The Best Week To List Your House Is Just Around the Corner

Are you thinking about selling your house? If so, you may want to make it a priority to start the process soon. According to realtor.com, the sweet spot for sellers is just around the corner. In a recent study, experts analyzed housing market trends by looking at data from the past several years (excluding 2020, since it was an atypical year). When applied to the current market, experts determined the ideal week to list a house this year. The research says:

“Home sellers on the fence waiting for that perfect moment to sell should start preparations, because the best time to list a home in 2022 is approaching quickly. The week of April 10-16 is expected to have the ideal balance of housing market conditions that favor home sellers, more so than any other week in the year.”

If you’ve been putting your move on the back burner waiting for the ideal time to sell, you should know your golden window of opportunity is coming up. If you’re able to get your house ready quickly, here’s what you can expect from that week.

You Should See More Buyer Activity

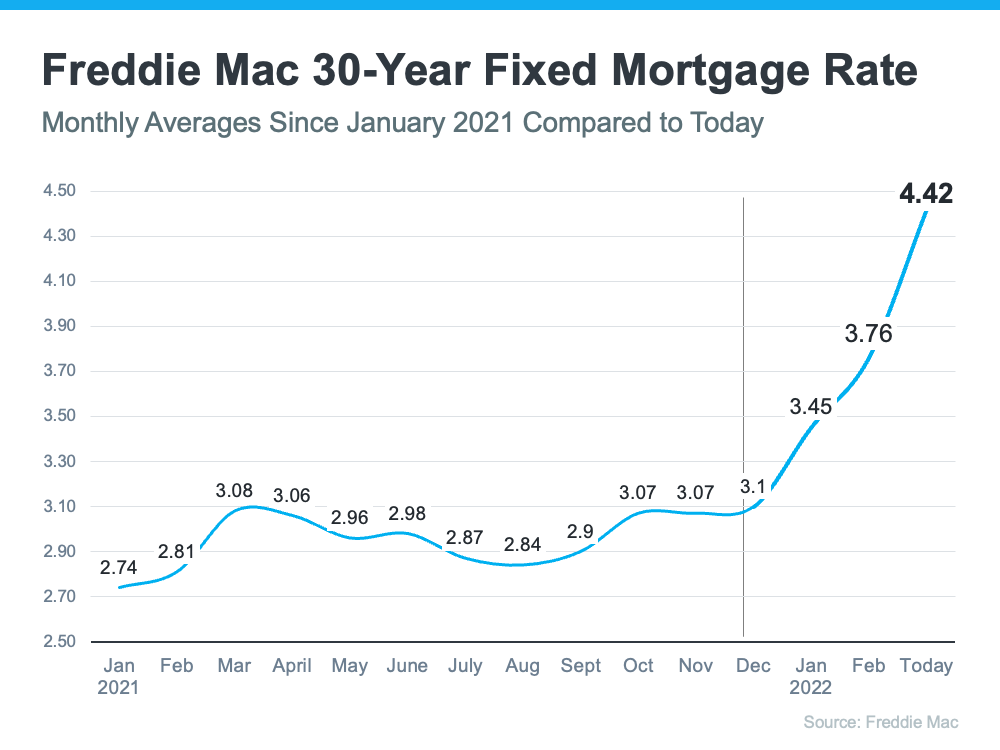

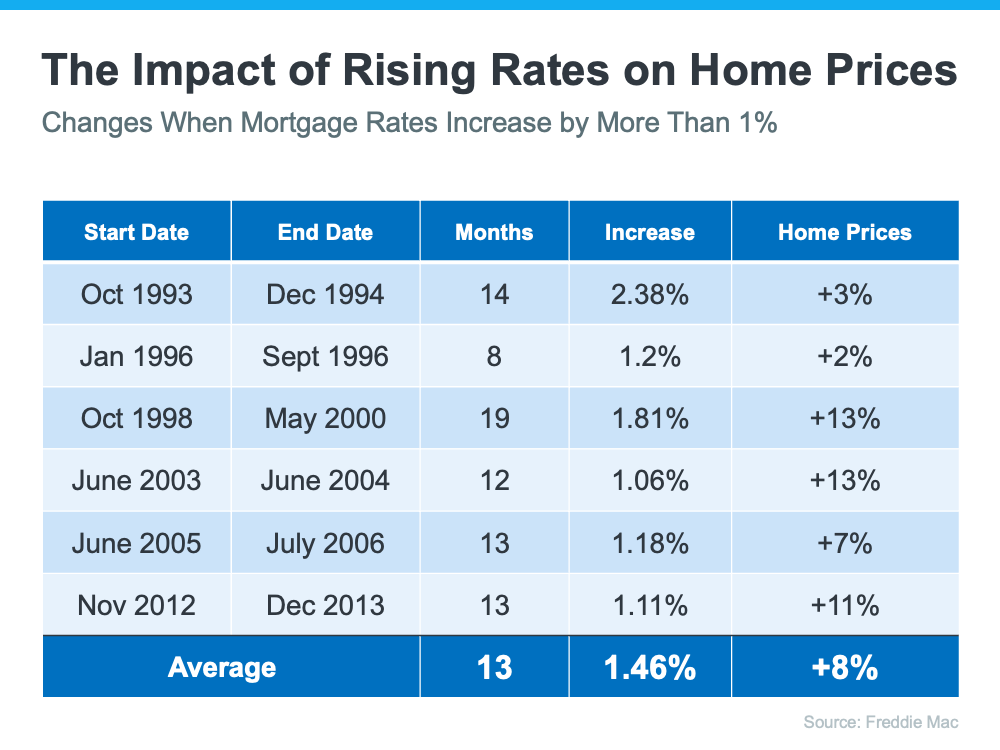

The article expects higher buyer demand based on what’s happened in previous years. This could result in increased competition among buyers and ultimately a bidding war over your house. And since mortgage rates recently ticked up over 4%, chances are good that analysis is right. When rates rise, experts say buyers often hurry to make their purchase before rates climb higher. As Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), says:

“. . . Buyers are rushing to lock in lower rates as the outlook is for even higher mortgage rates in the following months.”

Your House Is Expected To Sell Quickly

Additionally, the realtor.com analysis shows houses sell even faster during this week of the year, likely due to the heightened buyer demand. If you work with a trusted real estate professional to price your house right, it should sell quickly. And when homes are already selling in just 18 days according to NAR, that could set you up for a big win.

