Congrats To Tammy Scotto For Reaching The Cap!

Tammy Scotto reached the cap!

Congratulations from Geoffrey Green, President of Green Team Realty, to Tammy Scotto for reaching the commission cap for company dollar contribution in 2020!

A quote from Geoff:

“Do you know the old saying, “Nice guys finish last”? Not at Green Team Realty. Tammy Scotto is proof positive of that. Tammy is a friend to all who know her. She uses her warm spirit and honesty in her day to day business. This translates into great sales production for Tammy because her clients truly know that she cares. “

Tammy’s dedication to her clients and hard work has allowed her to reach the cap on her commission with Green Team Realty. This is an outstanding accomplishment and means Tammy will now receive a 100% commission split on any deal she closes during 2020.

Tammy’s Thoughts:

“I am honored and grateful to the Green Team and all of my clients that have made it possible for my “capping out”. The program Geoff has in place at the Green Team is not only motivating, it’s rewarding. I love working with both buyers and sellers and this year has truly been a blessing given the year it has been. Helping both buyers and sellers on a daily basis never feels like a “job” to me. I truly LOVE what I do and my ultimate goal is to get everyone to the closing table and have it be as smooth of a process as possible.”

Green Team Realty’s commission structure is, no doubt, one of the finest in the industry, but it doesn’t end there. Our lead generation platform, certified sales assistant program, and dynamic training systems are just a few other things worth mentioning.

To learn more about Green Team Realty and why you should join our team click here.

Congratulations, Tammy!

Where Are Home Values Headed Over the Next 12 Months?

As shelter-in-place orders were implemented earlier this year, many questioned what the shutdown would mean to the real estate market. Specifically, there was concern about home values. After years of rising home prices, would 2020 be the year this appreciation trend would come to a screeching halt? Even worse, would home values begin to depreciate?

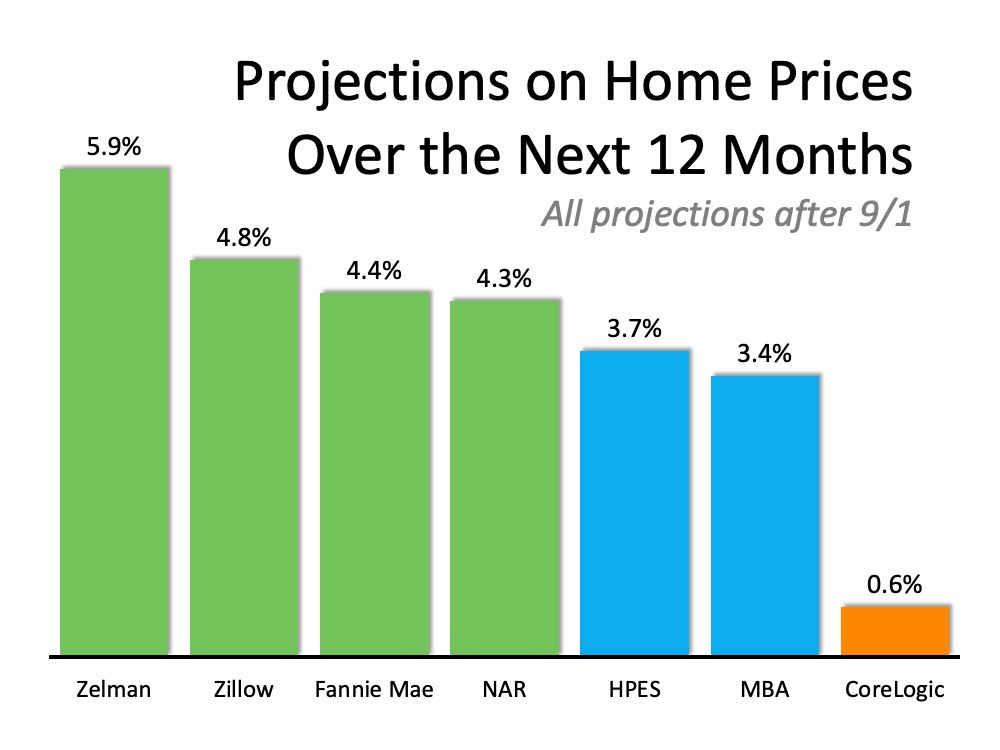

Original forecasts modeled this uncertainty, and they ranged anywhere from home values gaining 3% (Zelman & Associates) to home values depreciating by more than 6% (CoreLogic).

