[et_pb_section admin_label=”section”]

[et_pb_row admin_label=”row”]

[et_pb_column type=”4_4″][et_pb_text admin_label=”Text”]

Green Team Realty’s March 2019 Housing Market Update was presented live on Facebook Tuesday, March 19 at 2 p.m. If you were unable to view the webinar live, you can watch at your convenience by clicking here. Sign up for future updates here.

Geoff Green, President of Green Team Realty, gave a breakdown of both national and local statistics:

National Statistics

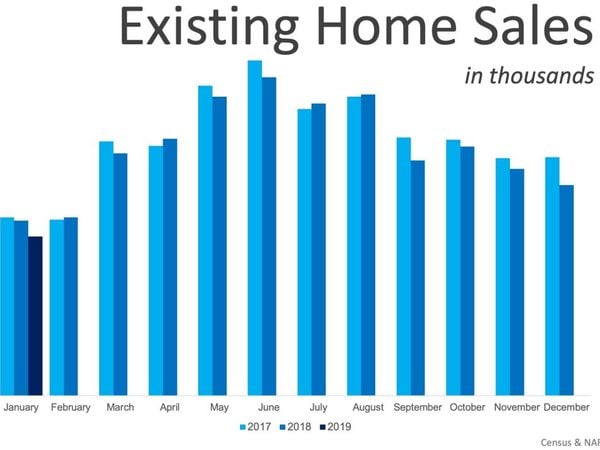

This is a 3-year comparison, 2017-2019. The later the year, the darker the color. January shows a decline in 2018 and 2019. In August, things started to turn in year over year increases.

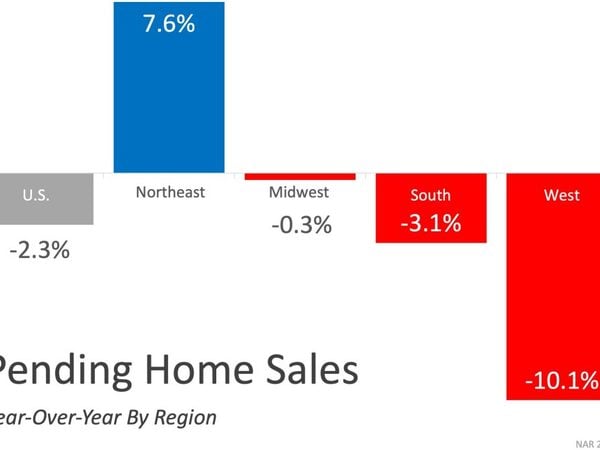

The Northeast is still chugging along, though usually the northeast market lags. However, on the whole, pending home sales are down, region by region.

As far as pricing goes, this is a composite of the top 20 cities in the US. Over the last 10 months and pricing is steadily decreasing. However, it’s more of a soft landing. There is nothing indicative of a “crash.” Historical norms are around 3.6% and we’re around that mark, with 4.2%.

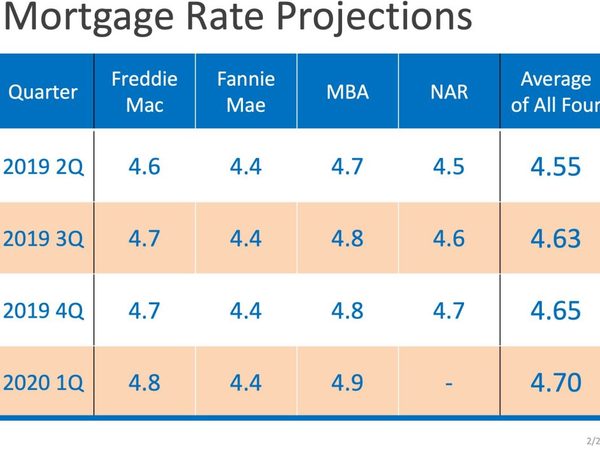

On the mortgage side, here is an average of four entities making projections of where rates will be in 2019. They are projecting that rates will continue to increase, below 5%. Geoff feels this is historically a very low rate. While some in the mortgage industry are projecting a decline in refinancing, money for the resale and construction markets seem to be in good shape.