Your House Will Be in the Spotlight

Since the beginning of the year, the number of homes available for sale has been at or near record lows. According to the realtor.com study, the typical trend for this week of the year is that there will be even fewer sellers on the market. If you list when inventory is low, your house will be the center of attention for eager buyers craving options.

If you’re ready to move fast, you may want to shoot for April 10th-16th as your target goal. Just remember, even if you’re not ready to list within the next couple of weeks, rest assured this is still a hot sellers’ market. If you list later in April, you’ll still be in the driver’s seat.

Bottom Line

Ready to get the ball rolling? Let’s connect and schedule a time to go over your next steps. In the meantime, make a checklist of things you need to tackle to get your house ready. When we talk, we can prioritize your to-do list and get you on the road to selling your house.

The #1 Reason To Sell Your House Today

Almost every industry is currently struggling with supply chain disruptions. This also applies to the current U.S. housing market, where buyer demand far exceeds housing supply.

Purchaser demand is very strong right now. The National Association of Realtors (NAR) just released their latest Existing Home Sales Report which reveals that sales surged in January. Existing home sales rose to a seasonally adjusted annual rate of 6.5 million – an increase of 6.7% from the prior month, with sales up in all regions. However, there’s one big challenge.

Inventory Is at an All-Time Low

Because purchaser demand is so high, the market is running out of available homes for sale. The above-mentioned report states that the current months’ supply of inventory of homes for sale has fallen to 1.6 months. This prompts Lawrence Yun, Chief Economist at NAR, to say:

“The inventory of homes on the market remains woefully depleted, and in fact is currently at an all-time low.”

