Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

March 2019 Housing Market Update

[et_pb_section admin_label=”section”]

[et_pb_row admin_label=”row”]

[et_pb_column type=”4_4″][et_pb_text admin_label=”Text”]

Green Team Realty’s March 2019 Housing Market Update was presented live on Facebook Tuesday, March 19 at 2 p.m. If you were unable to view the webinar live, you can watch at your convenience by clicking here. Sign up for future updates here.

Geoff Green, President of Green Team Realty, gave a breakdown of both national and local statistics:

National Statistics

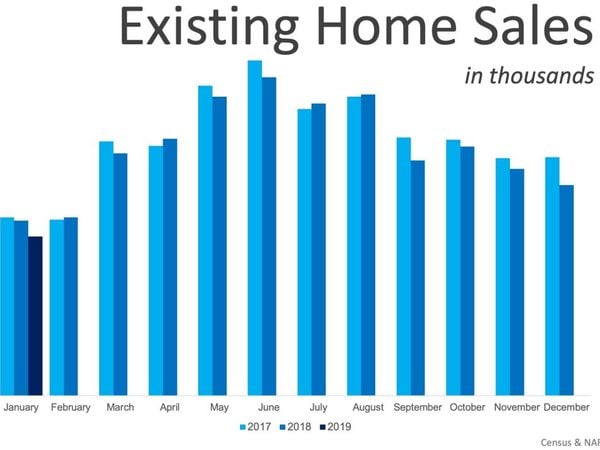

This is a 3-year comparison, 2017-2019. The later the year, the darker the color. January shows a decline in 2018 and 2019. In August, things started to turn in year over year increases.

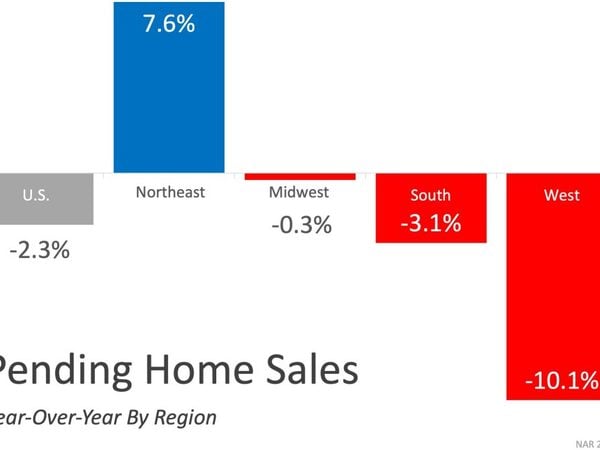

The Northeast is still chugging along, though usually the northeast market lags. However, on the whole, pending home sales are down, region by region.

As far as pricing goes, this is a composite of the top 20 cities in the US. Over the last 10 months and pricing is steadily decreasing. However, it’s more of a soft landing. There is nothing indicative of a “crash.” Historical norms are around 3.6% and we’re around that mark, with 4.2%.

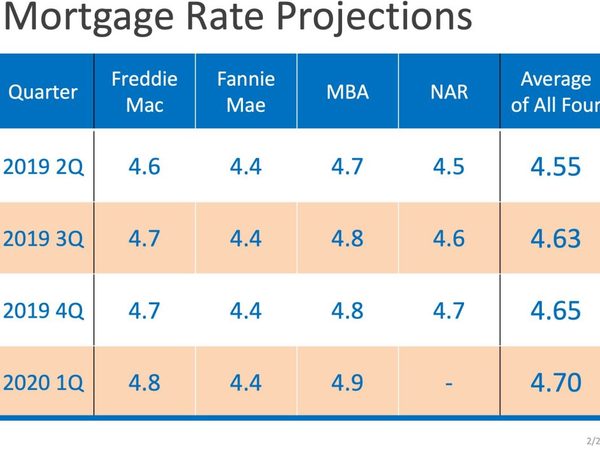

On the mortgage side, here is an average of four entities making projections of where rates will be in 2019. They are projecting that rates will continue to increase, below 5%. Geoff feels this is historically a very low rate. While some in the mortgage industry are projecting a decline in refinancing, money for the resale and construction markets seem to be in good shape.

Local Statistics

Orange County, New York

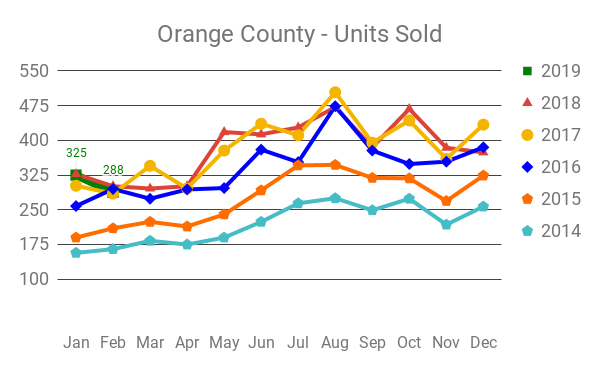

In the year over year comparisons, we’re at or below the last few years, but still hanging in there. However, we’re not in an increasing market.

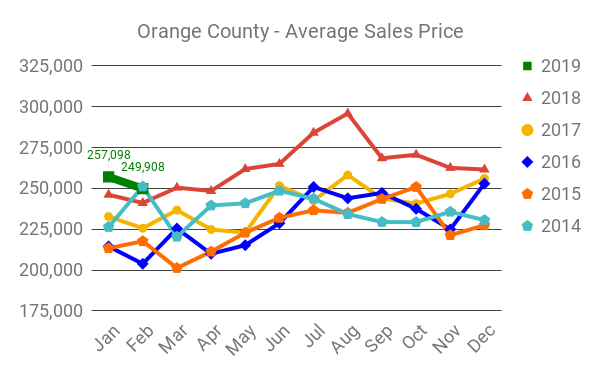

Last year we were in the red all year long. While the stats show year over year increases, this was not our highest February.

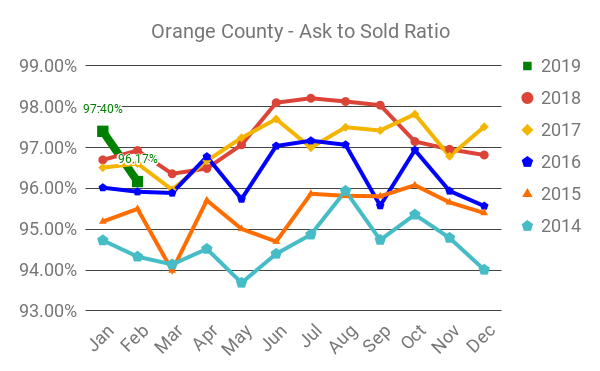

The asked to sold ratio, the last asking price versus what homes are selling for, took a dip in February but it’s easy to see that year over year we continue to see an increase.

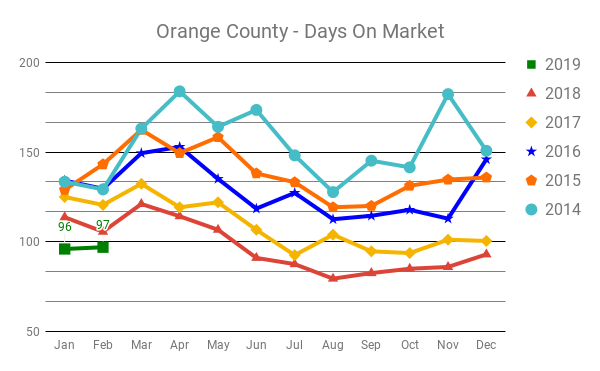

Days in market still indicate a hot market, being lower than any of the previous years shown.