However, as the year unfolded, it became clear that there would be little negative impact on the housing market. As Mark Fleming, Chief Economist at First American, recently revealed:

“The only major industry to display immunity to the economic impacts of the coronavirus is the housing market.”

Have prices continued to appreciate so far this year?

Last week, the Federal Housing Finance Agency (FHFA) released its latest Home Price Index. The report showed home prices actually rose 6.5% from the same time last year. FHFA also noted that price appreciation accelerated to record levels over the summer months:

“Between May & July 2020, national prices increased by over 2%, which represents the largest two-month price increase observed since the start of the index in 1991.”

What are the experts forecasting for home prices going forward?

Below is a graph of home price projections for the next year. Since the market has changed dramatically over the last few months, this graph shows forecasts that have been published since September 1st.

Bottom Line

The numbers show that home values have weathered the storm of the pandemic. Find out what your home is currently worth and how that may enable you to make a move this year.

Welcome Kathy Moran

The Green Team is proud to announce that Kathy Moran has decided to join our Warwick, NY office. We’re excited to have her on our team and look forward to helping her grow!

Please join us in Welcoming Kathy to The Green Team New York!

To learn more about Kathy and her business visit her website.

The Surging Real Estate Market Continues to Climb

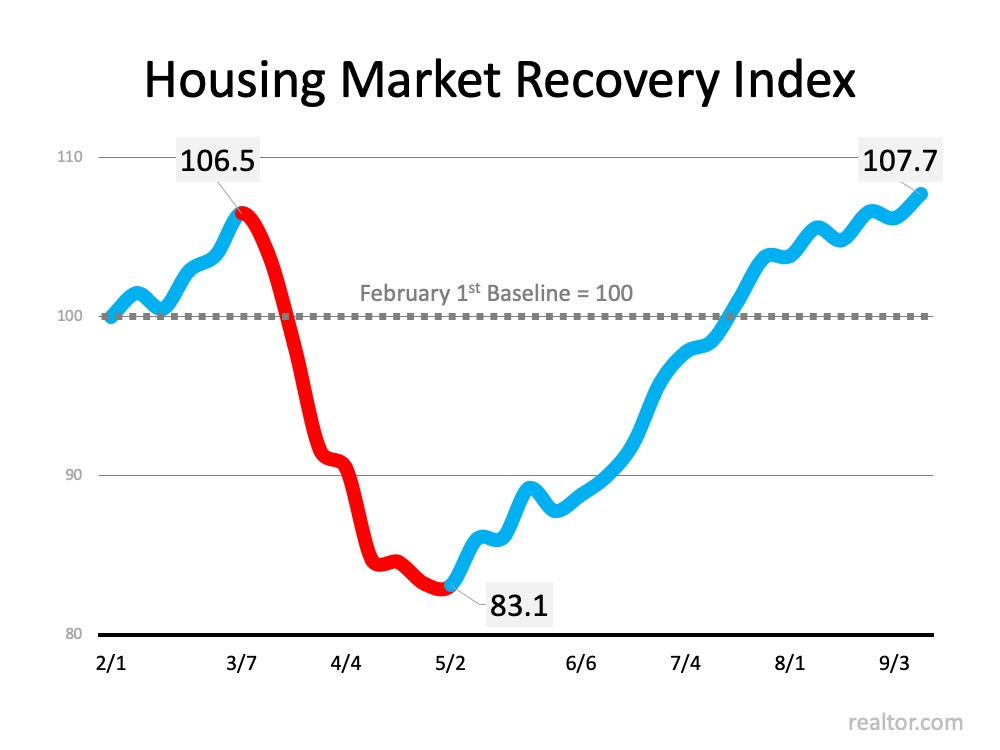

Earlier this year, realtor.com announced the release of the Housing Recovery Index, a weekly guide showing how the pandemic has impacted the residential real estate market. The index leverages a weighted average of four key components of the housing industry by tracking each of the following:

- Housing Demand – Growth in online search activity

- Home Price – Growth in asking prices

- Housing Supply – Growth of new listings

- Pace of Sales – Difference in time-on-market

The index compares the current status “to the January 2020 market trend, as a baseline for pre-COVID market growth. The overall index is set to 100 in this baseline period. The higher a market’s index value, the higher its recovery and vice versa.”

The graph below charts the index by showing how the real estate market started out strong in early 2020, and then dropped dramatically at the beginning of March when the pandemic paused the economy. It also shows the strength of the recovery since the beginning of May. Today, the index stands at its highest point all year, including the time prior to the economic shutdown.

Today, the index stands at its highest point all year, including the time prior to the economic shutdown.

The Momentum Is Still Building

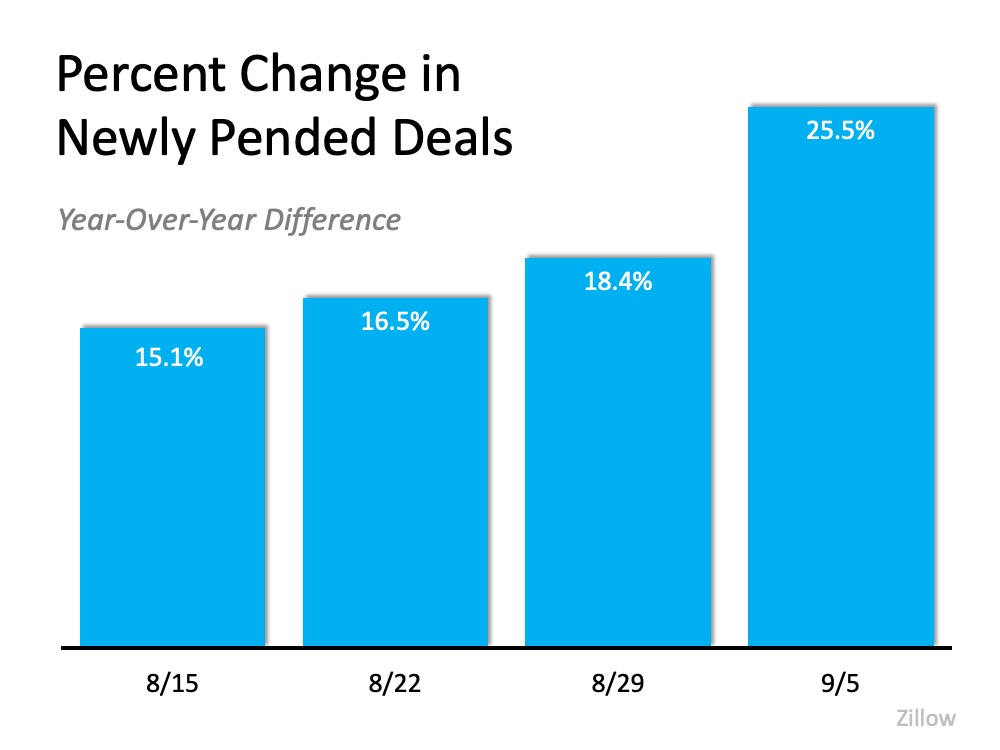

Though there is some evidence that the overall economic recovery may be slowing, the housing market is still gaining momentum. Zillow tracks the number of homes that are put into contract on a weekly basis. Their latest report confirms that buyer demand is continuing to dramatically outpace this same time last year, and the percent increase over last year is growing. Clearly, the housing market is not only outperforming the grim forecasts from earlier this year, but it is also eclipsing the actual success of last year.

