Sellers Are Returning to the Housing Market

[et_pb_section fb_built=”1″ _builder_version=”3.0.47″][et_pb_row _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.18.2″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]

In today’s housing market, it can be a big challenge for buyers to find homes to purchase, as the number of houses for sale is far below the current demand. Now, however, we’re seeing sellers slowly returning to the market, a bright spark for potential buyers. Javier Vivas, Director of Economic Research at realtor.com, explains:

“Seller confidence has been improving gradually after reaching its bottom in mid-April, and now it appears to have reached an important recovery milestone…After five long months, sellers are back in the housing market; while encouraging, the improvement to new listings is only the first step in the long road to solving low inventory issues keeping many buyers at bay.”

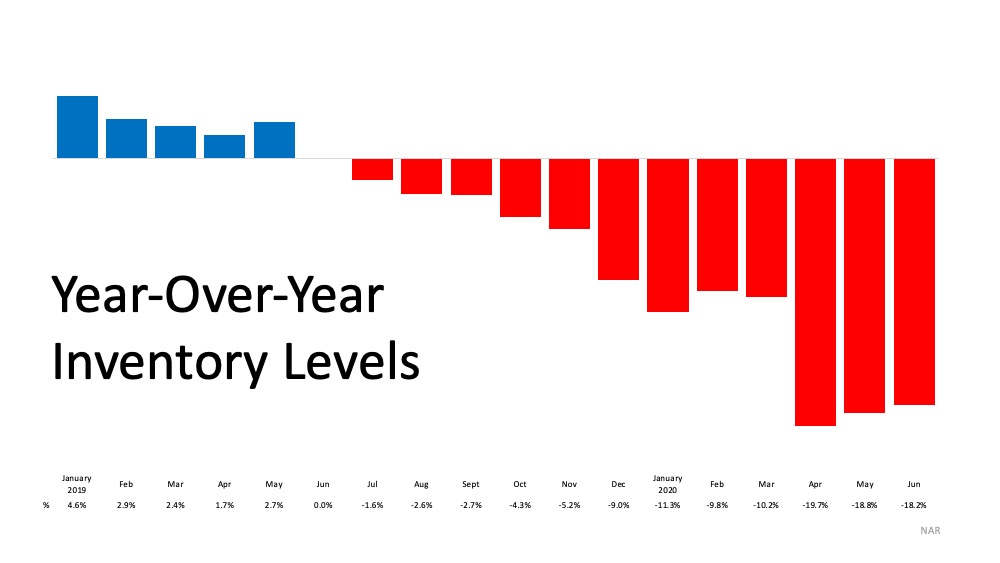

Even with the number of homes coming into the market, the available inventory is well below where it needs to be to satisfy buyer interest. The National Association of Realtors (NAR) reports:

“Total housing inventory at the end of June totaled 1.57 million units, up 1.3% from May, but still down 18.2% from one year ago (1.92 million). Unsold inventory sits at a 4.0-month supply at the current sales pace, down from both 4.8 months in May and from the 4.3-month figure recorded in June 2019.”

Houses today are selling faster than they’re coming to market. That’s why we only have inventory for 4 months at the current sales pace when in reality we need inventory for 6 months to keep up. But, as mentioned above, sellers are starting to return to the game. Realtor.com explains:

“The ‘housing supply’ component – which tracks growth of new listings – reached 101.7, up 4.9 points over the prior week, finally reaching the January growth baseline. The big milestone in new listings growth comes as seller sentiment continues to build momentum…After constant gradual improvements since mid-April, seller confidence appears to be reaching an important milestone. The temporary boost in new listings comes as the summer season replaces the typical spring homebuying season. More homes are entering the market than typical for this time of the year.”

Why is this good for sellers?

A good time to enter the housing market is when the competition in your area is low, meaning there are fewer sellers than interested buyers. You don’t want to wait for all of the other homeowners to list their houses before you do, providing more options for buyers to choose from. With sellers starting to get back into the market after five months of waiting, if you want to sell your house for the best possible price, now is a great time to do so.

Why is this good for buyers?

It can be challenging to find a home in today’s low-inventory environment. If more sellers are starting to put their houses up for sale, there will be more homes for you to choose from, providing a better opportunity to find the home of your dreams while taking advantage of the affordability that comes with historically low mortgage rates.

