The July Housing Market Update was held live on Facebook on Tuesday, July 10, at 9 a.m. If you missed the live webinar, you can view it at your convenience by clicking here.

Meet the Panel

Geoff Green moderated the webinar and also presented relevant statistics in a historical context. Keren Gonen of Green Team Real Estate New Jersey conveyed the sales associate’s perspective on the housing market. Melissa Bressette, Green Team’s Marketing Director, rounded out the company’s participants. This month’s special panelists were Kevin Dolan, Branch Manager and Co-Director of Renovation and Construction Lending at Annie Mac Home Mortgage and Joe Panebianco, CEO of Annie Mac.

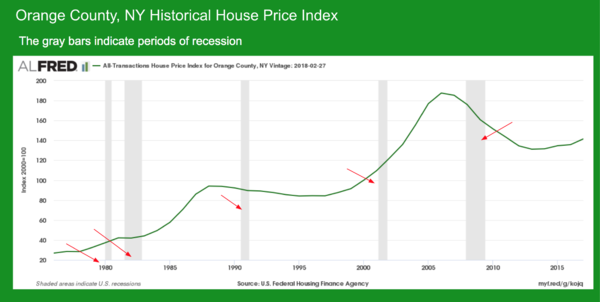

Orange County Historical House Price Index

Geoff presented a historical view of national and local prices, and a look at the market before, during and after recessions. In this chart of the Orange County, NY price index, gray bars indicate periods of recession. As shown in the graph, recessions don’t necessarily trigger downturns in the housing market. The inverse is usually true, with downturns in the housing market generally triggering recessions. Exceptions include the recession between 2000 and 2005. The housing market actually started to downturn around 2005, long before the financial collapse of 2008. Prices peaked in 2006, then continued to slide for over a decade. The steepness and duration of the curve is what is of special interest.

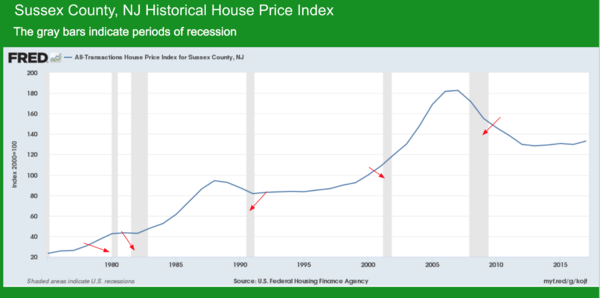

Sussex County NJ Historical House PriceIndex

In a historical context, the Sussex County and Orange County stats show a similarity, reflecting national trends.

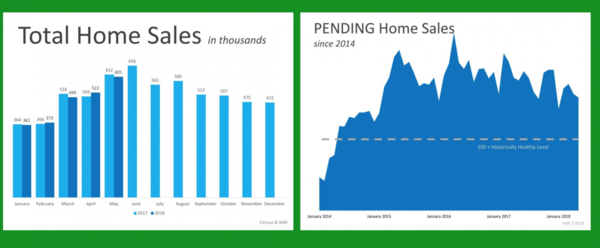

National Stats

In Total Home Sales in thousands there are no major increases in the year over year stats.

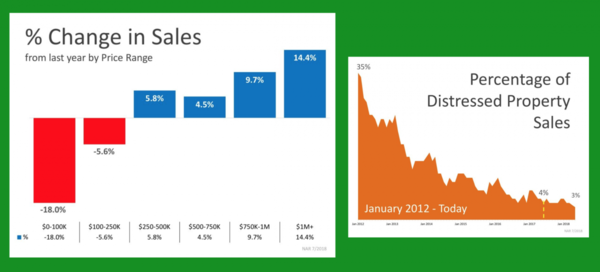

The number of houses available in lower price ranges is way down. However, there is an uptick in higher priced homes. Because of lack of inventory, buyers are being pushed into that higher price bracket.

The percentage of distressed properties for sale is way down from 2012.

