#1 Financial Benefit of Homeownership: Family Wealth

While growing up, we were taught by our parents and grandparents that owning a home is a financially savvy move. They explained how a mortgage is like a “forced savings plan.” When you pay rent, that money is lost forever. When you make a mortgage payment, much of that money accumulates as equity in the home. So, what exactly is equity? The equity in your home is the amount of money you can sell it for minus what you still owe on the mortgage. Every month you make a mortgage payment, and every month a portion of what you pay reduces the amount you owe. That reduction of your mortgage every month increases your equity. A recent study by CoreLogic explained that homeowners gained substantial equity over the last twelve months, and are essentially sitting on large sums of cash in their homes. In the study, Frank Nothaft, Chief Economist for CoreLogic explained:

“The CoreLogic Home Price Index recorded a quickening of home price gains during the fourth quarter of 2019, helping to boost home equity wealth. The average family with a mortgage had a $7,300 gain in home equity during the past year, and a total of $177,000 in home equity wealth.”

For most families, their home is their largest financial asset. This increase in equity drives the net worth, or family wealth, of the homeowner. Renters are not earning that benefit. Instead, they’re building the net worth of their landlord.

Bottom Line

Home price growth will moderate during the pandemic. But once a cure is available, most experts agree that home values will again begin to appreciate at levels similar to what we’ve seen over the last several years. In the long run, our family elders will be proven correct: owning a home is a savvy financial move and there are many benefits of homeownership. Check out our article on the impact Covid might have on Home Values here.

Will this Economic Crisis Have a V, U, or L-Shaped Recovery?

[et_pb_section fb_built=”1″ _builder_version=”3.0.47″][et_pb_row _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.0.74″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]Many American businesses have been put on hold as the country deals with the worst pandemic in over one hundred years. As the states are deciding on the best strategy to slowly and safely reopen, the big question is: how long will it take the economy to fully recover? Let’s look at the possibilities. Here are the three types of recoveries that follow most economic slowdowns (the definitions are from the financial glossary at Market Business News):

- V-shaped recovery: an economic period in which the economy experiences a sharp decline. However, it is also a brief period of decline. There is a clear bottom (called a trough by economists) which does not last long. Then there is a strong recovery.

- U-shaped recovery: when the decline is more gradual, i.e., less severe. The recovery that follows starts off moderately and then picks up speed. The recovery could last 12-24 months.

- L-shaped recovery: a steep economic decline followed by a long period with no growth. When an economy is in an L-shaped recovery, getting back to where it was before the decline will take years.

What type of recovery will we see this time?