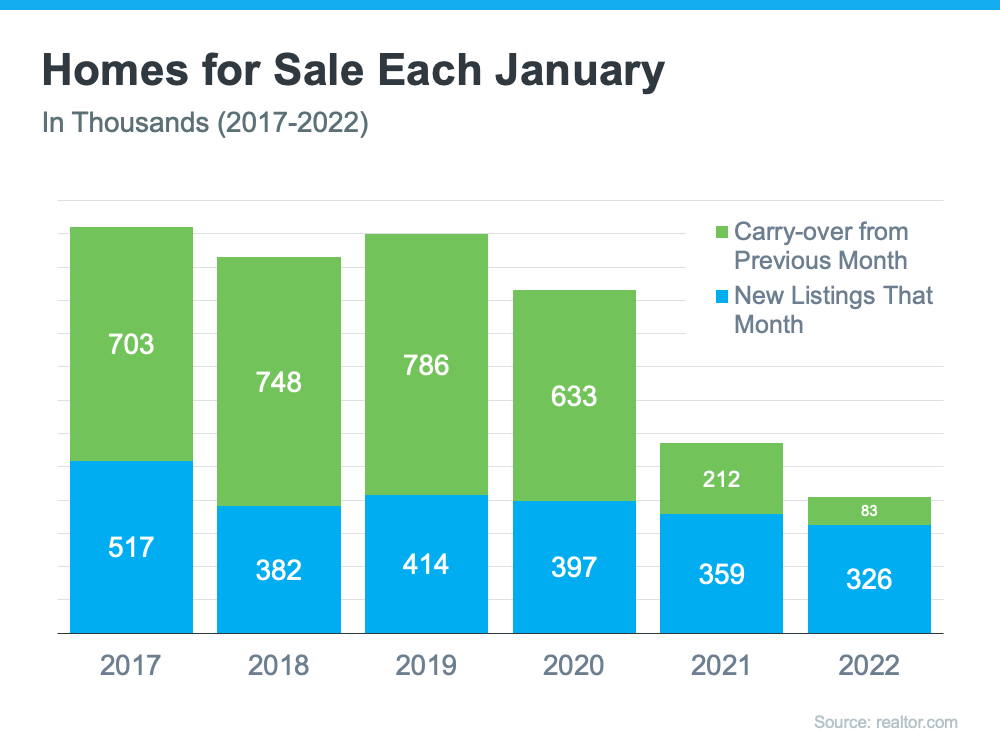

Earlier this month, realtor.com released their inventory data for January. It helps confirm this point. Here’s a graph comparing inventory levels for January over the last six years:

As the graph shows, new listings coming on the market have decreased over the last four years (shown in blue in the graph). The graph also reveals that carry-over inventory has plummeted in recent years. This is because listings are now sold so quickly, they don’t stay on the market long enough to carry over month-to-month (shown in green in the graph). In other words, homes are not staying on the market for months as they had prior to the pandemic. In the report mentioned above, NAR reveals that:

“Seventy-nine percent of homes sold in January 2022 were on the market for less than a month.”

Odeta Kushi, Deputy Chief Economist at First American, explains it like this:

“A higher velocity of sales (lower [Days on Market]) helps to explain a housing market characterized by both higher sales & lower inventory. Many resale transactions are happening so quickly that they ‘flow’ in & then out of the ‘stock’ between the fixed monthly measurement of inventory.”

What Does This Mean for Sellers?

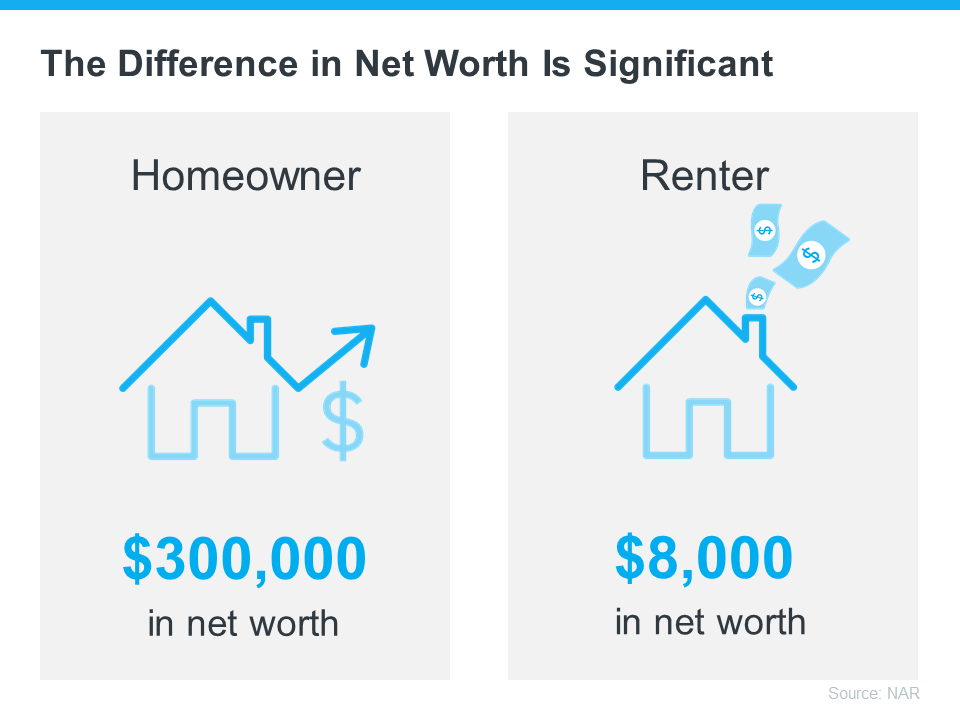

Anyone thinking of putting their home on the market shouldn’t wait. A seller will always negotiate the best deal when demand is high and supply is limited. That’s exactly the situation in the real estate market today.

Later this year, inventory (and by extension, your competition) will increase as many homeowners are waiting to put their homes on the market in the spring and early summer.

In addition, Len Kiefer, Deputy Chief Economist at Freddie Mac, says:

“Housing starts start off 2022 strong, just edging out 2021 for most in January since 2006.”

As these newly built homes are completed, they will also become competition for your house. This gives you a tremendous opportunity right now. Don’t wait for that increase in competition in your area. If you want to sell in 2022 and are ready to start the process, today is the day to list your house.

Bottom Line

If you’re ready to sell, let’s connect to get your house on the market while today’s inventory situation is in your favor.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Supply and Demand in Today’s Market [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/03/03164955/20220304-MEM-1046x2586.png)