The April 2019 Housing Market Update was held on Facebook Live Tuesday, April 16 at 2 p.m. If you missed the live webinar, you can view it at your convenience by clicking here. You can also sign up for updates at GreenTeamRealty.com/HMU.

Geoff Green, President of Green Team Realty, began the update with some national statistics. Discussions have been going on for months as to what the 2019 would look like. And, for the most part, it’s roaring. At least that is the case in our area, the northeast.

National Housing Market Statistics

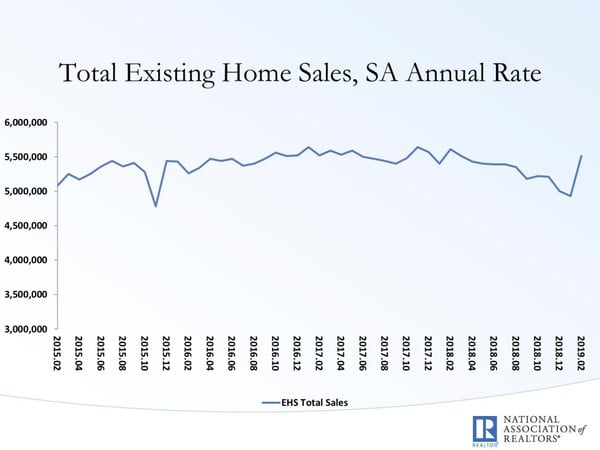

Total Existing Home Sales

This chart shows the total existing home sales for every two months, year over year. There was a dip, with things trending down, from the end of 2017 through 2018 nationally. But there is a bump at the beginning of 2019. And it seems to be busy for everyone right now. The thinking is that this may be another banner year.

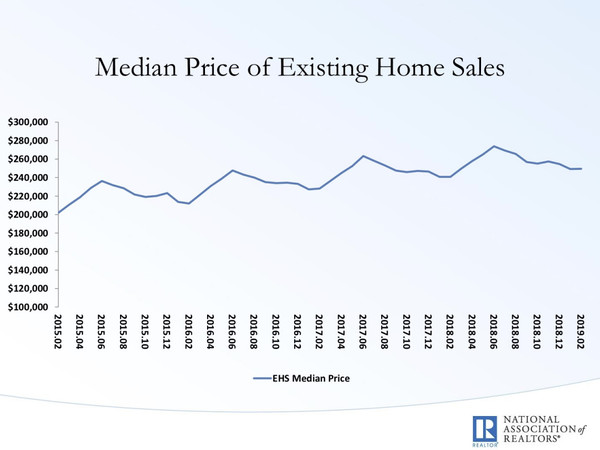

Median Price of Existing Home Sales

Prices have very consistently increased over the last 3 to 4 years. And there doesn’t seem to be a reason to anticipate any change in that trajectory any time soon.

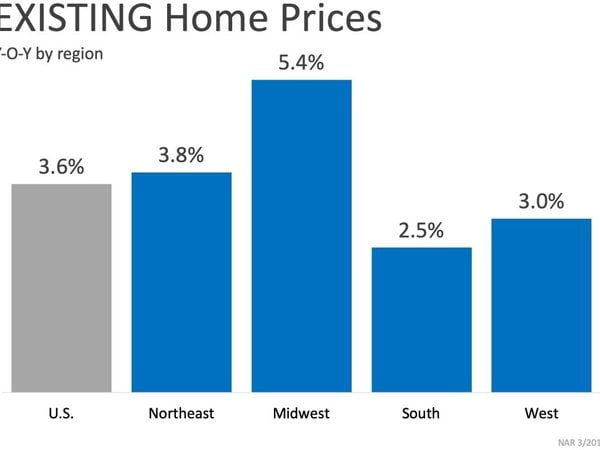

Existing Home Prices by Region

Breaking down existing home prices in terms of regions, this shows where we are now versus last year. The Midwest is leading home prices increases, followed by the Northeast.

