Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

October 2018 Housing Market Update

The Green Team’s October 2018 Housing Market Update was held live on Facebook Tuesday, October 16 at 2 p.m. If you missed the live webinar, you can view it at your convenience by clicking here.

You can also sign up for future updates at GreenTeamHQ.com/hmu

Meet this month’s Panelists from Green Team New Jersey Realty and Green Team Home Selling System

Geoffrey Green, President/Broker of Green Team Home Selling System, is the moderator of the monthly webinar and presents stats and market updates for Orange and Sussex County. He is joined this month by Keren Gonen, Pamela Zachowski and Alison Miller of Green Team New Jersey Realty in Vernon and Jacqueline Kraszewski of Green Team Home Selling System in Warwick.

Market Update – The National Perspective

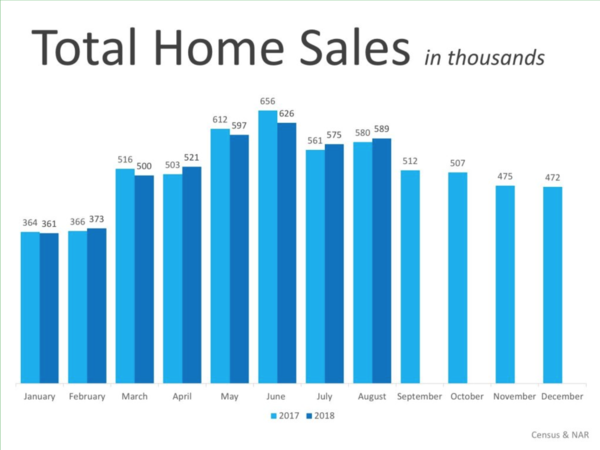

A look at Total Home Sales Nationally

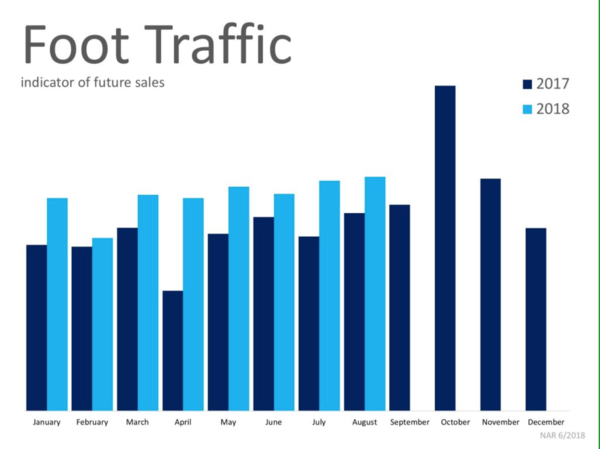

Things seem to be shifting in the housing market. For Geoff, the stats of homes sold are the “mother’s milk” of the industry. Nationally it’s been a mixed bag through 2018. September’s numbers are not yet in, but August numbers for total home sales were just about even for 2017 and 2018. It appears that things are shifting in the market, with the number of sales not increasing like last year, year over year. However, foot traffic in August was much higher in 2018 than in the same period in 2017.

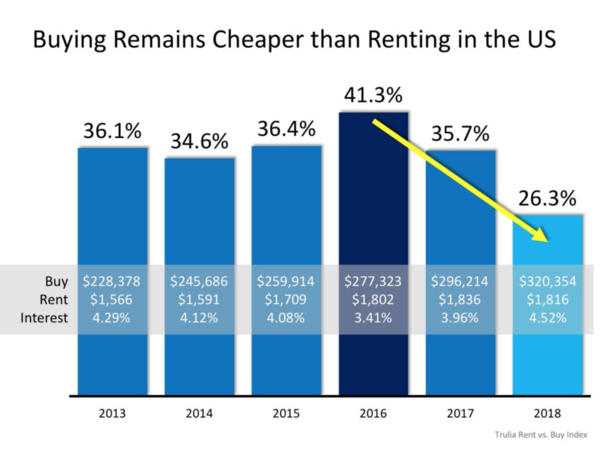

Buying versus Renting…Which is the best way to go?