Local Statistics

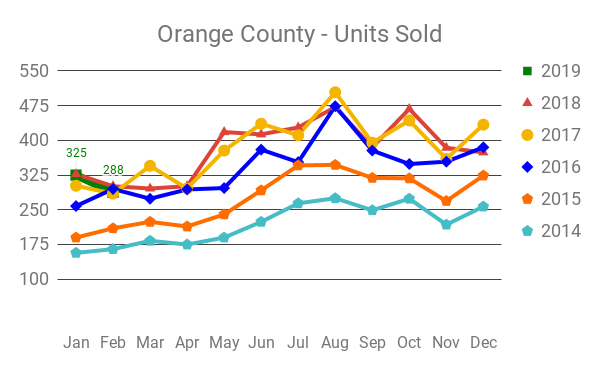

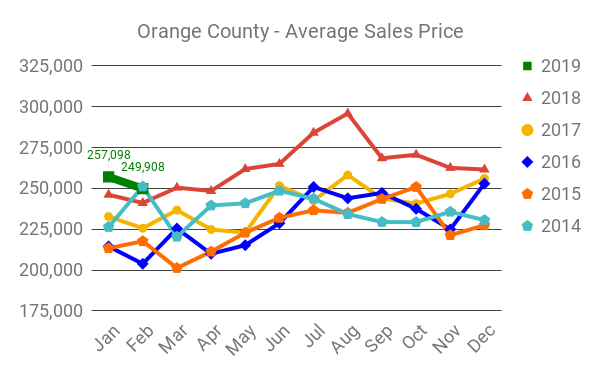

Orange County, New York

In the year over year comparisons, we’re at or below the last few years, but still hanging in there. However, we’re not in an increasing market.

Last year we were in the red all year long. While the stats show year over year increases, this was not our highest February.

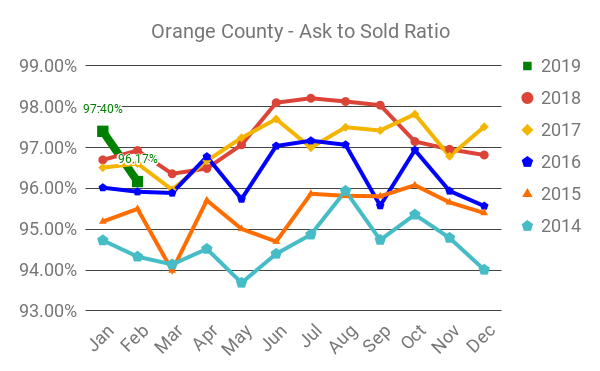

The asked to sold ratio, the last asking price versus what homes are selling for, took a dip in February but it’s easy to see that year over year we continue to see an increase.

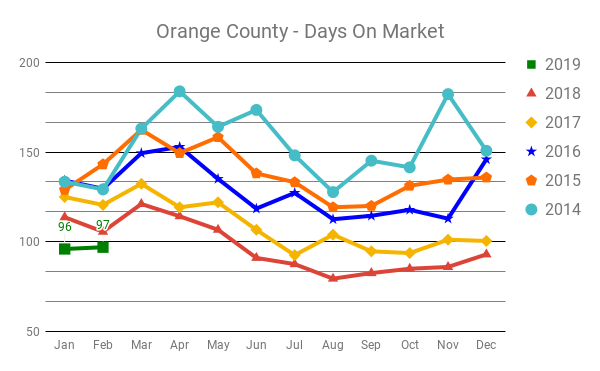

Days in market still indicate a hot market, being lower than any of the previous years shown.

