Geoff Green, President of Green Team Realty and Co-Founder and CEO of NuOp welcomed viewers to the February 2022 Housing Market Update. If you haven’t yet seen the webinar or would like to see it again, it’s available below.

Inflation – and its impact on homeownership

It seems that the “I”s (inventory, interest rates and inflation) have it when it comes to some of the major factors affecting the housing market. First, we have been talking about inventory, at historic lows. Then, there were interest rates; again, at historic lows although we have begun to see them rise. And now, inflation is taking top billing:

According to Mark P. Cussen, Financial Writer for Investopedia,

“Real estate is one of the time-honored inflation hedges. It’s a tangible asset, and those tend to hold their value when inflation reigns, unlike paper assets. More specifically, as prices rise, so do property values.”

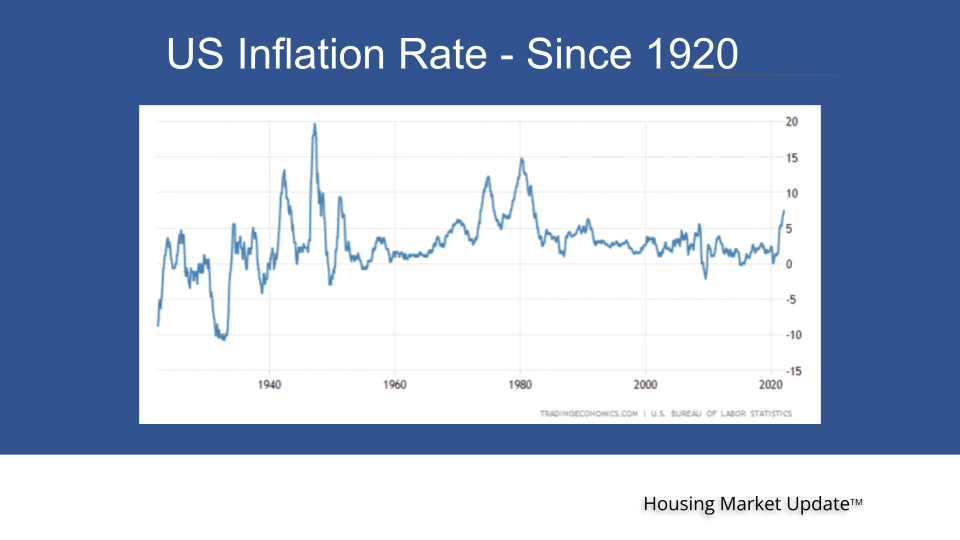

A look at the US inflation rate since 1920 shows that we have been through worse. And, while current inflation is not as high as it was in the late 1970s, early 1980s, it is a serious problem.

Owning versus renting

According to James Royal, Senior Wealth Management Report, Bankrate,

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same. That’s certainly not the case if you’re renting.”

In addition, rent increases have been greater than inflation most years.

Mortgage Rates

Before the pandemic, the 30-year fixed rate was 3.70%. It reached historic lows during the pandemic, dipping just below 2.7%. The rate is now 3.55% but are no higher than we were pre-pandemic. Historically, current mortgage rates are the lowest they’ve been in five decades. In fact, in the 1980s, they rose as high as 12.70%.

According to Sam Khater, Chief Economist, Freddie Mac,

“As mortgage rates rise, we do expect some moderation n housing demand, causing house prices growth to temper. However, the combination of large number of entry-level homebuyers facing a shortage of entry-level inventory of homes for sale should keep the housing market competitive.”

National Stats

The average home sales price has gone up, very much due to inventory going down. Accordingly, it is very much a case of supply and demand.

Meet the Panel

Joining Geoff Green is Keren Gonen of Green Team New Jersey Realty, Carol Buchanan of Green Team New York Realty, and Chad Barris, Family First Funding.

The panel discussed the information presented by Geoff as it relates to their experiences in the field. To watch the webinar and see the panel discussion, click here.

“Housekeeping Items”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link