Raising the Roof at Green Team New York Realty

7 Main Street, Warwick NY – Before the Renovation

Raising the roof at Green Team New York Realty was just one of the improvements made to its building at 7 Main Street in Warwick, NY. Geoff Green, President of Green Team Realty, would walk around downtown, admiring the beautiful buildings and the renovations taking place. Then he’d glance over at the Green Team building, knowing it needed a major face lift. In addition, there was the issue of the four roofs. Yes, the building basically had four separate roofs just slapped together over the years. Geoff took aerial photos with his drone which show the poor state these roofs were in.

Making It Happen

Geoff relays the story beyond the renovation below:

I would have done it 10 years sooner, but I simply didn’t have the money. My wife Laura and I saved for many years to make this renovation happen.

There are aerial shots I took with my drone showing the poor state of affairs for the roof. The solution that you see now is all credited to our Architect Christopher Collins. I am extremely grateful for Chris’ work on our building. We originally had a different plan from a different architect and it just simply wasn’t as good of a plan as what we now have. The building would not have looked nearly as good as it does now. Chris was a God send.

Up on the Roof

Geoff talked about the team put together to put Christopher Collins’ plan into effect.

Russ Tellier was the contractor who did the large majority of the work on the 7 Main St building along with his friend Wayne Cosh. Russ was good enough to let me GC the project so that I could save some money and ultimately make it happen. Russ and Wayne did a fine job. As one would expect with a restoration job of this size it also required an electrical upgrade of sorts. All of the electrical work was done by Ralph & Tommy Edwards. In fact, one year after the major portion of the exterior renovation, Ralph and Tommy just finalized a new service line to the building. The building was painted by Christopher Colin, d/b/a “Chris The Contractor“. Chris also did a fine job, and he continues to do all sorts of jobs here and there for us on this building and many others that we are involved in.

A Labor Of Love

Geoff’s love of construction and renovation started in childhood. And it continues to this day.

I am not really sure why, but my history has been to purchase older properties in need of repair. Pretty much every building my wife and I own has undergone some major improvements at one point or another. Early on in my career I would be on site swinging the hammer. By way of building tree forts with my Brother Matt as a kid, I learned enough about construction to be able to maintain our investment properties. However, at this point I have built a great team of contractors who allow me to pick my spots, oversee what I need to in order to cut cost down, etc. . .

I have to say this is a labor of love for me. It literally goes back to my childhood days of building tree houses and skateboard ramps. It was fun waking up early in the morning, putting on a tool belt and going out to build something. But now after about 1 hour of labor I now get aggravated and say to myself, “what the heck am I doing”. So I now tend to leave the labor to the guys who do it best.

7 Main St, Warwick, NY After the Renovation

One thing is certain. Now, when Geoff walks through downtown Warwick, he can take pride in the Green Team New York Realty building at 7 Main Street. Because it is now one of those beautiful buildings he so much admired.

January 2019 Housing Market Update

The Green Team’s January 2019 Housing Market Update was held on Facebook Live Tuesday, January 15 at 2 p.m. If were unable to view the webinar live, you can watch it at your convenience here. You can also sign up for future updates at GreenTeamHQ.com/hmu.

This month’s panelists…

Geoffrey Green, President/Broker of Green Team Realty, moderates the monthly webinars. He also presents national statistics, together with local updates for Orange County, NY and Sussex County, NJ. This month he is joined by Carol Buchanan of Green Team New York Realty, Keren Gonen of Green Team New Jersey Realty and Patrick “PJ” Keelin of Family First Funding.

The National Outlook

The above charts are raw numbers – the number of homes that were sold from 2014-2018. It appears that things are softening a bit, but it doesn’t appear that it will be drastic.

The analytic showing inventory levels is important. It has been difficult to find homes for buyers over the last few years. However, it appears that inventory levels may be coming back a bit. Lower demand should yield more inventory, but hopefully what some inventory may do is bring some people back into the game who may have been been frustrated previously.

This survey of experts, market analysts, etc. addressed the question, “What Will Home Prices Do in 2019?” 100 people were surveyed and 94% projected that housing prices on a national basis will continue to appreciate. Geoff aligns himself with that 94%. He believes that in 2019 prices will come up again in spite of the fact that activity went down. Price always lags activity.

According to Geoff, this quote from Goldman Sachs is a good one. “Despite the headwinds facing the housing market going into 2019, we expect U.S. house prices to generally achieve a soft landing. We expect national average price appreciation to remain positive.” If this comes true, it’s music to Geoff’s ears. He lived and worked through the last downturn, where 50% of the number of homes that sold went away within a 2-year period of time once the market starting declining. It was a difficult time

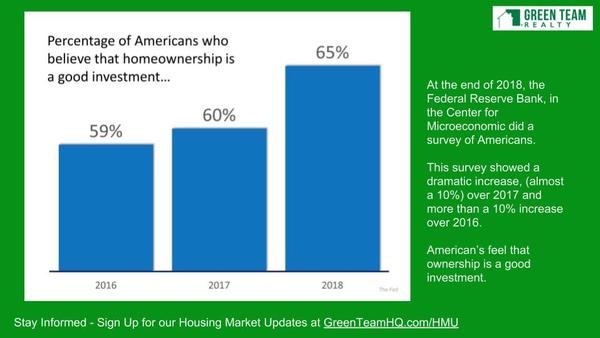

The percentage of Americans who believe homeownership is a good investment continues to increase. The market is at a peak and confidence continues to increase. However, Geoff finds that people tend to buy high and sell low. They should be buying low and selling high. The bottom of the market, 2011, 2012, and 2013 would have been a good time for investment.