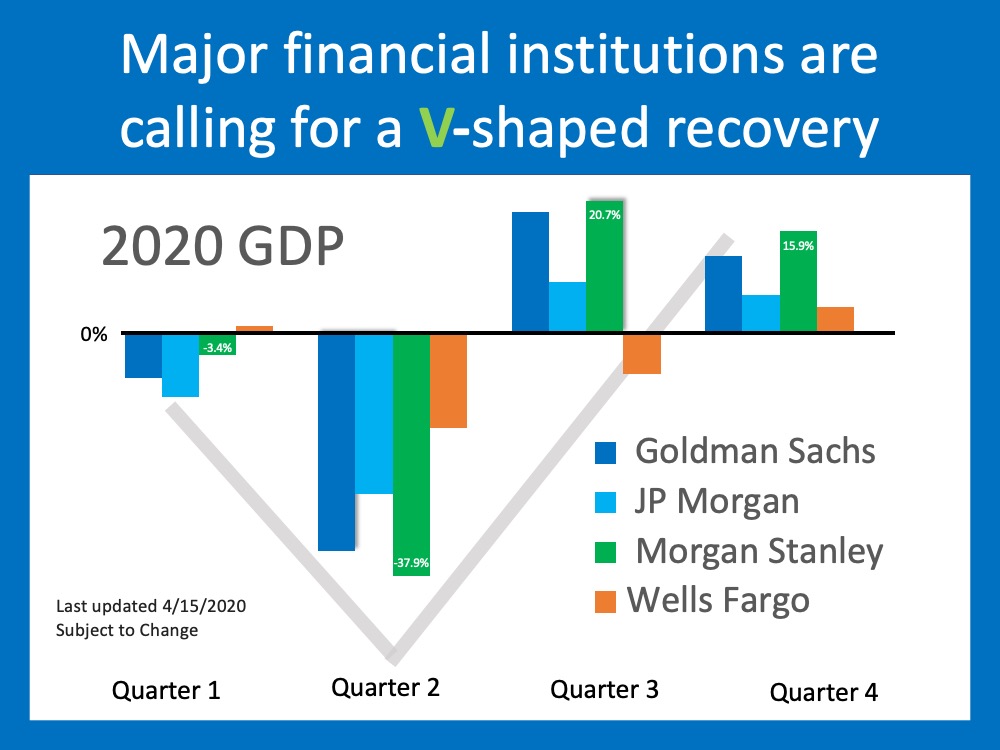

No one can answer this question with one hundred percent certainty. However, most top financial services firms are calling for a V-shaped recovery. Goldman Sachs, Morgan Stanley, Wells Fargo Securities, and JP Morgan have all recently come out with projections that call for GDP to take a deep dive in the first half of the year but have a strong comeback in the second half.

Is there any research on recovery following a pandemic?

There have been two extensive studies done that look at how an economy has recovered from a pandemic in the past. Here are the conclusions they reached: 1. John Burns Consulting:

“Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices), and some very cutting-edge search engine analysis by our Information Management team showed the current slowdown is playing out similarly thus far.”

2. Harvard Business Review:

“It’s worth looking back at history to place the potential impact path of Covid-19 empirically. In fact, V-shapes monopolize the empirical landscape of prior shocks, including epidemics such as SARS, the 1968 H3N2 (“Hong Kong”) flu, 1958 H2N2 (“Asian”) flu, and 1918 Spanish flu.”

The research says we should experience a V-shaped recovery.

Does everyone agree it will be a ‘V’?

No. Some are concerned that, even when businesses are fully operational, the American public may be reluctant to jump right back in. As Market Business News explains:

“In a typical V-shaped recovery, there is a huge shift in economic activity after the downturn and the trough. Growing consumer demand and spending drive the massive shift in economic activity.”

If consumer demand and spending do not come back as quickly as most expect it will, we may be heading for a U-shaped recovery. In a message last Thursday, Chris Hyzy, Chief Investment Officer for Merrill and Bank of America Private Bank, agrees with other analysts who are expecting a resurgence in the economy later this year:

“We’re forecasting real economic growth of 30% for the U.S. in the 4th quarter of this year and 6.1% in 2021.”

His projection, however, calls for a U-shaped recovery based on concerns that consumers may not rush back in:

“After the steep plunge and bottoming out, a ‘U-shaped’ recovery should begin as consumer confidence slowly returns.”

Bottom Line

The research indicates the recovery will be V-shaped, and most analysts agree. However, no one knows for sure how quickly Americans will get back to “normal” life. We will have to wait and see as the situation unfolds.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”3.18.2″][et_pb_row _builder_version=”3.18.2″][et_pb_column type=”4_4″ _builder_version=”3.18.2″ parallax=”off” parallax_method=”on”][et_pb_post_nav in_same_term=”on” _builder_version=”3.18.2″ title_font=”|800|||||||” title_text_color=”#ffffff” title_font_size=”15px” background_color=”#007a42″ border_radii=”on|2px|2px|2px|2px” border_width_all=”2px” border_color_all=”#007a42″ custom_padding=”1px|4px|1px|4px”][/et_pb_post_nav][/et_pb_column][/et_pb_row][/et_pb_section]

April 2020 Housing Market Update

[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”3.0.47″][et_pb_row admin_label=”row” _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text admin_label=”Text” _builder_version=”3.0.74″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]

Covid19 has caused economic turmoil, health crises and uncertainty. However, a historical perspective may help us manage emotions and enable us to see what is happening in the housing market and navigate it accordingly. Below is a recording of the Housing Market Update as well as a summary of the most important discussion points.

National – Historical Perspective

Will this be like 2008, the start of the great recession?