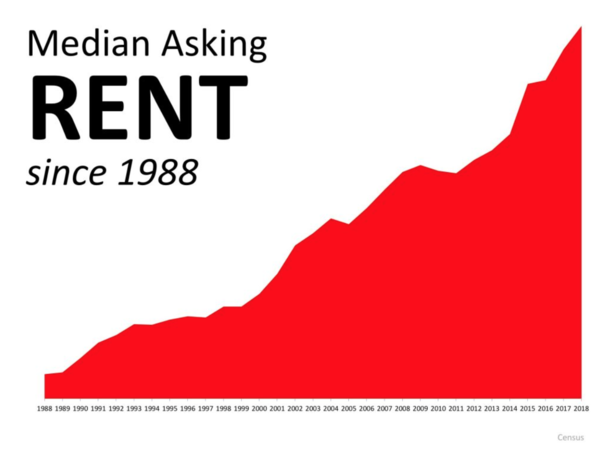

Lawrence Yun, the economist of NAR, has said that we’ll probably see growth in terms of the housing market on the lower end because the job market is strong. People are working, making money and want to invest their money in real estate. However, there may be a slowdown in the higher end because interest rates are rising. How does affordability of renting compare with buying? There is a steep curve, not a good outlook for renters. Since 2013 it has been cheaper to buy instead of rent on an overall national basis. If you have the ability, it costs less to buy than to rent on an overall monthly basis.

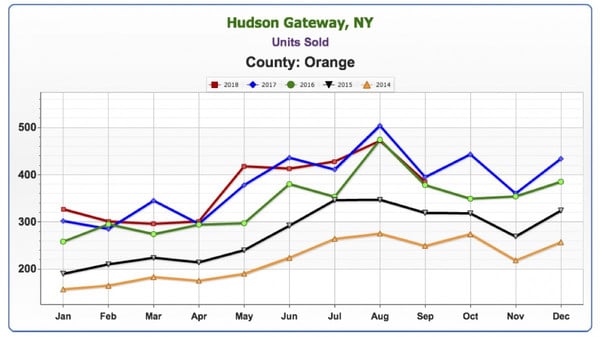

October 2018 Housing Market Update – Orange County

Units Sold

As stated before, Geoff sees this number as the mother’s milk of the housing market. This all-important number gives us a snapshot of how many homes are selling. The number of units sold in Orange County appears to be cooling off. He believes we’ve seen the peak of the last runoff and that it’s behind us. Geoff’s view seems to be backed up by an article that appeared last week in the Wall Street Journal, which referred to a soft downturn in the market.

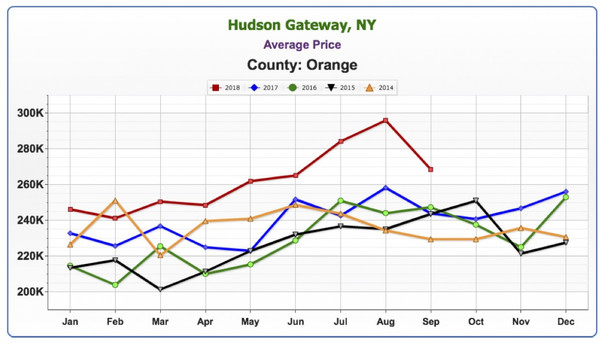

Average Price

There is a big variance in price from where we were last year. The downward trend is a seasonal fluctuation and not a cause for concern. Price always lags units sold at least 6 months or more. Price increases may occur over the next 6 to 12 months, even though the number of units sold is dropping.

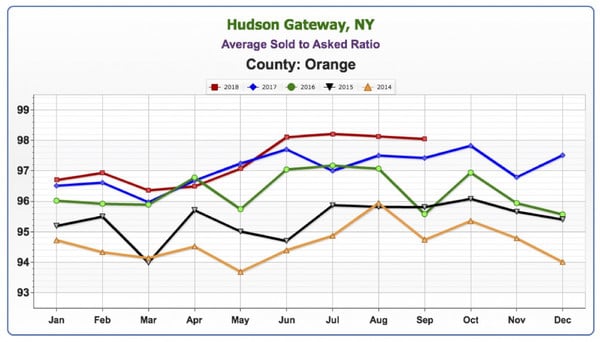

Average Sold to Asked Ratio

We are still pretty high, still over 98%, which means sellers are only having to negotiate 2% from their asking price.

