This Spring Presents Sellers with a Golden Opportunity

If you’re thinking of selling your house this year, timing is crucial. After all, you’ll want to balance getting the most out of the sale of your current home and making the best investment when you buy your next one.

If that’s the case, you should know – you may be able to get the best of both worlds today. Here are four reasons why this spring may be your golden window of opportunity.

1. The Number of Homes on the Market Is Still Low

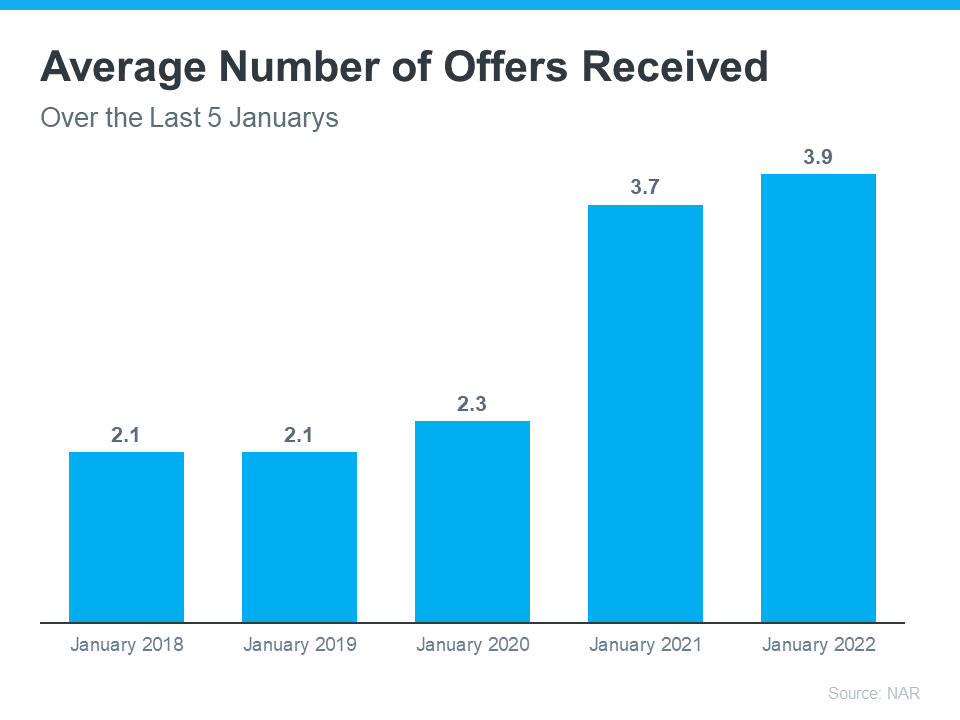

Today’s limited supply of houses for sale is putting sellers in the driver’s seat. There are far more buyers in the market today than there are homes available. That means purchasers are eagerly waiting for your house.

Listing your house now makes it the center of attention. And if you work with a real estate professional to price your house correctly, you can expect it to sell quickly and likely get multiple strong offers this season.

2. Your Equity Is Growing in Record Amounts

According to the most recent Homeowner Equity Insight report from CoreLogic, homeowners are sitting on record amounts of equity thanks to recent home price appreciation. The report finds that the average homeowner has gained $55,300 in equity over the past year.

That much equity can open doors for you to make a move. If you’ve been holding off on selling because you’re worried about how rising prices will impact your next home search, rest assured your equity can help fuel your move. It may be just what you need to cover a large portion – if not all – of the down payment on your next home.

3. Mortgage Rates Are Increasing

While it’s true mortgage rates have already been climbing this year, current mortgage rates are still below what they’ve been in recent decades. In the 2000s, the average mortgage rate was 6.27%. In the 1990s, the average rate was 8.12%.

For context, the current average 30-year fixed mortgage rate, according to Freddie Mac, is 3.85%. And while recent global uncertainty caused rates to dip slightly in the near-term, experts project rates will rise in the months ahead. Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae, says:

“For homebuyers, we believe that borrowing costs will likely rise with the increase in mortgage rates….”

When that happens, it’ll cost you more to purchase your next home. That’s why it’s important to act now if you’re ready to sell. Work with a trusted advisor to kickstart the process so you can take key steps to making your next purchase before rates climb further.

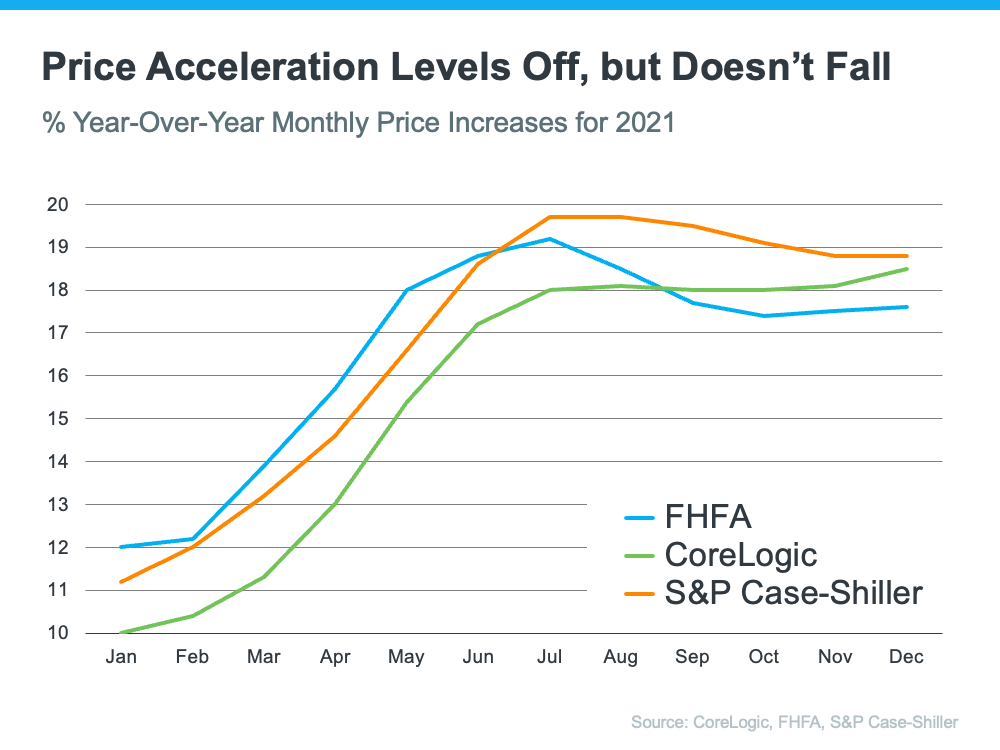

4. Home Prices Are Climbing Too

Home prices have been skyrocketing in recent years because of the imbalance of supply and demand. And as long as that imbalance continues, so will the rise in home values.

What does that mean for you? If you’re selling so you can move into the home of your dreams or downsize into something that better suits your current needs, you have an opportunity to get ahead of the curve by leveraging your growing equity and purchasing your next home before prices climb higher.

And, once you make your purchase, you can find peace of mind in knowing ongoing home price appreciation is growing the value of your new investment.

Bottom Line

If you want to win when you sell and when you buy, this spring could be your golden opportunity. Let’s connect so you have the insights you need to take advantage of today’s incredible sellers’ market.

Geoff and Joe Green – Son & Father Together Again

Forty years after founding his own brokerage, Joe Green has joined his son’s company. And father and son are a force to be reckoned with.

In Orange County, NY the name Green is synonymous with Real Estate. Furthermore, it is associated with exceptional client service. Joseph Green Realtor was founded in 1978, and 27 years later that’s where Geoff Green began his career. That’s where Geoff learned from some of the best in the business – his mom and dad, Marie Pennings and Joe Green.

Eventually Geoff did what kids do. He decided to spread his wings. And in 2005, Geoff founded Green Team New York Realty.

