Green Team 2018 Awards Ceremony celebrates another year of growth and success

Agents and staff of Green Team Realty gathered together on January 18 at the Warwick Country Club to celebrate a year that was momentous in many ways. Geoff Green welcomed everyone and outlined some of the year’s milestones.

Among them, a new home for Green Team New Jersey Realty and a beautiful renovation of the Warwick Office. Add to that the many new sales associates that have joined Green Team New York Realty and Green Team New Jersey Realty.

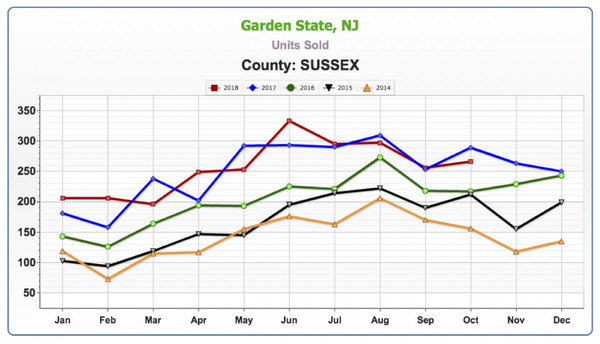

Growth was an important topic. Through dedication, hard work, support, creative marketing and consistent training programs, many Green Team sales associates saw their businesses grow. And both offices saw sales volume increase. In fact, Green Team New Jersey Realty became #1 in Vernon (based on a comparison to all GSMLS offices in the township by closed sales volume for the period of 1/1/18-12/31/18). This achievement is made even more impressive considering GTNJR first opened its doors in 2016.

Award Presentations

Geoff Green believes in acknowledging and rewarding both growth and achievement. And what makes the award presentations so special is the support and pride that the whole Green Team family shows to the recipients.

Yearly Sales Leaders & 4th Quarter Sales Leaders

President’s Club

As several sales associates achieved between $5 and $10 Million in Sales Volume, a new award category became necessary. Meet the charter members of the President’s Club.

From Left to Right: Jennifer DiCostanzo, Ted VanLaar, Joyce Rogers, Charles Nagy, Pip Klein, Tammy Scotto, Nancy Sardo and Dean Diltz.

Captain’s Club

This established award is given to those who do $3 to $5 Million in Sales Volume.

From Left to Right: Keren Gonen, Barbara Tesa, Vikki Garby, Lucyann Tinnirello, Linda VanDeWeert, Chris Kimiecik and Kim Lesley.

Honorable Mention

This new category was created to acknowledge those Sales Associates who had $1.5 to $3 Million in Sales Volume.

From Left to Right: Kimberly Lasalandra, Janine Blandino, Angela Murphy, Jacque Kraszewski, Mary Lynch, Terry Gavan, Toni Vogel, Tom Folino, Alison Miller, Ann Nussberger.

Not shown: Julianna Green, Toni Kreusch, Connie Marines, Denise Schmidt.

The Momentum Builder Award

The People’s Choice Awards

The winners of these awards are selected by their peers.

Citizen of the Year

Team Player Award

And a special thank you goes to…

Why It Makes No Sense to Wait for Spring to Sell

The price of any item (including residential real estate) is determined by the theory of ‘supply and demand.’ If many people are looking to buy an item and the supply of that item is limited, the price of that item increases.