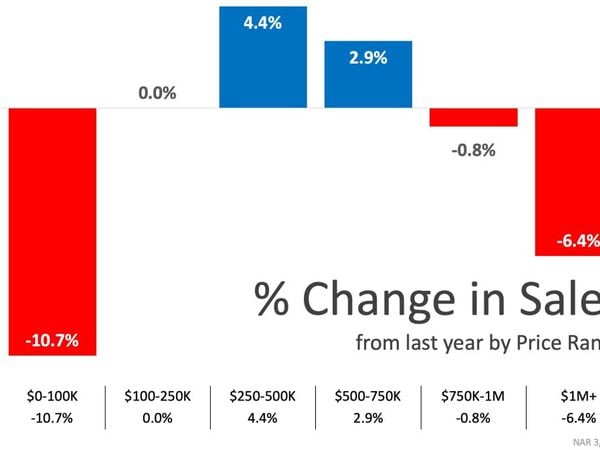

% Change in Sales

As prices have risen, there are fewer homes across the nation in the $0-$100,000 range. This low inventory has resulted in the change in sales for that price range. However, it is also interesting that on the very high end, transactions of $1 Million+ have faltered and slowed down. When you start to get into those metro areas where $1+ Million is not unusual, people may be starting to find it’s a little out of reach.

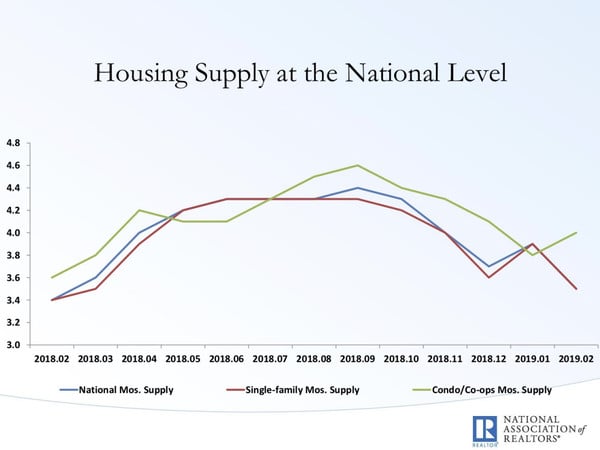

Housing Supply at the National Level

The lack of inventory has been seen as a reason for why the number of transactions was softening for the last 12, 14 months; The supply level peaked in 2018 and then came down towards the end of 2018. But it now looks like it may be coming up again. We really need this to happen to keep the transactions going.

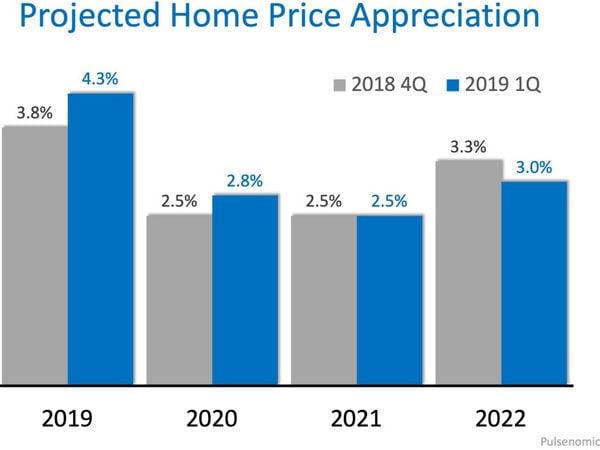

Projected Home Price Appreciation

A panel of over 100 economists, real estate experts and investment and market strategists were interviewed for the most recent Home Price Expectations Survey. These experts have raised the projections they made in the 4th quarter of 2018 for 2019 and 2020. They are anticipating a better year than they first thought.

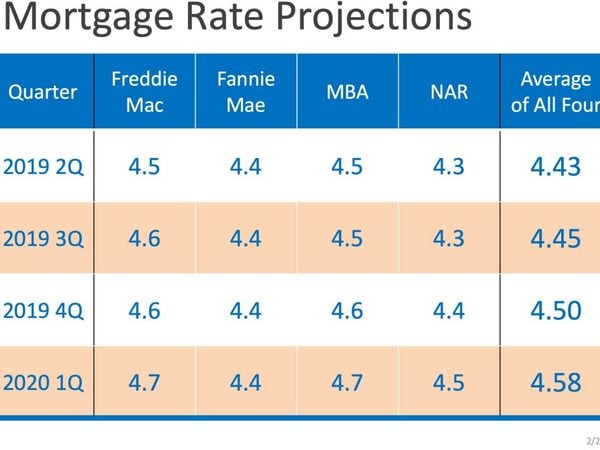

Mortgage Rate Projections

Despite a zooming market and a very solid economy, rates in Geoff’s view are still remaining low. Someone who was looking for a home a year and a half ago may now see rates up a point and think that they are now “high.” However, Geoff says that rates are still historically low.

