Green Team Realty Third Quarter 2019 Sales Leaders

Congratulations from Geoff Green, President of Green Team Realty, to our Third Quarter 2019 Sales Leaders

Congratulations to Jennifer DiCostanzo of Green Team New York Realty and the dynamic team of Charlie Nagy and Ted Van Laar of Green Team New Jersey Realty for taking first prize as our third quarter sales leaders. It’s no secret that Q3 is the biggest quarter of the year in our industry. Therefore, it shouldn’t come as a surprise that we’re seeing these three names at the top once again. The truth is, behind the accolades there is a lot of hard work. All three of these individuals work tirelessly to yield the results they do. So, keep up the great work everyone!

Jennifer DiCostanzo, Warwick

For this hard working Associate Broker, success is not measured by sales numbers alone. Rather, Jen views true success by the clients she’s helped and the satisfaction she gets from doing her best at something she loves. She is constantly striving to enhance her knowledge and skills so that she can provide her clients with an edge in this competitive market.. Jen has earned her Seller Representative Specialist (“SRS”) and Accredited Buyer’s Representation (“ABR”) Designations. In 2016, 2017 and 2018, she received the annual Sales Leader Award as well as the Citizenship award. Further, in 2017 she became the first recipient of the Green Team MVP Award for over $10 Million in sales. Jen is a member of the NYS Association of Realtors, the Hudson Gateway Association of Realtors, the National Association of Realtors, and the Warwick Chamber of Commerce. In addition, as a Warwick resident married to a NYC firefighter, she understands the needs of commuters and has helped many buyers relocate to Orange County.

Charles Nagy and Theodore Van Laar, Vernon

Ted Van Laar, Charles Nagy & Geoff Green

In addition to this Q3 Award, the team of Charles Nagy and Theodore Van Laar earned Green Team New Jersey Realty’s 1st Quarter Sales Leader Award for 2019. That follows their 4th Quarter and Yearly Sales Leader Awards for 2018. The Dynamic Duo, as Geoff Green affectionately calls them, are equity partners in the brokerage. And they are committed to leading by example. They are strong believers in the Green Team’s unique system of training and support which gives sales associates the tools to provide the best possible customer service and experience. Charlie and Ted come from diverse backgrounds in real estate. Yet together they form a productive, successful team. One bond that unites them is their love of resort properties and living. They have been recipients of the Circle of Excellence Award multiple times between 2014 and 2018. That Award requires minimum sales of $2.5 Million and 15 transactions to qualify. In addition, they were Second Quarter Sales Leaders at Green Team New Jersey Realty for both 2017 and 2018.. And in 2018 they became part of the Green Team’s President’s Club, which honors those associates with $5 to $10 Million in sales volume.

Charlie and Ted are proud of Green Team New Jersey Realty’s growth and achievements. After only two years in business, GTNJR owns their own office building and ended 2018 as the #1 firm in sales volume and transactions in all of Vernon, NJ. They also take pride in the team they are building.

Congratulations to our 2nd and 3rd Place Winners

Green Team New York Realty: Toni Vogel is our second place Q3 Sales Leader, with Nancy Sardo in third place.

Green Team New Jersey Realty: Kristi Anderson is second place Q3 Leader, with Alison Miller in third place.

Sept 2019 Housing Market Update

Recap

Geoffrey Green, President of Green Team Realty, invited viewers to the Sept 2019 Housing Market Update. The update took place on Sept 17, 2019, 2 p.m. on Facebook Live.

National Housing Market Statistics

Recession Worries

According to Geoff, we’re starting to hear the word recession far more than we did a year ago, far more than six months ago. The big buzz is, are we headed to a recession? If so, when? And how dramatic will it be? The bottom line is most people think we won’t be experiencing anything like we went through from 2008 to around 2016.

“The housing crash during the Great Recession left a lasting impression… But as we look ahead to the next recession, it’s important to recognize how unusual the conditions were that caused the last one, and what is different about the housing market today.” Jeff Tucker, the Zillow Economist

Reasons why housing prices and the real estate market should remain strong

- Many people are in a very strong equity position as far as their home goes. That’s the amount of money that is in the value of the home. If you know the fair market value of your home minus the pay off amount of your mortgage, the difference is the equity. Keren Gonen and our Producer, Melissa Bressette, were discussing that over one-third of US households are free and clear of any mortgage. That is a very strong number. From a balance sheet perspective, we’re doing very well as a nation.

- We’ve had good appreciation over the last few years. It continues and most experts agree that despite the market slowing, appreciation is still going to be something that will continue for the next 12 months at least. The question is really by how much.

- Inventory levels are still relatively low. Days on market are low, bidding wars are still happening.

- Mortgage and interest rates are fantastic. Geoff thinks that if you had asked a lot of mortgage professionals a year ago where rates would be now, they would not have predicted how low rates would be. The low rate environment is continuing to fuel the real estate market.

- There is a level of affordability we haven’t seen in a long time. When you package everything together; earnings, mortgage rates, taxes, prices of homes, etc.you get affordability rates that are historically high. That is, how affordable it is for the average American to buy a home.

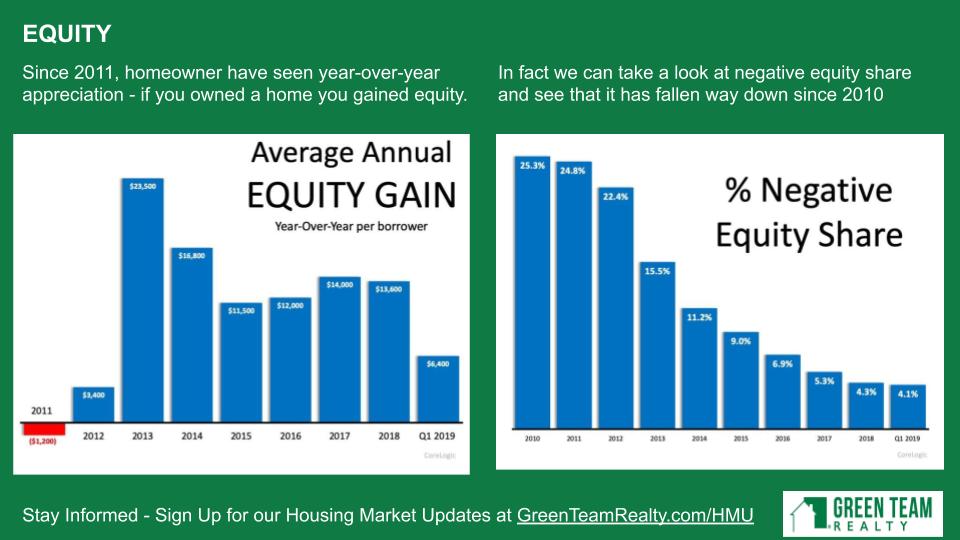

Equity

Here we’re seeing year over year appreciation growth. It is still very strong. Still where it was a couple of years ago. Percent of negative equity share refers to who is in negative equity situation. That occurs when the mortgage payoff is higher than the fair market value of the home. That has been steadily declining since 2010 and we are now at the lowest level since then. Those are very good signs.

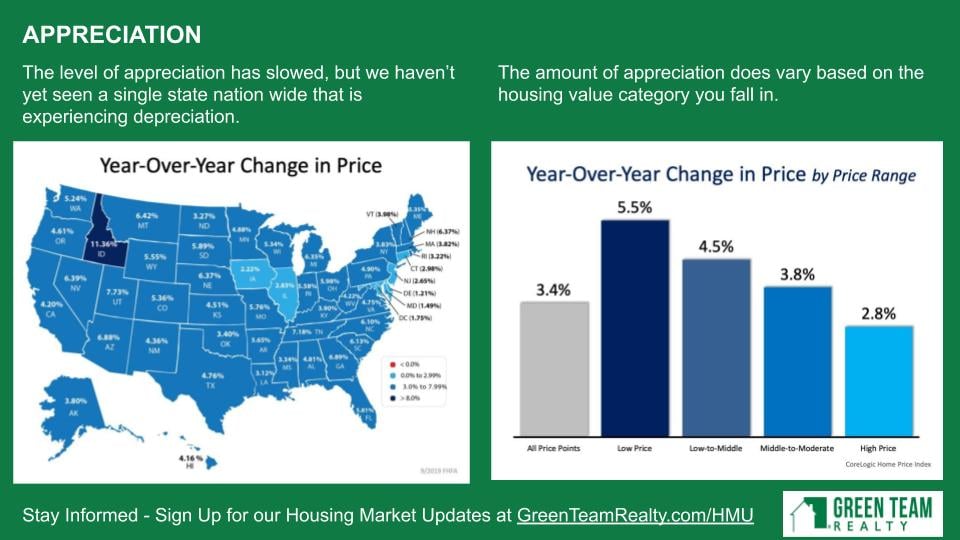

Appreciation

A quick glance at the map of the U.S. on the left side shows nothing is below “0” and everything is still appreciating. Then we review the right side, which examines year-over-year change in price by price range. All price points are in grey. Lower end homes have a bigger market, more demand, which drives up price. However, even the high range homes are experiencing appreciation.

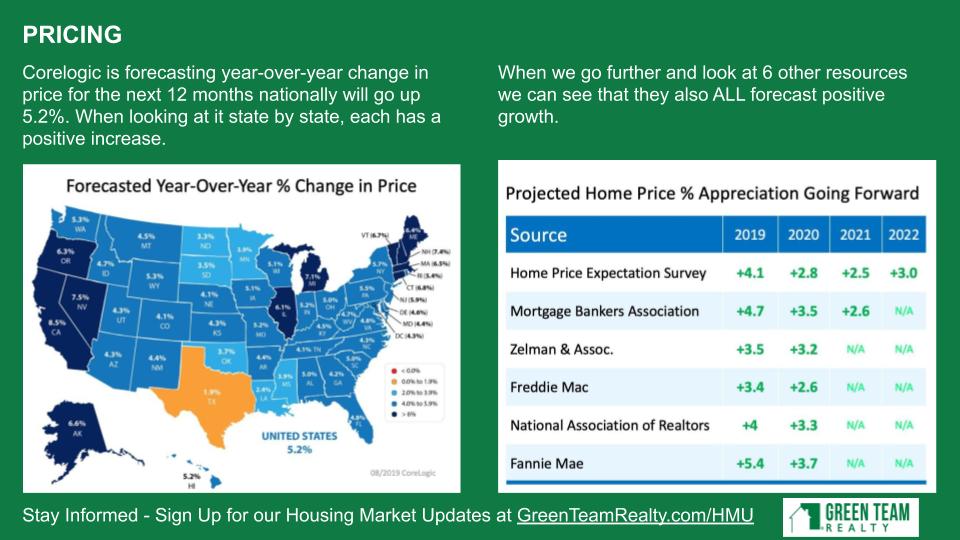

Pricing

Corelogic,a leading provider of statistical data on the housing market is projecting, per the above map, that over the next 12 months the nation will go up another 5.2%. That is a very healthy rate of appreciation. In addition, some other sources, shown here on the right, are predicting a fairly substantial level of appreciation, even into 2021.

Inventory

Historically, left to right, we are still at a very low level of inventory, which means that pricing should continue to increase. or stay strong year over year. Year-over-year inventory levels, we’ve had a bump at the end of 2018, beginning of 2019. Now we can see inventory starting to tighten up again a little.

