Heidi Hyland has always gone above and beyond.

[et_pb_section fb_built=”1″ _builder_version=”3.0.47″][et_pb_row custom_padding=”32px|0px|31px|0px|false|false” _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.18.2″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]

Geoffrey Green, President of Green Team Realty received this letter from Naveen Sharma, a client of Heidi Hyland, Broker/Sales Associate of Green Team New Jersey Realty.

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row _builder_version=”3.18.2″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” locked=”off”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text admin_label=”Quote” _builder_version=”3.18.2″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” box_shadow_style=”preset2″]

“Throughout my years of owning a condo in the Vernon area, Heidi Hyland has always gone above and beyond. She has made certain that my interests were being met and at many times exceeding them. Heidi is not just your normal real estate agent. She has become a trusted advisor and friend. Heidi’s knowledge of the real estate market, the local community and her list of contacts has been a comfort to me when making decisions from afar. I relied on her consistently. And, without fail, she always delivers. This isn’t just a one time thing or a small sample of services Heidi provided. Rather, it’s over a 10 year period which is what makes this impressive.For those fortunate enough to work with Heidi Hyland, you know this is her norm. Thank you Heidi!!!”

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” locked=”off”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.18.2″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]

It’s always great to hear from clients about their experience working with a Sales Agent. Great job, Heidi!

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

Are NYC residents moving to the suburbs?

Are people really leaving NYC for the suburbs?

Are NYC residents moving to the suburbs? Statistics show how Covid-19 has devastated New York City. The number of people with COVID-19 and the number of deaths is staggering. Social distancing is difficult. There is no doubt that crowded streets, elevators, and often apartments are not conducive to sheltering-in-place. So, are people really leaving NYC for the suburbs?

According to both local and national news sources, the answer is a resounding “YES!” The headlines tell the story.

National Media

USA Today‘s headline screams, “Get me out of here! Americans flee crowded cities amid Covid-19, consider permanent moves.” According to that article, nearly one-third of Americans are considering moving to less densely populated areas because of Covid-19. On May 8 the New York Times described this phenomenon in “Coronavirus Escape: To the Suburbs.” Then, on May 16 they published “Where New Yorkers Moved to Escape Coronavirus.” According to CNBC, Wealthy New Yorkers flee Manhattan for suburbs and beyond.

Local Media

Locally, radio station 101.5 WPDH posted two blogs on this subject. The first, “NYC Residents Expected to Move to Hudson Valley in Droves.” And “Sellers market driving Hudson Valley Home Prices Way Up.” Additionally, Straus News just published the following story in all its local papers for Orange County NY, and Sussex County NJ: “Pandemic-driven house frenzy hits local towns.”

Green Team Realty Sales Associates: Are they seeing NYC residents moving to the suburbs?

Current real estate market conditions and economic trends were major points of discussion during Green Team Realty’s monthly Housing Market Update. We asked several sales associates if they are seeing NYC residents moving to the suburbs as a result of COVID-19.

Green Team New York Realty – Warwick and Orange County, New York

Angela Murphy, Real Estate Salesperson, and Business Development Associate,

I have seen a rise of new buyers coming from all 5 boroughs of the city. Most of my clients want municipals verses septic, well or oil tanks, which has opened up many areas to view in Orange County. The pandemic has definitely pushed them to head north quicker than they might have, otherwise.

Nancy Sardo, Associate Real Estate Broker

I am seeing an influx of highly qualified tenants as well as an above-average amount of new buyers ready to move quicker than before. We are seeing many more cash buyers, many more full-price offers with less negotiation from a smart buyer. Experienced buyers to the area are more willing to do some elbow grease in order not to hiccup on the deal. Otherwise, they risk the seller moving onto the backup offer. Buyers and people, in general, are serious about the betterment of their surroundings. And, with what we are currently going through, they are now more apt to pay for it. We are in a seller’s market and here in Warwick NY and Orange County on a whole, there is an exaggerated upswing of interest in our beautiful Hudson Valley.

Jennifer DiCostanzo, Associate Broker

Interest is trending with buyers looking for a home that meets their needs both for lifestyle and working from home. They like the idea of self-sufficient living. Being just 60 miles from NYC makes the lower Hudson Valley, with its pricepoint, very attractive for primary and secondary homes. Everyone is coming to a realization that home has to meet both work and leisure needs. Also desired are adaptable living spaces. Living through this pandemic has redefined the concept of home for many people. Outdoor space has become a luxury, particularly for City dwellers. However, it’s not just City dwellers who are redefining what “home” means. There are local buyers who are also looking for that change in lifestyle, space and function.

Green Team New Jersey Realty – Vernon and Sussex County, New Jersey

Kristi Anderson, Realtor

I think that many buyers are coming to the Sussex area because we have had much fewer cases of COVID-19 up here. Most of my clients are buying second homes.

Keren Gonen, Real Estate Salesperson

I am seeing a LOT of NYC buyers. They are CASH mostly and looking to run away. Some are buying a second home, but plenty are moving in this direction to get away from the City completely and realizing the advantages of living in “The Country.” Those buyers have a much larger budget than our “usual” buyers and are looking for updated houses mostly. They are ready, willing, able and QUALIFIED buyers. They are all mesmerized by our charm here in Sussex county.

After months of sheltering in place, many people are reexamining their concept of the ideal home. This pandemic has shown us that we can’t take for granted life as usual. New York City has undergone a drastic transformation. That ideal City life is on pause. Broadway shows, restaurants, boutiques, department stores, museums, vibrant nightlife, closed, Families living in cramped apartments, worried about catching the virus, long for privacy, more room, areas to work, and space for the kids. Furthermore, they’re looking for outdoor living space. And approximately 60 miles away is the beautiful countryside of Orange and Sussex Counties.

NYC residents are looking for homes that provide lots of room for their family’s needs, including work from home space. Covid-19 has shown us the possibilities that exist in telecommuting. People and businesses are realizing that it may not be necessary for people to go to the office every day. As noted above, there are also people looking for second homes, so that they have someplace to “escape” to, should another shelter-in-place be required. Even in a seller’s market, they know they can get more house for their money here. Finally, there are unique hamlets, villages, and towns that offer lifestyles and qualities that people have decided are just what they need in this day and age.

April 2020 Housing Market Update

[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”3.0.47″][et_pb_row admin_label=”row” _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text admin_label=”Text” _builder_version=”3.0.74″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]

Covid19 has caused economic turmoil, health crises and uncertainty. However, a historical perspective may help us manage emotions and enable us to see what is happening in the housing market and navigate it accordingly. Below is a recording of the Housing Market Update as well as a summary of the most important discussion points.

National – Historical Perspective

Will this be like 2008, the start of the great recession?

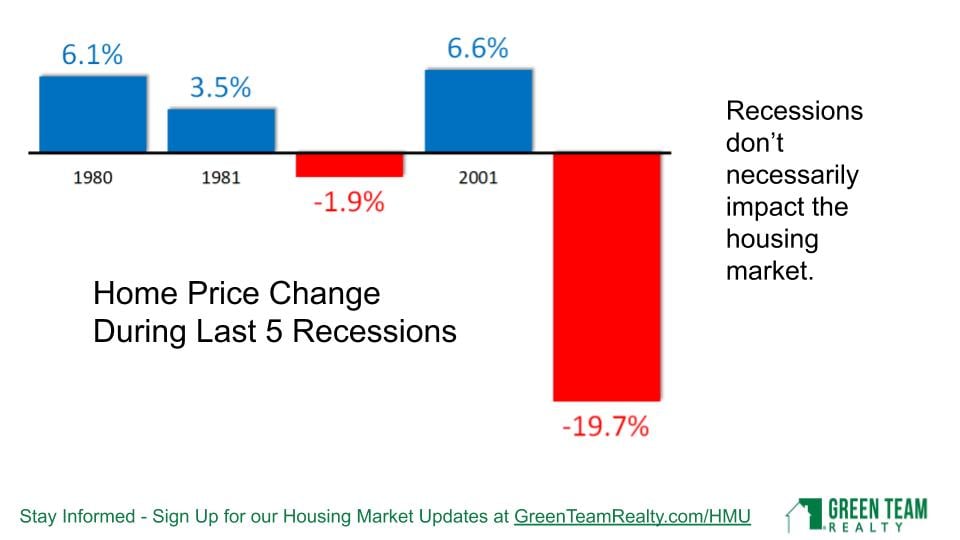

The Housing Market was greatly impacted at that time because it was the catalyst that caused the Great Recession. Home price changes during last 5 recessions indicate that recessions do not necessarily impact the housing market. In 3 of the last 5 recessions, housing markets actually increased.