Bottom Line

While we still have a long way to go to catch up with the current demand, inventory is slowly starting to return to the market. If you’re thinking of moving this year, talk to one of our Real Estate Sales Agents today so you’re ready to make your move when the home of your dreams comes up for sale.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row custom_padding=”12px|0px|17.5781px|0px|false|false” _builder_version=”3.18.2″ locked=”off”][et_pb_column type=”4_4″ _builder_version=”3.18.2″ parallax=”off” parallax_method=”on”][et_pb_blog fullwidth=”off” posts_number=”3″ include_categories=”43″ show_author=”off” show_date=”off” show_categories=”off” _builder_version=”3.18.2″ header_level=”h5″ header_font=”||||||||” body_font=”||||||||” border_radii=”on|12px|12px|12px|12px” text_orientation=”center”][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

Current Buyer & Seller Perks in the Housing Market

[et_pb_section fb_built=”1″ _builder_version=”3.0.47″][et_pb_row _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.0.74″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]

Today’s housing market is making a truly impressive turnaround, and it’s also setting up some outstanding opportunities for buyers and sellers. Whether you’re thinking of buying or selling a home this year, there are perks today that are rarely available, and definitely worth looking into. Here are the top two.

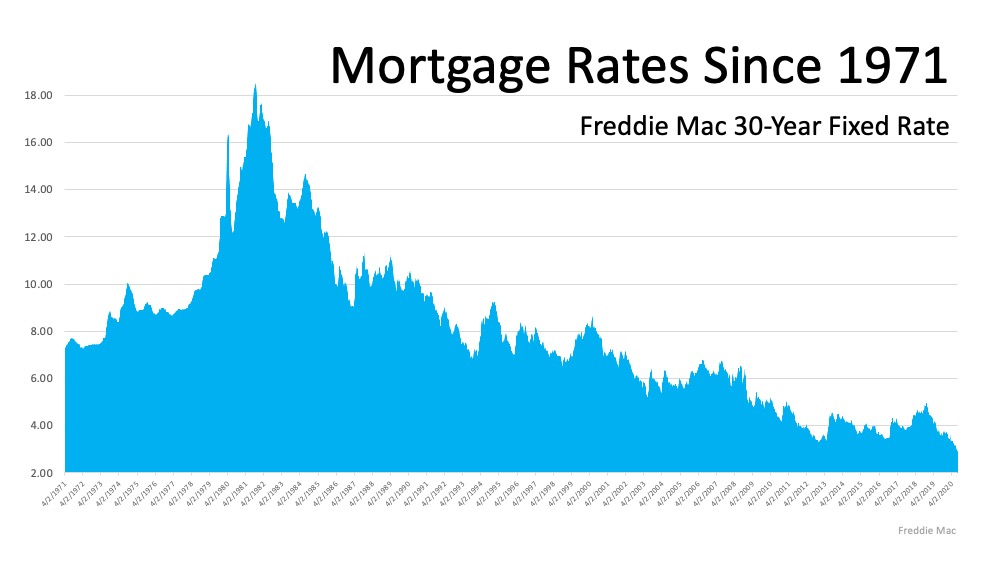

The Biggest Perk for Buyers: Low Mortgage Rates

The most impressive buyer incentive today is the average mortgage interest rate. Just last week, mortgage rates hit an all-time low for the eighth time this year. The 30-year fixed-rate is now averaging 2.88%, the lowest rate in the survey’s history, which dates back to 1971 (See graph below): This is a huge advantage for buyers. To put it in perspective, it means that today you can get a lower rate than any of the past two generations of homebuyers in your family if you decide to purchase at this time.

This is a huge advantage for buyers. To put it in perspective, it means that today you can get a lower rate than any of the past two generations of homebuyers in your family if you decide to purchase at this time.

“Historically-low mortgage rates are stoking demand for real estate, as buyers are rushing to lock-in low monthly payments,” said George Ratiu, senior economist with Realtor.com.

In addition, the National Mortgage News notes how today’s buyers have increasing purchasing power due to these low mortgage rates:

“Purchasing power rose 10% year-over-year…With interest rates hitting record lows, buyers were able to afford $32,000 “more house” as of July 23 than they could the year before with the same monthly payment.”

This is a great perk for buyers who are hoping to potentially get more for their money in a home, something many are considering today as they re-evaluate the amount of space they ideally need for their families. It is an opportunity not seen in 50 years, and one not to be missed if the time is right for you to buy a home.