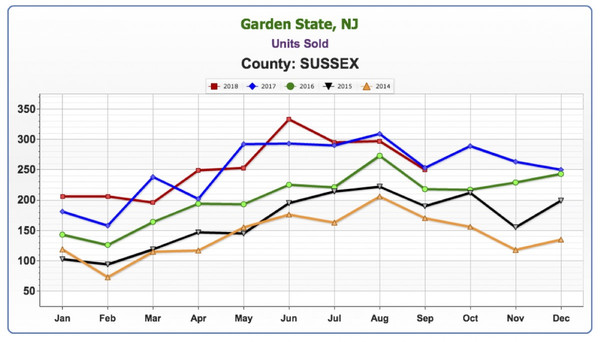

October 2018 Housing Market Update – Sussex County

Units Sold

A similar trend to Orange County, where some months are up, some down, on a year over year basis. It’s a mixed bag, and the numbers seem to indicate a cooling off.

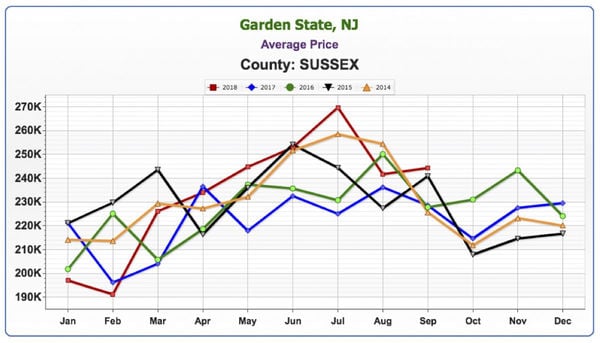

Average Price

Average prices never rocketed in Sussex as they did in Orange County. In previous updates, we’ve spoken about how there is simply more foreclosure inventory and activity which has dragged down the average. However, that doesn’t mean that homes that are well maintained and well located haven’t done well.

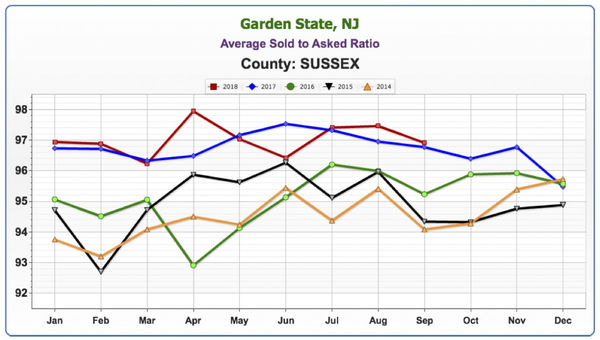

Average Sold to Asked Ratio

Average price never rocketed here like it did in Orange County. There has been much more foreclosure inventory and activity in Sussex and that has dragged down the average home price. However, that doesn’t mean that well-located, well-maintained homes haven’t done well.

Slightly below Orange County, the numbers are still hovering around 98%.

Panel Discussion

The Sales Associates Point of View

Geoff believes the market is cooling. He asked the panelists what they were sensing in the field. Keren replied that there are fewer houses that are updated and nicely done, and buyers have higher expectations. During the summer, people were rushing to find homes in order to get situated before the start of the school year. Without that added stress, many buyers are being pickier. Alison finds that people are looking for something that is just not there. Inventory is not meeting the demand. In addition, many of her closings were delayed, affecting numbers for September.

Jacque is finding that there is a lack of finished, move-in-ready homes under the $400,000 price point in Warwick. In addition, many families with school-aged children are waiting for the spring to resume their search. Also, the seasonal fluctuation impacts the market as people are beginning their holiday preparations. Pam is also seeing the issues mentioned by the other sales associates. The inventory shortage, buyers being very picky, even homes that have been flipped that aren’t good enough. It’s difficult for people to find what they’re looking for in their dollar amount.

Geoff summed up these comments by stating it is still a very good time to sell a house. However, there is nothing to stop the housing market from slowing down. Thus he advises sellers not to put off listing their home if they are planning on selling.

Guest Panelist, Matt Zagroda, discusses the bond market…

Matt Zagroda is a Sales Manager at MBS Highway, the leading provider of real-time market data for mortgage professionals. As such, Geoff welcomed his input on the bond market. Geoff asked Matt what is happening with the bond market, as rates seem to be increasing by the minute. Matt explained that at the end of last year the Fed wanted to do quantitative tightening. Previously they had been reinvesting gains from the bond market back into the bond market, which brought their balance sheet up greatly.

Matt Zagroda is a Sales Manager at MBS Highway, the leading provider of real-time market data for mortgage professionals. As such, Geoff welcomed his input on the bond market. Geoff asked Matt what is happening with the bond market, as rates seem to be increasing by the minute. Matt explained that at the end of last year the Fed wanted to do quantitative tightening. Previously they had been reinvesting gains from the bond market back into the bond market, which brought their balance sheet up greatly.