Meet Joe Green

Joe didn’t start out wanting to be in the real estate business. Rather, his goal was to teach. He taught physical education and coached football in Warwick. His wife, Marie, was a registered, part-time nurse.

Joe loved what he was doing, but back in 1974 a teacher’s salary wasn’t enough to support a family with 5 kids. Since he needed to supplement his income, Joe saw real estate as a way to make extra money if he worked hard at it

Finding His Calling

However, once he got into it, he discovered he’d found his calling. Because it wasn’t just about making more money. It was about meeting new people, and the adventure that came with each unique transaction. Maybe the most important aspect was that helping people was becoming emotionally rewarding. Marie also got her license, and real estate became a family affair.

In 1980, Joe and Marie decided it was time to go into real estate full-time. They purchased the building at 7 Main Street in Warwick. In 1982 they bought a building in Goshen and opened their 2nd office. Finally, they expanded into Washingtonville.

Life is what happens while you’re busy making plans

When Geoff was in the third grade, everything changed. Joe and Marie divorced, and the children went to live with their mom. While divorce is hard for the parents, it is also difficult for the children.

But life goes on, even when families are divided. Joe continued to build his real estate business, but found that divorce wasn’t the only hardship. In 1987 the housing market tanked, and they had to downsize. Marie took over the Warwick office. Joe closed down the Washingtonville office and kept the Goshen office. Despite all of the hardships Joe persisted.

Experience that spans decades

Joe has been in this ever-changing profession for over 40 years. Back in 1974, when Joe first started practicing, everything was open listing. Clients would call several brokers and they’d all be in direct competition with each other. Then MLS came along and exclusive right to sell became the norm. One brokerage firm tried to impress Joe with the latest in technology, which would change the way business was done. And so, Joe received his introduction to the fax machine.

However, it’s the experience that counts. And Joe and his team provided a full complement of real estate services. That included residential, commercial, land, farm and ranch sales, investment sales, leasing, property management, residential appraising, financial and legal referral services, and relocation services. They covered Orange, Rockland, Westchester, Sullivan and Ulster Counties. Furthermore, his expertise and vision helped to safely guide his clients through some very difficult economic cycles.

Change in the Air

In 2013 Joe decided to shut down the Goshen office and moved his Agency to Chester. However, he began to see that the key to a successful brokerage was technology. And his son was a master at using technology to grow his business. When Geoff opened his own office in 2005, at the 7 Main Street location, Joe couldn’t have been prouder or more excited.

And through the years, he saw what was happening at the Green Team. Technology was enhancing the way brokers worked. Consequently, Joe decided that it was time to join forces with his son and combine the best of both worlds. Each man brings incredible experience and expertise. Together, there is no stopping them.

And Joe doesn’t come to the Green Team alone. He brings with him three of his best agents. Cam Monaco has been with Joe for 30 years. While Krissy Many is newer to the business, she’s a powerhouse. And Vilma Lawla is also excited to be part of the Green Team.

The Future Looks Bright

Joe looks forward to sharing his knowledge. His advice? “Every day you can learn something new. Be like a sponge. Do it your way. Don’t copy but learn from everyone else. Experience can help some of the more inexperienced.” And Joe hopes that his years of experience will help newer agents.

Geoff is excited about having his dad join the firm, “I can’t explain how blessed I feel that Pop is now part of our Agency. It’s amazing to not only see him around the office, but to watch him doing what he does best: sharing his wisdom. Pop is one of the most experienced Real Estate Brokers I know. It’s a simple fact that our Agency just got a lot better as a result of Pop deciding to come on board with the Green Team.”

The two men respect each other and their individual contributions to the industry and their community. They look forward to combining over 50 years of experience and forging a new beginning. They are indeed a force to be reckoned with.

Thanksgiving Pie – A Green Team Tradition

Thanksgiving Pie – A Green Team Tradition

Thanksgiving. It’s a time of gratitude, friends and family; of turkey and all the trimmings. And at the Green Team, it’s a time to let clients know how much they are valued. The Client Appreciation Program, or CAP, is the cornerstone of the Green Team’s foundation. The Green Team doesn’t take its clients for granted. Through the CAP program sales associates find ways to say “I appreciate you” throughout the year. However, one of the highlights of the program is Thanksgiving Pie. A Green Team CAP tradition, clients are invited to come to the office for a casual party. And to pick up their Thanksgiving pie. Because this gift from their sales associate is a way of saying “Thank You.” Thank you for your business, your referrals, and your friendship.

Thanksgiving. It’s a time of gratitude, friends and family; of turkey and all the trimmings. And at the Green Team, it’s a time to let clients know how much they are valued. The Client Appreciation Program, or CAP, is the cornerstone of the Green Team’s foundation. The Green Team doesn’t take its clients for granted. Through the CAP program sales associates find ways to say “I appreciate you” throughout the year. However, one of the highlights of the program is Thanksgiving Pie. A Green Team CAP tradition, clients are invited to come to the office for a casual party. And to pick up their Thanksgiving pie. Because this gift from their sales associate is a way of saying “Thank You.” Thank you for your business, your referrals, and your friendship.

Thanksgiving Pie… A “family” event for both the Warwick and Vernon Offices

Walking into either office you can feel the warmth and joy and know that you are welcome. Pies are stacked high, waiting to be distributed. Being a local brokerage, it’s important to the Green Team to support other local businesses. Thus Noble Pies has become part of the tradition. Their pies are baked from locally sourced ingredients when available. Cider, wine, donuts and more await the clients as they drop in to pick up their pies. And, of course, there is laughter; lots of laughter!

important to the Green Team to support other local businesses. Thus Noble Pies has become part of the tradition. Their pies are baked from locally sourced ingredients when available. Cider, wine, donuts and more await the clients as they drop in to pick up their pies. And, of course, there is laughter; lots of laughter!

Green Team Sales Associates agree that the Client Appreciation Program is something they themselves appreciate. It keeps the focus on the people who are most important to their businesses: their clients. And events like this one bring everyone together, strengthening bonds between associates and between clients and associates. Probably one of the best things is that two days later pies from the Green Team’s sales associates will be sweetening Thanksgiving Dinners at many homes. Again letting clients know how much they are appreciated.

August Housing Market Update

The August Housing Market Update was held live on Facebook on Tuesday, August 14, at 9 a.m. If you missed the live webinar, you can view it at your convenience by clicking here.

Next month, the Housing Market Update webinar will take place on Tuesday, September 18 at 2 p.m. You can sign up for updates at GreenTeamHQ.com/HMU.

Meet the Panel

Keren Gonen

Patrick Keelin

Jeff Lobb

Geoff Green moderated the webinar and presented statistics for Orange and Sussex Counties. Keren Gonen, of Green Team Real Estate New Jersey and Green Team Home Selling System, gave her perspective on the market from the sales associate’s view. Guest panelists were Patrick Keelin, Branch Manager of Family First Funding’s Warwick office, and Jeff Lobb, Founder and CEO of SparkTank Media. Green Team’s Marketing Director, Melissa Bressette, was on hand to make sure everything ran smoothly.

