Housing Market Update December 2020

Geoff Green, President of Green Team Realty, welcomed everyone to the December 2020 Housing Market Update. This webinar, held on Tuesday, December 15, at 2 p.m., examined the housing market on both national and local levels.

If you missed the webinar or would like to view it again, it is available here.

Meet the Panel

Panelists included Keren Gonen and Pam Zachowski of Green Team New Jersey Realty, Toni Kreusch, and Karen Gauvin of Green Team New York Realty. Michael Giannetto of CrossCountry Mortgage LLC joined them.

2020 – The Year in Review

What a year it has been! The real estate industry has had a strong year. The housing market has experienced a “V-shaped” recovery. Furthermore, according to Realtor.com, it continues to ascend based on demand, supply, price, and time on market.

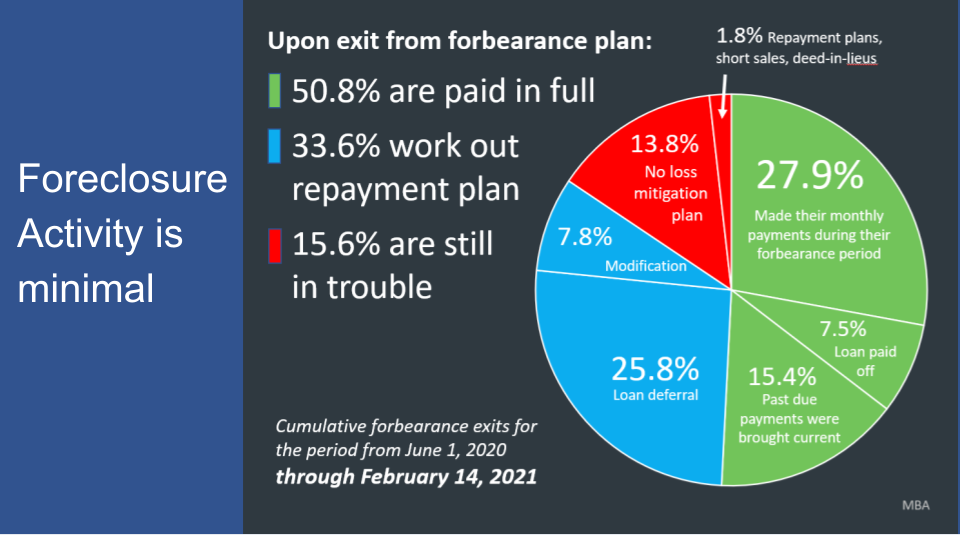

There are no signs of an impending foreclosure increase. In fact, the number of mortgages in forbearance is decreasing.

Are prices going up too fast?