They wanted to wind that balance sheet down and made a plan just before Janet Yellen stepped down as Fed Chair. So, October of last year they wanted to reduce it by $10 billion. January of this year, $20 billion, April $30 billion, July $40 billion and October, $50 billion. That was the last tightening session. They weren’t going to continue to reinvest it. There is no Fed buying into the bond market, which is why we’re seeing changes in interest rates. There was a drop in the bond market and a rise in rates.

Matt expects that in the upcoming months we’ll be experiencing volatility. However, this is actually a more normal bond market. If there is any economic news that would potentially hurt bonds, we’ll notice it more. Previously the Fed was buying back into it, softening the blow, creating almost a safety net. Now there is no safety net, so if it’s going to hurt – it’s going to hurt. That doesn’t mean that if there’s good news that it will be the opposite and that it will help the bond market… Again, the Fed is not juicing the good news to buy and make that increase even more so.

More volatility is expected into the future, potentially more to the downside, but it’s not expected to be a straight downward line. Rates may continue to get worse, though the hope is that they’ll remain steady. Much depends on what happens with the Fed and their plans for rate hikes.

Geoff recalled buying his first home around 2003. His 30 year fixed rate was at 6.5%. We’re hovering now at about 5% now. Matt agreed that was about right.

Looking back, it hasn’t been higher than this since 2009. Previously, it was much higher. Rates have been pretty much below 5% since then. The largest run on the housing market was 2005, 06, 07 and rates were pretty high back then. The rates may impact the mortgage industry insofar as refinancing. However, when rates eventually come down, the refinancing market should open up again.

… the stock market, and global contagion

Geoff asked Matt his thoughts on the stock market and its unbelievable run. Matt expects that eventually we can’t go much higher and things will come back to a more normal range. Not a crash, but just a more normal range that will help bonds and interest rates even a little bit. When money comes out of stocks it is generally invested in bonds, especially when there’s talk of trade wars, etc. When there is uncertainty in the market, many people invest in safer, long-term investments like bonds.

Geoff had a final question… The idea that there could be a global contagion. By and large, there is a lot of risk around the globe. Many governments are not in a good fiscal situation. Currencies are all over the place. There’s a lot of risk around the globe. The US seems like the shining city on the hill, on our own pedestal for some time. He asked Matt his thoughts on the global market. Matt replied that there is turmoil in Europe, and especially Italy right now. The world is interconnected. However, we’re not expecting great leaps and bounds right now because of that turmoil. However, it does affect us.

In closing, Geoff recommends the article he mentioned at the beginning of the update. Written by Laura Kusisto, it was published in the Wall Street Journal on October 13. “Housing Market Positioned for a Gentler Slowdown Than in 2007″ provides a good, historical outlook on the market and its future.

How Much Has Your Home Increased in Value?

Home values have risen dramatically over the last twelve months. In CoreLogic’s most recent Home Price Index Report, they revealed that national home prices have increased by 6.2% year-over-year.

CoreLogic broke down appreciation even further into four price ranges, giving us a more detailed view than if we had simply looked at the year-over-year increases in national median home price.

The chart below shows the four price ranges from the report, as well as each one’s year-over-year growth from July 2017 to July 2018 (the latest data available).

It is important to pay attention to how prices are changing in your local market. The location of your home is not the only factor which determines how much your home has appreciated over the course of the last year.

Lower-priced homes have appreciated at greater rates than homes at the upper ends of the spectrum due to demand from first-time home buyers and baby boomers looking to downsize.

Bottom Line

If you are planning to list your home for sale in today’s market, let’s get together to go over exactly what’s going on in your area and your price range. Find out what your home’s value is today – click here.

Green Team New Jersey Realty celebrates the opening of their new office building.

Green Team New Jersey Realty celebrates the opening of their new office building

Just two years and five days after the ribbon cutting that launched the opening of the Green Team’s Vernon office, a new ribbon cutting was held. On Thursday, September 13, Green Team New Jersey Realty (“GTNJR”) celebrated the official opening of its new office building at 293 South Route 94, Vernon, New Jersey. And the ample parking lot was perfect for the celebration that followed.

