Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Knowledge Is Power on the Path to Homeownership

Homeownership is on the goal list for many young adults, but sometimes it’s hard to know exactly how to get there. From understanding the home buying process to pre-approval and down payment assistance options, uncertainty along the way can ultimately hold some buyers back.

Today, there are over 75 million Millennials and 67 million Gen Z’ers in the U.S., making up a significant number of both current and soon-to-be homebuyers. According to a recent Fannie Mae survey of more than 2,000 of these individuals:

“88% said they are confident they will achieve homeownership someday.”

In addition, the survey also reveals that for younger generations, the motivation to own a home may be more emotional than financial compared to previous generations:

- <50% say they want to use their home as an asset

- 78% believe it’s the best way to live the way they want, without restrictions

- 80% believe homeownership is the best way to make it on their own

Whether homeownership goals come from the heart or are driven by financial aspirations (or maybe both), the obstacles standing in the way don’t have to bring these dreams to a screeching halt. The same survey also reveals two key roadblocks for potential buyers. Thankfully, they’re both easily overcome with the power of knowledge and trusted advisors leading the way. Here’s a look at these two challenges potential homebuyers face today:

1. 73% of future homebuyers are unaware of low-down-payment mortgage options

For those who want to purchase a home, low-down-payment options are instrumental to affording one sooner rather than later, especially given the amount of debt many younger adults have accumulated. Fannie Mae also notes:

“Among the challenges they face is an unprecedented amount of debt, along with a lack of understanding of the mortgage process and their own purchasing power. Debt, in particular, creates many obstacles such as a limited ability to save and the fear of taking on more debt.”

Today, there are more than 2,340 down payment assistance programs available nationwide to help relieve this pressure. Understanding what’s out there and the options available may help many buyers become homeowners faster than they thought possible. In a year like this, with record-low mortgage rates making their mark in the history books, being able to take advantage of the opportunity buyers have right now is essential to long-term affordability.

2. 64% of buyers expect lenders and other real estate professionals to educate them about the mortgage process

While many people love to do a quick search online to find instant answers to their questions, it isn’t the only way younger generations want to consume information or build their knowledge base. As the survey mentions, having trusted professionals help them learn what it takes to achieve their dreams is definitely on their wish list too.

Bottom Line

If you’re aiming for homeownership someday, it may be in closer reach than you think. Let’s connect so you can learn about the process and get the guidance you need to make it happen.

Is Buying a Home Today a Good Financial Move?

[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”3.0.47″ custom_padding=”22px|0px|0px|0px|false|false”][et_pb_row custom_padding=”13px|0px|32px|0px|false|false” admin_label=”row” _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text admin_label=”Text” _builder_version=”3.0.74″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]There’s no doubt 2020 has been a challenging year. A global pandemic coupled with an economic recession has caused heartache for many. However, it has also prompted more Americans to reconsider the meaning of “home.” This quest for a place better equipped to fulfill our needs, along with record-low mortgage rates, has skyrocketed the demand for home purchases.

This increase in demand, on top of the severe shortage of homes for sale, has also caused more bidding wars and thus has home prices appreciating rather dramatically. Some, therefore, have become cautious about buying a home right now.