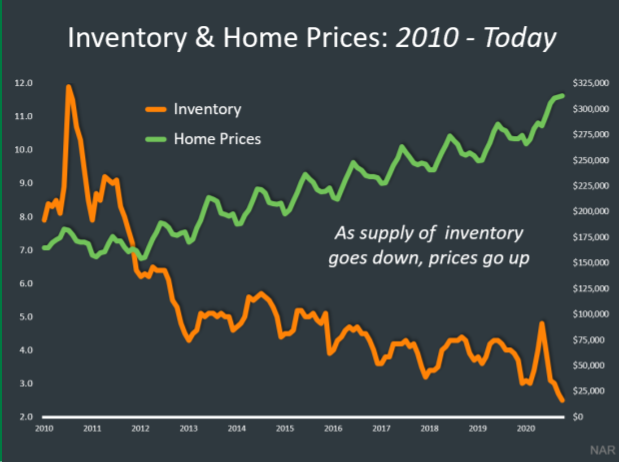

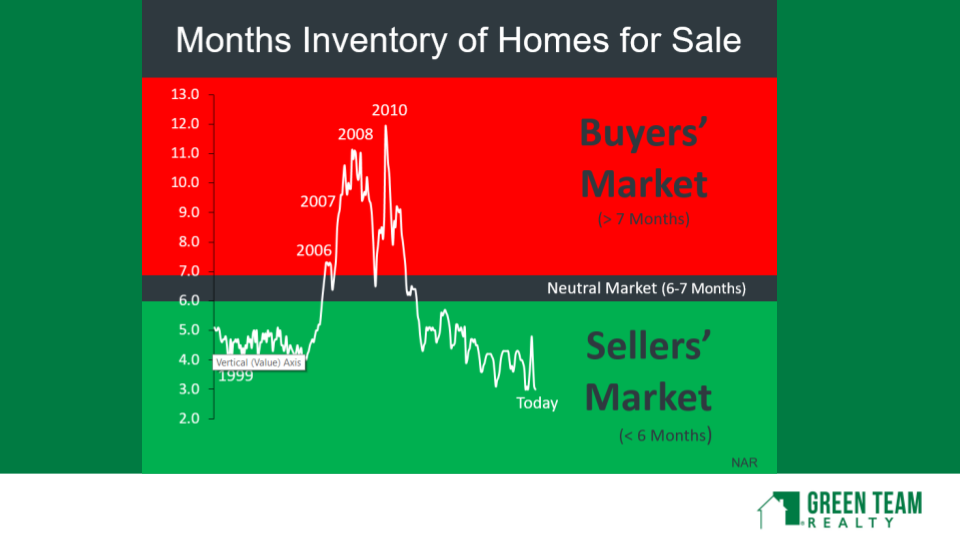

Geoff Green addresses this question, using actual and historic appreciation factors. However, it all comes back to supply and demand, as shown below. The less inventory you have, the more demand and prices go up.

Lawrence Yun, Chief Economist at NAR, explained why there is no comparison between today’s market and the frenzy of activity seen in 2006, which led to the recession. You can view his full quote in the December 2020 HMU video. Also, the good news is mortgage affordability based on household debt service as a percentage of disposable personal income. Furthermore, mortgage rates are projected to remain low in 2021, and home prices continue to increase.

The new Winter 2021 Buyer and Seller Guides are now available on the Green Team Realty website.

Click here and scroll halfway down the screen to request your guide.

Housing Market Stats – Nationwide and Local

Existing home sales have risen, and home prices continue to soar. Of course, inventory continues to plummet. Locally, average prices have soared. The panelists discussed the impact of current market conditions on both buyers and sellers, and what they are seeing in their businesses. You can see the panel discussion here.

“Housekeeping” Items

Contact our Panelists

We’ll see you on Tuesday, January 29, 2021, at 12 p.m.

Click here to register.

November 2020 Housing Market Update

Geoff Green, President of Green Team Realty, welcomed everyone to the November 2020 Housing Market Update. The webinar, held on Tuesday, November 17 at 2 p.m. examined the housing market on both national and local levels.

If you missed the webinar or would like to view it again, it’s available here:

Meet the Panel:

Panelists included Keren Gonen and Barbara Tesa, of Green Team New Jersey Realty and Carol Buchanan, with Green Team New York Realty. Also joining the discussion were Ken Ford of Warwick Valley Financial Advisors, and Laura Moritz with Classic Mortgage LLC.

First, let’s talk about the economy

In January, the economy was strong, there were no signs of the housing market slowing down. It took a major global event to slow down a roaring economy.

So, what did people do with stimulus checks?

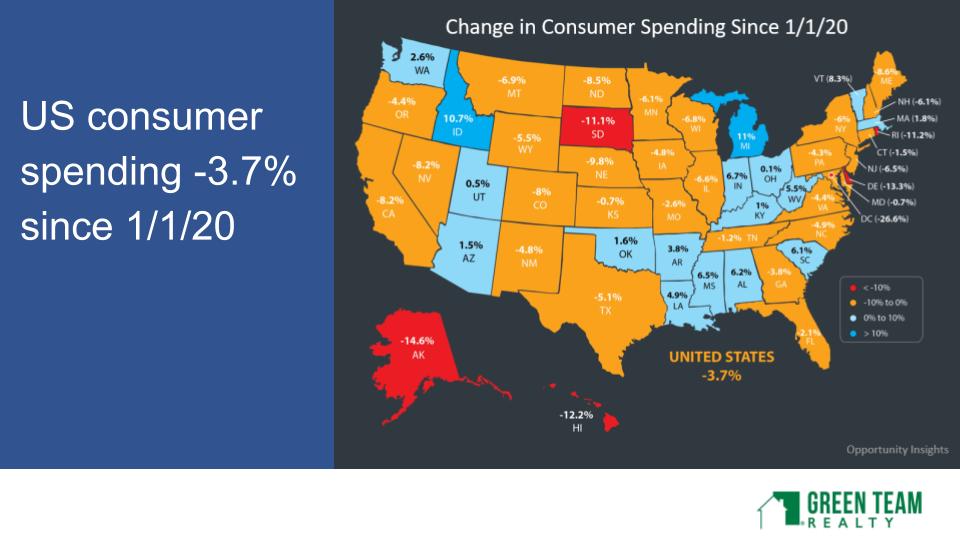

35% used it to pay down debts. 36% saved the money, and 29% spent the money. U.S. Consumer spending since January 1, 2020, is down by -3.7%. Changes in consumer spending by state is shown below:

Unemployment filings and benefits

Unemployment filings and benefits

Weekly unemployment filings have been steadily coming down. However, unemployment does remain at a high number. The number of people receiving unemployment benefits is also trending downwards.