A little history…

The Green Team Home Selling System, founded in 2005, is in the top ten of all brokerages in Orange County, New York. When Geoffrey Green was approached by agents wanting to open an office in Vernon, New Jersey, it made perfect sense. Vernon was an underserved market, just across the border from Warwick, New York where the Green Team is based. However, even Geoff and equity partners Kim Lasalandra, Charles Nagy and Ted VanLaar couldn’t foresee the rapid growth of Green Team New Jersey Realty. For Charles, real estate has always been about people and making relationships. It’s what he truly loves about the business. However, his long term plans included retirement and relaxation. Now Green Team New Jersey Realty and its rapid success has put all talks of retirement on hold. There are new people to meet, new relationships to forge, and an exciting business to grow.

Utilizing the systems developed by Geoff Green, the Vernon office flourished. At six months there were 8 sales associates. That number kept growing as agents learned about the Green Team’s core values, its unique training and mentoring programs, and its commitment to providing the best possible client service.

In 2017, six GTNJR sales associates were recognized by the New Jersey Association of Realtors for achievement and excellence in sales. Considered among the most prestigious honors awarded to Realtors in the Garden State, the NJAR Circle of Excellence recognizes members who have excelled in the field of salesmanship. Ann Nussberger achieved the Silver Level ($6.5 million and 20 units minimum or 70 units). Recipients of the Bronze award ($2.5 million and 15 units minimum or 30 units) were Barbara Tesa, Joyce Rogers, Charles Nagy, Keren Gonen and Theodore Van Laar.

The future looks great…

As Geoff Green so eloquently put it, “Even though we’re here to celebrate the grand opening of the new building, it’s really a celebration of the people of the Green Team.” In less than two years, Green Team New Jersey Realty has become one of the top 20 real estate agencies in all of Sussex County and is one of the top five in Vernon. Thus, with 18 Sales Associates and a new home, the sky’s the limit. Yes, the Green Team has good reason to celebrate.

8 things to avoid when purchasing a home

You need to understand and follow those above tips

Should I Rent or Buy a Home?

Choosing whether to rent or own a home is not an easy decision.

Home Inspections: What to Expect

[et_pb_section fb_built=”1″ _builder_version=”3.0.47″][et_pb_row _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.0.74″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]

Home Inspections: What to Expect

So you made an offer, it was accepted, and now your next task is to have the home inspected prior to closing. Oftentimes, agents make your offer contingent on a clean home inspection.

This contingency allows you to renegotiate the price you paid for the home, ask the sellers to cover repairs, or even, in some cases, walk away. Your agent can advise you on the best course of action once the report is filed.

How to Choose an Inspector

Your agent will most likely have a shortlist of inspectors that they have worked with in the past that they can recommend to you. HGTV recommends that you consider the following 5 areas when choosing the right home inspector for you:

- Qualifications – find out what’s included in your inspection and if the age or location of your home may warrant specific certifications or specialties.

- Sample Reports – ask for a sample inspection report so you can review how thoroughly they will be inspecting your dream home. The more detailed the report, the better in most cases.

- References – do your homework – ask for phone numbers and names of past clients who you can call to ask about their experiences.

- Memberships – Not all inspectors belong to a national or state association of home inspectors, and membership in one of these groups should not be the only way to evaluate your choice. Membership in one of these organizations often means that continued training and education are provided.

- Errors & Omission Insurance – Find out what the liability of the inspector or inspection company is once the inspection is over. The inspector is only human after all, and it is possible that they might miss something they should have seen.

Ask your inspector if it’s okay for you to tag along during the inspection, that way they can point out anything that should be addressed or fixed.

Don’t be surprised to see your inspector climbing on the roof or crawling around in the attic and on the floors. The job of the inspector is to protect your investment and find any issues with the home, including but not limited to: the roof, plumbing, electrical components, appliances, heating & air conditioning systems, ventilation, windows, the fireplace and chimney, the foundation, and so much more!

Bottom Line

They say ‘ignorance is bliss,’ but not when investing your hard-earned money into a home of your own. Work with a professional who you can trust to give you the most information possible about your new home so that you can make the most educated decision about your purchase.