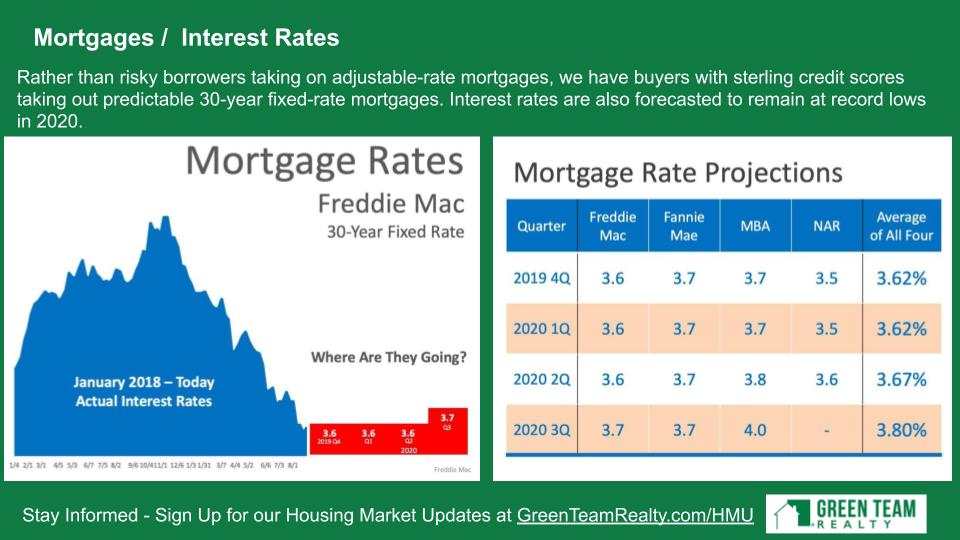

Mortgages/Interest Rates

Where are they headed? Where are they now? We can see from January 2018 to today the rates that could not have been predicted a few years ago to be so low. And we recognize that this is a good spot that we’re in.

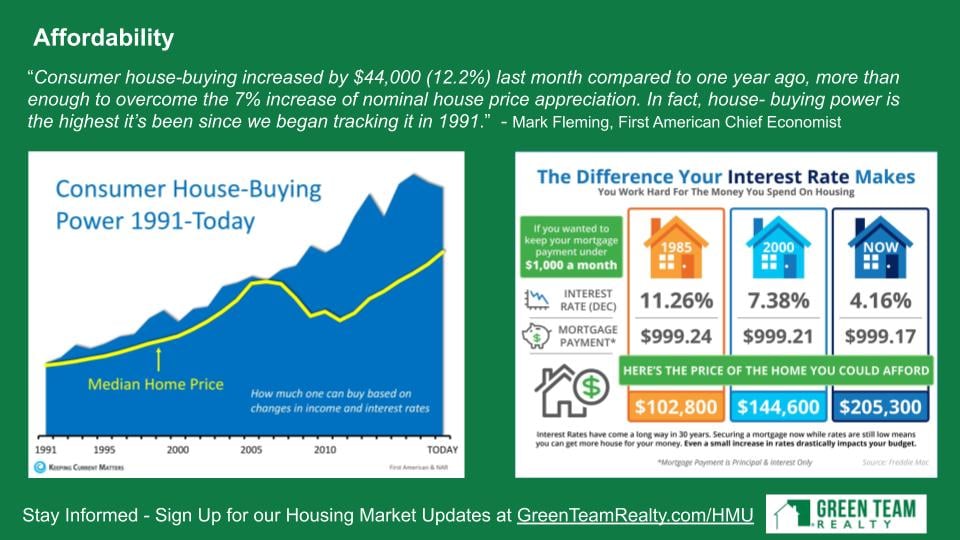

Affordability

On the graph to the left, the yellow line represents median home price while the blue represents purchasing power. It’s evident that there is much less of a variance between the two up to 2005, which was the worst period of time. But we’ve stayed strong. During the crash, home prices went down while affordability went up. And it hasn’t really changed. There is still ta good opportunity for people to secure one of the most important assets they ever will own – a home.

Historical Recession Data

Geoff agrees with everyone who believes that this recession will be much shorter than the last one. The housing market is in a better position. We have better fundamentals in place than we did the last time around. There is not nearly as much sub-prime lending as there was. Of the last five recessions, home prices went down in just two. Home prices went up in the other three.

Having gone through the last recession, it can be hard to believe that prices can actually rise. But maybe this one will go that way as well.

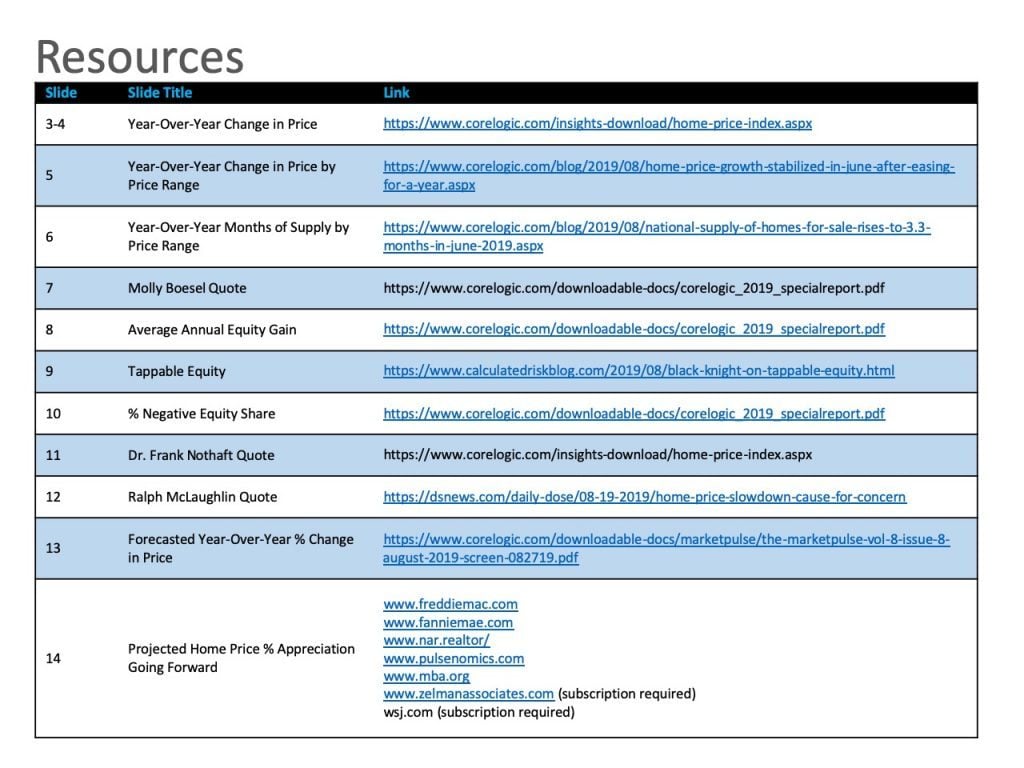

Resource Center

Each month we bring you stats, data and quotes from various trusted industry sources. These resources will now be available to you in our monthly Housing Market Update recap blog post, which can be accessed from GreenTeamRealty.com/hmu/ under Housing Market Recap.

Local Housing Market Updates

Orange County, New York

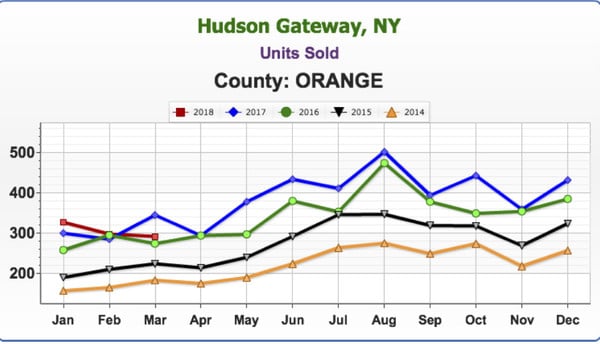

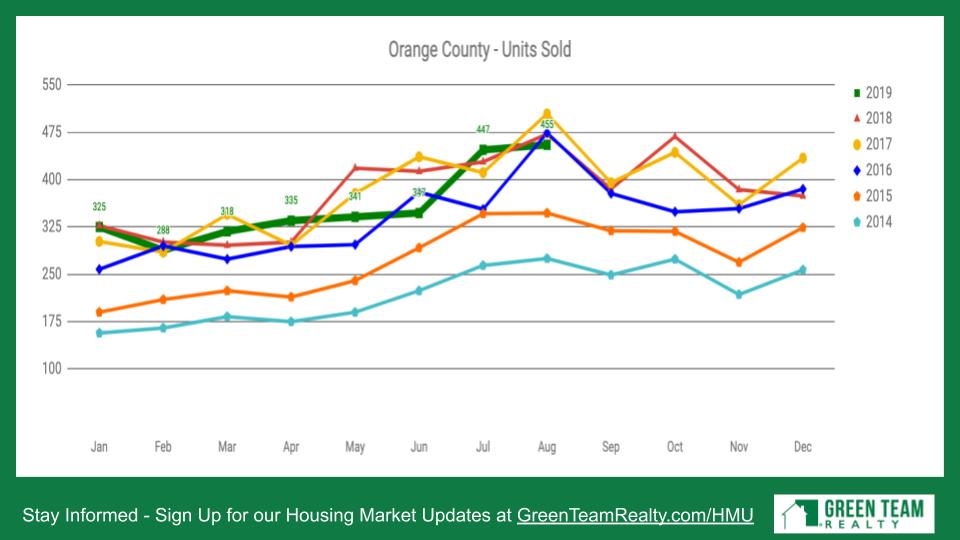

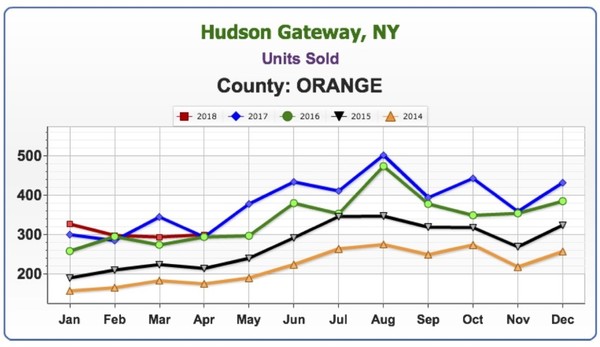

Units Sold

It’s been a mixed bag this year. The green line is 2019. It’s fair to say the number of units sold is consistent with 2018. We’re definitely seeing a slowing in the number of transactions. But, it’s still a very high historical level. And it’s still a very strong market. So, yes, it’s cooling, but it’s still a very high rate.