Sussex County, New Jersey

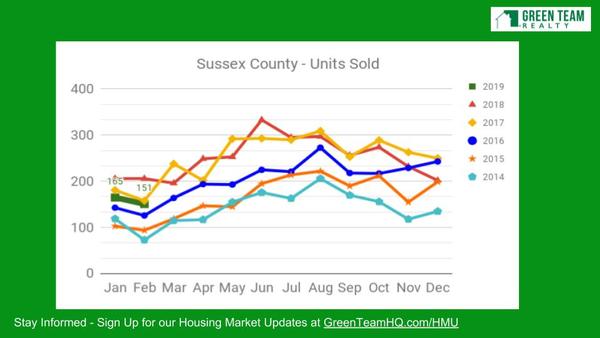

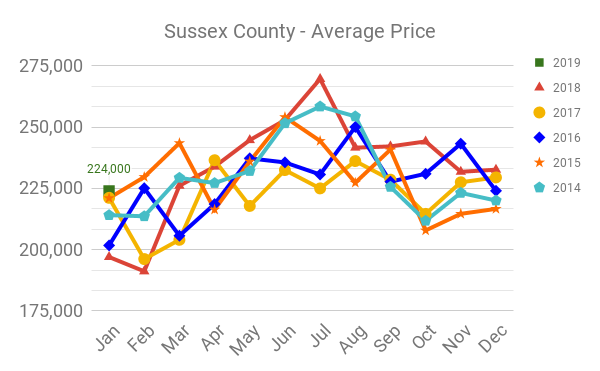

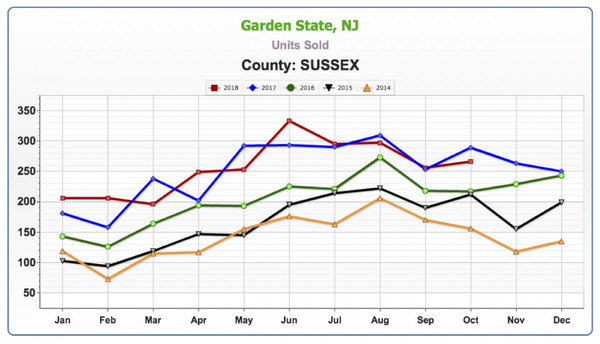

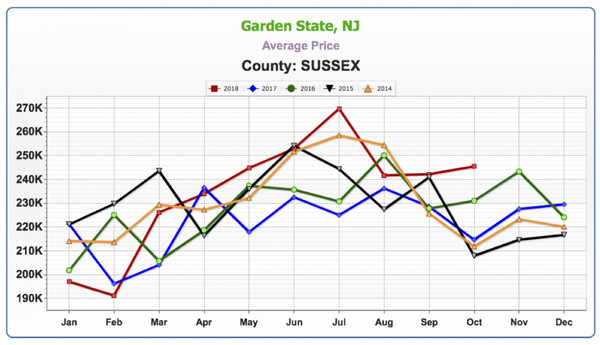

Units sold are down, below 2017 levels.

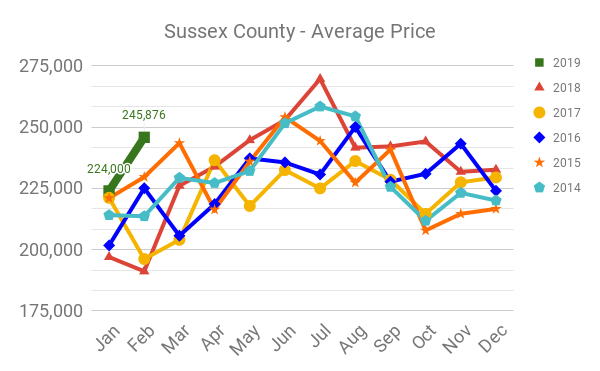

Average price, however, is increasing. We may actually be seeing further increases in price in Sussex, something we didn’t see much of last year.

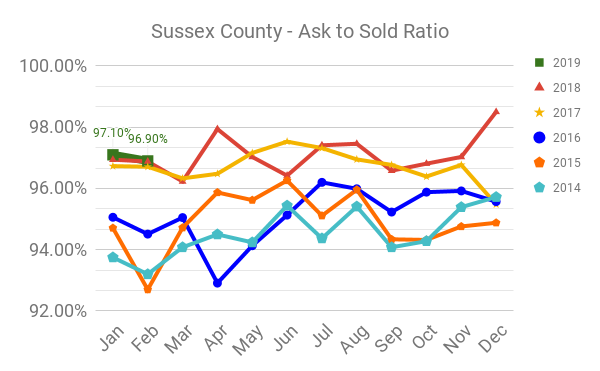

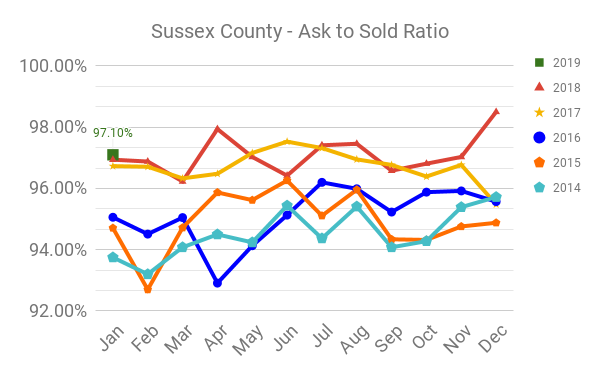

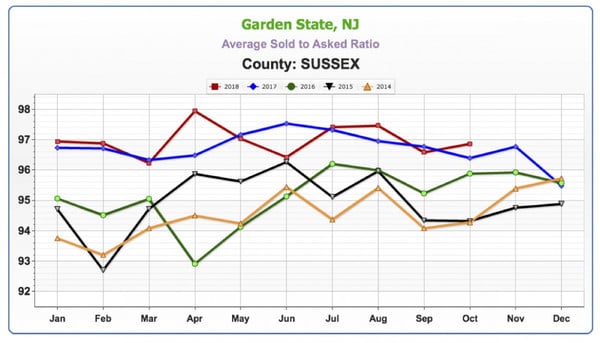

Numbers here are similar to those we saw in Orange County, around 96 to 97%.

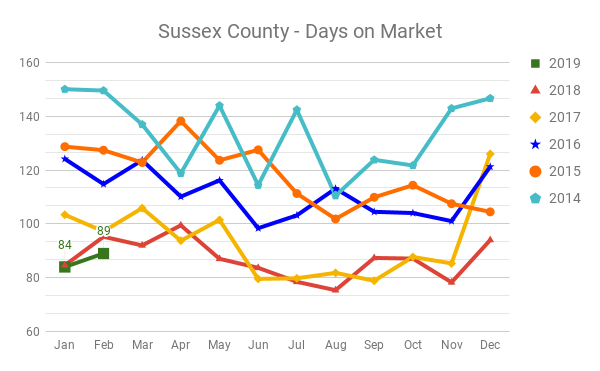

The numbers indicate this is still a hot market.

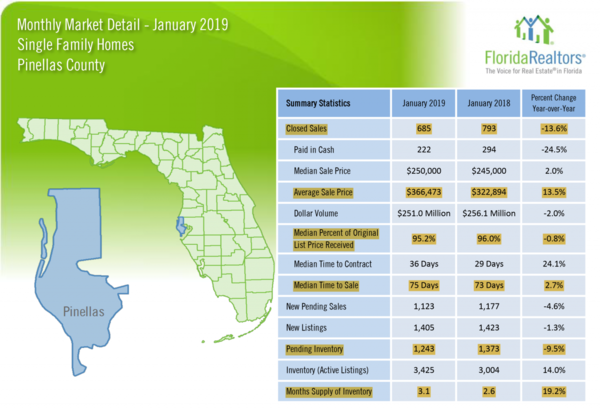

Pinellas County, FL

This month we’re also taking a look at the local market in Pinellas County, Florida.

Year over year stats for January 2019 over 2018 show a wide variation. While the number of closed sales decreased by 13%, prices increased by that same percentage.

ARE SENIOR HOUSEHOLDS REALLY CAUSING HOUSING SHORTAGE?

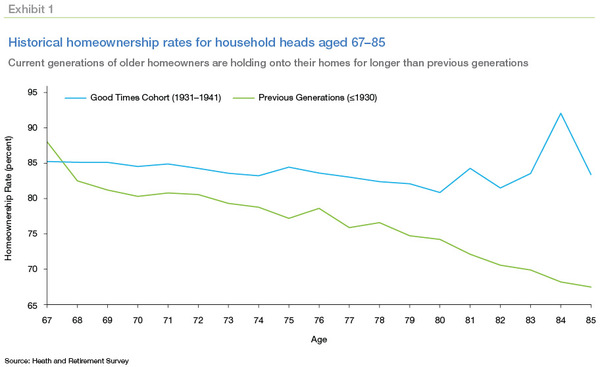

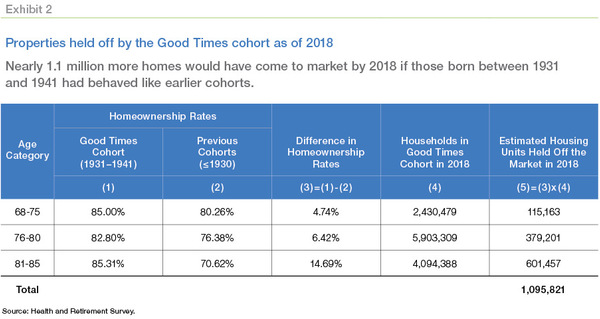

Ali Chamois of Homestead Funding Corp. shared this information with Geoff about the impact of people aging in place. Prior to the Good Times Cohort (those born between 1931 and 1941), people moved out of their houses at a much faster rate.

Exhibit 2 breaks down the number of housing units by age group and shows that 115,200 housing units would have been supplied to the market by respondents aged 68 to 75; 379,200 by respondents aged 76 to 80; and 601,500 by respondents aged 81 to 85.

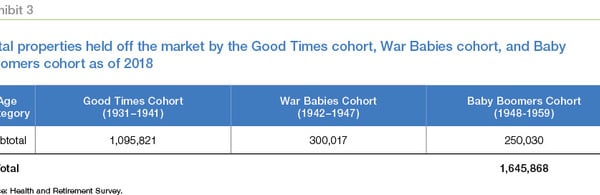

A similar calculation for the War Babies and Baby Boomers estimate that an additional 550,000 homes were held off the market by these cohorts by 2018, as shown in Exhibit 3.

