Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

April 2022 Housing Market Update

Geoff Green is President of Green Team Realty and Co-founder and CEO of NuOp. In addition, he is the moderator of the monthly Housing Market Updates. With so many changes in the market, Geoff began the April 2022 Housing Market Update with information on rising mortgage rates.

If you haven’t yet seen the April 2022 Housing Market Update or would like to watch it again, it’s available below.

Geoff provided some historical perspectives on rising rates and their impact. With statistics going back to 1993, it appears that prices will continue to climb even as rates are climbing.

Spring Market

Buyer traffic is very strong. Inventory continues to be very low. However, there has been a slight bump in active listings for the first time in 6 months. According to Lance Lambert, Editorial Director, Fortune,

“…some experts say that 2022 spring housing market might go down as one of the most competitive on record.”

Home Sale Price

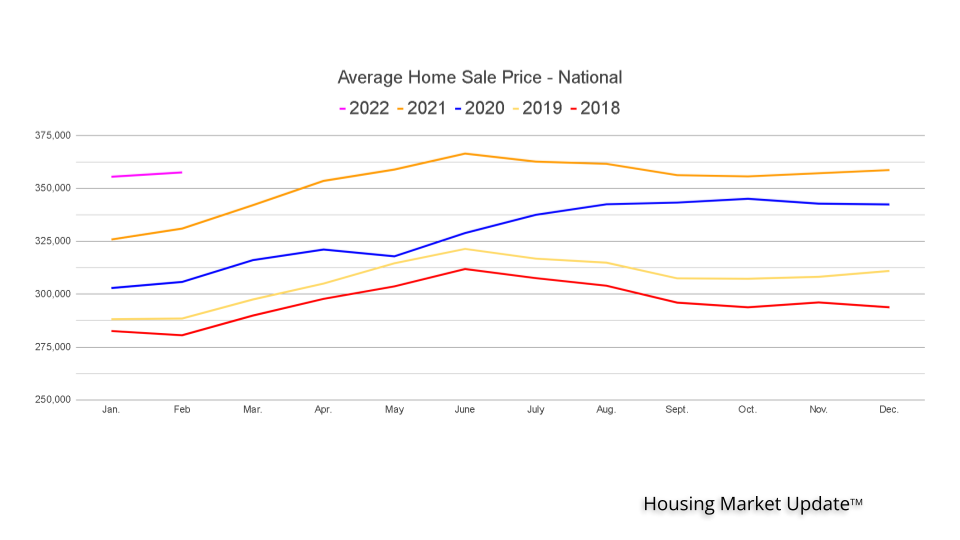

The year-over-year stats show that sales prices are not going backward.

Meet our Panel

Vikki Garby, of Green Team New York Realty and Michael Giannetto of CrossCountry Mortgage, joined Geoff for their take on the market. To watch the panel discussion, click here.

Thanks to our Sponsor

NuOp is the Business Opportunity Exchange. View a live feed of Real Estate and Mortgage Referrals on NuOp.com

Sign up for Housing Market Updates

Join us for our next Housing Market Update on May 15, 2022. To stay informed and sign up for our housing market updates, click here.

Myths About Today’s Housing Market [INFOGRAPHIC]

![Myths About Today’s Housing Market [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/04/21104919/20220422-MEM-1046x1690.png)

Some Highlights

- If you’re planning to buy or sell a home today, it’s important to be aware of common misconceptions.

- Whether it’s timing your purchase as a buyer based on home prices and mortgage rates or knowing what to upgrade or repair before listing your house as a seller, it takes a professional to guide you through those decisions.

- Let’s connect so you have an expert to help separate fact from fiction in today’s housing market.

The Future of Home Price Appreciation and What It Means for You

Many consumers are wondering what will happen with home values over the next few years. Some are concerned that the recent run-up in home prices will lead to a situation similar to the housing crash 15 years ago.

However, experts say the market is totally different today. For example, Odeta Kushi, Deputy Chief Economist at First American, tweeted just last week on this issue:

“. . . We do need price appreciation to slow today (it’s not sustainable over the long run) but high price growth today is supported by fundamentals- short supply, lower rates & demographic demand. And we are in a much different & safer space: better credit quality, low DTI [Debt-To-Income] & tons of equity. Hence, a crash in prices is very unlikely.”

Price appreciation will slow from the double-digit levels the market has seen over the last two years. However, experts believe home values will not depreciate (where a home would lose value).

