August Housing Market Update

The August Housing Market Update was held live on Facebook on Tuesday, August 14, at 9 a.m. If you missed the live webinar, you can view it at your convenience by clicking here.

Next month, the Housing Market Update webinar will take place on Tuesday, September 18 at 2 p.m. You can sign up for updates at GreenTeamHQ.com/HMU.

Meet the Panel

Keren Gonen

Patrick Keelin

Jeff Lobb

Geoff Green moderated the webinar and presented statistics for Orange and Sussex Counties. Keren Gonen, of Green Team Real Estate New Jersey and Green Team Home Selling System, gave her perspective on the market from the sales associate’s view. Guest panelists were Patrick Keelin, Branch Manager of Family First Funding’s Warwick office, and Jeff Lobb, Founder and CEO of SparkTank Media. Green Team’s Marketing Director, Melissa Bressette, was on hand to make sure everything ran smoothly.

Housing Market Update – National

Nationally, for the last two months, the number of homes selling is down slightly from 2017. Earlier in the year it was almost even. There is a mixed bag, not a continued trend. Common knowledge says it’s all about inventory. There are just not enough homes for all the buyers out there.

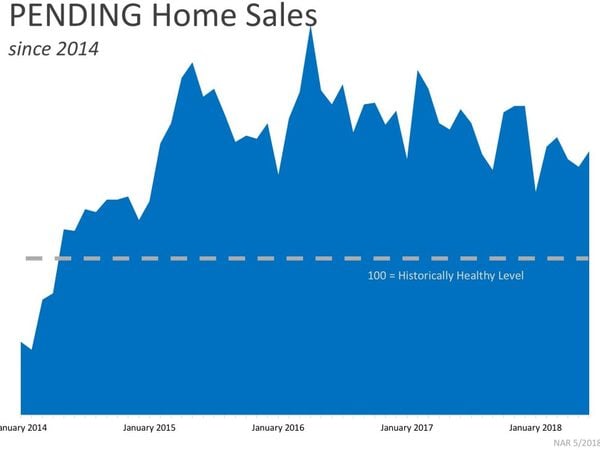

Pending home sales seem to be trending downward nationally.

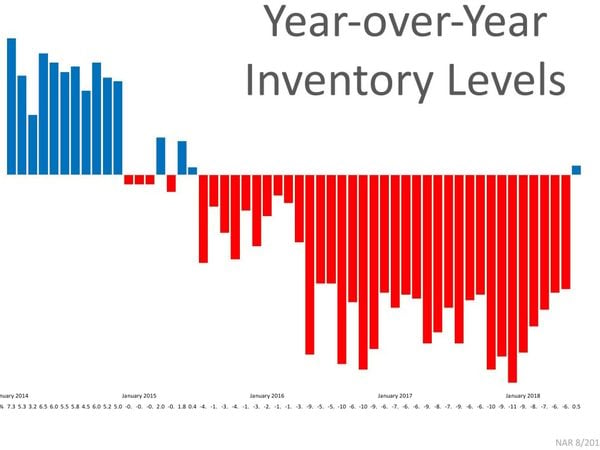

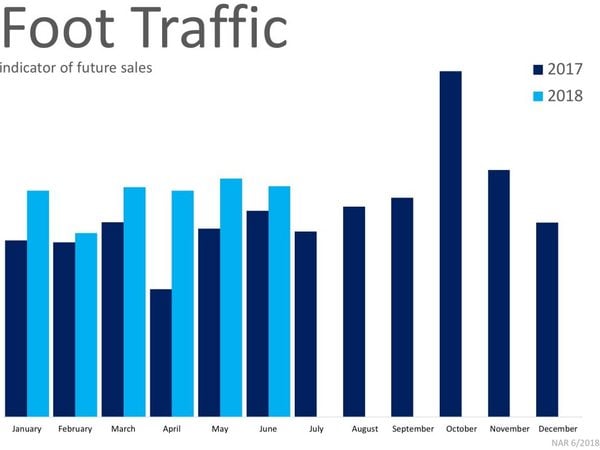

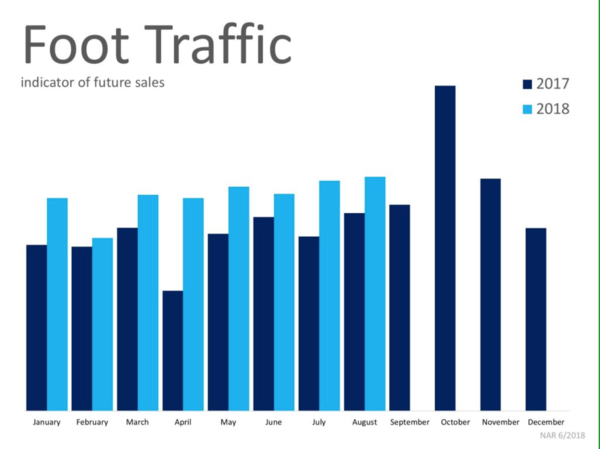

The National Association of Realtors shows year-over-year inventory levels up for the first time in 36 months. It may be a good sign, though it may also be indicative of the market slowing a little. However, foot traffic is up in 2018, compared to 2017. This graphic represents the numbers of people actually in homes, looking to buy. This number has been up consistently all year, though sales are down on a national level. From a national perspective, it’s still a very solid market.

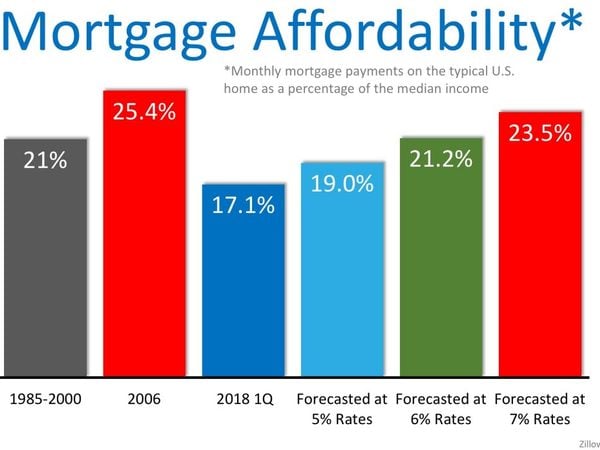

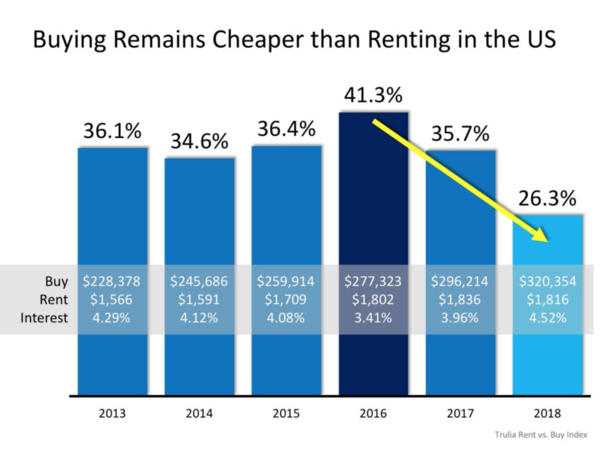

From 1985 to 2000, 21% of household income was dedicated to mortgage payments. In the first quarter of 2018 we’re well below that number. At 17.1%, we’re about 4 points below the historical average over the last 25 years. Therefore, even though prices are rising and inventory is tight, homes are still relatively affordable compared to 1985 to 2000. Even if rates do get to 6% or so, household income dedicated to mortgage payments will be only a few points higher than the 1985 to 2000 average.

Housing Market Update – Orange County, NY

Getting down to local stats, although at a slowing pace, the numbers are still at historical levels. In our area, where the current number of homes selling is the equivalent of 2006 (which was one year after the absolute peak in the market that occurred in 2005), the rate of sales is historically very high. This is a very hot market.

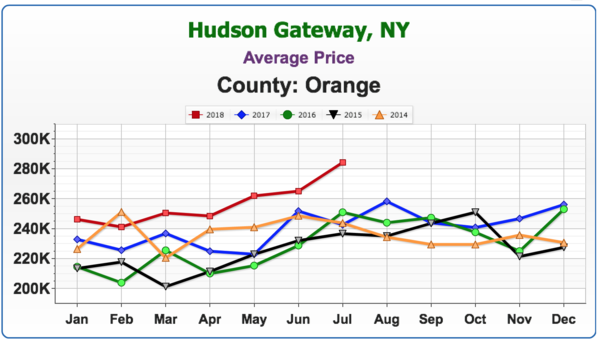

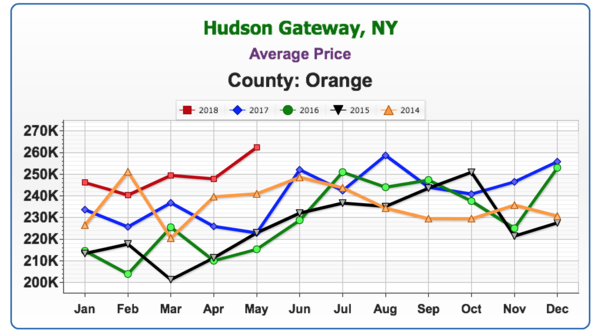

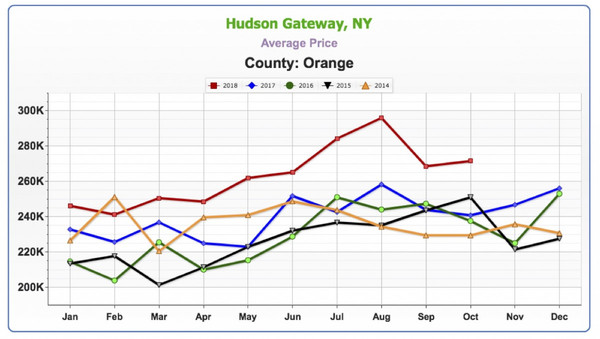

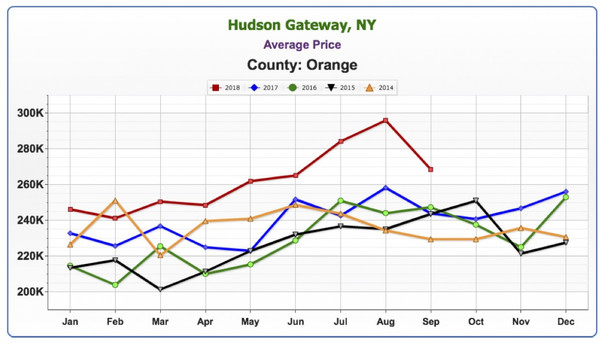

Average price is clearly rising in 2018. Geoff noted that in his experience units sold would increase, but average price didn’t quite get there. Then, units sold would start to decrease but price didn’t follow that trend, with a lag of about 6 months. There was almost a 2-year lag in average price that came after the downturn in the market.