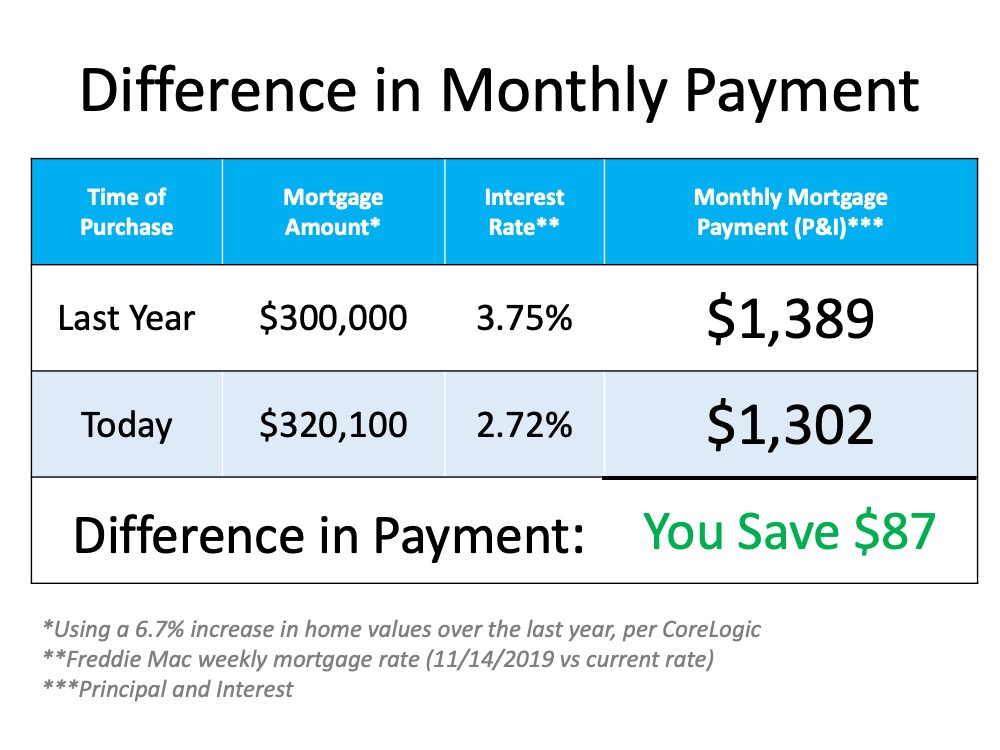

The truth of the matter is, even though homes have appreciated by a whopping 6.7% over the last twelve months, the cost to buy a home has actually dropped. This is largely due to mortgage rates falling by a full percentage point.

Let’s take a look at the monthly mortgage payment on a $300,000 house one year ago, and then compare it with that same home today, after it has appreciated by 6.7% to $320,100: Compared to this time last year, you’ll actually save $87 dollars a month by purchasing that home today, which equates to over one thousand dollars a year.

Compared to this time last year, you’ll actually save $87 dollars a month by purchasing that home today, which equates to over one thousand dollars a year.

But isn’t the economy still in a recession?

Yes, it is. That, however, may make it the perfect time to buy your first home or move up to a larger one. Tom Gil, a Harvard trained negotiator and real estate investor, recently explained:

“When volatile assets are facing recessions, hard assets, such as gold and real estate, thrive. Historically speaking, residential real estate has done better compared to other markets during and after recessions.”

That thought is substantiated by the fact that homeowners have 40 times the net worth of renters. Odeta Kushi, Deputy Chief Economist for First American Financial Corporation, recently said:

“Despite the risk of volatility in the housing market, numerous studies have demonstrated that homeownership leads to greater wealth accumulation when compared with renting. Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments, which become a form of forced savings for homeowners.”

Bottom Line

With home prices still increasing and mortgage rates perhaps poised to begin rising as well, buying your first home, or moving up to a home that better fits your current needs, likely makes a ton of sense.[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”3.18.2″][et_pb_row _builder_version=”3.18.2″][et_pb_column type=”4_4″ _builder_version=”3.18.2″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.18.2″]

Read More News and Insights

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row _builder_version=”3.18.2″][et_pb_column type=”4_4″ _builder_version=”3.18.2″ parallax=”off” parallax_method=”on”][et_pb_blog fullwidth=”off” posts_number=”3″ include_categories=”38,234″ show_author=”off” show_date=”off” show_categories=”off” _builder_version=”3.18.2″ header_level=”h5″ header_font=”||||||||” body_font=”||||||||” border_radii=”on|12px|12px|12px|12px” text_orientation=”center”][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

October 2020 Housing Market Update

Geoff Geen, President of Green Team Realty, welcomed everyone to the October 2020 Housing Market Update. The webinar, held on Tuesday, October 20 at 2 p.m. examined the housing market on both national and local levels.

If you missed the webinar or would like to view it again, it’s available here.

Meet the Panel

October Housing Market Update panelists were Nancy Sardo, and Tammy Scotto of Green Team New York Realty, and Keren Gonen of Green Team New Jersey Realty. Also joining the discussion was Ken Aulicino, Mortgage Loan Originator at Family First Funding.

Can the housing market recovery be sustained?