However, people are confident that it’s a good time to buy now. And one thing that will never change is that homeownership is a good thing.

January 2019 Local Housing Market Update for Orange and Sussex Counties

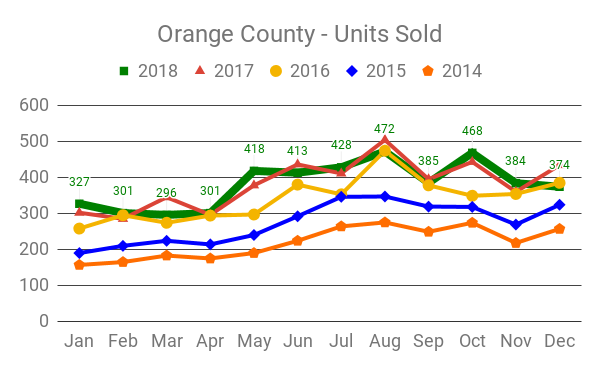

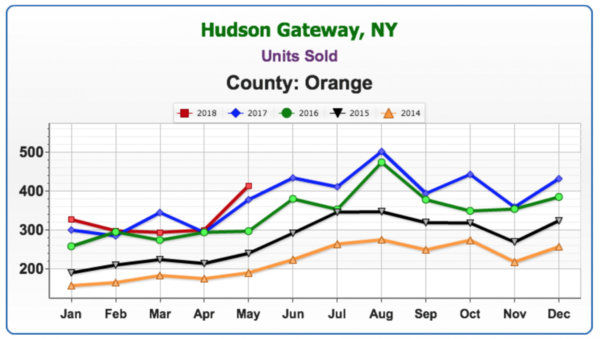

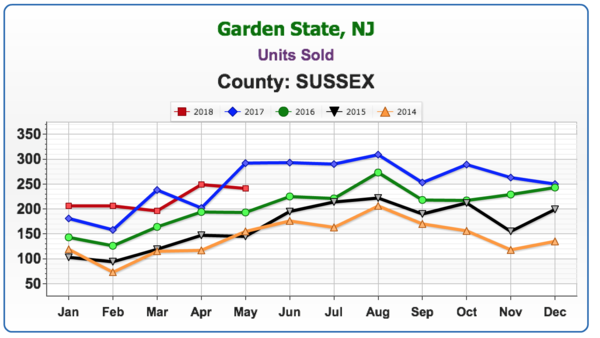

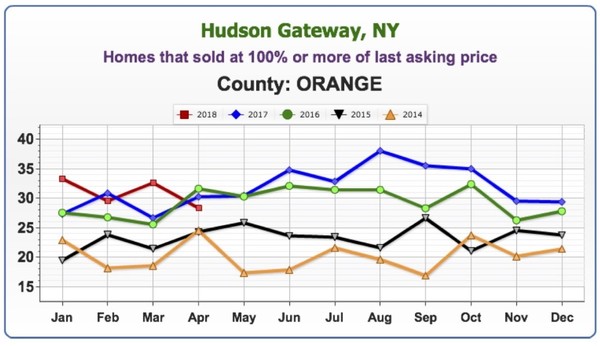

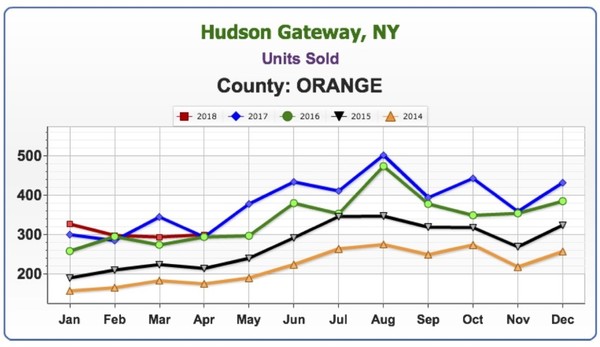

Units Sold

Five year look back. The thick green line is 2018 and while it’s been a mixed bag throughout the year, we ended up just a tad bit lower than the past two years.

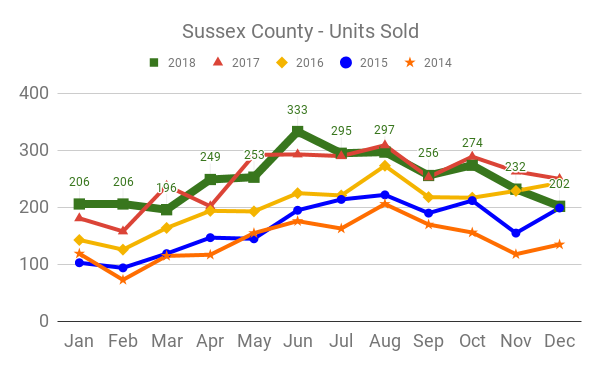

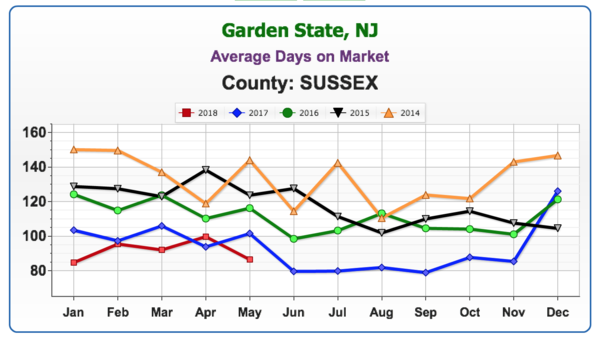

In Sussex County, Units Sold was also a mixed bag, with one of the lowest totals in almost 4 years.