Mortgage Forbearance, Home Inventory, Home Appreciation, and Mortgage Rates

The number of mortgages in active forbearance is decreasing dramatically. As of Oct 20, out of 2,397,000 families granted forbearance, some have extended it, However, 44% came out of the program while paying on time. In addition, 500,000 people paid off their mortgage.

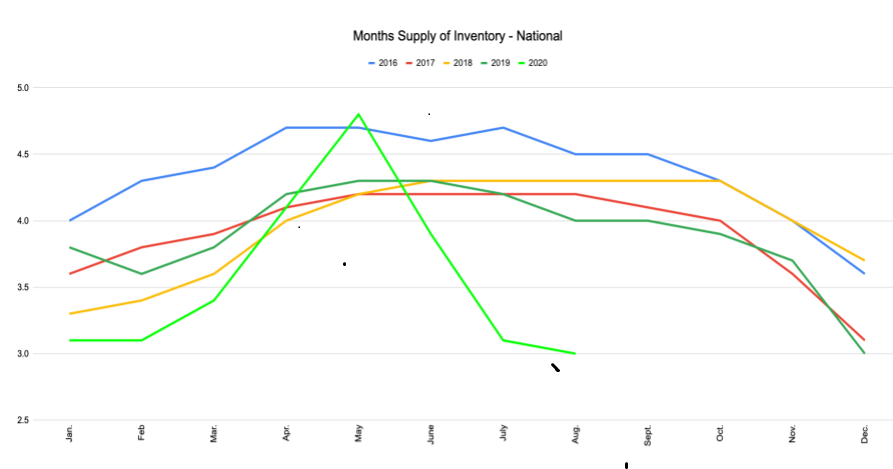

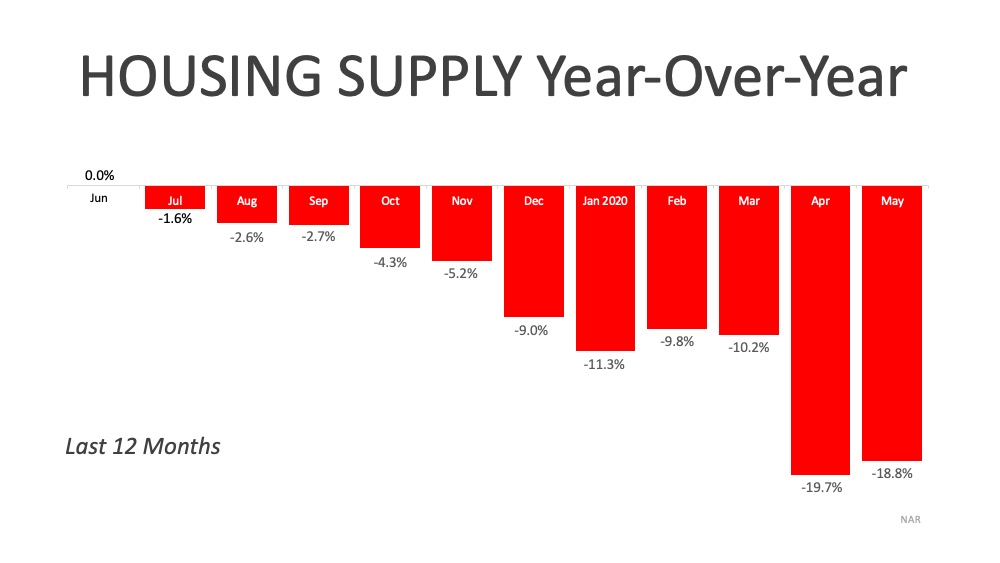

Moreover, stats show the decrease in inventory over the last 12 months. According to Zillow, the top reasons for people not putting their homes on the market now are financial uncertainty, uncertainty about life in general, and COVID-19 health concerns.