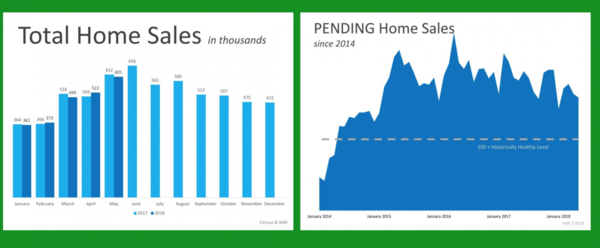

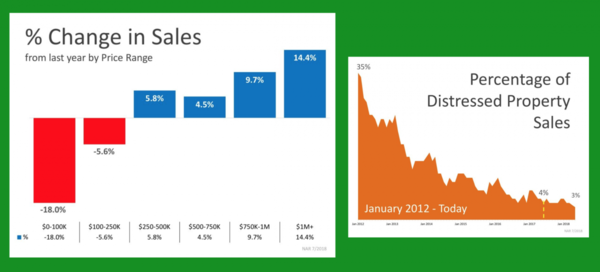

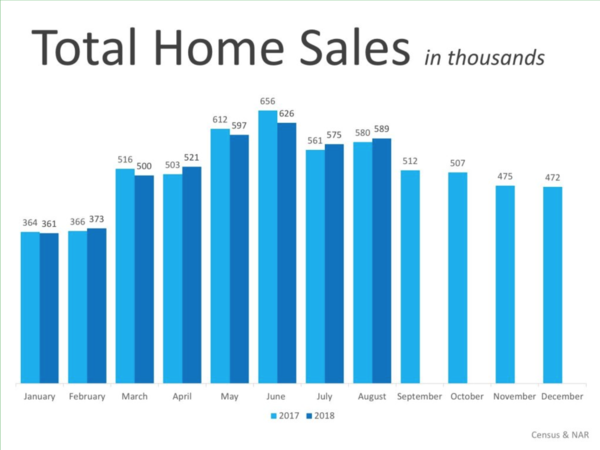

Housing Market Update – National

Nationally, for the last two months, the number of homes selling is down slightly from 2017. Earlier in the year it was almost even. There is a mixed bag, not a continued trend. Common knowledge says it’s all about inventory. There are just not enough homes for all the buyers out there.

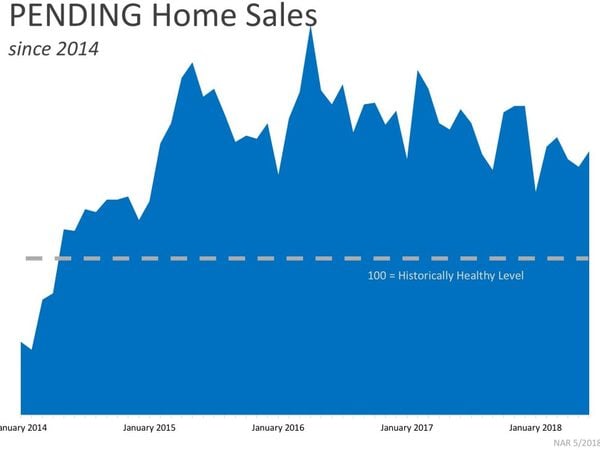

Pending home sales seem to be trending downward nationally.

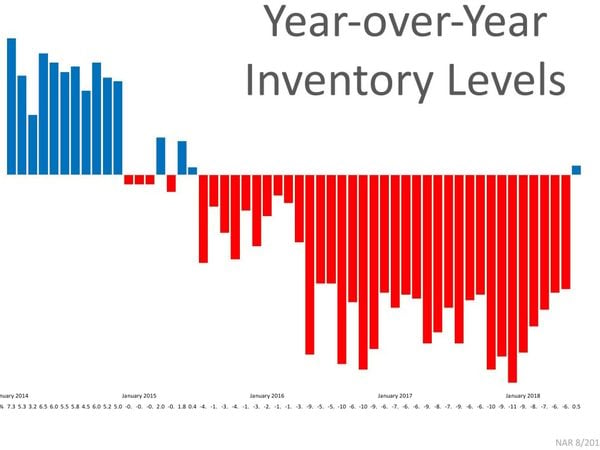

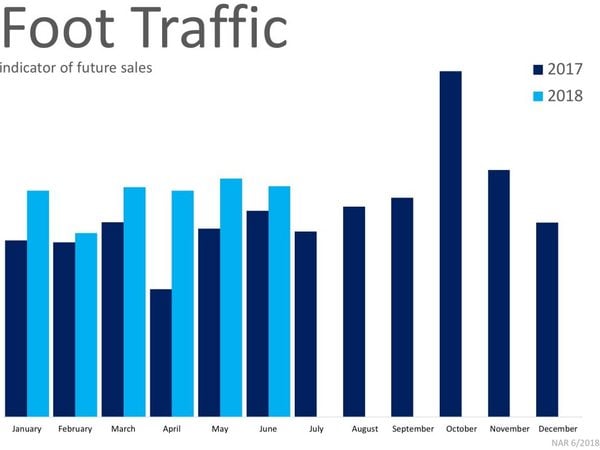

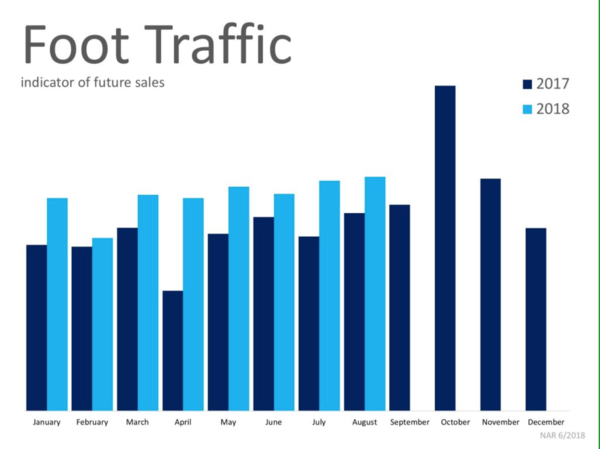

The National Association of Realtors shows year-over-year inventory levels up for the first time in 36 months. It may be a good sign, though it may also be indicative of the market slowing a little. However, foot traffic is up in 2018, compared to 2017. This graphic represents the numbers of people actually in homes, looking to buy. This number has been up consistently all year, though sales are down on a national level. From a national perspective, it’s still a very solid market.