Learn More about the home buying process, request our Home Buyers Guide or visit our Home Buyers Blog

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row custom_padding=”12px|0px|17.5781px|0px|false|false” _builder_version=”3.18.2″ locked=”off”][et_pb_column type=”4_4″ _builder_version=”3.18.2″ parallax=”off” parallax_method=”on”][et_pb_blog fullwidth=”off” posts_number=”3″ include_categories=”34″ show_author=”off” show_date=”off” show_categories=”off” _builder_version=”3.18.2″ header_level=”h5″ header_font=”||||||||” body_font=”||||||||” border_radii=”on|12px|12px|12px|12px” text_orientation=”center”][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

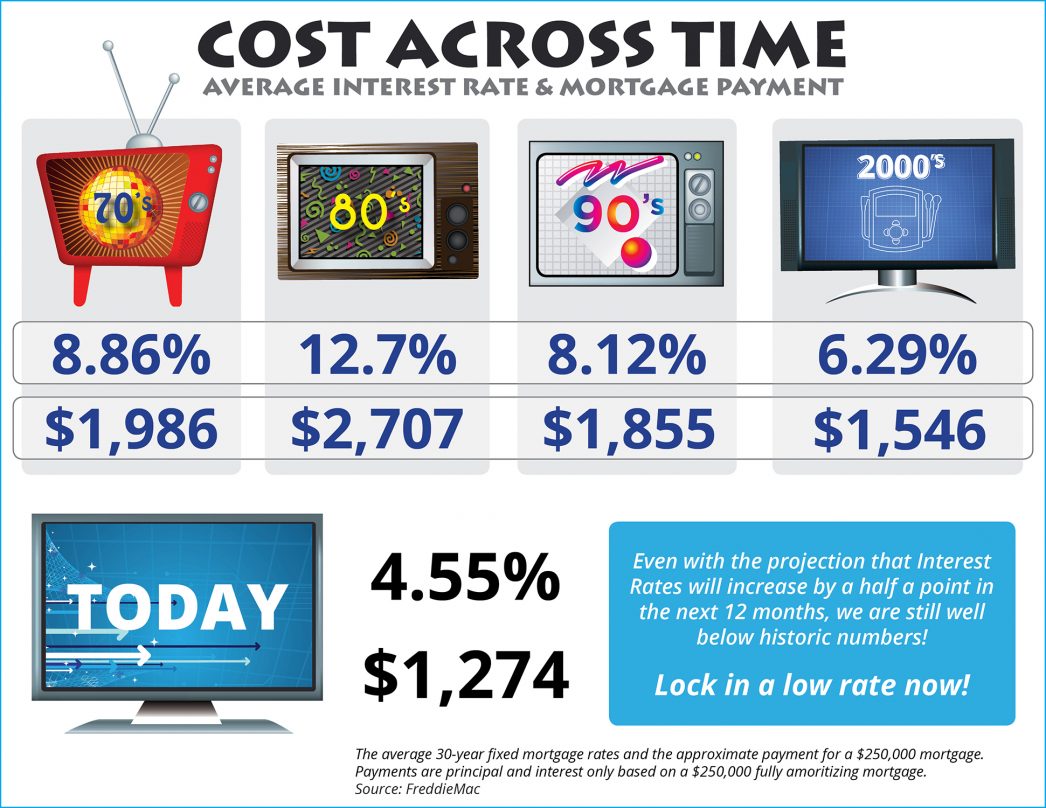

Cost Across Time [INFOGRAPHIC]

Some Highlights:

- With interest rates still around 4.5%, now is a great time to look back at where rates have been over the last 40 years.

- Rates are projected to climb to 5.1% by this time next year according to Freddie Mac.

- The impact your interest rate makes on your monthly mortgage cost is significant!

- Lock in a low rate now while you can!

Want to learn more?

Register for our July Housing Market Update with the CEO of Annie Mac Home Mortgage

It’s Free – Click Here

Did Tax Reform Kill the Luxury Market? NOT SO FAR!

The new tax code limits the deduction of state and local property taxes, as well as income or sales taxes, to a total of $10,000. When the tax reform legislation was put into law at the beginning of the year, some experts felt that it could have a negative impact on the luxury housing market.

Capital Economics:

“The impact on expensive homes could be detrimental, with a limit on the MID raising taxes for those that itemize.”

Mark Zandi of Moody’s Analytics:

“The impact on house prices is much greater for higher-priced homes, especially in parts of the country where incomes are higher and there are thus a disproportionate number of itemizers, and where homeowners have big mortgages and property tax bills.”

The National Association of Realtors (NAR) predicted price declines in “high cost, higher tax areas” because of the tax changes. They forecasted a depreciation of 6.2% in New Jersey and 4.8% in Washington D.C. and New York.

What has actually happened?

Here are a few metrics to consider before we write-off the luxury market:

1. According to NAR’s latest Existing Home Sales Report, here is the percent change in sales from last year:

- Homes sales between $500,000 – $750,000 are up 11.9%

- Homes sales between $750,000 – $1M are up 16.8%

- Homes sales over $1,000,000 are up 26.7%

2. In a report from Trulia, it was revealed that searches for “premium” homes as a percentage of all searches increased from 38.4% in the fourth quarter of 2017 to 41.4% in the first quarter of 2018.