Housing and Mortgage Crash

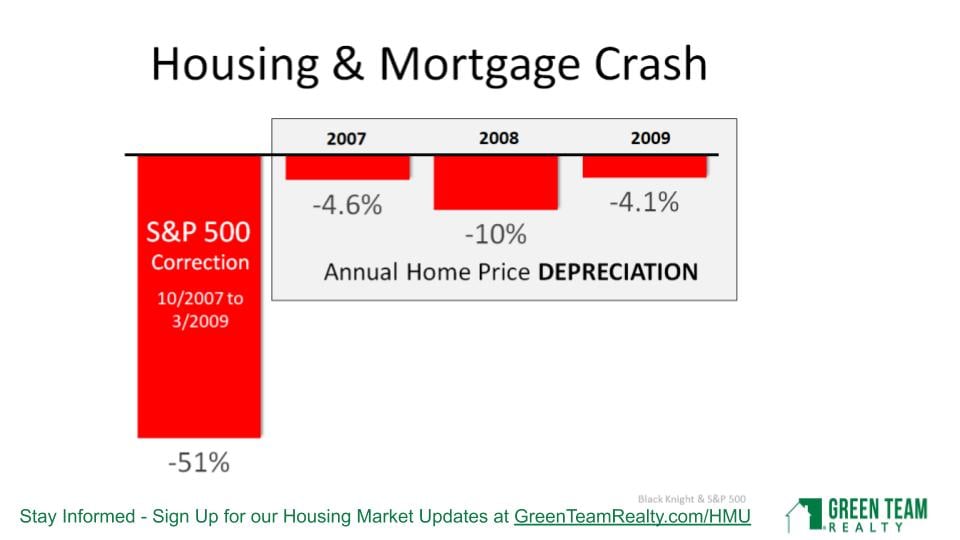

In 2007, 2008 and 2009, the annual home price depreciation was significant. However, at the time we were dealing with sub-prime lending, etc. However, looking further back, to the Dot.com crash and 9/11 market crash, there was a significant S&P 500 stock market correction. Yet prices in the housing market continued to increase. There were good fundamentals in place.

Annual Home Price Appreciation

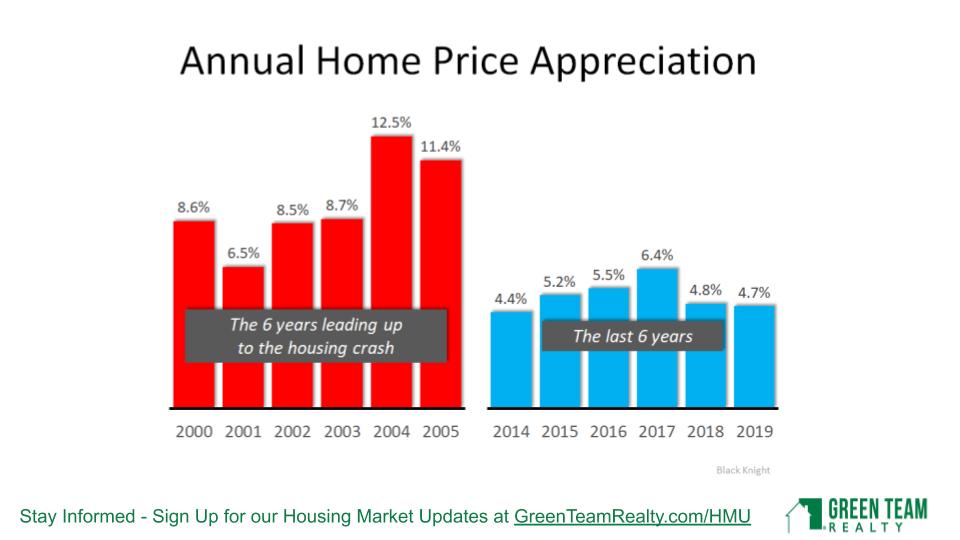

In any marketplace, you have to look at overall values. Are assets undervalued or overvalued? With the run-up to 2008, from 2000 to 2005, there were major price increases year over year. 6.5% was the lowest increase, with the highest being 12.5%. However, since 2014, 6.4% has been the highest increase. We haven’t gone back to those major subprime lending issues that happened before.

Mortgage Credit Availability and Affordability

The Great Recession required mortgage industry restructuring. That, in turn, led to qualified buyers not being able to borrow. This time around, it’s a different landscape. We don’t have a subprime lending bubble in the residential housing market. Loans will be processed for good buyers with good credit. Mortgage requirements are tightening a bit, but not to an unreasonable level. Another analytic compares total home equity cashed out in the years 2005-2007 and 2017-2019. People were using their homes “like ATMs” during the former period. The leverage people are putting on their homes has dropped from $824 Billion during 2005-2007 to $232 Billion during 2017-2019. 53.8% of all homes in America have at least 50% equity.

The percentage of median income needed to purchase a median-priced home has dropped from 25.4% in 2006 to 14.8% today. Affordability is in much better shape, largely due to mortgage rates being very low.

The Impact of Unemployment

Concerns about job losses are very real. A breakdown of the April 3 Unemployment Report shows the different sectors affected. 59.5% are from restaurant services and drinking places. The accommodation industry, retail trade, temporary help services, child daycare workers, health care office workers and construction workers make up most of the balance. In other words, these are jobs that should be coming back as soon as these businesses can operate again. It may take some time until people are confident and comfortable enough to get back out there. The next numbers come out on May 8, 2020 and will be discussed during the May HMU.

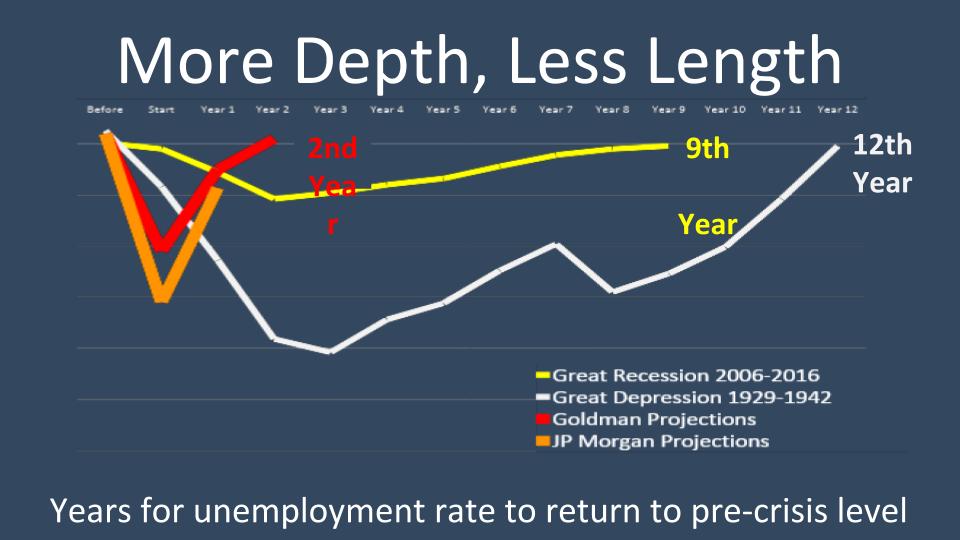

Unemployment rates and home sales do not seem to have a direct relationship. Current Unemployment Rates were compared to past financial crises. In 1933, during the Great Depression, unemployment rates were at a high of 24.9%. Goldman Sachs is predicting unemployment to be 15% in 2020. They are also predicting that number to go down to 6-8% in 2021, 5% in 2022 and 4% in 2023.

Based on data from the US Department of Labor accessed by Haver Analysis, the current employment situation is more like a natural disaster than a recession. The problem is how long this natural disaster, Covid19, is going to last. There are many unknowns, and no answers. We’ll be tracking what happens as parts of the economy reopen.