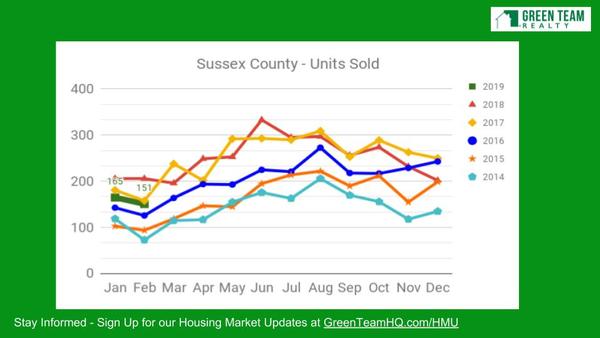

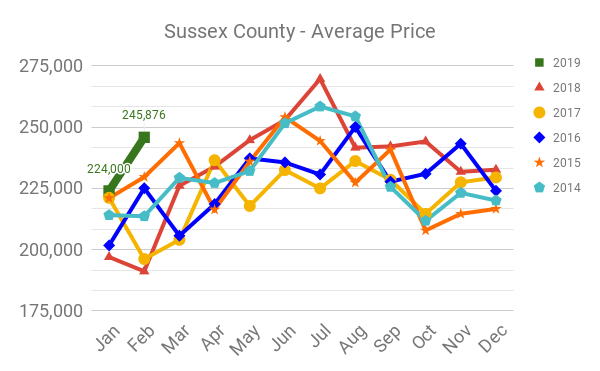

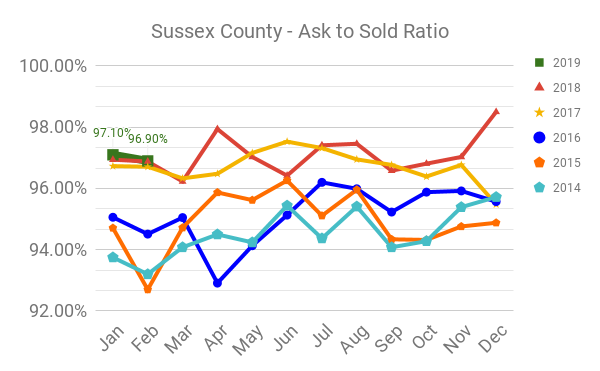

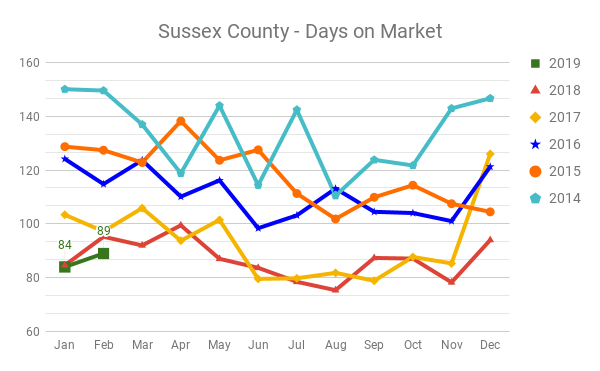

Sussex County, New Jersey

Units sold are down, below 2017 levels.

Average price, however, is increasing. We may actually be seeing further increases in price in Sussex, something we didn’t see much of last year.

Numbers here are similar to those we saw in Orange County, around 96 to 97%.

The numbers indicate this is still a hot market.

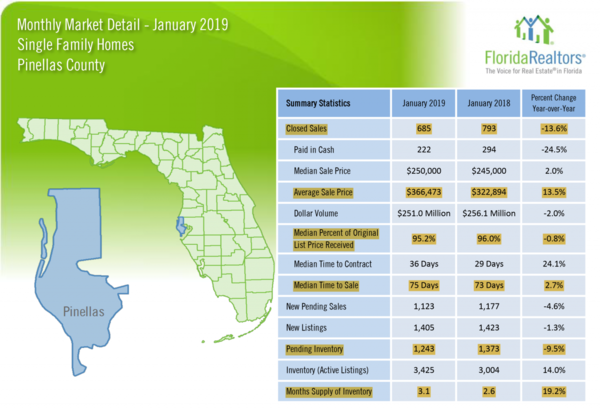

Pinellas County, FL

This month we’re also taking a look at the local market in Pinellas County, Florida.

Year over year stats for January 2019 over 2018 show a wide variation. While the number of closed sales decreased by 13%, prices increased by that same percentage.

ARE SENIOR HOUSEHOLDS REALLY CAUSING HOUSING SHORTAGE?

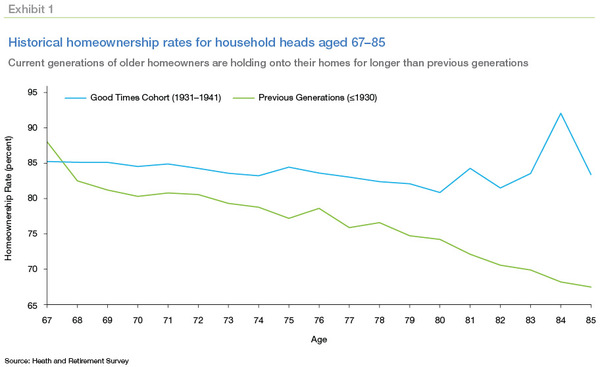

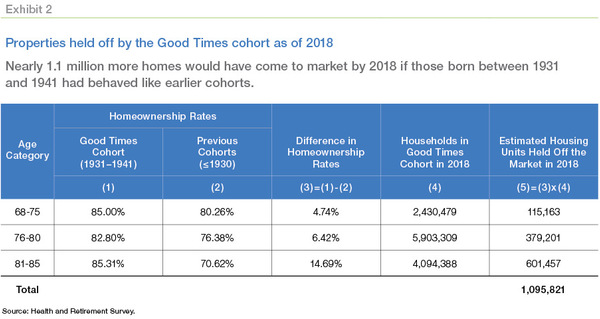

Ali Chamois of Homestead Funding Corp. shared this information with Geoff about the impact of people aging in place. Prior to the Good Times Cohort (those born between 1931 and 1941), people moved out of their houses at a much faster rate.