Clearly, the housing market is not only outperforming the grim forecasts from earlier this year, but it is also eclipsing the actual success of last year.

Frank Martell, President and CEO of CoreLogic, explains it best:

“On an aggregated level, the housing economy remains rock solid despite the shock and awe of the pandemic.”

Bottom Line

Whether you’re considering buying or selling, staying on top of the real estate market over the coming months will be essential to your success.

How Low Inventory May Impact the Housing Market This Fall

[et_pb_section admin_label=”section”]

[et_pb_row admin_label=”row”]

[et_pb_column type=”4_4″][et_pb_text admin_label=”Text”]Real estate continues to be called the ‘bright spot’ in the current economy, but there’s one thing that may hold the housing market back from achieving its full potential this year: the lack of homes for sale.

Buyers are actively searching for and purchasing homes, looking to capitalize on today’s historically low interest rates, but there just aren’t enough houses for sale to meet that growing need. Sam Khater, Chief Economist at Freddie Mac, explains:

“Mortgage rates have hit another record low due to a late summer slowdown in the economic recovery…These low rates have ignited robust purchase demand activity…However, heading into the fall it will be difficult to sustain the growth momentum in purchases because the lack of supply is already exhibiting a constraint on sales activity.”

According to the National Association of Realtors (NAR), right now, unsold inventory sits at a 3.1-month supply at the current sales pace. To have a balanced market where there are enough homes for sale to meet buyer demand, the market needs inventory for 6 months. Today, we’re nowhere near where that number needs to be. If the trend continues, it will get even harder to find homes to purchase this fall, and that may slow down potential buyers. Danielle Hale, Chief Economist at realtor.com, notes:

“The overall lack of sustained new listings growth could put a dent in fall home sales despite high interest from home shoppers, because new listings are key to home sales.”