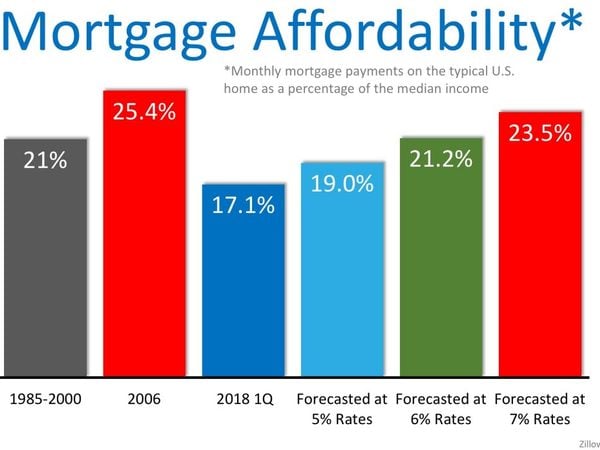

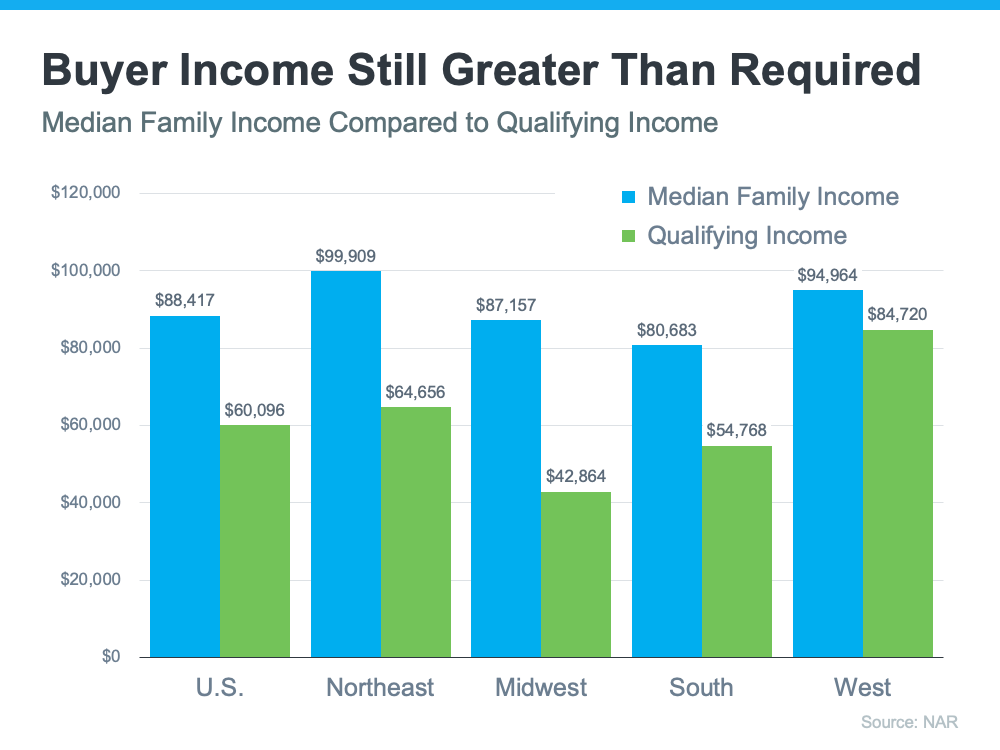

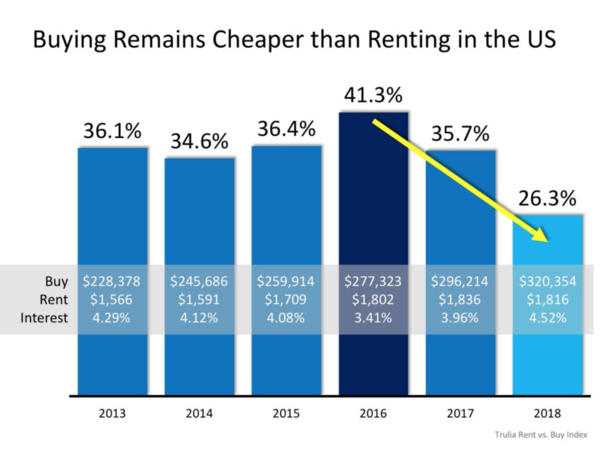

From 1985 to 2000, 21% of household income was dedicated to mortgage payments. In the first quarter of 2018 we’re well below that number. At 17.1%, we’re about 4 points below the historical average over the last 25 years. Therefore, even though prices are rising and inventory is tight, homes are still relatively affordable compared to 1985 to 2000. Even if rates do get to 6% or so, household income dedicated to mortgage payments will be only a few points higher than the 1985 to 2000 average.

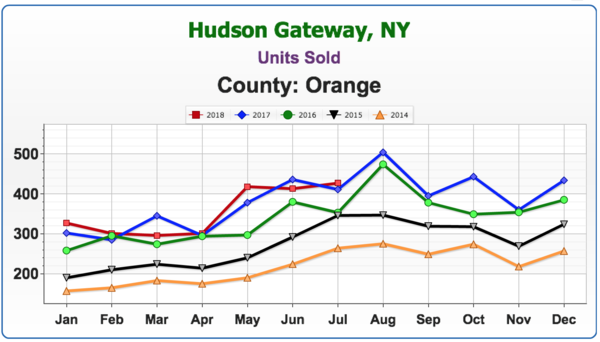

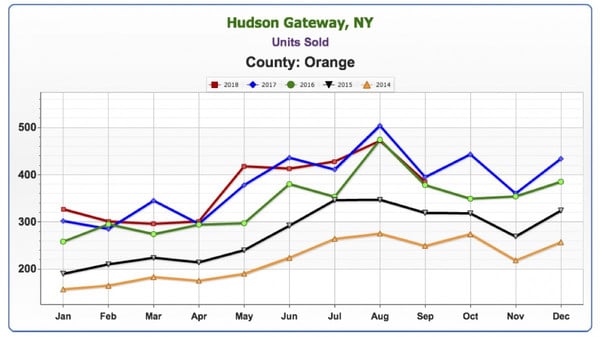

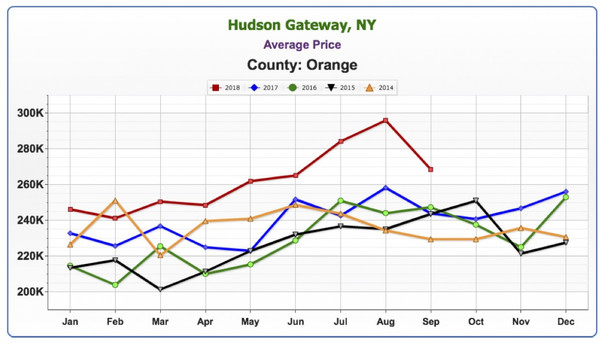

Housing Market Update – Orange County, NY

Getting down to local stats, although at a slowing pace, the numbers are still at historical levels. In our area, where the current number of homes selling is the equivalent of 2006 (which was one year after the absolute peak in the market that occurred in 2005), the rate of sales is historically very high. This is a very hot market.

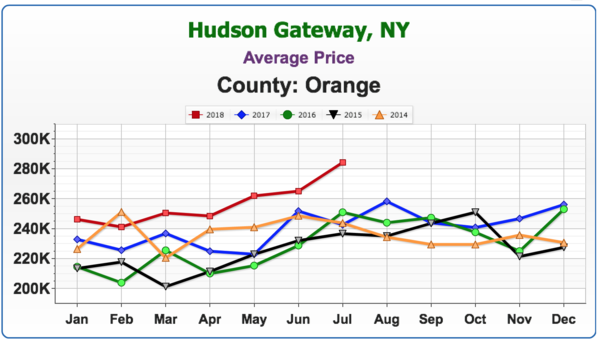

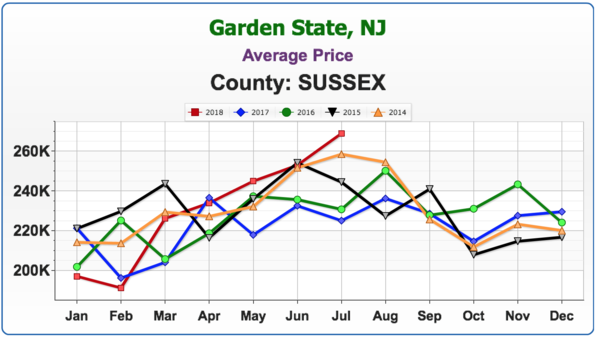

Average price is clearly rising in 2018. Geoff noted that in his experience units sold would increase, but average price didn’t quite get there. Then, units sold would start to decrease but price didn’t follow that trend, with a lag of about 6 months. There was almost a 2-year lag in average price that came after the downturn in the market.

