Orange & Sussex Counties – Housing Market Update for June 2018 and Impact of Federal Tax Reform on the Housing Market

The Green Team went live on Facebook Tuesday, June 12 with its monthly housing market update. Geoff Green, President of the Green Team, moderated the event. Panelists included sales associates Vikki Garby and Kim Leslie of the Warwick office and Keren Gonen and Joyce Rogers from the Vernon Office. Guest panelists were Dan Bounds, Senior Home-Lending Advisor with Chase Bank and Ed Mainland, Executive Director at JP Morgan Chase & Co. A special presentation was given by Thomas McGlynn, Managing Director of BDO Expatriate Services, on the impact of federal tax reform on the housing market.

Overview

Nationally there has been a 5.3% year-over-year increase in existing home prices. Low to middle-level houses are moving faster than higher-end homes. However, economists are concerned about the affordability of homes for the entry buyer level. The lack of inventory is driving home prices up. The West Coast has been moving at a greater pace than here in the North East. Supply and demand is taking hold. Foot traffic stats are very interesting. There has been more foot traffic this year than last year during the same time. On a national level, existing home sales are slightly down from where they were last year during the same period. This may be a reflection of inventory problems.

Orange County Update

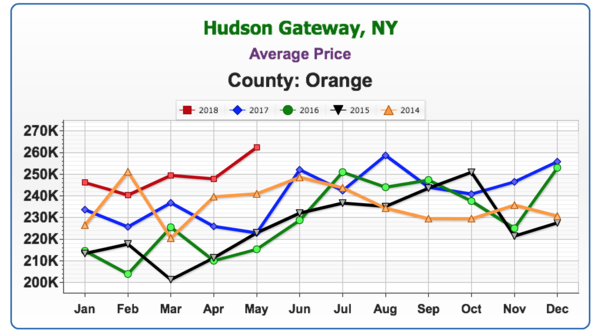

Average Price

Average price has really taken off. There was a mixed bag of results until this year.

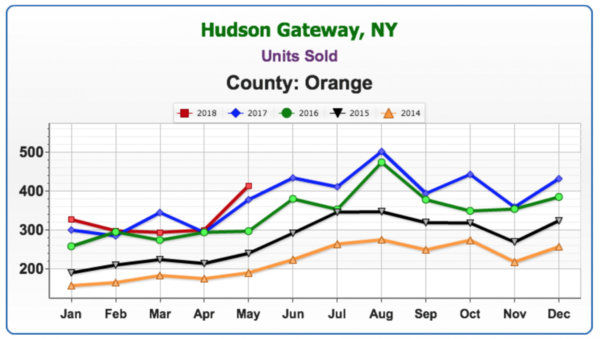

Units Sold

May saw the most units sold for this month since 2014. However, prior to May, this year is the first where we’ve seen more than one month at or less than the same month in previous years. There has been a steady increase year-over-year until 2018. We will continue to keep a watch on this analytic as it may be the most important indicator of when there will be a downturn.

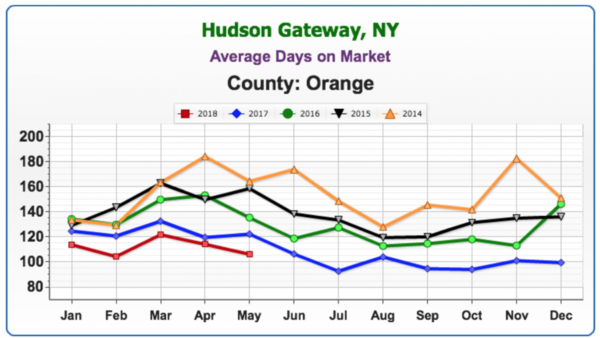

Average Days on Market

The average days on market continues to decrease. This indicates the market is hot; a good seller’s market. For some who have been waiting a long time, now may be a good opportunity to sell their homes.