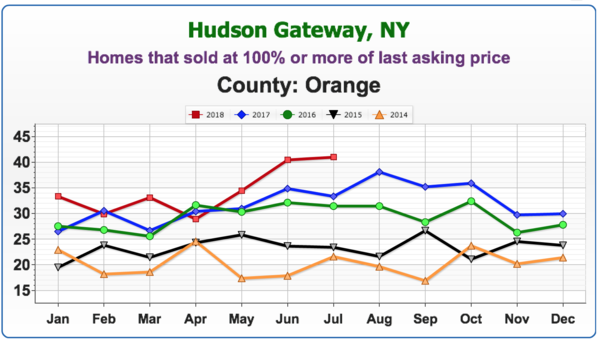

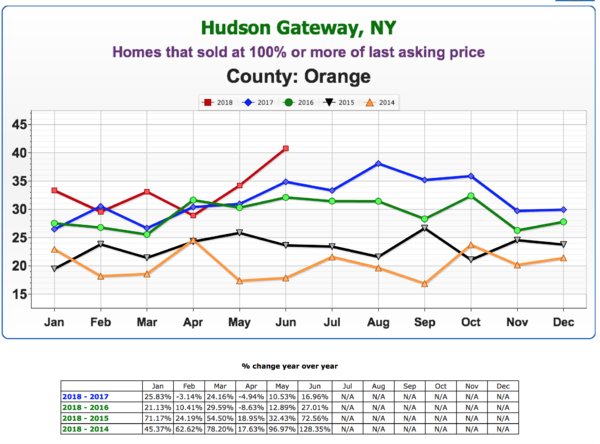

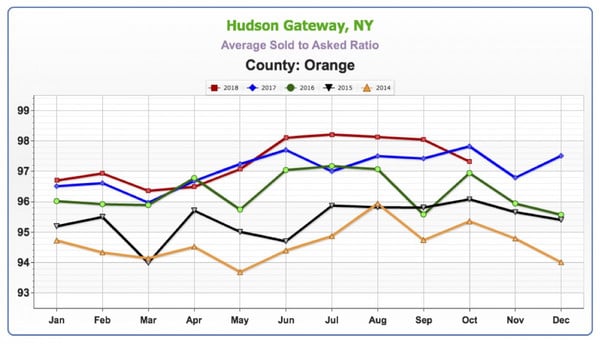

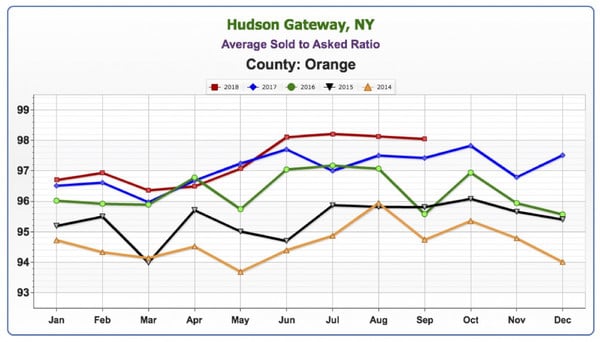

Approximately 40% of homes are selling at 100% or more of their last asking price. There are a lot of bidding wars going on, and this is indicative of how hot the current market is.

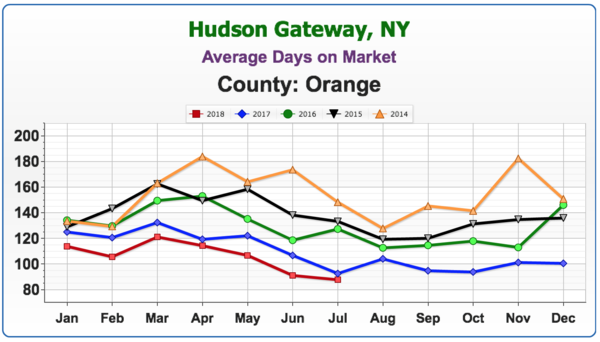

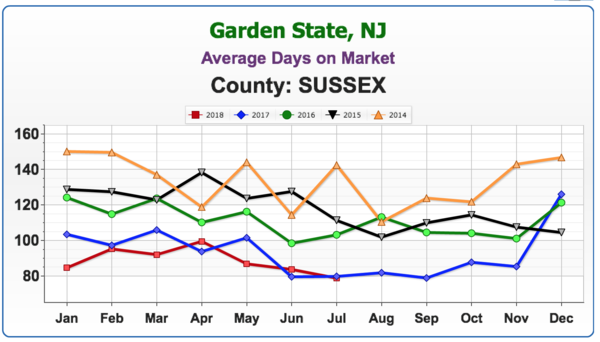

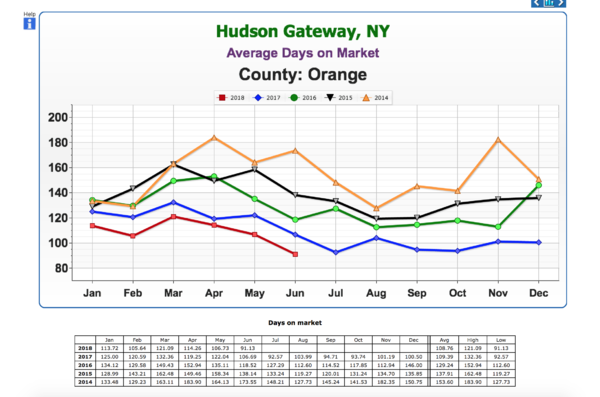

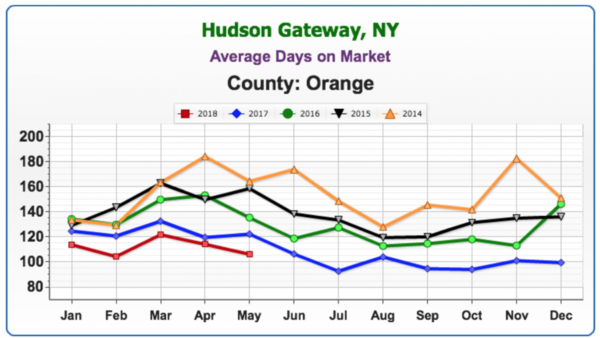

This number continues to decline, another sign that this market is hot.

Housing Market Update – Sussex County, NJ

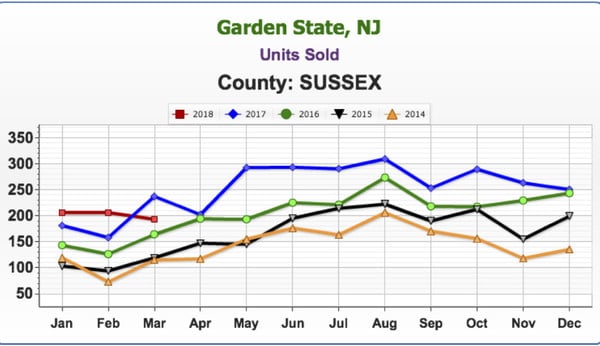

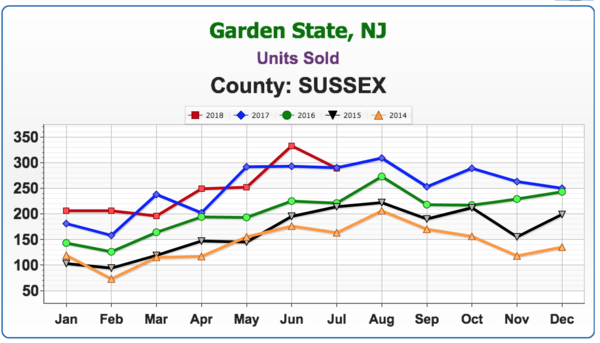

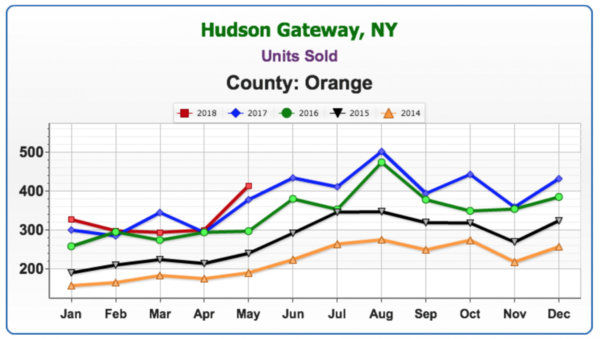

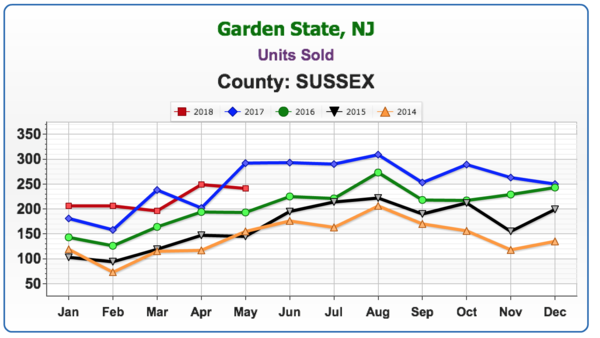

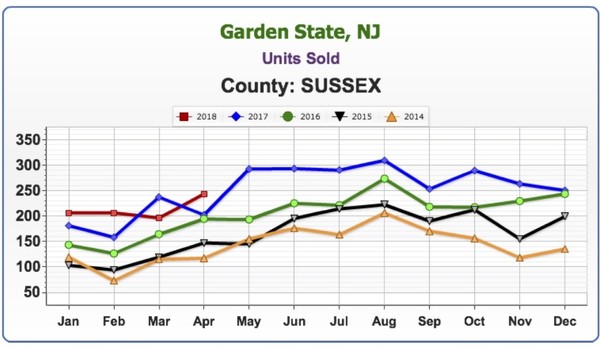

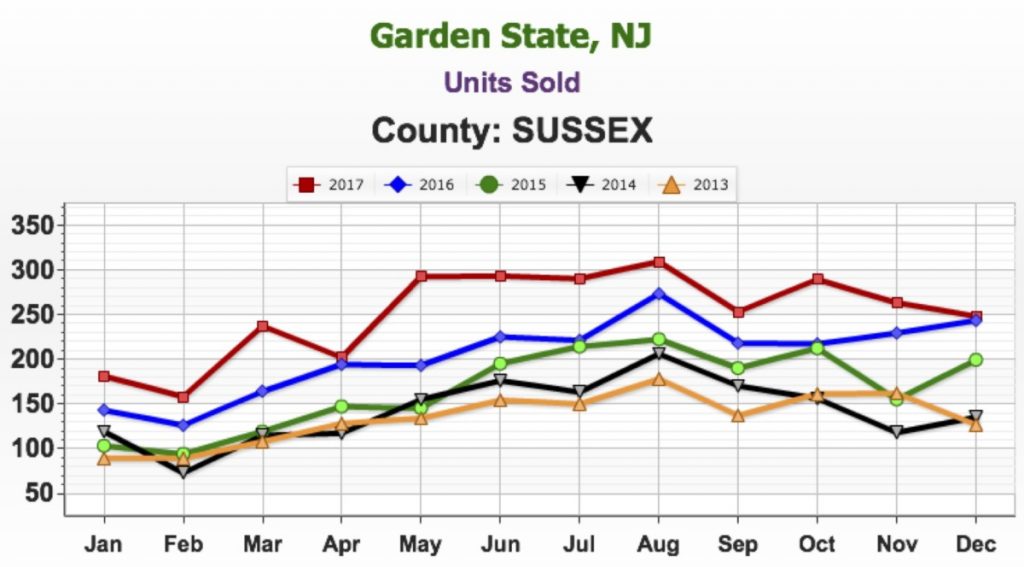

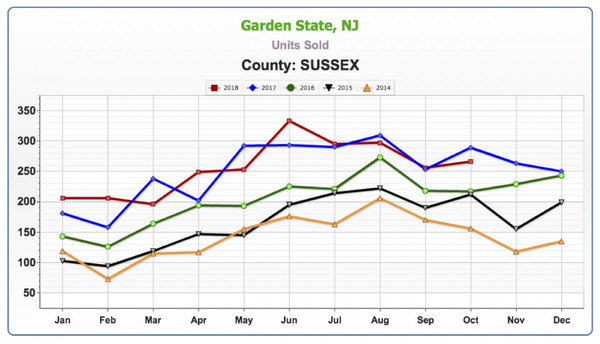

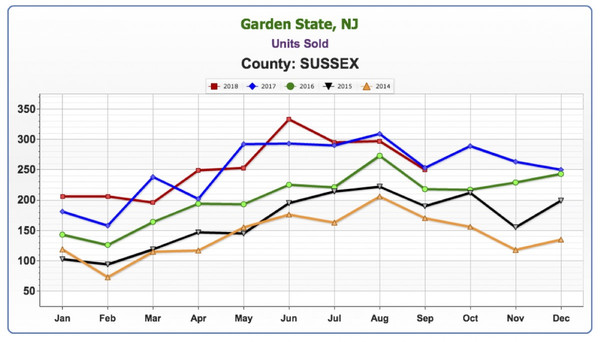

The stats are showing a fluctuation in the number of units sold in Sussex County. It’s a mixed bag – some months below, some months above. No definitive trend has emerged.