Orange County Market Stats for June 2018

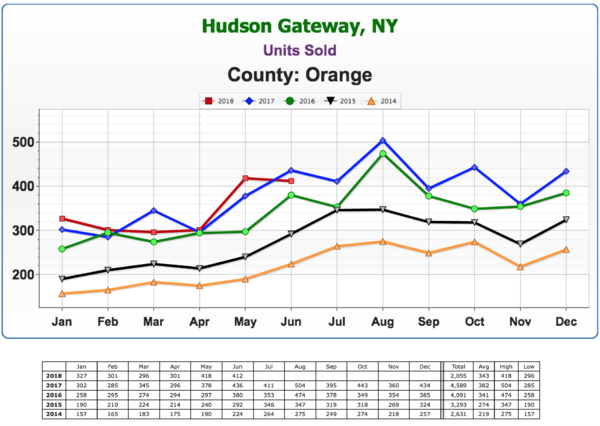

Units Sold

According to Geoff, this is one of the most important analytics in the housing market. No matter where pricing is, you can get an idea of the market by how many houses actually sold. There has been a great year over year increase for the past five years, but now it’s slowing down and we’re seeing a flattening now.

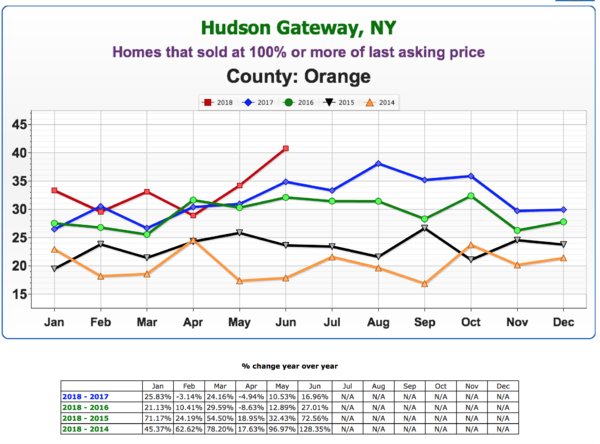

Homes that sold at 100% or more of last asking price

There’s a spike in this number. This is a hot market, and any home that is well located and in good condition will most likely have multiple offers at any one particular time. Basically, almost half of every listing on the market is being bid over asking. Note: Stats are based on last asking price, not original asking price.

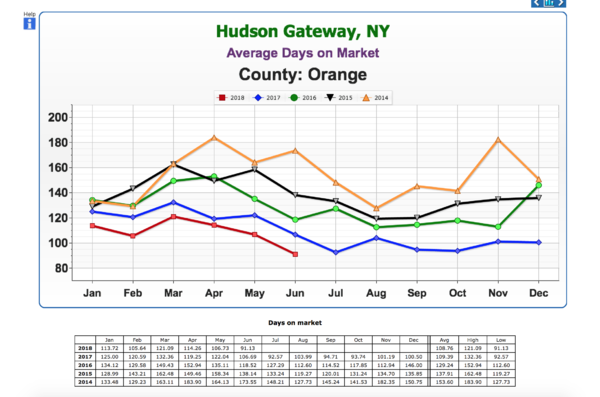

Average Days on Market

This number continues to decline, again showing a strong seller’s market.

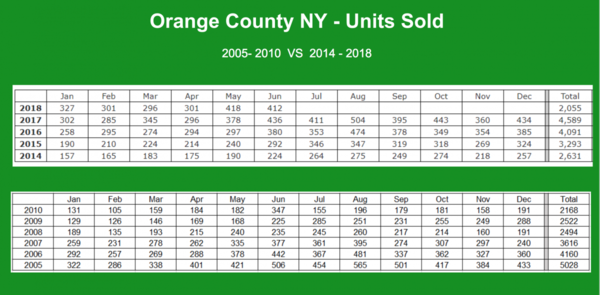

A Comparison of Units Sold from 2005-2010 versus 2014-2018

Geoff researched units sold in Orange County from 2005-2010 versus 2014-2018. Trends here follow National trends. The peak year was 2005 in terms of units sold. 2006 was the highest average home price the County has seen.. However, in 2010, the number of units sold had slid to almost half of the 2005 figure. Last year, we were above 2006 numbers, and close to 2005 in terms of units sold. Whether we’ll match or exceed that number in 2018 remains to be seen.

Recession

In a capitalist society, it is not a question as to whether or not there will be another recession. The question is when.

As defined in Merriam-Webster Dictionary, recession is “a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.” There is, of course, great interest in when the next recession will hit, and what impact it will have on the housing market.