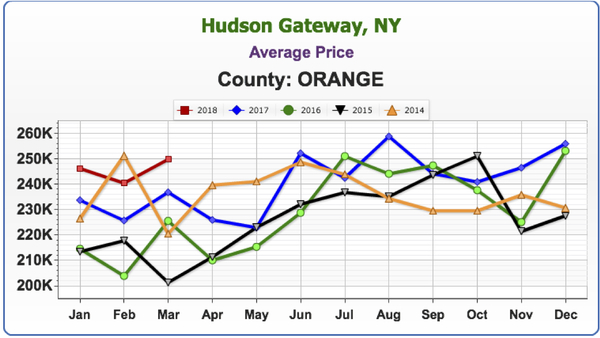

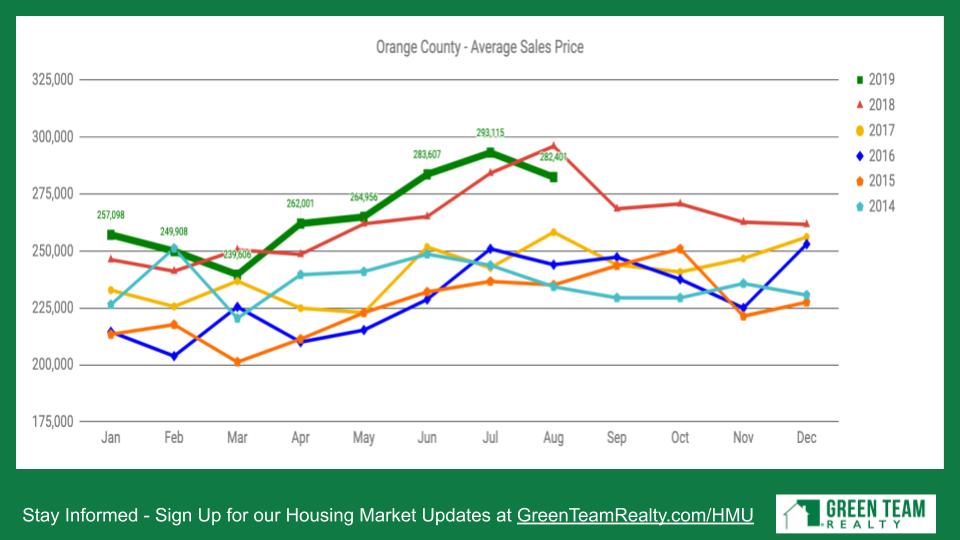

Average Sales Price

The average sales price took a little dip this month.That doesn’t mean that prices will ultimately continue to go down year-over-year over 2018. However, units sold has been slowing. Geoff believes we’ll see a softening of the market, rather than a crash.

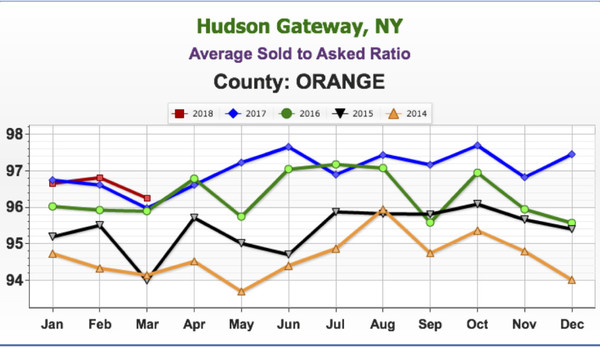

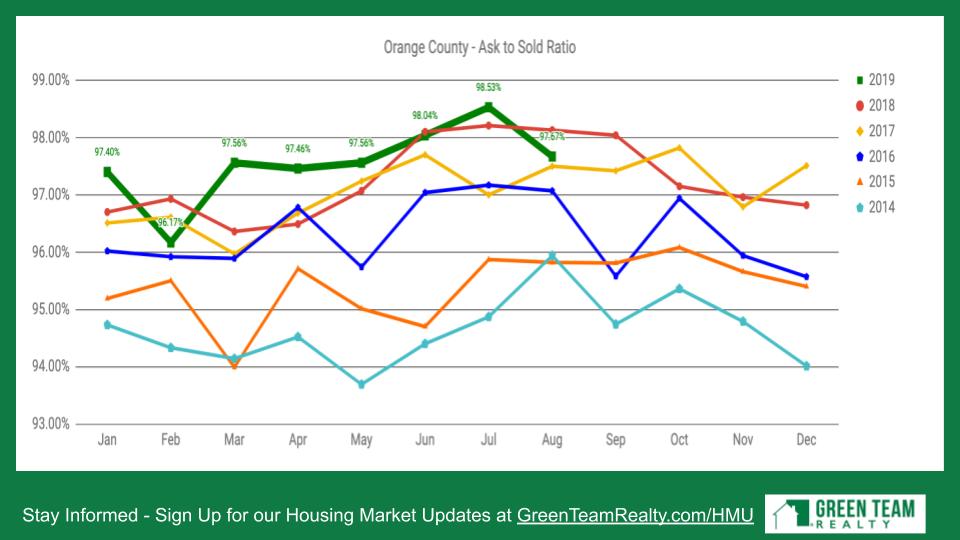

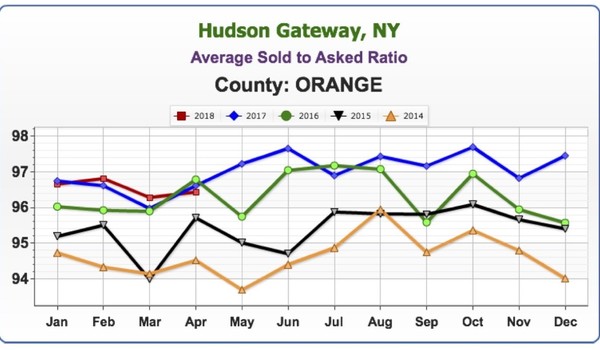

Ask to Sold Ratio

The last asking price versus what the house sold for and the ratio thereof. As you an see, this year it’s been high, meaning sellers haven’t had to negotiate much off of their asking price. However, recently we’re seeing a dip, which is worth noting.

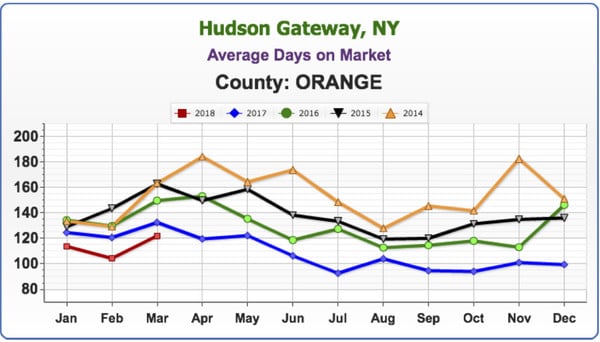

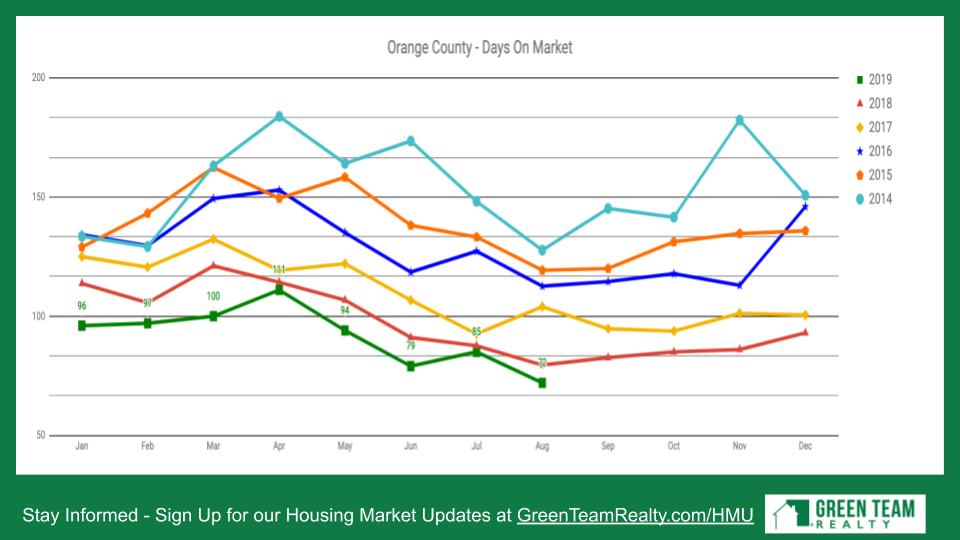

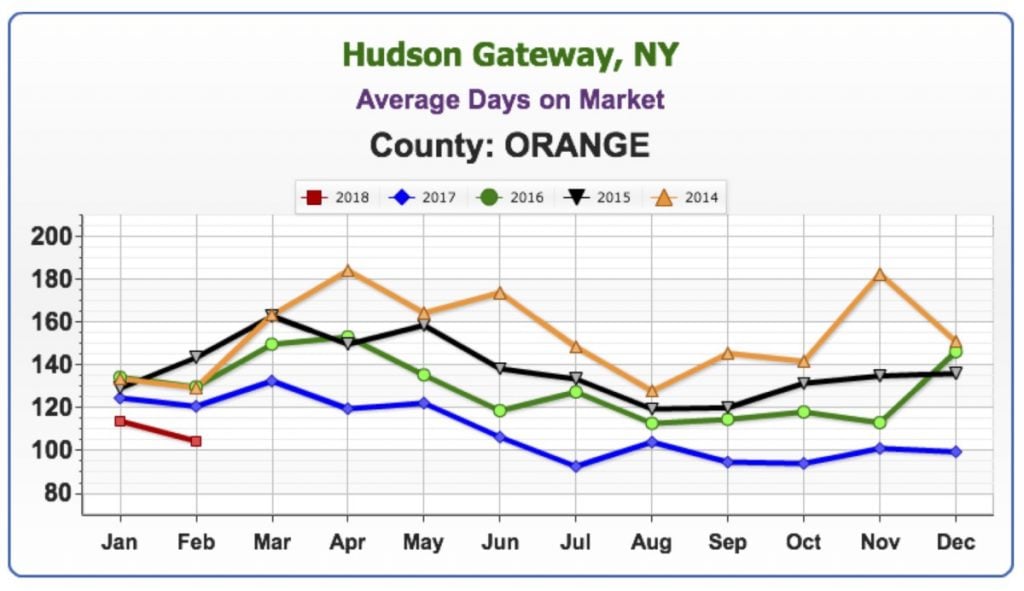

Days on Market

The days on market have consistently been lower than the previous 6 years, remaining a strong factor in the market.

Sussex County, New Jersey

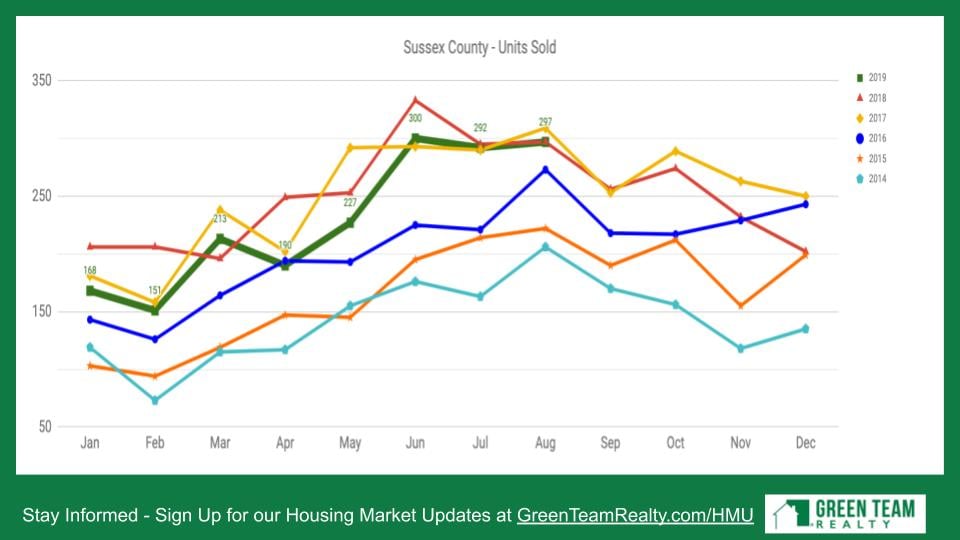

Units sold

There is a similar situation here in Sussex County; a mixed bag, up and down. However, it’s clear that in the last 18 months or so, the number of units sold has been slowing.