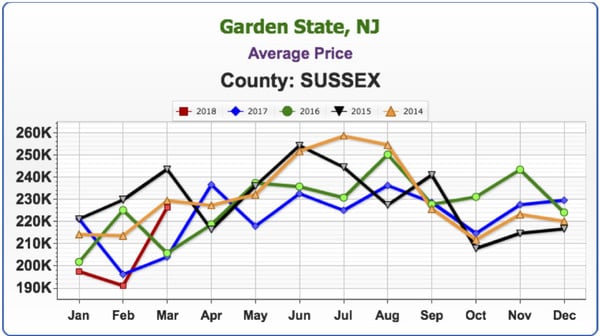

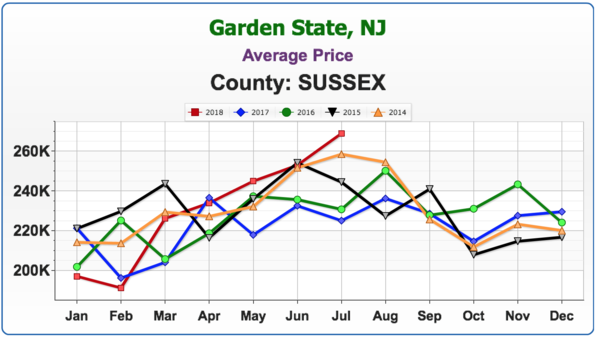

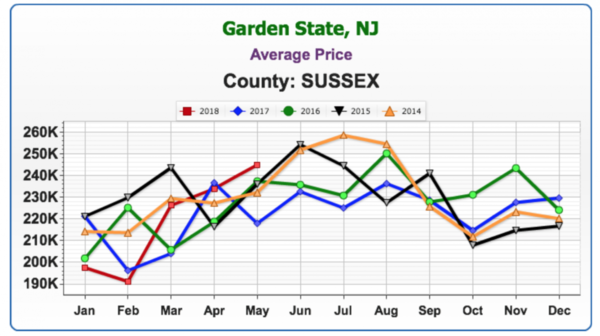

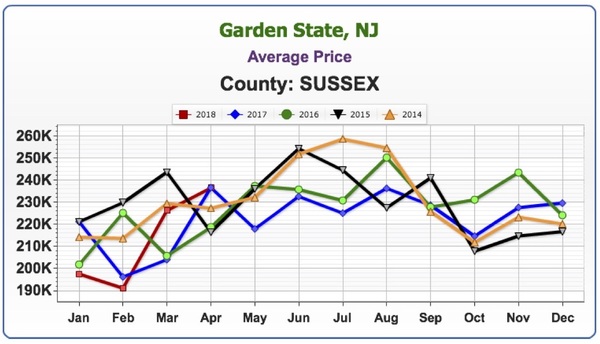

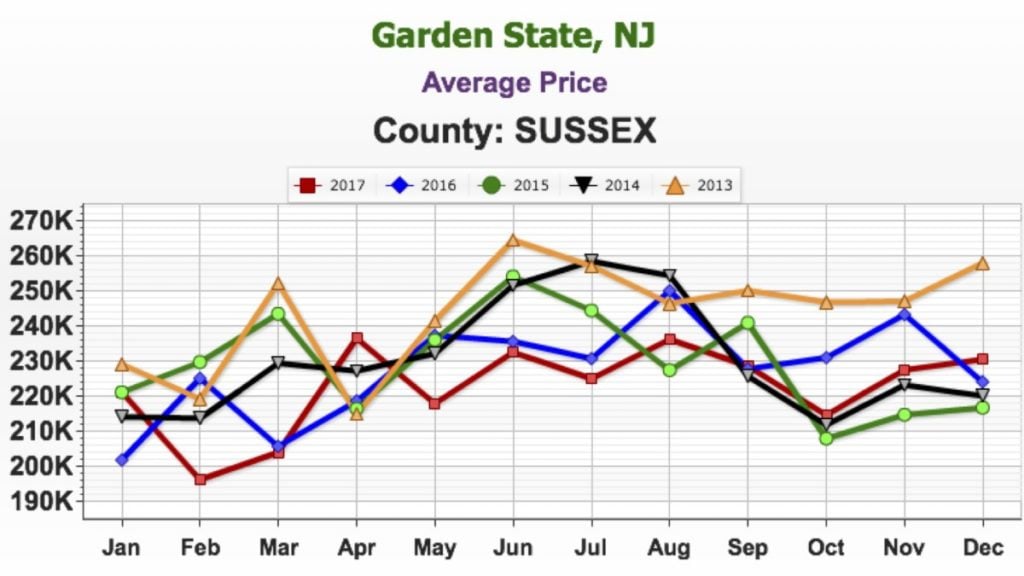

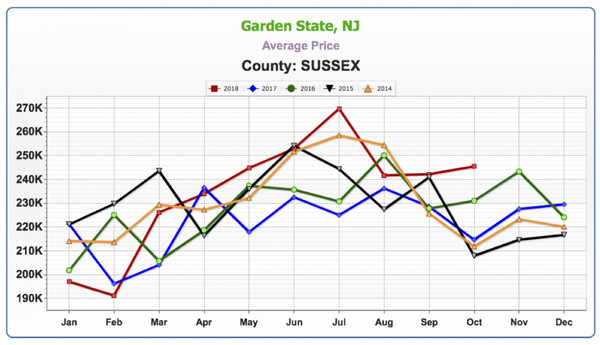

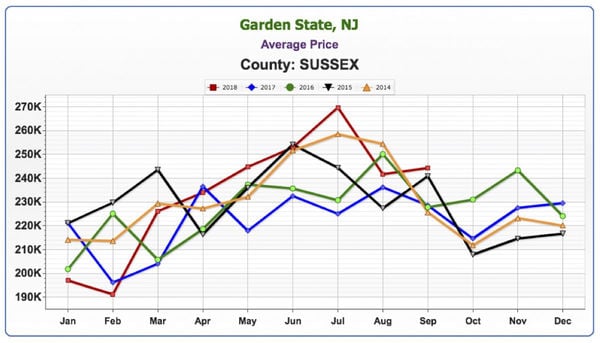

Not quite the lift-off that’s occurring in Orange County, but after the first two months of 2018, there is a definite rise in average price and July is at the highest point of the last five years.