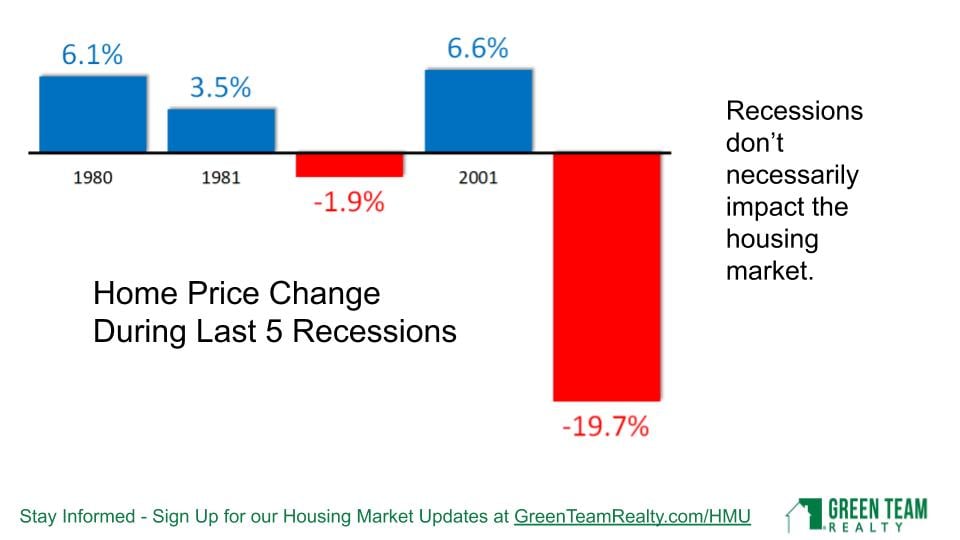

The Housing Market was greatly impacted at that time because it was the catalyst that caused the Great Recession. Home price changes during last 5 recessions indicate that recessions do not necessarily impact the housing market. In 3 of the last 5 recessions, housing markets actually increased.

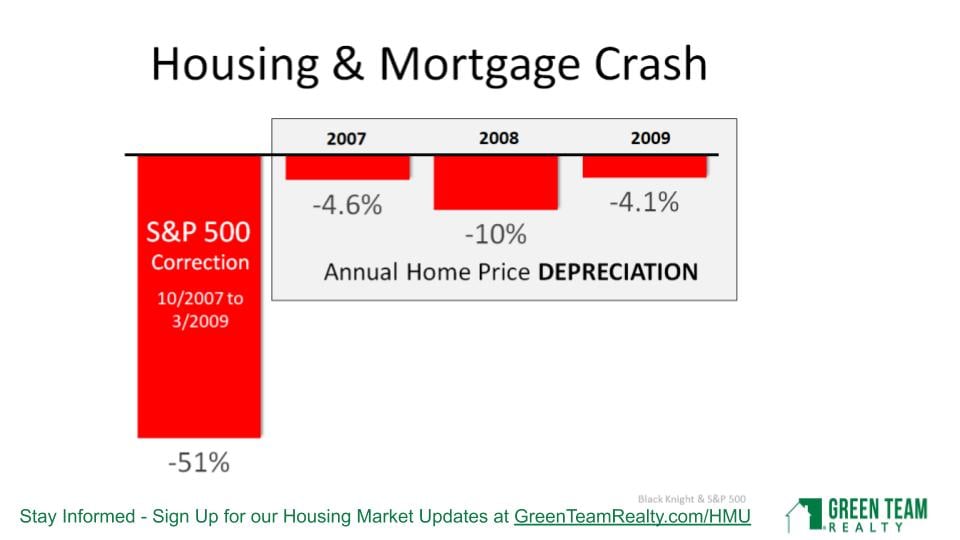

Housing and Mortgage Crash

In 2007, 2008 and 2009, the annual home price depreciation was significant. However, at the time we were dealing with sub-prime lending, etc. However, looking further back, to the Dot.com crash and 9/11 market crash, there was a significant S&P 500 stock market correction. Yet prices in the housing market continued to increase. There were good fundamentals in place.