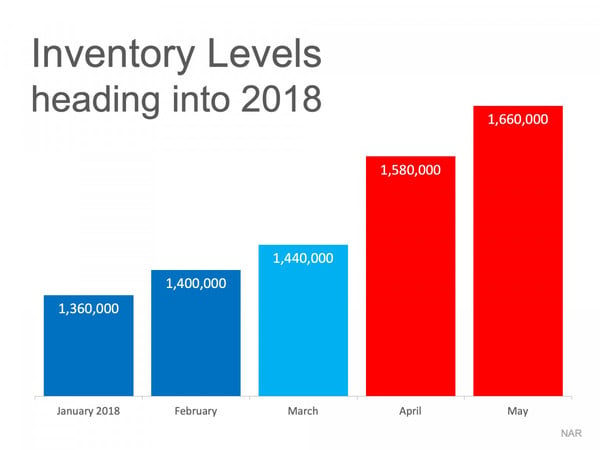

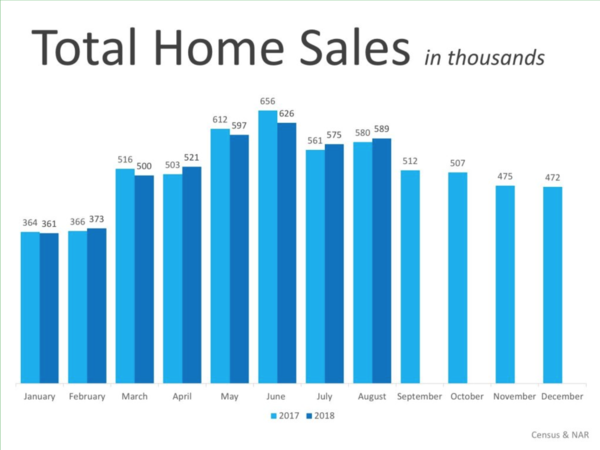

The supply of homes for sale dramatically increases every spring, according to the National Association of Realtors (NAR). As an example, here is what happened to housing inventory at the beginning of 2018:

Putting your home on the market now, rather than waiting for increased competition in the spring, might make a lot of sense.

Bottom Line

Buyers in the market during the winter are truly motivated purchasers and they want to buy now. With limited inventory currently available in most markets, sellers are in a great position to negotiate.

Thinking about selling your home?

Find out what your home is worth, use our free and easy Home Value Estimator.

The Best Time to List Your House? TODAY!

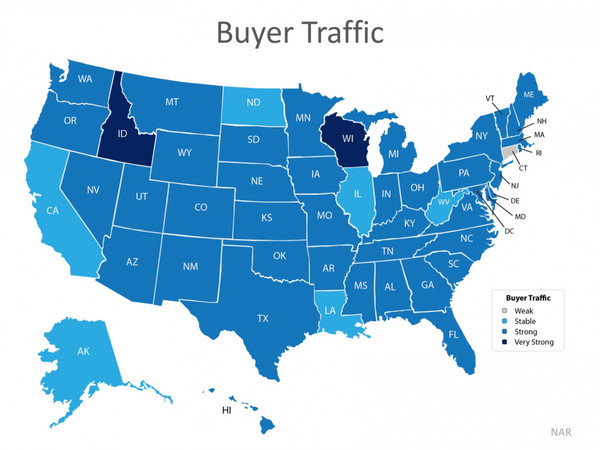

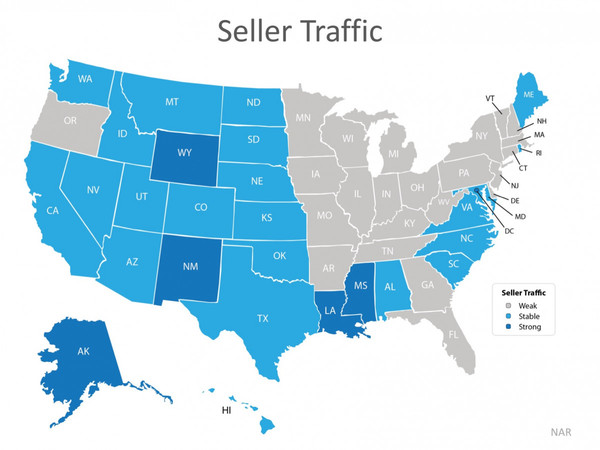

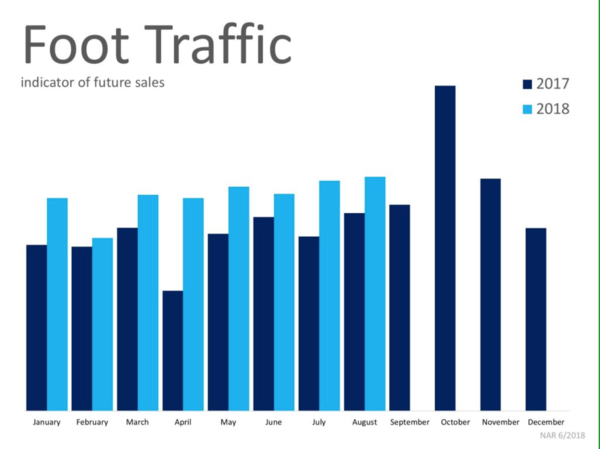

You may have heard that the housing market is softening. There is no doubt that buyer traffic has decreased. There are fewer purchasers in the market than there were last month and at this time last year. What you may not have heard, however, is that there is still a severe shortage of listing inventory in many regions of the country.