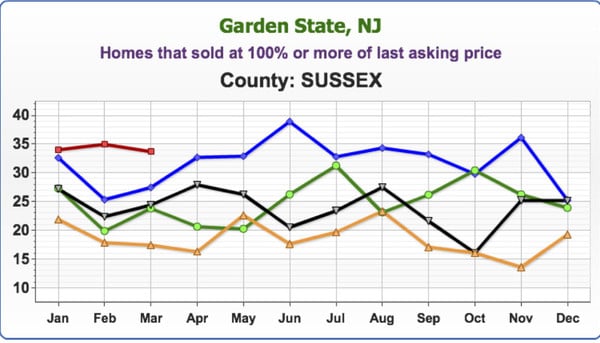

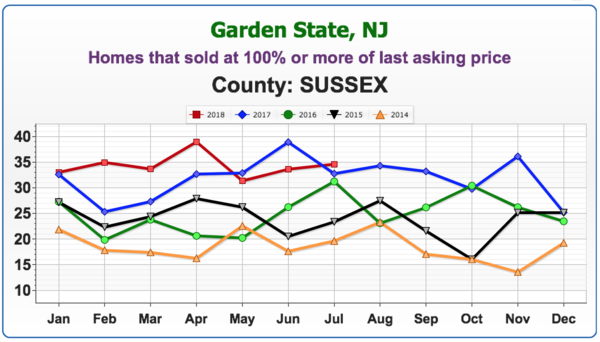

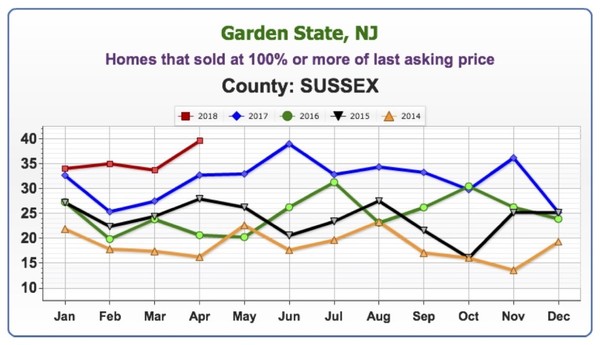

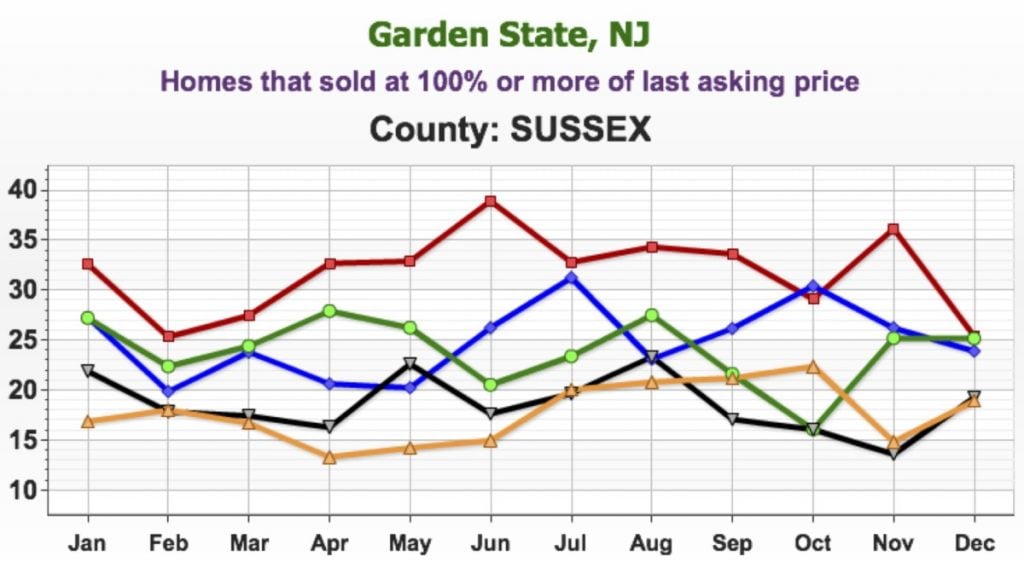

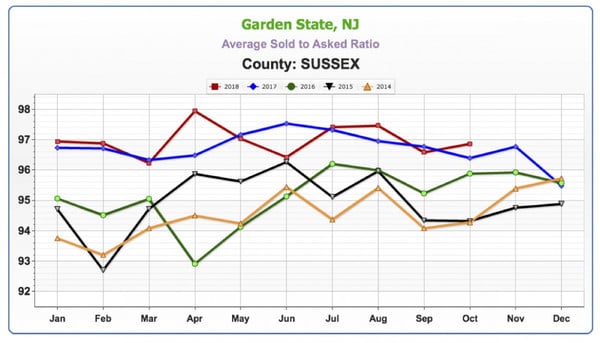

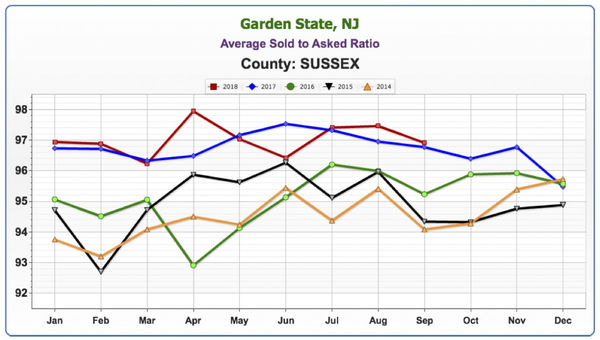

While not quite as high as Orange County, between 30 to 40% of homes are selling at 100% or more of last asking price.

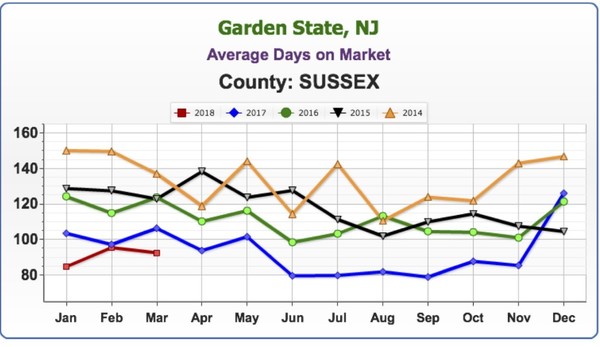

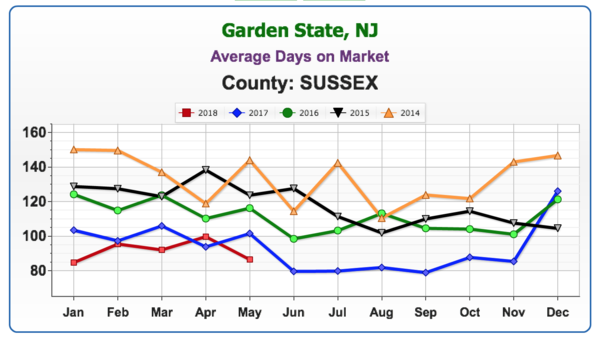

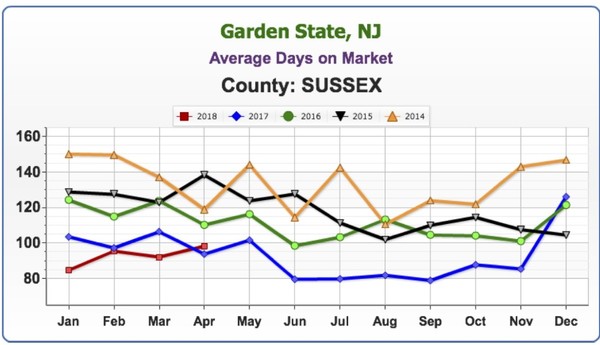

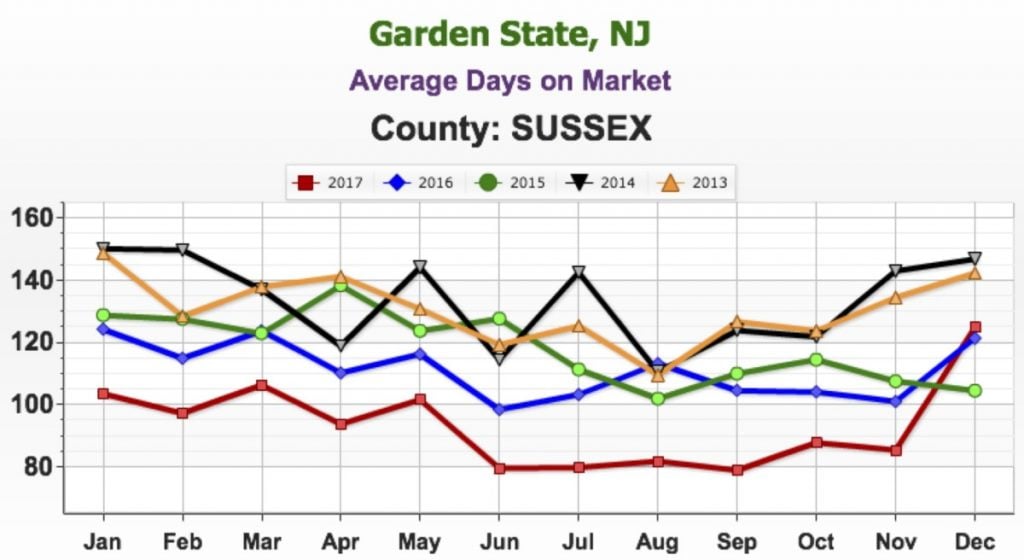

We’re seeing a similar trend to New York, with homes selling at around the 90-day mark.

Keren Goren – A Sales Associate’s Perspective on the Market

Geoff asked Keren Goren, one of Green Team’s top producers, for her thoughts on the current market. Licensed in both New York and New Jersey, Keren finds that there are many prospective buyers for both Orange and Sussex Counties. Lots of bidding wars are going on.

She does feel that some of the flippers in the area are doing less and asking for more. This appears to be a new trend. Keren recalled that flippers used to do a much better job, but many houses on the market now are unfinished and are scaring buyers away as opposed to inviting bids. Therefore, some outdated homes are actually selling for prices higher than they should or would have a few months ago.

Keren sees no sign of the market slowing down. However, she is seeing delays in closings due to issues with some mortgage companies, and with buyers making poor decisions with their finances. Keren did note that her experiences with Family First were extremely positive, and she highly recommended them.

Geoff noted that the current market upturn stands a chance at longevity. Following the downturn, as deep and as long it was, people weren’t moving. Banks have since cleaned up their balance sheets, tightened programs up, and are making money. There are fewer defaults happening. Basically, everything depends on how much money the banks are willing to lend.

PJ Keelin – A Lender’s Perspective

The mortgage industry is doing well, offering a lot more first-time homebuyer programs with as little as 3% down, USDA becoming very popular in Orange and Sussex County areas. Also trending is loosening up a bit and coming up with more portfolio loan products, personal products and using common-sense underwriting and ability to fund when looking at today’s borrowers.

With homes in the $200,000 to $300,000 price range becoming few and far between, they are looking at different programs, such as adjustable rates, less money down, and interest only type payments. However, in these cases, information and education should be given to borrowers upfront. It’s necessary to prepare the borrower for everything that will come together throughout the process. It’s extremely important for borrowers to be aware of what they are getting into with these products and understand how they work.

Geoff noted that with the last downturn, banks were not requiring people to have much “skin in the game.” Zero down, lying about income, jamming loans through. Geoff asked if PJ was seeing any of those practices coming back, or if there remains more oversight. scrutinizing income and the buyer’s comprehensive financial situation, down payments, etc. before loans are going out.

PJ replied that FANNIE and FREDDIE are doing a great job operating more with common sense with people who can have a little more risk, etc. They are requiring more skin in the game. Banks are protecting themselves and borrowers by not letting people put themselves under water.

Where are mortgage rates headed?

Geoff noted that the Fed has been raising short-term interest rates and will probably continue to do so to stifle inflation. He asked PJ where he saw mortgage rates landing over the next 12 to 18 months. PJ answered that he believes rates will be consistently in the 5’s through most programs. The market is being built into where those rates are and is slowly trending. Supply and demand are balancing each other out. Geoff feels that if you buy now, the value of your home won’t drop out like it did 12, 14 years ago. Pricing levels appear to be realistic and should hold for some time in the future. Buyers want to know if the asset they’re buying will be worth at least as much or more than they’re paying now. Even though it is a seller’s market, Geoff and PJ concurred that it is a good time to buy.

Furthermore, PJ stated that appraisers are not allowing appraisal inflation to come above where the market truly should be. It’s better for appraisers to be a little tight because that will keep the longevity of this strong market going on for 12, 18, 24 months. Geoff replied that appraisals have been challenging over the last 3 years. Prior to the upturn, prices were a mixed bag, leaving appraisers unwilling to take a chance as they couldn’t see where the market was going. However, he noted that now some appraisers are more willing to take a chance and make an allowance because of the steady upward-trending market, even though there might not be a comp that can exactly substantiate it. There are fewer appraiser issues, though there are still times when they won’t go along with the offering price. This hurts the seller but protects the buyer. And it’s another way of controlling the market.

Jeff Lobb – A Marketing Expert’s Perspective

Geoff asked Jeff for his views on the future of service providers in the real estate industry in this age of technology. Are realtors going to be the next victims of business models like Amazon? Will technology replace realtors just as retail stores (like ToysRUs) and their employees have been replaced?

Jeff’s view? While buzzwords like “disruption” do sell media, there are things happening at higher levels. However, the real estate agent is not going away anytime soon for one simple reason. There are too many moving parts to a transaction, and emotion is one of those. Technology has not reached the stage where it can handle all these parts.

Disruption occurs with more brands trying to change the way we are doing business, making it faster, more tech, or more niche. New companies are coming into play. Compass, Redfin models, Purple Bricks. And new people are coming into the space trying to change and elevate what we do. At the same time. the industry has seen some large teams leave major brands, saying they can do things better by themselves, without the big brand box.

Taking care of business…

One way to keep track of business is to every day look at local inventory. If there are 500 listings, see how many of those you got. If it’s only 2, there is a lot to be done. The business is a marathon; it’s a competitive race, but not many have enough drive to do the hard work that’s needed. To say the business is slow is not valid. Every day more homes come on the market and more get sold. Someone is getting those listings. And that is where the challenge comes in. It’s about doing the day-to-day work. All the technology that is available can make us work faster and smarter, but we still have to do the work.

Philosophically speaking…

Geoff has a broader perspective as to where realtors stand and what the future holds. As an example, despite all the tools available online there are more travel agents now than in the year 2000. It takes time to do all the research, etc., and many people are finding it more desirable to hire someone to do that work for them.