Historical look at Existing Home Sales Price

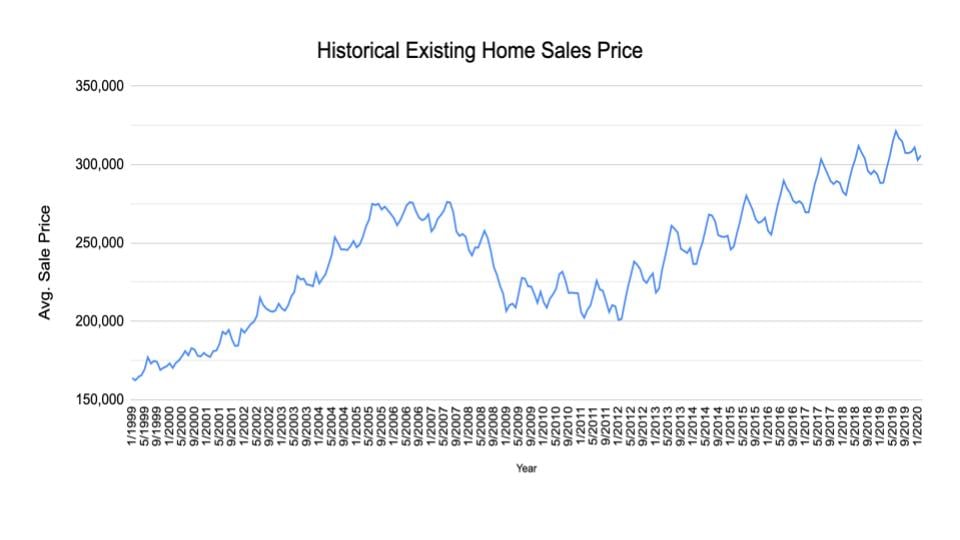

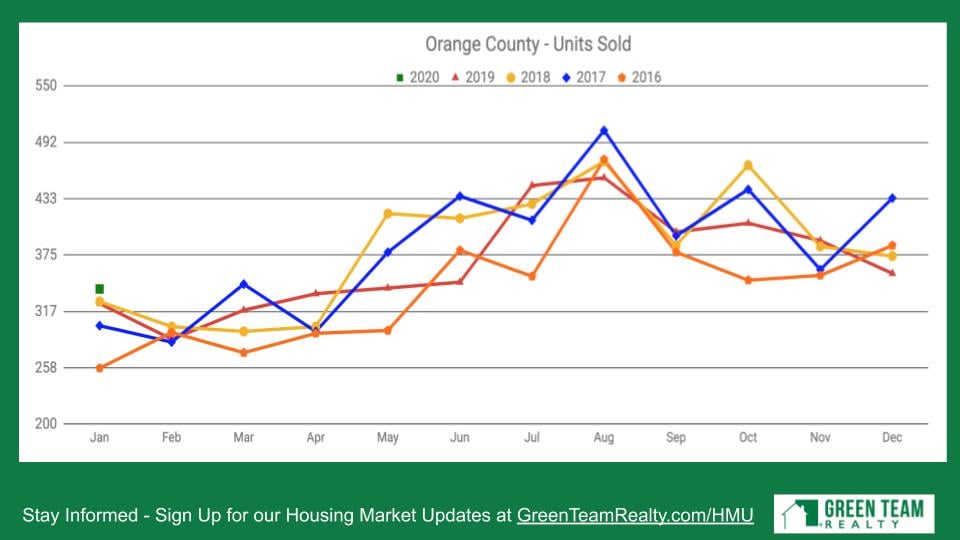

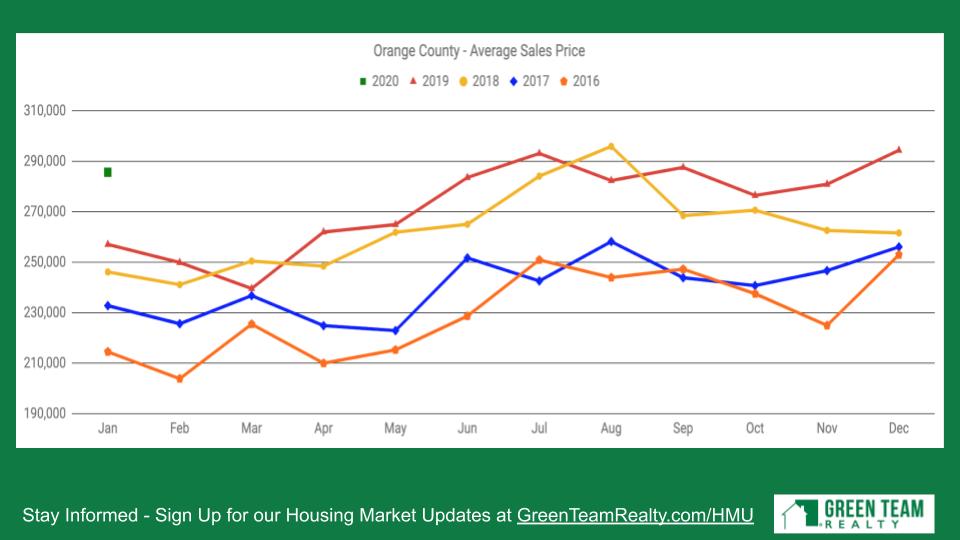

The market was hot the first two months of 2020, with average home sale price higher in January and February than those months in the preceding four years. It will be interesting to see what the numbers show over the next several months.

The above analytic shows Existing Home Sales Prices from January 1999 to January 2020. Even if you bought at the peak of 2007 or 2008, as Geoff did, just before the housing market plunged, it took 8 years for the market to recover. Historically speaking, people moved after an average of 6 years. That number is now inching up to 9 years. The average homeowner generally doesn’t buy or sell during a period of up or down. They want to wait and gain equity in their home. However, if you are not going to buy, what will you do? Rent? If so, you’re not building equity, you’re not getting tax write-offs, and other benefits of home ownership.

Inventory

In 2007, there were 8.2 months of inventory. Right now there are 3.1 months of inventory available. The market is much hotter now than in 2007 (leading into the Great Recession). Geoff believes that now is a very good time to buy, and not a bad time to sell, either, as inventory levels are so low. Historically, 6 months of supply is an average market. We are now down to 3 months of inventory. He does not see this number climbing anytime soon. Many sellers are not putting their homes on the market now, wanting to wait and see what will be happening. And, while people have to weigh their options, the low inventory can benefit those putting their home on the market.

April 2020 Local Stats

Orange & Sussex Counties

In Orange County, Units Sold were actually better in March than in February. Average Sales Price was way up. In Sussex County, Units Sold and Average Sales Price both coming out at a good solid pace. It will be interesting to see what the stats reflect when we take a look at our next Housing Market Update. At that time we’ll see the impact of Covid closures and stay-at-home regulations.

Housekeeping Items

Panel Discussion

Geoff Green was joined by Ken Flood of Quest Financial Services and Ken Aulicino of Family First Funding LLC. Vikki Garby and Carol Buchanan of Green Team New York Realty and Keren Gonen of Green Team New Jersey Realty represented the real estate agents’ points of view. Discussion ranged from the current state of commercial and residential real estate markets. There was positive feedback on how agents are adapting to the Covid19 regulations and are still able to assist clients and close deals. All three agents spoke of strong, serious buyer interest. Ken Flood discussed the financial market and Ken Aucilino the mortgage industry. Because of the wealth of information and graphics as well as the fascinating panel discussion, it is highly recommended that you watch the webinar. Click here to view the April 2020 Housing Market Update.

Remember to sign up below for the next Housing Market Update

[/et_pb_text][et_pb_agentfire_lead_form form=”contact” _builder_version=”3.18.2″][/et_pb_agentfire_lead_form][/et_pb_column][/et_pb_row][/et_pb_section]

March 2020 Housing Market Update

[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”3.0.47″][et_pb_row admin_label=”row” _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text admin_label=”Text” _builder_version=”3.0.74″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]

Note

Things are happening rapidly. Just three days after the March 2020 Housing Market Update on the 17th, everything changed. On March 20 Governor Cuomo issued the New York State on PAUSE Executive Order. One day later, Governor Murphy announced a Statewide Stay at Home Order for New Jersey. And even though our physical offices are closed, Green Team Realty sales associates and support staff are all working remotely.

March 2020 Housing Market Update

Geoff Green, President of Green Team Realty, welcomed everyone to the webinar. He began by discussing last month’s Housing Market Update. One month ago on the February 2020 HMU, things were looking great. The stock market was nearing all-time highs. One month later the coronavirus had set in. Now everything is different.

We are in historical times now. And the panel will try to break it apart and make some sense of what’s happening. The panel includes a mortgage expert and financial expert, in addition to sales associates from Green Team New Jersey Realty and Green Team New York Realty.

Silver Linings

Mortgage rates are extremely low and there are lots of good programs that help people buy a home. Looking at rates from 2016 to today, they are now historically low. Things are fluid now. The Central Bank is in flux, determining 10 year treasure rate. There is a correlation between the treasury rates and 30 year mortgage rates, but they are not one and the same. Laura Moritz, the panel’s mortgage professional, reiterated that. The treasury rates that you hear about on the news do not translate to mortgage rates. Reach out to your mortgage professional to find out what the rates are for your current financial situation.

Some Other Positives

According to ShowingTime, at the start of the year there was a 20.2% increase in showings. 2020 was off to a great start. Geoff sees this as a positive. After we get through this tough period of time these numbers should bode well.

A Mixed Bag

Crude prices present a mixed bag. We are experiencing the single largest decline in the history of crude oil prices. This is due to an oil-price clash between Saudi Arabia and Russia. On the positive side, we’re potentially paying less at the pump and to heat our homes. On the negative side, those companies involved in the oil industry stand a chance of going out of business, defaulting and impacting banks that financed their operations. Without banks lending money, the housing market cannot move forward.

The Coronavirus and the Real Estate Market

The CDC and the White House, during their press briefing, seemed to indicate that this would not be over anytime soon. A lot of school districts, local business leaders, politicians may be saying “For the next few weeks this is going to happen.” However, Geoff’s sense from the briefing was that this halt of movement will actually be prolonged until this virus is truly contained.

Therefore, we need to find ways to operate responsibly and respectfully, to keep the housing market in check and not experience a complete crash.

Impact on Stock Market

Just a month ago the Dow Industrial Average was wavering between an incredible 29,000 and 30,000. The take-away at that time was that 2020 was going to be a great year, as long as there wasn’t a major global crisis. During the February Housing Market Update, Geoff mentioned that he thought the coronavirus might become that global crisis. Within a few days of that the virus began to quickly spread globally. The day before the March 2020 Housing Market Update, the Dow dropped 3,000, its worst day since 1987. And now, the global economy is at a standstill.

A Commercial Real Estate Bubble?

One thing that not many people are talking about yet is the Commercial Real Estate Bubble. Carl Icahn, a billionaire investor, is betting on the commercial real estate market being in a bubble and about to crumble. That is a big deal as banks are heavily involved in commercial real estate and lending. This is a situation we’ll be keeping an eye on.