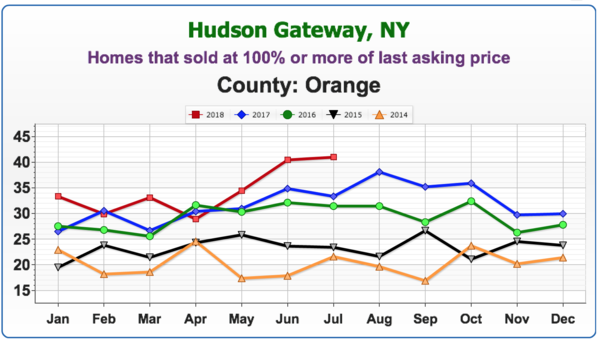

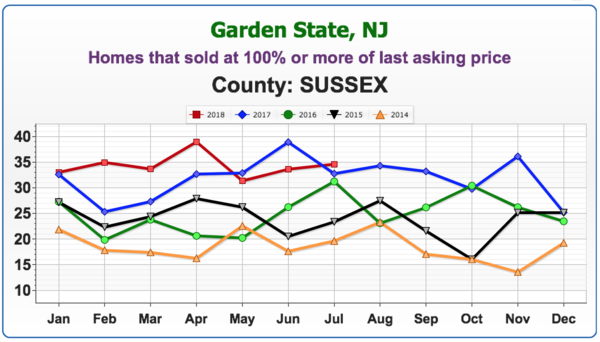

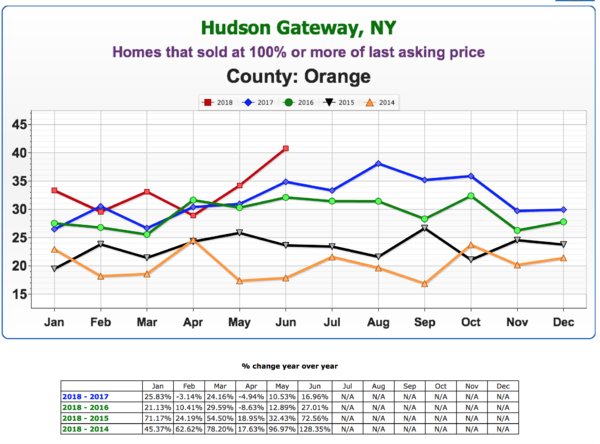

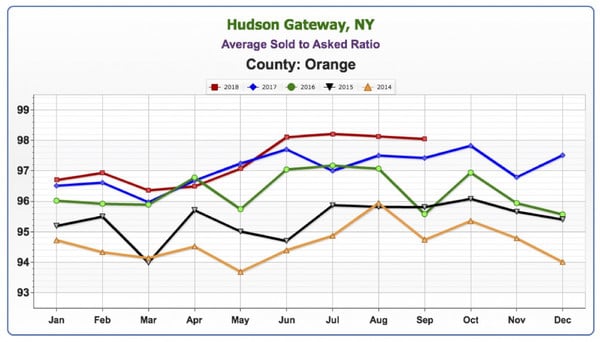

Approximately 40% of homes are selling at 100% or more of their last asking price. There are a lot of bidding wars going on, and this is indicative of how hot the current market is.

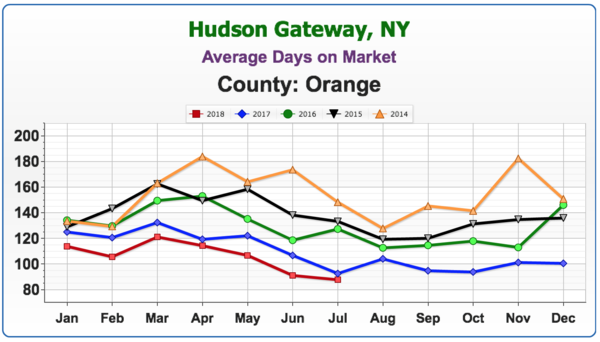

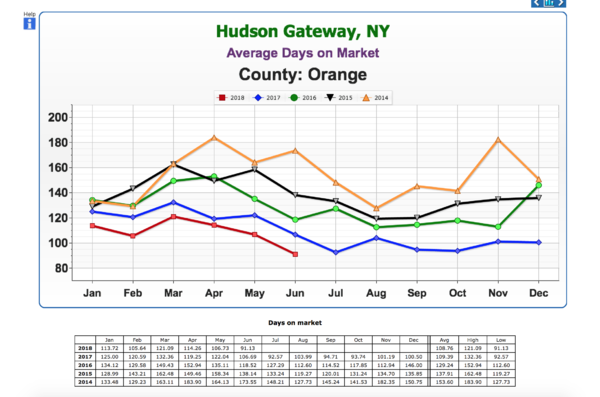

This number continues to decline, another sign that this market is hot.

Housing Market Update – Sussex County, NJ

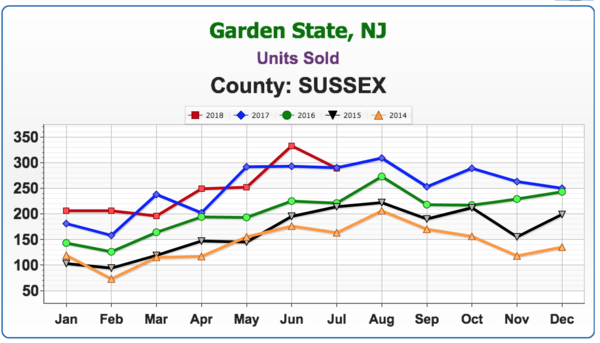

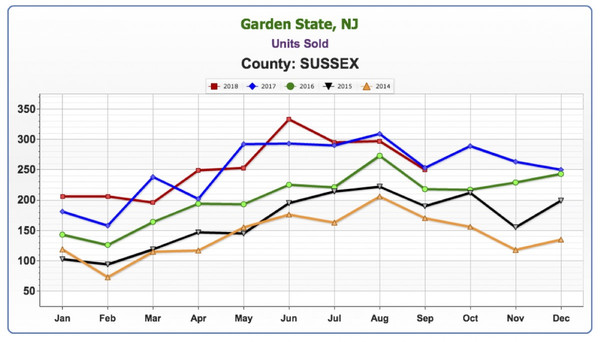

The stats are showing a fluctuation in the number of units sold in Sussex County. It’s a mixed bag – some months below, some months above. No definitive trend has emerged.

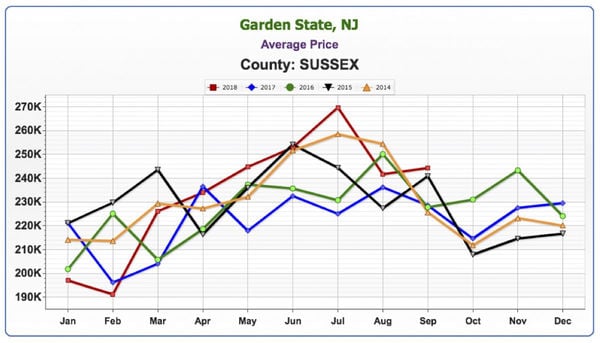

Not quite the lift-off that’s occurring in Orange County, but after the first two months of 2018, there is a definite rise in average price and July is at the highest point of the last five years.

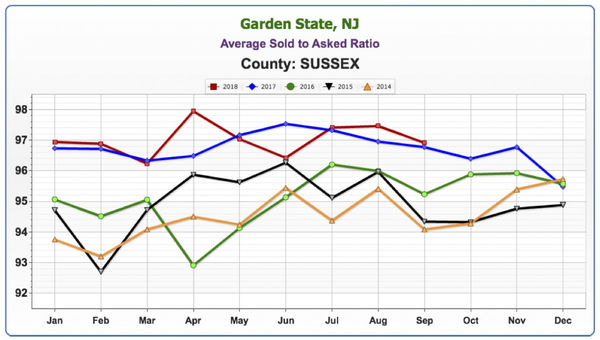

While not quite as high as Orange County, between 30 to 40% of homes are selling at 100% or more of last asking price.

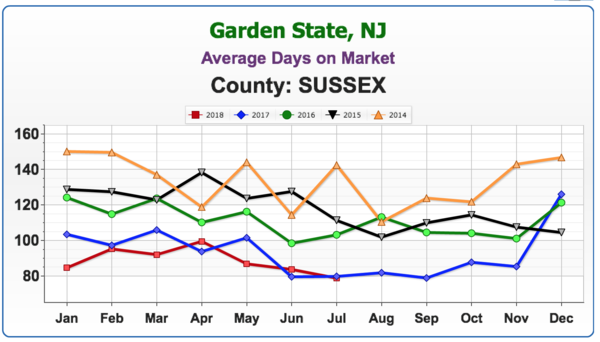

We’re seeing a similar trend to New York, with homes selling at around the 90-day mark.

Keren Goren – A Sales Associate’s Perspective on the Market

Geoff asked Keren Goren, one of Green Team’s top producers, for her thoughts on the current market. Licensed in both New York and New Jersey, Keren finds that there are many prospective buyers for both Orange and Sussex Counties. Lots of bidding wars are going on.

She does feel that some of the flippers in the area are doing less and asking for more. This appears to be a new trend. Keren recalled that flippers used to do a much better job, but many houses on the market now are unfinished and are scaring buyers away as opposed to inviting bids. Therefore, some outdated homes are actually selling for prices higher than they should or would have a few months ago.

