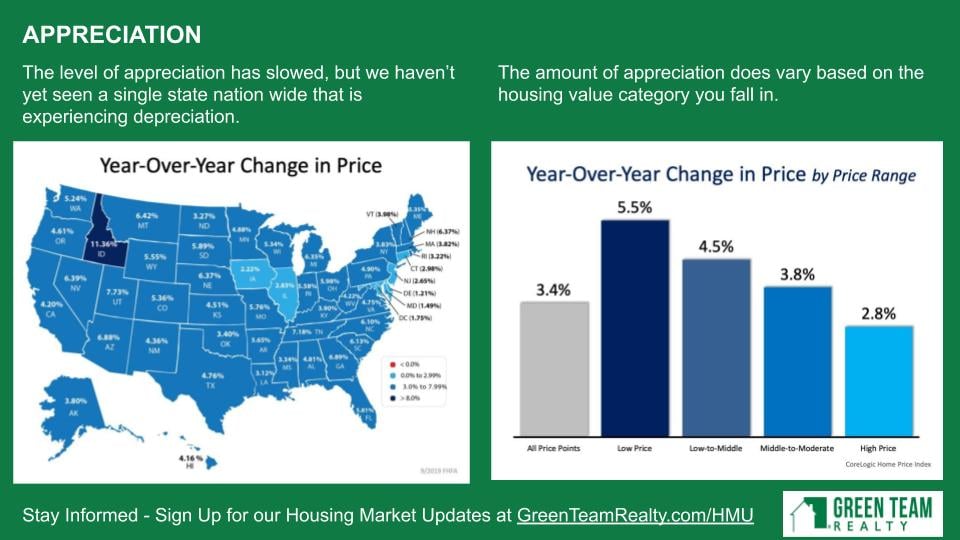

Pricing

Corelogic,a leading provider of statistical data on the housing market is projecting, per the above map, that over the next 12 months the nation will go up another 5.2%. That is a very healthy rate of appreciation. In addition, some other sources, shown here on the right, are predicting a fairly substantial level of appreciation, even into 2021.

Inventory

Historically, left to right, we are still at a very low level of inventory, which means that pricing should continue to increase. or stay strong year over year. Year-over-year inventory levels, we’ve had a bump at the end of 2018, beginning of 2019. Now we can see inventory starting to tighten up again a little.

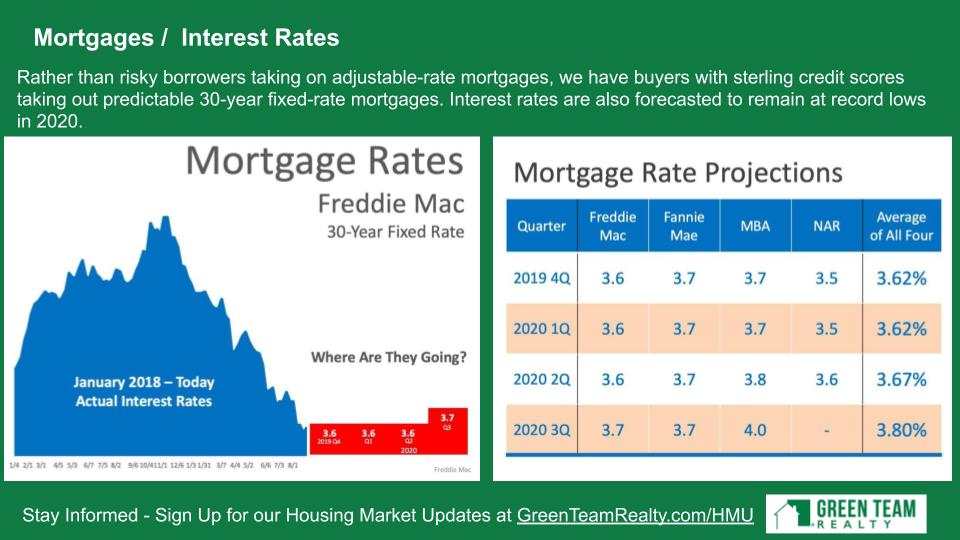

Mortgages/Interest Rates

Where are they headed? Where are they now? We can see from January 2018 to today the rates that could not have been predicted a few years ago to be so low. And we recognize that this is a good spot that we’re in.