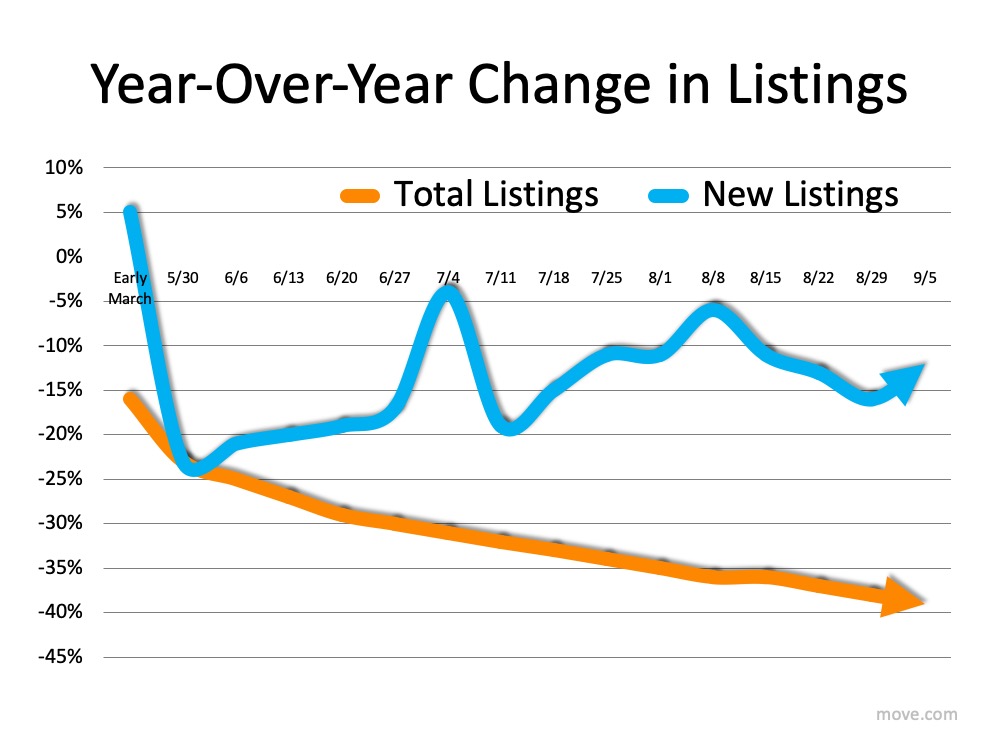

The realtor.com Weekly Recovery Report keeps an eye on the number of listings coming into the market (houses available for sale) and the total number of listings staying in the market compared to the previous year (See graph below): Buyers are clearly scooping up homes faster than they’re being put up for sale. The number of total listings (the orange line) continues to decline even as new listings (the blue line) are coming to the market. Why? Javier Vivas, Director of Economic Research at realtor.com, notes:

Buyers are clearly scooping up homes faster than they’re being put up for sale. The number of total listings (the orange line) continues to decline even as new listings (the blue line) are coming to the market. Why? Javier Vivas, Director of Economic Research at realtor.com, notes:

“The post-pandemic period has brought a record number of homebuyers back into the market, but it’s also failed to bring a consistent number of sellers back. Homes are selling faster, and sales are still on an upward trend, but rapidly disappearing inventory also means more home shoppers are being priced out. If we don’t see material improvement to supply in the next few weeks, we could see the number of transactions begin to dwindle again even as the lineup of buyers continues to grow.”

Does this mean it’s a good time to sell?

Yes. If you’re thinking about selling your house, this fall is a great time to make it happen. There are plenty of buyers looking for homes to purchase because they want to take advantage of low interest rates. Realtors are also reporting an average of 3 offers per house and an increase in bidding wars, meaning the demand is there and the opportunity to sell for the most favorable terms is in your favor as a seller.

Bottom Line

If you’re considering selling your house, this is the perfect time to connect so we can talk about how you can benefit from the market trends in our local area.[/et_pb_text][/et_pb_column]

[/et_pb_row]

[/et_pb_section]

Is the Economic Recovery Beating All Projections?

[et_pb_section fb_built=”1″ _builder_version=”3.0.47″][et_pb_row _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.0.74″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]Earlier this year, many economists and market analysts were predicting an apocalyptic financial downturn that would potentially rattle the U.S. economy for years to come. They immediately started to compare it to the Great Depression of a century ago. Six months later, the economy is still trying to stabilize, but it is evident that the country will not face the total devastation projected by some. As we continue to battle the pandemic, forecasts are now being revised upward. The Wall Street Journal (WSJ) just reported:

“The U.S. economy and labor market are recovering from the coronavirus-related downturn more quickly than previously expected, economists said in a monthly survey.

Business and academic economists polled by The Wall Street Journal expect gross domestic product to increase at an annualized rate of 23.9% in the third quarter. That is up sharply from an expectation of an 18.3% growth rate in the previous survey.”

What Shape Will the Recovery Take?

