The Green Team’s January 2019 Housing Market Update was held on Facebook Live Tuesday, January 15 at 2 p.m. If were unable to view the webinar live, you can watch it at your convenience here. You can also sign up for future updates at GreenTeamHQ.com/hmu.

This month’s panelists…

Geoffrey Green, President/Broker of Green Team Realty, moderates the monthly webinars. He also presents national statistics, together with local updates for Orange County, NY and Sussex County, NJ. This month he is joined by Carol Buchanan of Green Team New York Realty, Keren Gonen of Green Team New Jersey Realty and Patrick “PJ” Keelin of Family First Funding.

The National Outlook

The above charts are raw numbers – the number of homes that were sold from 2014-2018. It appears that things are softening a bit, but it doesn’t appear that it will be drastic.

The analytic showing inventory levels is important. It has been difficult to find homes for buyers over the last few years. However, it appears that inventory levels may be coming back a bit. Lower demand should yield more inventory, but hopefully what some inventory may do is bring some people back into the game who may have been been frustrated previously.

This survey of experts, market analysts, etc. addressed the question, “What Will Home Prices Do in 2019?” 100 people were surveyed and 94% projected that housing prices on a national basis will continue to appreciate. Geoff aligns himself with that 94%. He believes that in 2019 prices will come up again in spite of the fact that activity went down. Price always lags activity.

According to Geoff, this quote from Goldman Sachs is a good one. “Despite the headwinds facing the housing market going into 2019, we expect U.S. house prices to generally achieve a soft landing. We expect national average price appreciation to remain positive.” If this comes true, it’s music to Geoff’s ears. He lived and worked through the last downturn, where 50% of the number of homes that sold went away within a 2-year period of time once the market starting declining. It was a difficult time

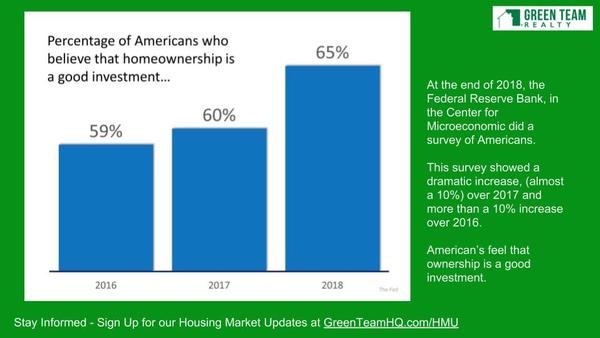

The percentage of Americans who believe homeownership is a good investment continues to increase. The market is at a peak and confidence continues to increase. However, Geoff finds that people tend to buy high and sell low. They should be buying low and selling high. The bottom of the market, 2011, 2012, and 2013 would have been a good time for investment.

However, people are confident that it’s a good time to buy now. And one thing that will never change is that homeownership is a good thing.

January 2019 Local Housing Market Update for Orange and Sussex Counties

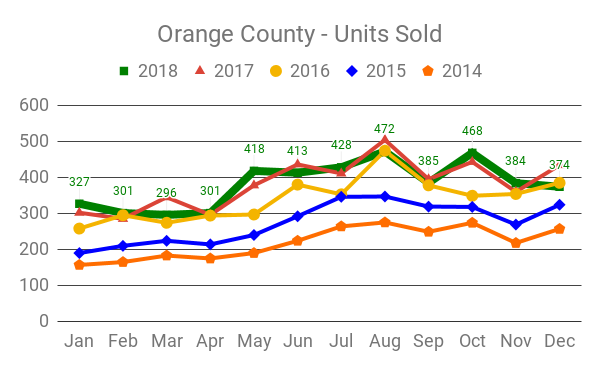

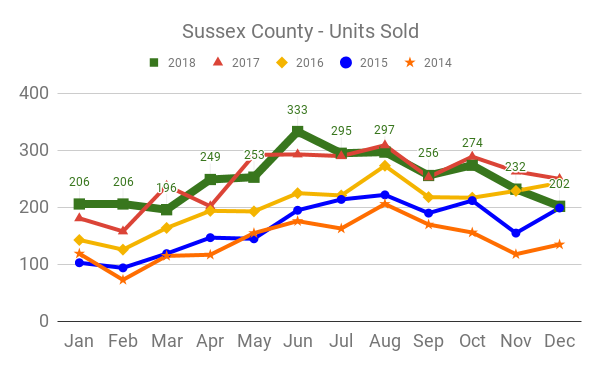

Units Sold

Five year look back. The thick green line is 2018 and while it’s been a mixed bag throughout the year, we ended up just a tad bit lower than the past two years.