Affordability

On the graph to the left, the yellow line represents median home price while the blue represents purchasing power. It’s evident that there is much less of a variance between the two up to 2005, which was the worst period of time. But we’ve stayed strong. During the crash, home prices went down while affordability went up. And it hasn’t really changed. There is still ta good opportunity for people to secure one of the most important assets they ever will own – a home.

Historical Recession Data

Geoff agrees with everyone who believes that this recession will be much shorter than the last one. The housing market is in a better position. We have better fundamentals in place than we did the last time around. There is not nearly as much sub-prime lending as there was. Of the last five recessions, home prices went down in just two. Home prices went up in the other three.

Having gone through the last recession, it can be hard to believe that prices can actually rise. But maybe this one will go that way as well.

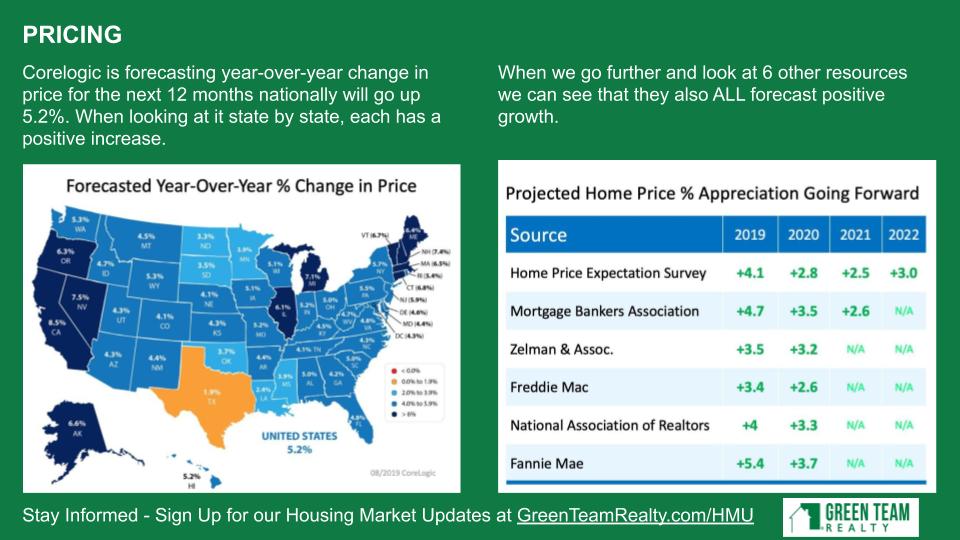

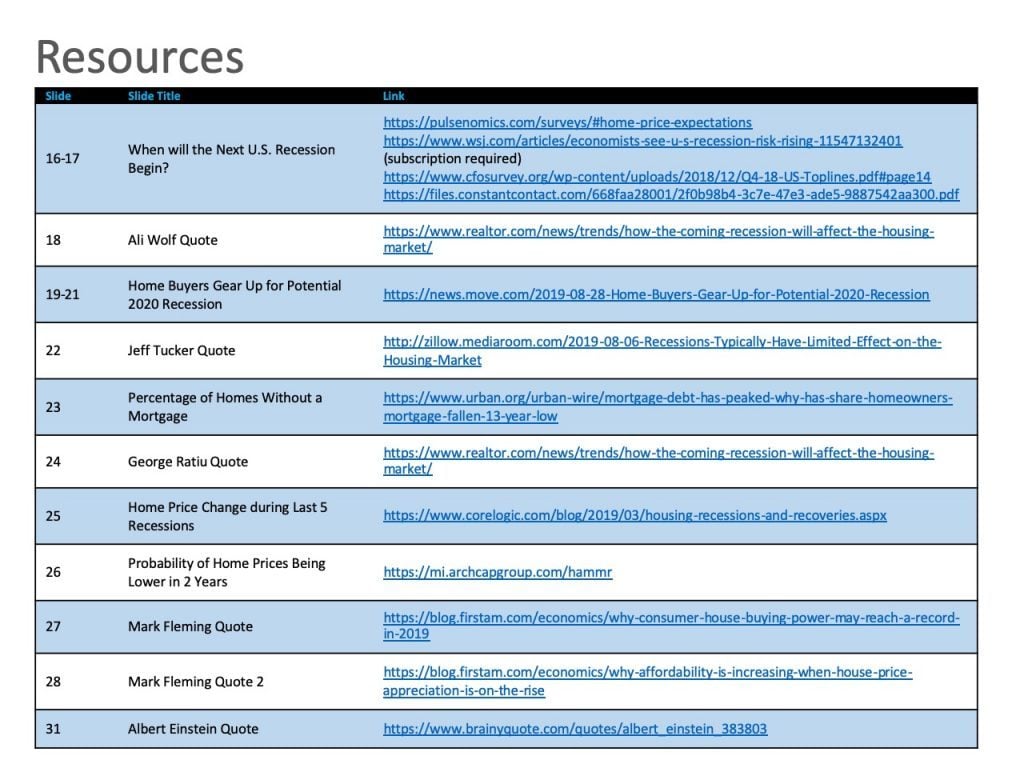

Resource Center

Each month we bring you stats, data and quotes from various trusted industry sources. These resources will now be available to you in our monthly Housing Market Update recap blog post, which can be accessed from GreenTeamRealty.com/hmu/ under Housing Market Recap.

Local Housing Market Updates

Orange County, New York

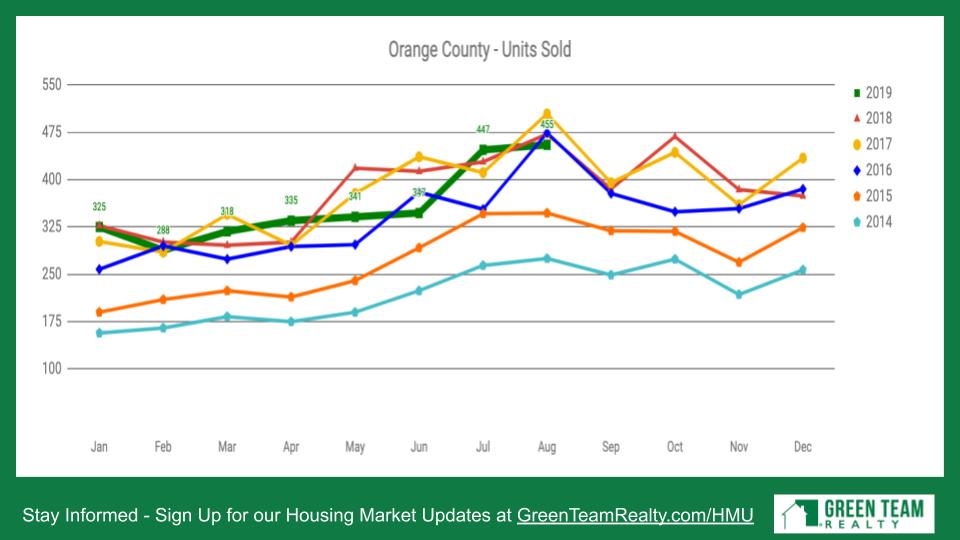

Units Sold

It’s been a mixed bag this year. The green line is 2019. It’s fair to say the number of units sold is consistent with 2018. We’re definitely seeing a slowing in the number of transactions. But, it’s still a very high historical level. And it’s still a very strong market. So, yes, it’s cooling, but it’s still a very high rate.