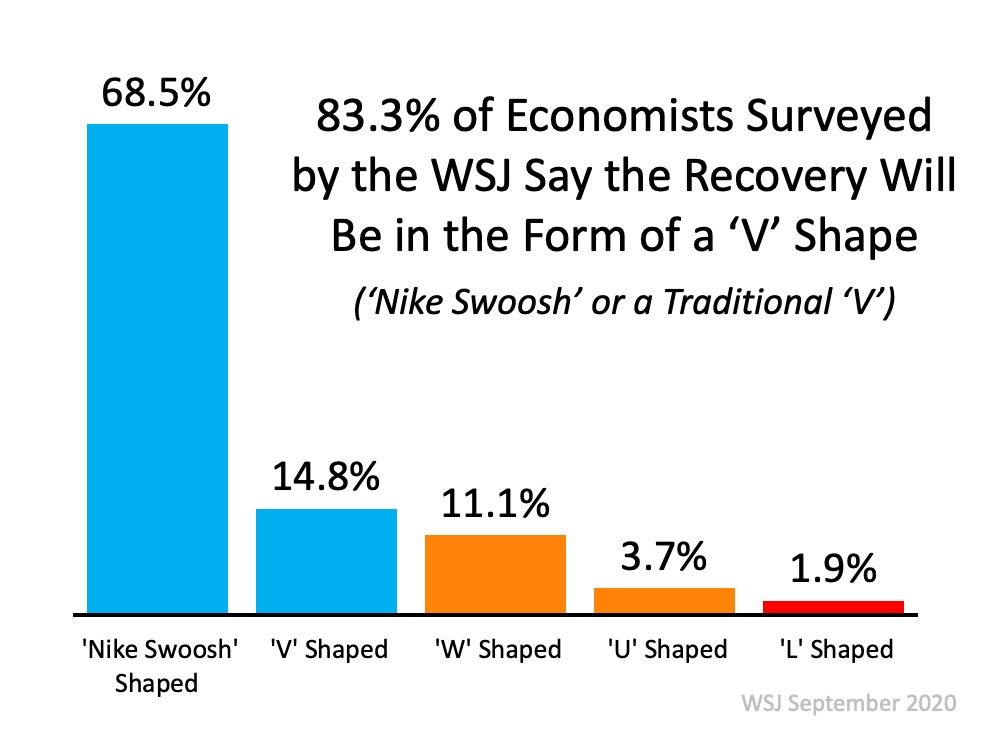

Economists have historically cast economic recoveries in the form of one of four letters – V, U, W, or L.

A V-shaped recovery is all about the speed of the recovery. This quick recovery is treated as the best-case scenario for any economy that enters a recession. NOTE: Economists are now also using a new term for this type of recovery called the “Nike Swoosh.” It is a form of the V-shape that may take several months to recover, thus resembling the Nike Swoosh logo.

A U-shaped recovery is when the economy experiences a sharp fall into a recession, like the V-shaped scenario. In this case, however, the economy remains depressed for a longer period of time, possibly several years, before growth starts to pick back up again.

A W-shaped recovery can look like an economy is undergoing a V-shaped recovery until it plunges into a second, often smaller, contraction before fully recovering to pre-recession levels.

An L-shaped recovery is seen as the worst-case scenario. Although the economy returns to growth, it is at a much lower base than pre-recession levels, which means it takes significantly longer to fully recover.

Many experts predicted that this would be a dreaded L-shaped recovery, like the 2008 recession that followed the housing market collapse. Fortunately, that does not seem to be the case.

The same WSJ survey mentioned above asked the economists which letter this recovery will most resemble. Here are the results:

What About the Unemployment Numbers?