Keren sees no sign of the market slowing down. However, she is seeing delays in closings due to issues with some mortgage companies, and with buyers making poor decisions with their finances. Keren did note that her experiences with Family First were extremely positive, and she highly recommended them.

Geoff noted that the current market upturn stands a chance at longevity. Following the downturn, as deep and as long it was, people weren’t moving. Banks have since cleaned up their balance sheets, tightened programs up, and are making money. There are fewer defaults happening. Basically, everything depends on how much money the banks are willing to lend.

PJ Keelin – A Lender’s Perspective

The mortgage industry is doing well, offering a lot more first-time homebuyer programs with as little as 3% down, USDA becoming very popular in Orange and Sussex County areas. Also trending is loosening up a bit and coming up with more portfolio loan products, personal products and using common-sense underwriting and ability to fund when looking at today’s borrowers.

With homes in the $200,000 to $300,000 price range becoming few and far between, they are looking at different programs, such as adjustable rates, less money down, and interest only type payments. However, in these cases, information and education should be given to borrowers upfront. It’s necessary to prepare the borrower for everything that will come together throughout the process. It’s extremely important for borrowers to be aware of what they are getting into with these products and understand how they work.

Geoff noted that with the last downturn, banks were not requiring people to have much “skin in the game.” Zero down, lying about income, jamming loans through. Geoff asked if PJ was seeing any of those practices coming back, or if there remains more oversight. scrutinizing income and the buyer’s comprehensive financial situation, down payments, etc. before loans are going out.

PJ replied that FANNIE and FREDDIE are doing a great job operating more with common sense with people who can have a little more risk, etc. They are requiring more skin in the game. Banks are protecting themselves and borrowers by not letting people put themselves under water.

Where are mortgage rates headed?

Geoff noted that the Fed has been raising short-term interest rates and will probably continue to do so to stifle inflation. He asked PJ where he saw mortgage rates landing over the next 12 to 18 months. PJ answered that he believes rates will be consistently in the 5’s through most programs. The market is being built into where those rates are and is slowly trending. Supply and demand are balancing each other out. Geoff feels that if you buy now, the value of your home won’t drop out like it did 12, 14 years ago. Pricing levels appear to be realistic and should hold for some time in the future. Buyers want to know if the asset they’re buying will be worth at least as much or more than they’re paying now. Even though it is a seller’s market, Geoff and PJ concurred that it is a good time to buy.

Furthermore, PJ stated that appraisers are not allowing appraisal inflation to come above where the market truly should be. It’s better for appraisers to be a little tight because that will keep the longevity of this strong market going on for 12, 18, 24 months. Geoff replied that appraisals have been challenging over the last 3 years. Prior to the upturn, prices were a mixed bag, leaving appraisers unwilling to take a chance as they couldn’t see where the market was going. However, he noted that now some appraisers are more willing to take a chance and make an allowance because of the steady upward-trending market, even though there might not be a comp that can exactly substantiate it. There are fewer appraiser issues, though there are still times when they won’t go along with the offering price. This hurts the seller but protects the buyer. And it’s another way of controlling the market.

Jeff Lobb – A Marketing Expert’s Perspective

Geoff asked Jeff for his views on the future of service providers in the real estate industry in this age of technology. Are realtors going to be the next victims of business models like Amazon? Will technology replace realtors just as retail stores (like ToysRUs) and their employees have been replaced?

Jeff’s view? While buzzwords like “disruption” do sell media, there are things happening at higher levels. However, the real estate agent is not going away anytime soon for one simple reason. There are too many moving parts to a transaction, and emotion is one of those. Technology has not reached the stage where it can handle all these parts.

Disruption occurs with more brands trying to change the way we are doing business, making it faster, more tech, or more niche. New companies are coming into play. Compass, Redfin models, Purple Bricks. And new people are coming into the space trying to change and elevate what we do. At the same time. the industry has seen some large teams leave major brands, saying they can do things better by themselves, without the big brand box.

Taking care of business…

One way to keep track of business is to every day look at local inventory. If there are 500 listings, see how many of those you got. If it’s only 2, there is a lot to be done. The business is a marathon; it’s a competitive race, but not many have enough drive to do the hard work that’s needed. To say the business is slow is not valid. Every day more homes come on the market and more get sold. Someone is getting those listings. And that is where the challenge comes in. It’s about doing the day-to-day work. All the technology that is available can make us work faster and smarter, but we still have to do the work.

Philosophically speaking…

Geoff has a broader perspective as to where realtors stand and what the future holds. As an example, despite all the tools available online there are more travel agents now than in the year 2000. It takes time to do all the research, etc., and many people are finding it more desirable to hire someone to do that work for them.

There has been an explosion of information and technology, but at the end of the day, it’s time. Do most people want to spend the amount of time it takes to properly sell their house or negotiate to buy a home? Most people prefer to hire a real estate professional to handle all the parts of the puzzle. In addition, Geoff believes the housing market is important to the overall US and global economy. The economy is revving. largely because of the housing market healing and coming back. And real estate agents are critical to the health of the economy.

Jeff added, “Will Amazon and Facebook get into the real estate marketplace? Probably!” The big picture is that some companies are coming in trying to acquire agents and market share. Others are trying to change the way technology is driven. However, you still need the people to execute the transactions and deal with the emotional process of a sale.

Geoff’s final analysis? We, humans, are complicated beings, and it takes a human to navigate this process of buying a home. And after much consideration, we should continue to invest in real estate agents and our industry because we’re needed and timeless.

Visit our website, greenteamhq.com/HMU to register for our next Webinar on Tuesday, September 18 at 2 pm. You can also view previous webinars videos and access other recaps like this.

July Housing Market Update

The July Housing Market Update was held live on Facebook on Tuesday, July 10, at 9 a.m. If you missed the live webinar, you can view it at your convenience by clicking here.

Meet the Panel

Geoff Green moderated the webinar and also presented relevant statistics in a historical context. Keren Gonen of Green Team Real Estate New Jersey conveyed the sales associate’s perspective on the housing market. Melissa Bressette, Green Team’s Marketing Director, rounded out the company’s participants. This month’s special panelists were Kevin Dolan, Branch Manager and Co-Director of Renovation and Construction Lending at Annie Mac Home Mortgage and Joe Panebianco, CEO of Annie Mac.

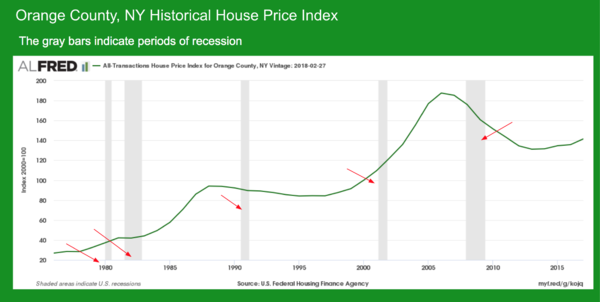

Orange County Historical House Price Index

Geoff presented a historical view of national and local prices, and a look at the market before, during and after recessions. In this chart of the Orange County, NY price index, gray bars indicate periods of recession. As shown in the graph, recessions don’t necessarily trigger downturns in the housing market. The inverse is usually true, with downturns in the housing market generally triggering recessions. Exceptions include the recession between 2000 and 2005. The housing market actually started to downturn around 2005, long before the financial collapse of 2008. Prices peaked in 2006, then continued to slide for over a decade. The steepness and duration of the curve is what is of special interest.

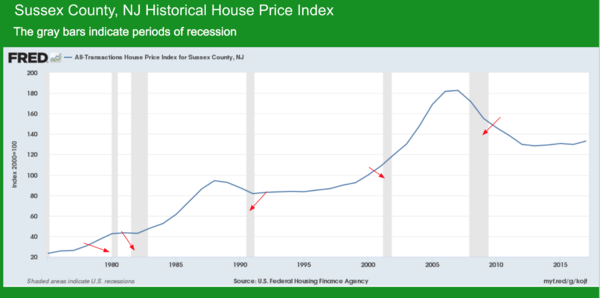

Sussex County NJ Historical House PriceIndex

In a historical context, the Sussex County and Orange County stats show a similarity, reflecting national trends.