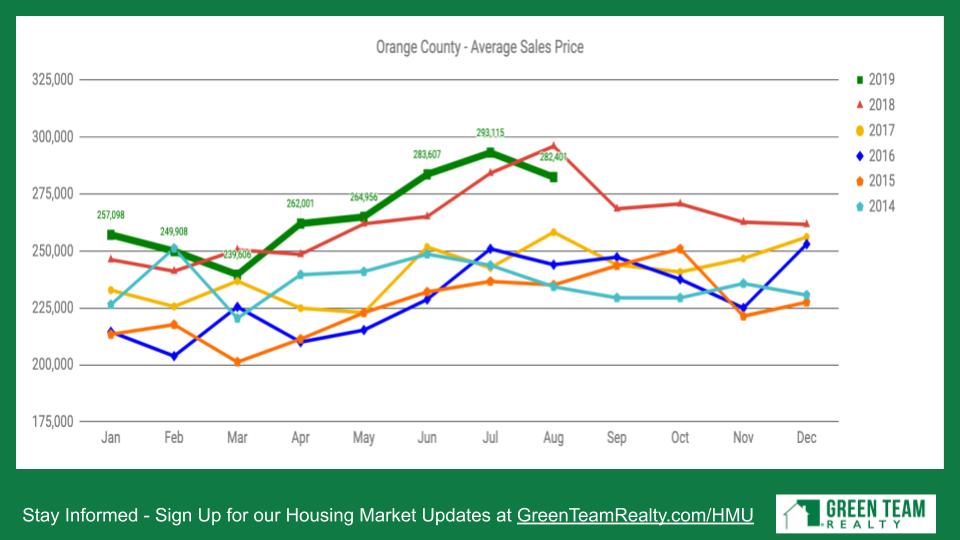

Average Sales Price

The average sales price took a little dip this month.That doesn’t mean that prices will ultimately continue to go down year-over-year over 2018. However, units sold has been slowing. Geoff believes we’ll see a softening of the market, rather than a crash.

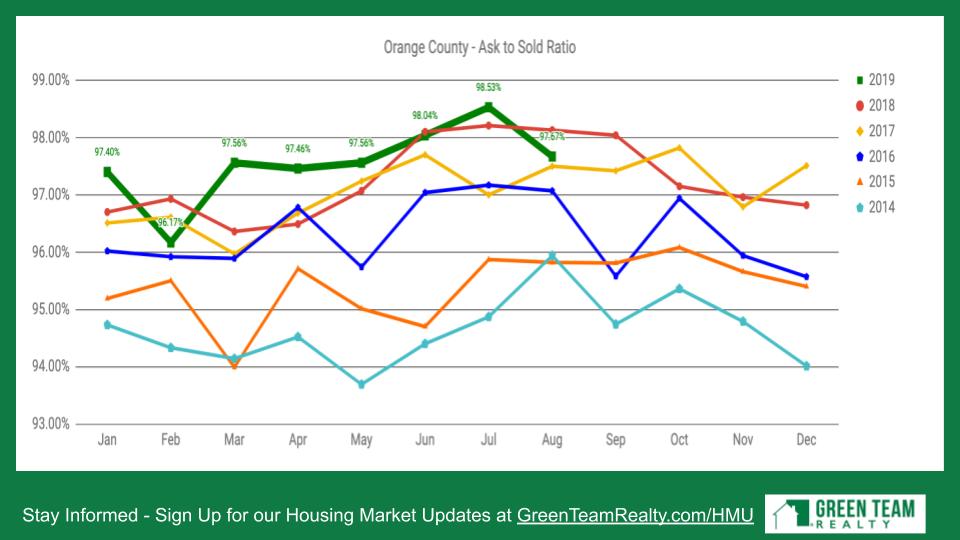

Ask to Sold Ratio

The last asking price versus what the house sold for and the ratio thereof. As you an see, this year it’s been high, meaning sellers haven’t had to negotiate much off of their asking price. However, recently we’re seeing a dip, which is worth noting.