In a recent interview discussing the housing market, First American’s Chief Economist Mark Fleming put it simply:

“The biggest challenge is really the availability of supply.”

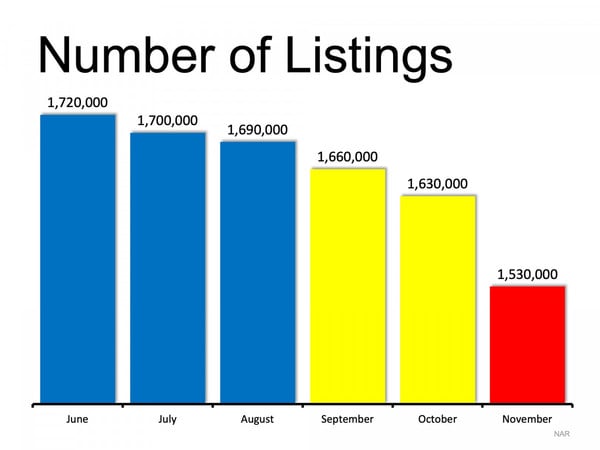

When we look at available inventory numbers released by the National Association of Realtors (NAR), we see that the actual number of homes for sale has decreased in each of the last five months.

What does this mean to you as a seller?

The best time to sell is when there is less competition. That guarantees you a better price and fewer hassles in the transaction.

Bottom Line

If you are thinking of selling your house this year, the best time to put it on the market might be right now. Let’s get together to evaluate the demand for your house in our market!

Start by finding out what your home is worth, use our quick and free Home Evaluation tool.

December 2018 Housing Market Update

The Green Team’s December 2018 Housing Market Update was held on Facebook Live Tuesday, December 11 at 2 p.m. If you were unable to view the webinar live, you can watch it at your convenience here. You can also sign up for future updates at GreenTeamHQ.com/hmu.

This month’s panelists…

Geoffrey Green is the President/Broker of Green Team Home Selling System. In addition to moderating the monthly webinars, Geoff also presents national statistics as well as local updates for Orange County, NY and Sussex County, NJ. This month he is joined by regular panelist Keren Goren, and by Joyce Rogers, both from Green Team New Jersey Realty.

The National Outlook

Will home prices continue to appreciate through 2019?

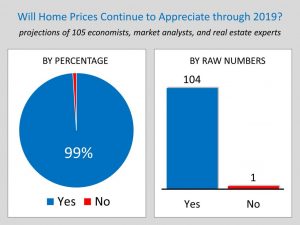

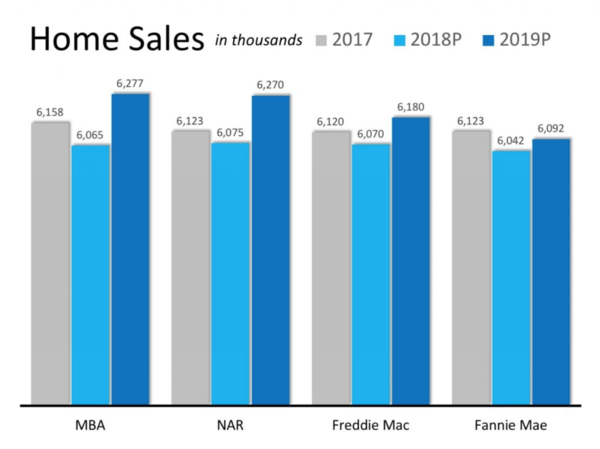

Overall sentiment is that the housing market seems to be cooling off, so now we’re at the prediction stage, trying to foresee what will happen next. Per the graphic, 99% of the 105 economists, market analysts and real estate experts consulted felt that home prices will continue to appreciate through 2019. However, that does not mean that the market won’t continue to slow; it means that the rate of appreciation will continue on a positive note. Most agree that it will continue to appreciate at a lesser value in the coming year.