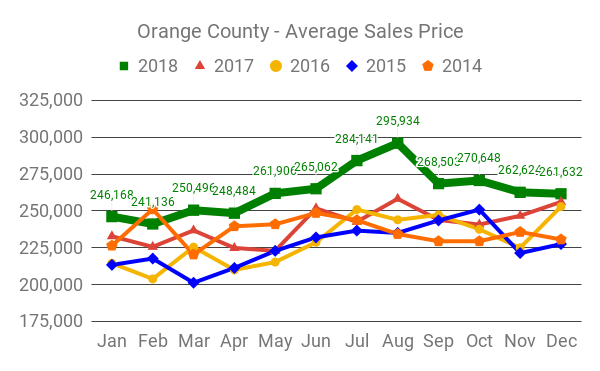

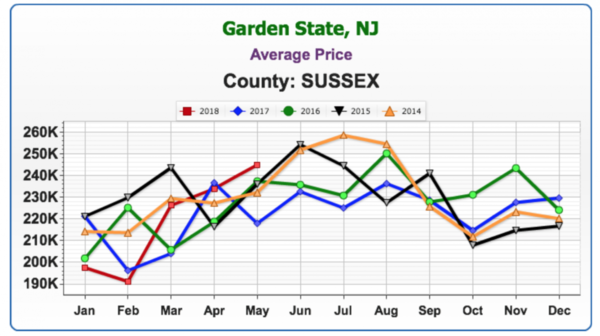

Average Price

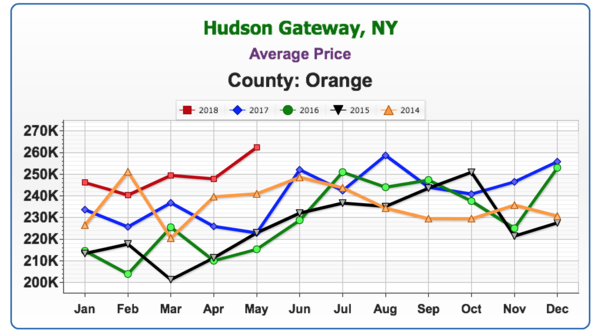

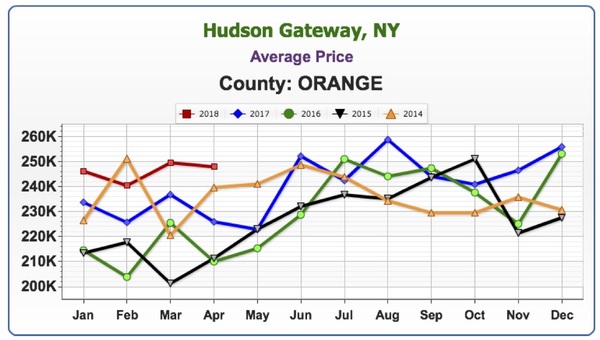

In Orange County, prices were up substantially for a good part of the year. However, there was a cooling-off period towards the end of the year.

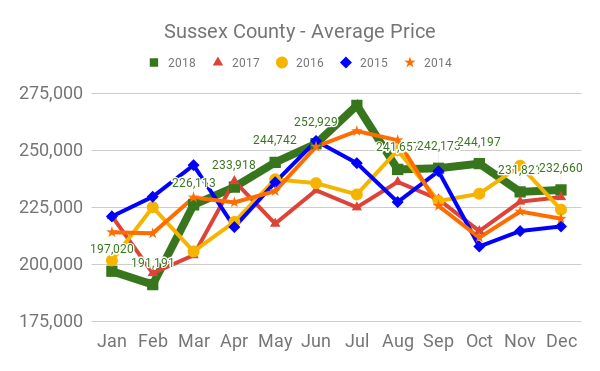

Sussex County never saw as much of an appreciation as Orange County did. However, 2018 was still a leading year over the past 5 years.

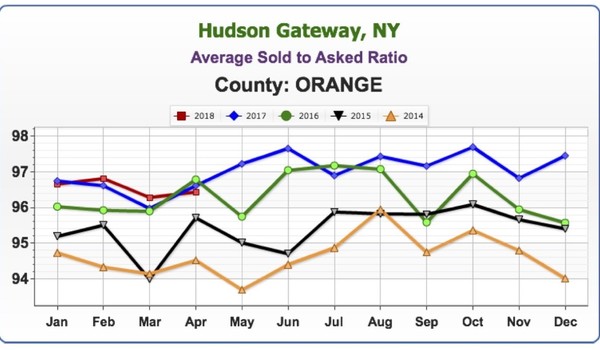

Asking to Sold Ratio

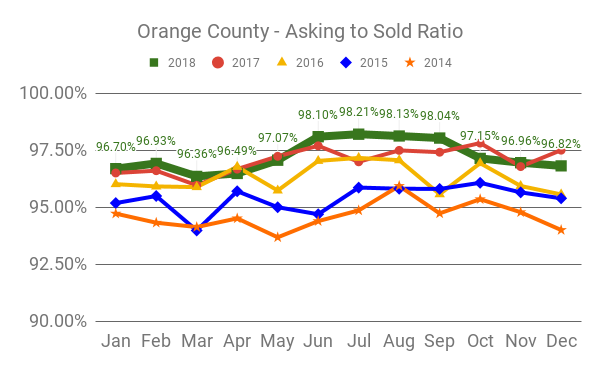

What price do homes on average sell for versus the last asking price? The higher towards 100% the hotter the market. The numbers have been strong for Orange County throughout the year.