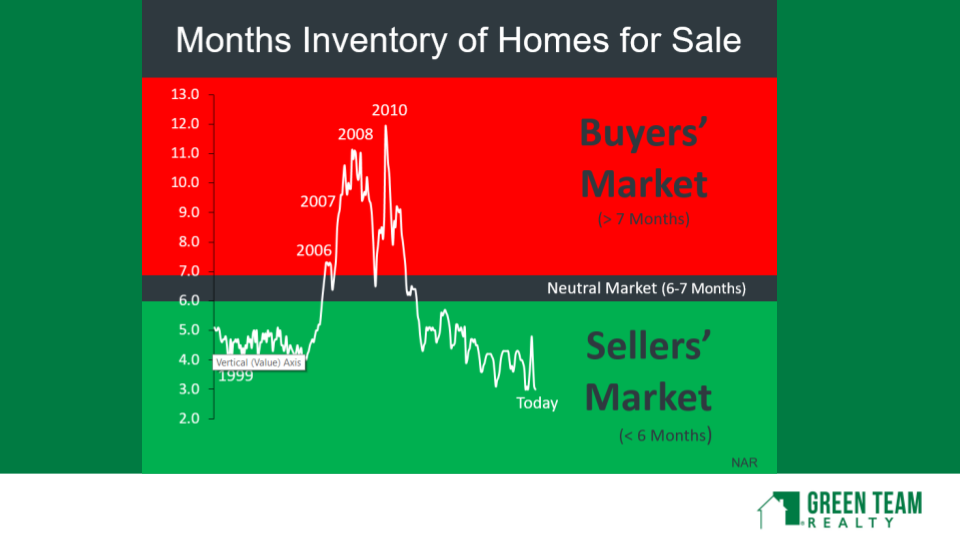

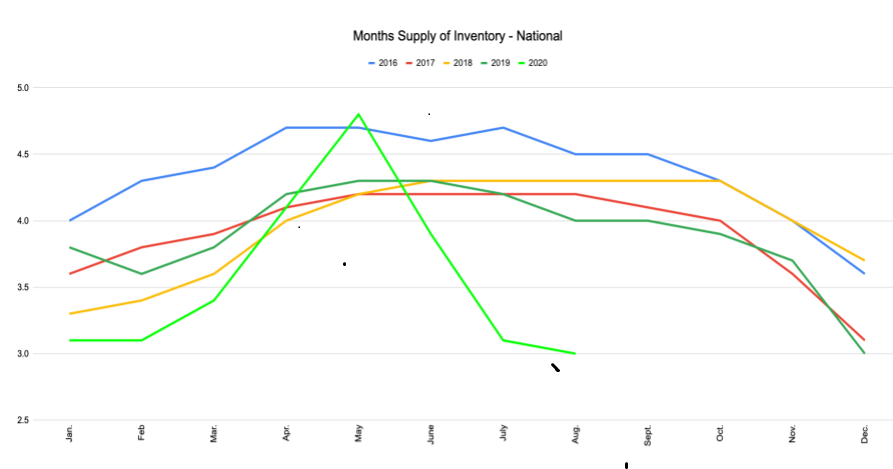

The U.S housing market has been a “V-shaped” Recovery. However, inventory continues to decline and is a big challenge. So, can the housing market keep it up?

Pros

US Consumer Spending is almost in a V-shaped recovery. Unemployment has been coming down the last 6 to 7 months. The number of mortgages in active forbearance is decreasing. Prior to the Great Recession, it was a buyers market, due to the number of homes on the market. In the early 2000s, there was also a lot of new construction happening. Now, we are firmly in a sellers’ market. There are just not enough homes to satisfy the needs of the current market.

Cons

The shortage of inventory remains a major issue. According to Realtor.com,

“Since the beginning of the COVID pandemic in March, nearly 400,000 few homes have been listed compared to last year, leaving a gaping hole in the U.S. housing inventory…

As a result, home prices are accelerating at double last year’s pace.”

According to the National Association of Realtors, Existing Home Sales are up by 10.5%. However, listings are down 39%. Listings for New Homes are down by 31%. However, sales of new homes have increased by 43%.

This really shows the inventory story.

Local Stats

In Orange County, NY, there are increases in units sold and in average sales price. Sussex County, NJ is now showing strong increases in average sales price, as well as in units sold.

Learn More, Watch the Webinar

Watch Geoff’s full presentation on national and local economic and real estate trends. In addition, our expert panel discusses their experiences in this market, including new construction. Click here to view the webinar.

Furthermore, you can compare prior statistics and trends. Click here for the September 2020 Housing Market Update.

“Housekeeping” Items

Contact our Panelists

Join us on Tuesday, November 17 at 2 p.m.

Sign up for updates now at GreenTeamRealty.com/HMU

Do You Have Enough Money Saved for a Down Payment?

One of the biggest misconceptions for first-time homebuyers is how much you’ll need to save for a down payment. Contrary to popular belief, you don’t always have to put 20% down to buy a house. Here’s how it breaks down.