Local Housing Market Stats

Orange County

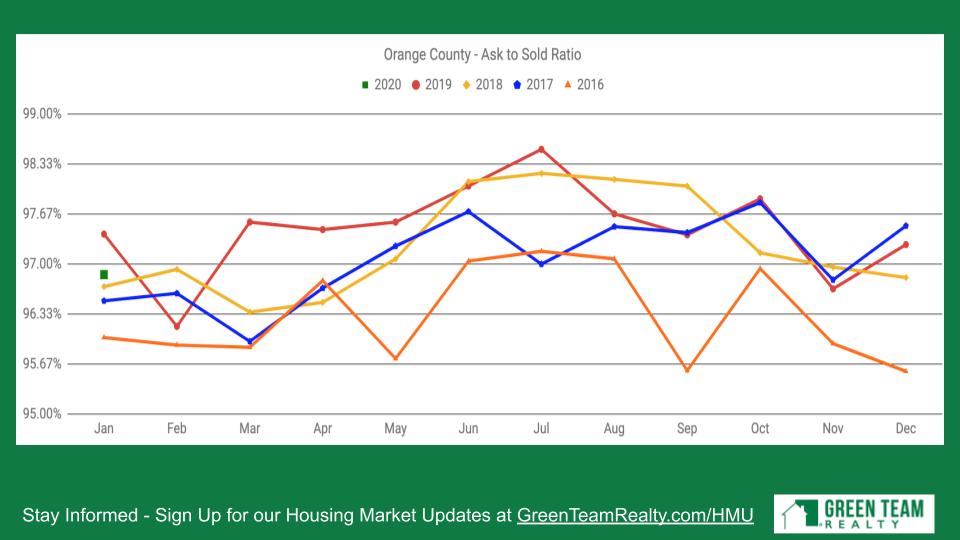

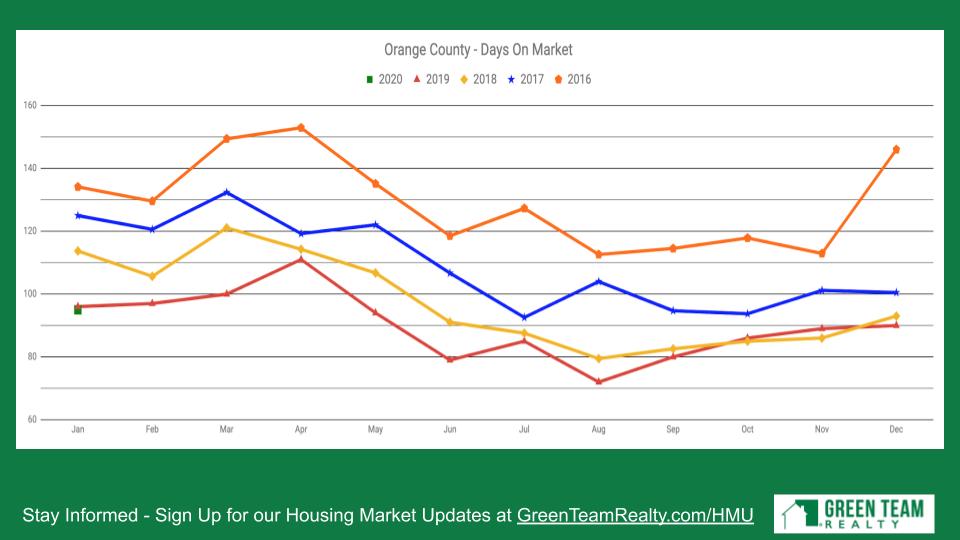

Units sold was lower than preceding years for the month of February, while it had been higher during January. That kind of fluctuation is not uncommon and when averaged out, it’s right in the mix. Sales prices came out way ahead of previous years, much the result of low inventory. Ask to sold ratio is still at a very high percentage. That means sellers on average are only negotiating 3% off their last asking price. Days on market has gone up a little, which generally means a slowing of the market. At this pre-coronavirus stage, there were some indications that the market was slowing a little.

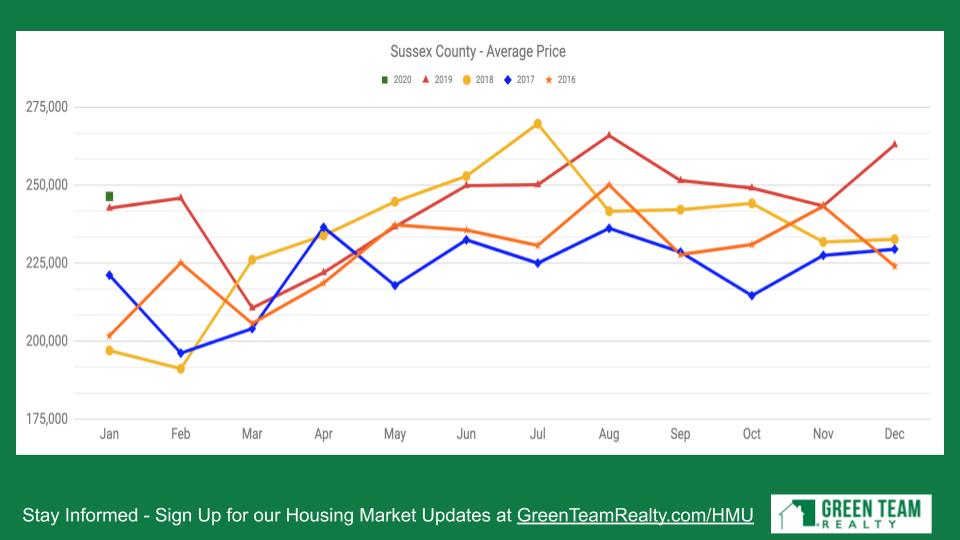

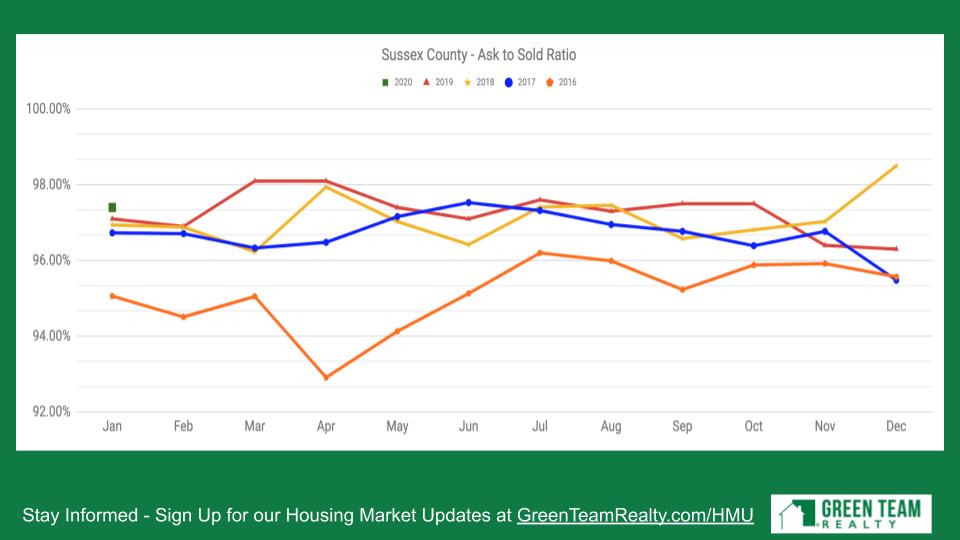

Sussex County

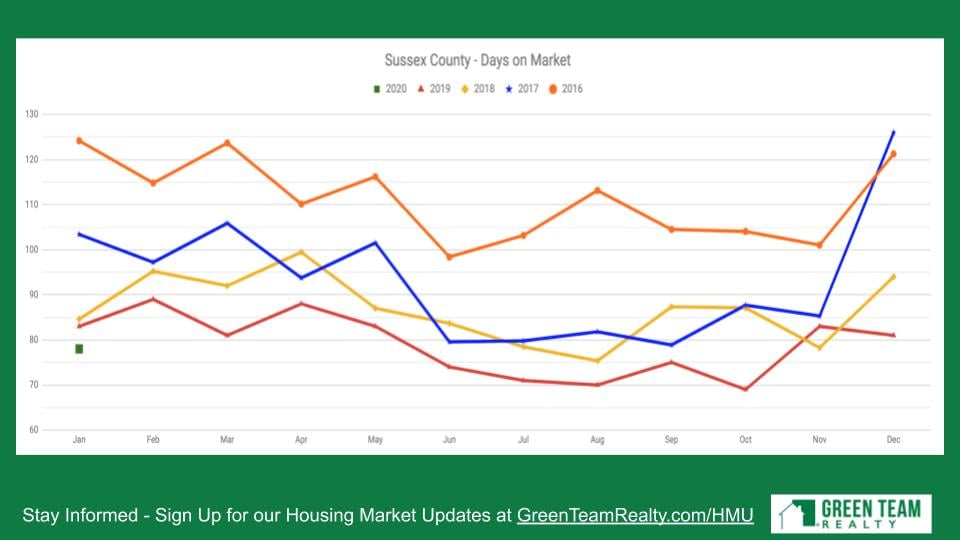

Units sold in Sussex County were a mixed bag. Not quite as high as 2018, but a little higher than 2019. Average price is up, and ask to sold ratio is at 97%, As in Orange County, days on market is going up, again indicating a slowing in the market.

As Real Estate Professionals, what can we do during this crisis?

Whether you’re a home owner, potential buyer or realtor, we all need to take this seriously. Geoff mentioned that one of the doctors on the coronavirus news briefing on March 16 said that this is all about the Greatest Generation. Many of the people who are dying from the coronavirus are from the World War II generation. And we owe it to them to try to safeguard their health. We have to make sure we’re doing the right thing.

We have to make sure we’re watching the WHO and CDC guidelines and operating within those confines. Some countries are shutting down, others are not. Geoff’s take away is no more group meetings. If you are having symptoms, then you and your household must self-quarantine. If you’re a real estate agent and you have symptoms, take it seriously. Do not show homes, do not pretend you’re asymptomatic.