Sussex County Update

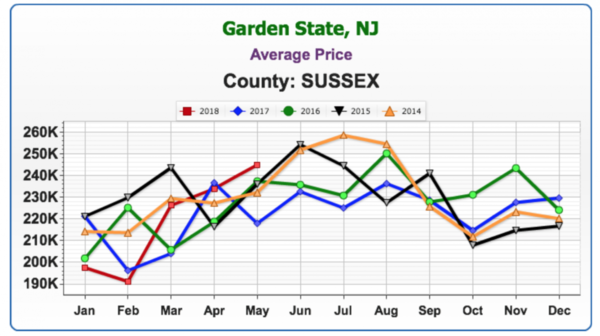

Average Price

The amount of distressed inventory (foreclosures, short sales, etc.) has stymied price growth and appreciation in Sussex. However, the average price in May of this year is the highest it has been for this month since 2014.

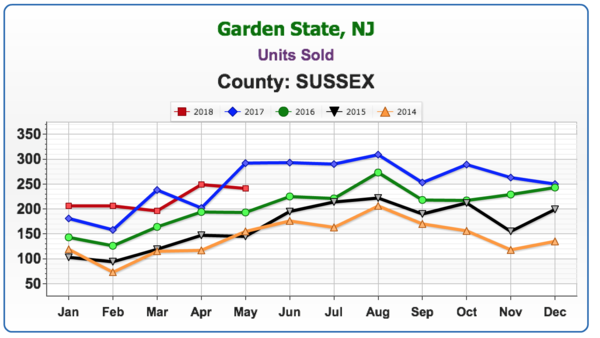

Units Sold.

There has been a substantial decrease in units sold, even with average price increasing and average days on market decreasing.

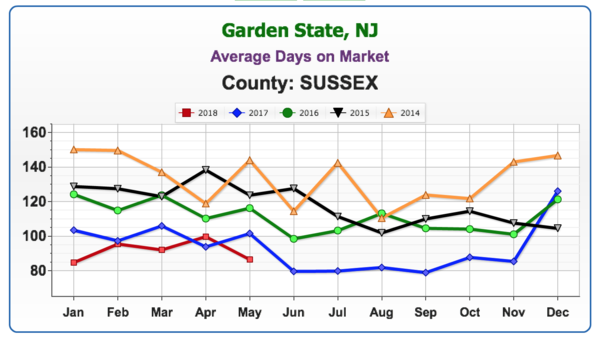

Average Days on Market

The average days on market keeps going down, indicating a hot market.

Market Q&A

Buyer Concerns – Price or Inventory?

Geoff Green asked Vikki Garby whether she got a sense that her buyers were more worried about current prices or not being able to find a home due to lack of inventory. Vikki responded that inventory was the biggest problem. However, once they found a home, buyers were concerned about going to contract quickly. People were getting stressed out about interest rates. Therefore, they want to get them locked in as soon as possible since rates are rising. Dan Bounds advised that their mortgage customers are able to get their rate locked in once they have a signed one-page purchase agreement.

Appraisals – On Point?

Geoff then asked Keren Goren if appraisals were coming in on point, or if there were still problems. Keren replied that appraisers were coming in on point in New Jersey. Geoff responded that in a solid, appreciated market appraisers seem to be more comfortable and confident coming in on valuation.

Inventory – Quality or Quantity?

Geoff’s question to Joyce was, “Everyone says there’s no inventory, but there are homes on the market. Is the physical nature of inventory not what buyers are looking for? Is it the condition of homes?” Joyce stated that there was not a lot in good shape in certain price points. Much is a total gut job. Buyers want what they want, and many don’t see the potential in getting a fixer-upper.

Geoff felt that money, time and ability can be a deciding factor. In addition, as a property owner himself, he knows how hard it can be to get good contractors. They’re busy, materials are costing more, and prices are coming up. Both Joyce and Keren said that they’ve seen flippers making mistakes and poor choices that are visible to buyers. Using lower grade materials, not putting finishing touches (outlets without covers, exposed wiring, etc.), they are hurting themselves in their rush to put the house on the market. The problem is then compounded by listing agents overpricing these homes.

The Luxury Home Market

There has been discussion about possible negative impact of the new tax laws on the luxury, hi-end real estate market. While too soon to know what the true impact will be, the luxury market is currently doing better on a year-over-year basis. Sales of high-end homes ($500-$750,000) are up in both Orange and Sussex Counties.

