The Green Team’s November 2018 Housing Market Update was held live on Facebook Tuesday, November 13 at 2 p.m. If you missed the live webinar, you can view it at your convenience by clicking here.

You can also sign up for future updates at GreenTeamHQ.com/hmu.

Meet this month’s Panelists…

Geoffrey Green , President/Broker of Green Team Home Selling System, moderates the monthly webinar and presents the national stats, as well as the market updates for Orange and Sussex Counties. This month he is joined by Pam Zachowski and Keren Goren of Green Team New Jersey Realty and Vikki Garby, Green Team Home Selling System, Warwick.

Joe Moschella, Branch Manager and Vice President of Lending, and Amy Green, Vice President of Lending, of Guaranteed Rate discuss market updates from a mortgage industry perspective.

The National Outlook

According to Geoff Green, it’s a very exciting time in the housing market right now as we’re starting to see some shifts. We’re experiencing all-time highs reminiscent of 2008 over the last 18 months. It does seem like things are cooling off. According to Michael Fratantoni, Chief Economist of the Mortgage Bankers Association, he expects that home sales growth will pick up again over the next year, even with somewhat higher mortgage rates, though the pace of price growth will likely slow.

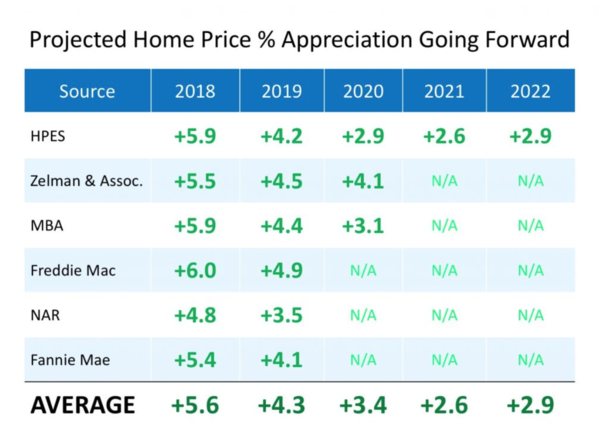

Despite the fact that national and local numbers indicate that the velocity of homes selling is actually slowing, Fratantoni and some others are predicting that it is going to increase in 2018. So, it’s not that appreciation is going down, it’s just slowing down.

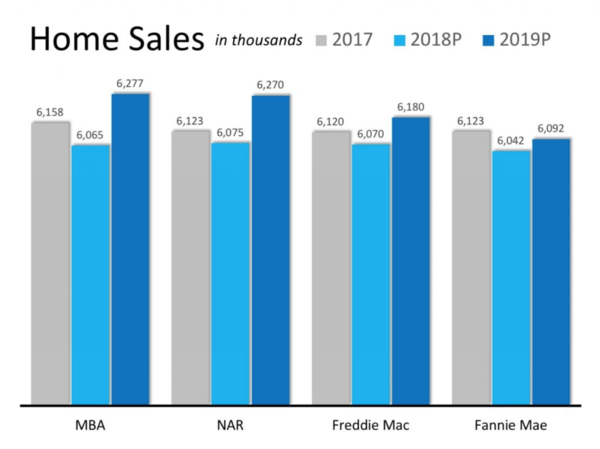

The Mortgage Bankers Association, National Association of Realtors, and Freddie Mac, with the exception of Fannie Mae, all are predicting increases over the past two years. All are predicting increases over the past year. For the most part each of these organizations wants the housing market to continue to grow. Geoff reminds us that it’s in their best interest. It’s important to be aware of the source of information. During the downturn In 2006, 2007 and 2008, during the downturn, some organizations were putting out information that did not accurately portray what was happening. However, you can rely on the Green Team to put out information that is accurate and honest.

In projections for 2018 through 2022, everyone seems to have a positive outlook that the market will continue to appreciate. Just at a slower pace.

November 2018 Housing Market Update – Orange County

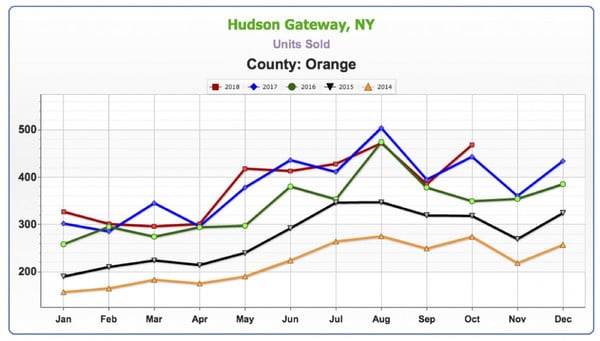

Units Sold

While this is hyper local, it is reflective of the 2018 national numbers. While prices may increase and decrease, depending on inventory, units sold have been a mixed bag this year versus last year. It’s been up, it’s been down.