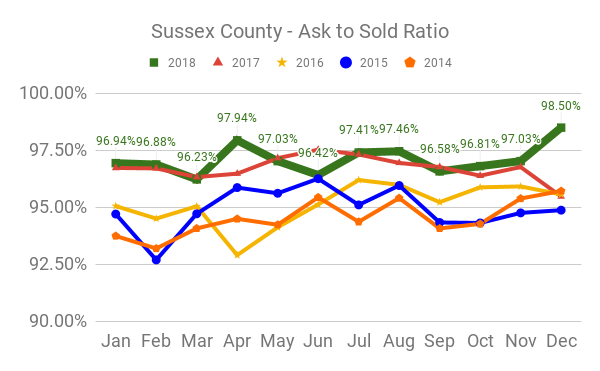

Sussex County was strong in this category throughout the year. However, it hit its highest point in December 2018 with a ratio of 98.50%.

Panel Discussion

Geoff asked Carol Buchanan and Keren Gonen what they think of the market, as it appears a softening is underway. Carol stated that inventory is still low, and January and February are common months for the market to slow down. Carol does believe that 2019 is going to be a very good year. People seem undaunted by higher interest rates. Still a lot of buyers; just not enough homes.

Keren also agrees that 2019 will be a very good year. She thinks that people will start listing homes for sale within the next few months. Right now buyers are looking but there is still not enough inventory. She feels there are sellers sitting on the fence, not sure what to do and just holding out for a few more weeks or months. Geoff commented that the bread and butter of the season is March through August. So it’s natural for many homeowners to wait until March to list their homes.

Talking with Keren regarding foreclosure activity, Geoff asked if she see a decline? Banks are fixing up houses and putting them up at market prices. If the quality of work was good, that would be fine. However banks are bidding jobs out and the resulting work is not necessarily good work. Buyers expect to see good quality and are disappointed with what they’re finding. They often would prefer to pay more for a house that is in good shape. Therefore, many of these homes being sold by the banks are just sitting on the market. Banks are now competing with flippers who, generally speaking, do a better job at fixing up homes than the contractors. Buyers most often prefer paying full price for a home that was “flipped” well than on an REO that was not done well.

Geoff mentioned that this was not the trend in the past. Banks would not fix up their properties and try to sell them for more money. They’d just try to unload them at lower prices and buyers could get a good deal. Over the course of time we’ll see if banks decide to go back to the way they used to handle foreclosures.

Regarding the financing environment, Geoff asked Patrick “PJ” Keelin what we’re looking at for 2019. As Geoff put it, at the end of the day we’re really in the land of the banks, dependent on what they’re willing to do. And how many times the Federal government is willing to let banks leverage their money. PJ indicated that on a global scale, at the end of the year there was talk of the Feds raising the interest rate. That usually indicates a stronger economy; stronger aspects coming from the financing angle and mortgage-backed securities, etc. Unfortunately, at the end of the year there was a huge difference and the Dow dropped significantly. The drop in the Dow affected reports of things they were coming out with. So trends and thoughts of increased interest rates by the end of the year through that New Year boom fizzled out. There are reports that there is potentially going to be a decrease in interest rate for the year 2019. PJ believes that is something being put out there for a little bit of hope.

However, the biggest thing we’re competing with is the lack of inventory and what people will be able to purchase. Looking at an average household income of $60,000 to $70,000, that probably puts a person on average of what they can afford in terms of a property at $1,500 to $1,600 range. That gives them a certain price point that they have to stay in, and with increases in interest rates that is going to affect their eligibility to be able to purchase properties within a certain price range.

Geoff stated that all signs point to Fed raising interest rates. He asked PJ if he thinks that won’t be the case in 2019. PJ replied that there will be a lot less than they were expecting in 2018. They may skip the first interest rate rise. Hopes on the industry side are that there will be a potential interest rate drop. That may push that boom for people who are still sitting on the edge. He sees a stronger trend with the amount of people who are actually motivated in purchasing. They may finally be believing the reports that interest rates are not going to stay historically low and will go up. So many reports are going in different directions that it’s unsure what to make of it. Industry leaders are saying the market is staying relatively steady, but be prepared. There could be a drastic change.

Right the now trend is slow and steady. PJ commented that Geoff is proactive in all that he does; communicating with his sales associates and with the lenders they work with. Because ultimately these transactions need to happen quickly in order for them happen. When they remain open, bigger changes are coming.

Geoff wrapped up, saying that at the end of the day, interest rates are impacted by bond markets. As long as there is no major economic collapse, the housing market should be fine. He predicts a good 2019. PJ agrees, that it will be a good, strong year. People are getting more motivated.