In total, it’s estimated that there were around 1.6 million housing units held off the market by those three cohorts as of 2018. This amounts to 2.1 percent of total owner-occupied housing units in the United States as of 2018.

Meet this month’s panelists:

Geoff Green, President of Green Team Realty, is our moderator. Laura Marie of Keller Williams, St. Petersburg, Florida joined the panel as a special guest. Keren Gonen of Green Team New Jersey Realty, Vikki Garby of Green Team New York Realty and Ali Chamois, Homestead Funding.Corp.who joined the conversation by phone, rounded up the panel.

Geoff opened the discussion by introducing Keren Gonen, who has been a panelist every month. Her feeling has been it’s going to be a strong market in 2019, but that the inventory shortage is still happening; not as many foreclosures, etc. Geoff asked if she is still in this same mindset? Keren replied “Absolutely!” Properties are not being released by banks, who are flipping them themselves. Housing shortage has more to do with number of units going down than buyer demand. Sellers are still sitting on houses, waiting to see how strong the spring market will be.

Vikki Garby joined the conversation, saying much is the same in Orange County. Inventory problem is still out there. Buyers are out there. Properties in good condition, priced right, are going quickly. Investors, experienced flippers and new flippers, are trying to find properties. More REO’s are hitting the market and are going quickly, the ones not being done by the banks. Flippers are out and scooping them out.

Laura Marie saw many similarities with Pinellas County, FL. There were 11 short sales and 31 REOs total for Jan. Ones being sold are not much under market. Still hardcore investors are looking for the right deal. The margins have shrunk… To get ahead of the market you have to get off market. A huge amount of fixer uppers. Investors not wanting to purchase some of these homes because of cost of materials, etc. Pinellas County was developed between 1920 and 1960. Buyers are looking for updated, polished, shiny homes.

Geoff asked Ali if she agreed with the projections for the average 30 year fixed mortgage. Ali brought up that for Fannie Mae and Freddie Mac, rates are based on downpayment and credit scores. These factors impact the rate. Regarding projections, clients ask whether they should lock in rates or hold off… Ali never advises them on that because forecasts and predictions can change due to a variety of causes. Geoff said that Freddie Mac is much tougher now, which may be holding the market steady. There is not a lot of subprime lending. Because not a lot of defaults are happening, credit isn’t tightening up. Ali sees a little loosening up on credit standards.

Regarding Aging in Place, Geoff sees this happening within his own family. Ali stated that overall health is better, support systems are better. People don’t want to leave their homes. The current trend is to provide outpatient services for health care. Per Keren, people are living a lot longer. It seems that we do need more houses. There are also people moving in with other generations.

Parents, adult children and grandchildren, living as extended families. The US is transforming. Laura seeing the same thing in Florida. Downsizing, 55+ communities also allow people to have independence – but less yard care. Vikki said that we have more 2 income families. Grandparents often help with childcare instead of relocating, then kids are taking care of the parents as they age.

THANKS TO OUR SPONSOR…

Green Team Realty’s Housing Market Updates are sponsored by REALLY – Better, Smarter, Faster. A real estate referral network for agents. Learn more at ReallyHQ.com

NEXT HOUSING MARKET UPDATE: TUESDAY APRIL 16 AT 2PM

Stay informed – Sign up for our Housing Market Updates at GreenTeamHQ.com/HMU

[/et_pb_text][/et_pb_column]

[/et_pb_row]

[/et_pb_section]

Vikki Garby – 1st Quarter Sales Leader for Green Team New York Realty

Geoffrey Green, President of Green Team Realty, presents Vikki Garby with the 1st Quarter Sales Leader Award for 2019

Vikki Garby is Green Team New York Realty’s 1st Quarter Sales Leader for 2019

Green Team New York Realty is proud to announce that Vikki Garby is the 1st Quarter Sales Leader. According to Geoff Green, President of Green Team Realty, “Vikki Garby is a very smart and focused Real Estate professional. She is establishing herself as a true leader in the Orange County Real Estate marketplace. Vikki’s analytical abilities have served her well in both Residential and Commercial Real Estate. And both are contributors to her sales success. It’s going to be exciting to watch Vikki grow her Real Estate business. We are extremely blessed to have her as part of our Agency.”

About Vikki…

Prior to entering the world of real estate, Vikki worked for a major bank in New York City as an investment banker. There she reviewed and negotiated complex contracts on a regular basis. During that time, she became a real estate investor, negotiating her own transactions as a buyer. And her love of real estate and skill at navigating its many transactional parts, lead her to obtain her license so that she could help others with their real estate needs. In addition, Vikki has received her Commercial Investment Real Estate Certification. And this further enhances her ability to assist real estate investors and commercial clients.

Vikki had the following to say: “I appreciate this recognition very much. Success in this business is achieved by chugging away every day to help our clients as best we can. Thank you to all my loyal clients for trusting in me and for referring me to your family and friends. You have helped me grow my business to what it is today and I am extremely grateful for that. The support, tools and resources I receive by being a part of Green Team New York Realty make my job that much easier and more rewarding!”

Green Team’s 2019 Launch Competition has blasted off!

Green Team’s 2019 Launch Competition has blasted off. And it looks like this year’s teams are all on board for an exciting ride!

The Launch Competition is about inspiring sales associates to get back to basics, enhancing those skills that lead to the exceptional client service the Green Team is known for. During this yearly event, associates compete individually and on teams. And Team Captains lead the way, motivating and training team members to best utilize the Green Team’s custom-designed customer relationship management system, or CRM.

Meet the Teams

The Masterminds, Warwick, NY Office

Angela Murphy returns again as Launch Team Captain. The team’s goal is to utilize the CRM during the competition, as well as throughout the year for a more organized business. According to Angela, “We have an energetic and supportive team and we truly enjoy each other as team mates.”

Mastermind Team Members include: Anthony Ajello; Al Beers; Janine Blandino; Carol Buchanan; June Cosgrove-Hays; Rich Czubak; Kristen DeRosso; Jennifer DiCostanzo; Barry Ferrari; Tom Folino; Karen Gauvin; Terry Gavan; Chris Gehrlein; Toni Kreusch; Vilma Lawla; Mary Lynch; Krissy Many; Connie Marines; Tiffany Megna; Angela Murphy; Nancy Sardo; Ed Sattler; Denise Schmidt; Susan Stinneford; Gidget Tavares; Lucyann Tinnirello; Bobby Valentine; Linda Vandeweert, and Nicole Willner.

Rock’n’Roll, Warwick, NY Office

Kim Lesley stepped up to volunteer as Team Captain for this aptly named group. According to Kim, “Our strategy is to develop a feeling of support, fun and results!”

Rock’n’Roll Team Members include: Tracey Decker; Kasey Decker; Dean Diltz; Jason Gaer; Vikki Garby; Julianna Green; Joe Green; Anne Hemmer; James House; Rebecca Hundley; Chris Kimiciek; Megan Kimiciek; Pip Klein; Jacque Kraszewski; Kim Lesley; Cam Monaco; Jim Moser; Nick Nocosia; Alan Norberg; Alyson Pulliam; Jane Reilly; Walter Ross; Cynthia Sanford; Tammy Scotto; Tom Shields; Janet Sutherland; Toni Vogel, and Ali Yurchuck.

Gonen’s Greenies, Vernon, NJ Office

Keren Gonen is another returning Team Captain. Their team strategy is to work together to make it happen. And Keren’s team motto is “There is no TRY. There is only DO!”

Gonen’s Greenies Team Members include: Keren Gonen; Alison Miller; Charlie Nagy; Marissa Rossi; Yvette Saldana; Stacey Springer; Barbara Tesa; Ted Van Laar and Pam Zachowski.

Witte’s Wonders, Vernon, NJ Office

Cathie Witte has also volunteered to be a Team Captain. Her team strategy is simple, “Just encouraging each other.”

Witte’s Wonders Team Members include: Jaime Dalton; Heidi Hyland; Jared Kunish; Kim Lasalandra; Sheena Masters; Ann Nussberger; Joyce Rogers; Cathie Witte and Sharon O’Roarke.

2019 Will Be a Great Year for Buyers AND Sellers

Many homeowners believe that rising interest rates and home prices have scared away buyers and therefore have not listed their houses for sale. However, the truth is that buyers who were unable to find a home last year are out in force, and there are even more coming!

NerdWallet’s 2018 Home Buyer Report revealed that:

“Approximately one-third (32%) of Americans plan to purchase a home in the next five years. Millennials are most likely to have such a purchase in their five-year plan (49%), versus 35% of Generation X and 17% of baby boomers.”

As we can see, buyers are optimistic! According to the report, here are the top reasons Americans plan to buy:

The most common reason Americans prioritize buying is that they believe it’s a good investment!

If you’re a homeowner looking to sell, 2019 is the perfect year to put your house on the market. But why?

- Buyers want to buy

- No competition!