In Sussex County, Units Sold was also a mixed bag, with one of the lowest totals in almost 4 years.

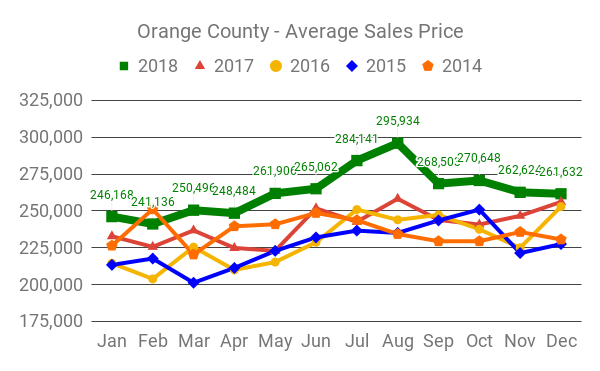

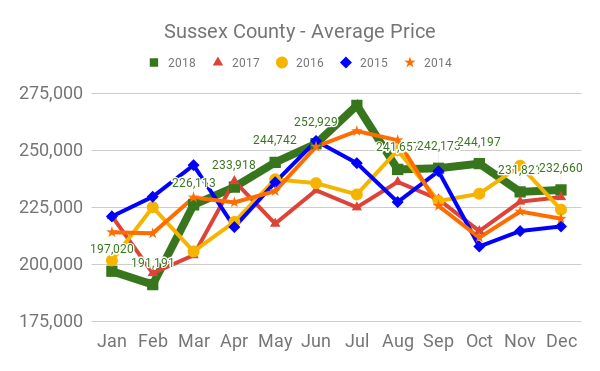

Average Price

In Orange County, prices were up substantially for a good part of the year. However, there was a cooling-off period towards the end of the year.

Sussex County never saw as much of an appreciation as Orange County did. However, 2018 was still a leading year over the past 5 years.

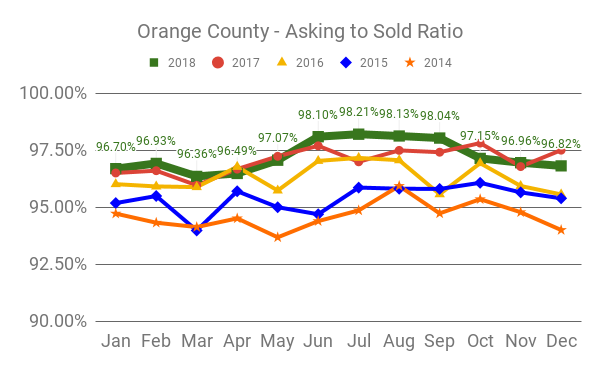

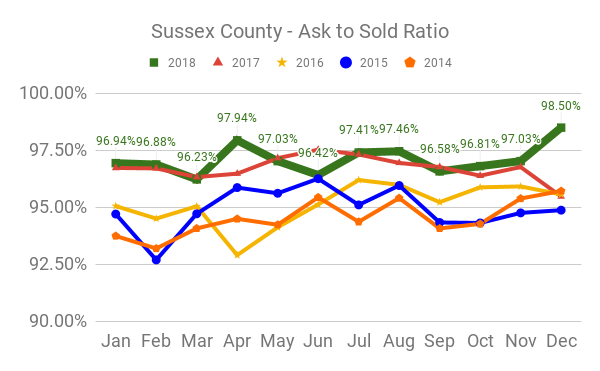

Asking to Sold Ratio

What price do homes on average sell for versus the last asking price? The higher towards 100% the hotter the market. The numbers have been strong for Orange County throughout the year.