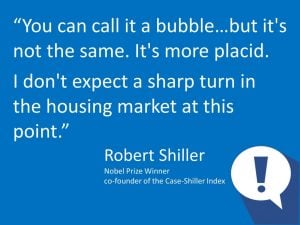

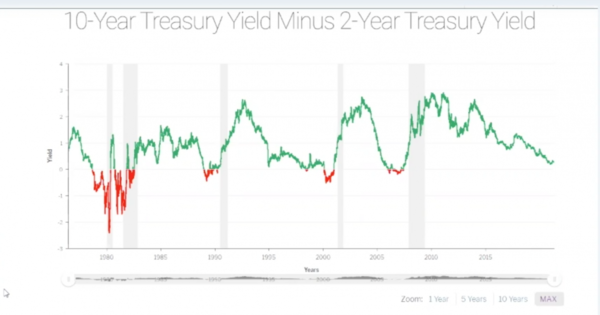

Will there be a sharp turn in the housing market?

Geoff Green finds this quote to be of great importance. Nobel Price Winner Robert Shiller is one of the thought leaders of real estate analytics. Compared to where we were in 2008, where almost 50% of transactions just went away within a two year period of time, and where we are now, Shiller doesn’t expect a sharp turn. This point of view coincides with Geoff’s observation’s over the last several months.

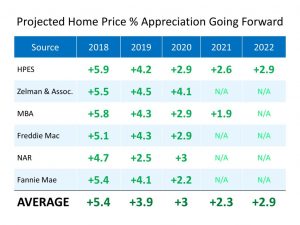

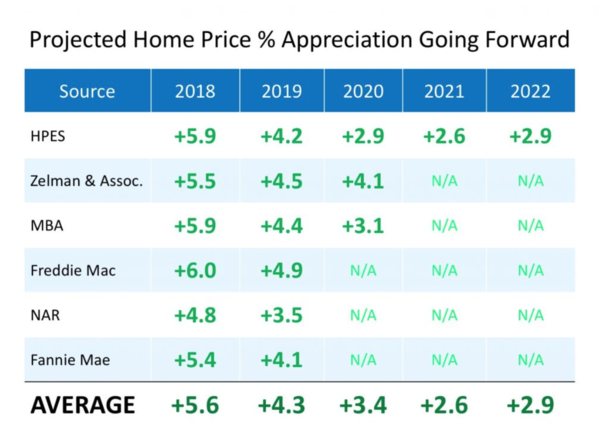

Looking forward – Predictions of the experts on home appreciation growth over the next 3-5 years

This chart has been updated from November to include predictions of where things are headed in the future. Some of the larger organizations that provide information to the industry are showing a slow turn to the downside. And, important to note, there are no numbers indicating a reduction in price.

Corelogic’s State by State forecasted changes in price

Price appreciation most often happens in the south and on the coast, where many people tend to move as they get older. No projections are in the red for any state. Historically speaking, most of the country is looking at a very substantial increase in terms of price. The numbers are solid, and if this trend continues through 2019, it will be a very good year.