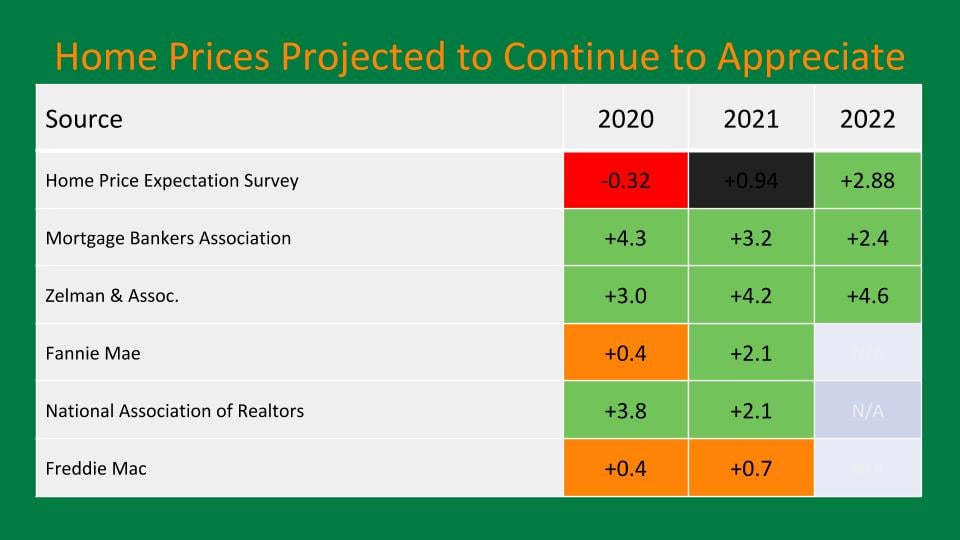

Most experts are bullish on home price appreciation. However, Mortgage Bankers’ Association is predicting rising mortgage rates over the next 3 years.

Learn more. Watch the Webinar.

For updates on what is happening in commercial real estate, the crisis facing renters at the end of moratoriums, and national and local market stats, click here.to watch the webinar. You’ll also be hearing from the sales associates, and financial and mortgage experts on what they are seeing in the market.

Furthermore, you can compare this month’s stats with those in the October Housing Market Update.

“Housekeeping” Items

Contact our Panelists

Join us for the last Housing Market Update of 2020 on Tuesday, December 15 at 2 p.m.

Sign up for updates now at GreenTeamRealty.com/HMU

September 2020 Housing Market Update

[et_pb_section admin_label=”section”]

[et_pb_row admin_label=”row”]

[et_pb_column type=”4_4″][et_pb_text admin_label=”Text”]Geoff Green, President of Green Team Realty, welcomed everyone to the September 2020 Housing Market Update. The webinar, held on Tuesday, September 15 at 2 p.m., examined the housing market on both national and local levels. Discussion included the impact of various economic factors resulting from the COVID-19 pandemic.

If you missed the webinar or would like to view it again, it is available here.

Meet the Panel

September Housing Market Update panelists were Kristi Anderson and Keren Gonen of Green Team New Jersey Realty. They shared their knowledge and expertise in the Vernon and Sussex County, New Jersey markets. Carol Buchanan, Green Team New York Realty, shared her experiences with the Warwick, Orange County, New York markets. In addition, our guest panelist was Michael Giannetto of Cross Country Mortgage. Michael shared his expertise on the

First, here are some stats on the national and local markets, presented by Geoff.

We’re Up, Up, and Away

July marked ten straight months of year-over-year gains in price. In addition, we have first time ever, national median home prices breaching the $300,000 level. With the easing of lock-down regulations, showing traffic is now way up, year over year. Mortgage applications, year-over-year, are also popping. Realtor.com’s chief economist says that inventory is down 38%.

Demand is way up, supply is way down

Builder confidence is also growing. It tied its highest reading in NAHB/Wells Fargo Housing Market index’s 35-year history. However, lumber prices have more than doubled since mid-April. The pricing of lumber should come back down, based on supply issues as opposed to supply and demand.

Housing affordability

The housing market is about affordability as opposed to just pricing. While prices continue to go up, mortgage rates have been going down. Thus, lower mortgage rates make buying a home more affordable.

Learn more, watch the webinar

Watch Geoff’s full presentation on national and local economic and real estate trends. In addition, hear our expert panel discuss their experiences in this market. Click here to view the webinar.

Furthermore, compare prior stats. Click here for the July 2020 Housing Market Update.

“Housekeeping” Items

Contact our Panelists

Join us on Tuesday, October 20 at 2 p.m.

Sign up for updates now at GreenTeamRealty.com/HMU

[/et_pb_text][/et_pb_column]

[/et_pb_row]

[/et_pb_section]