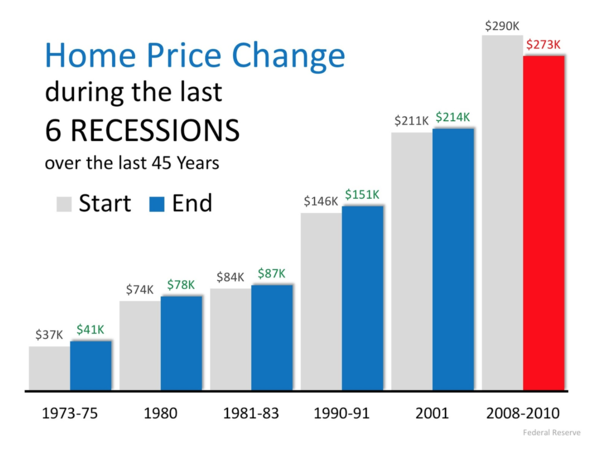

The graph shows home price changes during the last 6 recessions, over 45 years. The recession periods as designated by economists do not include the housing market downturns. Historically, prices haven’t been that affected during the recession; however, the definition of recession doesn’t include the whole downturn. And the real estate market takes time to recover.

‘

Keren Gonen’s perspective on the market from a sales associate’s point of view…

The market is very hot, in both Orange and Sussex Counties. In Warwick, if you don’t jump on a house right away, you can lose it. Keren is seeing bidding wars on homes within days of listing them.

When asked how long she thought the market would remain strong, she estimated about a year. One of the reasons we’re not seeing the lower priced homes sold, Keren indicated, was that banks that do have foreclosures are releasing them at much higher prices. Some banks are also renovating and flipping homes and charging even more.

Geoff commented that previously, when the market was really bad, there was shadow inventory. Banks would hold on to foreclosures, creating fear in the market that they would dump their inventory of low-priced homes, driving down prices. However, the banks seem to be changing their ways of doing things by renting out some homes, and fixing up others and selling them at higher prices.

The Mortgage Market – Where are we now?

Geoff stated that we’re definitely in an increasing rate environment and the Fed has signaled that they are going to continue to increase the overnight lending rates into the foreseeable future. Geoff asked Kevin Dolan to address where we are at now…

Kevin responded that where rates are concerned, they’re turning higher for the foreseeable future. Partly due to media coverage, people are starting to take the rise of interest rates and home prices seriously. They see continual coverage of higher rates on news shows. Thus, people are becoming proactive, buyers and sellers alike, driving productivity level.

Interest rates, inventory and recession. Oh my!

Joe Panebianco does economic analysis and strategy for Annie Mac. His expertise made him the perfect person to discuss specifics and timings of interest rates, inventory and recession.

Interest Rates: We will most likely be range bound from a 10-year treasury perspective from approximately 2.75 to 3.05 yield in the ten year. In other words, we’ll be relatively stable. Should this estimate be incorrect, Joe believes a slightly higher rise in interest rates will not significantly hurt the housing market. At some point, rates rising will have a deleterious effect and purchasers’ ability to afford a home may be impacted. However, we’re not at that point now.

Inflation and economic growth are the two primary components of interest rates. Inflation has remained stubbornly low and will most likely remain so. Hence, one reason why rates should remain relatively low. People talk about the Fed increasing rates, but they are increasing the short end of the curve.

As the Fed continues to hike rates, the result will be 10 and 30-year rates looking more like 2 and 5 year rates. Most of the duration of a mortgage-backed security is in a 7, 10 and 30-year part of the curve. And Joe believes that the more the Fed increases rates, the more likely we are to be in a recession and more likely to have lower, longer-term rates remain where they are or go lower. The mortgage market on Adjustable Rate Mortgages could be hurt because they’re much more likely to rise as they’re sensitive to the shorter end of the curve. 30-year fixed mortgages are more likely to stay in the aforementioned range.

The Global Connection

We live in a globally connected network and there is a yield spread between US 10-year Treasury bond and bonds in other countries, like Germany, Japan, Australia.. For central banks, very large institutions,etc., putting their money in US Treasuries provides a safer, purer investment over countries with significantly lower yields. However, regarding tariffs, trade wars are inherently bad for economies and may throw a curve ball into any predictions.

There are some who refer to our current economy as a “Goldilocks economy.” Not too hot, not too cold, just right… in some ways. The economy is growing enough to create jobs. And, according to Joe, jobs are far more important to home purchases than interest rates are. In the early 1980’s, interest rates were at 15% and yet homes were flying off the market. When rates go up, prices tend to come down. And there is always a buyer, especially if there is value to be had.