The Biggest Perk for Sellers: Low Inventory

Today, there are simply not enough houses on the market for the number of buyers looking to purchase them. According to the National Association of Realtors (NAR):

“Total housing inventory at the end of June totaled 1.57 million units, up 1.3% from May, but still down 18.2% from one year ago (1.92 million).”

The red bars in the graph below indicate that the inventory of homes coming into the market continues to decline. It was low as we entered the pandemic and has reduced even further this year. Houses today are selling faster than they’re being listed, and that’s creating an even greater supply shortage (See graph below): The lack of inventory has been a challenging situation for a while now, and with low mortgage rates fueling buyer demand, inventory is even harder for buyers to find today. Buyers are eager to purchase, and because of the shortage of homes available, they’re encountering more bidding wars. This is one of the factors keeping home prices strong, an advantage for sellers. Lawrence Yun, Chief Economist for NAR notes that this trend may continue, too:

The lack of inventory has been a challenging situation for a while now, and with low mortgage rates fueling buyer demand, inventory is even harder for buyers to find today. Buyers are eager to purchase, and because of the shortage of homes available, they’re encountering more bidding wars. This is one of the factors keeping home prices strong, an advantage for sellers. Lawrence Yun, Chief Economist for NAR notes that this trend may continue, too:

“Home prices rose during the lockdown and could rise even further due to heavy buyer competition and a significant shortage of supply.”

With low inventory and high buyer demand, homeowners can potentially earn an increasing profit on their houses and sell them quickly in this sizzling summer market.

Bottom Line

Whether you’re thinking about buying or selling at home, there are some key perks available right now. Let’s connect today to discuss how they may play to your advantage in our local market.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”3.18.2″][et_pb_row _builder_version=”3.18.2″][et_pb_column type=”4_4″ _builder_version=”3.18.2″ parallax=”off” parallax_method=”on”][et_pb_blog fullwidth=”off” posts_number=”3″ include_categories=”38,234″ show_author=”off” show_date=”off” show_categories=”off” _builder_version=”3.18.2″ header_level=”h5″ header_font=”||||||||” body_font=”||||||||” border_radii=”on|12px|12px|12px|12px” text_orientation=”center”][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

Why Homeowners Have Great Selling Power Today

[et_pb_section fb_built=”1″ _builder_version=”3.0.47″][et_pb_row _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.18.2″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]

We’re sitting in an optimal moment in time for homeowners who are ready to sell their houses and make a move this year. Today’s homeowners are, on average, staying in their homes longer than they used to, and this is one factor driving increased homeowner equity. When equity grows, selling a house becomes increasingly desirable. Here’s a breakdown of why it’s a great time to capitalize on equity gain in today’s market.

As average homeowner tenure lengthens and home prices rise, equity, a form of forced savings, can be applied forward to the purchase of a new home. CoreLogic explains:

“Over the past 10 years, the equity position of homeowners has positively changed as a result of more than eight years of rising home prices. As the economy climbed out of the recession in the first quarter of 2010, 25.9% or 12.1 million homes were still underwater, compared to the first quarter of 2020 when the negative equity share was at 3.4%, or 1.8 million properties. Borrowers have seen an aggregate increase of $6.2 trillion in home equity since the first quarter of 2010 and the average homeowner has gained about $106,100 in equity.”

Increasing equity is enabling many homeowners who are ready to sell their current houses today to sell for an increased profit, and then reinvest their earnings in a new home. According to the Q2 2020 U.S. Home Sales Report from ATTOM Data Solutions, in the second quarter of 2020:

“Home sellers nationwide realized a gain of $75,971 on the typical sale, up from the $66,500 in the first quarter of 2020 and from $65,250 in the second quarter of last year. The latest figure, based on median purchase and resale prices, marked yet another peak level of raw profits in the United States since the housing market began recovering from the Great Recession in 2012.”

If you’ve been taking a closer look at your house recently and are thinking it might be time for you to make a move, determining your equity position is a great place to start. Understanding how much equity you’ve earned over time can be a key factor in helping you realize the potential profits in your real estate investment and move toward your next homeownership goal.