Exhibit 2 breaks down the number of housing units by age group and shows that 115,200 housing units would have been supplied to the market by respondents aged 68 to 75; 379,200 by respondents aged 76 to 80; and 601,500 by respondents aged 81 to 85.

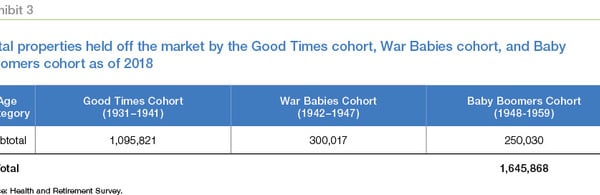

A similar calculation for the War Babies and Baby Boomers estimate that an additional 550,000 homes were held off the market by these cohorts by 2018, as shown in Exhibit 3.

In total, it’s estimated that there were around 1.6 million housing units held off the market by those three cohorts as of 2018. This amounts to 2.1 percent of total owner-occupied housing units in the United States as of 2018.

Meet this month’s panelists:

Geoff Green, President of Green Team Realty, is our moderator. Laura Marie of Keller Williams, St. Petersburg, Florida joined the panel as a special guest. Keren Gonen of Green Team New Jersey Realty, Vikki Garby of Green Team New York Realty and Ali Chamois, Homestead Funding.Corp.who joined the conversation by phone, rounded up the panel.

Geoff opened the discussion by introducing Keren Gonen, who has been a panelist every month. Her feeling has been it’s going to be a strong market in 2019, but that the inventory shortage is still happening; not as many foreclosures, etc. Geoff asked if she is still in this same mindset? Keren replied “Absolutely!” Properties are not being released by banks, who are flipping them themselves. Housing shortage has more to do with number of units going down than buyer demand. Sellers are still sitting on houses, waiting to see how strong the spring market will be.

Vikki Garby joined the conversation, saying much is the same in Orange County. Inventory problem is still out there. Buyers are out there. Properties in good condition, priced right, are going quickly. Investors, experienced flippers and new flippers, are trying to find properties. More REO’s are hitting the market and are going quickly, the ones not being done by the banks. Flippers are out and scooping them out.

Laura Marie saw many similarities with Pinellas County, FL. There were 11 short sales and 31 REOs total for Jan. Ones being sold are not much under market. Still hardcore investors are looking for the right deal. The margins have shrunk… To get ahead of the market you have to get off market. A huge amount of fixer uppers. Investors not wanting to purchase some of these homes because of cost of materials, etc. Pinellas County was developed between 1920 and 1960. Buyers are looking for updated, polished, shiny homes.

Geoff asked Ali if she agreed with the projections for the average 30 year fixed mortgage. Ali brought up that for Fannie Mae and Freddie Mac, rates are based on downpayment and credit scores. These factors impact the rate. Regarding projections, clients ask whether they should lock in rates or hold off… Ali never advises them on that because forecasts and predictions can change due to a variety of causes. Geoff said that Freddie Mac is much tougher now, which may be holding the market steady. There is not a lot of subprime lending. Because not a lot of defaults are happening, credit isn’t tightening up. Ali sees a little loosening up on credit standards.

Regarding Aging in Place, Geoff sees this happening within his own family. Ali stated that overall health is better, support systems are better. People don’t want to leave their homes. The current trend is to provide outpatient services for health care. Per Keren, people are living a lot longer. It seems that we do need more houses. There are also people moving in with other generations.

Parents, adult children and grandchildren, living as extended families. The US is transforming. Laura seeing the same thing in Florida. Downsizing, 55+ communities also allow people to have independence – but less yard care. Vikki said that we have more 2 income families. Grandparents often help with childcare instead of relocating, then kids are taking care of the parents as they age.

THANKS TO OUR SPONSOR…

Green Team Realty’s Housing Market Updates are sponsored by REALLY – Better, Smarter, Faster. A real estate referral network for agents. Learn more at ReallyHQ.com

NEXT HOUSING MARKET UPDATE: TUESDAY APRIL 16 AT 2PM

Stay informed – Sign up for our Housing Market Updates at GreenTeamHQ.com/HMU

[/et_pb_text][/et_pb_column]

[/et_pb_row]

[/et_pb_section]

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link