Join us for the next Market Update

The next Housing Market Update will be held on Tuesday, February 12 at 2 p.m., when the Green Team will again be going live on Facebook. Sign up for updates at Greenteamhq.com/hmu.

Nancy Sardo, First and Second Quarter Sales Leader Award Winner

Nancy Sardo does it again…

The Green Team is pleased to announce that Nancy Sardo is the Sales Leader Award Winner for both the First and Second Quarters of 2018. Nancy is not a stranger to this achievement. In 2017 she was the winner for the Second and Third Quarters. And some things just don’t change. Nancy still does not want to talk about herself. Instead, she would prefer to talk about the Green Team and the support and training offered.

A Mutual Admiration Society

When Nancy and Geoff Green talk about each other, their mutual admiration is evident. Nancy is proud to be with a broker who is constantly on the cutting edge of technology He provides Green Team sales sssociates with the marketing tools, technical training and practice sessions they need to provide the utmost in client service.

Nancy finds the Green Team Home Selling System to be unsurpassed when it comes to providing education, training and support. And, whether an agent is new or seasoned, Geoff always makes time to talk and brainstorm a problem. He may not know this, but he inspires Nancy to get out there and do her best everyday.

And Geoff’s thoughts on Nancy? He takes great pride and joy in all of her successes. He has called her a true superstar, and that description continues to hold true, maybe now more than ever.

It Takes a Team

One of the reasons Nancy doesn’t like to talk about herself is that she believes it takes more than one person to properly market a property or create a presentation to a perspective client. The team approach is a major part of the Green Team’s way of doing business. Geoff makes sure that his sales associates are backed up by a talented support team: office support, marketing director, graphic designer, copywriter, and computer specialists.

Being in the business of listing and selling homes throughout Orange County since 2005, Nancy has seen the positive impact of the Green Team’s approach as opposed to other brokerages. The emphasis on exceptional service and client appreciation has made a very real difference in her business.

New Construction: Combining passion and expertise

Nancy enjoys real estate in all its forms, whether helping someone buy, sell, or lease a property. However, her real passion is new construction. She has extensive experience working with both builders and clients. Her experience has led her to serve as listing broker for many subdivisions throughout Orange County. Nancy keeps up-to-date on new building codes and their impact on current and planned building designs and costs.

Nancy walks the buyer through all the steps of building their dream home. From the first meeting with the builder, obtaining financing, selecting finishes and upgrades and making sure that decisions are made in a timely manner to meet construction schedules, Nancy is there. Her goal is to make the experience of building a home as positive and stress-free as possible. And she keeps costs in mind as she guides buyers through the process, doing her best to keep them on their budget and not overspend on finishes and options.

The Whole Package…

With a shortage of existing homes on the market, new construction offers an option that might not have been previously considered. If you choose this route, being represented by a sales associate with knowledge, experience, an eye for detail, and the ability to keep track of and explain the process is priceless.

Nancy Sardo has all those qualities and more. Her real estate credentials are impressive. She’s an Accredited Buyer’s Representative (ABR), earned her Associate Broker’s License, and also has the Seniors Real Estate designation (SRES). She works non-stop and is constantly in motion. But there is something else about Nancy that makes her stand out and helps explain her success. Even in the midst of difficult times, she remembers to look for the good. Combine her knowledge, expertise, and energy with a remarkable attitude and you know that Nancy is, indeed, the whole package.

Housing Market Update for June 2018 & Impact of Federal Tax Reform on Housing Market

Orange & Sussex Counties – Housing Market Update for June 2018 and Impact of Federal Tax Reform on the Housing Market

The Green Team went live on Facebook Tuesday, June 12 with its monthly housing market update. Geoff Green, President of the Green Team, moderated the event. Panelists included sales associates Vikki Garby and Kim Leslie of the Warwick office and Keren Gonen and Joyce Rogers from the Vernon Office. Guest panelists were Dan Bounds, Senior Home-Lending Advisor with Chase Bank and Ed Mainland, Executive Director at JP Morgan Chase & Co. A special presentation was given by Thomas McGlynn, Managing Director of BDO Expatriate Services, on the impact of federal tax reform on the housing market.

Overview

Nationally there has been a 5.3% year-over-year increase in existing home prices. Low to middle-level houses are moving faster than higher-end homes. However, economists are concerned about the affordability of homes for the entry buyer level. The lack of inventory is driving home prices up. The West Coast has been moving at a greater pace than here in the North East. Supply and demand is taking hold. Foot traffic stats are very interesting. There has been more foot traffic this year than last year during the same time. On a national level, existing home sales are slightly down from where they were last year during the same period. This may be a reflection of inventory problems.

Orange County Update

Average Price

Average price has really taken off. There was a mixed bag of results until this year.

Units Sold

May saw the most units sold for this month since 2014. However, prior to May, this year is the first where we’ve seen more than one month at or less than the same month in previous years. There has been a steady increase year-over-year until 2018. We will continue to keep a watch on this analytic as it may be the most important indicator of when there will be a downturn.