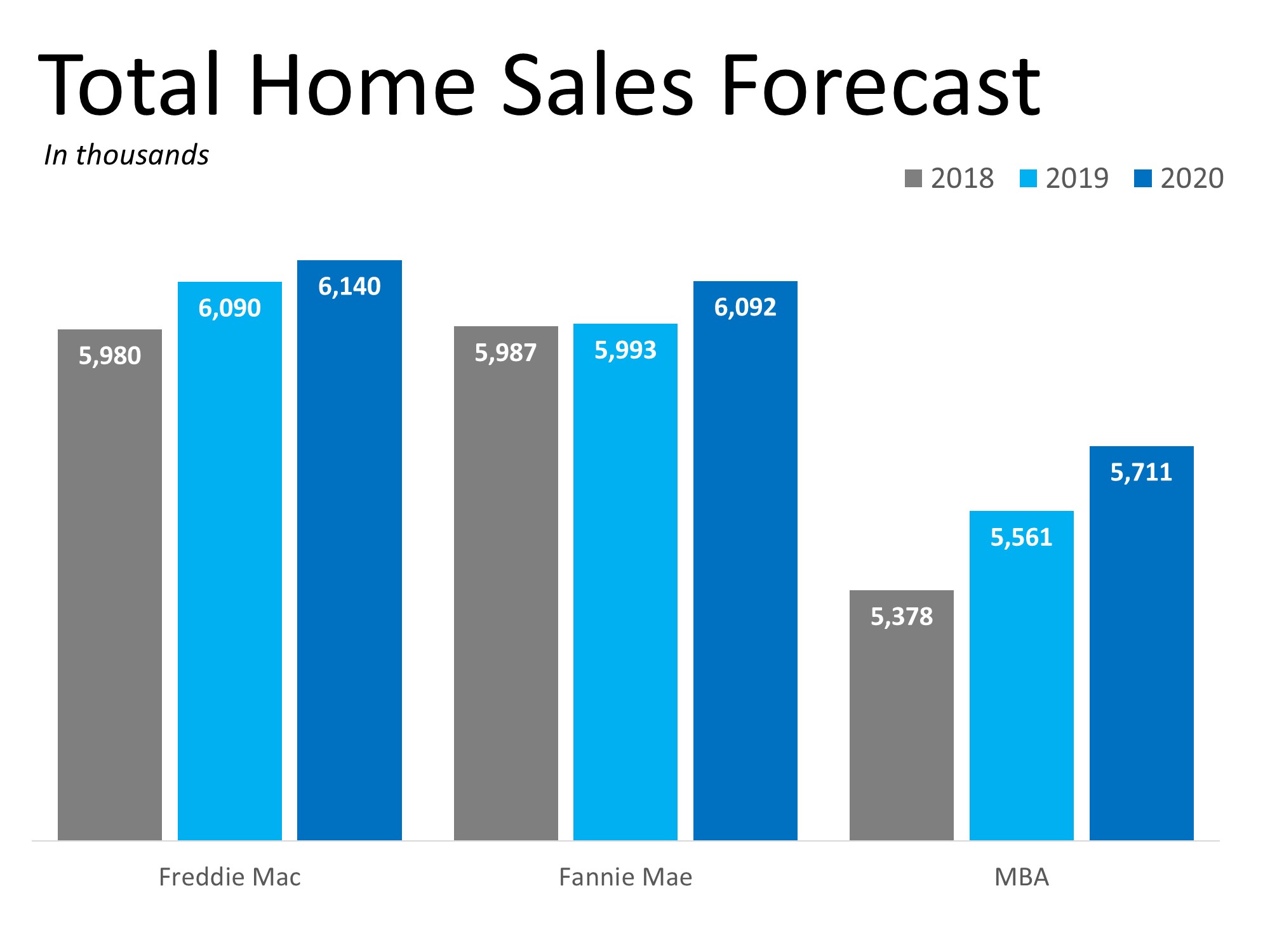

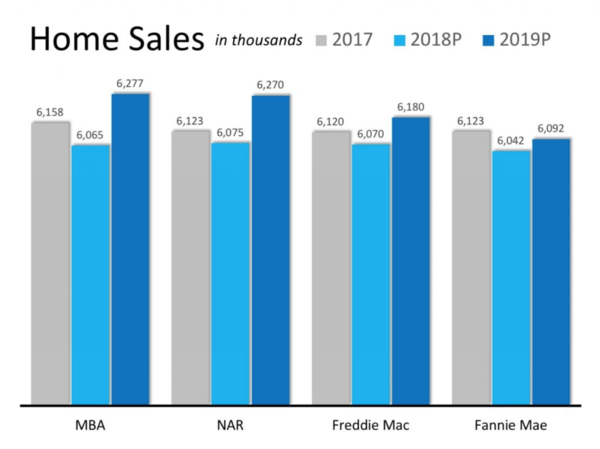

At least 3 of the renowned organizations that report on real estate market trends predict that homeowners are going to wait until 2020 to list their homes, leading to a nice increase in sales (as shown in the graph below).

Don’t wait for a competitive market; be ahead of the curve and sell your house at the best possible price!

Bottom Line

There are plenty of buyers entering the market! Whether you’re a first-time homebuyer or a current homeowner looking to move-up to your next home, get in touch with one of our Sales Agents to discuss your real estate needs!

February 2019 Housing Market Update

Green Team Realty’s February 2019 Housing Market Update went live on Facebook February 12 at 2 p.m. If you were unable to view the webinar live, you can watch it at your convenience by clicking here. Sign up for future updates here.

Meet this month’s panelists…

Moderating the Market Update is Geoffrey Green, President of Green Team Realty. In addition, Geoff presents national statistics as well as local updates for Orange County, NY and Sussex County, NJ. This month he is joined by Jennifer DiCostanzo of Green Team New York Realty, Michael Giannetto of Residential Home Funding, and Keren Gonen of Green Team New Jersey Realty.

The National Perspective

According to Geoff, this time last year no one was really talking about a slowdown in the housing market. The conversation was more about how fast and how far everything would go. A few months later some chinks in the armor appeared. And now we’re looking at national numbers, comparing 2018 to 2017, Sept – Dec, all below the year over year numbers from 2017. The year over year drop by each region, 10.3% overall, 6.8 in the northeast, 15% in the west, etc., is also of interest.

A quote by Mike Fratantoni, chief economist for the MBA, is relevant: “The spring home buying season is almost upon us, and if rates stay lower, inventory continues to grow, and the job market maintains its strength, we do expect to see a solid spring market.” In Geoff’s experience, this just seems to be a very slow moving market pace; unlike the fast paced ups and downs of the stock market. From the perspective of number of units sold, we’re clearly trending down. It seems that every region in the U.S. is on that same path.

Over the last 12 months, housing supply was in the red, meaning there was a lack of it. In June there was a turnaround, with more supply. Some people are saying that transactions are going to catch up again, with more supply becoming available. However, Geoff is not entirely sure that is going to happen at this time. While he does believe there will be a strong market in 2019, the real debate is what is going to happen in 2020, 2021, 2022.

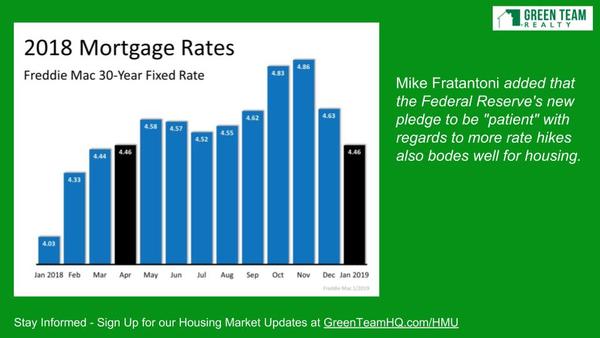

There was a period of time when rates were climbing, but now they are almost 1/2 a point lower than they were in October, November. The Fed is pledging to be patient with raising short term rates, as they’re seeing indicators of a potential recession on the horizon. They’re slowing down anticipated rate hikes which had been slated at the end of last year.

The Local Perspective – Orange and Sussex Counties

Units Sold

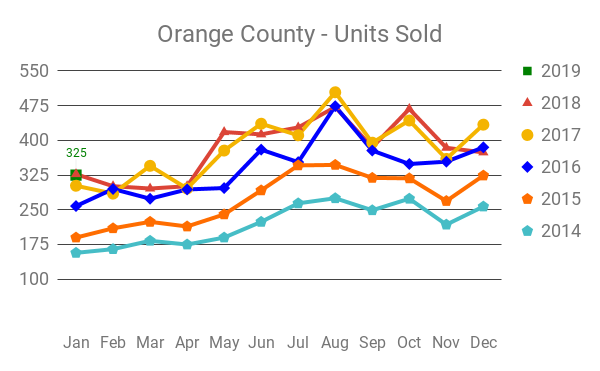

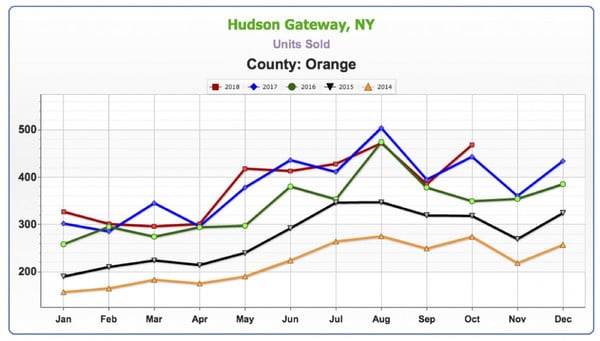

There is a lot to glean from the local stats, even as they play out on the national stage. In January, while the same as in 2018, it’s still higher than the previous four years. This is a good indicator.