There has been an explosion of information and technology, but at the end of the day, it’s time. Do most people want to spend the amount of time it takes to properly sell their house or negotiate to buy a home? Most people prefer to hire a real estate professional to handle all the parts of the puzzle. In addition, Geoff believes the housing market is important to the overall US and global economy. The economy is revving. largely because of the housing market healing and coming back. And real estate agents are critical to the health of the economy.

Jeff added, “Will Amazon and Facebook get into the real estate marketplace? Probably!” The big picture is that some companies are coming in trying to acquire agents and market share. Others are trying to change the way technology is driven. However, you still need the people to execute the transactions and deal with the emotional process of a sale.

Geoff’s final analysis? We, humans, are complicated beings, and it takes a human to navigate this process of buying a home. And after much consideration, we should continue to invest in real estate agents and our industry because we’re needed and timeless.

Visit our website, greenteamhq.com/HMU to register for our next Webinar on Tuesday, September 18 at 2 pm. You can also view previous webinars videos and access other recaps like this.

July Housing Market Update

The July Housing Market Update was held live on Facebook on Tuesday, July 10, at 9 a.m. If you missed the live webinar, you can view it at your convenience by clicking here.

Meet the Panel

Geoff Green moderated the webinar and also presented relevant statistics in a historical context. Keren Gonen of Green Team Real Estate New Jersey conveyed the sales associate’s perspective on the housing market. Melissa Bressette, Green Team’s Marketing Director, rounded out the company’s participants. This month’s special panelists were Kevin Dolan, Branch Manager and Co-Director of Renovation and Construction Lending at Annie Mac Home Mortgage and Joe Panebianco, CEO of Annie Mac.

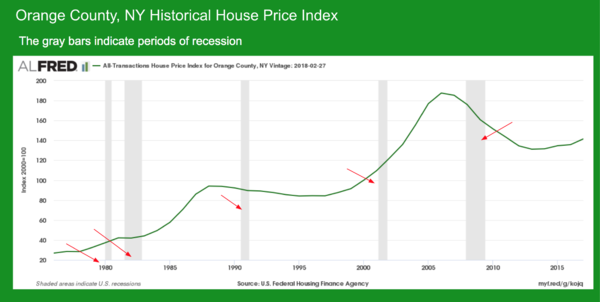

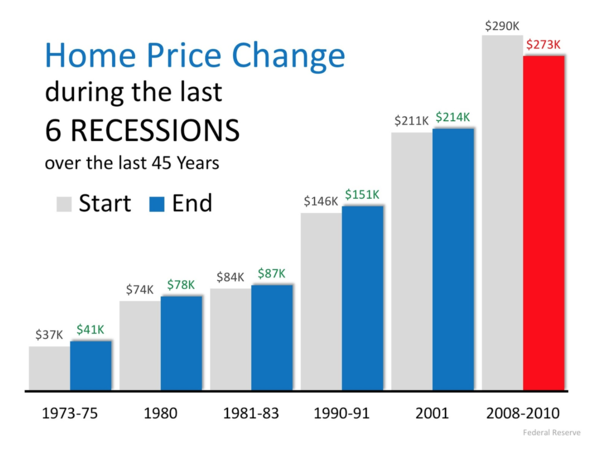

Orange County Historical House Price Index

Geoff presented a historical view of national and local prices, and a look at the market before, during and after recessions. In this chart of the Orange County, NY price index, gray bars indicate periods of recession. As shown in the graph, recessions don’t necessarily trigger downturns in the housing market. The inverse is usually true, with downturns in the housing market generally triggering recessions. Exceptions include the recession between 2000 and 2005. The housing market actually started to downturn around 2005, long before the financial collapse of 2008. Prices peaked in 2006, then continued to slide for over a decade. The steepness and duration of the curve is what is of special interest.

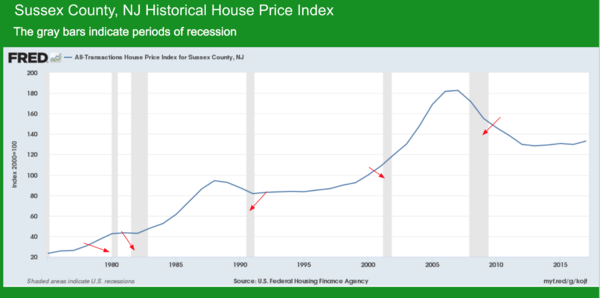

Sussex County NJ Historical House PriceIndex

In a historical context, the Sussex County and Orange County stats show a similarity, reflecting national trends.

National Stats

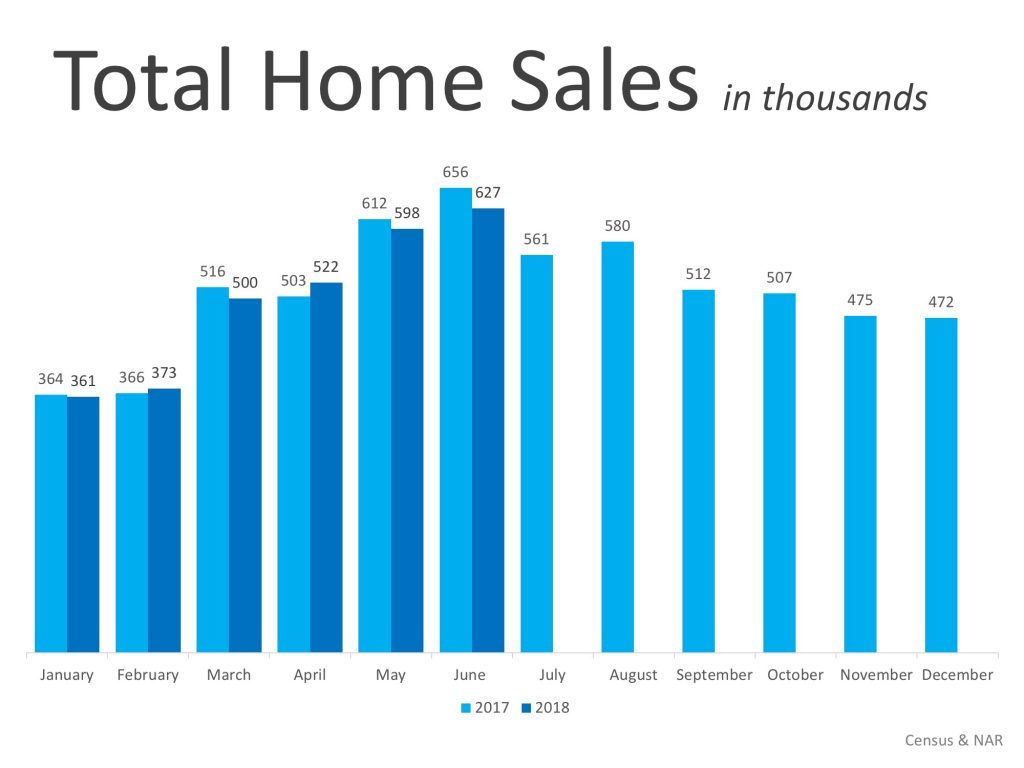

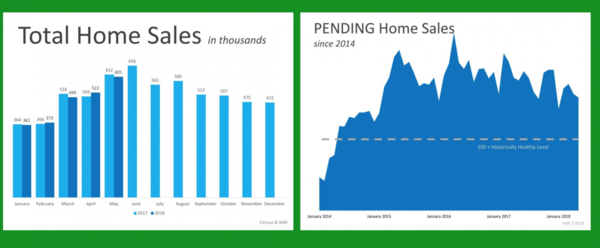

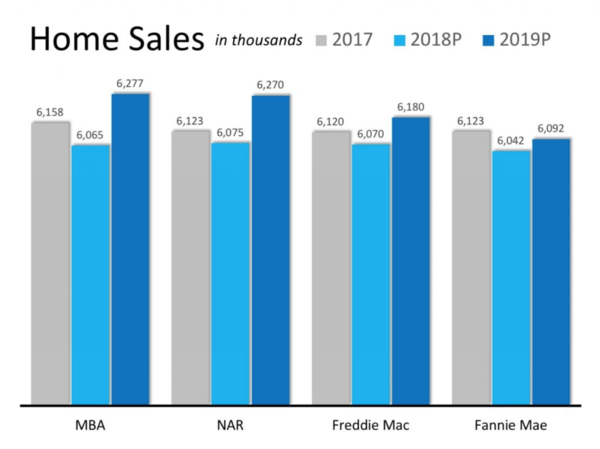

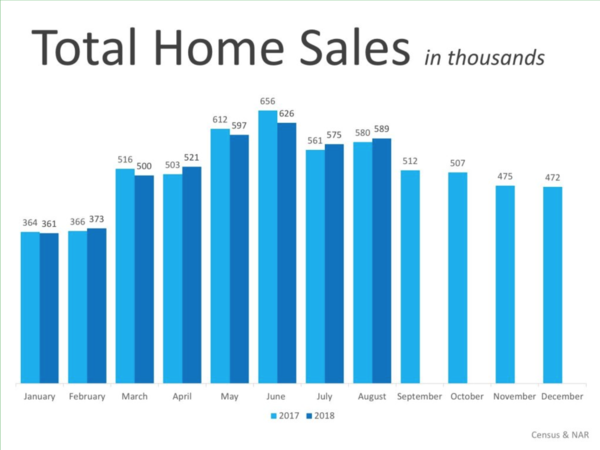

In Total Home Sales in thousands there are no major increases in the year over year stats.

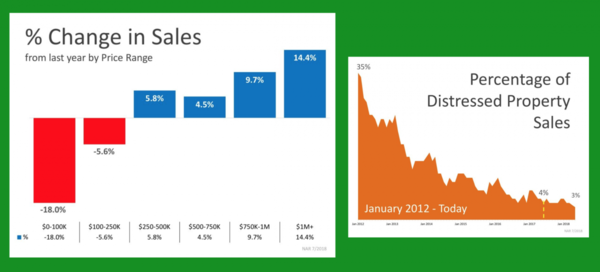

The number of houses available in lower price ranges is way down. However, there is an uptick in higher priced homes. Because of lack of inventory, buyers are being pushed into that higher price bracket.

The percentage of distressed properties for sale is way down from 2012.