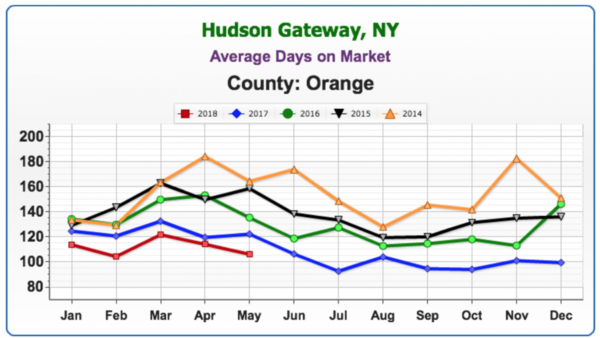

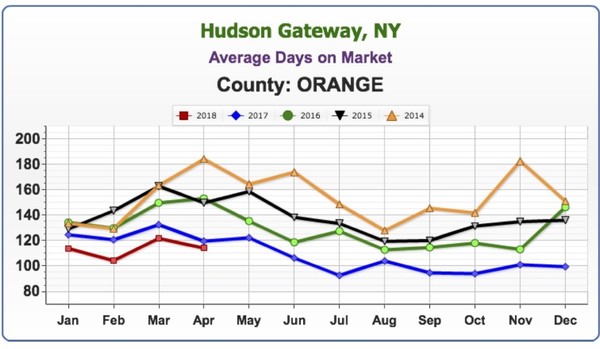

Average Days on Market

The average days on market continues to decrease. This indicates the market is hot; a good seller’s market. For some who have been waiting a long time, now may be a good opportunity to sell their homes.

Sussex County Update

Average Price

The amount of distressed inventory (foreclosures, short sales, etc.) has stymied price growth and appreciation in Sussex. However, the average price in May of this year is the highest it has been for this month since 2014.

Units Sold.

There has been a substantial decrease in units sold, even with average price increasing and average days on market decreasing.

Average Days on Market

The average days on market keeps going down, indicating a hot market.

Market Q&A

Buyer Concerns – Price or Inventory?

Geoff Green asked Vikki Garby whether she got a sense that her buyers were more worried about current prices or not being able to find a home due to lack of inventory. Vikki responded that inventory was the biggest problem. However, once they found a home, buyers were concerned about going to contract quickly. People were getting stressed out about interest rates. Therefore, they want to get them locked in as soon as possible since rates are rising. Dan Bounds advised that their mortgage customers are able to get their rate locked in once they have a signed one-page purchase agreement.

Appraisals – On Point?

Geoff then asked Keren Goren if appraisals were coming in on point, or if there were still problems. Keren replied that appraisers were coming in on point in New Jersey. Geoff responded that in a solid, appreciated market appraisers seem to be more comfortable and confident coming in on valuation.

Inventory – Quality or Quantity?

Geoff’s question to Joyce was, “Everyone says there’s no inventory, but there are homes on the market. Is the physical nature of inventory not what buyers are looking for? Is it the condition of homes?” Joyce stated that there was not a lot in good shape in certain price points. Much is a total gut job. Buyers want what they want, and many don’t see the potential in getting a fixer-upper.

Geoff felt that money, time and ability can be a deciding factor. In addition, as a property owner himself, he knows how hard it can be to get good contractors. They’re busy, materials are costing more, and prices are coming up. Both Joyce and Keren said that they’ve seen flippers making mistakes and poor choices that are visible to buyers. Using lower grade materials, not putting finishing touches (outlets without covers, exposed wiring, etc.), they are hurting themselves in their rush to put the house on the market. The problem is then compounded by listing agents overpricing these homes.

The Luxury Home Market

There has been discussion about possible negative impact of the new tax laws on the luxury, hi-end real estate market. While too soon to know what the true impact will be, the luxury market is currently doing better on a year-over-year basis. Sales of high-end homes ($500-$750,000) are up in both Orange and Sussex Counties.

The Impact of Tax Reform on the Housing Market

Following the monthly market update, guest speaker Tom McGlynn of BDO spoke about the impact of tax reform on the Housing Market, as well as in general. The Tax Cuts and Jobs Act was signed on Dec 22, 2017, the President’s “gift” to the nation. There wasn’t time to process the impact as changes began Jan 1, 2018. The Legislation will expire for individuals on Dec 31, 2025.

Tax Rates for 2018

It had been expected that tax rates would be limited to 3 or 4 bands. However, the bands are dramatically expanded. Furthermore, there is a drop in rates from a high of 39.6% to a high of 37% in 2018, going forward. The expectation is that people with higher income levels will see a decrease in federal income tax liability.

Major Changes:

Above-the-line deductions:

Moving expense deductions: Only available for US military moving pursuant to military order. As a result, changes will impact US citizens who move for employment, whether in the US, abroad, or to the US.

Alimony: For Agreements entered into after Dec 31, 2018. the deduction for alimony or separate maintenance payments has been repealed. Furthermore, inclusion of money received for alimony as income is repealed. Existing agreements are grandfathered in.

Standard & personal exemptions: Standard deduction increased, almost doubled. Married filing jointly, is now $24,000. More taxpayers may end up claiming the standard as opposed to itemizing. Personal exemption is suspended through 2025.

Medical Expenses. Threshhold lowered to 7.5 percent from 10% for out-of-pocket expenses not covered by insurance.

Real Estate impacted regulations

State and local taxes: In our market this is the big item. Taxpayers are now only allowed to deduct a maximum $10,000 aggregate of state and local real property, personal property, and state and local income sales taxes.

Mortgage Interest: Amount of acquisition indebtedness applies to new loans. However, mortgages in place before 2017 grandfathered in up to $1,000,000 mortgage. For debt incurred after Dec 15, 2017, you can only deduct interest paid on indebtedness of up to $750,000. Furthermore, home equity interest deduction has been suspended.