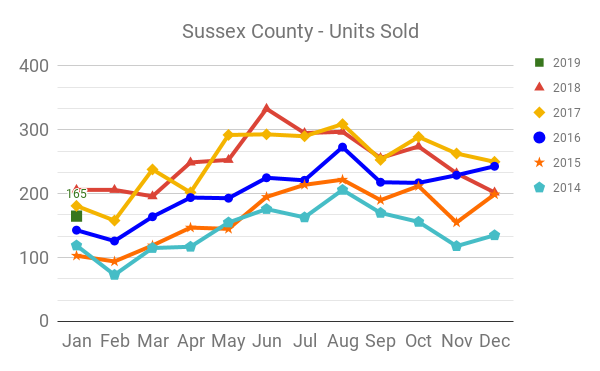

In Sussex County, we’re just above 2016, but below 2017 and 2018, for the month of January.

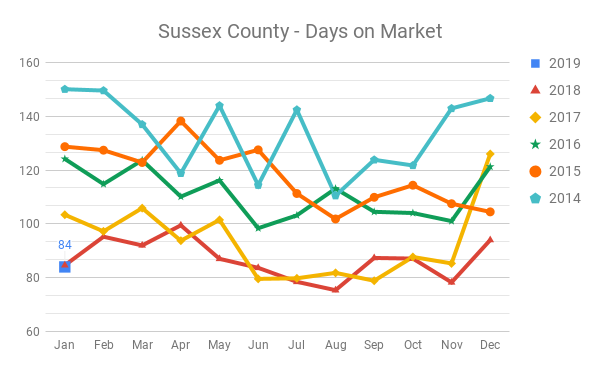

Days on Market

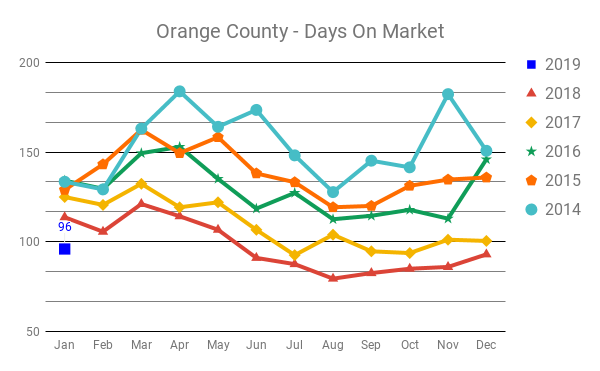

This stat is an indicator of how fast things are moving. In Orange County, January 2019 is the lowest it’s been for this month in five years.

In Sussex County, the number of days on the market is tied for the lowest it’s been in five years.

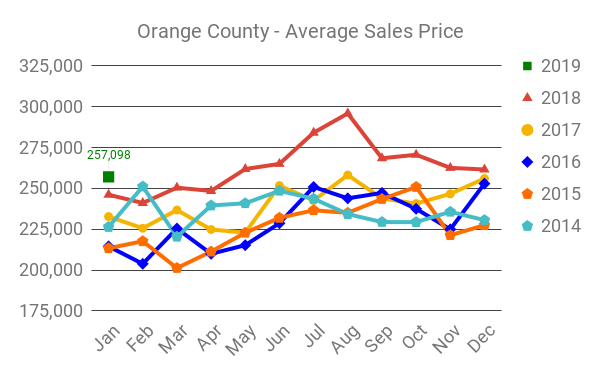

Average Sales Price

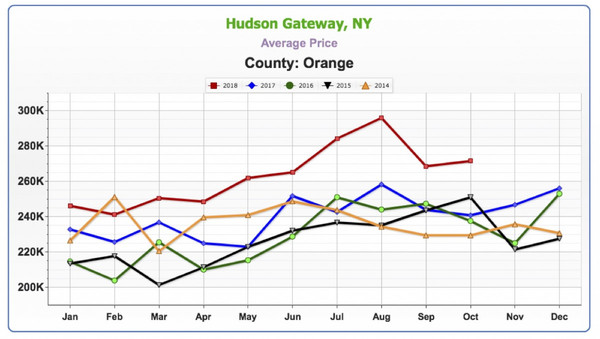

As Geoff has mentioned in the monthly housing market updates, price lags activity. Price appreciation should be seen throughout the first half of 2019, but he believes in the second half of the year, prices will start to come down.

The highest peak was in 2018. January 2019 has the highest price for that month in the last five years. In general, higher prices should bring out more sellers, which should create more inventory and allow more units to sell.

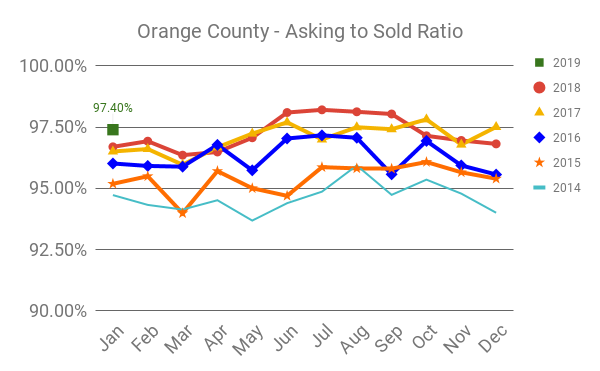

Asking to Sold Ratio

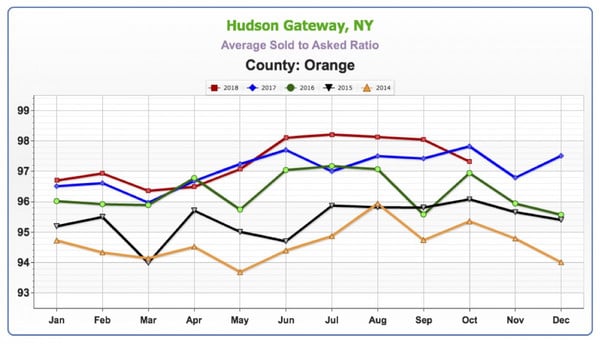

This is the ratio of the last asking price versus where are homes selling. This shows on average how much sellers are having to negotiate off the price of their property. This is the highest ratio for this month since 2014.

This number is strong in Sussex County as well as in Orange. The numbers are still showing a strong market.

And thanks to our Sponsor…

The Housing Market Update is sponsored by REALLY – a better, smarter, faster real estate referral network for Agents. Learn more at ReallyHQ.com.

Panel Discussion:

Geoff introduced Jennifer DiCostanzo of Green Team New York Realty, the top producer in the company. According to Jen, supply and demand are a real challenge. On the Orange County side, sellers are afraid to list because they have nowhere to go if they’re shopping in the same market. If sellers are relocating, it’s easier for them to let go as they don’t have the same issues and can secure housing. She is welcoming this market because she finds buyers to be more educated and sellers more realistic. Jen is hoping to see the market open up.

Keren Gonen of Green Team New Jersey is a regular panelist on the Housing Market Update. Her thoughts on the January sales numbers were that the totals were a reflection of inventory not being available. Sales were higher last year as there was more inventory to sell. It still is a seller’s market due to lack of inventory. And there are several sellers on the fence, waiting to see what will happen in the near future. There is hope that these sellers will soon be listing.

According to Geoff, the lack of inventory is a real problem. Nationally and locally, seeing the numbers going down, it seems like less people are buying homes. There has been a lot of frustration for some trying to buy a home, and some may have rented when they couldn’t find anything. Some may now be locked into leases.

What will the market look like over the next few years?

Geoff asked Jen what she thinks the market will look like in 2020, 2021,2022 as far as pricing, activity… She feels that we’re at a more stable point now; that it will not be quite as erratic. After the last downturn, when prices finally started going up in 2016, 2017, it was a very poignant time. If you bought at the height of the market, you could actually sell and recoup equity. That is the silver lining in helping sellers make that decision when they need to sell. And now is that time. If job growth is good and stable and interest rates make home buying and financing affordable, the market should stay at a steady pace. Real estate is fueled by circumstance, regardless of the market. People will always need to buy and sell. If we can give leverage to the market by educating our buyers and sellers and strategically strategizing, you put them ahead of the game.

Geoff asked if Jen had been referring to those buying homes in 2006, 2007 and 2008 when she talked about recouping equity. Jen replied that basically, it would go short. Jen purchased her own home in 2007, and almost immediately she would have been unable to sell her home for what she bought it for. Where we are now is a good time to step back and walk away with equity. Whether you’ve been in your house for 10 years or 50 years, you’re going to recoup on your investment. Geoff recalled the downturn. There was a huge loss, almost 50% of the number of transactions from 2006 to 2008 disappeared, and it was a very difficult time. He found Jen’s point valid; that people should finally be able to move on and move into something else should they want to.