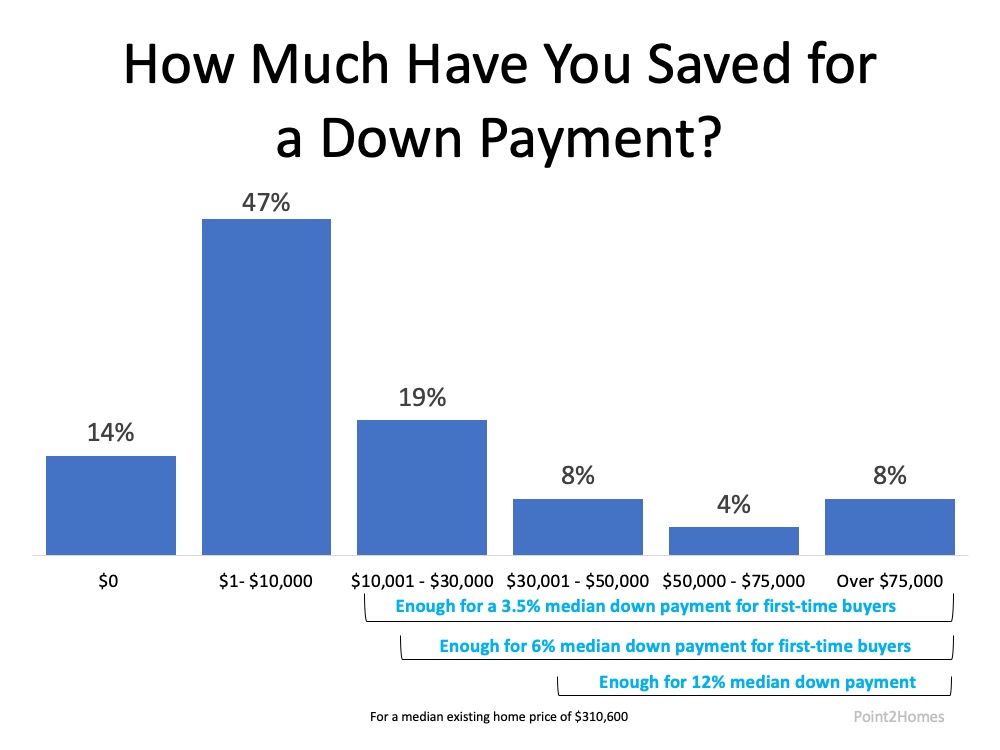

A recent survey by Point2Homes mentions that 74% of millennials (ages 25-40) say they’re interested in purchasing a home over the next 12 months. The study notes, “88% say they have significantly less savings than the average national down payment amount, which is $62,600.”

Thankfully, $62,600 is not the amount every buyer needs for a down payment in the United States. There are many different options available, especially for first-time homebuyers (millennial or not). That amount can also be significantly less, depending on the purchase price of the house.

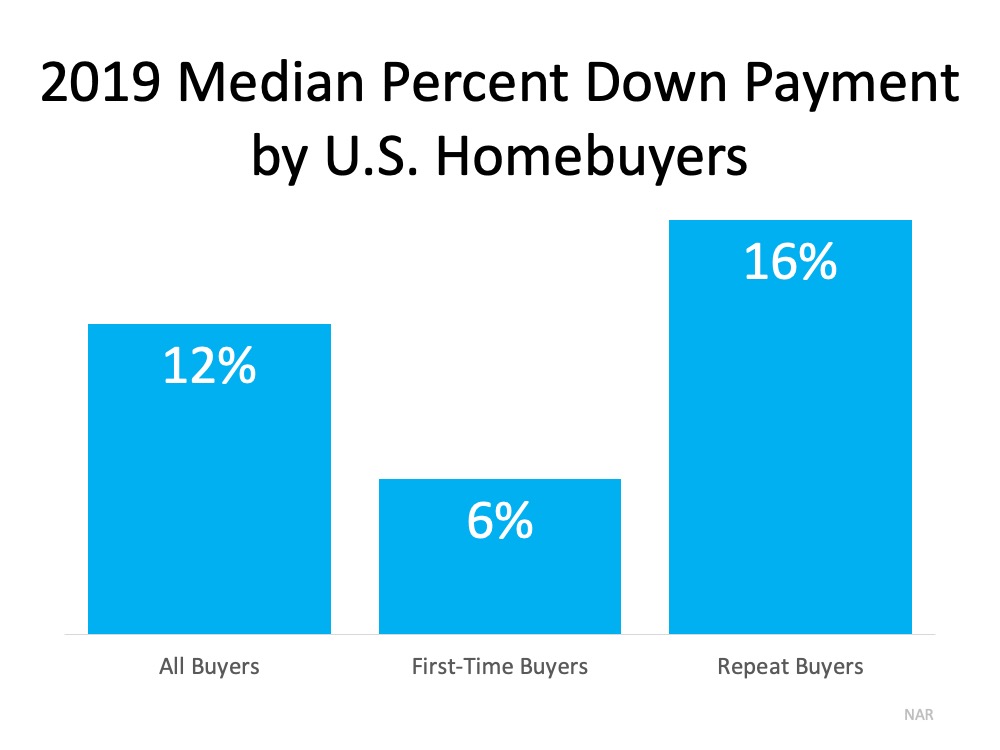

According to the National Association of Realtors (NAR), “The median existing-home price for all housing types in August was $310,600.” (These are the latest numbers available). NAR also indicates that:

“In 2019, the median down payment was 12 percent for all buyers, six percent for first-time buyers, and 16 percent for repeat buyers.” (See graph below):

That means if a qualified first-time buyer purchases a home at today’s median price, $310,600, with a 6% down payment, in reality, the down payment only amounts to $18,636. That’s nowhere near $62,600.

That means if a qualified first-time buyer purchases a home at today’s median price, $310,600, with a 6% down payment, in reality, the down payment only amounts to $18,636. That’s nowhere near $62,600.

Knowing there are also programs like FHA where the down payment can be as low as 3.5% of the purchase price for a first-time buyer, that up-front cost could be significantly less – as little as $10,871 for the same home noted above. There are also other programs like USDA and loans for Veterans that waive down payment requirements.

The Point2Homes study also shares how much millennials have indicated they’ve saved for a down payment. As we can see in the graph below, 39% have already saved enough for a down payment on a median-priced home. Another 47% are close to reaching that goal, depending on the purchase price of the home. Unfortunately, the lack of knowledge about the homebuying process is keeping many motivated first-time buyers on the sidelines. That’s why it’s important to contact a local real estate professional to understand the requirements in your local area if you want to buy a home. A trusted agent and your lender can guide you through the process.