Annual Home Price Appreciation

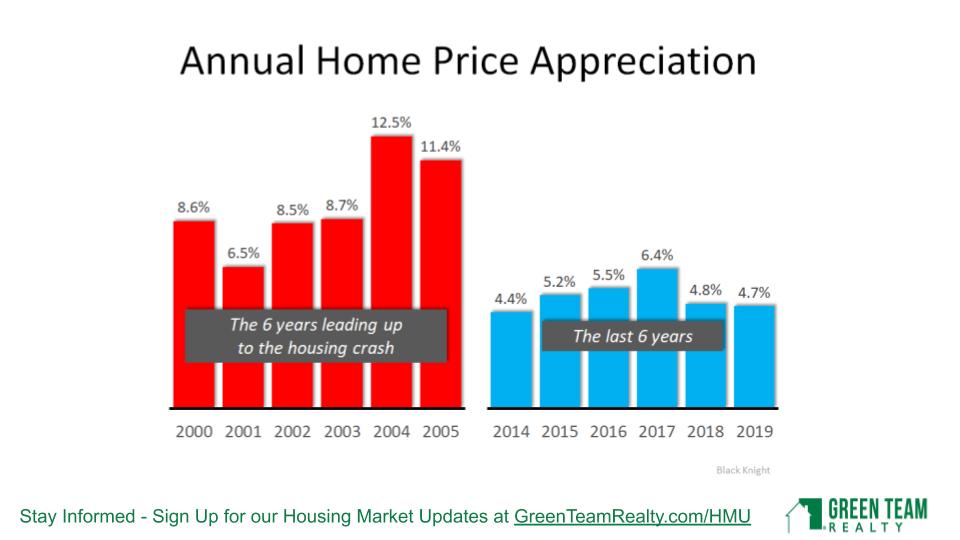

In any marketplace, you have to look at overall values. Are assets undervalued or overvalued? With the run-up to 2008, from 2000 to 2005, there were major price increases year over year. 6.5% was the lowest increase, with the highest being 12.5%. However, since 2014, 6.4% has been the highest increase. We haven’t gone back to those major subprime lending issues that happened before.

Mortgage Credit Availability and Affordability

The Great Recession required mortgage industry restructuring. That, in turn, led to qualified buyers not being able to borrow. This time around, it’s a different landscape. We don’t have a subprime lending bubble in the residential housing market. Loans will be processed for good buyers with good credit. Mortgage requirements are tightening a bit, but not to an unreasonable level. Another analytic compares total home equity cashed out in the years 2005-2007 and 2017-2019. People were using their homes “like ATMs” during the former period. The leverage people are putting on their homes has dropped from $824 Billion during 2005-2007 to $232 Billion during 2017-2019. 53.8% of all homes in America have at least 50% equity.

The percentage of median income needed to purchase a median-priced home has dropped from 25.4% in 2006 to 14.8% today. Affordability is in much better shape, largely due to mortgage rates being very low.