Bottom Line

With average home sale profits growing, it’s a great time to leverage your equity and make a move, especially while the inventory of houses for sale and mortgage rates are historically low. If you’re considering selling your house, let’s connect today so you can better understand your home equity position and take one step closer to the home of your dreams.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”3.18.2″ custom_padding=”0px|0px|0|0px|false|false”][et_pb_row _builder_version=”3.18.2″][et_pb_column type=”4_4″ _builder_version=”3.18.2″ parallax=”off” parallax_method=”on”][et_pb_button button_text=”Get an Instant Home Value Estimate” _builder_version=”3.18.2″ button_url=”https://greenteamrealty.com/home-value-estimate/”][/et_pb_button][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”3.18.2″][et_pb_row custom_padding=”18px|0px|17.5781px|0px|false|false” _builder_version=”3.18.2″][et_pb_column type=”4_4″ _builder_version=”3.18.2″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.18.2″]

You Might Also Enjoy Reading…

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row custom_padding=”12px|0px|17.5781px|0px|false|false” _builder_version=”3.18.2″][et_pb_column type=”4_4″ _builder_version=”3.18.2″ parallax=”off” parallax_method=”on”][et_pb_blog fullwidth=”off” posts_number=”3″ include_categories=”38,234″ show_author=”off” show_date=”off” show_categories=”off” _builder_version=”3.18.2″ header_level=”h5″ header_font=”||||||||” body_font=”||||||||” border_radii=”on|12px|12px|12px|12px” text_orientation=”center”][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

Welcome Kevin Many

The Green Team is proud to announce that Kevin Many has decided to join our Warwick, NY office. We’re excited to have him on our team and look forward to helping him grow!

Please join us in Welcoming Kevin to The Green Team New York!

To learn more about Kevin and his business visit his website.

Welcome Sandra Medina

The Green Team is proud to announce that Sandra Medina has decided to join our Warwick, NY team. We’re excited to have her on our team and look forward to helping her grow!

Please join us in Welcoming Sandra to The Green Team New York Realty!

To learn more about Sandra Medina and her business visit her website here.

Two Reasons We Won’t See a Rush of Foreclosures This Fall

The health crisis we face as a country has led businesses all over the nation to reduce or discontinue their services altogether. This pause in the economy has greatly impacted the workforce and as a result, many people have been laid off or furloughed. Naturally, that would lead many to believe we might see a rush of foreclosures this fall like we saw in 2008. The market today, however, is very different from 2008.

The concern of more foreclosures based on those that are out of work is one that we need to understand fully. There are two reasons we won’t see a rush of foreclosures this fall: forbearance extension options and strong homeowner equity.

1. Forbearance Extension

Forbearance, according to the Consumer Financial Protection Bureau (CFPB), is “when your mortgage servicer or lender allows you to temporarily pay your mortgage at a lower payment or pause paying your mortgage.” This is an option for those who need immediate relief. In today’s economy, the CFPB has given homeowners a way to extend their forbearance, which will greatly assist those families who need it at this critical time.

Under the CARES Act, the CFPB notes:

“If you experience financial hardship due to the coronavirus pandemic, you have a right to request and obtain a forbearance for up to 180 days. You also have the right to request and obtain an extension for up to another 180 days (for a total of up to 360 days).”

2. Strong Homeowner Equity

Equity is also working in favor of today’s homeowners. This savings is another reason why we won’t see substantial foreclosures in the near future. Today’s homeowners who are in forbearance actually have more equity in their homes than what the market experienced in 2008.