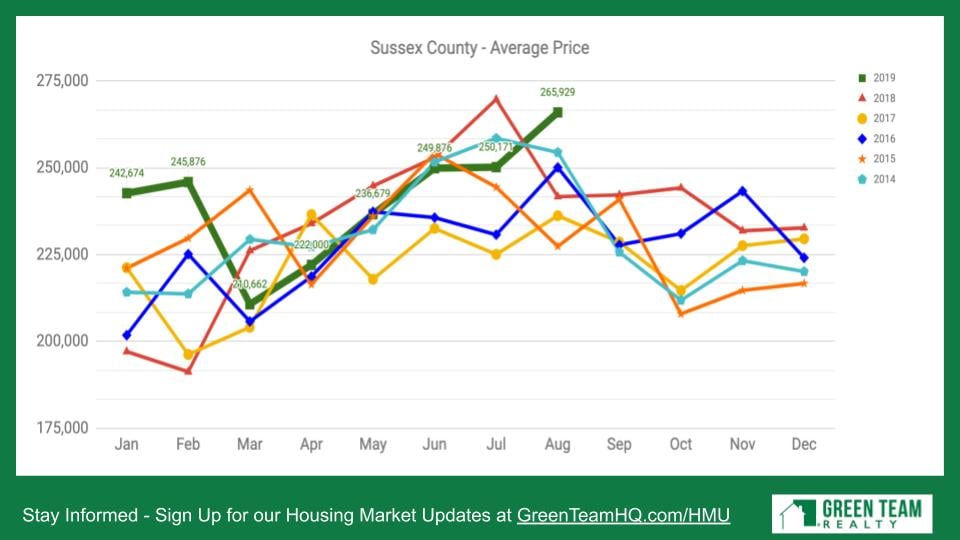

Average Price

It’s interesting that all through this time period average price in Sussex was kind of languishing. And now we see prices taking off,. almost the highest level of prices in the county in almost 8 years. Only July of 2018 was slightly higher.

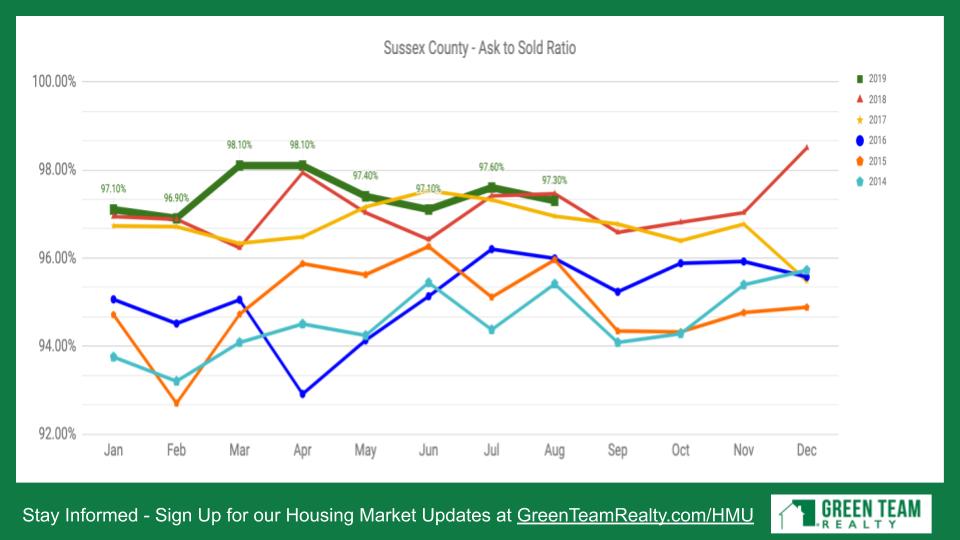

Ask to Sold Ratio

The ask to sold ratio is again similar to what we’re seeing in Orange County. at 97, 98%, it’s still a strong market with sellers only having to come down a little bit off their asking price.

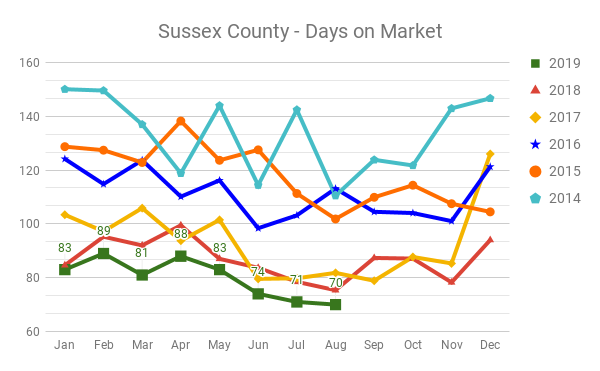

Days on Market

Days on market are lowest over last 6 years. The market continues to be strong. Further discussion will take place with our panel.

Thank you to our sponsor

Meet our Panel

Keren Gonen is from Green Team New Jersey Realty and is a regular panelist on our Housing Market Updates.

Geoff asked Keren what’s actually happening in the field; if there are signs of the market taking a downturn.

Keren stated that it’s important to note that there are still people buying. still people selling, and there are still bidding wars due to low inventory. On both sides of the border we’re dealing with a lack of good houses. Now that it’s so easy and affordable to buy a good home, it’s really a question of inventory. Some sellers are on the fence, waiting to hear what will happen in 2020. Agents and Sellers would like more inventory to choose from. However, if agents educate their sellers we’ll see a lot more houses on the market in the coming months.

Geoff asked if Keren has found buyers becoming more picky as time goes on. Keren replied that it’s the opposite; Buyers are rushing to put in offers on the houses that they like. She said we want to make sure that good houses on the market do sell quickly, because that makes everyone look good. Whether it’s the listing agent or selling agent, everyone does better in that type of a market.

From the Seller’s perspective, Geoff asked if Keren agreed that we’re not in a market where they can list at any price and sell. Keren stated that surprisingly all the listings she’s had have either come in on point asking price or a few thousand dollars above asking price due to bidding wars. In addition, they’re going under contract very quickly. Attorneys are moving them along, with attorney review much faster than earlier in the year and last year. She had one listing got out of attorney review in literally 48 hours, which was a first for Keren.

Pricing

Geoff said he was sure that Keren was choosing comparables carefully to make sure the information is accurate and she’s setting a good asking price. She replied, absolutely. That’s the first thing – Listing Agent 101. You want to make sure you do your comps properly so that you don’t sit on the market. Geoff stated that ‘s the message to all Sellers. The hardest conversation to have as realtors is price reduction. It’s kind of like having mud on your face. We’re the ones who bring in the comps, make recommendations on what we feel the fair market is for their home, Many Sellers don’t listen and just want to list at the price they want. But many people do listen. However, sometimes a price reduction is necessary. However, no matter what market you’re in, you have to price it right.

Keren said one of the things she does with all of her Sellers is ask them what their time line is for selling their home. Meaning, are we okay to sit on the market for 3, 4, 5, 6 months? Or are we looking to get an offer within the next month to 2 months. Then, according to what they tell her that’s where she prices the house. She has had clients that tell her they don’t care when they move, the house is paid off and they’re not in a rush. And they want a specific amount for their house. So Keren tells them that’s okay as long as they understand that according to her market analysis, they won’t sell until we reach this price. As long as they understand that, she’s fine with listing it at that price. Ultimately it’s always the Seller’s decision.

The recommendation

Price it right from the beginning. Price it to sell from the get go. You’re likely to get a higher price. There is never a better time to sell your home than when you first list it. It’s new, there are buyers out there waiting for the next house to come out on the market. They’ve been out there looking and haven’t found what they’re looking for yet. Now your home is new and it’s on the market.

Bank Inventory

Geoff asked Keren what she is seeing as far as bank-owned inventory. He considers Keren to be a leading expert in Sussex County on the subject. Keren stated that they are not seeing too much being released by the banks. Whatever was out there was sold. She hasn’t seen anything new that’s affordable for an investor or flipper or someone who wants to take on renovations on their own. It has been quite a few weeks since she’s seen those. She has seen some that are borderline, with a few things missing, but those are priced too high. There really isn’t any new release of inventory from them.

Geoff then asked if Keren is still seeing bank-owned properties continue to be rented, an anomaly that we’re seeing over the last 5-6 years. As far as Keren knows, they are, remarking that it seems banks now want to be landlords as well. Geoff mentioned some clients who rented a bank-owned property and once they got in there was problem after problem. It was discovered that there was a lot of substandard that had been done. Caution people buying inventory to make sure that the renovations have been done correctly. The flips that Keren has seen by banks are usually bid out to the lowest bidder and that reflects in the workmanship.People can get caught up in the moment; the price seems right. And they may think they’re getting a better deal because the property is bank-owned.

Wrapping it up

Geoff has been in the real estate industry for going on 15 years. He has worked a lot of hours every week during those years and developed a great appreciation for agents like Keren, working in the field.The housing market in this country would not be what it is without the hardworking agents. They keep data accurate, make sure clients needs are met. Other market places around the world are not nearly as well run as they are here. We are getting into an age where it may be possible to just buy a home from Zillow offers, etc. However, the expertise, knowledge and support offered by real estate agents cannot be duplicated. Geoff’s final word… Find a Realtor!

Keren Gonen can be reached at: 551-262-4062.

Vikki Garby is Green Team New York Realty’s 2019 2nd Quarter Sales Leader

[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”3.0.47″][et_pb_row admin_label=”row” _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text admin_label=”Text” _builder_version=”3.18.2″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]Vikki Garby is having a great year. She was 1st Quarter Sales Leader for 2019, And now Green Team New York Realty is very proud to announce that Vikki is 2nd Quarter Sales Leader. According to Geoff Green, President of Green Team New York,

“Vikki Garby is a smart, focused Real Estate professional. Furthermore, the analytical abilities developed during her time as an investment banker and real estate investor contribute to her success in both Residential and Commercial Real Estate. It’s exciting watching Vikki grow her Real Estate Business. Green Team New York Realty is extremely blessed to have her as part of our Agency.”

More about Vikki…

As mentioned above, Vikki was an investment banker for a major bank in New York City. During that time she reviewed and negotiated complex contracts on a regular basis. And it was also during that time that Vikki became a real estate investor, negotiating on her own behalf as a buyer.

Her love of real estate and skill at navigating its many transactional parts lead her to obtain her license so that she could help others achieve their real estate goals. Furthering her education and skills, Vikki obtained her Commercial and Investment Properties Real Estate Certification (“CIREC”) last summer.

Vikki had this to say about her recent achievements:

“I have been blessed with a great year working with wonderful and supportive clients. Their loyalty has allowed me to grow my business each year. It has been an extremely rewarding and fulfilling year so far. The great team I have at Green Team New York Realty helps tremendously.”

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

July 2019 Housing Market Update

July 2019 Housing Market Update

Geoffrey Green, President of Green Team Realty, welcomed viewers to the July 2019 Housing Market Update, held on Tuesday, July 16 at 2 p.m. He started off by presenting the most recent numbers.

National Housing Market Statistics

Pricing – Where are things headed?