A Historic Rebound for the Housing Market

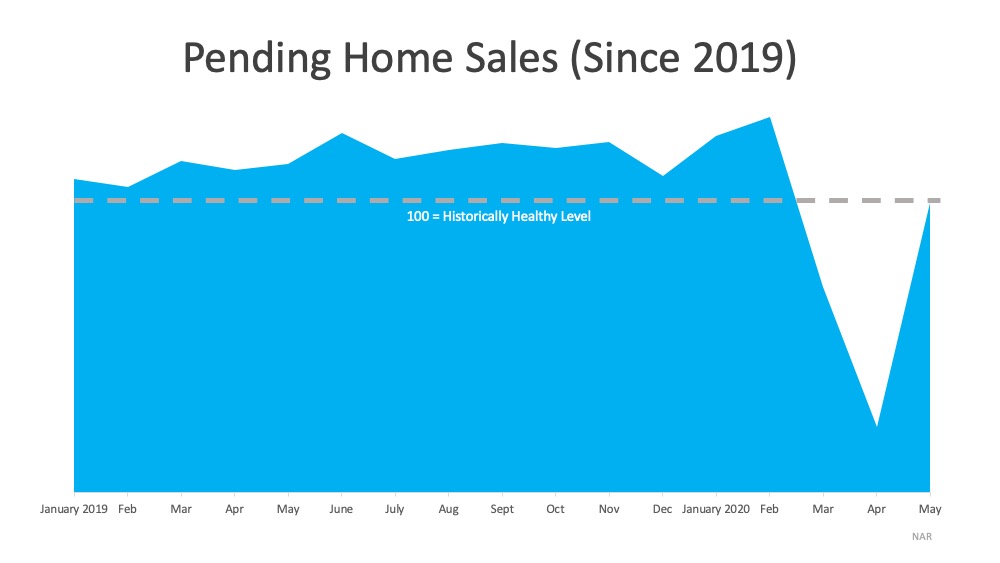

[et_pb_section fb_built=”1″ _builder_version=”3.0.47″][et_pb_row _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.0.74″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]Pending Home Sales increased by 44.3% in May, registering the highest month-over-month gain in the index since the National Association of Realtors (NAR) started tracking this metric in January 2001. So, what exactly are pending home sales, and why is this rebound so important?

According to NAR, the Pending Home Sales Index (PHS) is:

“A leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos, and co-ops. Because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing-Home Sales by a month or two.”

In real estate, pending home sales is a key indicator in determining the strength of the housing market. As mentioned before, it measures how many existing homes went into contract in a specific month. When a buyer goes through the steps to purchase a home, the final one is the closing. On average, that happens about two months after the contract is signed, depending on how fast or slow the process takes in each state.

Why is this rebound important?

With the COVID-19 pandemic and a shutdown of the economy, we saw a steep two-month decline in the number of houses that went into contract. In May, however, that number increased dramatically (See graph below): This jump means buyers are back in the market and purchasing homes right now. Lawrence Yun, Chief Economist at NAR mentioned:

This jump means buyers are back in the market and purchasing homes right now. Lawrence Yun, Chief Economist at NAR mentioned:

“This has been a spectacular recovery for contract signings and goes to show the resiliency of American consumers and their evergreen desire for homeownership…This bounce back also speaks to how the housing sector could lead the way for a broader economic recovery.”

But in order to continue with this trend, we need more houses for sale on the market. Yun continues to say:

“More listings are continuously appearing as the economy reopens, helping with inventory choices…Still, more home construction is needed to counter the persistent underproduction of homes over the past decade.”

As we move through the year, we’ll see an increase in the number of houses being built. This will help combat a small portion of the inventory deficit. The lack of overall inventory, however, is still a challenge, and it is creating an opportunity for homeowners who are ready to sell. As the graph below shows, during the last 12 months, the supply of homes for sale has been decreasing year-over-year and is not keeping up with the demand from homebuyers.

Bottom Line

If you decided not to sell this spring due to the health crisis, maybe it’s time to jump back into the market while buyers are actively looking for homes. Let’s connect today to determine your best move forward.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”3.18.2″][et_pb_row _builder_version=”3.18.2″][et_pb_column type=”4_4″ _builder_version=”3.18.2″ parallax=”off” parallax_method=”on”][et_pb_post_nav in_same_term=”on” _builder_version=”3.18.2″ title_font=”|800|||||||” title_text_color=”#ffffff” title_font_size=”15px” background_color=”#007a42″ border_radii=”on|2px|2px|2px|2px” border_width_all=”2px” border_color_all=”#007a42″ custom_padding=”1px|4px|1px|4px”][/et_pb_post_nav][/et_pb_column][/et_pb_row][/et_pb_section]

April 2020 Housing Market Update

[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”3.0.47″][et_pb_row admin_label=”row” _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text admin_label=”Text” _builder_version=”3.0.74″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]

Covid19 has caused economic turmoil, health crises and uncertainty. However, a historical perspective may help us manage emotions and enable us to see what is happening in the housing market and navigate it accordingly. Below is a recording of the Housing Market Update as well as a summary of the most important discussion points.

National – Historical Perspective

Will this be like 2008, the start of the great recession?

