Green Team Business Review – April 2018

There has been a lot of excitement at the Green Team lately. Much of it was generated by the Launch Competition, which was a tremendous success this year. You can read about this annual contest, its goals, the winners, and the prizes here. In addition, Joyce Rogers was named the recipient of the First Quarter Sales Leader Award for the Vernon office.

Making Market Updates More Informative and More Accessible

While it seems that would be enough to report, there’s more. The Green Team strives to bring its agents and its clients up-to-date market information as well as insights into the mortgage market, events that impact interest rates, and more. To provide all this information in an expanded, far-reaching format, the Green Team is going Live on Facebook!

Sussex County, NJ Real Estate Market Report – March 2018 Results

We are pleased to share with you the Housing Market Report for March 2018. We break down local real estate activities and provide you with stats, graphs, and analysis of our local and regional real estate markets. The April Market Update was held Tuesday, April 17 on Facebook Live. It was moderated by Geoff Green, the Broker/Manager of Green Team Home Selling System. Panelists included sales agents Barbara Tesa and Keren Gonen. In addition, Jeremy Miller of First Home Bank provided insights on mortgage and housing industry stats. Dan Habib, of MBS Highway, a firm that provides insight and analytics to industries, discussed where interest rates are headed and the topic of affordability. Watch the video on our Facebook page to hear what these experts had to share.

Also, you can sign up on the Green Team website to receive monthly updates by email.

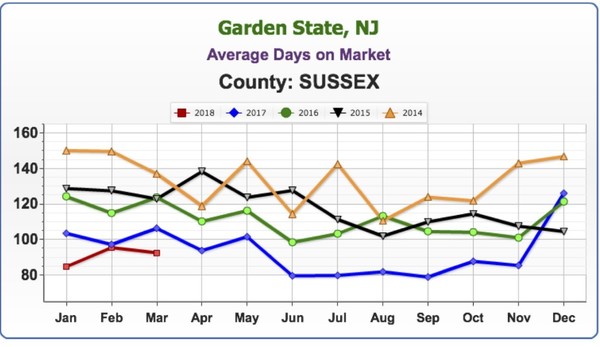

Average Days on the Market

The faster homes are selling, the hotter the market. Look for the lowest number on the graph, as opposed to the highest.

We take a snapshot of the past 5 years and see how the current market compares. The average number of days on the market is the lowest it’s been for March since 2014, coming in at 92.51 days. This is great news for sellers, but not such good news for buyers.

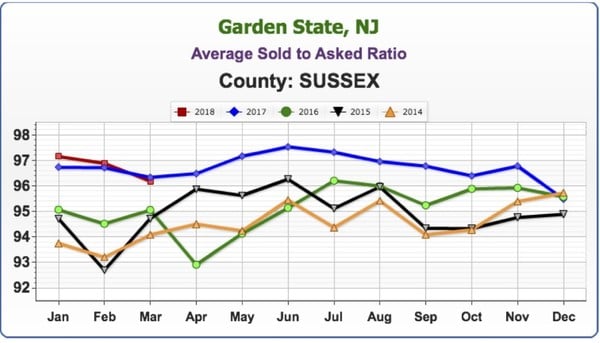

Average Sold to Asked Ratio

The percentage a house sold for under or over the last asking price (not the original price).

The Average Sold to Asked Ratio has been closely tracking 2017 numbers and is above the prior three years.

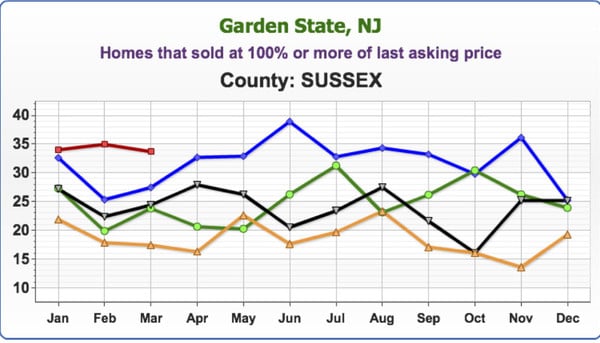

Homes that sold at 100% or more of last asking price

The first 3 months of 2018 have consistently been higher than the previous four years. In March almost 35 percent of homes sold at 100% or more of their last asking price..

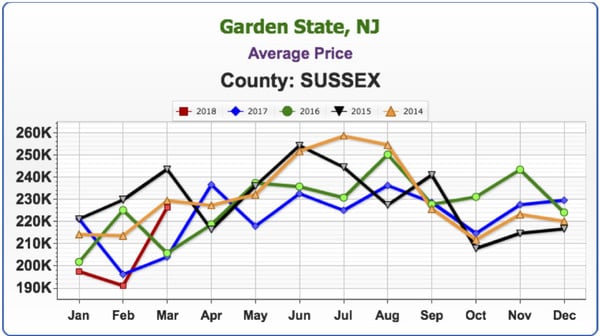

Average Price

There have been some interesting stats on average price. February 2018 was the lowest month in 5 years, but the March numbers are climbing up, higher than March 2016 and 2017, closing in on 2014, and and trying to close the gap with 2015’s numbers.

Barbara stated that so many homes are at or below the $200,000 mark that they’re dragging down the County average. There are also foreclosures below $100,000 that need so much work they’re just tear downs. Add the underwater inventory, short sales or foreclosures into the mix and that further brings down the average. According to Keren, banks are getting smarter, spending $20,000 to paint, put in new kitchen, flooring, or trying to make a house a little more acceptable. However, more often than not, the house is not in good enough condition for new buyers.. Buyers are willing to pay more, but don’t want to pay more when they see mold, etc. Banks are putting houses up at prices too high for flippers to purchase, flip and make a profit on. When a foreclosure does come up that is in good condition, intense bidding wars ensue.

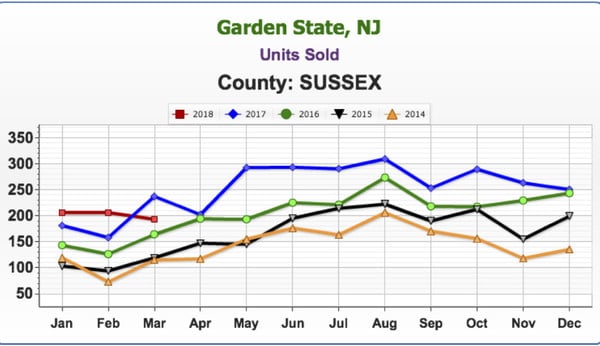

Units Sold

March dipped below the number of units sold in 2017, though it remained higher than the previous three years.

Keren stated that the banks have been holding on to inventory, waiting to release foreclosures in the spring market for a higher return on their investment. They’re thinking things are bad right now, so let’s just hold on and wait for the spring market. Keren Goren has experience in real estate investment, flipping homes, etc., so she brings a valuable perspective to the conversation.

Next Market Update

Mark your calendars and join us on Tuesday, May 8 at 9:15 a.m. for our next Facebook Live Market Update. Our special guests will be Michael Giannetto of Residential Home Financing, who will be offering substantive updates on the mortgage market and Ken Ford of Warwick Valley Financial Advisors, who will discuss other economic factors impacting the housing market. If you can’t make it at 9:15, be sure to watch the video later!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link