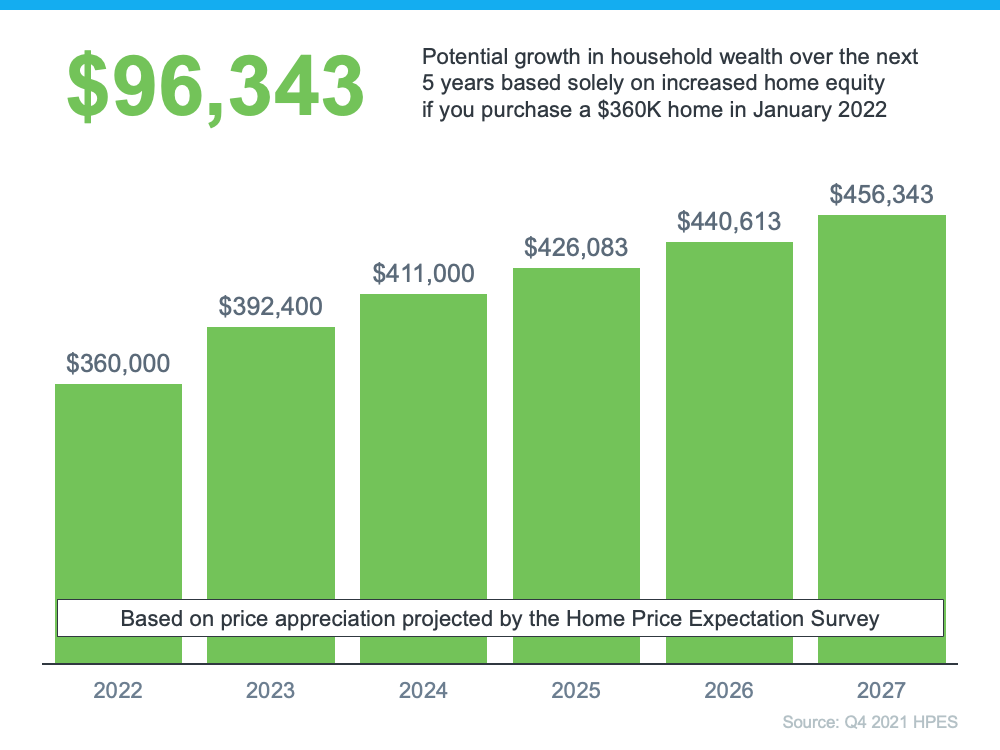

To this point, Pulsenomics just released the latest Home Price Expectation Survey – a survey of a national panel of over 100 economists, real estate experts, and investment and market strategists. It forecasts home prices will continue appreciating over the next five years. Below are the expected year-over-year rates of home price appreciation based on the average of all 100+ projections:

- 2022: 9%

- 2023: 4.74%

- 2024: 3.67%

- 2025: 3.41%

- 2026: 3.57%

Those responding to the survey believe home price appreciation will still be relatively high this year (though half of what it was last year), and then return to more normal levels over the next four years.

What Does This Mean for You as a Buyer?

With a limited supply of homes available for sale and both prices and mortgage rates increasing, it can be a challenging market to navigate as a buyer. But buying a home sooner rather than later does have its benefits. If you wait to buy, you’ll pay more in the future. However, if you buy now, you’ll actually be in the position to make future price increases work for you. Once you buy, those rising home prices will help you build your home’s value, and by extension, your own household wealth through home equity.

As an example, let’s assume you purchased a $360,000 home in January of this year (the median price according to the National Association of Realtors rounded up to the nearest $10K). If you factor in the forecast for appreciation from the Home Price Expectation Survey, you could accumulate over $96,000 in household wealth over the next five years (see graph below):

Bottom Line

If you’re trying to decide whether to buy now or wait, the key is knowing what’s expected to happen with home prices. Experts say prices will continue to climb in the years ahead, just at a slower pace. So, if you’re ready to buy, doing so now may be your best bet for your wallet. It’ll also give you the chance to use the future home price appreciation to build your own net worth through rising equity. If you want to get started, let’s connect today.

What You Can Expect from the Spring Housing Market

As the spring housing market kicks off, you likely want to know what you can expect this season when it comes to buying or selling a house. While there are multiple factors causing some uncertainty, including the conflict overseas, rising inflation, and the first rate increase from the Federal Reserve in over three years — the housing market seems to be relatively immune.

Here’s a look at what experts say you can expect this spring.

1. Mortgage Rates Will Climb

Freddie Mac reports the 30-year fixed mortgage rate has increased by more than a full point in the past six months. And despite some mild fluctuation in recent weeks, experts believe rates will continue to edge up over the next 90 days. As Freddie Mac says:

“The Federal Reserve raising short-term rates and signaling further increases means mortgage rates should continue to rise over the course of the year.”

If you’re a first-time buyer or a seller thinking of moving to a home that better fits your needs, realize that waiting will likely mean you’ll pay a higher mortgage rate on your purchase. And that higher rate drives up your monthly payment and can really add up over the life of your loan.