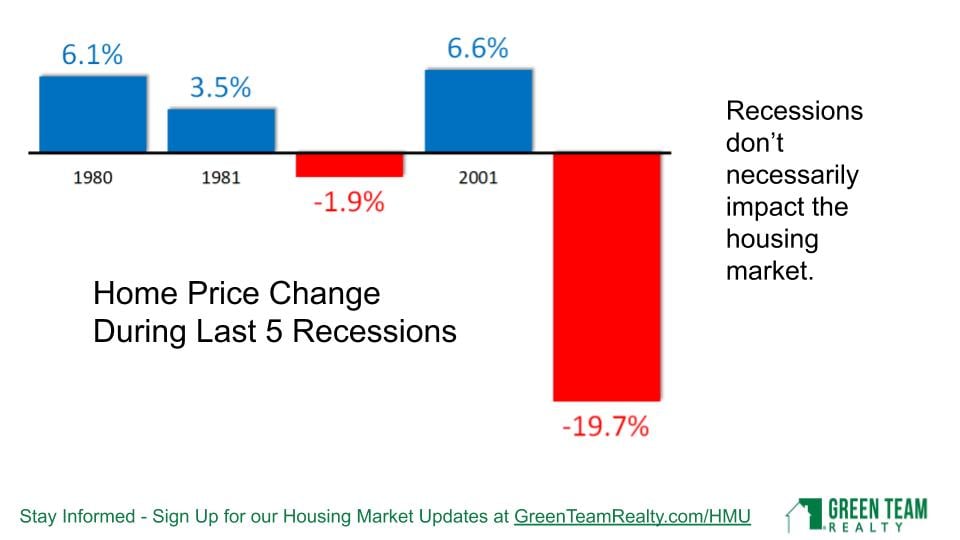

The Housing Market was greatly impacted at that time because it was the catalyst that caused the Great Recession. Home price changes during last 5 recessions indicate that recessions do not necessarily impact the housing market. In 3 of the last 5 recessions, housing markets actually increased.

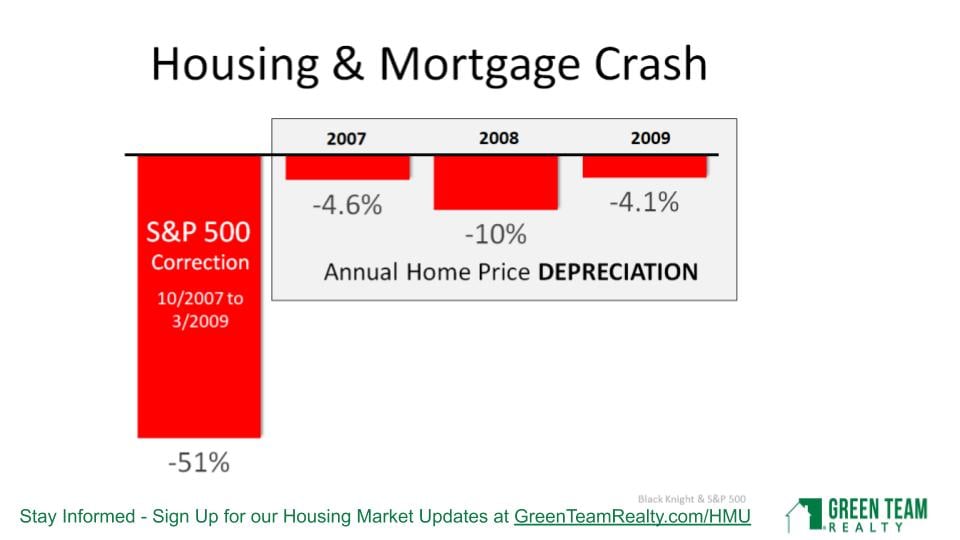

Housing and Mortgage Crash

In 2007, 2008 and 2009, the annual home price depreciation was significant. However, at the time we were dealing with sub-prime lending, etc. However, looking further back, to the Dot.com crash and 9/11 market crash, there was a significant S&P 500 stock market correction. Yet prices in the housing market continued to increase. There were good fundamentals in place.