National Stats

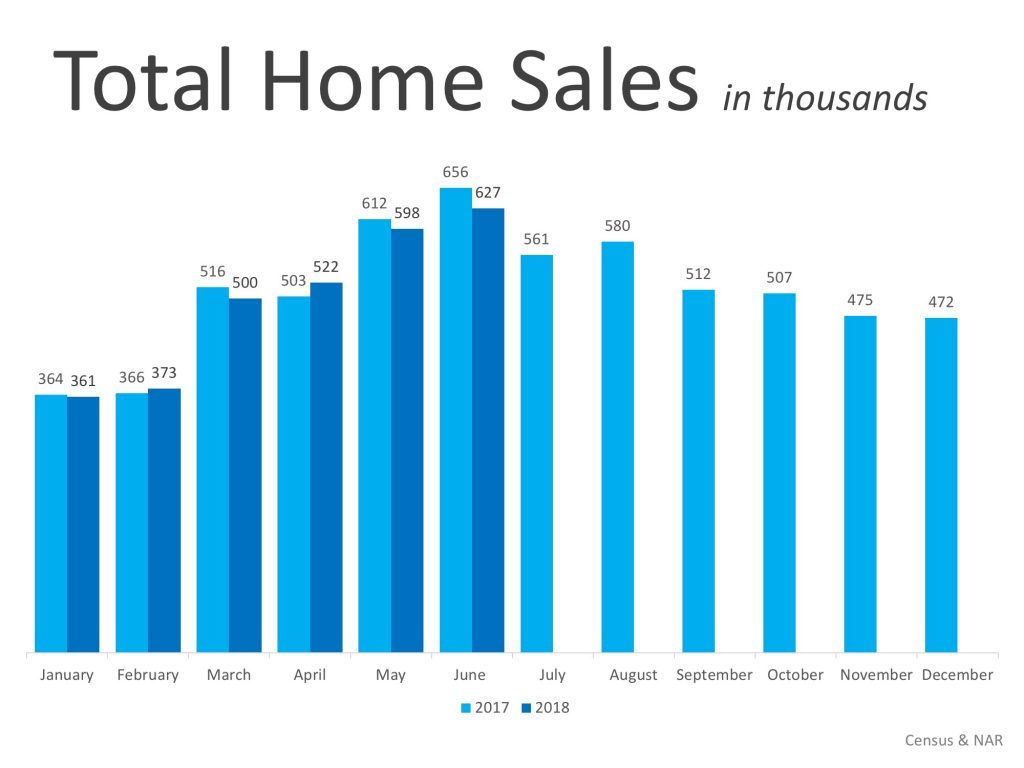

In Total Home Sales in thousands there are no major increases in the year over year stats.

The number of houses available in lower price ranges is way down. However, there is an uptick in higher priced homes. Because of lack of inventory, buyers are being pushed into that higher price bracket.

The percentage of distressed properties for sale is way down from 2012.

Orange County Market Stats for June 2018

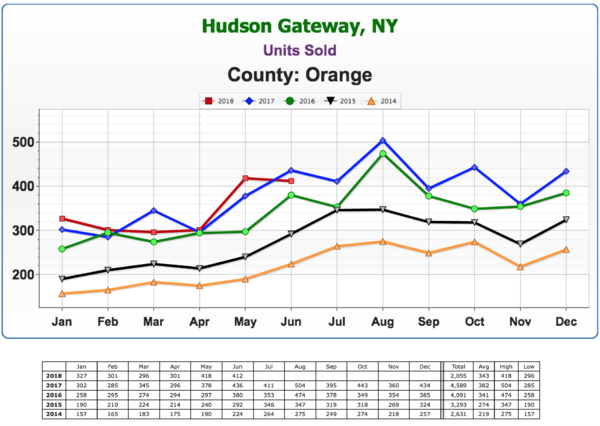

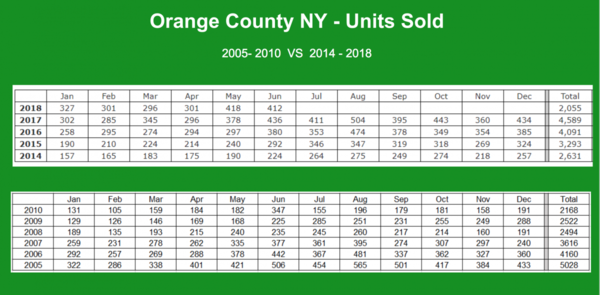

Units Sold

According to Geoff, this is one of the most important analytics in the housing market. No matter where pricing is, you can get an idea of the market by how many houses actually sold. There has been a great year over year increase for the past five years, but now it’s slowing down and we’re seeing a flattening now.

Homes that sold at 100% or more of last asking price

There’s a spike in this number. This is a hot market, and any home that is well located and in good condition will most likely have multiple offers at any one particular time. Basically, almost half of every listing on the market is being bid over asking. Note: Stats are based on last asking price, not original asking price.

Average Days on Market

This number continues to decline, again showing a strong seller’s market.

A Comparison of Units Sold from 2005-2010 versus 2014-2018

Geoff researched units sold in Orange County from 2005-2010 versus 2014-2018. Trends here follow National trends. The peak year was 2005 in terms of units sold. 2006 was the highest average home price the County has seen.. However, in 2010, the number of units sold had slid to almost half of the 2005 figure. Last year, we were above 2006 numbers, and close to 2005 in terms of units sold. Whether we’ll match or exceed that number in 2018 remains to be seen.

Recession

In a capitalist society, it is not a question as to whether or not there will be another recession. The question is when.

As defined in Merriam-Webster Dictionary, recession is “a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.” There is, of course, great interest in when the next recession will hit, and what impact it will have on the housing market.

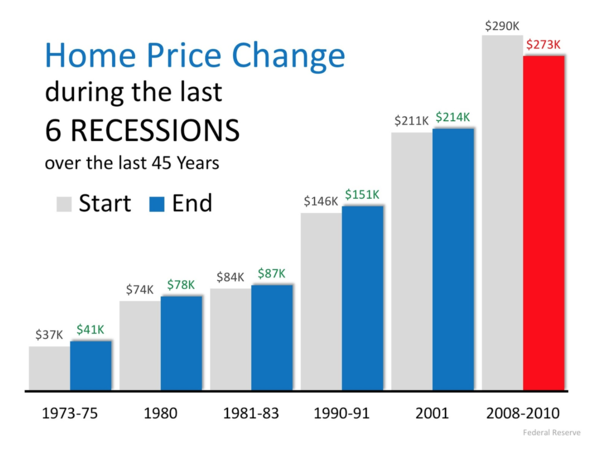

The graph shows home price changes during the last 6 recessions, over 45 years. The recession periods as designated by economists do not include the housing market downturns. Historically, prices haven’t been that affected during the recession; however, the definition of recession doesn’t include the whole downturn. And the real estate market takes time to recover.

‘

Keren Gonen’s perspective on the market from a sales associate’s point of view…

The market is very hot, in both Orange and Sussex Counties. In Warwick, if you don’t jump on a house right away, you can lose it. Keren is seeing bidding wars on homes within days of listing them.

When asked how long she thought the market would remain strong, she estimated about a year. One of the reasons we’re not seeing the lower priced homes sold, Keren indicated, was that banks that do have foreclosures are releasing them at much higher prices. Some banks are also renovating and flipping homes and charging even more.

Geoff commented that previously, when the market was really bad, there was shadow inventory. Banks would hold on to foreclosures, creating fear in the market that they would dump their inventory of low-priced homes, driving down prices. However, the banks seem to be changing their ways of doing things by renting out some homes, and fixing up others and selling them at higher prices.