The history is if the Fed goes too far, it will drive the country into recession. Joe believes we have approximately 12 to 18 months left in this cycle. And that at the end of this period, we’ll be in a more normal market with a healthier balance between demand and sup

Factors that impact inventory

Labor, or lack thereof, is a major component. Many significant builders have unused land on their balance sheets, on hold because of the great recession of 2007 to 2010. About 70 to 75% capacity of the productive capacity of the home building industry was lost. Brick layers, sheet rockers, carpenters, plumbers, electricians, etc. – left the industry to seek employment in other fields. In addition, when major storms hit Texas, Florida, etc., many people in the industry picked up and went to work in those cities where they could make much more money. There are simply not enough craftsmen and laborer to build all the homes necessary to meet current need.

Municipal Fees, laws – Fees, regulations, etc., have made building a home both difficult and expensive. To help increase taxable base, some municipalities are now trying to make things a little easier for those seeking to build new construction.

Tariffs – The “War of Words” regarding trade with Canada is not good news for the housing industry. A disproportionate share of home building lumber comes from Canada, and price of lumber futures has already risen on expectation of tariffs.

Easing of Credit

In the next 12 months, we may see easing of some requirements. At this time, no one knows how this will be done. However, some options might include reducing Mortgage Insurance on the FHA side, especially for first-time buyers. Also, Freddie Mac might follow Fannie Mae’s lead in reducing Long Term Debt and Debt to Income Ratio. Average renters spends 50-55% on rent. However, the current Debt To Income ratio is in the low 40’s for purchases. There might be a move to update the DTI.

Demand is not going to Cease

According to Joe, by 2025 there will be approximately 10 million new household formations. 35% will be from millenials, 35-40% from among the Hispanic community (with some overlap between the two), and 10% from the African-American community. Many of these new home buyers will be DTI (Debt to Income Ratio) challenged. They will need the services of qualified real estate agents, knowledgeable mortgage specialists/

Geoff pointed out that purchase and rental markets are both hot at the same time. This indicates a true housing shortage. The Millennial population seems to be exceeding Baby Boomers. Pent up demand and limited supply serve to elongate and stretch out the cycle.

Home ownership improves communities – and the economy

Home ownership lends itself to not only building communities, but also to building up business, including home improvement and furniture stores, furniture stores, durable goods vendors, etc., etc.- all of which will help the economy. Inventory may become less of an issue month by month by month.

Renovation Loans

Kevin Dolan is an expert in renovation loans. There are homes on the market that just won’t sell because they are not in good shape. He believes the renovation lending program is under-utilized simply because it is not understood and there are many misconceptions.

There are two types of renovation loan programs – conventional and FHA. This opens up versatility for buyers as to who it can serve, such as a down payment as low as 3-1/2%. It also allows for lower credit scores. These loans can be utilized for primary homes, second homes and investment properties. The loan allows for someone to buy a house in need of repair, and have an approved, qualified contractor bid on work to be done. Depending on scope of work, sometimes a HUD consultant will make sure prices quoted for the work are appropriate. The renovation funds goes into an escrow account, and contractor has specified time to do improvements, usually within six months. The bank pays contractor directly. The process is streamlined and efficient.

Kevin feels that educating buyers and real estate agents alike is key to opening up this market. Keren agreed, stating that she often does sell homes by telling buyers that renovation loans are available, and explaining how they work. It opens up options and vision for the buyers who cannot afford to buy a home in the $300-$400,000 range. Annie Mac does have a certification program available for real estate agents who would like to become expert in this area.

Renovation loans – not just for buyers

Kevin commented that renovation loans can also be helpful for sellers who need to update their homes in order to sell. By adding another bath or more bedrooms, the value of the home can be increased so that the seller can pay off existing mortgage and closing costs, and hopefully make a profit as well. Also, from Seller’s position, if they have a failed septic tank, they can sell the home at a lower price and buyer can get a renovation loan to cover the cost of having the work done themselves.

Joe added that in looking to build wealth in addition to creating a home for their family, renovations can help improve their property, and therefore their investment.

Geoff spoke about the importance of finding someone who truly understands these loans as they can be tricky for the loan originator. Geoff spoke highly of Annie Mac, not just for renovation loans, but for all financing needs.

Stay tuned for the next market update

The next update is August 14, 2018 at 9 a.m. You can sign up at GreenTeamHQ.com/HMU

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link