Vikki asked for confirmation that limitations do not apply to real property taxes and personal property taxes paid or accrued in carrying on trade or business? Tom confirmed that this is correct; real estate traders/investors filing Schedule E are not subject to the new limits. In addition, properties held for investment are not effected by the mortgage limitation.

Changes in other deductions

Charitable contributions: Limitation on deduction for cash contributions increased to 60% of AGI. However, this cannot be in addition to Standard deduction. The deduction can only be taken if the taxpayer is itemizing. It is not known how or if this will affect charitable giving.

Casualty losses: Suspended through 2025, unless loss is attributable to a Federally declared disaster area.

Wagering Transactions: Limited to income offsetting expenses.

Miscellaneous itemized deductions: Suspended through 2025. Includes unreimbursed business expenses, investment fees, tax prep fees.

Pease limitation suspends limitation on itemized deductions. For 2018-2025, no limitation on itemizations exceeding standard deduction.

AMT (Alternative Minimum Tax): Put in place to make sure taxpayers weren’t able to reduce their tax liability by utilizing certain itemized deductions (income taxes, real property, state and local taxes) due to income. Congress minimized Corporate AMT. The individual AMT was expected to be eliminated. However, Congress decided to keep it in place but significantly increased exemption amounts and thresholds.

Selling Your Home – Tax Basics Relating to Closing Disclosure Statement

Nothing changes regarding home sale rules if you can show you owned and used home for principal use 2 out of 5 years. Hence, the first $500,000 of gain is exempt from federal and state tax. Basis is the amount home is worth for tax purposes. This includes what you paid for home, improvements, closing costs, etc. However, current year deductions may be subject to limitations.

The above are just highlights of the discussions and presentation. You can watch the entire video here.

We Keep You Informed:

The Green Team Shares this information and more each month during our Live Housing Market Update. Register to join the webinar and hear directly from our participating Green Team Sales Associates who share their personal take on how the marketplace is doing.

Industry experts join us each month to share insights into the currently financing environment, as well as broader economic issues affecting the housing market.

Check out our past Housing Market Updates. Then Register to get our Housing Market Updates.

Orange County Real Estate Market Report for May 2018

Green Team Business Review – May 2018

The numbers tell a story all their own. Despite the lack of inventory on the market, despite the specter of rising interest rates, loss of deductions due to new tax laws, etc., the Green Team is doing something very right and finding people buyers for their homes and finding homes for buyers! Both the Warwick and Vernon offices have more than doubled their sales volume from a year ago.

Orange County, NY Real Estate Market Report – April 2018 Results

The May Market Update was held on Tuesday, May 8 on Facebook Live. It was moderated by Geoff Green, Founder of Green Team Home Selling System. Panelists included sales agents Vikki Garby from the Warwick office, Keren Goren of the Vernon office, Michael Giannetto from Residential Home Funding and Ken Ford from Warwick Valley Financial Advisors.

If you missed the original live event, click here to watch. The discussion involved not only the housing market, but also perspectives on the economy. Our guest panelists have a great deal of knowledge and expertise, and the conversation was informative, educational and lively.

You can also sign up for monthly updates by email on the Green Team website.

We were experiencing technical difficulties:

Prior to the update going live, the following discussion took place:

The lack of inventory remains the biggest impediment to home sales, and the panel discussed the various reasons why people are reluctant to sell now. Vikki Garby stated that there were more buyers this winter than last spring, but that there is not a lot to buy. Cash buyers were coming in strong, with some people getting full asking price, or over. Keren Goren stated that many people she spoke to were just hanging on, waiting to see what would happen in the market.

Geoffrey Green told the panel that he is often asked, “Should I wait, because prices are going higher?” According to Vikki, sellers are worried about finding a home! People move up here from other places and swamp the market, and people who want to sell but stay in the area are concerned. Keren said that houses in Sussex are outdated, older than what buyers are looking for. Geoff said, “At the end of the day, if you’re moving and need to sell, try to sell and buy at the same time.”

The conversation turned to “fixer-uppers.” Geoff felt that most buyers don’t have the time, experience, and money to do renovation after buying a home. However, he asked the panel if they were seeing more buyers willing to take on a fixer-upper.

Keren cited a buyer who was willing to take out a loan to put a new roof on a house where everything else had been done. He was willing to go that step. Vikki stated there was not much to choose from and buyers trying to get into the area are having to be more flexible. Mike Giannetto stated that reno loans are now a big product and many people are taking the opportunity to fix up a house, put in new appliances, roof, etc., using equity.

Watch the video for more discussion, including a fascinating look into the world of economics and how the bond market impacts the interest rate that buyers may soon be paying.

Orange County, NY Real Estate Market Report – April 2018 Results

We are pleased to share with you the Housing Market Report for April 2018. We break down local real estate activities and provide you with stats, graphs, and analysis of our local and regional real estate market. In addition, we provide insight from some of the people most familiar with market trends: sales associates, mortgage funding specialists and financial advisers.

Average Days on the Market

The faster homes are selling, the hotter the market. Look for the lowest number on the graph, as opposed to the highest. The calculation in New York State is from the List Date to the Contract Date.

With numbers in for April, the average days on are the lowest they’ve been for this month for 5 years.