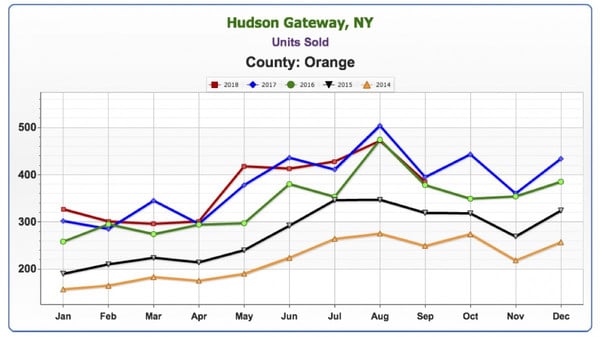

December 2018 Housing Market Update – Orange County

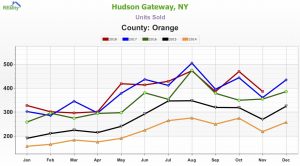

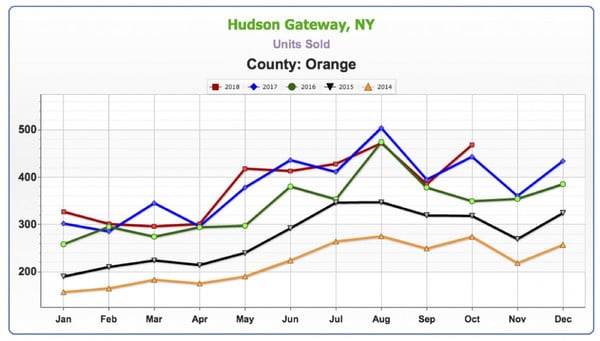

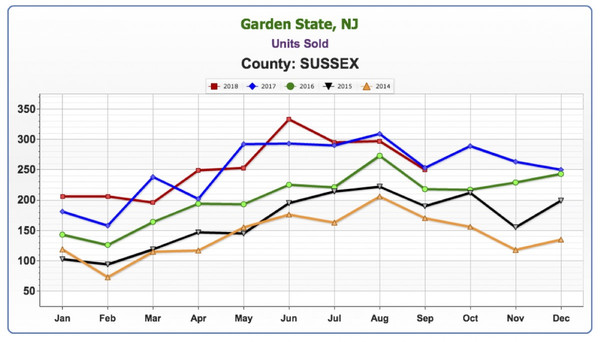

Units Sold

The red line representing 2018 shows there is not too much of a variance between this year and last year.