For those sales agents who do not have symptoms and have not been exposed to the virus, Geoff recommended the following. Tell sellers who might be concerned about buyers coming into their homes that we will do personal showings and greet the potential buyer and buyer’s agent at the door. Make judgment call if you think they might be ill. Walk them through the home, opening doors, closets, etc., then wipe them down before leaving.

Video tours provide a good alternative, if necessary. Buyers are never physically in the property. The sales associate, with boots on the ground, walks them through, using video conferencing.

Before opening the discussion up to the panel, Geoff had one more thing to say… WE WILL PREVAIL!

Housekeeping items

Meet our Panel

From left to right, Laura Moritz, Clasic Mortgage; Ken Ford, Warwick Valley Financial Advisors

From left to right, Kristi Anderson, Green Team New Jersey Realty, Keren Gonen, Green Team New Jersey Realty, Angela Murphy, Green Team New York Realty

Discussion

Looking for “boots on the ground,” Geoff first asked the sales associates what was happening with ShowingTime. Were people continuing to want to see homes, were they cancelling? Kristi stated that she was still getting lots of showings on her properties. Personally she showed 8 different prospects homes over the weekend. It’s very busy still at this point. Keren had two cancellations over the weekend, then got calls from a brand new client she showed homes to. And just the day before she showed one client eight properties. Angela agreed that not only are people viewing homes, they’re purchasing homes. Six out of ten homes she had showed to buyers had accepted offers within a week. Kristi added that she had two properties go to contract this day.

Geoff stated it’s interesting that the housing market in total – sales, exchange of real property, renovations, maintenance, etc. roughly equates to almost 20% to 25% of national GDP. It is a major force, economically speaking. His hope is that the housing market will stay relatively healthy during all this. If we do go into recession, it may not be that deep and that bad. He asked Ken for his opinion on this.

Are we heading towards a recession?

Ken first talked about the history of recessions. He said this is the longest period that the US has gone without a recession. The last was 2008/2009, the period of the great financial crisis. And we’ve never gone a decade without one. Going back 150 years of data, we’ve had one or two recessions each decade. Recessions can be healthy, weeding out the excesses of economic expansion. Our economic expansion has been built on more debt, more credit, low interest rates and the Federal Reserve pumping money into the economy. The saying goes, the bigger the boom, the bigger the bust. And the last ten years have been the biggest boom he’s ever seen.

If liquidity and the financial markets seize up like they did in 2008, then we are going to have a recession. The Fed dropped the interest rate to 0%, providing lots of liquidity. They’re trying not to repeat 2008, but Ken is not sure they’ll be able to do it. We don’t have any stimulus that can jump start the economy. Plus we have a trillion dollar deficit, so where do we go from there? If we start losing confidence in the market, there will be a problem. Greed and fear often drive decisions. However, he said if you know how to value assets and have the capital there will be some great investment opportunities going forward. And Ken does believe that we’re headed for a recession, with everything shutting down, people working from home, unable to go to stores, restaurants, etc.. It’s just a question of how bad the recession will be.

From the lender’s perspective

Geoff asked Laura for her thoughts. She reiterated what Geoff had said. We’ve survived bad times before. And, unlike the big cities, a lot of people are looking to move to less densely populated areas. Our proximity and distance from major cities are important factors. From a lender’s perspective, she had four accepted offers the day before. She does see buyers putting offers in, and she had three closings this week. On the other hand, she does see evidence of the banks tightening up. Putting down 3% or 0% may not be feasible. Property values may be depreciating in the short term, larger down payments may be required. People still need a roof over their heads, so it’s different than the commercial market that Geoff described before.

Laura said that she’s been inundated with calls from people wanting to refinance they’re mortgages. She closed ten last month. However, right now banks do not want to refinance mortgages and are pricing them accordingly. They don’t want to compromise their portfolios. If you want to refinance, you may have to hold on. Geoff said that one of the strengths, compared to 2008, is the level of equity in homes, in general. A lot of households don’t have a mortgage, and a lot have a pretty low loan to value ratio. He hopes that the housing market, which caused the 2008 financial collapse, is now carrying the U.S. economy. We’ve been in a boom compared to the rest of the world.

Can a strong housing market make a recession not hurt as much as last one?

Geoff asked if it’s fair to say that the U.S. housing market might actually make this recession not hurt as much as the last time?

Ken replied that he was looking at something that was the best indicator of valuation of residential housing. The Case-Shiller Index shows that with real estate in Warwick, you can’t buy the same house in Greenwich, CT. You can’t buy the same square footage, etc. The denominator is the income of the town you live in; the value of real estate divided by the average income. It is higher than 2007/2008. We have a higher valuation than what they deemed to be a housing bubble.

Geoff believes low mortgage rates and low inventory, providing supply and demand, has driven real estate value up. He believes there is still so much demand, without the supply. Ken said if we wind up with inflation, mortgage rates will go up. Income inequality is a major problem. Interest rates drive the pricing power of all assets.

Impact of the job market

Geoff said it will all boil down to people having jobs and having confidence to buy a home. The job market is another interesting discussion. The number of layoffs that might occur during this halting of movement will be of interest. He hopes that companies will hang on to cash flow to keep their employees on. He said that is what they’re doing at Green Team. Everyone is working remotely, and they haven’t dialed back on staff. They’re trying to do more with what they have and hope other businesses do the same.

Ken said it all comes back to the stock market. The biggest cost of any corporation is the employees. If stock plummets and earnings go down, the CEO or CFO of major corporations will normally cut employees. Decision makers start laying people off when revenue and earnings go down. As financial planner he tells people to have emergency savings, just in case they are laid off from their jobs.

Wrapping it up

Geoff thanked everyone for their participation. The take-away is, if you’re a seller worried about putting your home on the market because of what is going on, for market reasons get your home on the market now. The market is still very robust, as Kristi, Keren and Angela had stated. We don’t know what the future holds, so why wait? If you’re concerned for health reasons, that is understandable. There might be ways around that, as well. He suggested talking to a Green Team realtor, such as Kristi Anderson, Keren Gonen or Angela Murphy. Regardless, this is what realtors do… find ways to make it happen. For buyers, there may be some unique opportunities.

We have no choice but to keep going. Keren added that she listed a house on Saturday and the next day had three full-priced offers. Good houses are selling. Have trust that we can get this done for you.

Laura added, with everyone staying together, being with their families, they’ll re-evaluate priorities. And what is the heart of the family? Their home. Extended families may blend, people will find comfort in their homes. She feels in that regard, this will be good in our market.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

Green Team 2019 Awards Ceremony Looks Back at Momentous Year

Agents and staff of Green Team Realty gathered together on January 17 for their 2019 Award Ceremony. Warwick Valley Country Club was the perfect place to celebrate a year that was momentous in many ways.

2019 – A Year to Remember

According to Geoff Green, President of Green Team Realty, the “Green Team 2019 Awards Ceremony is all about appreciation for our Sales Associates. They are the ones out there in the field doing the hard work of listing and selling homes. This is a tough business that puts many demands on their time and resources. The Green Team Award Ceremony is a way to say thank you, highlight their achievements, and get them ready for another busy year.”

Geoff welcomed everyone and outlined some of the year’s milestones. Once again, through dedication, hard work, support, creative marketing, and consistent training programs, many Green Team Sales Associates saw their businesses grow.

Green Team #1 In Warwick and Vernon for Sales Volume and Units Sold

It was with great pride that Geoff announced Green Team was #1 in Warwick and Vernon. Green Team New York Realty (“GTNYR”) was #1 in Warwick for sales volume and units sold. Furthermore, Green Team New Jersey Realty (“GTNJR”) was #1 in Vernon for sales volume and units sold for the second year. Both did well in their respective counties, too. GTNYR was #8 out of 385 real estate offices in Orange County. And they were #9 out of 385 in terms of units sold. GTNJR was #8 out of 388 in terms of sales volume in Sussex County. And it was #6 out of 388 in terms of units sold.

Award Presentations

Geoff believes in acknowledging and rewarding both growth and achievement. And what makes the award presentations so special is the support and pride that the whole Green Team family shows to the recipients. This year Green Team Realty had a special presenter. Geoff’s wife, Laura, announced the winners in each category. She was aided by Donna Roberts, Green Team’s Agent Service Manager for the Vernon office, and event planner extraordinaire.

MVP Award

Jennifer DiCostanzo received the MVP Award for over $12 Million in sales for 2019. Jen, the first and only recipient of this award, also achieved the MVP in 2017 for over $10 Million in sales. Geoff Green had this to say about Jennifer: “While everyone can stand back and marvel at Jennifer’s accomplishments, what truly is the reason for her success is her work ethic. No one takes their business more seriously than Jennifer. She is a true professional in every sense of the word, and she works hard for everything she receives. There is no doubt that Jennifer will be at the top of Orange County, NY Real Estate Sales Associate production charts for many years to come.”

Yearly Sales Leaders

GTNJR’s team of Charles Nagy and Ted Van Laar received the Yearly Sales Leader Award for the second year in a row

.

And Jennifer DiCostanzo received GTNYR’S Yearly Sales Leader award for the fourth year in a row.

President’s Club

In 2018 a new level of achievement was introduced. The President’s Club Award is given to those sales associates achieving between $5 and $10 Million in Sales Volume. For 2019, recipients of the award were, from left to right: Charles Nagy, Keren Gonen, and Ted Van Laar of Green Team New Jersey Realty. And Vikki Garby, Nancy Sardo, and Dean Diltz of Green Team New York Realty.