Geoff then asked for Keren’s 2-3 year view. She hopes that we remain in a strong market. With rates coming down, she sees more people who had been renting once again looking to buy. However, the issue remains inventory. Keren sees growth in the area, with people moving to Sussex from other counties in New Jersey and some from New York, attracted to lower taxes, etc. Buyers are more educated, but so are the sellers. Therefore you see homes that are priced correctly. She believes the market will remain good for at least a couple of years.

Mortgage trends

Mike Giannetto of Residential Home Funding was asked if he sees the trend of lowering interest rates continuing. Mike replied he hopes so. There has been a decrease in interest rates. There is a global slow down. The economies in China and Europe are getting weaker. We’ve had a downturn in our rates because we are the safest investment at this point. This definitely had an affect on mortgage backed securities and hopefully the stronger US market will continue.

Geoff recapped. The more risky other assets are, the more money wants to seek a haven in bonds, which drives down the rate that people need to give to attract people to buy those bonds, which ultimately lowers interest rates on mortgages. Instability and uncertainty around the globe actually can be good for mortgage rates to come down.

We know a recession will be coming; just don’t know when. Those that went through the last downturn in the housing market are waiting “for the other shoe to drop.” As long as there is no global meltdown economically, we should be okay. The market is pretty healthy. Geoff has heard of some subprime lending happening; he asked Mike if he’s seen it occurring at levels similar to 2005-2007. Mike replied that there are safeguards in place, even as some new products are being introduced. Some of the products are necessary in order for some people, such as self-employed, to purchase a home. The money behind these products is portfolio money or hedge fund money, which is why the loans are scrutinized. The banks are lending their own money, so are therefore quite careful.

To reach the panelists:

Michael Giannetto, Residential Home Funding: 845-496-0836, rhfunding.com/michaelgiannetto

Jennifer DiCostanzo, Green Team New York Realty: 917-916-9995

Keren Gonen, Green Team New Jersey Realty: 551-262-4062

The next Housing Market Update will be held on Tuesday, March 19 at 2 pm. Stay informed and sign up for updates at GreenTeamHQ.com/HMU.

Tom Folino – This former teacher is getting straight A’s from his clients

Upon retirement, this well-respected teacher and coach decided to turn his attention to a new career – real estate. When Tom joined the Green Team, Geoff Green said, “There might not be a better person to get into Real Estate in the Warwick market than Tom Folino. A true example of someone who has a huge network, is extremely likable, and always acts with integrity. What people might not know about him is that he is extremely diligent in his follow up and a very smart guy to boot. We are extremely blessed that Tom has decided to join our company.”

Geoff’s predictions are coming true. In his first year as a sales associate with Green Team New York Realty, Tom received an Honorable Mention Award for 2018, for achieving $1.5 to $3 Million in sales volume. And, while awards are good, the true reward for Tom is knowing that he has gone above and beyond for his clients. It’s now the former teacher who is being “graded,” and by the looks of it, he’s getting straight A’s!

A Special Transaction

A very special transaction was with Claire and Nick Previdi. Claire was a former student of Tom’s at Kings Elementary School. They purchased their first home in Chester, NY. Tom was also the listing agent for this home! This property was listed on December 4, 2018, and closed on January 18, 2019.

Client Testimonials

Barbara and Rob Lattimer – Warwick, NY 10990 — May 2020

Thomas Folino: Realtor Extraordinaire We recently purchased a condo in Warwick long distance. Tom guided us through the process with patience, professionalism and so much more. The Home Inspection needed to be done. We were 1200 miles away. Tom oversaw that. Major repairs were needed for the heating and a/c system. He supervised that work. Since we have taken ownership we have received texts from Tom letting us know all is well. It is obvious Tom loves his job and genuinely cares for those he serves. Thank you, Tom Folino!

Don Denmead – Warwick, NY — March 2020

Tom did an outstanding job in guiding me through the sale of my rental property. He was able to uncover multiple buyers even though the property had not been officially listed. Additionally, he explained the process and helped with the paperwork which optimized the time it took to complete the sale. I would recommend him to a friend and plan to use him again when I decide to downsize in the future.

Greg Maher – Warwick, NY — March 2020

I have known Tom Folino for roughly 20 years as he was my former elementary school physical education teacher. When I learned Tom was doing real estate I knew he would be the right person to guide me through my first home purchase. I wasn’t wrong. Tom was knowledgeable, compassionate, and understanding of all the questions I had. He regularly called to make sure I had everything I needed. I’m pleased with my new home and glad we could close in nearly 4 weeks. Job well done !!!

Evelyn Rosado – Greenwood Lake, NY — December 2019

Thomas is responsible, dedicated, respectful. He’s someone you feel comfortable working with. I’m very grateful I was able to count on him. I would definitely highly recommend his services.

Troy Edwards & Dashika Stewart– Monroe, NY — October 2019

Working with Thomas Folino was the best choice my fiancé and I could’ve ever made in choosing a real estate agent. We were both first time home buyers looking to relocate out of NYC. Thomas was so kind and patient each step of the way and assured us that everything would be fine within the process. He even went out of his way to connect us with a local mortgage broker who did a phenomenal job. We ended up closing on a three-bed condo in Monroe that we absolutely love. I would totally recommend Thomas to anyone and will for sure use him again. If he ever retired I would ask him to be my agent again one last time. 2019

Patricia and Thomas Lorgan – Warwick, NY — July 2019

We’ve known Ton Folino for over 40 years and both had the pleasure of teaching him. We were able to see his growth into an outstanding young man. Tom also became a teacher, and once again, we saw his growth as both a teacher and coach. He was our son’s basketball coach, and he was our other son’s supervisor as a swimming instructor. Tom was a wonderful and caring role model for not only our sons, but for all those who were fortunate enough to come in contact with him.

As a realtor, Tom continues to be just as outstanding. He worked tirelessly for us as we sold our home. Living in the same house for over 50 years and raising our 2 sons there meant we had some long-lasting memories, which were not easy to give up. Tom guided us through all those emotional times, and he made the transaction of going from homeowner to home seller as smooth and caring as possible. We had complete trust in Tom, and as always, never disappointed us. Whatever the highest rank possible for a realtor, Tom Folino is a deserving candidate. I wish all those who decide to sell their loving home to be as fortunate as we were to have Tom guide them on their emotional journey. Simply put, Tom Folino is the BEST !!!!

Brian Cisek – Warwick, NY — Mar 2019

Tom was very professional and easy to work with. He found me a great place in the location I wanted.

Miriam Stanford-Cusack– Greenwood Lake, NY — Mar 2019

We happened on Tom while wandering beautiful Warwick and knew from that moment he would be amazing! He is so patient and genuine. Tom found us exactly what we were looking for and was personable and informed. The whole process was practically stress-free and I love the place we found. I would recommend him!!

Mary Cusack– Greenwood Lake, NY — Mar 2019

Tom was knowledgeable, honest, always good-natured, and very hard working. He never stopped looking for possible places that might meet our needs and he did accomplish it. Tom found a beautiful place that exceeded our expectations. He negotiated a great price for us as well. Tom was always available when we had questions or requests. We had had previous experiences with realtors and Tom was a breath of fresh air!!! We’d recommend Tom without hesitation to anyone in the future!!!

Claire and Nick Previdi – Monroe, NY — Jan 2019

We are so pleased with our experience working with Tom to purchase our first home! He guided us through the entire process and was always available to answer any questions we had while responding quickly to calls and texts. I couldn’t believe how fast we closed on our house! Tom worked hard for us and always made sure we felt comfortable and understood what was happening at every step along the way. He immediately put us at ease as first-time homebuyers with his kind and personable nature. We highly recommend Tom for anyone looking to buy a house!

Joe LaBarca – Greenwood Lake, NY — Jan 2019

I met Tom Folino from Green Team Realtors when I decided to sell my home. Tom was very personable and upbeat about the process. Our home went up for sale in July and closed in Nov. He worked hard on selling our home and his marketing skills and negotiations were the best. We had lots of conversations about selling the house. He listens to all that is said to him He is fantastic. BIG Thank You, Tom. With his help, we are also in our new home 2500 miles away in Nov. also and I highly recommend Tom if you are buying or selling a house

Nicholas Mazzella – Warwick, NY — Dec 2018

I am so thankful to Mr. Folino, he really helped me find and get a place that I absolutely love, answering all questions, and putting in the time needed to help me. He was always in my corner from start to finish keeping me up to date and informed about any available homes and getting showings. Tom’s a hell of a real estate agent and will give you nothing but the best in service and work his tail off to get you what you’re looking for. Truly a pleasure to work with.

Kathleen Cisek – Warwick, NY — Dec 2018

I’ve never worked with a real estate agent as skilled and kind as Thomas Folino. He didn’t waste my time with rentals that weren’t for me, and found me the perfect house for rent based on the guidelines I gave him from price, number of rooms, to the bright kitchen. Tom knew exactly what I needed without my embellishing. As a woman, sometimes agents take advantage & waste time, but I’m happy to say Tom is not one of them! I was very happy with my experience. Tom was very thorough and helpful with any questions I had regarding paperwork, state regulations, rental procedures, the house, landlord & neighborhood. He helped me put in a strong application and the landlord chose me. With this competitive market, when I buy a house in the future I will definitely contact him. Thank you, Tom!