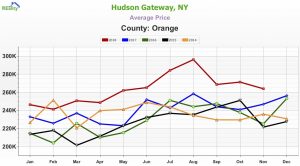

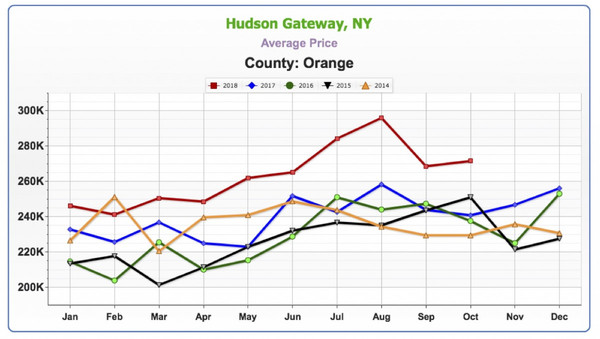

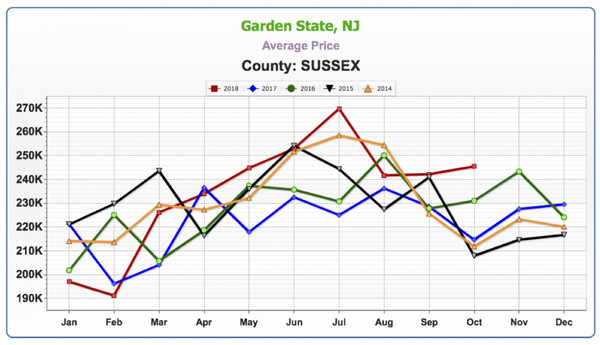

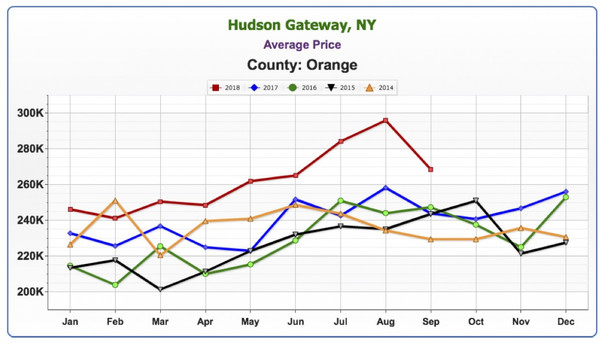

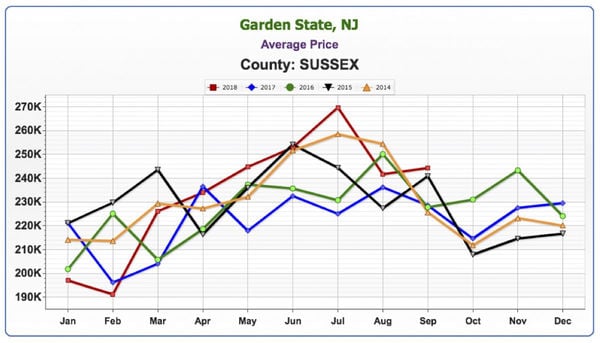

Average Price

Prices spiked during the summer and have been simmering down, coming a little closer to 2017’s numbers.

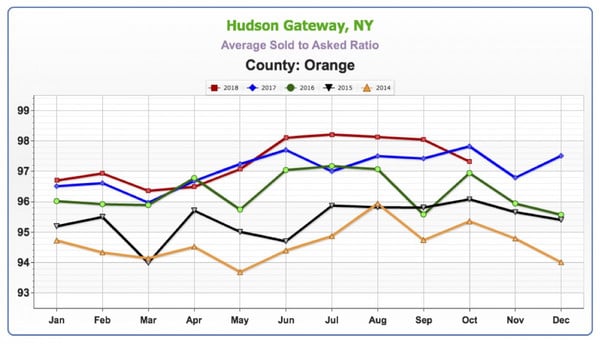

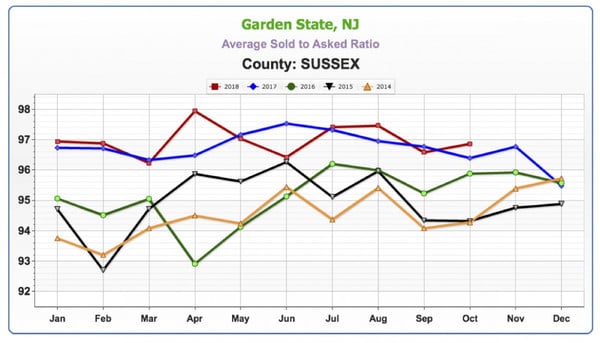

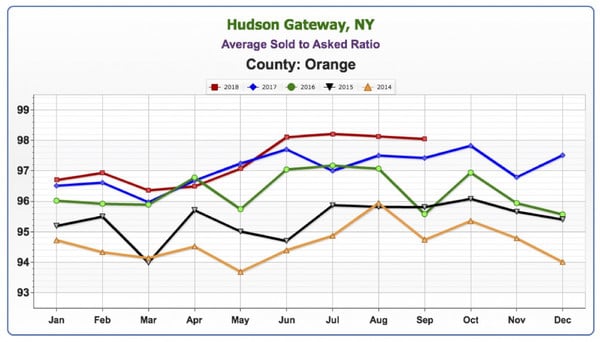

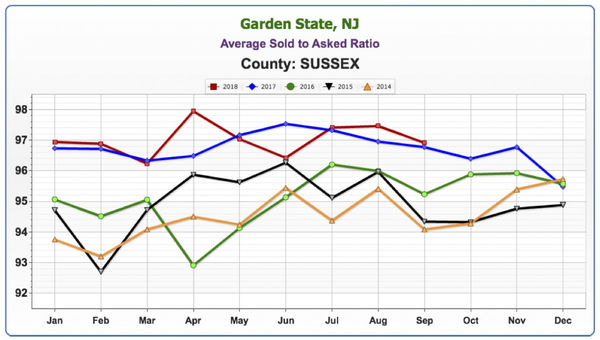

Average Sold to Asked Ratio

This number shows the price the home sold for versus the last asking price. The higher the number, the hotter the market. This is a mixed bag result from 2018 over 2017.