Unfortunately, the lack of knowledge about the homebuying process is keeping many motivated first-time buyers on the sidelines. That’s why it’s important to contact a local real estate professional to understand the requirements in your local area if you want to buy a home. A trusted agent and your lender can guide you through the process.

Bottom Line

Be careful not to let big myths about homebuying keep you and your family out of the housing market. Let’s connect you with one of our Sales Agents to discuss your options today.

Meet Ryan Fisher

Chapter One: How Ryan met Geoff

Ryan Fisher comes to the Green Team with a distinction that no other sales associate can claim. Ryan and Geoff Green went to the University of New Hampshire together. After college, they worked together in the mall industry. That’s when Geoff recruited Ryan to Pyramid Management Group. Ryan was a top-performing specialty leasing representative at Palisades Shopping Mall. Within two years he grew to be in the top four producers in the company. During his time with Pyramid, Ryan honed skills and techniques that he uses to this day. He learned how to canvas and generate leads. He also learned the art of follow-up and setting appointments. Most importantly, he learned how to close. Ryan also developed the habit of setting goals and acquiring the positive mindset it takes to accomplish them.

Chapter Two: New England, Taxis, then Real Estate

Ryan decided to return to New England. For 12 years he owned and operated a taxi company on Martha’s Vineyard. It was here he learned to run a business from start to finish. Using connections from his university days, he hired students to work each summer. Furthermore, many of them returned to work for multiple summers. He grew the business acquiring a second medallion. This allowed him to operate in two towns with a fleet of 12 vehicles.

Somehow, during this time, he also managed to get his real estate license in Massachusetts. When it came time to buy, Ryan was able to negotiate a seller-financed deal to buy the mixed-use property he ran his business out of. After the purchase, Ryan developed the property by replacing the not-to code garage with a commercial garage with an apartment on top. He eventually sold the taxi medallions, but still owns the property and rents both the commercial and residential units out.

Chapter Three: Ryan and Geoff, Together Again!

Once again, Geoff and Ryan began collaborating on a business idea. Geoff pitched the idea of REALLY – The Business Referral Exchange™. Referrals within real estate are fragmented. REALLY offers Business professionals the chance to network and grow their business. Ryan was intrigued. He had always thought real estate would be a good fit. Ryan loves working with people and enjoys the challenges that come in this field. He was also eager to play a part in helping REALLY grow. Furthermore, It seemed a natural fit to join the Green Team.

Ryan is currently licensed in both Massachusetts and New York. He is happily married with two children and a dog named Mona. Ryan and family moved from New England to Warwick. Ryan brings to his real estate business a unique and extremely relevant skillset. He also brings his love of music, drumming in particular. Of course, Ryan and Mona the dog enjoy hiking and outdoor activities.

Mortgage Rates & Payments by Decade [INFOGRAPHIC]

[et_pb_section fb_built=”1″ _builder_version=”3.0.47″][et_pb_row _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.18.2″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/08/13150648/20200814-MEM-1-1046x1306.jpg)

Some Highlights

- Sometimes it helps to see the dollars and cents you’ll save when you purchase a home while mortgage rates are low.

- It helps to get a rough idea of what your mortgage payment will be at different rates.

- Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your loan is significant.

- Connect with one of our Real Estate Sales Agents to determine the best way to position your family for a financially-savvy move in today’s market.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row custom_padding=”12px|0px|17.5781px|0px|false|false” _builder_version=”3.18.2″ locked=”off”][et_pb_column type=”4_4″ _builder_version=”3.18.2″ parallax=”off” parallax_method=”on”][et_pb_blog fullwidth=”off” posts_number=”3″ include_categories=”38″ show_author=”off” show_date=”off” show_categories=”off” _builder_version=”3.18.2″ header_level=”h5″ header_font=”||||||||” body_font=”||||||||” border_radii=”on|12px|12px|12px|12px” text_orientation=”center”][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