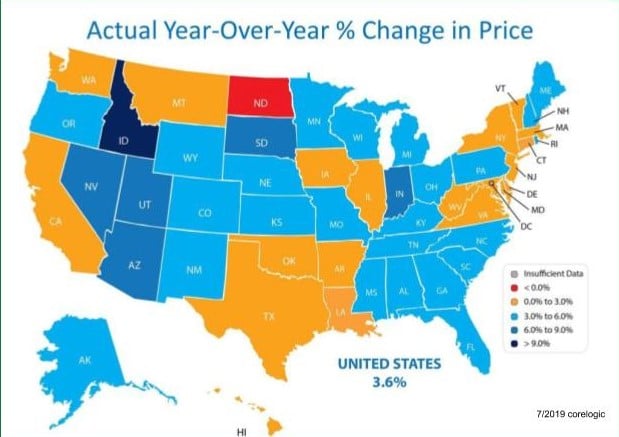

Looking at year-over-year change in price, only one state, North Dakota, is at a 0% price appreciation change year-over-year. Pretty much we’re seeing gains in price throughout the country. Idaho is leading the charge. The northeast is a little weaker than many other areas of the country.

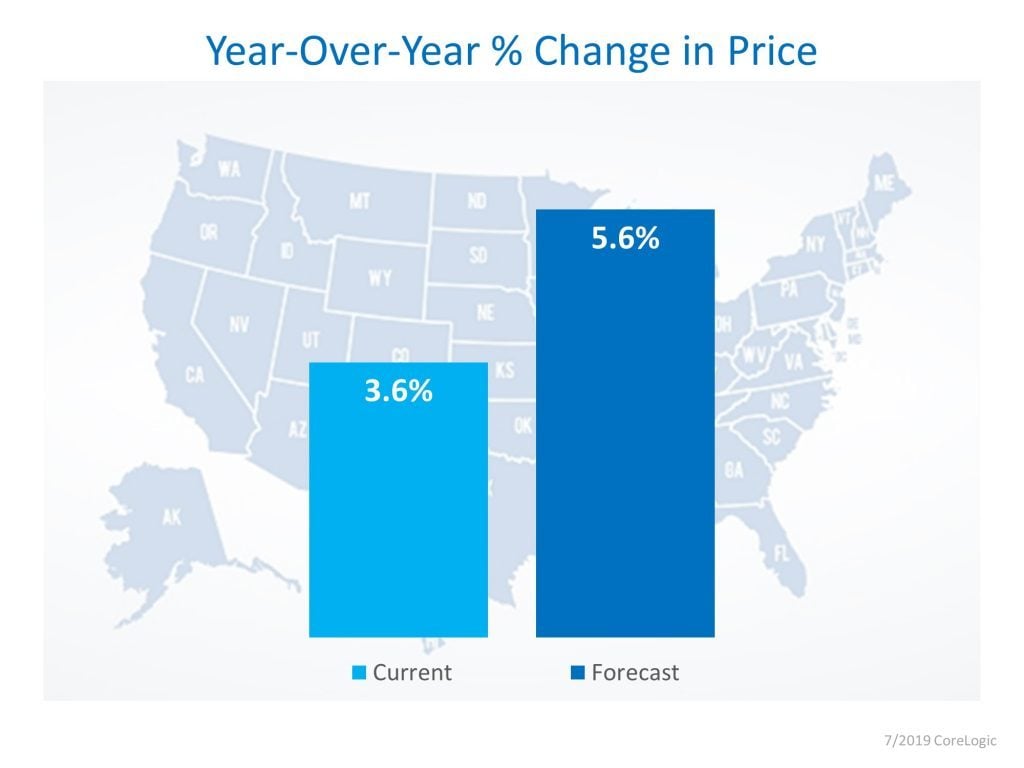

Corelogic is a substantial company that aggregates a lot of data from many sources. They are a player in regards to legitimate statistics in the real estate industry. Essentially they are predicting the year-over-year price change will round out at about 5.6% which is up from the previous prediction of 3.6%. There is enough economic data to support the higher prediction.

House Appreciation

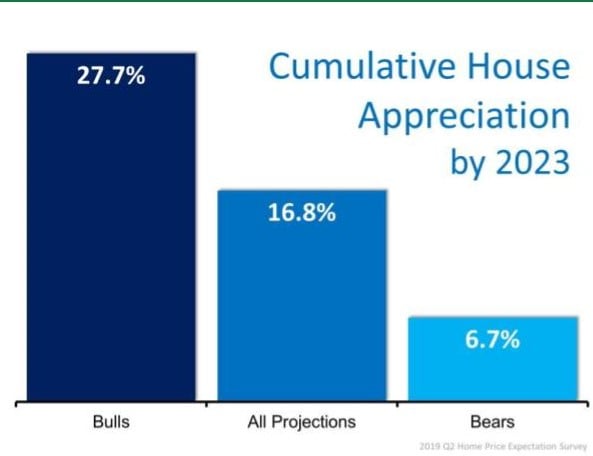

Over 100 economists, real estate experts and market strategists made predictions on cumulative house appreciation by 2023. The Bulls predicted 27.7%, the Bears 6.7%, while all projections indicated 16.8%. It is significant that even the Bears, the most cautious participants, did see some level of appreciation.

Optimism regarding future price appreciation

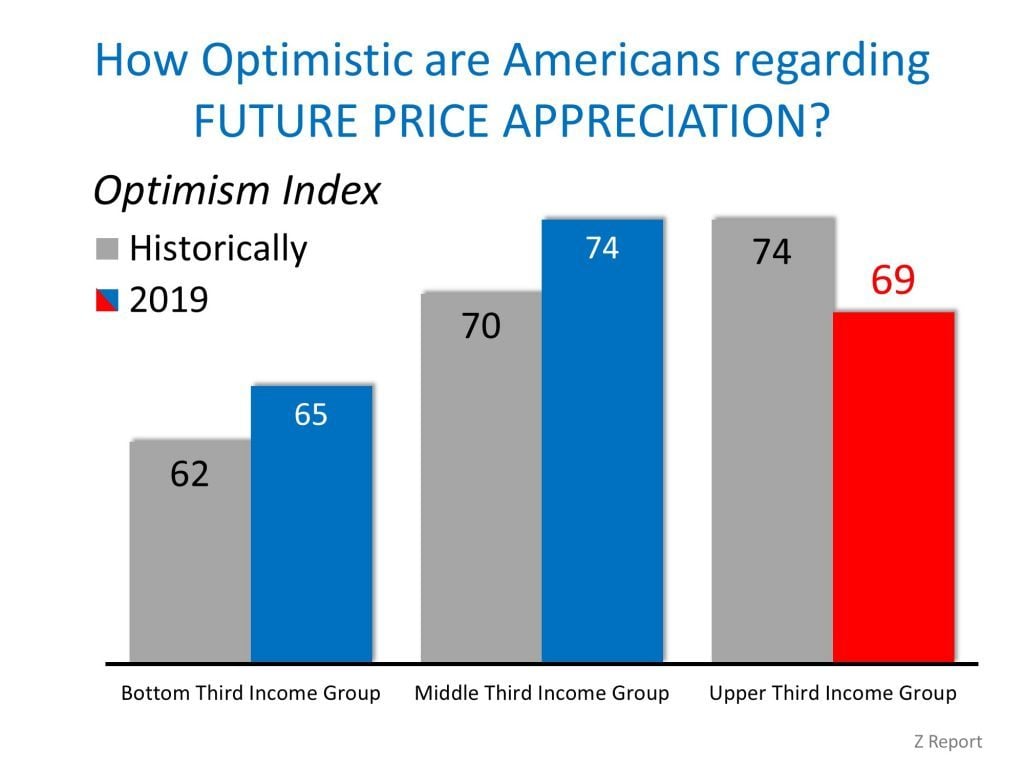

The most optimism lies within the middle income of the country.. The higher end is also optimistic. However, people at the lower income level are more pessimistic. The graph show historically how optimistic people in these income levels were, compared to where they are now. People in the upper third income group are a little less optimistic than they have been historically. Higher end sales seem to be dragging; there is a lot of inventory available. Perhaps there is a correlation there.

Seller Traffic

Traffic is up since February, and things are busy. The panelists will speak to this later.

February 2019 June 2019

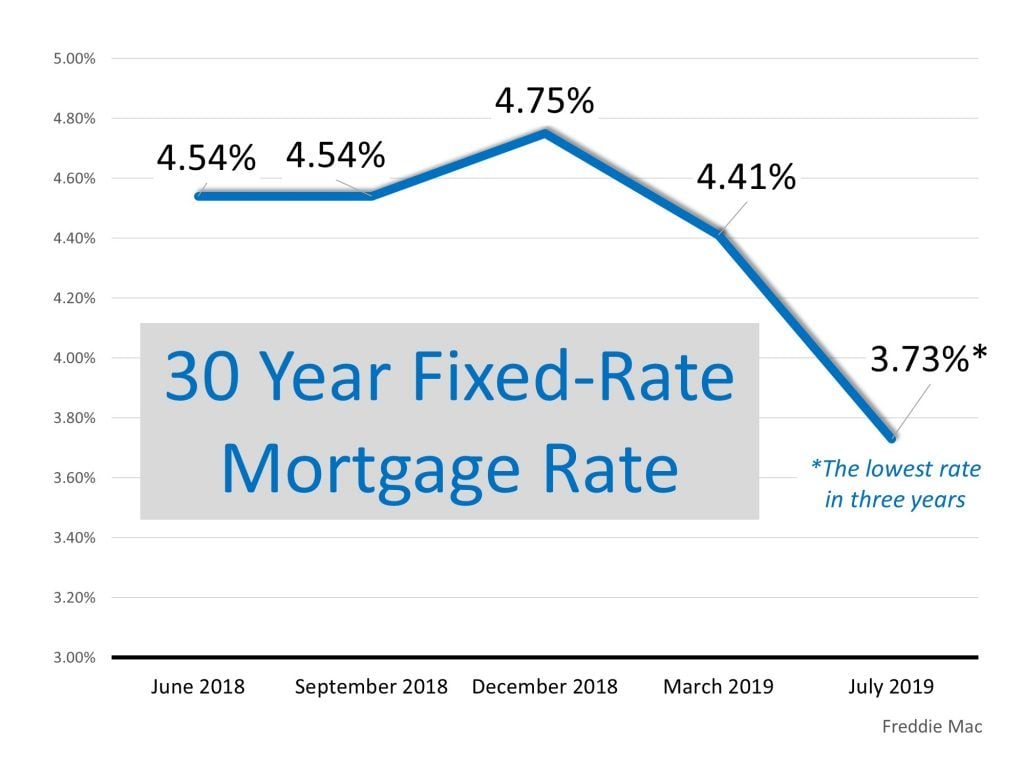

30 Year Fixed-Rate Mortgage Rates

30-year fixed-rate mortgages are at their lowest rate for 3 years, which is important. Mortgage rates have plummeted this year, leading many to anticipate the market will continue to increase as money becomes cheaper. The lower rates make it more affordable to own a home.

Quotes that tell us the second half of 2019 is on a path to be extremely strong

Danielle Hale, Realtor.com’s Chief Economist

“Lower mortgage rates, higher wages, and more homes for sale have helped counteract rising home prices, and ultimately, made it so that buyers are able to afford more than last year.”

Ralph McLaughlin, Deputy Chief Economist at CoreLogic

“With mortgage rates flat and inventory picking up, we expect more buyers to take advantage of easing housing market headwinds.”

Sam Khater, Chief Economist at Freddie Mac

“The drop in mortgage rates over the last two months is already being felt in the housing market. In the near term, we expect the housing market to continue to improve from both a sales and price perspective.”

Ivy Zelman and the “Z” Report

“Key metrics tracking existing home sales demand have been on an upward trajectory so far in 2019. This portends positively for our forecast for existing home closings to increase by 1% in 2019, despite a 3% decline though the first five months of the year.”