Average Price

Here again we’re seeing a trend. Prices are coming in at their highest point for April in 5 years, at an average of $247,849.

Average Sold to Asked Ratio

This is the percentage a house sold for under or over the last asking (not the original) price.

The higher the percentage, the hotter the market. This April the percentage dipped slightly below April 2016 and 2017, but sellers are still negotiating at approximately 3.5 points off the last asking price. As mentioned last month, this is an average of all of Orange County, with some areas having a higher percentage, and some a lower one.

Homes that sold at 100% or more of last asking price

Here again there was a slight dip below April 2016 and 2017, though the numbers remain higher than 2014 and 2015.

Units Sold

Units sold seems to have flat lined; however, more units were sold in April 2018 than in the four preceding years.

We Keep You Informed:

The Green Team Shares this information and more each month during our Live Housing Market Update. Register to join the webinar and hear directly from our participating Green Team Sales Associates who share their personal take on how the marketplace is doing.

Each month we are also joined by industry experts who share insights into the current financing environment as well as broader economic issues affecting the housing market.

Check out our past Housing Market Updates. Then Register to join our next one on June 12th at 9am.

[embedyt] https://www.youtube.com/embed?listType=playlist&list=PL6MEM7EpyL0E5YdU249T_KsDQTukboj8E&v=AQYblgrxmIY[/embedyt]

Tom Folino Joins the Green Team

The Green Team Home Selling System is pleased to announce that Tom Folino has joined our organization. Tom, a true Warwick native, was born and raised here. His father, the owner of Folino’s Shoe Repair, was a fixture in the Village of Warwick, and his mother remains active to this day, now involved in the senior citizens’ retirement group.

Tom grew up loving his hometown and sports. He combined his love of both by coaching teams in Little League Baseball, the Youth Recreation Soccer Program, and the Youth Basketball League. Tom received his B.S. in Physical Education and Health from Slippery Rock University and his M.S. in Sports Administration from Montclair University. He taught in the Warwick Valley Central School District for 34 years, where he was also the Boys Varsity Basketball Head Coach and the Boys Varsity Golf Head Coach. Tom and his beautiful wife of 29 years, Nancy, raised their two sons here in Warwick. Thomas, the eldest, is a 4th-year medical student at NYCOM and younger son, Tyler is pursuing his Master’s Degree in Real Estate Development at Columbia. Nancy is a Director of Nursing at White Plains Hospital in Westchester.

Even when buying and selling his own homes throughout the years, Tom found that he really enjoyed the process – from obtaining financing to negotiating the best deals, and everything else involved. After retiring from teaching, Tom decided to turn his attention to real estate full time, motivated by a desire to help people sell their houses and find homes they’ll love in this community he knows so well. Tom, a well-respected teacher, and coach brings the same enthusiasm, dedication, and professionalism to his real estate career. His clients’ needs and desires come first, and his familiarity with Warwick and its many neighborhoods and villages is a real asset.

When asked why he chose to join the Green Team, Tom said that was easily answered in two words: “Geoff Green.” It seems that Tom coached Geoff some years ago and even then was impressed by the young man’s work ethic, perseverance, and leadership skills.

And, according to Geoff, “There might not be a better person to get into Real Estate in the Warwick NY market than Tom Folino. A true example of someone who has a huge network is extremely likable and always acts with integrity. What people might not know about him is that he is extremely diligent in his follow up and a very smart guy to boot. We are extremely blessed that Tom has decided to join our company.”

So, here we have it! The former coach and former player… together on the same winning team again.

Nancy Sardo Wins Second Quarter Sales Award

Nancy Sardo Wins Second Quarter Sales Award

WARWICK – (August 8, 2017) The Green Team Home Selling System in Warwick, NY is proud to announce that Nancy Sardo recently won the Second Quarter Sales Leader Award.

Nancy has been listing and selling homes in Orange County, New York since 2005. Dedicated to her profession, she has earned her Associate Broker’s License, Seniors Real Estate Specialist designation and is an Accredited Buyer’s Representative. Nancy devotes her time and boundless energy to making sure she does her best for each and every client, staying on top of changes and trends in the real estate market and making sure that her clients have the best possible experience as they buy, sell, rent or build their home.

In addition, Nancy is passionate about new construction and her experience working with both builders and clients has led to her becoming the listing broker for several new subdivision developments throughout Orange County. Keeping on top of new building codes and their impact, as well as keeping the client on track with both schedule and budget, help her achieve her goal of making the experience of building a home a positive one for her clients.

Nancy’s philosophy is simple: “I love what I do for a living!” She goes on to say, “It takes a team to get the job done and I am proud to be part of a great team! I have the amazing opportunity to meet and work with the most wonderful clients and colleagues. Homeownership is a privilege and it is an honor to work with people who work so hard to achieve it.”

Sardo was born and raised in Queens, NY, but in 1999 she and husband Denis left the City for Warwick, where they raised their two children. A former Medical Assistant, Nancy volunteered with the Cub Scouts, as well as Meals on Wheels. Nancy made the transition to full time real estate agent 12 years ago and has never looked back.

According to Geoff Green, “This is Nancy Sardo’s first Quarterly Sales Leader award since becoming a Sales Associate here at The Green Team, and I am certain it will be the first of many. Nancy is a consummate professional hitting her stride, and it’s inspiring to watch her business grow before our eyes. I am honored that our company can assist her in all of her success.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link