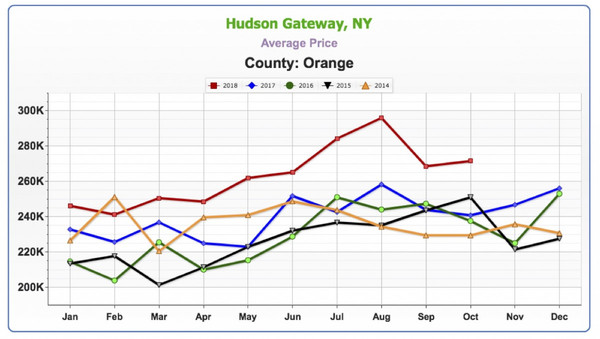

Average Price

Geoff has found that price always lags activity, according to his observations over the past 14 years. If you start to see a slowdown in activity, 6 to 8 months later you’ll start to see a slowdown in the rate of price increases.

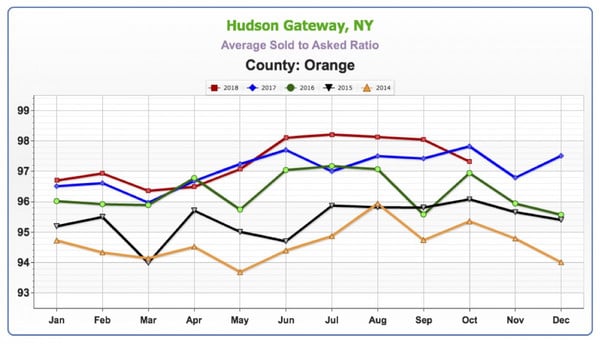

Sold to Asked Ratio

This is telling you at what percent of the asking price your home is selling for. The closer you are to 100%, the hotter the market. While this took a little dip recently, it is still at very high levels.

November 2018 Housing Market Update – Sussex County

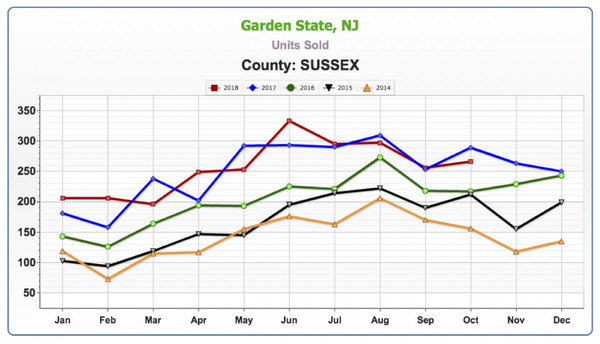

Units Sold

This is a small data sample that is still reflective of what is happening nationally. Again, it’s a mixed bag, up, down, then often flat.

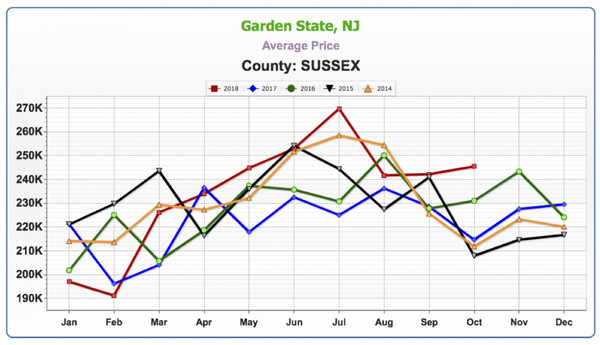

Average Price

Average price never really gained a tremendous amount of traction, as compared to Orange County, where there had been increases in price.

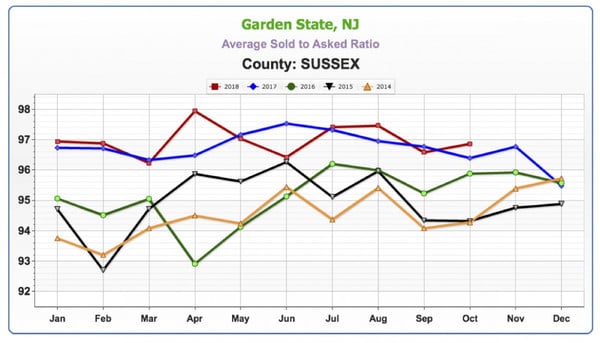

Sold to Asked Ratio

This looks similar to what is happening in Orange County.

Panel Discussion

The Sales Associates Points of View

Geoff asked Vikki what changes she’s seen since she was last on the panel about 4 months ago… Vikki agreed that she has been seeing a little bit of a slowdown, part of which she believes is due to timing. Many families time their house hunting to coincide with the start of school. However, what she’s finding is a lot of people are looking for land. Historically, we’ve had low inventory compared to the number of buyers, And, as existing house prices go up, more people are starting to consider new construction. Housing starts will be up 9% beginning of the coming year. So there is still a lack of inventory.