Local Housing Market Statistics

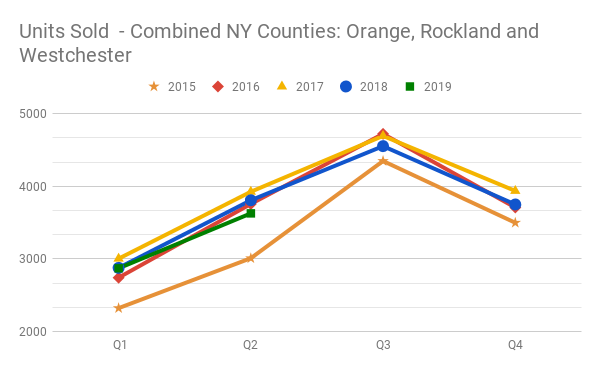

A Quarterly look for the last 5 years of the Combined Counties of Orange, Rochester and Westchester, New York

Units Sold

How many homes are selling is what Geoff calls the “mother’s milk” of the industry. With this bigger data sampling, trends can be more telling. There is no question that the market has been going down The market has been softening when you combine the three counties. In fact, outside of 2015 it is the weakest second quarter we’ve had in four years.

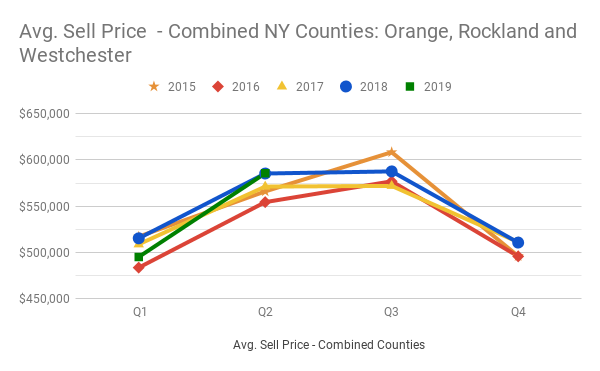

Average Selling Price

Prices are still strong, at or above the last four years per this chart. We should continue to see some appreciation, but Geoff does expect the numbers to get lower, despite predictions to the contrary by some others.

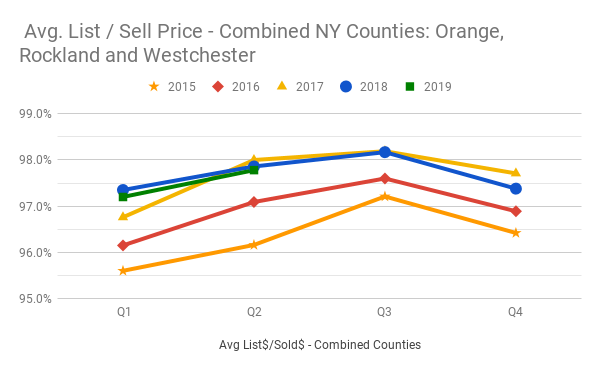

Average List to Sell Price Ratio

Basically this is the last asking price of the home versus what it sold for. The higher the number is to 100%, the hotter the market is. While it’s down a little from last year, the percentage is still good. However, it does indicate a softening of the market.

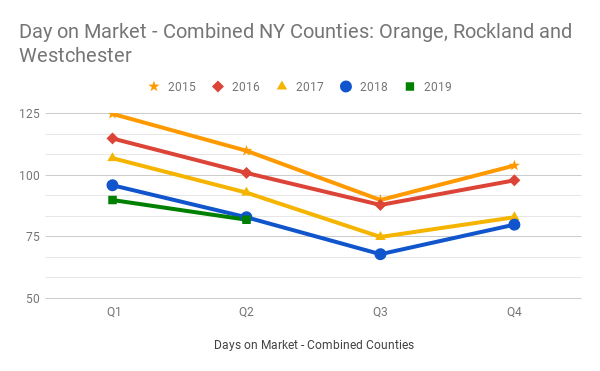

Days on Market

Here, the lower the number, the hotter the market. Here you can see that this number is softening, too, as it intersects with where it was last year at this time.

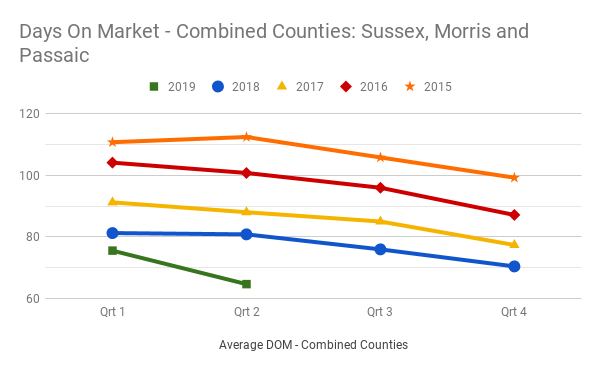

A Quarterly look for the last 5 years of the Combined Counties of Sussex, Morris and Passaic, New Jersey

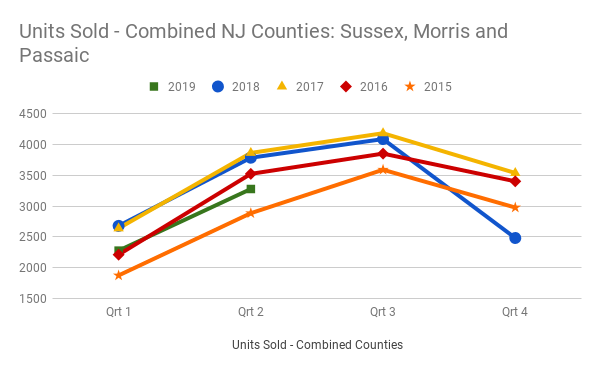

Units Sold

Things are definitely a little bit slower on the New Jersey side. We’re down significantly in the first two quarters of 2019 in these counties. We’re only above 2015 and below the last three years. Again, indications of a softening market.

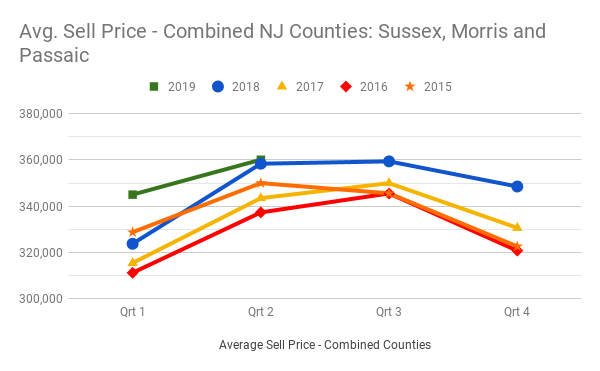

Average Price

Price was up first quarter of 2019, but we’re now starting to see prices soften as the average price is near even with 2018 second quarter number.

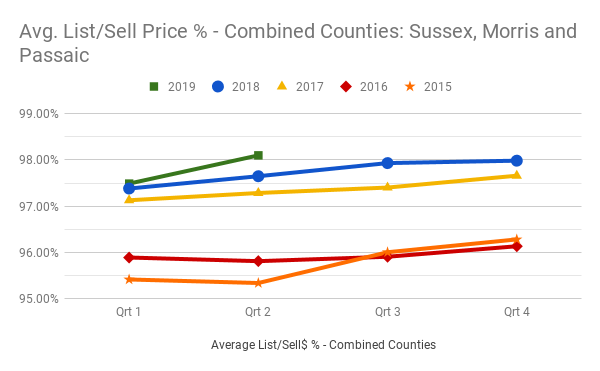

Average List to Sell Price Ratio

This number is going up, consistent with what is happening in New York.

Days on Market

In New Jersey, there is a marked decline in days on market, as opposed to New York, where that number was inching up. This indicates a more competitive market.

And now a word from our sponsor…

Meet our Panel

Geoffrey Green, Moderator, President, Green Team Realty

Jennifer DiCostanzo, Green Team New York Realty

Keren Gonen, Green Team New Jersey Realty

Momentum

Jen feels very good about momentum on the Orange County side. She feels it’s a great playing field for both buyers and sellers. Furthermore, having interest rates so low is an incentive for buyers. Some buyers who might have used cash are deciding to finance instead because of the low rates. We are fighting low inventory. But if the house is priced right and is in good condition, it’s sold. However, it still is vital to get inventory up.

Keren finds buyers much more educated than in the past. But they are also hesitant. She thinks some of that stems from deciding if this is where they really want to be. If you’re ready, have done your homework, then find a house, doubt can set it. Perhaps that it shouldn’t be this easy. She’s had situations where she’s told buyers that this is a hot market and if they’re interested they need to put an offer in that same day. Tomorrow the house will be gone. By waiting a week, they lost the house.

High End Market

Geoff asked Jen if she sees a lot of high-end inventory on the Orange County side. Jen replied that she’s seeing more of the $500,000/$600,000 in her own inventory and others. There is definitely an increase in the higher end homes. However she sees that market starting to soften. New construction has an impact on pricing of resales. Therefore, the higher-end homes are feeling that hit from the competition. The new property tax implications also impact the larger, high-end homes. She believes that ultimately we’ll see more downsizing.

Geoff responded that there could be interesting opportunities to buy high-end homes over the next five years for people who are looking for a weekend home or retreat. Jen has definitely seen an increase in purchases of second homes.

Geoff asked Keren about the situation in New Jersey. Keren feels that the stats on homes that haven’t sold more than previous years is more from Passaic and Morris Counties. Keren does business in those counties and in ones further south, but a lot of high-end houses in Bergen are being rented. Keren is also finding buyers looking for a second home in the $400,000-$500,000 range. And while we might consider that high-end, to them it’s just a home.

Bidding Wars

Geoff stated, “At the end of the day, we’re still there. There are still bidding wars. If something is priced right, it’s in the middle of the market, it’s well located, it’s gone. There are multiple offers immediately.” Keren thinks that homes that are more affordable in Sussex County have had above priced offers. She still sees a hot sellers market.

Geoff asked Jen if she is seeing the same thing in New York, with intense bidding wars. Jen replied that, again, if the product matches condition and pricing, it’s gone. Especially in the median price-points, Especially anything in the $200,000 to mid $400,000’s.

Appraisals

Geoff then asked about appraisals, if they are coming in okay, or if they are not valuing. Jen hasn’t had an issue with appraisals. She is starting to see some sellers’ concessions inching their way back in. Providing a cushion for buyers, that’s some equity there that they haven’t seen in awhile. That’s a good indicator.

Keren also finds that appraisals are coming in okay. She has also seen a lot of sellers’ concessions. According to Keren, 90% of offers she puts in on the buyer’s do get some concession from the seller.

Having done the Housing Market Updates for some time, Geoff finds that appraisals haven’t seemed to be an issue for the past 12-18 months. However, he recalls that it was a problem a few years ago. As the market was really taking off as prices were jumping it was hard for appraisers to justify comps. It seems that that has evened off.

What are banks doing with foreclosures?

Geoff asked Keren about the situation with bank foreclosures, REO’s. Whether they were releasing more inventory or hanging on tand renting them. Keren replied that they are flipping them, flips are not done well because work goes to lowest bidder. In the end it’s the buyer who gets the short end of the stick. They’ve bought a renovated home, they’re happy, and then she gets the call… This broke and this happened, but there is nothing that Keren can do at that point.

The panel turned the discussion towards the importance of trades people. Plumbers, contractors, etc. The more poorly done renovations there are, the more repairs will be required. Keren did point out that unfortunately there seems to be less people going into these trades. It can be challenging to find labor and materials are expensive.