Joanne Haberlin and William Schwartz – West Milford, NJ — Dec 2018

Mr. Folino is the epitome of professionalism. He had a great knowledge of this area and several others. Tom also had the patience of a saint with my husband and I being so unsure of what exactly we really wanted. He stuck with us found us exactly what we needed and when this lease is up we will be using him again hopefully to purchase versus rent this time. I would highly recommend using him to anyone renting or purchasing!

Alberto Mata – Suffern, NY — Dec 2018

Mr. Folino is a great human being. Always ready to help in any way he can. I will highly recommend him as your realtor. He will always go above and beyond to satisfy your needs.

Scott and Victoria Cable – Washingtonville, NY — Nov 2018

Tom did a great job of helping us purchase our first house. He is a great negotiator and does a great job of communicating with the listing agent to expedite the whole entire process. He was very knowledgeable and informative which was fantastic since this was our first home. Tom is always there for us, responding to text or calls quickly no matter the time or the day! We went through other realtors before Tom and once we met Tom it was night and day in quality of service. I will recommend Tom a thousand times over!

Amanda Calabrese – Warwick, NY — Jul 2018

I just wanted to reach out with some positive feedback regarding one of your agents, Tom Folino. I’m not sure if this is the best forum to send this to you, but wanted to start somewhere. My husband and I have been working with Tom since April and he has shown us nothing but dedication, hard work, positivity, and communication. Tom made himself available to us even on his own personal time and followed up with every question in a very timely manner. I have had a few experiences with other realtors and Tom, by far, has exceeded all of these other experiences. Although we haven’t bought a home yet with Tom I would not hesitate to use him in the future and would highly recommend him to everyone looking for an agent in Warwick, New York. Please let me know that you received this email and would love to put this in a more formal letter if that would be helpful. Thank you for your time, Amanda Calabrese

This post has been updated 6/16/2020

How to Get a Better Perspective on Affordability

Headlines spotlight the fact that buying a home is less affordable today than it was at any other time in more than a decade. Those headlines are accurate.

Understandably, buying a home is more expensive now than immediately following one of the worst housing crashes in American history. Over the past decade, the market was flooded with distressed properties (foreclosures and short sales) selling at 10-50% discounts. There were so many that this lowered the prices of non-distressed homes in the same neighborhoods. As a result, mortgage rates were kept low to help the economy.

Prices have since recovered. Mortgage rates have increased as the economy has gained strength. This has impacted housing affordability. However, it’s necessary to give historical context to the subject of affordability.

Two weeks ago, CoreLogic reported on what they call the “typical mortgage payment”. As they explain:

“One way to measure the impact of inflation, mortgage rates and home prices on affordability over time is to use what we call the ‘typical mortgage payment.’ It’s a mortgage-rate-adjusted monthly payment based on each month’s U.S. median home sale price. It is calculated using Freddie Mac’s average rate on a 30-year fixed-rate mortgage with a 20 percent down payment…

The typical mortgage payment is a good proxy for affordability because it shows the monthly amount that a borrower would have to qualify for to get a mortgage to buy the median-priced U.S. home…

When adjusted for inflation, the typical mortgage payment puts homebuyers’ current costs in the proper historical context.”

Here is a graph showing the results of CoreLogic’s research:

As the graph indicates, the most recent calculation remained 28% below the all-time peak of $1,275 in June 2006. That’s because the average mortgage rate at that time was 6.68%. As seen in the graph, both today’s typical payment and CoreLogic’s projection for the end of the year are less than it was in January 2000.

Bottom Line

Even though home prices are appreciating at a slower rate, home affordability will likely continue to slide. However, this does not mean that buying a house is an unattainable goal in most markets. It is still less expensive today than it was prior to the housing bubble and crash.

Get local housing market updates – sign up to receive the Green Team’s Housing Market Update Report.

Green Team New Jersey Realty is #1 in Vernon

Green Team New Jersey Realty is the #1 real estate office in Vernon* and they couldn’t be prouder.

Some of Green Team New Jersey Realty Partners share their thoughts

According to Equity Partner Charles Nagy, “2018 was an exciting year for Green Team New Jersey Realty on a number of fronts. First and foremost, it was a year of great accomplishments for the team. Not only did we bring on some new and experienced talent, but we also bought our own office building. And, as a result of the team effort, we ended the year as the #1 real estate office in sales volume and transactions in all of Vernon, NJ after only our second year in business. It is exciting to see what we accomplished as a team for the entire year.”

Kim Lasalandra, Managing Broker, described how she felt. “I’m ecstatic! To be the #1 office in terms of sales volume within two years of opening our doors is truly remarkable. And it’s a tribute to the incredible work ethic and determination of our sales associates.”

Geoffrey Green, the founder of Green Team New York Realty and a partner in Green Team New Jersey Realty, shared his thoughts. “I’m very proud of everyone at Green Team New Jersey Realty for taking Green Team Realty’s model, bringing it to Vernon, growing it, and achieving #1 status. I just can’t wait to see what 2019 brings!”

Green Team Realty’s dedicated approach…

Green Team Realty’s dedicated approach has proven that the results are impressive when you provide productive, dedicated agents with continual training and support, a culture that values clients through excellent service and an appreciation program, and an array of competitive advantages. Furthermore, Green Team Realty’s commitment to local community and charities is another aspect that attracts like-minded real estate professionals.

Green Team New Jersey Realty’s new office is located at 293 Route 94, Vernon, NJ. To learn more, visit GreenTeamHQ.com or call 973-814-7344.

*As compared to all GSMLS Offices located in Vernon Township by closed sales volume for the time period of 1/1/18-12/31/18.

How Does the Supply of Homes for Sale Impact Buyer Demand?

How Does the Supply of Homes for Sale Impact Buyer Demand?

The price of any item is determined by the supply of that item, as well as the market’s demand for it. The National Association of REALTORS (NAR) surveys “over 50,000 real estate practitioners about their expectations for home sales, prices and market conditions” for their monthly REALTORS Confidence Index.

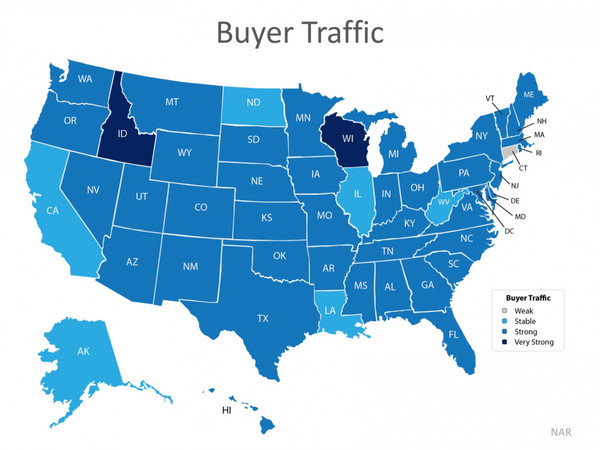

Their latest edition sheds some light on the relationship between seller traffic (supply) and buyer traffic (demand).

Buyer Demand

The map below was created after asking the question: “How would you rate buyer traffic in your area?”

The darker the blue, the stronger the demand for homes is in that area. The survey showed that in 38 out of 50 states buyer demand was slightly lower than this time last year but remains strong. Only six states had a ‘stable’ demand level.

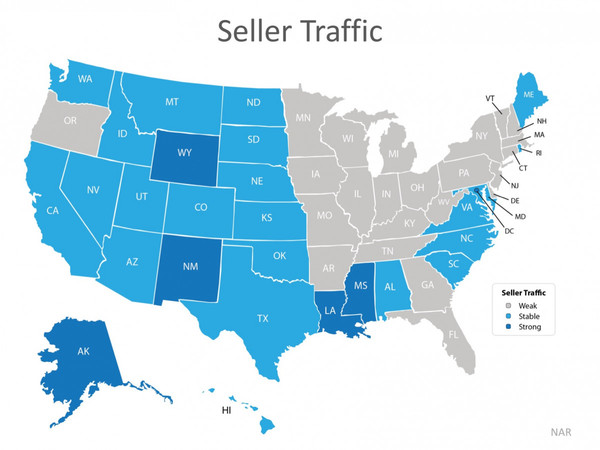

Seller Supply

The index also asked: “How would you rate seller traffic in your area?”

As you can see from the map below, 23 states reported ‘weak’ seller traffic, 22 states and Washington D.C. reported ‘stable’ seller traffic, and 5 states reported ‘strong’ seller traffic. This means there are far fewer homes on the market than what is needed to satisfy the buyers who are out looking for homes.

Bottom Line

Looking at the maps above, it is not hard to see why prices are appreciating in many areas of the country. Until the supply of homes for sale starts to meet buyer demand, prices will continue to increase. If you are debating listing your home for sale, let’s get together so I can help you capitalize on the demand in the market now!

Stay current with your local Housing Market New by signing up for our Housing Market Update Monthly Report.