Local Housing Market Update

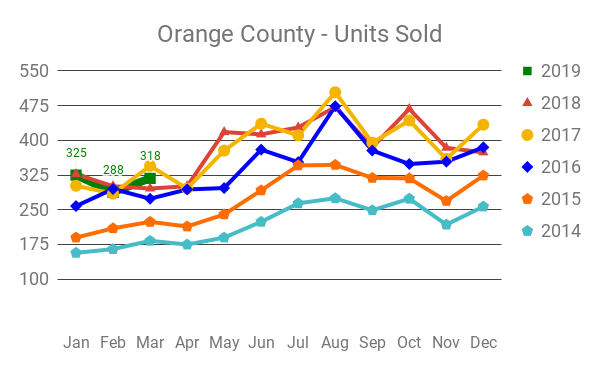

Orange County, NY – Units Sold

We seem to be holding even compared to last year. Perhaps a tick better. This is good news.

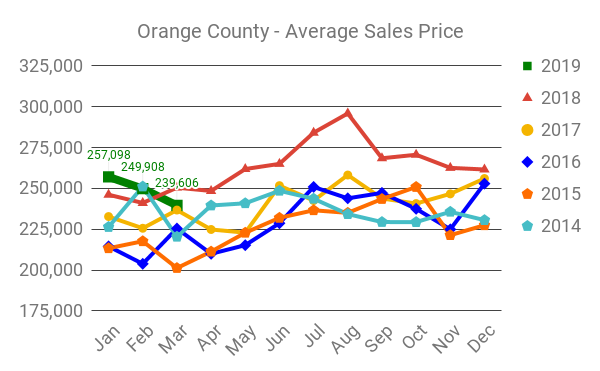

Orange County, NY – Average Sales Price

So far this year we’re basically even with last year.

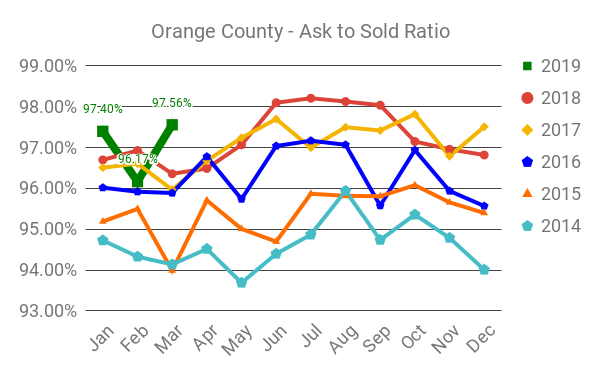

Orange County, NY – Ask to Sold Ratio

Ratio at which a home sells versus the last asking price. The ratio seems to be trending higher which means that demand is still very high. People are willing to pay at or near asking, if not over asking. Bidding wars are still continuing.

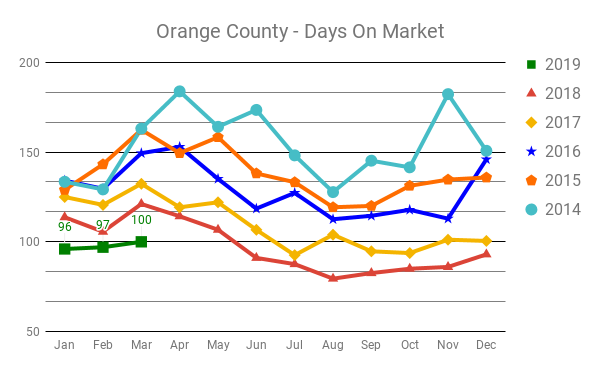

Orange County, NY – Days on Market

The days on market continue to drop consistently. Homes are still selling fast, selling quicker each year. All signs point to a continued Seller’s Market.

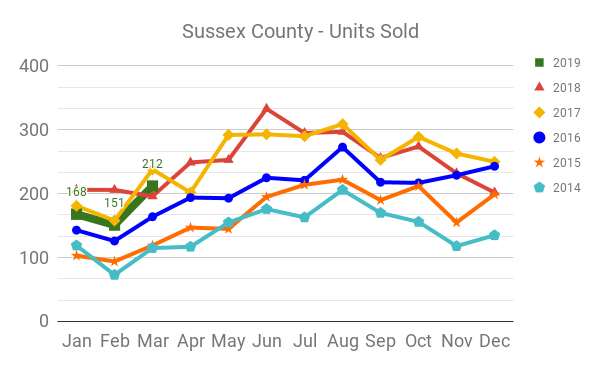

Sussex County, NJ – Units Sold

Units sold in January and February were lower than in 2018. However, in March the number rose, coming in a tick higher than March 2018.