3. According to an article from Bloomberg:

“Median home values nationally rose 8 percent in March compared with a year earlier, while neighborhoods of San Francisco and San Jose, California, have increased more than 25 percent.

Prices in affluent areas in Delaware and New York, such as the Hamptons, also surged more than 20 percent.”

Bottom Line

Aaron Terrazas, Zillow’s Senior Economist, probably summed up real estate’s luxury market the best:

“We are seeing the opposite of what was expected. We have certainly not seen the doomsday predictions play out.”

Want to learn more about how the new Tax Code will affect your local housing market – Register for our Housing Market Update on, Tuesday June 12 at 9am.

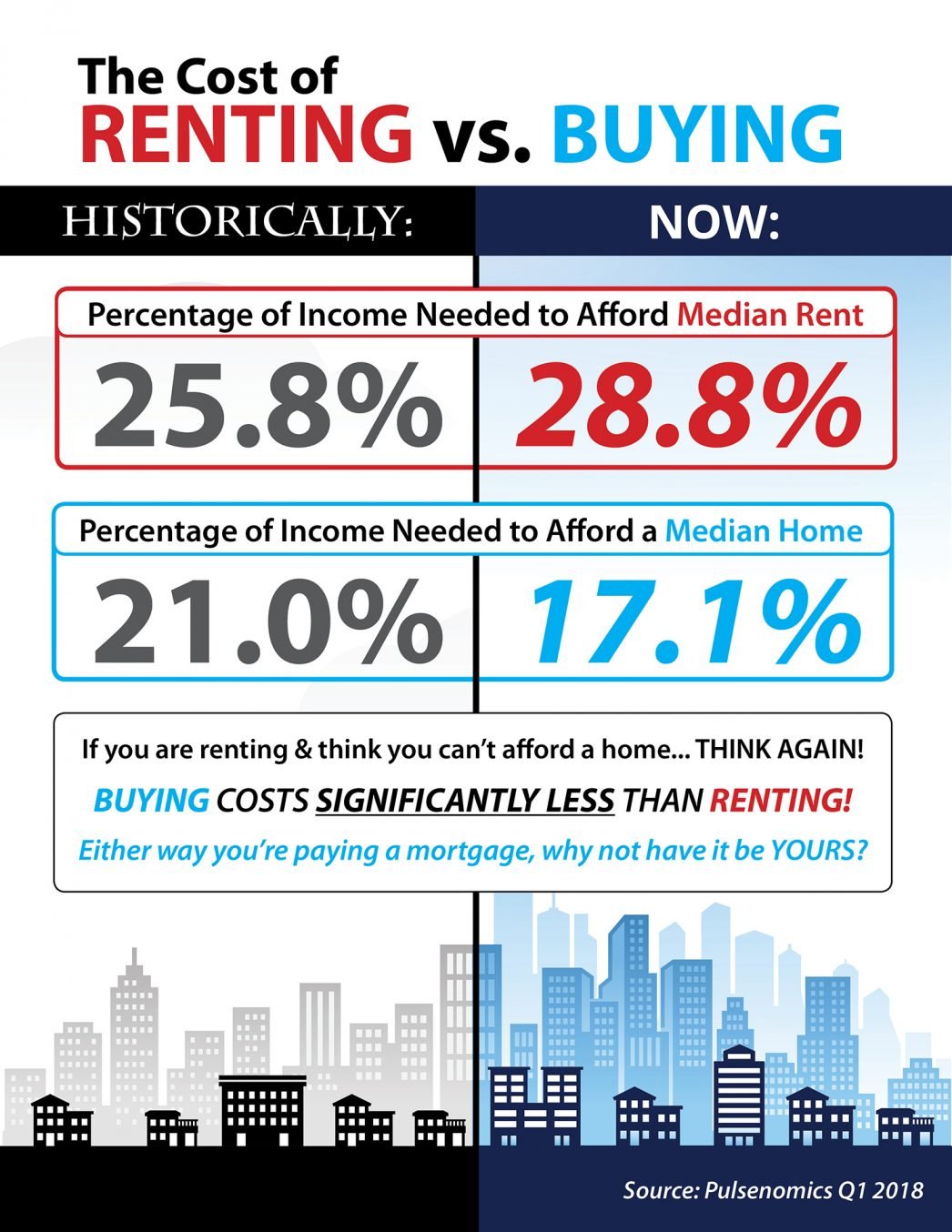

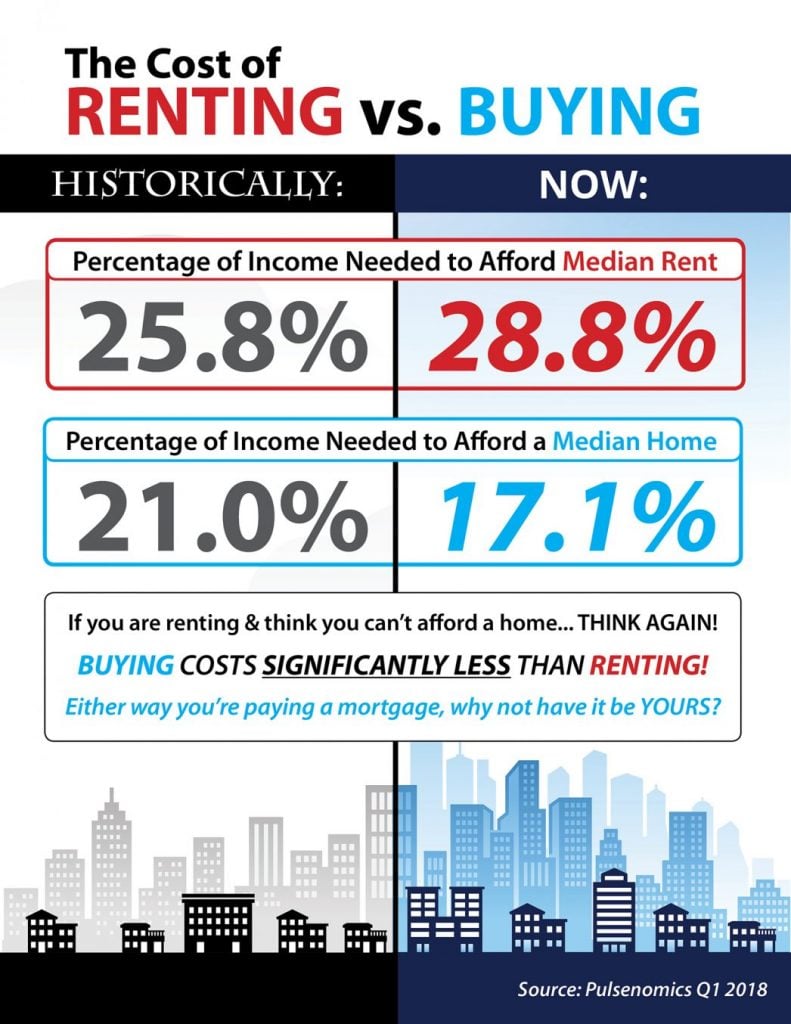

UPDATE: The Cost of Renting vs. Buying [INFOGRAPHIC]

Some Highlights:

- Historically, the choice between renting or buying a home has been a tough decision.

- Looking at the percentage of income needed to rent a median-priced home today (28.8%) vs. the percentage needed to buy a median-priced home (17.1%), the choice becomes obvious.

- Every market is different. Before you renew your lease again, find out if you can put your housing costs to work by buying this year!

How much home can you afford:

[affordability interest_rate=”6″]

Moving Up to Your Dream Home? Don’t Wait!

Mortgage interest rates have risen by more than half of a point since the beginning of the year, and many assume that if mortgage rates rise, home values will fall. History, however, has shown this not to be true.

Where are home values today compared to the beginning of the year?

While rates have been rising, so have home values. Here are the most recent monthly price increases reported in the Home Price Insights Report from CoreLogic:

- January: Prices were up 0.5% over the month before.

- February: Prices were up 1% over the month before.

- March: Prices were up 1.4% over the month before.

Not only did prices continue to appreciate, the level of appreciation accelerated over the first quarter. CoreLogic believes that home prices will increase by 5.2% over the next twelve months.

How can prices rise while mortgage rates increase?

Freddie Mac explained in a recent Insight Report:

“In the current housing market, the driving force behind the increase in prices is a low supply of both new and existing homes combined with historically low rates. As mortgage rates increase, the demand for home purchases will likely remain strong relative to the constrained supply and continue to put upward pressure on home prices.”

Bottom Line

If you are thinking about moving up to your dream home, waiting until later this year and hoping for prices to fall may not be a good strategy.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link