The Impact of Unemployment

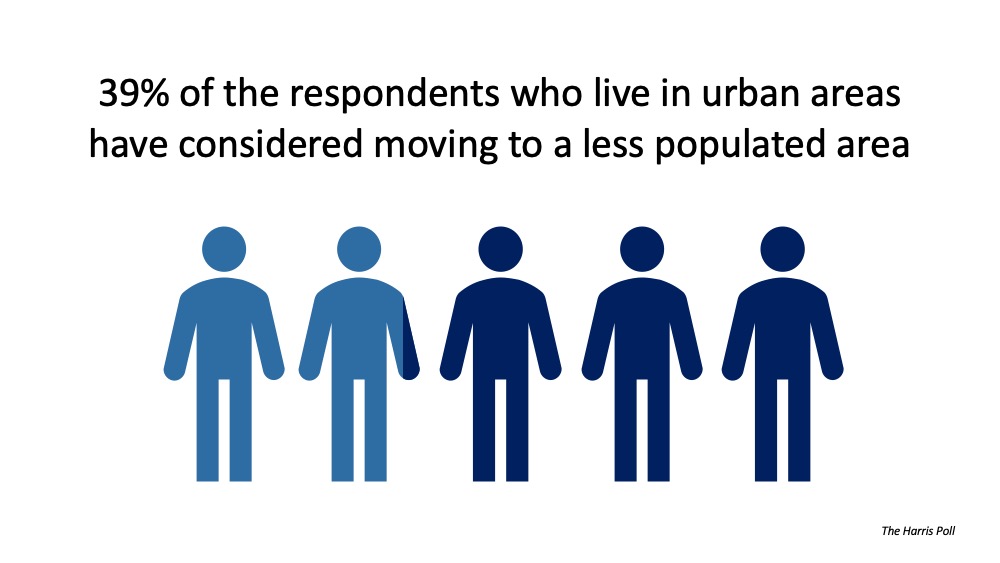

Concerns about job losses are very real. A breakdown of the April 3 Unemployment Report shows the different sectors affected. 59.5% are from restaurant services and drinking places. The accommodation industry, retail trade, temporary help services, child daycare workers, health care office workers and construction workers make up most of the balance. In other words, these are jobs that should be coming back as soon as these businesses can operate again. It may take some time until people are confident and comfortable enough to get back out there. The next numbers come out on May 8, 2020 and will be discussed during the May HMU.

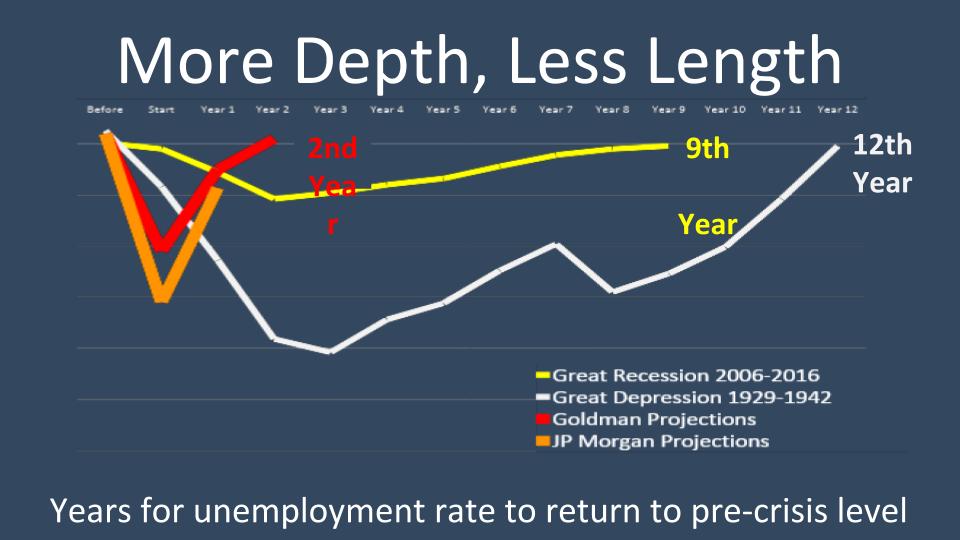

Unemployment rates and home sales do not seem to have a direct relationship. Current Unemployment Rates were compared to past financial crises. In 1933, during the Great Depression, unemployment rates were at a high of 24.9%. Goldman Sachs is predicting unemployment to be 15% in 2020. They are also predicting that number to go down to 6-8% in 2021, 5% in 2022 and 4% in 2023.

Based on data from the US Department of Labor accessed by Haver Analysis, the current employment situation is more like a natural disaster than a recession. The problem is how long this natural disaster, Covid19, is going to last. There are many unknowns, and no answers. We’ll be tracking what happens as parts of the economy reopen.