Wrapping it up

Jen’s final words…. “Keep buying!” According to Geoff, rates are declining, inventory is pretty good. Units sold is trending down, prices are softening. So if you’re a buyer, this is an interesting time. And Jen pointed out that even if someone is not interested in selling at this point, it’s a good time to refinance.

To contact the panelists:

Jennifer DiCostanzo – Cell #917-916-9995

Keren Gonen – Cell #551-262-4062

Next Housing Market Update

August 20 at 2 p.m. Stay informed – sign up for our Housing Market Updates at

Geoff and Joe Green – Son & Father Together Again

Forty years after founding his own brokerage, Joe Green has joined his son’s company. And father and son are a force to be reckoned with.

In Orange County, NY the name Green is synonymous with Real Estate. Furthermore, it is associated with exceptional client service. Joseph Green Realtor was founded in 1978, and 27 years later that’s where Geoff Green began his career. That’s where Geoff learned from some of the best in the business – his mom and dad, Marie Pennings and Joe Green.

Eventually Geoff did what kids do. He decided to spread his wings. And in 2005, Geoff founded Green Team New York Realty.

Meet Joe Green

Joe didn’t start out wanting to be in the real estate business. Rather, his goal was to teach. He taught physical education and coached football in Warwick. His wife, Marie, was a registered, part-time nurse.

Joe loved what he was doing, but back in 1974 a teacher’s salary wasn’t enough to support a family with 5 kids. Since he needed to supplement his income, Joe saw real estate as a way to make extra money if he worked hard at it

Finding His Calling

However, once he got into it, he discovered he’d found his calling. Because it wasn’t just about making more money. It was about meeting new people, and the adventure that came with each unique transaction. Maybe the most important aspect was that helping people was becoming emotionally rewarding. Marie also got her license, and real estate became a family affair.

In 1980, Joe and Marie decided it was time to go into real estate full-time. They purchased the building at 7 Main Street in Warwick. In 1982 they bought a building in Goshen and opened their 2nd office. Finally, they expanded into Washingtonville.

Life is what happens while you’re busy making plans

When Geoff was in the third grade, everything changed. Joe and Marie divorced, and the children went to live with their mom. While divorce is hard for the parents, it is also difficult for the children.

But life goes on, even when families are divided. Joe continued to build his real estate business, but found that divorce wasn’t the only hardship. In 1987 the housing market tanked, and they had to downsize. Marie took over the Warwick office. Joe closed down the Washingtonville office and kept the Goshen office. Despite all of the hardships Joe persisted.

Experience that spans decades

Joe has been in this ever-changing profession for over 40 years. Back in 1974, when Joe first started practicing, everything was open listing. Clients would call several brokers and they’d all be in direct competition with each other. Then MLS came along and exclusive right to sell became the norm. One brokerage firm tried to impress Joe with the latest in technology, which would change the way business was done. And so, Joe received his introduction to the fax machine.

However, it’s the experience that counts. And Joe and his team provided a full complement of real estate services. That included residential, commercial, land, farm and ranch sales, investment sales, leasing, property management, residential appraising, financial and legal referral services, and relocation services. They covered Orange, Rockland, Westchester, Sullivan and Ulster Counties. Furthermore, his expertise and vision helped to safely guide his clients through some very difficult economic cycles.

Change in the Air

In 2013 Joe decided to shut down the Goshen office and moved his Agency to Chester. However, he began to see that the key to a successful brokerage was technology. And his son was a master at using technology to grow his business. When Geoff opened his own office in 2005, at the 7 Main Street location, Joe couldn’t have been prouder or more excited.

And through the years, he saw what was happening at the Green Team. Technology was enhancing the way brokers worked. Consequently, Joe decided that it was time to join forces with his son and combine the best of both worlds. Each man brings incredible experience and expertise. Together, there is no stopping them.

And Joe doesn’t come to the Green Team alone. He brings with him three of his best agents. Cam Monaco has been with Joe for 30 years. While Krissy Many is newer to the business, she’s a powerhouse. And Vilma Lawla is also excited to be part of the Green Team.

The Future Looks Bright

Joe looks forward to sharing his knowledge. His advice? “Every day you can learn something new. Be like a sponge. Do it your way. Don’t copy but learn from everyone else. Experience can help some of the more inexperienced.” And Joe hopes that his years of experience will help newer agents.

Geoff is excited about having his dad join the firm, “I can’t explain how blessed I feel that Pop is now part of our Agency. It’s amazing to not only see him around the office, but to watch him doing what he does best: sharing his wisdom. Pop is one of the most experienced Real Estate Brokers I know. It’s a simple fact that our Agency just got a lot better as a result of Pop deciding to come on board with the Green Team.”

The two men respect each other and their individual contributions to the industry and their community. They look forward to combining over 50 years of experience and forging a new beginning. They are indeed a force to be reckoned with.

Orange County Real Estate Market Report for May 2018

Green Team Business Review – May 2018

The numbers tell a story all their own. Despite the lack of inventory on the market, despite the specter of rising interest rates, loss of deductions due to new tax laws, etc., the Green Team is doing something very right and finding people buyers for their homes and finding homes for buyers! Both the Warwick and Vernon offices have more than doubled their sales volume from a year ago.

Orange County, NY Real Estate Market Report – April 2018 Results

The May Market Update was held on Tuesday, May 8 on Facebook Live. It was moderated by Geoff Green, Founder of Green Team Home Selling System. Panelists included sales agents Vikki Garby from the Warwick office, Keren Goren of the Vernon office, Michael Giannetto from Residential Home Funding and Ken Ford from Warwick Valley Financial Advisors.

If you missed the original live event, click here to watch. The discussion involved not only the housing market, but also perspectives on the economy. Our guest panelists have a great deal of knowledge and expertise, and the conversation was informative, educational and lively.

You can also sign up for monthly updates by email on the Green Team website.

We were experiencing technical difficulties:

Prior to the update going live, the following discussion took place:

The lack of inventory remains the biggest impediment to home sales, and the panel discussed the various reasons why people are reluctant to sell now. Vikki Garby stated that there were more buyers this winter than last spring, but that there is not a lot to buy. Cash buyers were coming in strong, with some people getting full asking price, or over. Keren Goren stated that many people she spoke to were just hanging on, waiting to see what would happen in the market.

Geoffrey Green told the panel that he is often asked, “Should I wait, because prices are going higher?” According to Vikki, sellers are worried about finding a home! People move up here from other places and swamp the market, and people who want to sell but stay in the area are concerned. Keren said that houses in Sussex are outdated, older than what buyers are looking for. Geoff said, “At the end of the day, if you’re moving and need to sell, try to sell and buy at the same time.”

The conversation turned to “fixer-uppers.” Geoff felt that most buyers don’t have the time, experience, and money to do renovation after buying a home. However, he asked the panel if they were seeing more buyers willing to take on a fixer-upper.

Keren cited a buyer who was willing to take out a loan to put a new roof on a house where everything else had been done. He was willing to go that step. Vikki stated there was not much to choose from and buyers trying to get into the area are having to be more flexible. Mike Giannetto stated that reno loans are now a big product and many people are taking the opportunity to fix up a house, put in new appliances, roof, etc., using equity.

Watch the video for more discussion, including a fascinating look into the world of economics and how the bond market impacts the interest rate that buyers may soon be paying.

Orange County, NY Real Estate Market Report – April 2018 Results

We are pleased to share with you the Housing Market Report for April 2018. We break down local real estate activities and provide you with stats, graphs, and analysis of our local and regional real estate market. In addition, we provide insight from some of the people most familiar with market trends: sales associates, mortgage funding specialists and financial advisers.

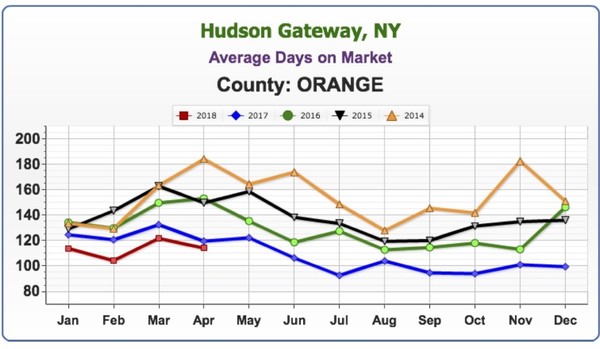

Average Days on the Market

The faster homes are selling, the hotter the market. Look for the lowest number on the graph, as opposed to the highest. The calculation in New York State is from the List Date to the Contract Date.

With numbers in for April, the average days on are the lowest they’ve been for this month for 5 years.

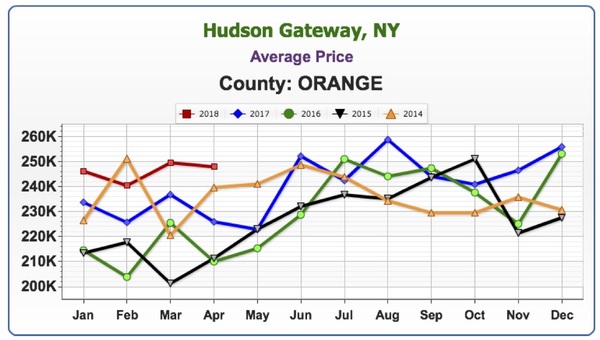

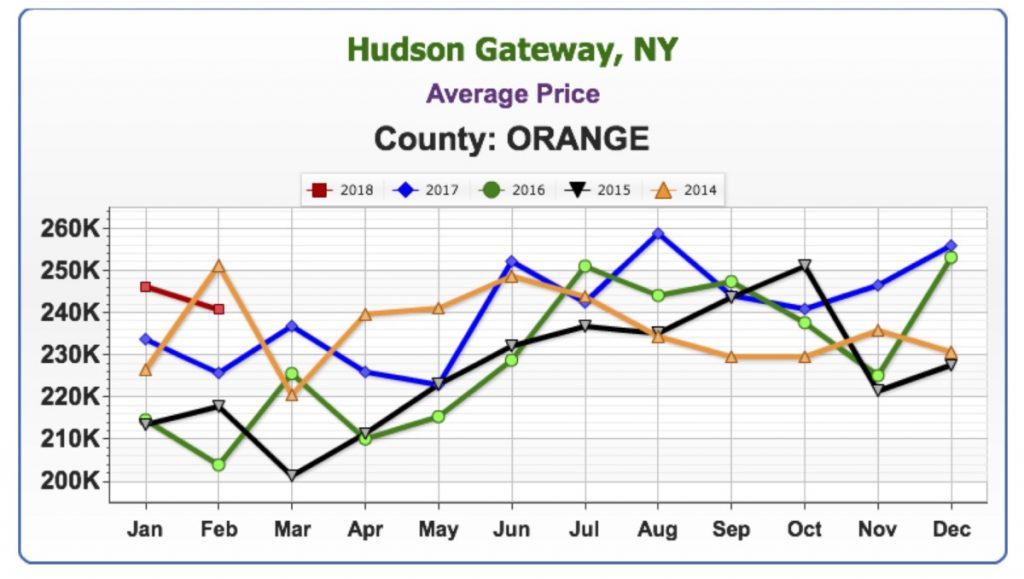

Average Price

Here again we’re seeing a trend. Prices are coming in at their highest point for April in 5 years, at an average of $247,849.