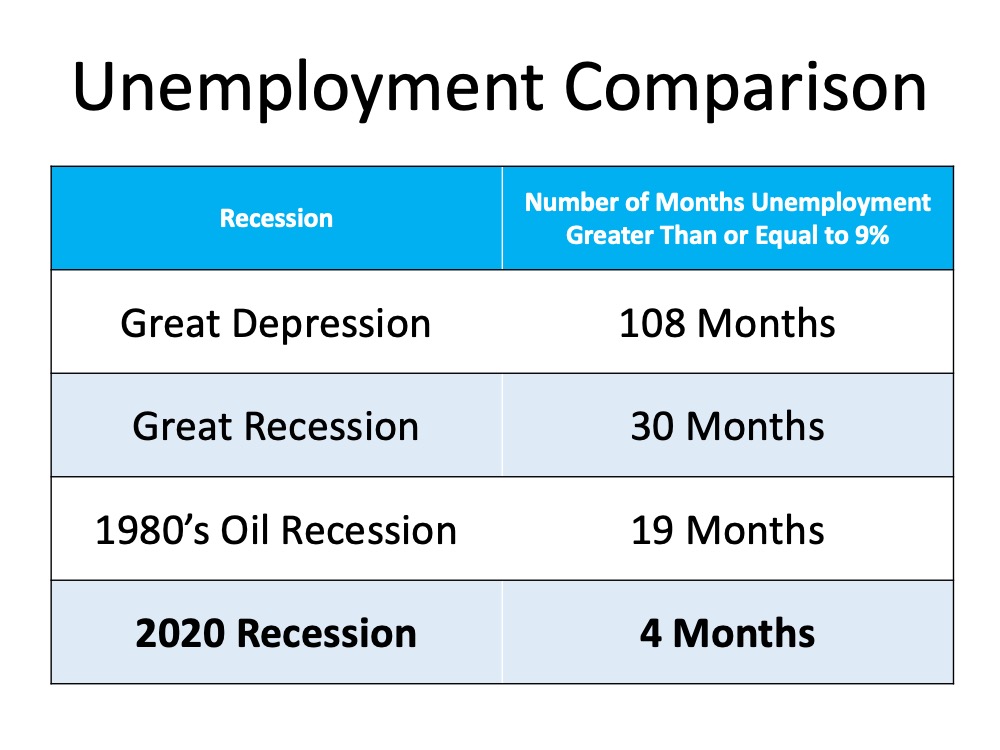

It’s difficult to speak positively about a jobs report that shows millions of Americans are still out of work. However, when we compare it to many forecasts from earlier this year, the numbers are much better than most experts expected. There was talk of numbers that would rival the Great Depression when the nation suffered through four consecutive years of unemployment over 20%.

The first report after the 2020 shutdown did show a 14.7% unemployment rate, but much to the surprise of many analysts, the rate has decreased each of the last three months and is now in the single digits (8.4%).

Economist Jason Furman, Professor at Harvard University‘s John F. Kennedy School of Government and the Chair of the Council of Economic Advisers during the previous administration, recently put it into context:

“An unemployment rate of 8.4% is much lower than most anyone would have thought it a few months ago. It is still a bad recession but not a historically unprecedented event or one we need to go back to the Great Depression for comparison.”

The economists surveyed by the WSJ also forecasted unemployment rates going forward:

- 2021: 6.3%

- 2022: 5.2%

- 2023: 4.9%

The following table shows how the current employment situation compares to other major disruptions in our economy:

Bottom Line

The economic recovery still has a long way to go. So far, we are doing much better than most thought would be possible.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

How Will the Presidential Election Impact Real Estate?

The year 2020 will be remembered as one of the most challenging times of our lives. A worldwide pandemic, a recession causing historic unemployment, and a level of social unrest perhaps never seen before have all changed the way we live. Only the real estate market seems to be unaffected, as a new forecast projects there may be more homes purchased this year than last year.

As we come to the end of this tumultuous year, we’re preparing for perhaps the most contentious presidential election of the century. Today, it’s important to look at the impact past presidential election years have had on the real estate market.

Is there a drop-off in home sales during a presidential election year?

BTIG, a research and analysis company, looked at new home sales from 1963 through 2019 in their report titled One House, Two House, Red House, Blue House. They noted that in non-presidential years, there is a -9.8% decrease in November compared to October. This is the normal seasonality of the market, with a slowdown in activity that’s usually seen in fall and winter.

However, it also revealed that in presidential election years, the typical drop increases to -15%. The report explains why:

“This may indicate that potential homebuyers may become more cautious in the face of national election uncertainty.”

Are those sales lost forever?

No. BTIG determined:

“This caution is temporary, and ultimately results in deferred sales, as the economy, jobs, interest rates and consumer confidence all have far more meaningful roles in the home purchase decision than a Presidential election result in the months that follow.”

In a separate study done by Meyers Research & Zonda, Ali Wolf, Chief Economist, agrees that those purchases are just delayed until after the election:

“History suggests that the slowdown is largely concentrated in the month of November. In fact, the year after a presidential election is the best of the four-year cycle. This suggests that demand for new housing is not lost because of election uncertainty, rather it gets pushed out to the following year.”