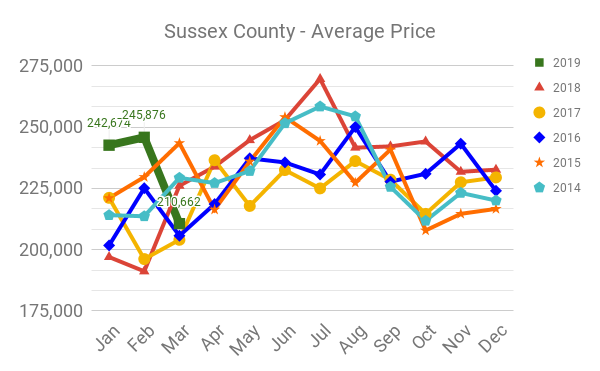

Sussex County, NJ – Average Price

Sales prices in Sussex have been a bit of a conundrum. Price hasn’t taken hold and there has been a significant one month drop from February to March. This will be an interesting analytic to watch as the year goes on.

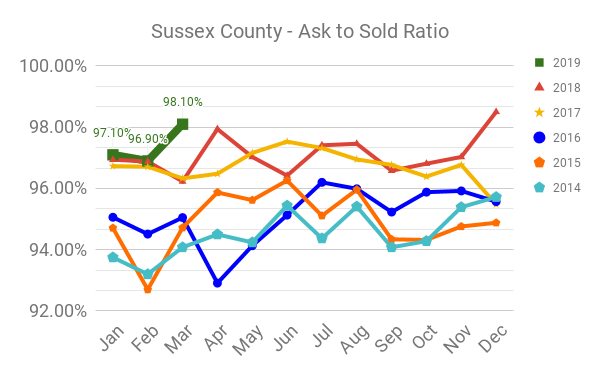

Sussex County, NJ – Ask to Sold Ratio

Again, the higher the number, the closer things are selling towards the asking price and the less sellers are having to negotiate off those prices. We’re looking at some very strong numbers here.

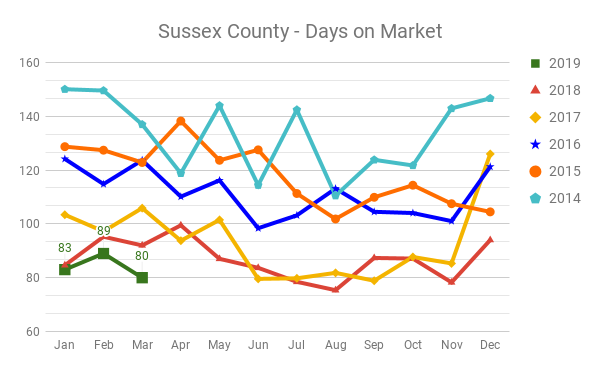

Sussex County, NJ – Days on Market

Again, here the lower the number the stronger the market. Here was have a steady pattern of fewer days on the market. Homes are selling faster and faster.

Meet our Sponsor

This Webinar is sponsored by REALLY – A real estate referral network for Agents. REALLY Easy Referrals are as Easy as 1, 2, 3…

- Enter your referral in 5 minutes or less

- REALLY notifies you of all willing Agents

- YOU choose the Agent and legally bind with one tap!

The best part – No fees on commissions exchanged between Agents. Join for FREE.

Meet the Panel

Geoffrey Green, Moderator

President, Green Team Realty

Vikki Garby,

Green Team

New York Realty

Keren Gonen,

Green Team

New Jersey Realty

Laura Moritz,

Classic Mortgage

aura Moritz has been with Classic Mortgage for 18 years.

Geoff Green began the panel discussion by asking about the trends they’ve been seeing in the Housing Market Updates and in the market itself. Geoff recalled that the numbers were softening during 2018. Therefore, there was a lot of uncertainty about how the market would be in 2019. However, the numbers seem to be indicating a very good year.

He asked Vikki and Keren what their experiences were in the field. Vikki said that the general market conditions she sees in Orange County, specifically the Warwick, Goshen, Middletown area, indicate a really strong market. There is still a shortage of inventory, which feeds the demand. She has received several new buyers recently coming from outside the area. Plus, many sellers are staying in the area, adding to the number of prospective buyers.