The Latest Unemployment Report: Slow and Steady Improvement

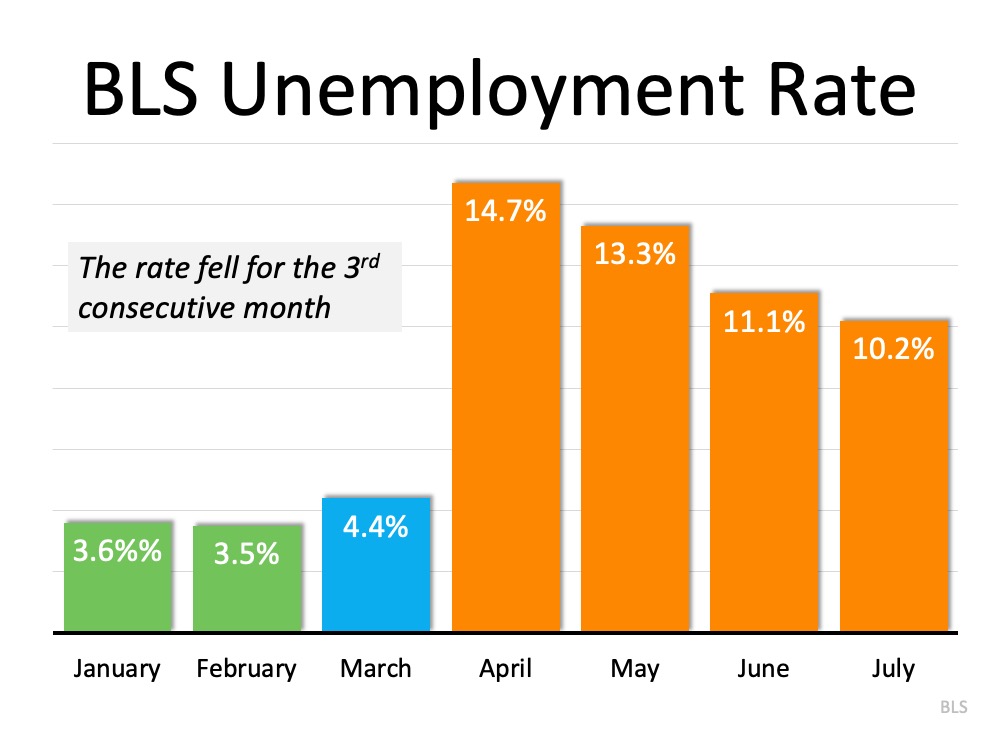

[et_pb_section fb_built=”1″ _builder_version=”3.0.47″][et_pb_row _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.0.74″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]Last Friday, the Bureau of Labor Statistics (BLS) released its latest Employment Situation Summary. Going into the release, the expert consensus was for 1.58 million jobs to be added in July, and for the unemployment rate to fall to 10.5%.

When the official report came out, it revealed that 1.8 million jobs were added, and the unemployment rate fell to 10.2% (from 11.1% last month). Once again, this is excellent news as this was the third consecutive month the unemployment rate decreased. There is, however, still a long way to go before the job market fully recovers. The Wall Street Journal (WSJ) put a potential date on that recovery:

There is, however, still a long way to go before the job market fully recovers. The Wall Street Journal (WSJ) put a potential date on that recovery:

“July’s payroll growth, at 1.8 million, still leaves total payrolls 12.9 million lower than in February. And yet if job gains continued at July’s pace, that deficit will be erased by March 2021. If payrolls reclaim their last peak in 13 months, that would be remarkably fast. It took more than six years after the last recession.”

Permanent vs. Temporary Unemployment

During a pandemic, it’s important to differentiate those who have lost their jobs on a temporary basis from those who have lost them on a permanent basis. Morgan Stanley economists noted in the same WSJ article:

“The rate of churn in the labor market remains incredibly high, but a notable positive detail in this month’s report was the downtick in the rate of new permanent layoffs.”

To address this, the core unemployment rate becomes increasingly important. It identifies the number of people who have permanently lost their jobs. This measure subtracts temporary layoffs and adds unemployed who did not search for a job recently. Jed Kolko, Chief Economist at Indeed and the founder of the index reported:

“Core unemployment fell in July for the first time in the pandemic. That’s the good news I was hoping for.”

What about the housing market?

The housing market has continued to show tremendous resilience during the pandemic. Commenting on the labor report, Robert Dietz, Chief Economist for the National Association of Home Builders (NAHB), tweeted:

“Housing continues to rebound in another positive labor market report. Home builder and remodeler job gains of 24K for July. Residential construction employment down just 56.4K compared to a year ago. Total residential construction employment at 2.85 million.”

Bottom Line

We should remain cautious in our optimism, as the recovery is ultimately tied to our future success in mitigating the ongoing health crisis. However, as Mike Fratantoni, Chief Economist for the Mortgage Bankers Association, reminds us: “The pace of job growth slowed in July, but the gains over the past three months represent an impressive rebound during the ongoing economic challenges brought forth by the pandemic.”

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”3.18.2″ custom_padding=”0px|0px|0|0px|false|false”][et_pb_row custom_padding=”66px|0px|17.5781px|0px|false|false” _builder_version=”3.18.2″][et_pb_column type=”4_4″ _builder_version=”3.18.2″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.18.2″]

You might also enjoy reading…

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”3.18.2″ custom_padding=”4px|0px|35.1719px|0px|false|false”][et_pb_row custom_padding=”5px|0px|17.5781px|0px|false|false” _builder_version=”3.18.2″][et_pb_column type=”4_4″ _builder_version=”3.18.2″ parallax=”off” parallax_method=”on”][et_pb_blog fullwidth=”off” posts_number=”3″ include_categories=”38,234″ show_author=”off” show_date=”off” show_categories=”off” _builder_version=”3.18.2″ header_level=”h5″ header_font=”||||||||” body_font=”||||||||” border_radii=”on|12px|12px|12px|12px” text_orientation=”center”][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