Pam also sees a slowdown. More people are looking for homes, but between the low inventory, the start of the school year, people are taking their time. She still sees investors trying to buy and flip homes but finding it harder and harder to find that good deal that makes it worthwhile.

Geoff then asked about appraisals. Are there issues with properties appraising, or are there now enough comps in the marketplace? Keren has not seen any problems recently. They’re all coming in at asking and a little bit above. One thing she has noticed is Sellers asking for CMA’s or listing presentations, more than she had over the summer. Keren always advises clients that we only know what the market is right now and can’t tell where it’s going. She lets them know that low inventory makes it a good time to put their home on the market, as opposed to waiting for Spring, Geoff replied that sellers that were holding off putting their home on the market may now decide to take a chance, seeing that the market is cooling off a little. This may ultimately bring more inventory and more transactions to the marketplace as a whole. There are still many buyers out there, anxious to find a home.

A Mortgage Industry Point of View

According to Joe Moschella, over the last 5 months they’ve seen a steady rise in interest rates. The year started with a 10-year treasury note at 2.21% and this week it was 3.21%, one full percent. That, along with the Fed stopping its purchasing of mortgage-backed securities, caused a liquidity crunch in the market. This contributed to pushing rates up. They started the year with 4% on a 30-year fixed rate and are now closing in on 5%.

Geoff asked Joe what the bond market was like 4 years ago on a percentage basis, just to give some perspective. Joe brings it back to 9/11, when the Fed didn’t want to see the economy spiral down. They jumped in and started dramatically dropping rates, bringing them down to almost zero. Now we’re seeing the unwinding of these artificially low rates. Thankfully the Fed eased into this, providing a “soft landing.” 2.21 to 3.2% represented about ¾ of a percent, interest rate wise. About 2, 2-1/2 years ago we were at 1.2% on the US Treasury. Before that, we were at the 0.7, 0.8% range. We’ve seen a steady rise, which hopefully the economy is strong enough to handle.

Some of the other changes in the market on the mortgage front are in the role technology is playing. Lenders are able to verify client’s income and assets automatically, do the application online and do the process without sending any paperwork back and forth. The whole process is done digitally.This is revolutionizing the industry and leading to higher consumer satisfaction. The industry is also easing credit standards. Geoff asked if easing credit standards was necessarily a good thing. Joe responded that rising rates have opened the door for new loan products to come out. Those new products are not coming from the banks, but rather from private equity firms flowing back into the market. No verification loans do not exist, but they have a bank statement loan that has come back into play. No seasoning waiting period for someone who had a foreclosure or bankruptcy or short sale, whereas before you had to wait three, four or seven years. Geoff stated that if you’re talking about private equity, they basically can do whatever they want with their money, as long as those products don’t make it into mortgage-backed securities. He asked if there were any controls in place to make sure that didn’t happen again. The trade-off with non-conforming products is that the buyer has to have some “skin in the game.” They need a sizeable down payment, and investors want higher return for higher risk, so rates may be at the 6-1/2% range.

Geoff said it’s important to keep things in perspective. The sky won’t be falling if rates hit 6-1/2%! Historically, it’s a pretty average rate.

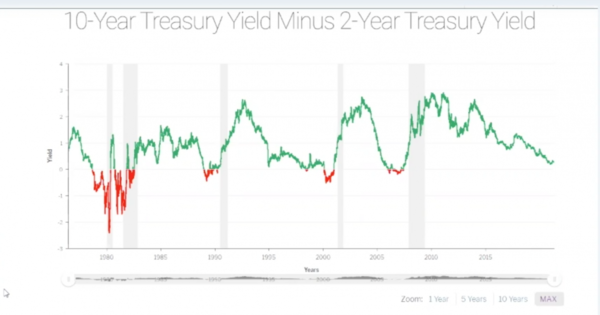

Joe and Amy had a graph showing 10-year treasury yield minus 2-year treasury yield. Historically when those yields come together, it signals a slowdown in the market or a recession. From Joe’s perspective, we might have a slow down in the stock market and see a pull back, but he’d rather see a market that goes up and goes down. In a stale market buyers and sellers are sitting on the fence; there is no call to action. As far as housing goes, everyone can do well and make some money.

Geoff thinks there is enough pent up demand from 2008 to 2016; there are a lot of people who need to buy a home and rates are still low enough. The American housing market is the place to be in the Global real estate market. There may be a continued cooling off and slow down a little. We’ve been at such high levels right now, it had to. Like the stock market, it can’t keep going up indefinitely; at some point it has to come down.

Thank you to our Sponsor,

REALLY – Agent to Agent Referrals

https://ReallyHQ.com

Please join us for the next Housing Market Update

December 11, 2018 at 2 p.m.

Stay informed. Sign up for our Housing Market Update at

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link