Orange County Market Stats for June 2018

Units Sold

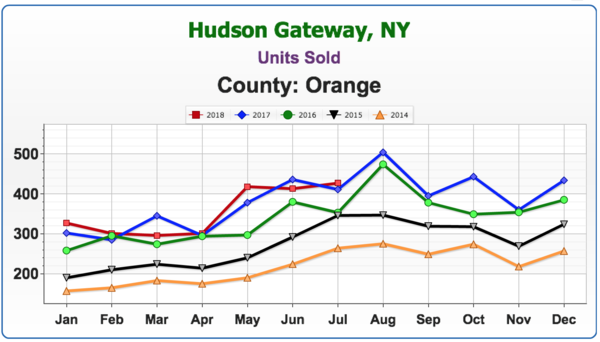

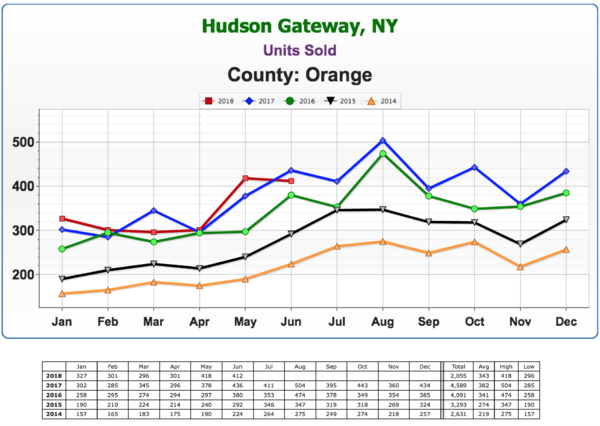

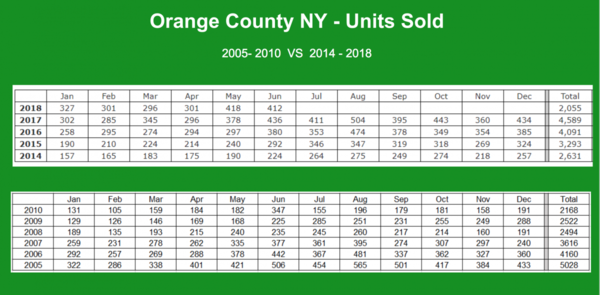

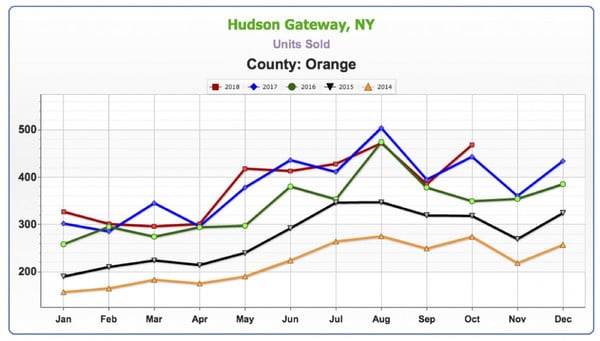

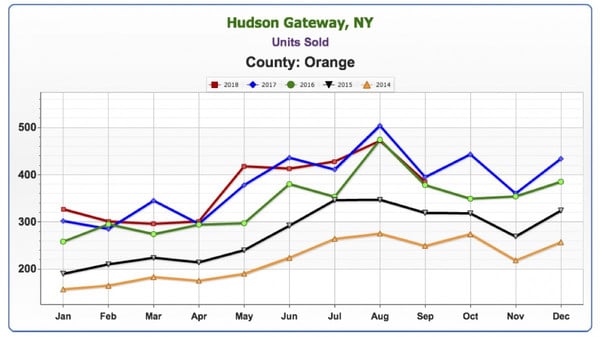

According to Geoff, this is one of the most important analytics in the housing market. No matter where pricing is, you can get an idea of the market by how many houses actually sold. There has been a great year over year increase for the past five years, but now it’s slowing down and we’re seeing a flattening now.

Homes that sold at 100% or more of last asking price

There’s a spike in this number. This is a hot market, and any home that is well located and in good condition will most likely have multiple offers at any one particular time. Basically, almost half of every listing on the market is being bid over asking. Note: Stats are based on last asking price, not original asking price.

Average Days on Market

This number continues to decline, again showing a strong seller’s market.

A Comparison of Units Sold from 2005-2010 versus 2014-2018

Geoff researched units sold in Orange County from 2005-2010 versus 2014-2018. Trends here follow National trends. The peak year was 2005 in terms of units sold. 2006 was the highest average home price the County has seen.. However, in 2010, the number of units sold had slid to almost half of the 2005 figure. Last year, we were above 2006 numbers, and close to 2005 in terms of units sold. Whether we’ll match or exceed that number in 2018 remains to be seen.

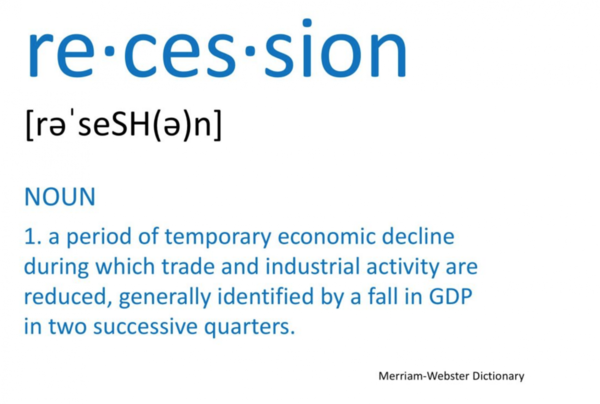

Recession

In a capitalist society, it is not a question as to whether or not there will be another recession. The question is when.

As defined in Merriam-Webster Dictionary, recession is “a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.” There is, of course, great interest in when the next recession will hit, and what impact it will have on the housing market.

The graph shows home price changes during the last 6 recessions, over 45 years. The recession periods as designated by economists do not include the housing market downturns. Historically, prices haven’t been that affected during the recession; however, the definition of recession doesn’t include the whole downturn. And the real estate market takes time to recover.

‘

Keren Gonen’s perspective on the market from a sales associate’s point of view…

The market is very hot, in both Orange and Sussex Counties. In Warwick, if you don’t jump on a house right away, you can lose it. Keren is seeing bidding wars on homes within days of listing them.

When asked how long she thought the market would remain strong, she estimated about a year. One of the reasons we’re not seeing the lower priced homes sold, Keren indicated, was that banks that do have foreclosures are releasing them at much higher prices. Some banks are also renovating and flipping homes and charging even more.

Geoff commented that previously, when the market was really bad, there was shadow inventory. Banks would hold on to foreclosures, creating fear in the market that they would dump their inventory of low-priced homes, driving down prices. However, the banks seem to be changing their ways of doing things by renting out some homes, and fixing up others and selling them at higher prices.

The Mortgage Market – Where are we now?

Geoff stated that we’re definitely in an increasing rate environment and the Fed has signaled that they are going to continue to increase the overnight lending rates into the foreseeable future. Geoff asked Kevin Dolan to address where we are at now…

Kevin responded that where rates are concerned, they’re turning higher for the foreseeable future. Partly due to media coverage, people are starting to take the rise of interest rates and home prices seriously. They see continual coverage of higher rates on news shows. Thus, people are becoming proactive, buyers and sellers alike, driving productivity level.

Interest rates, inventory and recession. Oh my!

Joe Panebianco does economic analysis and strategy for Annie Mac. His expertise made him the perfect person to discuss specifics and timings of interest rates, inventory and recession.

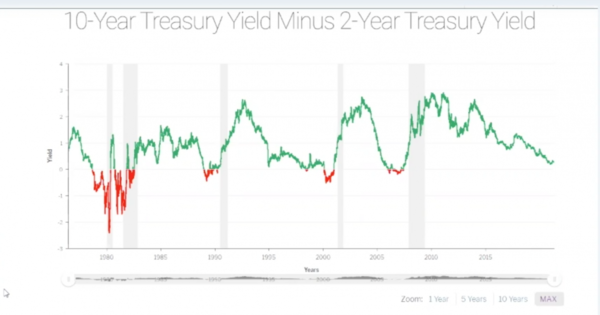

Interest Rates: We will most likely be range bound from a 10-year treasury perspective from approximately 2.75 to 3.05 yield in the ten year. In other words, we’ll be relatively stable. Should this estimate be incorrect, Joe believes a slightly higher rise in interest rates will not significantly hurt the housing market. At some point, rates rising will have a deleterious effect and purchasers’ ability to afford a home may be impacted. However, we’re not at that point now.

Inflation and economic growth are the two primary components of interest rates. Inflation has remained stubbornly low and will most likely remain so. Hence, one reason why rates should remain relatively low. People talk about the Fed increasing rates, but they are increasing the short end of the curve.

As the Fed continues to hike rates, the result will be 10 and 30-year rates looking more like 2 and 5 year rates. Most of the duration of a mortgage-backed security is in a 7, 10 and 30-year part of the curve. And Joe believes that the more the Fed increases rates, the more likely we are to be in a recession and more likely to have lower, longer-term rates remain where they are or go lower. The mortgage market on Adjustable Rate Mortgages could be hurt because they’re much more likely to rise as they’re sensitive to the shorter end of the curve. 30-year fixed mortgages are more likely to stay in the aforementioned range.

The Global Connection

We live in a globally connected network and there is a yield spread between US 10-year Treasury bond and bonds in other countries, like Germany, Japan, Australia.. For central banks, very large institutions,etc., putting their money in US Treasuries provides a safer, purer investment over countries with significantly lower yields. However, regarding tariffs, trade wars are inherently bad for economies and may throw a curve ball into any predictions.

There are some who refer to our current economy as a “Goldilocks economy.” Not too hot, not too cold, just right… in some ways. The economy is growing enough to create jobs. And, according to Joe, jobs are far more important to home purchases than interest rates are. In the early 1980’s, interest rates were at 15% and yet homes were flying off the market. When rates go up, prices tend to come down. And there is always a buyer, especially if there is value to be had.

The history is if the Fed goes too far, it will drive the country into recession. Joe believes we have approximately 12 to 18 months left in this cycle. And that at the end of this period, we’ll be in a more normal market with a healthier balance between demand and sup

Factors that impact inventory

Labor, or lack thereof, is a major component. Many significant builders have unused land on their balance sheets, on hold because of the great recession of 2007 to 2010. About 70 to 75% capacity of the productive capacity of the home building industry was lost. Brick layers, sheet rockers, carpenters, plumbers, electricians, etc. – left the industry to seek employment in other fields. In addition, when major storms hit Texas, Florida, etc., many people in the industry picked up and went to work in those cities where they could make much more money. There are simply not enough craftsmen and laborer to build all the homes necessary to meet current need.

Municipal Fees, laws – Fees, regulations, etc., have made building a home both difficult and expensive. To help increase taxable base, some municipalities are now trying to make things a little easier for those seeking to build new construction.

Tariffs – The “War of Words” regarding trade with Canada is not good news for the housing industry. A disproportionate share of home building lumber comes from Canada, and price of lumber futures has already risen on expectation of tariffs.

Easing of Credit

In the next 12 months, we may see easing of some requirements. At this time, no one knows how this will be done. However, some options might include reducing Mortgage Insurance on the FHA side, especially for first-time buyers. Also, Freddie Mac might follow Fannie Mae’s lead in reducing Long Term Debt and Debt to Income Ratio. Average renters spends 50-55% on rent. However, the current Debt To Income ratio is in the low 40’s for purchases. There might be a move to update the DTI.

Demand is not going to Cease

According to Joe, by 2025 there will be approximately 10 million new household formations. 35% will be from millenials, 35-40% from among the Hispanic community (with some overlap between the two), and 10% from the African-American community. Many of these new home buyers will be DTI (Debt to Income Ratio) challenged. They will need the services of qualified real estate agents, knowledgeable mortgage specialists/

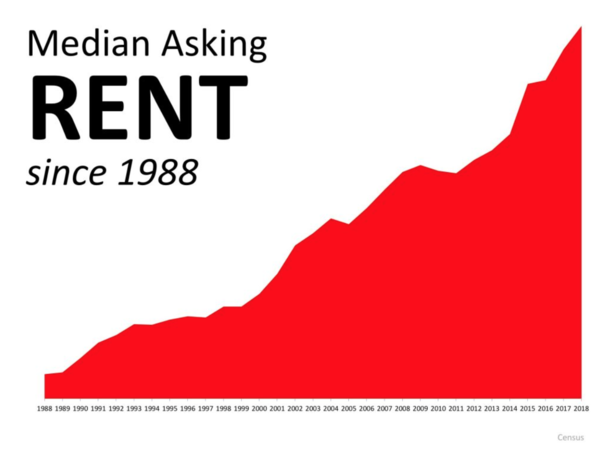

Geoff pointed out that purchase and rental markets are both hot at the same time. This indicates a true housing shortage. The Millennial population seems to be exceeding Baby Boomers. Pent up demand and limited supply serve to elongate and stretch out the cycle.