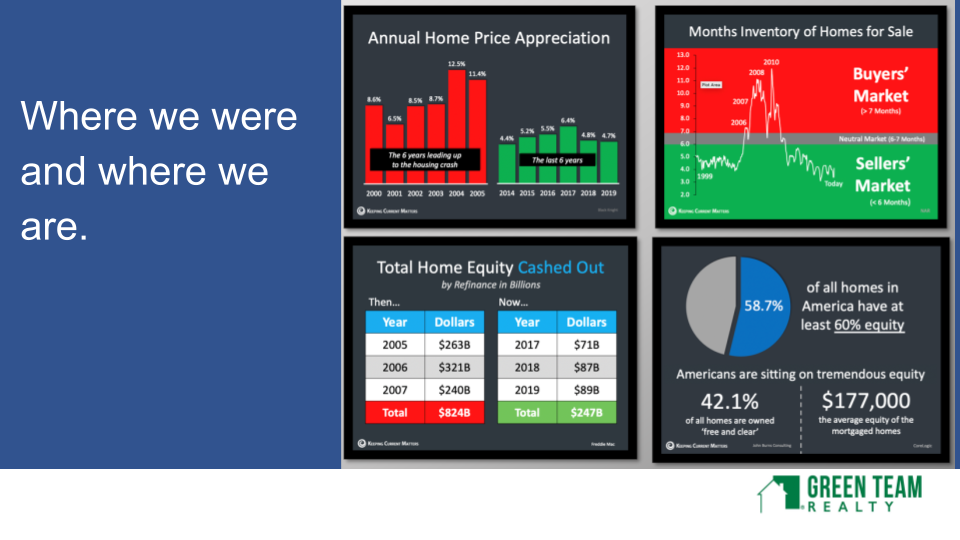

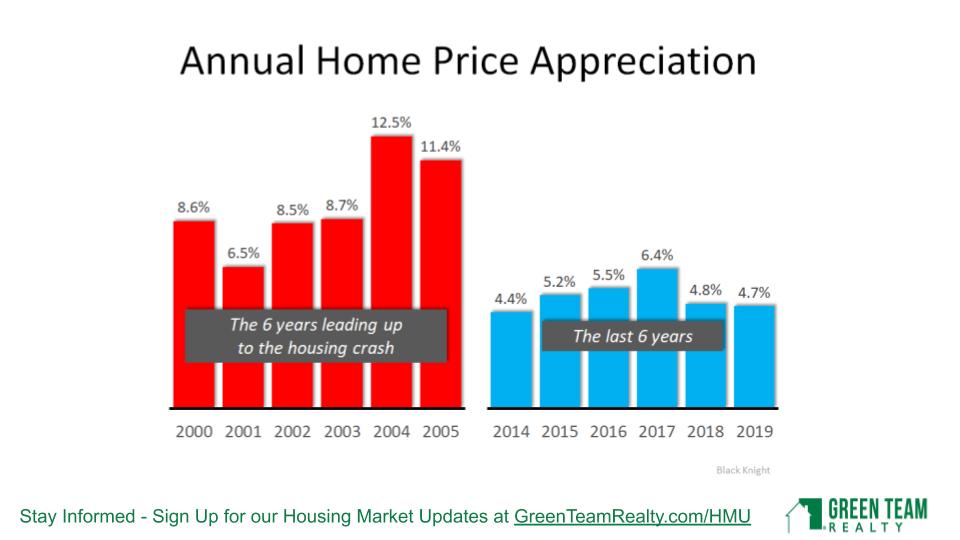

Annual Home Price Appreciation

In any marketplace, you have to look at overall values. Are assets undervalued or overvalued? With the run-up to 2008, from 2000 to 2005, there were major price increases year over year. 6.5% was the lowest increase, with the highest being 12.5%. However, since 2014, 6.4% has been the highest increase. We haven’t gone back to those major subprime lending issues that happened before.

Mortgage Credit Availability and Affordability

The Great Recession required mortgage industry restructuring. That, in turn, led to qualified buyers not being able to borrow. This time around, it’s a different landscape. We don’t have a subprime lending bubble in the residential housing market. Loans will be processed for good buyers with good credit. Mortgage requirements are tightening a bit, but not to an unreasonable level. Another analytic compares total home equity cashed out in the years 2005-2007 and 2017-2019. People were using their homes “like ATMs” during the former period. The leverage people are putting on their homes has dropped from $824 Billion during 2005-2007 to $232 Billion during 2017-2019. 53.8% of all homes in America have at least 50% equity.

The percentage of median income needed to purchase a median-priced home has dropped from 25.4% in 2006 to 14.8% today. Affordability is in much better shape, largely due to mortgage rates being very low.

The Impact of Unemployment

Concerns about job losses are very real. A breakdown of the April 3 Unemployment Report shows the different sectors affected. 59.5% are from restaurant services and drinking places. The accommodation industry, retail trade, temporary help services, child daycare workers, health care office workers and construction workers make up most of the balance. In other words, these are jobs that should be coming back as soon as these businesses can operate again. It may take some time until people are confident and comfortable enough to get back out there. The next numbers come out on May 8, 2020 and will be discussed during the May HMU.

Unemployment rates and home sales do not seem to have a direct relationship. Current Unemployment Rates were compared to past financial crises. In 1933, during the Great Depression, unemployment rates were at a high of 24.9%. Goldman Sachs is predicting unemployment to be 15% in 2020. They are also predicting that number to go down to 6-8% in 2021, 5% in 2022 and 4% in 2023.