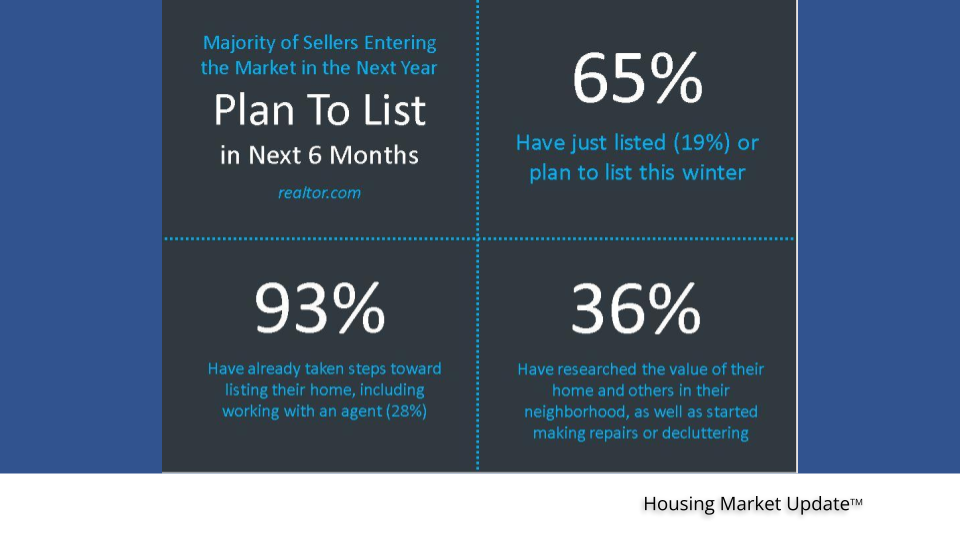

2. Housing Inventory Will Increase

There may be some relief coming for buyers searching for a home to purchase. Realtor.com recently reported that the number of newly listed homes has grown for each of the last two months. Also, the National Association of Realtors (NAR) just announced the months’ supply of inventory increased for the first time in eight months. The inventory of existing homes usually grows every spring, and it seems, based on recent activity, the next 90 days could bring more listings to the market.

If you’re a buyer who has been frustrated with the limited supply of homes available for sale, it looks like you could find some relief this spring. However, be prepared to act quickly if you find the right home.

If you’re a seller, listing now instead of waiting for this additional competition to hit the market makes sense. Your leverage in any negotiation during the sale will be impacted as additional homes come to market.

3. Home Prices Will Rise

Prices are always determined by supply and demand. Though the number of homes entering the market is increasing, buyer demand remains very strong. As realtor.com explains in their most recent Housing Report:

“During the final two weeks of the month, more new sellers entered the market than during the same time last year. . . . However, with 5.8 million new homes missing from the market and millions of millennials at first-time buying ages, housing supply faces a long road to catching up with demand.”

What does that mean for you? With the demand for housing still outpacing supply, home prices will continue to appreciate. Many experts believe the level of appreciation will decelerate from the high double-digit levels we’ve seen over the last two years. That means prices will continue to climb, just at a more moderate pace. Most experts are predicting home prices will not depreciate.