Sussex County was strong in this category throughout the year. However, it hit its highest point in December 2018 with a ratio of 98.50%.

Panel Discussion

Geoff asked Carol Buchanan and Keren Gonen what they think of the market, as it appears a softening is underway. Carol stated that inventory is still low, and January and February are common months for the market to slow down. Carol does believe that 2019 is going to be a very good year. People seem undaunted by higher interest rates. Still a lot of buyers; just not enough homes.

Keren also agrees that 2019 will be a very good year. She thinks that people will start listing homes for sale within the next few months. Right now buyers are looking but there is still not enough inventory. She feels there are sellers sitting on the fence, not sure what to do and just holding out for a few more weeks or months. Geoff commented that the bread and butter of the season is March through August. So it’s natural for many homeowners to wait until March to list their homes.

Talking with Keren regarding foreclosure activity, Geoff asked if she see a decline? Banks are fixing up houses and putting them up at market prices. If the quality of work was good, that would be fine. However banks are bidding jobs out and the resulting work is not necessarily good work. Buyers expect to see good quality and are disappointed with what they’re finding. They often would prefer to pay more for a house that is in good shape. Therefore, many of these homes being sold by the banks are just sitting on the market. Banks are now competing with flippers who, generally speaking, do a better job at fixing up homes than the contractors. Buyers most often prefer paying full price for a home that was “flipped” well than on an REO that was not done well.

Geoff mentioned that this was not the trend in the past. Banks would not fix up their properties and try to sell them for more money. They’d just try to unload them at lower prices and buyers could get a good deal. Over the course of time we’ll see if banks decide to go back to the way they used to handle foreclosures.

Regarding the financing environment, Geoff asked Patrick “PJ” Keelin what we’re looking at for 2019. As Geoff put it, at the end of the day we’re really in the land of the banks, dependent on what they’re willing to do. And how many times the Federal government is willing to let banks leverage their money. PJ indicated that on a global scale, at the end of the year there was talk of the Feds raising the interest rate. That usually indicates a stronger economy; stronger aspects coming from the financing angle and mortgage-backed securities, etc. Unfortunately, at the end of the year there was a huge difference and the Dow dropped significantly. The drop in the Dow affected reports of things they were coming out with. So trends and thoughts of increased interest rates by the end of the year through that New Year boom fizzled out. There are reports that there is potentially going to be a decrease in interest rate for the year 2019. PJ believes that is something being put out there for a little bit of hope.

However, the biggest thing we’re competing with is the lack of inventory and what people will be able to purchase. Looking at an average household income of $60,000 to $70,000, that probably puts a person on average of what they can afford in terms of a property at $1,500 to $1,600 range. That gives them a certain price point that they have to stay in, and with increases in interest rates that is going to affect their eligibility to be able to purchase properties within a certain price range.

Geoff stated that all signs point to Fed raising interest rates. He asked PJ if he thinks that won’t be the case in 2019. PJ replied that there will be a lot less than they were expecting in 2018. They may skip the first interest rate rise. Hopes on the industry side are that there will be a potential interest rate drop. That may push that boom for people who are still sitting on the edge. He sees a stronger trend with the amount of people who are actually motivated in purchasing. They may finally be believing the reports that interest rates are not going to stay historically low and will go up. So many reports are going in different directions that it’s unsure what to make of it. Industry leaders are saying the market is staying relatively steady, but be prepared. There could be a drastic change.

Right the now trend is slow and steady. PJ commented that Geoff is proactive in all that he does; communicating with his sales associates and with the lenders they work with. Because ultimately these transactions need to happen quickly in order for them happen. When they remain open, bigger changes are coming.

Geoff wrapped up, saying that at the end of the day, interest rates are impacted by bond markets. As long as there is no major economic collapse, the housing market should be fine. He predicts a good 2019. PJ agrees, that it will be a good, strong year. People are getting more motivated.

Join us for the next Market Update

The next Housing Market Update will be held on Tuesday, February 12 at 2 p.m., when the Green Team will again be going live on Facebook. Sign up for updates at Greenteamhq.com/hmu.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link