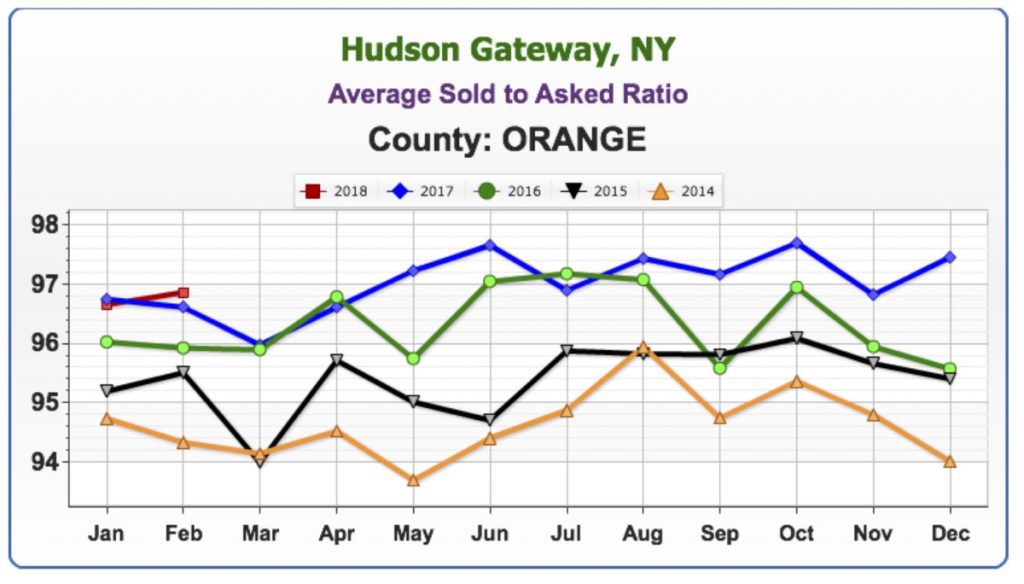

Average Sold to Asked Ratio

This is the percentage a house sold for under or over the last asking (not the original) price.

The higher the percentage, the hotter the market. This April the percentage dipped slightly below April 2016 and 2017, but sellers are still negotiating at approximately 3.5 points off the last asking price. As mentioned last month, this is an average of all of Orange County, with some areas having a higher percentage, and some a lower one.

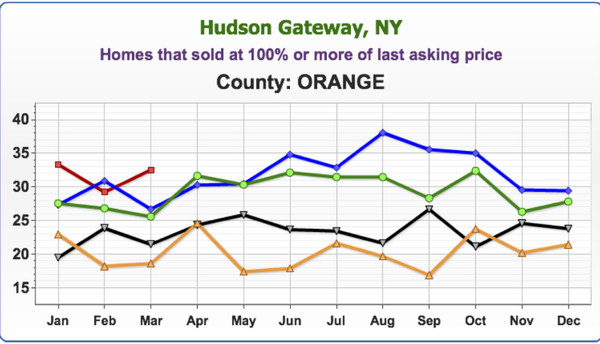

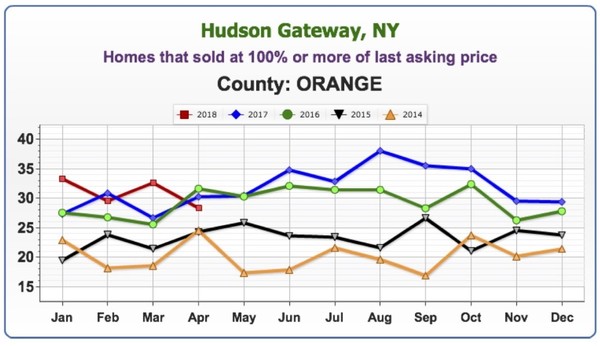

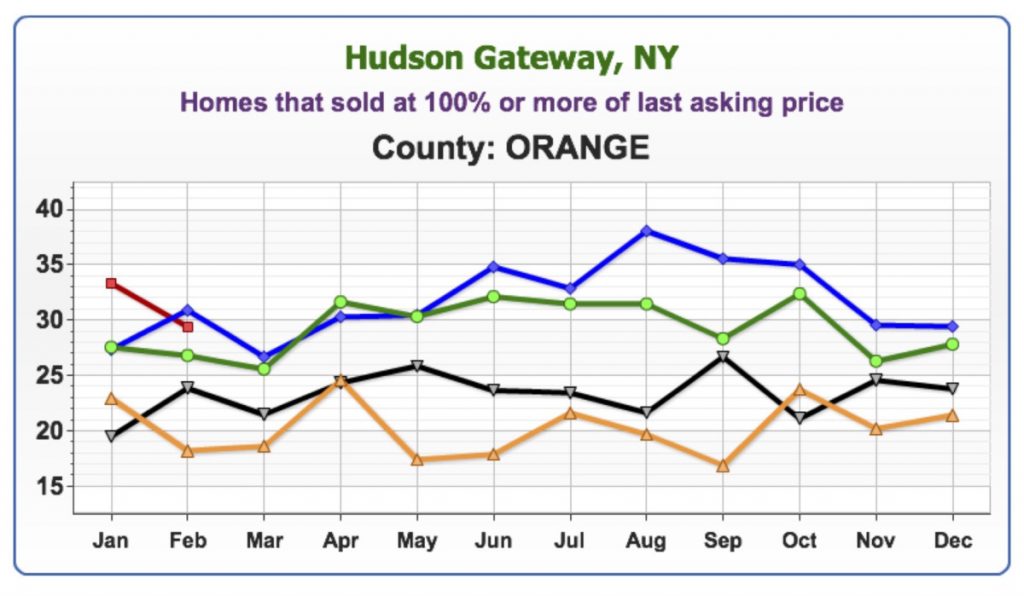

Homes that sold at 100% or more of last asking price

Here again there was a slight dip below April 2016 and 2017, though the numbers remain higher than 2014 and 2015.

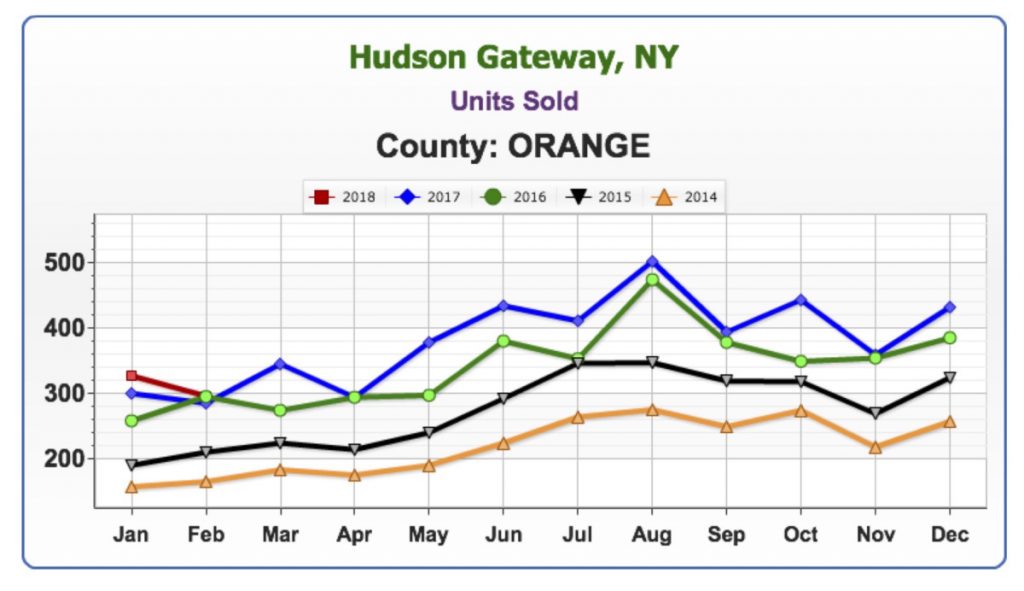

Units Sold

Units sold seems to have flat lined; however, more units were sold in April 2018 than in the four preceding years.

We Keep You Informed:

The Green Team Shares this information and more each month during our Live Housing Market Update. Register to join the webinar and hear directly from our participating Green Team Sales Associates who share their personal take on how the marketplace is doing.

Each month we are also joined by industry experts who share insights into the current financing environment as well as broader economic issues affecting the housing market.

Check out our past Housing Market Updates. Then Register to join our next one on June 12th at 9am.

[embedyt] https://www.youtube.com/embed?listType=playlist&list=PL6MEM7EpyL0E5YdU249T_KsDQTukboj8E&v=AQYblgrxmIY[/embedyt]

Orange County Real Estate Market Report for March 2018

Green Team Business Review – March 2018

February’s numbers are in, we’re nearing the end of March, and the Scoreboards show the possible contenders for the first quarter sales leader awards. Based on actual numbers for January and February, the Warwick Scoreboard has Vikki Garby in the lead, followed by Nancy Sardo and Lucyann Tinnirello. In Vernon, Joyce Rogers leads Charles Nagy and Ted Van Laar. In Warwick, total sales volume is down slightly from January/February of 2017, while Vernon’s total sales volume is up by over $700,000 from the same period in 2017. However, if projections are correct, March will see sales volume increase in both Orange and Sussex Counties. March may also see shifts in the Scoreboard tallies.

This month’s business review meeting marked a Green Team first. The market stats were reviewed on Facebook Live (facebook.com/greenteamhq), giving agents and clients alike the opportunity to participate in real time. Geoff Green moderated the review, with panelists Angela Murphy and Terry Gavan commenting on the Orange County market and Pamela Zachowski providing commentary on the Sussex County market. Melissa Bressette, Green Team’s Marketing Director, also participated, with questions regarding the impact of rising interest rates on home sales.

Orange County, NY Real Estate Market Report – February 2018 Results

We are pleased to share with you a Housing Market Report from February 2018. We break down the local real estate activities and provide you with stats, graphs, and analysis of our local and regional real estate market. You can sign up on our website (www.greenteamhq.com) for monthly market updates. This month the market review was held on Facebook Live. You can visit our Facebook page to view the video, as well as informative posts. (www.facebook.com/greenteamhq/videos)

Average Days on the Market

The faster homes are selling, the hotter the market. Look for the lowest number on the graph as opposed to the highest. The calculation in New York State is from the List Date to the Contract Date.

The average number of days on the market for homes in Orange County continues to decline, which is good news for the market. In February, the average number of days on the market was 104.

Average Price

Prices started coming back in July of 2017. There are Sellers with big mortgages on their homes who are patiently waiting, putting off retirement plans, etc., waiting for prices to come up more. When they do, inventory will open up. February of this year had the highest average price for a February since 2015.

Average Sold to Asked Ratio

The percentage a house sold for under or over the last asking price (not the original price)

The average sold to asked ratio is on the rise. At 96.86%, this is the highest number for a February since 2014.

Homes that sold at 100% or more of last asking price

The stats came in just slightly lower than February of last year, but higher than February 2014-2016. 2017’s numbers were consistently the highest since 2014, and 2018 is continuing that trend, indicating a strong market.

Units Sold

There were continual increases in January. While there was a slight log jam in February, the red line should consistently rise above the blue line for the rest of the year. It’s a healthy market place. According to Angela Murphy of the Green Team’s Warwick office, this is a strong, healthy market. There is a shortage of inventory, but no shortage of buyers. Additionally, most buyers don’t want to do work on a home. They are looking for turn-key properties. This is a good market for investors interested in flipping.

Note

Melissa Bressette, Marketing Director for the Green Team, asked what impact rising interest rates were having. According to Angela, despite rising interest rates, good connections with mortgage lenders can ease buyers’ minds and work with them on financing homes. Rates are still pretty low and affordable. If homes are priced correctly, there is usually a $10-$15,000 spectrum from asking price to where it’s sold. Comps of sold properties are more important than comps of properties that are for sale.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link