Captain’s Club

This established award is given to those who do $3 to $5 Million in Sales Volume. From left to right, recipients are Kristi Anderson, Heidi Hyland, Alison Miller, and Barbara Tesa of Green Team New Jersey Realty. And from Green Team New York Realty we have Tammy Scotto, Lucyann Tinnirello, Kristine Many, Angela Murphy, Carol Buchanan, and Toni Vogel. Not pictured is Chris Kimiecik.

Honorable Mention

This category was created in 2018 to acknowledge those Sales Associates who had $1.5 to $3 Million in Sales Volume. Recipients of this award, from left to right are Ann Nussberger and Cathie Witte of Green Team New Jersey Realty. Not pictured: Kimberly Lasalandra. From Green Team New York Realty are Pip Klein, June Cosgrove-Hays, Walter Ross, Tiffany Megna, Tom Folino, and Jacque Kraszewski. Denise Schmidt was given the award posthumously, with the certificate accepted by her daughter, Dana. Not pictured: Guillermina “GIdget” Tavares, Kim Lesley, and Linda VandeWeert.

The Momentum Builder Award

Every year Geoff Green selects a sales associate who has demonstrated hard work and determination while overcoming obstacles. Someone who has come through a tough spot in life and turned challenges into great success; not just in real estate but in life. A person who shows no signs of going backward. Because it’s all about building momentum towards a brighter future. This year’s Momentum Builder was Denise Schmidt, and there was not a dry eye in the house when Denise’s daughter, Dana came up to receive the award on her mother’s behalf.

Denise passed away suddenly in 2019, leaving family, friends, and co-workers in shock. She was much loved and is missed by all. Dana spoke movingly about Denise and her legacy. As a loving, hardworking single mom, Denise did whatever it took to provide for her family. In addition to being a sales associate with Green Team New York Realty, she was also a bus driver for the Warwick Valley Central School District.

The People’s Choice Awards

The winners of these awards are selected by their peers.

Citizen Of The Year

Recipients of this award are nominated by their co-workers. Both have made outstanding contributions to our local communities. This is the fourth year in a row that Jen DiCostanzo has been named Citizen of the Year by Green Team New York Realty. Jen originated Light Up the Holidays for Green Team to raise funds for local charities. The program evolved into Team Up for Hope, an initiative to raise funds and awareness of local organizations working in the fields of mental health, substance abuse prevention, and suicide prevention.

Keren Gonen has been named Citizen of the Year by her peers at Green Team New Jersey Realty for the third year. Keren has been instrumental in raising funds for local charities. She is also extremely active in Team Up for Hope.

These women truly believe in giving back to the community and put in the time, effort, and commitment to make things happen.

Team Player Award

Recipients of this award are deemed the most reliable, positive and dependable. Furthermore, they work well with others and have great problem-solving skills. It is no coincidence that the award went to the Agent Service Managers of each office. Andrea Wynn was voted Team Player by her peers in the Warwick office. And Donna Roberts was voted Team Player by her co-workers in Vernon.

In addition to her position as ASM of the Vernon, NJ office, Donna is a talented Event Planner and Coordinator. Her skill was evident in the many details of the Award Ceremony on display.

A Special Thank You To Our Sponsors

The event’s sponsors helped transform the Awards Ceremony into an awards Celebration!

Amy Green, VP of Mortgage Lending at Guaranteed Rate, was a Diamond Sponsor. Geoff Green watched with pride as his sister, Amy, addressed the gathering. Douglas R. Stage, Esq..of Stage Law Firm, LLP (formerly Stage & Nathans) was a Platinum Sponsor. And Gold Sponsors were: Joe Mayers of Septic Experts, LLC; David Willner, Pillar to Post Home Inspections; Kenneth Flood, Quest Financial Services; Jamie Fiscus, Allied Title, LLC, and Frank Frasco, Home Inspection LLC. As is usually the case when real estate professionals get together, there is “shop talk.” The Awards Ceremony provided an opportunity for Green Team Sales Associates to discuss local market conditions and community with sponsoring companies.

There was also the opportunity to dance! DJ Freddie Z kept the crowd entertained and energized. And George Tsakanias and Klaus-Peter

However, there was something else evident in the room. There was a sense that this was a TEAM. And as members of a team, there was pride, support, friendship, and respect for each other’s accomplishments. What’s more, you could tell that plans, goals, and dreams were beginning to take shape and would see the members of the Green Team through the coming year.

February 2020 Housing Market Update

Geoff Green, President of Green Team Realty, welcomed everyone to the February 2020 Housing Market Update held on Tuesday, February 18 at 2 p.m.. Topics to be discussed include the coronavirus and its potential impact, as well as the upcoming elections and local stats. If you missed the webinar, click here to watch it now.

National Stats

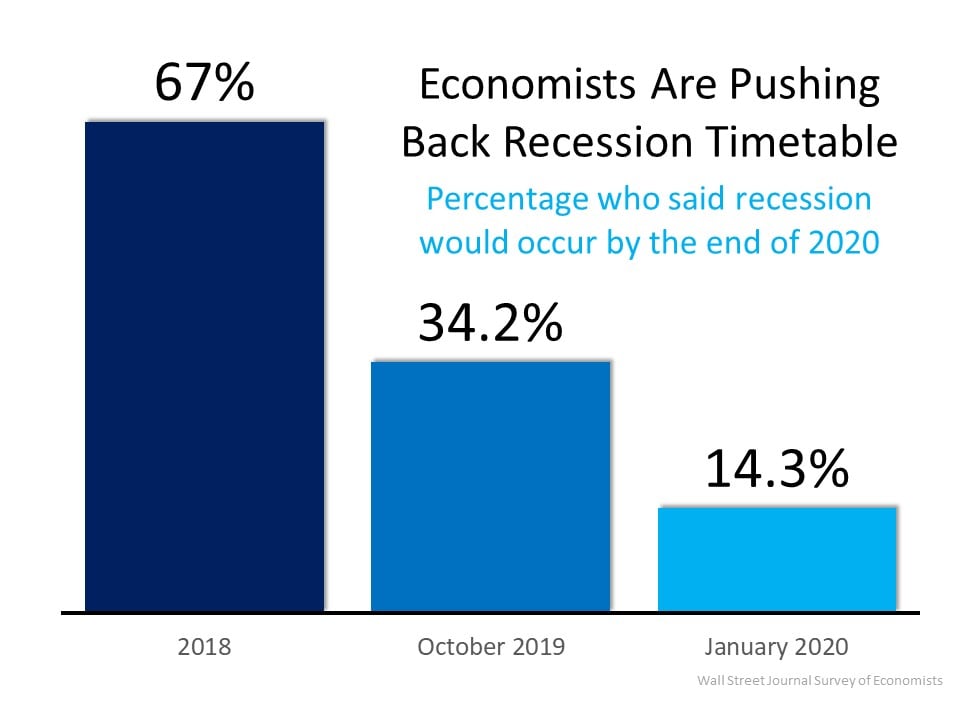

Recession Talk

The above graphic reflects the views of economists surveyed by the Wall Street Journal. In 2018, 67% of economists thought that by the end of 2020 there would be a recession. As early as October of 2019, that number was 34.2%. However, in January of 2020, that number was down to 14.3%.The economy seems to be outpacing the expectations of many who are watching a variety of analytics very closely.

Shrinking supply, rising prices

There is no question that the housing market did end red-hot in 2019.. Prices are continuing to rise, inventory is still low. While builders are more optimistic, they are still not meeting demand. Later, Geoff and David Willner, a home inspector, will be sharing thoughts on why more new construction houses aren’t happening.

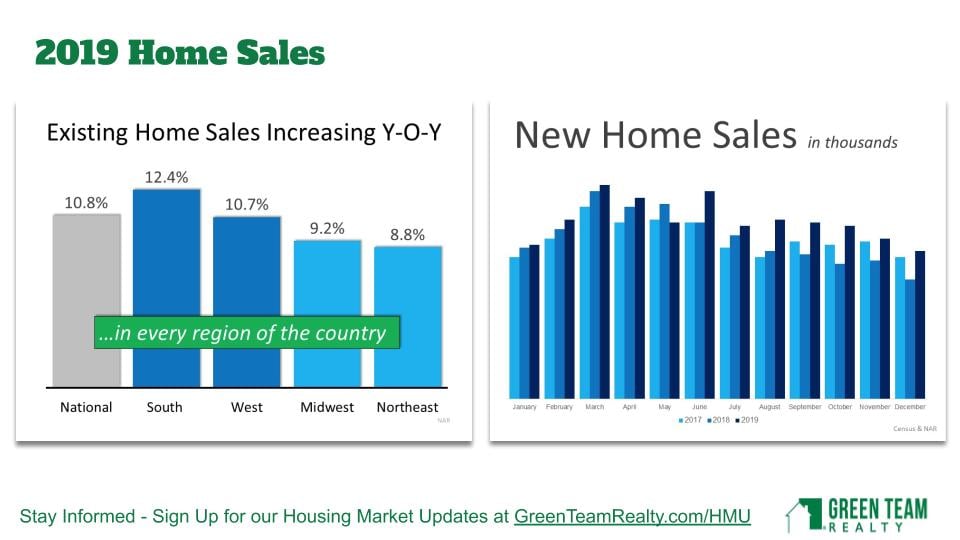

2019 Home Sales in every region

In 2019 existing home sales were increasing year-over-year in every region. There was also an increase in new construction in 2019 over 2017 and 2018. Everything was increasing throughout 2019, and is expected to continue through 2020.