Home ownership improves communities – and the economy

Home ownership lends itself to not only building communities, but also to building up business, including home improvement and furniture stores, furniture stores, durable goods vendors, etc., etc.- all of which will help the economy. Inventory may become less of an issue month by month by month.

Renovation Loans

Kevin Dolan is an expert in renovation loans. There are homes on the market that just won’t sell because they are not in good shape. He believes the renovation lending program is under-utilized simply because it is not understood and there are many misconceptions.

There are two types of renovation loan programs – conventional and FHA. This opens up versatility for buyers as to who it can serve, such as a down payment as low as 3-1/2%. It also allows for lower credit scores. These loans can be utilized for primary homes, second homes and investment properties. The loan allows for someone to buy a house in need of repair, and have an approved, qualified contractor bid on work to be done. Depending on scope of work, sometimes a HUD consultant will make sure prices quoted for the work are appropriate. The renovation funds goes into an escrow account, and contractor has specified time to do improvements, usually within six months. The bank pays contractor directly. The process is streamlined and efficient.

Kevin feels that educating buyers and real estate agents alike is key to opening up this market. Keren agreed, stating that she often does sell homes by telling buyers that renovation loans are available, and explaining how they work. It opens up options and vision for the buyers who cannot afford to buy a home in the $300-$400,000 range. Annie Mac does have a certification program available for real estate agents who would like to become expert in this area.

Renovation loans – not just for buyers

Kevin commented that renovation loans can also be helpful for sellers who need to update their homes in order to sell. By adding another bath or more bedrooms, the value of the home can be increased so that the seller can pay off existing mortgage and closing costs, and hopefully make a profit as well. Also, from Seller’s position, if they have a failed septic tank, they can sell the home at a lower price and buyer can get a renovation loan to cover the cost of having the work done themselves.

Joe added that in looking to build wealth in addition to creating a home for their family, renovations can help improve their property, and therefore their investment.

Geoff spoke about the importance of finding someone who truly understands these loans as they can be tricky for the loan originator. Geoff spoke highly of Annie Mac, not just for renovation loans, but for all financing needs.

Stay tuned for the next market update

The next update is August 14, 2018 at 9 a.m. You can sign up at GreenTeamHQ.com/HMU

Housing Market Update for June 2018 & Impact of Federal Tax Reform on Housing Market

Orange & Sussex Counties – Housing Market Update for June 2018 and Impact of Federal Tax Reform on the Housing Market

The Green Team went live on Facebook Tuesday, June 12 with its monthly housing market update. Geoff Green, President of the Green Team, moderated the event. Panelists included sales associates Vikki Garby and Kim Leslie of the Warwick office and Keren Gonen and Joyce Rogers from the Vernon Office. Guest panelists were Dan Bounds, Senior Home-Lending Advisor with Chase Bank and Ed Mainland, Executive Director at JP Morgan Chase & Co. A special presentation was given by Thomas McGlynn, Managing Director of BDO Expatriate Services, on the impact of federal tax reform on the housing market.

Overview

Nationally there has been a 5.3% year-over-year increase in existing home prices. Low to middle-level houses are moving faster than higher-end homes. However, economists are concerned about the affordability of homes for the entry buyer level. The lack of inventory is driving home prices up. The West Coast has been moving at a greater pace than here in the North East. Supply and demand is taking hold. Foot traffic stats are very interesting. There has been more foot traffic this year than last year during the same time. On a national level, existing home sales are slightly down from where they were last year during the same period. This may be a reflection of inventory problems.

Orange County Update

Average Price

Average price has really taken off. There was a mixed bag of results until this year.

Units Sold

May saw the most units sold for this month since 2014. However, prior to May, this year is the first where we’ve seen more than one month at or less than the same month in previous years. There has been a steady increase year-over-year until 2018. We will continue to keep a watch on this analytic as it may be the most important indicator of when there will be a downturn.

Average Days on Market

The average days on market continues to decrease. This indicates the market is hot; a good seller’s market. For some who have been waiting a long time, now may be a good opportunity to sell their homes.

Sussex County Update

Average Price

The amount of distressed inventory (foreclosures, short sales, etc.) has stymied price growth and appreciation in Sussex. However, the average price in May of this year is the highest it has been for this month since 2014.

Units Sold.

There has been a substantial decrease in units sold, even with average price increasing and average days on market decreasing.

Average Days on Market

The average days on market keeps going down, indicating a hot market.

Market Q&A

Buyer Concerns – Price or Inventory?

Geoff Green asked Vikki Garby whether she got a sense that her buyers were more worried about current prices or not being able to find a home due to lack of inventory. Vikki responded that inventory was the biggest problem. However, once they found a home, buyers were concerned about going to contract quickly. People were getting stressed out about interest rates. Therefore, they want to get them locked in as soon as possible since rates are rising. Dan Bounds advised that their mortgage customers are able to get their rate locked in once they have a signed one-page purchase agreement.

Appraisals – On Point?

Geoff then asked Keren Goren if appraisals were coming in on point, or if there were still problems. Keren replied that appraisers were coming in on point in New Jersey. Geoff responded that in a solid, appreciated market appraisers seem to be more comfortable and confident coming in on valuation.

Inventory – Quality or Quantity?

Geoff’s question to Joyce was, “Everyone says there’s no inventory, but there are homes on the market. Is the physical nature of inventory not what buyers are looking for? Is it the condition of homes?” Joyce stated that there was not a lot in good shape in certain price points. Much is a total gut job. Buyers want what they want, and many don’t see the potential in getting a fixer-upper.

Geoff felt that money, time and ability can be a deciding factor. In addition, as a property owner himself, he knows how hard it can be to get good contractors. They’re busy, materials are costing more, and prices are coming up. Both Joyce and Keren said that they’ve seen flippers making mistakes and poor choices that are visible to buyers. Using lower grade materials, not putting finishing touches (outlets without covers, exposed wiring, etc.), they are hurting themselves in their rush to put the house on the market. The problem is then compounded by listing agents overpricing these homes.

The Luxury Home Market

There has been discussion about possible negative impact of the new tax laws on the luxury, hi-end real estate market. While too soon to know what the true impact will be, the luxury market is currently doing better on a year-over-year basis. Sales of high-end homes ($500-$750,000) are up in both Orange and Sussex Counties.

The Impact of Tax Reform on the Housing Market

Following the monthly market update, guest speaker Tom McGlynn of BDO spoke about the impact of tax reform on the Housing Market, as well as in general. The Tax Cuts and Jobs Act was signed on Dec 22, 2017, the President’s “gift” to the nation. There wasn’t time to process the impact as changes began Jan 1, 2018. The Legislation will expire for individuals on Dec 31, 2025.

Tax Rates for 2018

It had been expected that tax rates would be limited to 3 or 4 bands. However, the bands are dramatically expanded. Furthermore, there is a drop in rates from a high of 39.6% to a high of 37% in 2018, going forward. The expectation is that people with higher income levels will see a decrease in federal income tax liability.

Major Changes:

Above-the-line deductions:

Moving expense deductions: Only available for US military moving pursuant to military order. As a result, changes will impact US citizens who move for employment, whether in the US, abroad, or to the US.

Alimony: For Agreements entered into after Dec 31, 2018. the deduction for alimony or separate maintenance payments has been repealed. Furthermore, inclusion of money received for alimony as income is repealed. Existing agreements are grandfathered in.

Standard & personal exemptions: Standard deduction increased, almost doubled. Married filing jointly, is now $24,000. More taxpayers may end up claiming the standard as opposed to itemizing. Personal exemption is suspended through 2025.

Medical Expenses. Threshhold lowered to 7.5 percent from 10% for out-of-pocket expenses not covered by insurance.

Real Estate impacted regulations

State and local taxes: In our market this is the big item. Taxpayers are now only allowed to deduct a maximum $10,000 aggregate of state and local real property, personal property, and state and local income sales taxes.

Mortgage Interest: Amount of acquisition indebtedness applies to new loans. However, mortgages in place before 2017 grandfathered in up to $1,000,000 mortgage. For debt incurred after Dec 15, 2017, you can only deduct interest paid on indebtedness of up to $750,000. Furthermore, home equity interest deduction has been suspended.

Vikki asked for confirmation that limitations do not apply to real property taxes and personal property taxes paid or accrued in carrying on trade or business? Tom confirmed that this is correct; real estate traders/investors filing Schedule E are not subject to the new limits. In addition, properties held for investment are not effected by the mortgage limitation.

Changes in other deductions

Charitable contributions: Limitation on deduction for cash contributions increased to 60% of AGI. However, this cannot be in addition to Standard deduction. The deduction can only be taken if the taxpayer is itemizing. It is not known how or if this will affect charitable giving.

Casualty losses: Suspended through 2025, unless loss is attributable to a Federally declared disaster area.

Wagering Transactions: Limited to income offsetting expenses.

Miscellaneous itemized deductions: Suspended through 2025. Includes unreimbursed business expenses, investment fees, tax prep fees.

Pease limitation suspends limitation on itemized deductions. For 2018-2025, no limitation on itemizations exceeding standard deduction.

AMT (Alternative Minimum Tax): Put in place to make sure taxpayers weren’t able to reduce their tax liability by utilizing certain itemized deductions (income taxes, real property, state and local taxes) due to income. Congress minimized Corporate AMT. The individual AMT was expected to be eliminated. However, Congress decided to keep it in place but significantly increased exemption amounts and thresholds.

Selling Your Home – Tax Basics Relating to Closing Disclosure Statement

Nothing changes regarding home sale rules if you can show you owned and used home for principal use 2 out of 5 years. Hence, the first $500,000 of gain is exempt from federal and state tax. Basis is the amount home is worth for tax purposes. This includes what you paid for home, improvements, closing costs, etc. However, current year deductions may be subject to limitations.

The above are just highlights of the discussions and presentation. You can watch the entire video here.

We Keep You Informed:

The Green Team Shares this information and more each month during our Live Housing Market Update. Register to join the webinar and hear directly from our participating Green Team Sales Associates who share their personal take on how the marketplace is doing.

Industry experts join us each month to share insights into the currently financing environment, as well as broader economic issues affecting the housing market.

Check out our past Housing Market Updates. Then Register to get our Housing Market Updates.

Sussex County Real Estate Market Report for May 2018

Green Team Business Review – May 2018

The numbers tell a story all their own. Despite the lack of inventory on the market, despite the specter of rising interest rates, loss of deductions due to new tax laws, etc., the Green Team is doing something very right and finding people buyers for their homes and finding homes for buyers! Both the Warwick and Vernon offices have more than doubled their sales volume from a year ago.