She has noticed more For Sale by Owner signs lately, and has had buyers request to see some of those. Vikki noted that that’s fine; she’s able to show her clients the homes and guide them through the home purchasing process. She then asked if Keren was seeing the same thing in Sussex County and if it’s a new trend. Keren said they are seeing the same thing in New Jersey. With today’s technology, some sellers are thinking they can do it on their own. And as Vikki mentioned, there are no issues approaching a FSBO and arranging a showing for their buyers.

In regard to home prices plummeting in Sussex, Keren said a new wave of REO’s has been released. This hasn’t happened in a while. They’re also being more logical in their pricing. That may be why we’re seeing that drop. In addition, there is that same problem of inventory. Recently Keren had buyer request to see a newly listed home over the weekend. However that home had an accepted offer on it before her clients could see it 4 days later. It’s still a seller’s market.

New Construction

Geoff agreed that there is clearly an inventory shortage. There is real, organic growth in the market. There are many people who can afford a home, and qualify. Yet there are more prospective buyers like this out there than there are suitable homes. In Warwick, in particular, there is a lot of new construction going on. He wondered if around our local counties there is enough new construction yet. He asked what the panelists were seeing. Had they noticed new subdivisions offering more options for their buyers?

Keren said in Sussex, there was Crystal Springs. A large halted construction site there had just been bought up, and there is new things going up. And there are a lot of people interested in them because there is not that much construction around. They also have those houses that have burnt down and had to be totally gutted. Those houses are getting a lot of activity as well.

Vikki is seeing a lot of new construction in the Warwick area specifically, and also in Goshen, Cornwall. She feels it’s a result of the lack of inventory. Geoff noted that he reads a lot of articles from economists, etc. He received an email from a loan company which urged homeowners to become more reasonable in their pricing. There has also been a lot of talk by economists about the importance of municipalities needing to loosen up their zoning requirements and do what they can to speed up municipalities.

Geoff’s response to these? “Welcome to my world!” Planning boards have gotten tighter and tighter and people are concerned about their communities growing too fast. Regulations have gotten tighter, rather than loosening up. And while Geoff doesn’t believe these things are bad, he’s just saying it’s harder to develop in today’s day and age than it was 50, 60 years ago. There’s just a lot more red tape involved.

Geoff said it will be really interesting to see. America is the place to be. Globally, our economy is far outpacing any other country out there. We’re the “shining city on the hill” again and many people want to be here. Also, many people just don’t want to move.

What’s happening with mortgage financing?

Geoff then asked Laura Moritz where we are with mortgages and where she see rates going, Further, he noted there seems there is a lot of loan of money available, and a lot of loan programs. He doesn’t think that’s the problem. Laura responded that she really doesn’t see a problem at all as far as qualified buyers getting financing. Even a few mortgages were done this month for people with credit scores in the 500’s. Underwriting guidelines have really loosened up. Borrowers may also have what’s called in banking compensating factors = their credit is not so great, but they have other factors, Laura is really not seeing any rejections. She also is not seeing houses not appraising for value. The market has been very steady.

Interest rates are very low now. She has locked in and closed some 30 year loans recently at 4-1/4% with 20% down and good credit. With 15 year loans , you’re looking at high 3’s%.

Geoff mentioned that we’ve talked about the appraisal situation often on the housing market updates. He said it was maybe a year or more that it wasn’t so certain that things would appraise and it was difficult. Now that we have in this steadily increasing medium price market appraisers can buy into the fact that this house is worth more than the one down the street because it’s selling six months later and it’s an increasing market. Where it’s hard on appraisers is on the turn, when the market is on its way up or on its way down.

Laura added that some high end properties with “fluff” amenities may not translate to an appraisal. However, ever her high-end appraisals have been coming in on point because they have the comps.

She doesn’t believe that rates will move in either direction very much over the next 6 to 9 months. However, as we know, one catastrophic event or something in the global economy can shift the bond market and it can change on a dime. It does look like rates will hold steady over the summer months.

Laura closed the discussion by noting that it’s a great time to buy a house. She’s seeing a lot of young people and couples trending towards buying a home before getting married in order to skip the renting stage. She loves hearing from them a few years later that they appreciated $70,000 gain and can now buy their forever home. It’s a great time to buy a home in the Northeast. Geoff added that even speaking to average price we’re still really not back to 2006 levels. As much as it’s a seller’s market now, there is still lots of room for growth in price appreciation in our local markets.

May Housing Market Update

The next Housing Market Update will be held on May 21 at 2 p.m. You can stay informed and sign up for Housing Market Updates. Just click here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link