Will it matter who is elected?

To some degree, but not in the overall number of home sales. As mentioned above, consumer confidence plays a significant role in a family’s desire to buy a home. How may consumer confidence impact the housing market post-election? The BTIG report covered that as well:

“A change in administration might benefit trailing blue county housing dynamics. The re-election of President Trump could continue to propel red county outperformance.”

Again, overall sales should not be impacted in a significant way.

Bottom Line

If mortgage rates remain near all-time lows, the economy continues to recover, and unemployment continues to decrease, the real estate market should remain strong up to and past the election. Contact one of our Sales Agents today to discuss your real estate needs.

WHY HAVING A MENTOR CAN MAKE ALL THE DIFFERENCE

Green Team Realty’s Mentor Program

When asked why they joined the Green Team, many sales associates cite the company’s exceptional training programs. There is an ever-growing library of video training sessions, as well as tech training and practice sessions. Education is an ongoing part of the Green Team. However, one of the most popular training programs is the Mentoring Program.

How the mentor program came into existence

Like many great ideas, this one had humble beginnings. Geoff Green says that the match that lit the fire was when one of his more experienced agents came to him. He told Geoff, “You have got to start training all these new agents because they keep bothering me!” Geoff replied, “You’re right! I do.” Thus, the mentoring program was born.

It was not without growing pains. There were lots of mistakes and missteps in the beginning, but since 2010 it has blossomed and evolved into a well-oiled machine. There are rules, responsibilities, and expectations for both mentor and mentee. It was important to make the program manageable for mentors and to make sure they were well paid for their time and effort. Most importantly, new sales associates entering into a mentoring arrangement benefit from real-life learning, day in, and day out.

The program benefits both Mentee and Mentor

The program works so well because it does provide benefits to both parties. A mentor provides time, experience, and knowledge. Mentees compensate their mentors according to the terms outlined in the contract they enter into. The mentor’s responsibilities are designed to offer mentees the knowledge and support they need to successfully do a transaction from beginning to end. For many of those entering into a mentor/mentee agreement, the end result is lasting friendship and mutual support.

Hear from some of the Sales Associates involved in the program

Probably one of the best ways to learn about the program is from those involved in it. Some started out as mentees and are now mentors. Dean Diltz in the Warwick office is very enthusiastic about the program. He came from a marketing background and when he started with the Green Team, Lucyann Tinnirello became his mentor. She showed him the ropes, helped him get up and running the Green Team way. They became friends and, even while her “student” now mentors sales associates himself, he still goes to her for advice. Dean advises new agents, as well as those coming from other offices, to work with a mentor.

Vikki Garby started with another agency in 2014 and received no training. The following year she was recruited and mentored by Green Team’s Tammy Scotto. In addition to the mentorship, Vikki found that the Green Team provided video tutorials and how-to’s on every aspect of real estate. She was highly motivated and dove into the videos and into shadowing Tammy, learning from every transaction. According to Vikki, if you work the mentorship program, it works for you. The tools are there, and if you use them, you’ll be successful. If you’re highly motivated, following your mentor around for a few months should give you enough confidence to go out on your own.

Mentoring at Green Team New Jersey Realty

When Green Team New Jersey Realty opened its doors in September 2016, the mentoring program began there, too. One of the first teams was Keren Gonen, mentor and Alison Miller, mentee. According to Geoff, Alison began “tearing it up!” Keren says that Alison had the drive to succeed, and that made it easy to work with her. And Keren enjoyed the satisfaction that came from contributing to someone’s success. As far as Alison goes, Geoff pushed for her to join the mentoring program as soon as she came on board with the Green Team. He said it would help her through every step of the way and so she signed up. While she liked doing a lot of things on her own, she was not afraid to call on Keren, who was always available when she needed something, including being there for her first closing. According to Alison, anyone new to the business needs the program. And, it’s always good to have that back-up.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link