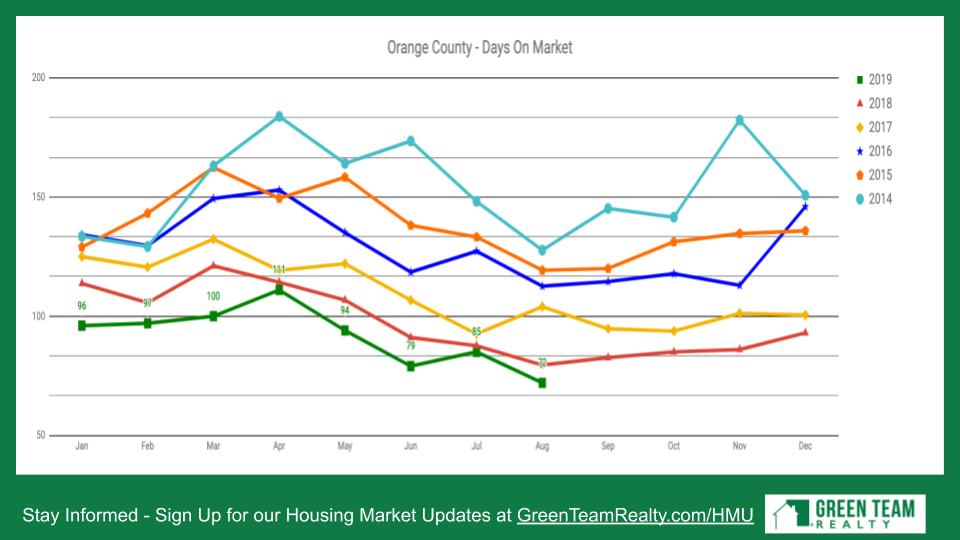

Days on Market

The days on market have consistently been lower than the previous 6 years, remaining a strong factor in the market.

Sussex County, New Jersey

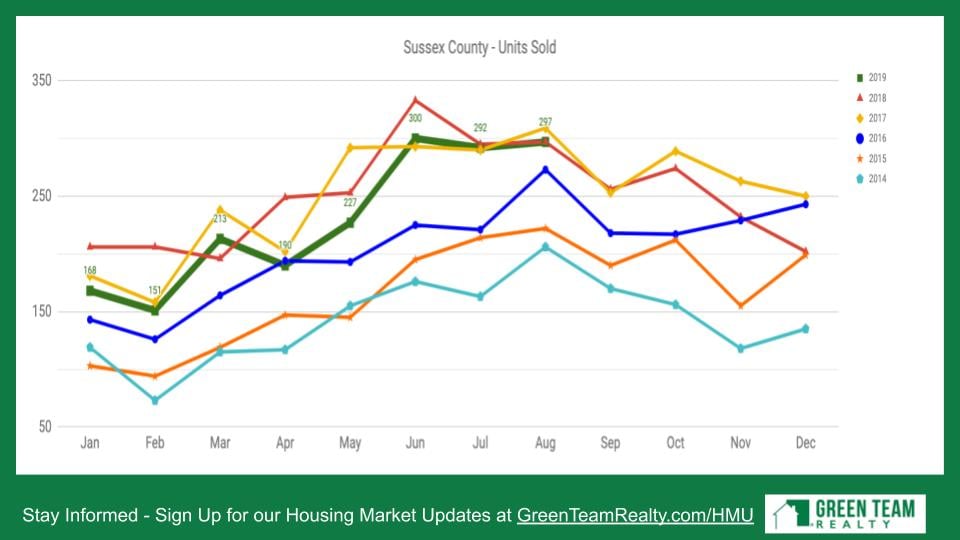

Units sold

There is a similar situation here in Sussex County; a mixed bag, up and down. However, it’s clear that in the last 18 months or so, the number of units sold has been slowing.