Based on data from the US Department of Labor accessed by Haver Analysis, the current employment situation is more like a natural disaster than a recession. The problem is how long this natural disaster, Covid19, is going to last. There are many unknowns, and no answers. We’ll be tracking what happens as parts of the economy reopen.

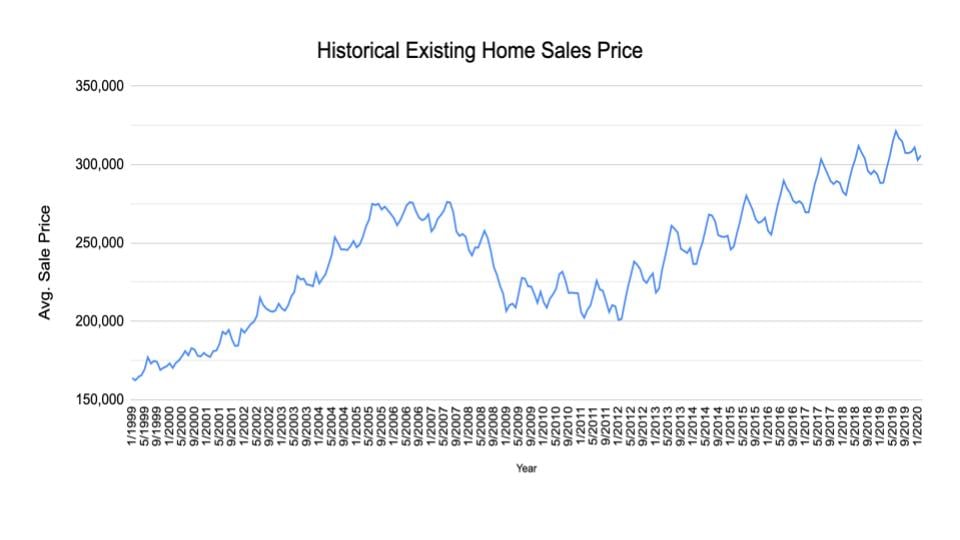

Historical look at Existing Home Sales Price

The market was hot the first two months of 2020, with average home sale price higher in January and February than those months in the preceding four years. It will be interesting to see what the numbers show over the next several months.

The above analytic shows Existing Home Sales Prices from January 1999 to January 2020. Even if you bought at the peak of 2007 or 2008, as Geoff did, just before the housing market plunged, it took 8 years for the market to recover. Historically speaking, people moved after an average of 6 years. That number is now inching up to 9 years. The average homeowner generally doesn’t buy or sell during a period of up or down. They want to wait and gain equity in their home. However, if you are not going to buy, what will you do? Rent? If so, you’re not building equity, you’re not getting tax write-offs, and other benefits of home ownership.

Inventory

In 2007, there were 8.2 months of inventory. Right now there are 3.1 months of inventory available. The market is much hotter now than in 2007 (leading into the Great Recession). Geoff believes that now is a very good time to buy, and not a bad time to sell, either, as inventory levels are so low. Historically, 6 months of supply is an average market. We are now down to 3 months of inventory. He does not see this number climbing anytime soon. Many sellers are not putting their homes on the market now, wanting to wait and see what will be happening. And, while people have to weigh their options, the low inventory can benefit those putting their home on the market.

April 2020 Local Stats

Orange & Sussex Counties

In Orange County, Units Sold were actually better in March than in February. Average Sales Price was way up. In Sussex County, Units Sold and Average Sales Price both coming out at a good solid pace. It will be interesting to see what the stats reflect when we take a look at our next Housing Market Update. At that time we’ll see the impact of Covid closures and stay-at-home regulations.

Housekeeping Items

Panel Discussion

Geoff Green was joined by Ken Flood of Quest Financial Services and Ken Aulicino of Family First Funding LLC. Vikki Garby and Carol Buchanan of Green Team New York Realty and Keren Gonen of Green Team New Jersey Realty represented the real estate agents’ points of view. Discussion ranged from the current state of commercial and residential real estate markets. There was positive feedback on how agents are adapting to the Covid19 regulations and are still able to assist clients and close deals. All three agents spoke of strong, serious buyer interest. Ken Flood discussed the financial market and Ken Aucilino the mortgage industry. Because of the wealth of information and graphics as well as the fascinating panel discussion, it is highly recommended that you watch the webinar. Click here to view the April 2020 Housing Market Update.

Remember to sign up below for the next Housing Market Update

[/et_pb_text][et_pb_agentfire_lead_form form=”contact” _builder_version=”3.18.2″][/et_pb_agentfire_lead_form][/et_pb_column][/et_pb_row][/et_pb_section]

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link