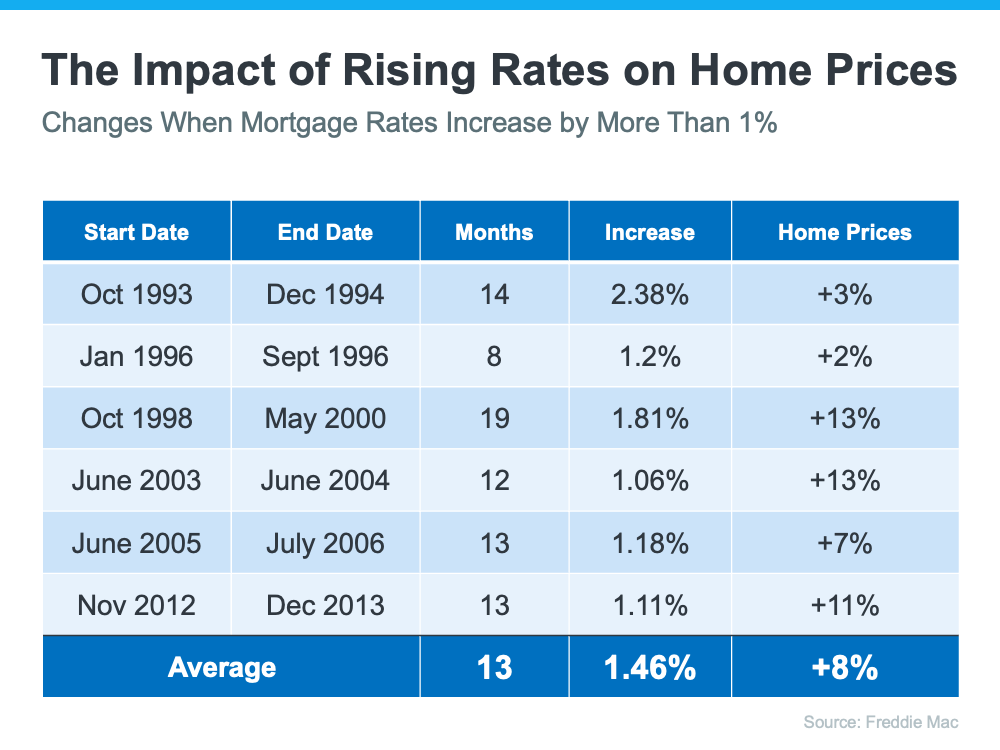

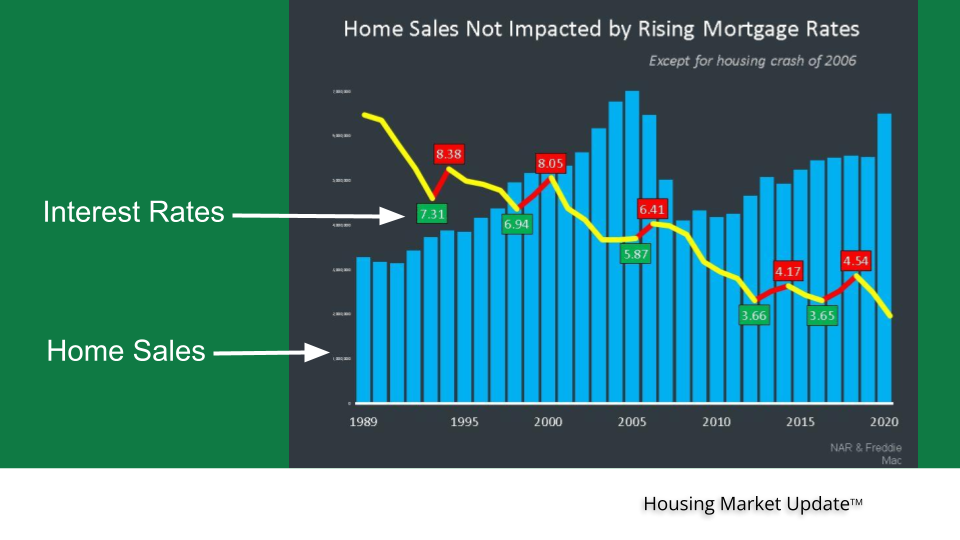

Won’t Increasing Mortgage Rates Cause Home Prices To Fall?

While some people may believe a 1% increase in mortgage rates will impact demand so dramatically that home prices will have to fall, experts say otherwise. Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae, says:

“What I will caution against is making the inference that interest rates have a direct impact on house prices. That is not true.”

Freddie Mac studied the impact that mortgage rates increasing by at least 1% has had on home prices in the past. Here are the results of that study:

As the chart shows, mortgage rates jumped by at least 1% six times in the last thirty years. In each case, home values increased.

So again, if you’re a first-time buyer or a repeat buyer, waiting to buy likely means you’ll pay more for a home later in the year (as compared to its current value).

Bottom Line

There are three things that seem certain going into the spring housing market:

- Mortgage rates will continue to rise

- The selection of homes available for sale will modestly improve

- Home prices will continue to appreciate, just at a slightly slower pace

If you’re thinking of buying, act now before mortgage rates and home prices increase further. If you’re thinking of selling, your best bet may be to sell soon so you can beat the increase in competition that’s about to come to market.

Key Terms for Homebuyers

![Key Terms for Homebuyers [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/03/09163312/20220311-MEM-1046x2681.png)

Some Highlights

- Knowing key housing terms and how they relate to today’s market is important. For example, when mortgage rates and home prices rise, it impacts how much home you can afford.

- Terms like appraisal (what lenders rely on to validate a home’s value) and the inspection contingency (which gives buyers essential information on a home’s condition) directly impact the transaction.

- Buying a home can be intimidating if you’re not familiar with the terms used throughout the process. Let’s connect so you have an expert guide and advice for any questions that may come up.