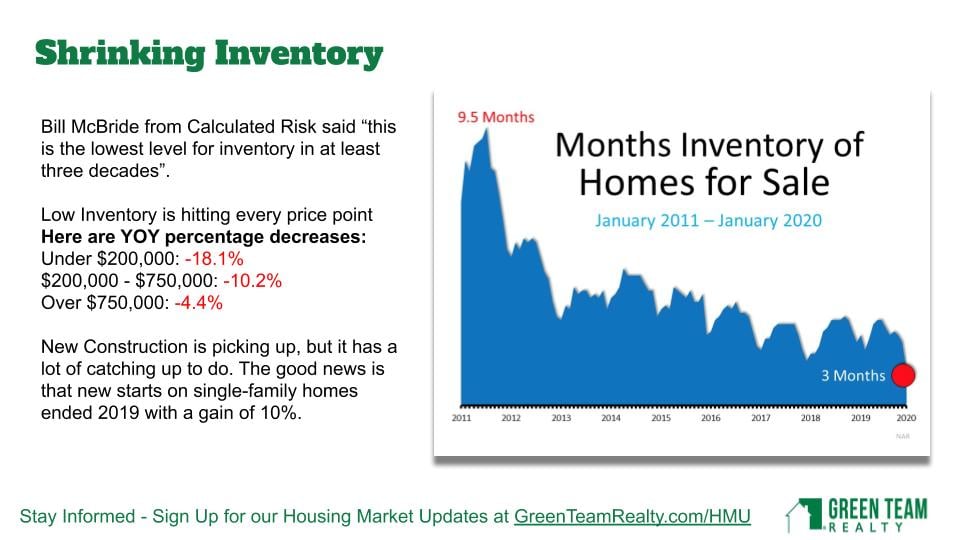

Inventory shrinking

Inventory continues to be a problem. This is the lowest level of inventory in at least three decades. The months inventory of homes for sales is 3 months. A normal market is 6 months. a buyer’s market is 9 months. A seller’s market is below 6 months. There is nothing to indicate that this number will increase. It may actually decrease. The only thing that could possible turn that around would be new construction picking up in big ways. However, it is not that easy to bring new houses online with zoning ordinances, etc.

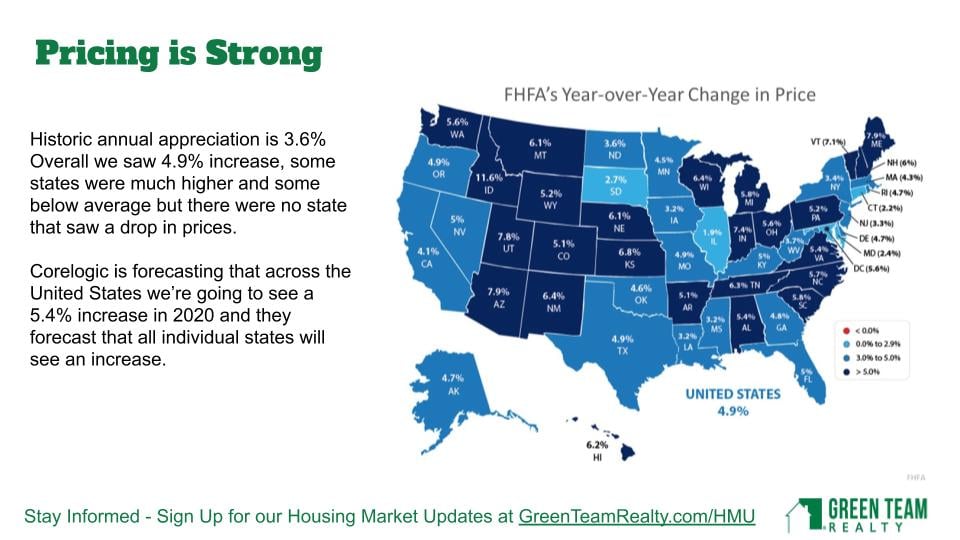

Strong Pricing

Back in the summer of 2018 we started to see different numbers and wondered if the market would rebound. It has rebounded strongly and price increases are anticipated for 2020. Every state is labeled in blue, indicating prices increasing. Corologic and other companies are predicting price appreciation.

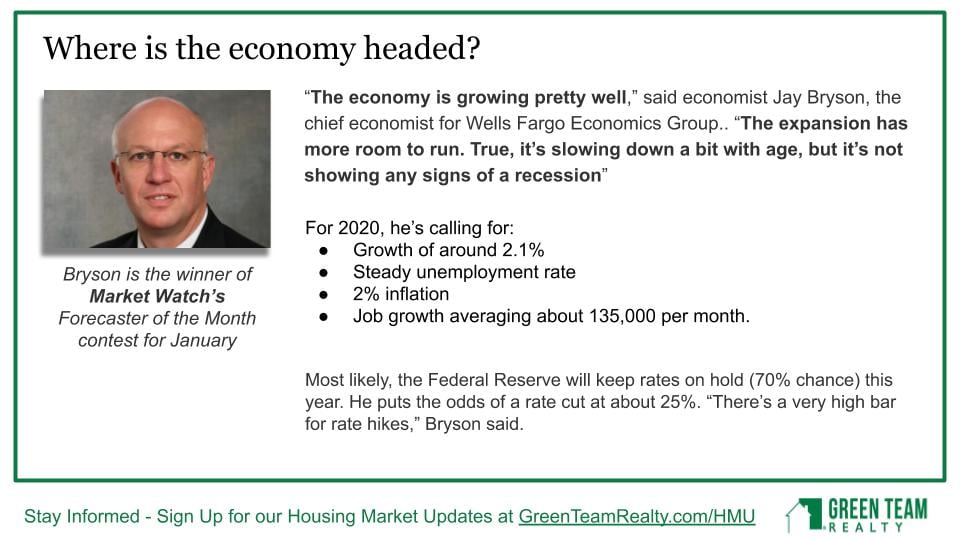

The economy – where is it headed?

According to Jay Bryson, chief economist for Wells Fargo Economics Group, the economy is growing well and the expansion still has room to run. While slowing down a little, the economy is not showing signs of a recession. There is growth of approximately 2.1%. Unemployment rates are steady. We’re at a relatively low rate of inflation. Job growth is good. It does not seem as though anything is poised enough to stop the growth.

Local Stats

Units Sold

2020 numbers for January show units sold at its highest number in the last five years.

Average Sales Price

Average Sales Price is way up. January is showing a remarkable jump. It will be interesting to see how this plays out the rest of the year.

Ask-to-Sold Ratio

This is the last asking price versus what the property sold for. Again, the number is high. Sellers are only having to negotiate about 2% off the asking price. These are strong numbers. And they mean that buyers don’t have too much leverage in this market.

Days on Market

The lower the number of days, the stronger the seller’s market it is. There has been a downward trend, year-over-year, and we’re starting 2020 at the same low mark as 2019. This is a strong number.

Units Sold

Units sold is same number as 2017. While not starting out at the highest level, it is still a pretty good level for Sussex County.

Average Price

Average price is up over the last five years, so that’s a good sign for people looking to sell their homes in Sussex County.

Ask-to-Sold Ratio

This is the last asking price versus what the property sold for. Again, the number is high. Sellers are only having to negotiate about 2% off the asking price. These are strong numbers. And they mean that buyers don’t have too much leverage in this market.

Days on Market

Again, this is the lowest level in five years in Sussex County. Things are going quickly.

Housekeeping Items

Join us for the next Housing Market Update, Tuesday March 17 (St. Patrick’s Day) at 2 p.m. Stay informed. Sign up for our Housing Market Updates at: GreenTeamRealty.com/HMU.

Thanks to our sponsor, REALLY, the Real Estate Referral Community. REALLY is where Professionals who serve the Real Estate Industry can connect, communicate, and securely exchange referrals with speed and ease. The best part? No fees on commissions exchanged between Agents. Join for free at ReallyHQ.com

Panel Discussion

Panelists were Geoff Green, President, Green Team Realty and Dave Willner, Pillar to Post Home Inspections. Before starting off the discussion, Geoff shared a few more stats. According to new stats released by the National Association of Home Builders the confidence index is as high as it’s been since 2008. As we had discussed in the summer of 2018, there was a dip in confidence in home builders. It’s now at its highest in 12 years. Housing starts are at the highest level since 2014.

Geoff introduced Dave Willner and began the discussion with:

Do you foresee anything slowing down the 2020 housing market?

The simple answer was “No!” Dave believes that 2020 is going to be a big year. January started off with a big bang. In January 2020 his company reported its highest earnings in three years. The number of inspections are up. They are seeing a niche in the under $500,000 market. Higher-end homes are not moving as quickly as those selling for $500,000 or less.

Geoff agreed that is definitely true for our area. While in some places, such as New York City and certain areas on the West Coast, $500,000 wouldn’t even buy a “fixer-upper.” Dave said that it definitely depends on the market, but that is what they’re finding here. Geoff also agreed that he doesn’t see anything to indicate that 2020 won’t be a big year. However, he does think that there are some interesting things happening economically on a macro scale that everyone should be aware of.