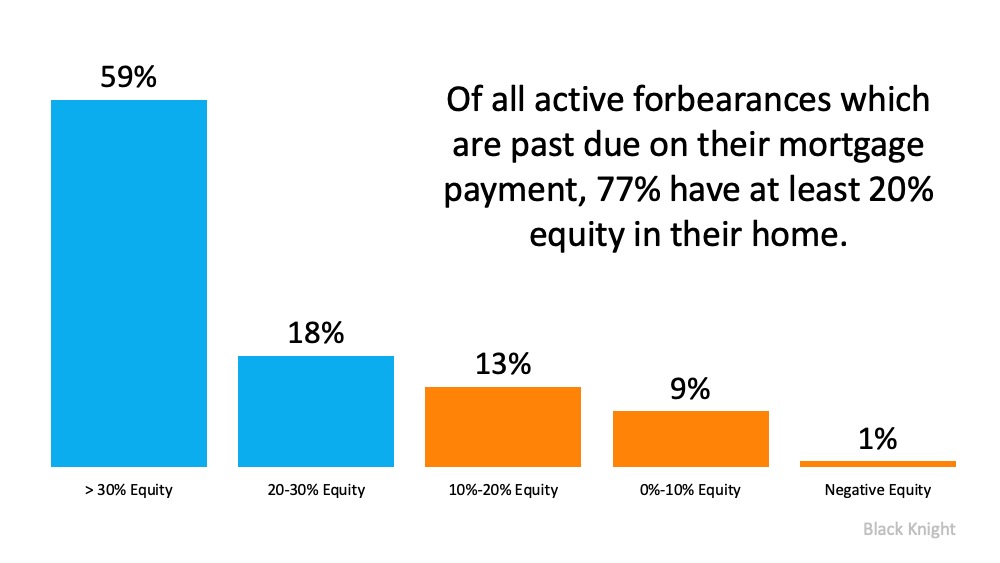

The Mortgage Monitor report from Black Knight indicates that of all active forbearances which are past due on their mortgage payment, 77% have at least 20% equity in their homes (See graph below): Black Knight notes:

Black Knight notes:

“The high level of equity provides options for homeowners, policymakers, mortgage investors and servicers in helping to avoid downstream foreclosure activity and default-related losses.”

Bottom Line

Many think we may see a rush of foreclosures this fall, but the facts just don’t add up in this case. Today’s real estate market is very different from 2008 when we saw many homeowners walk away when they owed more than their homes were worth. This time, equity is stronger and plans are in place to help those affected weather the storm.

Home Sales Hit a Record-Setting Rebound

With a worldwide health crisis that drove a pause in the economy this year, the housing market was greatly impacted. Many have been eagerly awaiting some bright signs of a recovery. Based on the latest Existing Home Sales Report from the National Association of Realtors (NAR), June hit a much-anticipated record-setting rebound to ignite that spark.

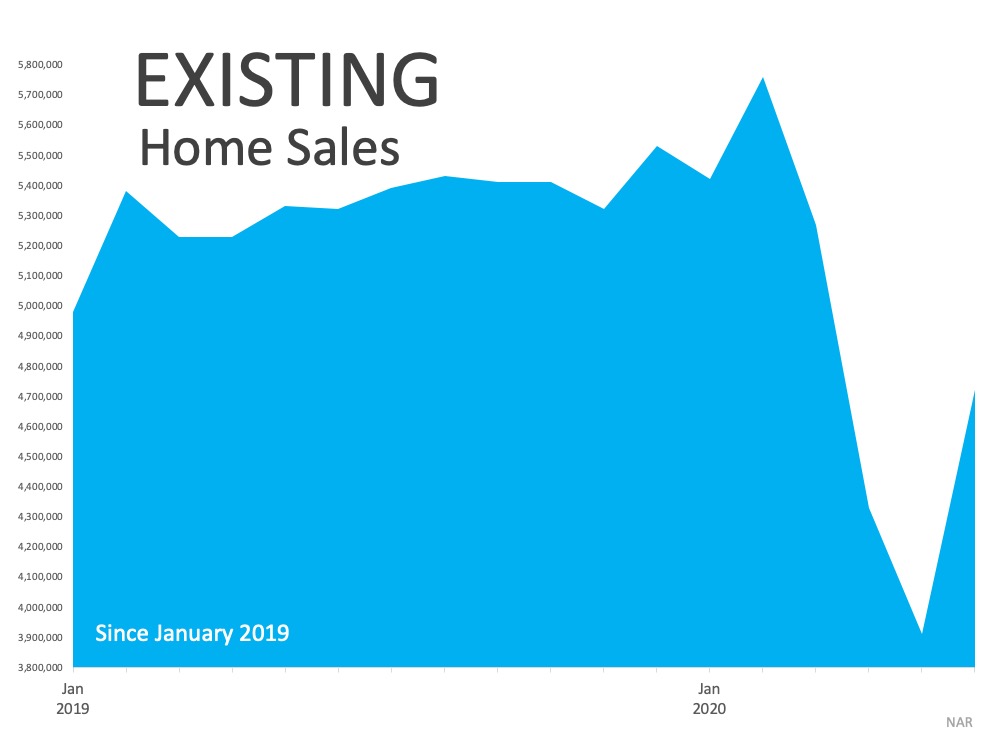

According to NAR, home sales jumped 20.7% from May to a seasonally-adjusted annual rate of 4.72 million in June:

“Existing-home sales rebounded at a record pace in June, showing strong signs of a market turnaround after three straight months of sales declines caused by the ongoing pandemic…Each of the four major regions achieved month-over-month growth.”