How Global Uncertainty Is Impacting Mortgage Rates

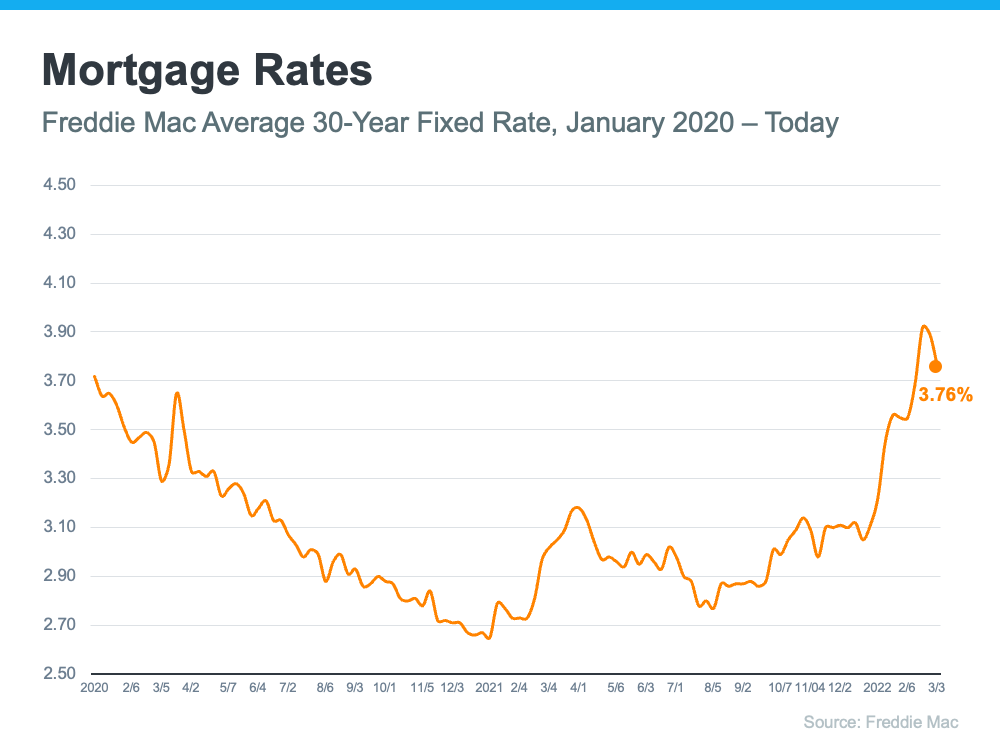

If you’re thinking about buying or selling a home, you’ll want to keep a pulse on what’s happening with mortgage rates. Rates have been climbing in recent months, especially since January of this year. And just a few weeks ago, the 30-year fixed mortgage rate from Freddie Mac approached 4% for the first time since May of 2019. But that climb has dropped slightly over the past few weeks (see graph below):

The recent decline in mortgage rates is primarily due to growing uncertainty around geopolitical tensions surrounding Russia and Ukraine. But experts say it’s to be expected.

Here’s a look at how industry leaders are explaining the impact global uncertainty has on mortgage rates:

Odeta Kushi, Deputy Chief Economist at First American, says:

“While mortgage rates trended upward in 2022, one unintended side effect of global uncertainty is that it often results in downward pressure on mortgage rates.”

In another interview, Kushi adds:

“Geopolitical events play an important role in impacting the long end of the yield curve and mortgage rates. For example, in the weeks following the ‘Brexit’ vote in 2016, the U.S. Treasury bond yield declined and led to a corresponding decline in mortgage rates.”

Kushi’s insights are a reminder that, historically, economic uncertainty can impact the 10-year treasury yield – which has a long-standing relationship with mortgage rates and is often considered a leading indicator of where rates are headed. Basically, events overseas can have an impact on mortgage rates here, and that’s what we’re seeing today.

Will Mortgage Rates Stay Down?

While no one has a crystal ball to predict exactly what will happen with rates in the future, experts agree this slight decline is temporary. Sam Khater, Chief Economist at Freddie Mac, echoes Kushi’s sentiment, but adds that the decline in rates won’t last:

“Geopolitical tensions caused U.S. Treasury yields to recede this week . . . leading to a drop in mortgage rates. While inflationary pressures remain, the cascading impacts of the war in Ukraine have created market uncertainty. Consequently, rates are expected to stay low in the short-term but will likely increase in the coming months.”

Rates will likely fluctuate in the short-term based on what’s happening globally. But before long, experts project rates will renew their climb. If you’re in the market to buy a home, doing so before rates start to rise again may be your most affordable option.

Bottom Line

Mortgage rates are an important piece of the puzzle because they help determine how much you’ll owe on your monthly mortgage payment in your next home. Let’s connect so you have up-to-date information on rates and trusted advice on how to time your next move.

February 2022 Housing Market Update

Geoff Green, President of Green Team Realty and Co-Founder and CEO of NuOp welcomed viewers to the February 2022 Housing Market Update. If you haven’t yet seen the webinar or would like to see it again, it’s available below.