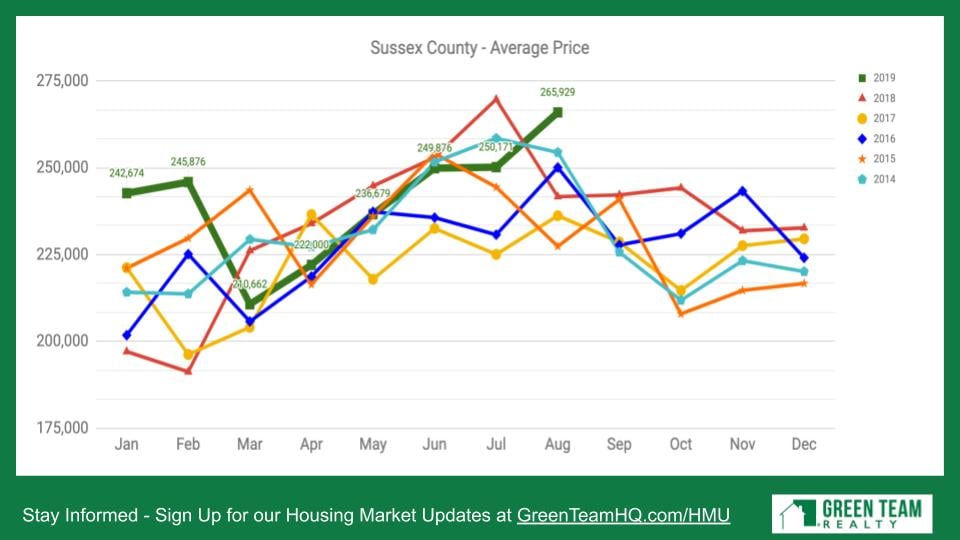

Average Price

It’s interesting that all through this time period average price in Sussex was kind of languishing. And now we see prices taking off,. almost the highest level of prices in the county in almost 8 years. Only July of 2018 was slightly higher.

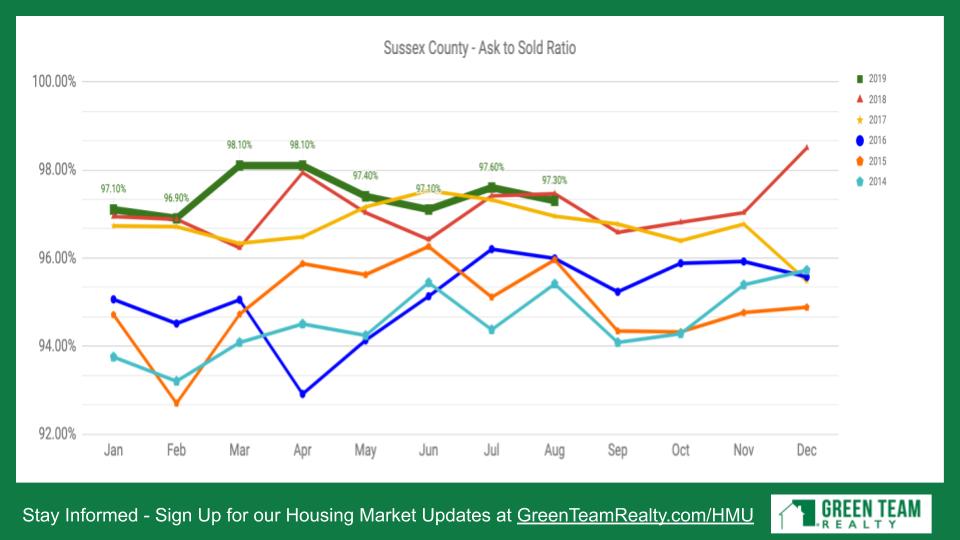

Ask to Sold Ratio

The ask to sold ratio is again similar to what we’re seeing in Orange County. at 97, 98%, it’s still a strong market with sellers only having to come down a little bit off their asking price.

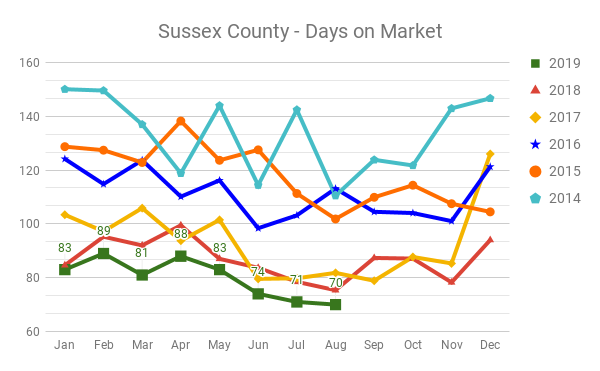

Days on Market

Days on market are lowest over last 6 years. The market continues to be strong. Further discussion will take place with our panel.

Thank you to our sponsor

Meet our Panel

Keren Gonen is from Green Team New Jersey Realty and is a regular panelist on our Housing Market Updates.

Geoff asked Keren what’s actually happening in the field; if there are signs of the market taking a downturn.

Keren stated that it’s important to note that there are still people buying. still people selling, and there are still bidding wars due to low inventory. On both sides of the border we’re dealing with a lack of good houses. Now that it’s so easy and affordable to buy a good home, it’s really a question of inventory. Some sellers are on the fence, waiting to hear what will happen in 2020. Agents and Sellers would like more inventory to choose from. However, if agents educate their sellers we’ll see a lot more houses on the market in the coming months.