Today’s Buyers Are Serious about Purchasing a Home

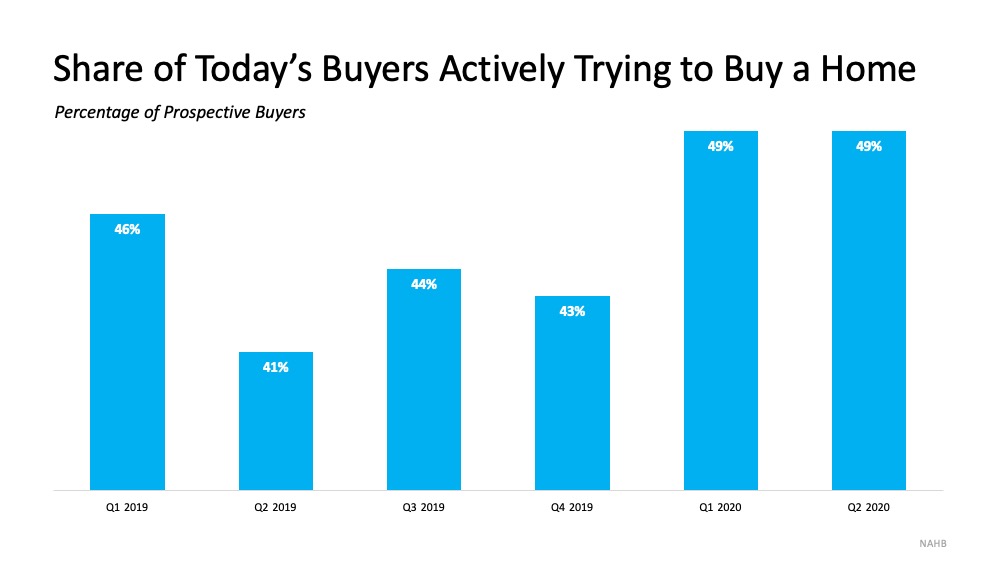

Today’s homebuyers are not just talking about their plans, they’re actively engaged in the buying process – and they’re serious about it. A recent report by the National Association of Home Builders (NAHB) indicates:

“…. Of American adults considering a future home purchase in the second quarter of 2020, about half (49%) are not simply planning it, they are actively engaged in the process to find a home. That is a significantly higher share than the comparable figure a year ago (41%), which suggests that the COVID-19 crisis and its accompanying record-low mortgage rates have converted some prospective buyers into active buyers.”

It’s no surprise that buyers are out in full force today. Many Americans now need more space to work from home, and the current low mortgage rates are providing an extra boost of motivation to enter the housing market.

It’s no surprise that buyers are out in full force today. Many Americans now need more space to work from home, and the current low mortgage rates are providing an extra boost of motivation to enter the housing market.

If you’re considering selling your house, know that today’s buyers are serious about making a move. Your opportunity to sell your house in a market with high demand is growing, especially as more millennials enter the housing market too. The same report also notes:

“Of Millennials planning a home purchase in the next year, 57% are already actively searching for a home.”

Odeta Kushi, Deputy Chief Economist at First American, explains:

“When breaking down house-buying power by educational attainment for millennials in 2019, we find that the higher the education, the higher the household income, and the higher the house-buying power. In 2019, median house-buying power for millennials increased 16 percent relative to 2018.”

As demand for homes to buy grows and more millennials enter the market with growing buying power, the opportunity to sell your house grows too.

Bottom Line

Today’s buyers are serious ones and more millennials are helping to fuel that charge. So, if you’re considering selling your home, let’s connect you with one of our Real Estate Sales Associates today to determine your next steps in the process while buyers are actively looking.

Taking Advantage of Homebuying Affordability in Today’s Market

Everyone is ready to buy a home at different times in their lives, and despite the health crisis, today is no exception. Understanding how affordability works and the main market factors that impact it may help those who are ready to buy a home narrow down their optimal window of time to make a purchase.

There are three main factors that go into determining how affordable homes are for buyers:

- Mortgage Rates

- Mortgage Payments as a Percentage of Income

- Home Prices

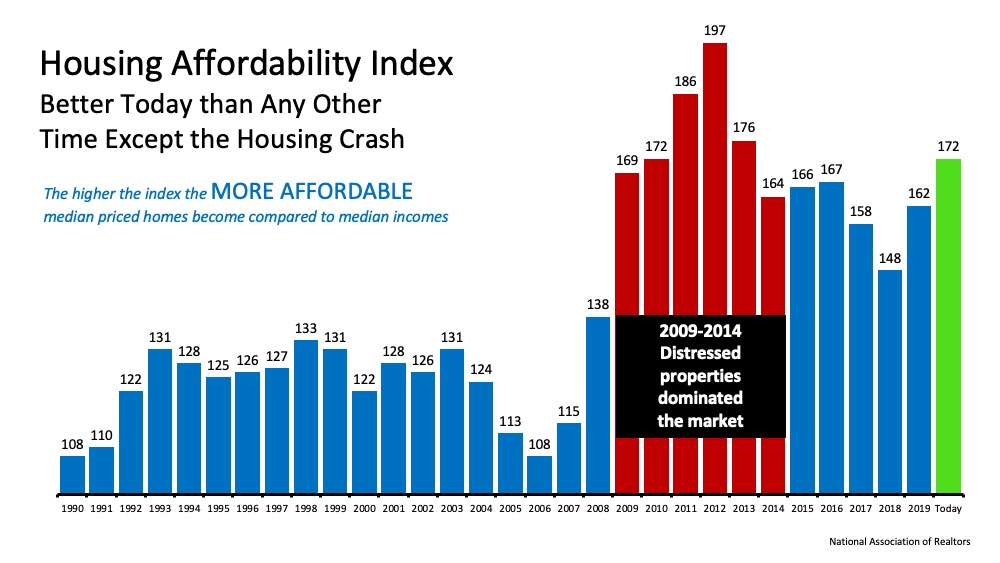

The National Association of Realtors (NAR), produces a Housing Affordability Index, which takes these three factors into account and determines an overall affordability score for housing. According to NAR, the index:

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

So, the higher the index, the more affordable it is to purchase a home. Here’s a graph of the index going back to 1990: The green bar represents today’s affordability. We can see that homes are more affordable now than they have been at any point since the housing crash when distressed properties (foreclosures and short sales) dominated the market. Those properties were sold at large discounts not seen before in the housing market.

The green bar represents today’s affordability. We can see that homes are more affordable now than they have been at any point since the housing crash when distressed properties (foreclosures and short sales) dominated the market. Those properties were sold at large discounts not seen before in the housing market.

Why are homes so affordable today?

Although there are three factors that drive the overall equation, the one that’s playing the largest part in today’s homebuying affordability is historically low mortgage rates. Based on this primary factor, we can see that it is more affordable to buy a home today than at any time in the last seven years.

If you’re considering purchasing your first home or moving up to the one you’ve always hoped for, it’s important to understand how affordability plays into the overall cost of your home. With that in mind, buying while mortgage rates are as low as they are now may save you quite a bit of money over the life of your home loan.

Bottom Line

If you feel ready to buy, purchasing a home this season may save you significantly over time based on historic affordability trends. Connect with one of our Sales Agents today to determine if now is the right time for you to make your move.

Is the Health Crisis Driving Buyers Out of Urban Areas?

The pandemic has caused consumers to re-examine the components that make up the “perfect home.” Many families are no longer comfortable with the locations and layouts of their existing homes. The allure of city life (more congested) seems to be giving way to either suburban or rural life (less congested). The fascination with an open floor plan seems to be fading as people are finding a need for more privacy while working from home.

Recently, news.com released a report that revealed how buyers’ views of listings are leaning heavily to more suburban and rural properties. Here are the year-over-year percentage increases in views per property type:

- Urban – 7%

- Suburban – 13%

- Rural – 16%

In the report, Javier Vivas, Director of Economic Research for realtor.com, gives these numbers some context:

“This migration to the suburbs is not a new trend, but it has become more pronounced. After several months of shelter-in-place orders, the desire to have more space and the potential for more people to work remotely are likely two of the factors contributing to the popularity of the burbs.”

Realtor Magazine also just reported that the desire to move is strongest in our city markets:

“Nearly 30% of respondents living in a high-density urban area say that the pandemic is prompting them to want to move by the end of the year…This is more than double the rate of those living in rural parts of the country, where residents are much more likely to stay put rather than to relocate.”

New Construction Also Seeing a Surge in Views

Since the pandemic has altered how consumers think about floor plans, builders are anticipating how future homes will change. In a recent press release by Zillow, it was explained that:

- Builders believe as people spend more time at home during the pandemic, buyers are realizing which features of their homes are working and not working.

- Homebuilders predict open-concept floor plans will be a thing of the past, as people now value more walls, doors, and overall privacy.

- New construction, which offers the chance to personalize home features, saw its listing page views grow by 73% over last May.

The Virus is Even Impacting the Luxury Second-Home Market

It appears that COVID-19 is impacting the luxury market too. In an article released last week titled, Luxury Buyers Return to Market in Force, Danielle Hale, Chief Economist for realtor.com reported:

“Stay at home orders and social distancing have put a new value on the extra space. We’re seeing this in the luxury market as well, which could mean there is renewed interest from high-end buyers to find a second-home that is within driving distance from their primary residence.

Much like the suburbs are gaining favor with home shoppers, second home markets are seeing increased interest from luxury buyers…Views of luxury properties accelerated 56% in The Hamptons, 28% in Palm Springs and 24% in Greenwich compared to January trends.”

Bottom Line

It appears that a percentage of people are preparing to leave many urban areas. Some of these moves will be permanent, while others will be temporary (such as a getaway to a second home). In either case, many consumers are on the move. Our Sales Agents are ready and willing to help in any way they can.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link