Inflation – and its impact on homeownership

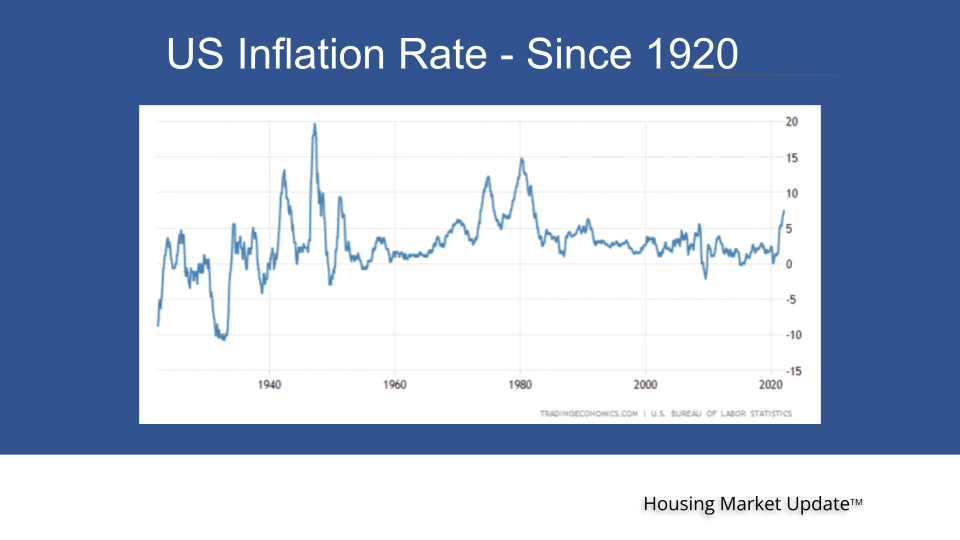

It seems that the “I”s (inventory, interest rates and inflation) have it when it comes to some of the major factors affecting the housing market. First, we have been talking about inventory, at historic lows. Then, there were interest rates; again, at historic lows although we have begun to see them rise. And now, inflation is taking top billing:

According to Mark P. Cussen, Financial Writer for Investopedia,

“Real estate is one of the time-honored inflation hedges. It’s a tangible asset, and those tend to hold their value when inflation reigns, unlike paper assets. More specifically, as prices rise, so do property values.”

A look at the US inflation rate since 1920 shows that we have been through worse. And, while current inflation is not as high as it was in the late 1970s, early 1980s, it is a serious problem.

Owning versus renting

According to James Royal, Senior Wealth Management Report, Bankrate,

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same. That’s certainly not the case if you’re renting.”

In addition, rent increases have been greater than inflation most years.

Mortgage Rates

Before the pandemic, the 30-year fixed rate was 3.70%. It reached historic lows during the pandemic, dipping just below 2.7%. The rate is now 3.55% but are no higher than we were pre-pandemic. Historically, current mortgage rates are the lowest they’ve been in five decades. In fact, in the 1980s, they rose as high as 12.70%.

According to Sam Khater, Chief Economist, Freddie Mac,

“As mortgage rates rise, we do expect some moderation n housing demand, causing house prices growth to temper. However, the combination of large number of entry-level homebuyers facing a shortage of entry-level inventory of homes for sale should keep the housing market competitive.”

National Stats

The average home sales price has gone up, very much due to inventory going down. Accordingly, it is very much a case of supply and demand.

Meet the Panel

Joining Geoff Green is Keren Gonen of Green Team New Jersey Realty, Carol Buchanan of Green Team New York Realty, and Chad Barris, Family First Funding.

The panel discussed the information presented by Geoff as it relates to their experiences in the field. To watch the webinar and see the panel discussion, click here.

“Housekeeping Items”

January 2022 Housing Market Update

The January 2022 Housing Market Update took place on January 18 at 12 p.m. Geoff Green, President of Green Team Realty and Co-founder and CO of NuOp, hosts the monthly market updates. If you missed the live FaceBook and Zoom event, or you’d like to watch the webinar again, it is available below.

It all comes down to inventory – and the lack thereof

Geoff started the discussion with this quote from Bill McBride, Founder, Calculated Risk:

“It is possible that rising mortgage rates will slow the housing market… or the Fed might raise rates sooner than expected due to the recent pickup in inflation… but I believe one thing is certain: inventory will tell the tale!”

Inventory is at an all-time low throughout the U.S., down an average of 27% compared to December of 2020. As the industry survives on turnover, this is not good news. A normal market has 6 months’ inventory, while we are currently at less than 2 months.

Buyer demand remains strong

According to Michael Lane, VP & General Manager of ShowingTime,

“Showings traditionally lag during the holiday season, but the data remains strong. The fact that every region showed a year-over-year increase indicates that buyers are undeterred… It speaks to their desire to keep searching for their next home.”