November 2018 HOUSING MARKET UPDATE

The Green Team’s November 2018 Housing Market Update was held live on Facebook Tuesday, November 13 at 2 p.m. If you missed the live webinar, you can view it at your convenience by clicking here.

You can also sign up for future updates at GreenTeamHQ.com/hmu.

Meet this month’s Panelists…

Geoffrey Green , President/Broker of Green Team Home Selling System, moderates the monthly webinar and presents the national stats, as well as the market updates for Orange and Sussex Counties. This month he is joined by Pam Zachowski and Keren Goren of Green Team New Jersey Realty and Vikki Garby, Green Team Home Selling System, Warwick.

Joe Moschella, Branch Manager and Vice President of Lending, and Amy Green, Vice President of Lending, of Guaranteed Rate discuss market updates from a mortgage industry perspective.

The National Outlook

According to Geoff Green, it’s a very exciting time in the housing market right now as we’re starting to see some shifts. We’re experiencing all-time highs reminiscent of 2008 over the last 18 months. It does seem like things are cooling off. According to Michael Fratantoni, Chief Economist of the Mortgage Bankers Association, he expects that home sales growth will pick up again over the next year, even with somewhat higher mortgage rates, though the pace of price growth will likely slow.

Despite the fact that national and local numbers indicate that the velocity of homes selling is actually slowing, Fratantoni and some others are predicting that it is going to increase in 2018. So, it’s not that appreciation is going down, it’s just slowing down.

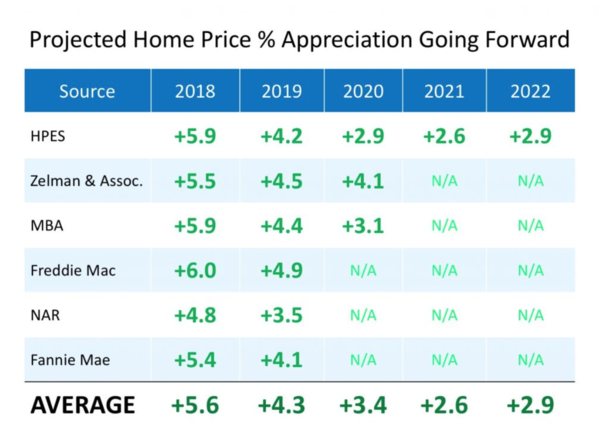

The Mortgage Bankers Association, National Association of Realtors, and Freddie Mac, with the exception of Fannie Mae, all are predicting increases over the past two years. All are predicting increases over the past year. For the most part each of these organizations wants the housing market to continue to grow. Geoff reminds us that it’s in their best interest. It’s important to be aware of the source of information. During the downturn In 2006, 2007 and 2008, during the downturn, some organizations were putting out information that did not accurately portray what was happening. However, you can rely on the Green Team to put out information that is accurate and honest.

In projections for 2018 through 2022, everyone seems to have a positive outlook that the market will continue to appreciate. Just at a slower pace.

November 2018 Housing Market Update – Orange County

Units Sold

While this is hyper local, it is reflective of the 2018 national numbers. While prices may increase and decrease, depending on inventory, units sold have been a mixed bag this year versus last year. It’s been up, it’s been down.

Average Price

Geoff has found that price always lags activity, according to his observations over the past 14 years. If you start to see a slowdown in activity, 6 to 8 months later you’ll start to see a slowdown in the rate of price increases.

Sold to Asked Ratio

This is telling you at what percent of the asking price your home is selling for. The closer you are to 100%, the hotter the market. While this took a little dip recently, it is still at very high levels.

November 2018 Housing Market Update – Sussex County

Units Sold

This is a small data sample that is still reflective of what is happening nationally. Again, it’s a mixed bag, up, down, then often flat.

Average Price

Average price never really gained a tremendous amount of traction, as compared to Orange County, where there had been increases in price.

Sold to Asked Ratio

This looks similar to what is happening in Orange County.

Panel Discussion

The Sales Associates Points of View

Geoff asked Vikki what changes she’s seen since she was last on the panel about 4 months ago… Vikki agreed that she has been seeing a little bit of a slowdown, part of which she believes is due to timing. Many families time their house hunting to coincide with the start of school. However, what she’s finding is a lot of people are looking for land. Historically, we’ve had low inventory compared to the number of buyers, And, as existing house prices go up, more people are starting to consider new construction. Housing starts will be up 9% beginning of the coming year. So there is still a lack of inventory.

Pam also sees a slowdown. More people are looking for homes, but between the low inventory, the start of the school year, people are taking their time. She still sees investors trying to buy and flip homes but finding it harder and harder to find that good deal that makes it worthwhile.

Geoff then asked about appraisals. Are there issues with properties appraising, or are there now enough comps in the marketplace? Keren has not seen any problems recently. They’re all coming in at asking and a little bit above. One thing she has noticed is Sellers asking for CMA’s or listing presentations, more than she had over the summer. Keren always advises clients that we only know what the market is right now and can’t tell where it’s going. She lets them know that low inventory makes it a good time to put their home on the market, as opposed to waiting for Spring, Geoff replied that sellers that were holding off putting their home on the market may now decide to take a chance, seeing that the market is cooling off a little. This may ultimately bring more inventory and more transactions to the marketplace as a whole. There are still many buyers out there, anxious to find a home.

A Mortgage Industry Point of View

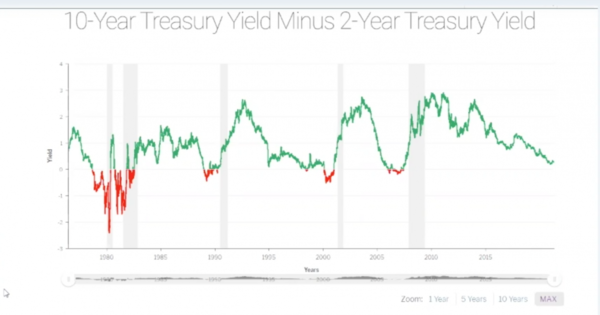

According to Joe Moschella, over the last 5 months they’ve seen a steady rise in interest rates. The year started with a 10-year treasury note at 2.21% and this week it was 3.21%, one full percent. That, along with the Fed stopping its purchasing of mortgage-backed securities, caused a liquidity crunch in the market. This contributed to pushing rates up. They started the year with 4% on a 30-year fixed rate and are now closing in on 5%.

Geoff asked Joe what the bond market was like 4 years ago on a percentage basis, just to give some perspective. Joe brings it back to 9/11, when the Fed didn’t want to see the economy spiral down. They jumped in and started dramatically dropping rates, bringing them down to almost zero. Now we’re seeing the unwinding of these artificially low rates. Thankfully the Fed eased into this, providing a “soft landing.” 2.21 to 3.2% represented about ¾ of a percent, interest rate wise. About 2, 2-1/2 years ago we were at 1.2% on the US Treasury. Before that, we were at the 0.7, 0.8% range. We’ve seen a steady rise, which hopefully the economy is strong enough to handle.

Some of the other changes in the market on the mortgage front are in the role technology is playing. Lenders are able to verify client’s income and assets automatically, do the application online and do the process without sending any paperwork back and forth. The whole process is done digitally.This is revolutionizing the industry and leading to higher consumer satisfaction. The industry is also easing credit standards. Geoff asked if easing credit standards was necessarily a good thing. Joe responded that rising rates have opened the door for new loan products to come out. Those new products are not coming from the banks, but rather from private equity firms flowing back into the market. No verification loans do not exist, but they have a bank statement loan that has come back into play. No seasoning waiting period for someone who had a foreclosure or bankruptcy or short sale, whereas before you had to wait three, four or seven years. Geoff stated that if you’re talking about private equity, they basically can do whatever they want with their money, as long as those products don’t make it into mortgage-backed securities. He asked if there were any controls in place to make sure that didn’t happen again. The trade-off with non-conforming products is that the buyer has to have some “skin in the game.” They need a sizeable down payment, and investors want higher return for higher risk, so rates may be at the 6-1/2% range.

Geoff said it’s important to keep things in perspective. The sky won’t be falling if rates hit 6-1/2%! Historically, it’s a pretty average rate.

Joe and Amy had a graph showing 10-year treasury yield minus 2-year treasury yield. Historically when those yields come together, it signals a slowdown in the market or a recession. From Joe’s perspective, we might have a slow down in the stock market and see a pull back, but he’d rather see a market that goes up and goes down. In a stale market buyers and sellers are sitting on the fence; there is no call to action. As far as housing goes, everyone can do well and make some money.

Geoff thinks there is enough pent up demand from 2008 to 2016; there are a lot of people who need to buy a home and rates are still low enough. The American housing market is the place to be in the Global real estate market. There may be a continued cooling off and slow down a little. We’ve been at such high levels right now, it had to. Like the stock market, it can’t keep going up indefinitely; at some point it has to come down.

Thank you to our Sponsor,

REALLY – Agent to Agent Referrals

https://ReallyHQ.com

Please join us for the next Housing Market Update

December 11, 2018 at 2 p.m.

Stay informed. Sign up for our Housing Market Update at

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link