Geoff asked if Keren has found buyers becoming more picky as time goes on. Keren replied that it’s the opposite; Buyers are rushing to put in offers on the houses that they like. She said we want to make sure that good houses on the market do sell quickly, because that makes everyone look good. Whether it’s the listing agent or selling agent, everyone does better in that type of a market.

From the Seller’s perspective, Geoff asked if Keren agreed that we’re not in a market where they can list at any price and sell. Keren stated that surprisingly all the listings she’s had have either come in on point asking price or a few thousand dollars above asking price due to bidding wars. In addition, they’re going under contract very quickly. Attorneys are moving them along, with attorney review much faster than earlier in the year and last year. She had one listing got out of attorney review in literally 48 hours, which was a first for Keren.

Pricing

Geoff said he was sure that Keren was choosing comparables carefully to make sure the information is accurate and she’s setting a good asking price. She replied, absolutely. That’s the first thing – Listing Agent 101. You want to make sure you do your comps properly so that you don’t sit on the market. Geoff stated that ‘s the message to all Sellers. The hardest conversation to have as realtors is price reduction. It’s kind of like having mud on your face. We’re the ones who bring in the comps, make recommendations on what we feel the fair market is for their home, Many Sellers don’t listen and just want to list at the price they want. But many people do listen. However, sometimes a price reduction is necessary. However, no matter what market you’re in, you have to price it right.

Keren said one of the things she does with all of her Sellers is ask them what their time line is for selling their home. Meaning, are we okay to sit on the market for 3, 4, 5, 6 months? Or are we looking to get an offer within the next month to 2 months. Then, according to what they tell her that’s where she prices the house. She has had clients that tell her they don’t care when they move, the house is paid off and they’re not in a rush. And they want a specific amount for their house. So Keren tells them that’s okay as long as they understand that according to her market analysis, they won’t sell until we reach this price. As long as they understand that, she’s fine with listing it at that price. Ultimately it’s always the Seller’s decision.

The recommendation

Price it right from the beginning. Price it to sell from the get go. You’re likely to get a higher price. There is never a better time to sell your home than when you first list it. It’s new, there are buyers out there waiting for the next house to come out on the market. They’ve been out there looking and haven’t found what they’re looking for yet. Now your home is new and it’s on the market.

Bank Inventory

Geoff asked Keren what she is seeing as far as bank-owned inventory. He considers Keren to be a leading expert in Sussex County on the subject. Keren stated that they are not seeing too much being released by the banks. Whatever was out there was sold. She hasn’t seen anything new that’s affordable for an investor or flipper or someone who wants to take on renovations on their own. It has been quite a few weeks since she’s seen those. She has seen some that are borderline, with a few things missing, but those are priced too high. There really isn’t any new release of inventory from them.

Geoff then asked if Keren is still seeing bank-owned properties continue to be rented, an anomaly that we’re seeing over the last 5-6 years. As far as Keren knows, they are, remarking that it seems banks now want to be landlords as well. Geoff mentioned some clients who rented a bank-owned property and once they got in there was problem after problem. It was discovered that there was a lot of substandard that had been done. Caution people buying inventory to make sure that the renovations have been done correctly. The flips that Keren has seen by banks are usually bid out to the lowest bidder and that reflects in the workmanship.People can get caught up in the moment; the price seems right. And they may think they’re getting a better deal because the property is bank-owned.

Wrapping it up

Geoff has been in the real estate industry for going on 15 years. He has worked a lot of hours every week during those years and developed a great appreciation for agents like Keren, working in the field.The housing market in this country would not be what it is without the hardworking agents. They keep data accurate, make sure clients needs are met. Other market places around the world are not nearly as well run as they are here. We are getting into an age where it may be possible to just buy a home from Zillow offers, etc. However, the expertise, knowledge and support offered by real estate agents cannot be duplicated. Geoff’s final word… Find a Realtor!

Keren Gonen can be reached at: 551-262-4062.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link