Homeowner equity still strong, still surging

According to CoreLogic’s Q3 Homeowner Equity Report,

“This summer, home price growth reached the highest level in more than 45 years, pushing equity gains to another record high.”

Mortgage rate projections

Mortgage rate projections show rates slowly rising, but still remaining at historic lows. Maiclaire Boltonk-Smith, Senior Leader of Research, CoreLogic, says:

“So overall I do think that 2022 will be another strong year for housing. All be it a little bit higher mortgage rates and we do think home sales will continue to rise and actually reach a 16 year high in 2022.”

Other factors impacting the housing market

The discussion included Gen Z, a massive population in their late 20’s, with many looking to buy homes. Some people migrate back to cities following moving to suburbs and rural areas. Geoff predicts that many people who left the City due to the pandemic will be moving back as the commute and home maintenance are more difficult than anticipated.

Nationally, existing homes sales are still strong, as is average home price, though showing signs of deceleration (not decrease) of prices.

Meet the panel

Joining Geoff is Terry Gavan of Green Team New York Realty and Kristi Anderson of Green Team New Jersey Realty. Also joining in is Michael Giannetto of CrossCountry Mortgage, to lend his expertise to the discussion.

A lively discussion ensued regarding what these real estate professionals are seeing on the ground, and their take on Geoff’s prediction about homeowners returning to the cities, appraisal valuations, etc..

To watch the webinar, including current stats and the panel discussion, click here:

“Housekeeping” Items

December 2021 Housing Market Update

The December 2021 Housing Market Update took place on December 21 at 12 p.m. Geoff Green, President of Green Team Realty and co-founder and CEO of NuOp, hosts the monthly market updates. If you missed the live Zoom and Facebook event, or you’d like to watch it again, it’s available below:

Will there be a slowdown?

This seems to be the question on everyone’s mind. According to the National Association of Realtors,

“…the pandemic likely spurred occupants to shorten their homestay, as tenure in the home decreased to eight years from 10 years, according to the report. This is the largest single-year change in home tenure since NAR began collecting such data.”

Where are interest rates headed? Some historical perspective on today’s mortgage rates…

We are heading back to a more normal interest rate environment after enjoying historically low rates.

House price appreciation, inventory of homes for sale; home sales forecast

According to Mark Fleming, Chief Economist of First American,

“House price appreciation is resistant to rising mortgage rates primarily because most home sellers would rather withdraw from the market than sell at lower prices – a phenomenon we refer to as ‘downside sticky.'”

Fannie Mae, Freddie Mac, MBA, Zelman, and NAR all project that home prices are going to appreciate over the next five years.

Inventory is still very low, so we remain in a Seller’s market.

What are the National Stats telling us?

While 2021 sales dipped below 2020 numbers, year over year they were still higher than the previous 3 years. Home sale prices are decelerating, not depreciating. Prices are still increasing, just not at the rate they were increasing in years prior. The month’s supply of inventory is still very, very low..

Meet the Panel

Joining Geoff are Keren Gonen of Green Team New Jersey Realty, and Vikki Garby of Green Team New York Realty. In addition, Chad Barris, of Family First Funding shares his knowledge and expertise with our viewers.

Geoff asked if Keren had noted any changes in appraisals lately. Keren has experienced issues with appraisals. Some issues are stemming from appraisers not being local to the area, coming in much lower than the asking price. Vikki hasn’t had any problems with appraisals in the Orange County market. However, she has found that the bidding wars aren’t happening like they were. She’s seen some sellers now needing to drop their price, with buyers now gaining some control. Keren has also seen fewer bidding wars in Sussex County.

Geoff asked Chad Barris if there is subprime lending happening. An interesting discussion followed on this and other current issues impacting the current housing market. To view the panel discussion, click here.

“Housekeeping” Details

November 2021 Housing Market Update

The November 2021 Housing Market Update was held on November 16 at 12 p.m. Geoff Green, President of Green Team Realty and co-founder and CEO of NuOp, hosts the monthly market updates. If you missed the live Zoom and Facebook event or would like to watch it again, it’s available below.

It’s not depreciation. It’s deceleration

Housing market prices are not declining or depreciating, The rate at which they’re increasing is just slowing down.