Sussex County, NJ Real Estate Market Report – April 2018 Results

The May Market Update was held on Tuesday, May 8 on Facebook Live. It was moderated by Geoff Green, Founder of Green Team Home Selling System. Panelists included sales agents Vikki Garby from the Warwick office, Keren Goren of the Vernon office, Michael Giannetto from Residential Home Funding and Ken Ford from Warwick Valley Financial Advisors.

If you missed the original live event, click here to watch. The discussion involved not only the housing market, but also perspectives on the economy. Our guest panelists have a great deal of knowledge and expertise, and the conversation was informative, educational and lively.

You can also sign up for monthly updates by email on the Green Team website.

We were experiencing technical difficulties:

Prior to the update going live, the following discussion took place:

The lack of inventory remains the biggest impediment to home sales, and the panel discussed the various reasons why people are reluctant to sell now. Vikki Garby stated that there were more buyers this winter than last spring, but that there is not a lot to buy. Cash buyers were coming in strong, with some people getting full asking price, or over. Keren Goren stated that many people she spoke to were just hanging on, waiting to see what would happen in the market.

Geoffrey Green told the panel that he is often asked, “Should I wait, because prices are going higher?” According to Vikki, sellers are worried about finding a home! People move up here from other places and swamp the market, and people who want to sell but stay in the area are concerned. Keren said that houses in Sussex are outdated, older than what buyers are looking for. Geoff said, “At the end of the day, if you’re moving and need to sell, try to sell and buy at the same time.”

The conversation turned to “fixer-uppers.” Geoff felt that most buyers don’t have the time, experience, and money to do renovation after buying a home. However, he asked the panel if they were seeing more buyers willing to take on a fixer-upper.

Keren cited a buyer who was willing to take out a loan to put a new roof on a house where everything else had been done. He was willing to go that step. Vikki stated there was not much to choose from and buyers trying to get into the area are having to be more flexible. Mike Giannetto stated that reno loans are now a big product and many people are taking the opportunity to fix up a house, put in new appliances, roof, etc., using equity.

Watch the video for more discussion, including a fascinating look into the world of economics and how the bond market impacts the interest rate that buyers may soon be paying.

Sussex County, NJ Real Estate Market Report – April 2018 Results

Average Days on the Market

The faster homes are selling, the hotter the market. Look for the lowest number on the graph, as opposed to the highest.

The average days on the market are slightly higher than April of 2017 but are way below the previous three years. The average number of days on the market is 92.57 for the first four months of 2018.

Average Price

The average price is just about where it was this time last year and is above the prior three years.

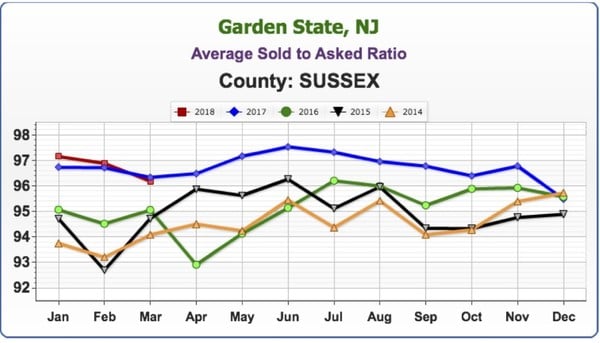

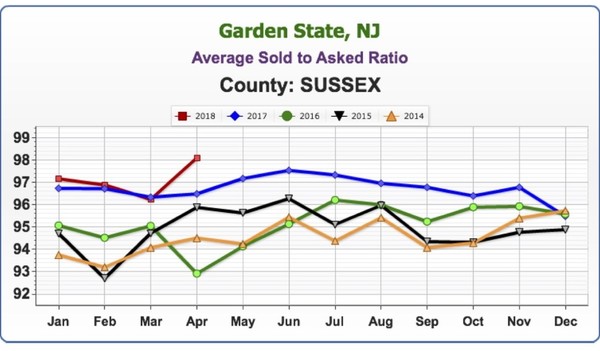

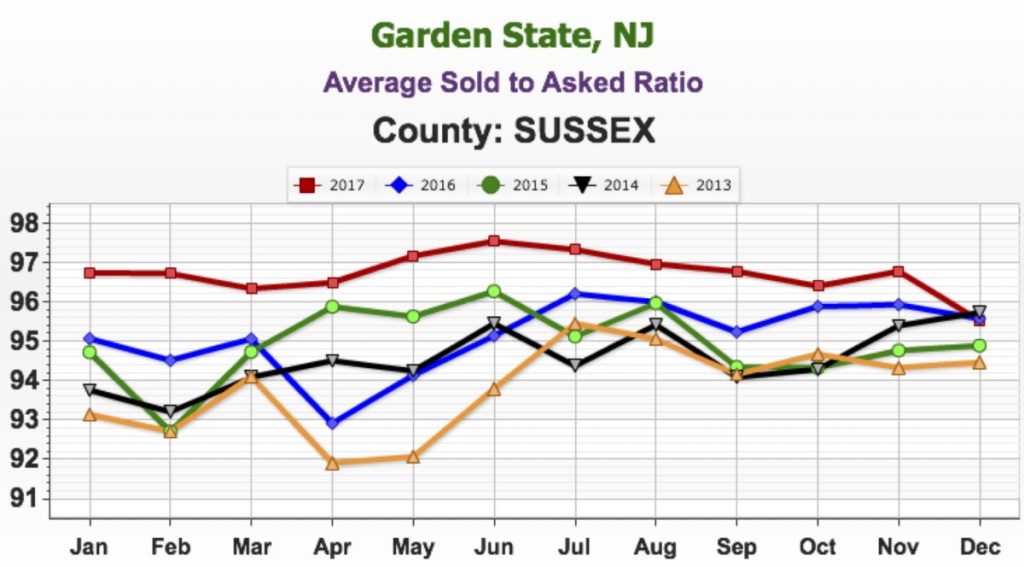

Average Sold to Asked Ratio

This is the percentage a house sold for under or over the last asking (not the original) price.

There was a jump in this number, with the percentage at 98.98% for this April, the highest point for any month in the past five years. Sellers were negotiating at approximately 2 points off the last asking price.

Homes that sold at 100% or more of last asking price

Here again there was a jump in the numbers, reaching the highest point for any month in the past 5 years.

Units Sold

There was a climb in the numbers here, as well, with April 2018 showing the most units sold for this month over the past four years.

We Keep You Informed:

The Green Team Shares this information and more each month during our Live Housing Market Update. Register to join the webinar and hear directly from our participating Green Team Sales Associates who share their personal take on how the marketplace is doing.

Each month we are also joined by industry experts who share insights into the current financing environment as well as broader economic issues affecting the housing market.

Check out our past Housing Market Updates. Then Register to join our next one on June 12th at 9am.

[embedyt] https://www.youtube.com/embed?listType=playlist&list=PL6MEM7EpyL0E5YdU249T_KsDQTukboj8E&v=AQYblgrxmIY[/embedyt]

Green Team Business Review – January 2018

The 2017 Scoreboard

The first order of business at the Green Team monthly market review meeting was the Agents’ Scoreboard. In Warwick, Jennifer DiCostanzo finished first, for the second year in a row. Jen closed out $10,500,000 in sales volume, beating Geoff Green’s single year, all-time Green Team record! Geoff was more than happy to relinquish the title “Number One All Time” to Jen. Nancy Sardo came in second, with sales at $7,200,00, more than doubling her total from 2016. Tammy Scotto was third with sales of almost $5,000,000, way up from $1,350,00 in 2016. Most agents had a solid year and saw increases over last year. Linda VanDeWeert saw her sales volume rise from $1,017,000 in 2016 to $2,147,000 in 2017. Perhaps the most dramatic difference was in Chris Kimiecik’s numbers, which went from sales of $260,000 in 2016 to $2,900,000 in 2017! With a total sales volume of $74,000,000, it looks like the Green Team will be among the top ten agencies in Orange County.

The first order of business at the Green Team monthly market review meeting was the Agents’ Scoreboard. In Warwick, Jennifer DiCostanzo finished first, for the second year in a row. Jen closed out $10,500,000 in sales volume, beating Geoff Green’s single year, all-time Green Team record! Geoff was more than happy to relinquish the title “Number One All Time” to Jen. Nancy Sardo came in second, with sales at $7,200,00, more than doubling her total from 2016. Tammy Scotto was third with sales of almost $5,000,000, way up from $1,350,00 in 2016. Most agents had a solid year and saw increases over last year. Linda VanDeWeert saw her sales volume rise from $1,017,000 in 2016 to $2,147,000 in 2017. Perhaps the most dramatic difference was in Chris Kimiecik’s numbers, which went from sales of $260,000 in 2016 to $2,900,000 in 2017! With a total sales volume of $74,000,000, it looks like the Green Team will be among the top ten agencies in Orange County.

In the Sussex County office, Keren Gonen just finished her first year in the real estate business. She also finished number one on the scoreboard, with $4,300,000 in sales volume. She is, according to Geoff Green, a rising star! She is followed by Charles Nagy in the number two spot, with $3,600,000 in sales volume. Barbara Tesa is in third place with $3,300,000 in sales volume, which does not include sales from her previous agency. According to Geoff’s predictions, Barbara will be even higher up on the scoreboard in 2018!

“How is the Market?”

When asked this question, agents must be clear on the trends that have been occurring in their local markets and be able to explain them and the effect they may have on the client’s real estate needs.

Sussex County Real Estate Market Report for Dec 2017

Housing Market Report – Sussex County, NJ

We are pleased to share with you a Housing Market Report from December 2017 as well as a look at the trends for the entire 2017 year. We break down the local real estate activities and provide you with stats, graphs, and analysis of our local and regional real estate market.

Average Days on the Market

The faster things are selling, the hotter the market. Look for the lowest number on the graph as opposed to the highest.

In contrast to Orange County, the days on market shot up in December. However, this may be an outlier, due to snow and extreme cold temperatures. January’s numbers may help us understand if this is the result of specific circumstances, or part of a trend.

Average Price

Sussex County is not seeing the upward trend in price that is being seen in Orange County, but the average price in December is still above every year except 2013. For most of the year the average price was significantly below 2016. However, this may be due to an unloading of foreclosure activity. There was a great deal of foreclosure inventory and short sales, which impacted the “average” price. It is important to remember that prices will fluctuate in hyper local markets.

Average Sold to Asked Ratio

The percentage a house sold for under or over the last asking price (not the original price).

The higher the number, the hotter the seller’s market.

On average, sellers are having to negotiate less than 3% off their last asking price. While down slightly from November, the average sold to asked ratio is holding strong and was consistently higher in 2017 than in any year since 2013.

Homes that sold at 100% or more of last asking price

About one-third of all homes were sold at 100% or more of their last asking price, another indication of a strong market. This is very similar to the Orange County, NY which our Green Team Home Selling System office is located in.

Units Sold

The term units here includes single family homes, condominiums, town house and multi-family homes with 1-4 units.

The market is still strong, higher than any of the years since 2013. 2017 has consistently had the highest number of units sold in each year since 2013.

[gravityform id=”16″ title=”true” description=”true”]

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link

Matt Zagroda is a Sales Manager at

Matt Zagroda is a Sales Manager at