Economics – the Macro and the Micro

How might the coronavirus on the granular level, impact economics? Geoff shared some of the things he’s learned.

In addition to the coronavirus, there is something happening regarding travel. The Boeing 737 Max was grounded last year. That has had a major impact on the airline industry, which further impacts overall travel spending. There is a “double whammy” happening within the travel industry. Further, travel is a significant segment of the U.S. economy; not something to be dismissed. A micro example would be Corning in Upstate New York. A lot of their revenue is received from people traveling from New York City up to Niagara Falls. As it’s a midway point, a lot of international travelers go to the Corning plant to see how glass is manufactured. So many people have traveled there from China that they have tours in Mandarin. Thus, the coronavirus and the Boeing 737 Max have impacted this local economy.

As real estate is local, there could be a locally impacted market while the nation is booming. Those in travel-related economies should keep an eye on these developments. Dave asked if vacation housing in Orange and Sullivan Counties might be affected as a result of these issues. For example, would more people seek a summer retreat? Geoff didn’t think that market would be especially impacted, since much of the tourism in the area is people traveling from other countries. Second homes are more for people in the NYC/metro area who want to get away for a weekend. He doesn’t necessarily see the coronavirus as impacting that end of the travel spectrum. However, the idea is not to be dismissed. It’s an interesting dynamic to keep an eye on.

The Coronavirus and the Impact of Quarantines

Another aspect of the coronavirus is quarantine. China is literally quarantining cities, shutting down transportation, etc. Not only can people not leave their city. They can’t travel. But many also cannot go to work. Stores are being closed, factories shut down and unable to operate. You are now seeing headlines about Apple revising its earnings. They’re saying the supply chain is being affected because much of their manufacturing is done in China. Not only is demand being impacted by the economy in China, which has been affected by the virus. The supply chain is being impacted as well in terms of production. Further, you have to think about commodities. If factories are not running, you don’t need iron, heavy metals. Commodity prices, such as oil, are dropping.

Globally a lot of things are happening now that many people seem to overlook. Right now, things are good in the United States. However, globally many economies have not been doing so well for the last few years. Hopefully the coronavirus will have reached its peak and begin to dissipate.

The Presidential Election

It will be interesting to see what evolves in this election year. There are candidates who are at the opposite economic spectrum of the Trump administration. And if elected, what would the impact be? It would probably not affect 2020 as the election is not till November. However, needless to say, it’s an issue that should not be dismissed.

Trade agreements with Canada and Mexico and China will also impact the economy. Again, it will be interesting to see the impact of global factors.

Keren Gonen joins the conversation

Keren Gonen of Green Team New Jersey Realty joined the panel discussion. Having just arrived from a closing, Geoff filled Keren in on what had been discussed regarding the 2020 market stats. He asked if she agreed with their prediction that 2020 would be a big year. Geoff also talked about inventory pressure and problems. Then he asked what she is seeing now. Keren stated that she’s seeing the same things, and that Spring Market has already started. She’s as busy now as she should be at the end of April. This month alone she has 3 closings. And she’s projecting another 5 closings for next month.

Geoff said that the mild winter might also be a factor. Many people just don’t want to go out and look at homes when it’s raining, snowing, etc. While it has been cold, there has not been a lot of snow to deal with, which helped catapult things. More importantly, interest rates are really low. And that is something that can help offset the high price of homes for some buyers. While the price may be on the high end, it’s what fits the monthly budget that really counts. If that low rate can be locked in buyers can set themselves up for success as home owners.

Wrapping it up

Geoff asked Dave and Keren if they could think of anything that might stop this market from churning as fast as they think it’s going to in 2020. Dave replied it’s about managing the inventory out there. It is definitely a limited-inventory market, and the good deals have been had. Dave has seen a strong influx of people coming up to more rural communities from the city. That’s where many of the buyers are coming from, looking to get out of renter-ship. As long as interest rates stay low, people will continue to buy.

According to Geoff, the Fed is in a holding pattern, neither raising or lowering the federal funds rate that they use to manipulate the economy. It’s interesting that in the last 10-15 years that lever they had, that once meant so much, has little meaning now. Needless to say, it looks like the Fed will hold in place, which just provides more information to consider.

Home Ownership vs. Renting

Keren added that there are plenty of people renting, even in Sussex County, that could actually afford to be home owners. They would pay less for a mortgage than they pay for rent right now. That’s something important to remember. A lot of renters don’t realize they can afford to be homeowners, so they should get in touch with a mortgage broker to see what their options are. In our area, you can pay $800 in a mortgage payment opposed to $1,200 in rent. It’s important to educate people as to what their options are.

Geoff agreed, saying that many people got caught in the downturn of the market 10 or 12 years ago.To them he says, don’t be afraid. Research. Talk to a mortgage professional to see if your income and credit is where it needs to be, and get in the game. Banks who have been renting homes are starting to sell those homes, leaving renters in the lurch. They can’t find other rentals and are in a bad spot. It’s in their best interest to own a home.

Dave remarked that there has been more of a trend for FHA loans. They are no money down essentially. There are lots of options available. Geoff stated that another great thing for this recovery is that you are not seeing a lot of sub-prime lending. That means this recovery is true.

Contact the panelists

Dave Willner, Pillar to Post Home Inspection, 732-647-5231 or email dave.willner@pillartopost

Keren Gonen, Call or text 551-262-4062

Join us at 2 p.m. on St. Paddy’s day for our next Housing Market Update.

Green Team Realty’s Launch 2020 is about to take off!

It’s an annual “start the year off right” tradition for Green Team Sales Associates. And so Green Team Realty’s Launch 2020 is about to take off . Launch is a “friendly little competition” designed to enhance skills that will lead to excellent client service throughout the year. Therefore, even for those not on a winning team, it’s still a win-win situation.

It’s a new kind of competition this year!

This year Geoff Green, President of Green Team Realty, has created a totally new format. There are still two teams in each office (Warwick and Vernon) battling it out for first place. However this year’s Launch requires team members to attend training sessions, one a week, for ten weeks. After each session there will be a ten question quiz. The team in each office with the highest cumulative score will earn a place on the Launch perpetual plaque. In addition, they’ll receive a prize budget to be spent on a team event of their choosing. Of course, we’ll also have a blog post and press release created for our winning teams.

This year’s team captains and names are:

Green Team New York Realty

- Karen Gauvin, EMPIRE!!

- Tiffany Megna, Dream Makers

Karen and Tiffany are first-time team leaders, and both are very enthusiastic about the upcoming competition.

Green Team New Jersey Realty

- Keren Gonen, Gonen’s Greenies

- Cathie Witte, Witte’s Wonders

Keren and Cathie’s team’s had a tight competition during 2019 Launch, but Witte’s Wonders took the prize. We can expect another very close race and great results from these teams.

Five… four… three… two… one

Launch 2020 is taking off, providing Green Team’s Sales Associates with up-to-date knowledge about the industry, marketing, social media, technology tools and training and more. And that is definitely a win-win situation. For our Sales Associates and for their clients.

Green Team Realty 4th Quarter 2019 Sales Leaders

Congratulations from Geoff Green, President of Green Team Realty, to our 4th Quarter 2019 Sales Leaders

I am thrilled to see that Nancy Sardo of Green Team New York Realty has won the 2019 Q4 Sales Leader Award. This is no small accomplishment as there are many top producers in our Warwick Office. Nancy is an exceptional Realtor, a great businesswoman and a good friend to myself and many others in our community.

And we are very excited to announce Kristi Anderson for her first Quarterly Sales Leader award with Green Team New Jersey Realty. Kristi has been an outstanding Realtor and citizen in Sussex County for many years, and we are just thrilled to see her rising to the top of the production ranks. This will be the first of many for Kristi.

Nancy Sardo, Green Team New York Realty

Nancy Sardo has been listing and selling homes in Orange County, New York since 2005. Her experience and eye for detail allow her to see potential in resales. And her knowledge as a new construction broker offers building as another option for the buyer who has exhausted the limited resale market.

Nancy has earned her Associate Broker’s License, Seniors Real Estate Specialist (SRES) designation. She is also an Accredited Buyer’s Representative (ABR).

I am grateful for achieving 4th Quarter Sales Leader at Green Team New York Realty. It’s a great group of professionals to work with, even in an independent, competitive industry.We’re in a business that changes day to day. However, “setting goals is the first step in turning the invisible into the visible.” This small but valuable quote from Tony Robbins goes a long way. I had a great year and most of all thank my family, friends, and the clients who are now friends, I have a “dream team” of colleagues to work with. Your referrals are the heart and soul of my business. I promise integrity, commitment, communications and trust.

Kristi Anderson, Green Team New Jersey Realty

When Kristi Anderson joined Green Team New Jersey Realty she brought with her over 18 years of experience. The Broker-Realtor® is an Accredited Buyer’s Representative (ABR) and has Short Sale and Foreclosure Resource Certification.

In addition, as a Vernon resident of 15 years she has a thorough knowledge of the area and local market. This busy mom of four still finds time to volunteer with the Vernon Township School District’s SCA. And she is also a dedicated and hardworking volunteer board member of the Vernon Chamber of Commerce. But perhaps most importantly, she brings a desire to help people make their real estate dreams come true.

I am so happy to be part of a team with the passion, energy and commitment to client service that I have. I do whatever it takes to get the home SOLD! Thank you to all of my clients. You are the reason I love my job!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

.

.