Thanksgiving Pie – A Green Team Tradition

Thanksgiving Pie – A Green Team Tradition

Thanksgiving. It’s a time of gratitude, friends and family; of turkey and all the trimmings. And at the Green Team, it’s a time to let clients know how much they are valued. The Client Appreciation Program, or CAP, is the cornerstone of the Green Team’s foundation. The Green Team doesn’t take its clients for granted. Through the CAP program sales associates find ways to say “I appreciate you” throughout the year. However, one of the highlights of the program is Thanksgiving Pie. A Green Team CAP tradition, clients are invited to come to the office for a casual party. And to pick up their Thanksgiving pie. Because this gift from their sales associate is a way of saying “Thank You.” Thank you for your business, your referrals, and your friendship.

Thanksgiving. It’s a time of gratitude, friends and family; of turkey and all the trimmings. And at the Green Team, it’s a time to let clients know how much they are valued. The Client Appreciation Program, or CAP, is the cornerstone of the Green Team’s foundation. The Green Team doesn’t take its clients for granted. Through the CAP program sales associates find ways to say “I appreciate you” throughout the year. However, one of the highlights of the program is Thanksgiving Pie. A Green Team CAP tradition, clients are invited to come to the office for a casual party. And to pick up their Thanksgiving pie. Because this gift from their sales associate is a way of saying “Thank You.” Thank you for your business, your referrals, and your friendship.

Thanksgiving Pie… A “family” event for both the Warwick and Vernon Offices

Walking into either office you can feel the warmth and joy and know that you are welcome. Pies are stacked high, waiting to be distributed. Being a local brokerage, it’s important to the Green Team to support other local businesses. Thus Noble Pies has become part of the tradition. Their pies are baked from locally sourced ingredients when available. Cider, wine, donuts and more await the clients as they drop in to pick up their pies. And, of course, there is laughter; lots of laughter!

important to the Green Team to support other local businesses. Thus Noble Pies has become part of the tradition. Their pies are baked from locally sourced ingredients when available. Cider, wine, donuts and more await the clients as they drop in to pick up their pies. And, of course, there is laughter; lots of laughter!

Green Team Sales Associates agree that the Client Appreciation Program is something they themselves appreciate. It keeps the focus on the people who are most important to their businesses: their clients. And events like this one bring everyone together, strengthening bonds between associates and between clients and associates. Probably one of the best things is that two days later pies from the Green Team’s sales associates will be sweetening Thanksgiving Dinners at many homes. Again letting clients know how much they are appreciated.

Pip Klein 3rd Quarter Sales Leader

The Green Team Home Selling System is pleased to announce Pip Klein as 3rd Quarter Sales Leader.

“Ever since I got my license in 2011, it was always a personal goal to win a quarterly award. In the beginning it felt unattainable. But with every transaction, every year that passed, I knew I was learning and growing as an agent.”

A Natural People Person…

Pip feels fortunate to be part of the Green Team and to have found a new career at this point in her life. “I was at a turning point,” adds Klein. “Many of my peers were starting to slow down or retire, when Geoff Green encouraged me to dive head first into this fascinating business.” At the time, Pip had her late parents’ home to sell and as a natural “people person,” she was an ideal candidate to become an agent. “I am so grateful that Geoff gave me that push and this opportunity to put my skills to work in this industry. It’s been a great journey and I love working in my hometown!”

According to Geoff Green, “It’s hard to believe, because she is such a great producer, that this is Pip’s first quarterly Sales Leader Award. That said, it has come at the busiest time of the year in the fastest moving market that Pip has experienced in her career as a Realtor. So this is a truly awesome accomplishment. And probably the first of many such awards for Pip.”

Team Up for Hope: The Green Team Went Live with NAMI Orange County, NY

Team Up for Hope

As a copywriter for the Green Team, one of my jobs is to do write-ups of the various webinars held by the company. On October 10, 2018 a special webinar was held on Facebook. Team Up for Hope: The Green Team Live with NAMI Orange County, NY. For those unfamiliar with the organization, NAMI stands for the National Alliance on Mental Illness. It is the largest grassroots organization in the nation dedicated to building better lives for the millions of Americans affected by mental illness. It operates on national, state and local levels by volunteers who are themselves impacted by mental illness. And these volunteers go through extensive training to offer education, support and advocacy to those of us who have had our lives turned upside down.