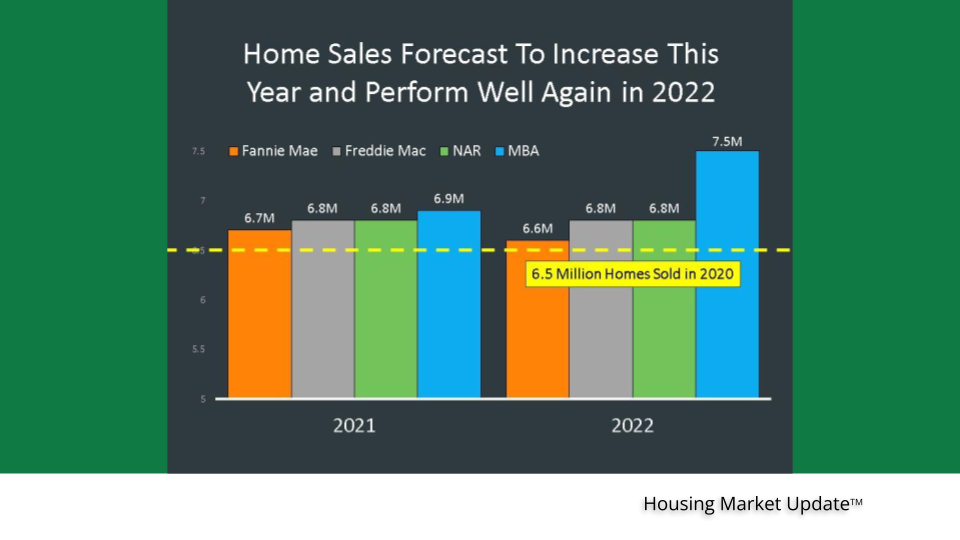

Home Sales forecast

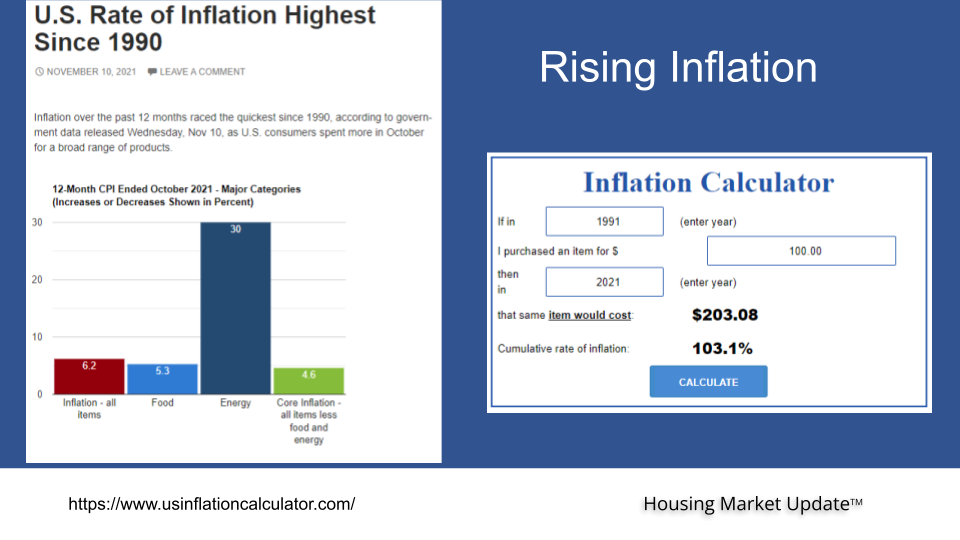

Rising Inflation

The impact on the housing market is very simple. According to Green, at the end of the day, it’s all about monthly cash flow. People know how much they make each month and how much they can afford to pay for their mortgage. The more things cost, the less money is available for a mortgage payment.

What are the national stats telling us?

Existing home sales have come down a little from last year. However, they are still very strong compared to the market pre-Pandemic. Average sales price is still up, above 2017 – 2020 prices. Furthermore, the months supply of inventory is starting to come up a little.

Meet the panel

Panelists for the November 2021 Housing Market Update are Keren Gonen, Green Team New Jersey Realty, Vikki Garby, Green Team New York Realty, and Gian Russo, Northpointe Bank Branch Manager.

The market is softening, according to Keren’s experience. Accordingly, buyers are having more options. Furthermore, she is seeing overpriced homes no longer selling as they did 6-months ago. Keren’s advice to those thinking about selling? Do it now!

Vikki agrees that we have reached a point where sellers can no longer just slap on a high price and have buyers in a bidding war. Buyers are not throwing crazy offers in desperation to buy a home Furthermore, some appraisals seem to be pushing back against the pricing.

Rental prices have shot up even more than sales prices. Geoff talked about the importance of owning real estate as a hedge against inflation. Real estate increases in value. Gian explained the process of mortgage origination and how an increase in rates impacts monthly payments. Gian’s advice to buyers is to make sure you stay with a one-on-one lender as well as a one-on-one real estate agent. The market and its changes are complex and buyers will benefit from working with local real estate and mortgage professionals.

For the complete webinar, including the panel discussion, click here:

“Housekeeping” Details

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link