The Impact of Tax Reform on the Housing Market

Following the monthly market update, guest speaker Tom McGlynn of BDO spoke about the impact of tax reform on the Housing Market, as well as in general. The Tax Cuts and Jobs Act was signed on Dec 22, 2017, the President’s “gift” to the nation. There wasn’t time to process the impact as changes began Jan 1, 2018. The Legislation will expire for individuals on Dec 31, 2025.

Tax Rates for 2018

It had been expected that tax rates would be limited to 3 or 4 bands. However, the bands are dramatically expanded. Furthermore, there is a drop in rates from a high of 39.6% to a high of 37% in 2018, going forward. The expectation is that people with higher income levels will see a decrease in federal income tax liability.

Major Changes:

Above-the-line deductions:

Moving expense deductions: Only available for US military moving pursuant to military order. As a result, changes will impact US citizens who move for employment, whether in the US, abroad, or to the US.

Alimony: For Agreements entered into after Dec 31, 2018. the deduction for alimony or separate maintenance payments has been repealed. Furthermore, inclusion of money received for alimony as income is repealed. Existing agreements are grandfathered in.

Standard & personal exemptions: Standard deduction increased, almost doubled. Married filing jointly, is now $24,000. More taxpayers may end up claiming the standard as opposed to itemizing. Personal exemption is suspended through 2025.

Medical Expenses. Threshhold lowered to 7.5 percent from 10% for out-of-pocket expenses not covered by insurance.

Real Estate impacted regulations

State and local taxes: In our market this is the big item. Taxpayers are now only allowed to deduct a maximum $10,000 aggregate of state and local real property, personal property, and state and local income sales taxes.

Mortgage Interest: Amount of acquisition indebtedness applies to new loans. However, mortgages in place before 2017 grandfathered in up to $1,000,000 mortgage. For debt incurred after Dec 15, 2017, you can only deduct interest paid on indebtedness of up to $750,000. Furthermore, home equity interest deduction has been suspended.

Vikki asked for confirmation that limitations do not apply to real property taxes and personal property taxes paid or accrued in carrying on trade or business? Tom confirmed that this is correct; real estate traders/investors filing Schedule E are not subject to the new limits. In addition, properties held for investment are not effected by the mortgage limitation.

Changes in other deductions

Charitable contributions: Limitation on deduction for cash contributions increased to 60% of AGI. However, this cannot be in addition to Standard deduction. The deduction can only be taken if the taxpayer is itemizing. It is not known how or if this will affect charitable giving.

Casualty losses: Suspended through 2025, unless loss is attributable to a Federally declared disaster area.

Wagering Transactions: Limited to income offsetting expenses.

Miscellaneous itemized deductions: Suspended through 2025. Includes unreimbursed business expenses, investment fees, tax prep fees.

Pease limitation suspends limitation on itemized deductions. For 2018-2025, no limitation on itemizations exceeding standard deduction.

AMT (Alternative Minimum Tax): Put in place to make sure taxpayers weren’t able to reduce their tax liability by utilizing certain itemized deductions (income taxes, real property, state and local taxes) due to income. Congress minimized Corporate AMT. The individual AMT was expected to be eliminated. However, Congress decided to keep it in place but significantly increased exemption amounts and thresholds.

Selling Your Home – Tax Basics Relating to Closing Disclosure Statement

Nothing changes regarding home sale rules if you can show you owned and used home for principal use 2 out of 5 years. Hence, the first $500,000 of gain is exempt from federal and state tax. Basis is the amount home is worth for tax purposes. This includes what you paid for home, improvements, closing costs, etc. However, current year deductions may be subject to limitations.

The above are just highlights of the discussions and presentation. You can watch the entire video here.

We Keep You Informed:

The Green Team Shares this information and more each month during our Live Housing Market Update. Register to join the webinar and hear directly from our participating Green Team Sales Associates who share their personal take on how the marketplace is doing.

Industry experts join us each month to share insights into the currently financing environment, as well as broader economic issues affecting the housing market.

Check out our past Housing Market Updates. Then Register to get our Housing Market Updates.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link