As a copywriter for the Green Team, one of my jobs is to do write-ups of the various webinars held by the company. On October 10, 2018 a special webinar was held on Facebook. Team Up for Hope: The Green Team Live with NAMI Orange County, NY. For those unfamiliar with the organization, NAMI stands for the National Alliance on Mental Illness. It is the largest grassroots organization in the nation dedicated to building better lives for the millions of Americans affected by mental illness. It operates on national, state and local levels by volunteers who are themselves impacted by mental illness. And these volunteers go through extensive training to offer education, support and advocacy to those of us who have had our lives turned upside down.

So why is a real estate company spending time talking about mental illness? Because the Green Team cares about what happens in the communities we’re part of and which we serve. Every year we raise money for a local charity. This year, our committee felt that we should do something more than hold a fundraiser. We decided to team up with NAMI for an initiative to help end the stigma surrounding mental illness and to provide much needed information to our communities. Thus, this webinar was held, featuring two members of NAMI Orange who presented the personal side of mental illness as well as information and the services NAMI offers.

About our guest panelists

Marcy Felter and Sheila Sutton are working with the Green Team’s Team Up for Hope Committee, educating us on mental illness and the services that NAMI offers. We are also working with Annie Glynn, President, and Jeri Doherty, Treasurer, of NAMI Sussex. Marcy and Sheila volunteered to do the webinar on behalf of both NAMI Affiliates.

Marcy is Chair of the Education Committee, teaches the NAMI Basics and Family to Family Courses, is a Family Support Group Facilitator and serves as a volunteer for Families Helping Families at Orange Regional Medical Center. She is also teaching a new NEABPD (National Education Alliance on Borderline Personality Disorder) class on Borderline Personality Disorder. Hosted by NAMI, this is the first class of its kind being offered in Orange County.

Sheila is a member of the Board of Directors and manages the lending library. She also teaches the NAMI Basics and Family to Family Courses, is a Family Support Group Facilitator and serves as a volunteer for Families Helping Families at Orange Regional Medical Center. In the webinar, Sheila shares her powerful story of the effects of mental illness on her son and her family and how NAMI changed her life.

To write or not to write, that is the question

As I watched the webinar, I realized that I could not do justice to what I was hearing and seeing. To do so would be to rob it of its power, its intent, and its ability to reach people. So I am going to ask everyone reading this to watch the webinar. Spend a few minutes learning about the lives many of you, your family, your friends and your neighbors are living. There are people living in the shadows, afraid of discrimination, bullying, being deserted by friends and family… being judged. Imagine living in fear for a loved one, not understanding what had happened, where that person went, what to do when things got out of control and scary… And then being thrown a lifeline by people like the two women talking to us. And that is exactly what NAMI is, a lifeline.

https://www.facebook.com/greenteamhq/videos/1147158258784487/

Want to learn more? Here are some facts and resources from NAMI.ORG

Mental Health Facts in America

Mental Health Facts Children & Teens

Navigating a Mental Health Crisis

Taking Charge of your Mental Health

Want to Know How to Help a Friend?

Where to go for help

Local Nami Affiliates:

Orange County, NY

Email: namiorangeny@warwick.net

Website: namiorangeny.org

Telephone: 845-956-NAMI (6264) or Toll-free: 1-866-906-NAMI (6264)

FaceBook: @namiorangecountyny, NAMI Orange Discussion Group

Sussex County, NJ

Email: nami.sussex@gmail.com

Website: www.nami-sussex-nj.org

Telephone: 9793-214-0632

Facebook: @namisussex

NAMI National Helpline:

1-800-950-NAMI (6264) or info@nami.org

Crisis Text Line: Text 741741 from anywhere in the USA to text with a trained Crisis Counselor

National Suicide Prevention Lifeline:

Call 1-800-273-8255

Online Chat: https://suicidepreventionlifeline.org/chat

Mental Health First Aid Class – to learn how to identify, understand and respond to symptoms of mental illnesses and substance abuse disorders in your community

Website: https://www.mentalhealthfirstaid.org/

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Matt Zagroda is a Sales Manager at

Matt Zagroda is a Sales Manager at