The Mortgage Market – Where are we now?

Geoff stated that we’re definitely in an increasing rate environment and the Fed has signaled that they are going to continue to increase the overnight lending rates into the foreseeable future. Geoff asked Kevin Dolan to address where we are at now…

Kevin responded that where rates are concerned, they’re turning higher for the foreseeable future. Partly due to media coverage, people are starting to take the rise of interest rates and home prices seriously. They see continual coverage of higher rates on news shows. Thus, people are becoming proactive, buyers and sellers alike, driving productivity level.

Interest rates, inventory and recession. Oh my!

Joe Panebianco does economic analysis and strategy for Annie Mac. His expertise made him the perfect person to discuss specifics and timings of interest rates, inventory and recession.

Interest Rates: We will most likely be range bound from a 10-year treasury perspective from approximately 2.75 to 3.05 yield in the ten year. In other words, we’ll be relatively stable. Should this estimate be incorrect, Joe believes a slightly higher rise in interest rates will not significantly hurt the housing market. At some point, rates rising will have a deleterious effect and purchasers’ ability to afford a home may be impacted. However, we’re not at that point now.

Inflation and economic growth are the two primary components of interest rates. Inflation has remained stubbornly low and will most likely remain so. Hence, one reason why rates should remain relatively low. People talk about the Fed increasing rates, but they are increasing the short end of the curve.

As the Fed continues to hike rates, the result will be 10 and 30-year rates looking more like 2 and 5 year rates. Most of the duration of a mortgage-backed security is in a 7, 10 and 30-year part of the curve. And Joe believes that the more the Fed increases rates, the more likely we are to be in a recession and more likely to have lower, longer-term rates remain where they are or go lower. The mortgage market on Adjustable Rate Mortgages could be hurt because they’re much more likely to rise as they’re sensitive to the shorter end of the curve. 30-year fixed mortgages are more likely to stay in the aforementioned range.

The Global Connection

We live in a globally connected network and there is a yield spread between US 10-year Treasury bond and bonds in other countries, like Germany, Japan, Australia.. For central banks, very large institutions,etc., putting their money in US Treasuries provides a safer, purer investment over countries with significantly lower yields. However, regarding tariffs, trade wars are inherently bad for economies and may throw a curve ball into any predictions.

There are some who refer to our current economy as a “Goldilocks economy.” Not too hot, not too cold, just right… in some ways. The economy is growing enough to create jobs. And, according to Joe, jobs are far more important to home purchases than interest rates are. In the early 1980’s, interest rates were at 15% and yet homes were flying off the market. When rates go up, prices tend to come down. And there is always a buyer, especially if there is value to be had.

The history is if the Fed goes too far, it will drive the country into recession. Joe believes we have approximately 12 to 18 months left in this cycle. And that at the end of this period, we’ll be in a more normal market with a healthier balance between demand and sup

Factors that impact inventory

Labor, or lack thereof, is a major component. Many significant builders have unused land on their balance sheets, on hold because of the great recession of 2007 to 2010. About 70 to 75% capacity of the productive capacity of the home building industry was lost. Brick layers, sheet rockers, carpenters, plumbers, electricians, etc. – left the industry to seek employment in other fields. In addition, when major storms hit Texas, Florida, etc., many people in the industry picked up and went to work in those cities where they could make much more money. There are simply not enough craftsmen and laborer to build all the homes necessary to meet current need.

Municipal Fees, laws – Fees, regulations, etc., have made building a home both difficult and expensive. To help increase taxable base, some municipalities are now trying to make things a little easier for those seeking to build new construction.

Tariffs – The “War of Words” regarding trade with Canada is not good news for the housing industry. A disproportionate share of home building lumber comes from Canada, and price of lumber futures has already risen on expectation of tariffs.

Easing of Credit

In the next 12 months, we may see easing of some requirements. At this time, no one knows how this will be done. However, some options might include reducing Mortgage Insurance on the FHA side, especially for first-time buyers. Also, Freddie Mac might follow Fannie Mae’s lead in reducing Long Term Debt and Debt to Income Ratio. Average renters spends 50-55% on rent. However, the current Debt To Income ratio is in the low 40’s for purchases. There might be a move to update the DTI.

Demand is not going to Cease

According to Joe, by 2025 there will be approximately 10 million new household formations. 35% will be from millenials, 35-40% from among the Hispanic community (with some overlap between the two), and 10% from the African-American community. Many of these new home buyers will be DTI (Debt to Income Ratio) challenged. They will need the services of qualified real estate agents, knowledgeable mortgage specialists/

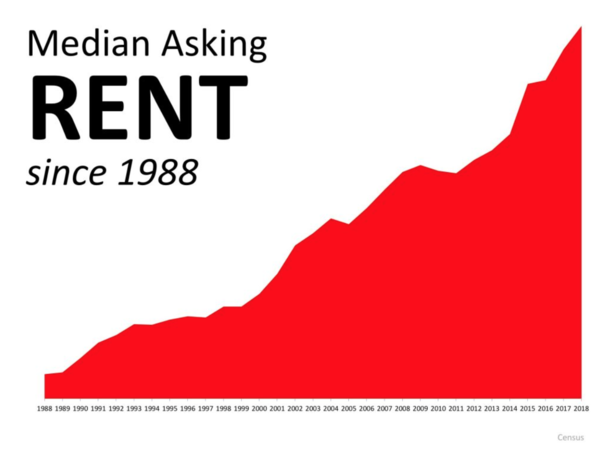

Geoff pointed out that purchase and rental markets are both hot at the same time. This indicates a true housing shortage. The Millennial population seems to be exceeding Baby Boomers. Pent up demand and limited supply serve to elongate and stretch out the cycle.

Home ownership improves communities – and the economy

Home ownership lends itself to not only building communities, but also to building up business, including home improvement and furniture stores, furniture stores, durable goods vendors, etc., etc.- all of which will help the economy. Inventory may become less of an issue month by month by month.

Renovation Loans

Kevin Dolan is an expert in renovation loans. There are homes on the market that just won’t sell because they are not in good shape. He believes the renovation lending program is under-utilized simply because it is not understood and there are many misconceptions.

There are two types of renovation loan programs – conventional and FHA. This opens up versatility for buyers as to who it can serve, such as a down payment as low as 3-1/2%. It also allows for lower credit scores. These loans can be utilized for primary homes, second homes and investment properties. The loan allows for someone to buy a house in need of repair, and have an approved, qualified contractor bid on work to be done. Depending on scope of work, sometimes a HUD consultant will make sure prices quoted for the work are appropriate. The renovation funds goes into an escrow account, and contractor has specified time to do improvements, usually within six months. The bank pays contractor directly. The process is streamlined and efficient.

Kevin feels that educating buyers and real estate agents alike is key to opening up this market. Keren agreed, stating that she often does sell homes by telling buyers that renovation loans are available, and explaining how they work. It opens up options and vision for the buyers who cannot afford to buy a home in the $300-$400,000 range. Annie Mac does have a certification program available for real estate agents who would like to become expert in this area.

Renovation loans – not just for buyers

Kevin commented that renovation loans can also be helpful for sellers who need to update their homes in order to sell. By adding another bath or more bedrooms, the value of the home can be increased so that the seller can pay off existing mortgage and closing costs, and hopefully make a profit as well. Also, from Seller’s position, if they have a failed septic tank, they can sell the home at a lower price and buyer can get a renovation loan to cover the cost of having the work done themselves.

Joe added that in looking to build wealth in addition to creating a home for their family, renovations can help improve their property, and therefore their investment.

Geoff spoke about the importance of finding someone who truly understands these loans as they can be tricky for the loan originator. Geoff spoke highly of Annie Mac, not just for renovation loans, but for all financing needs.

Stay tuned for the next market update

The next update is August 14, 2018 at 9 a.m. You can sign up at GreenTeamHQ.com/HMU

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Matt Zagroda is a Sales Manager at

Matt Zagroda is a Sales Manager at