This significant rebound is a major boost for the housing market and the U.S. economy. According to Lawrence Yun, Chief Economist for NAR, the momentum has the potential to continue on, too:

This significant rebound is a major boost for the housing market and the U.S. economy. According to Lawrence Yun, Chief Economist for NAR, the momentum has the potential to continue on, too:

“The sales recovery is strong, as buyers were eager to purchase homes and properties that they had been eyeing during the shutdown…This revitalization looks to be sustainable for many months ahead as long as mortgage rates remain low and job gains continue.”

With mortgage rates hitting an all-time low, dropping below 3% for the first time last week, potential homebuyers are poised to continue taking advantage of this historic opportunity to buy. This fierce competition among buyers is contributing to home price increases as well, as more buyers are finding themselves in bidding wars in this environment. The report also notes:

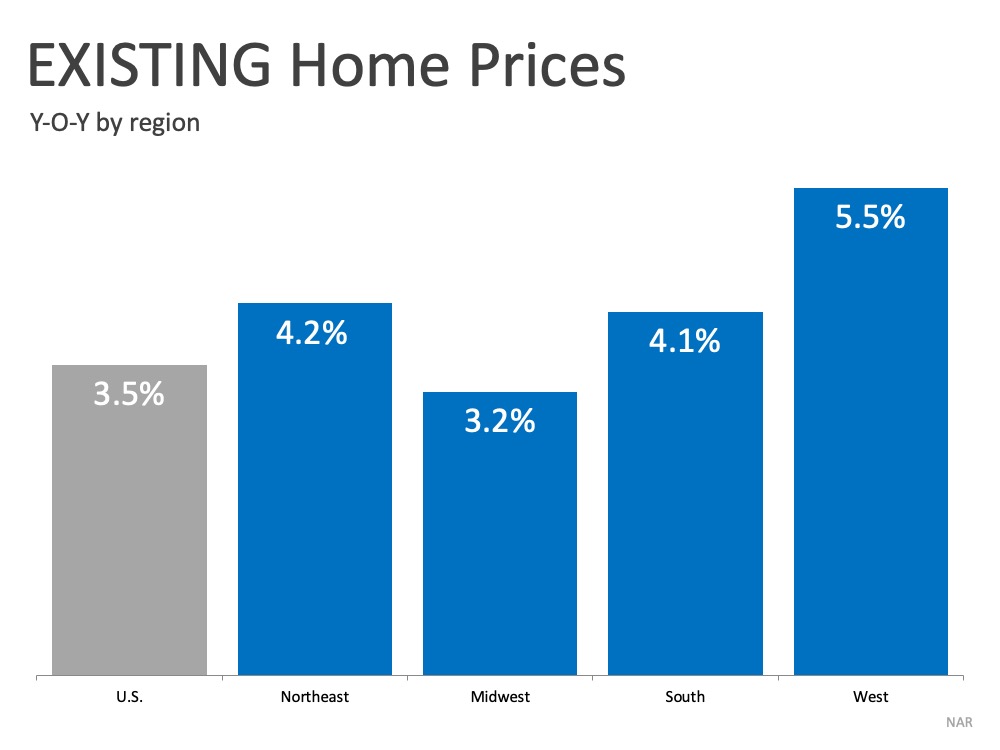

“The median existing-home price for all housing types in June was $295,300, up 3.5% from June 2019 ($285,400), as prices rose in every region. June’s national price increase marks 100 straight months of year-over-year gains.”

The graph below shows home price increases by region, powered by low interest rates, pent-up demand, and a decline in inventory on the market: Yun also indicates:

Yun also indicates:

“Home prices rose during the lockdown and could rise even further due to heavy buyer competition and a significant shortage of supply.”

Bottom Line

Buyers returning to the market is a great sign for the economy, as housing is still leading the way toward a recovery. If you’re ready to buy a home this year, let’s connect you to one of our Real Estate Agents to make sure you have the best possible guide with you each step of the way.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/08/13150648/20200814-MEM-1-1046x1306.jpg)