Historical look at Existing Home Sales Price

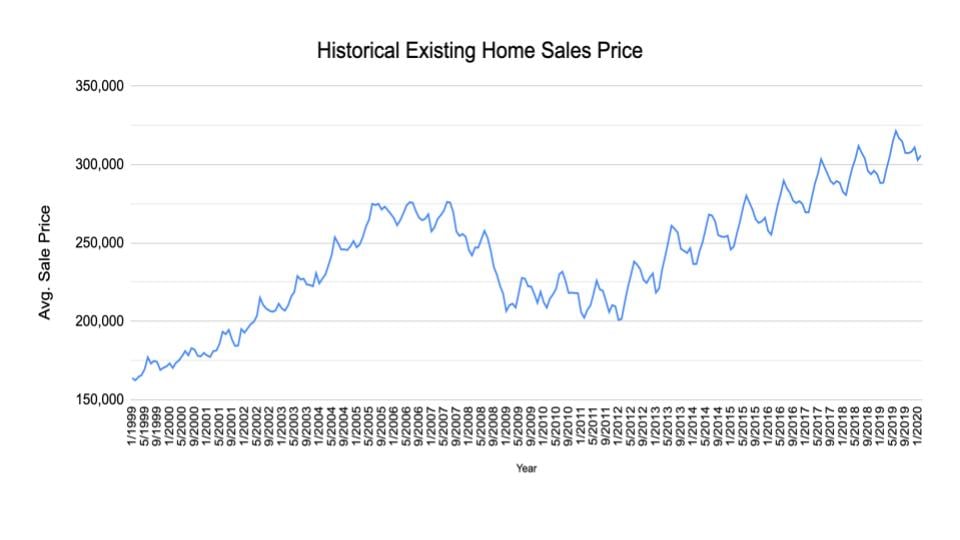

The market was hot the first two months of 2020, with average home sale price higher in January and February than those months in the preceding four years. It will be interesting to see what the numbers show over the next several months.

The above analytic shows Existing Home Sales Prices from January 1999 to January 2020. Even if you bought at the peak of 2007 or 2008, as Geoff did, just before the housing market plunged, it took 8 years for the market to recover. Historically speaking, people moved after an average of 6 years. That number is now inching up to 9 years. The average homeowner generally doesn’t buy or sell during a period of up or down. They want to wait and gain equity in their home. However, if you are not going to buy, what will you do? Rent? If so, you’re not building equity, you’re not getting tax write-offs, and other benefits of home ownership.

Inventory

In 2007, there were 8.2 months of inventory. Right now there are 3.1 months of inventory available. The market is much hotter now than in 2007 (leading into the Great Recession). Geoff believes that now is a very good time to buy, and not a bad time to sell, either, as inventory levels are so low. Historically, 6 months of supply is an average market. We are now down to 3 months of inventory. He does not see this number climbing anytime soon. Many sellers are not putting their homes on the market now, wanting to wait and see what will be happening. And, while people have to weigh their options, the low inventory can benefit those putting their home on the market.

April 2020 Local Stats

Orange & Sussex Counties

In Orange County, Units Sold were actually better in March than in February. Average Sales Price was way up. In Sussex County, Units Sold and Average Sales Price both coming out at a good solid pace. It will be interesting to see what the stats reflect when we take a look at our next Housing Market Update. At that time we’ll see the impact of Covid closures and stay-at-home regulations.

Housekeeping Items

Panel Discussion

Geoff Green was joined by Ken Flood of Quest Financial Services and Ken Aulicino of Family First Funding LLC. Vikki Garby and Carol Buchanan of Green Team New York Realty and Keren Gonen of Green Team New Jersey Realty represented the real estate agents’ points of view. Discussion ranged from the current state of commercial and residential real estate markets. There was positive feedback on how agents are adapting to the Covid19 regulations and are still able to assist clients and close deals. All three agents spoke of strong, serious buyer interest. Ken Flood discussed the financial market and Ken Aucilino the mortgage industry. Because of the wealth of information and graphics as well as the fascinating panel discussion, it is highly recommended that you watch the webinar. Click here to view the April 2020 Housing Market Update.

Remember to sign up below for the next Housing Market Update

[/et_pb_text][et_pb_agentfire_lead_form form=”contact” _builder_version=”3.18.2″][/et_pb_agentfire_lead_form][/et_pb_column][/et_pb_row][/et_pb_section]

How to Find the Perfect Real Estate Agent

There’s a ton of real estate information available in the news today and on the Internet. It can be extremely confusing, especially in times of uncertainty like we’re facing right now.

If you’re thinking of buying or selling this year, you need an agent who can help you:

- Make sense of this rapidly evolving housing market

- Navigate everything from virtual showings to new online marketing strategies

- Price your home correctly at the beginning of the selling process

- Determine what to offer on your dream home without paying too much or offending the seller

Dave Ramsey, a financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring an agent who has a finger on the pulse of the current market will make your buying or selling experience so much easier.

So, how do you identify who truly understands what’s happening right now? How do you know who will take the time to simply and effectively explain what today’s market conditions mean to you and your family?

Check out the agent on social media. What are they posting on Instagram, Facebook, Twitter, and more? Are they using their social media platforms to share relevant, helpful information, or are they just posting memes and recipes? The best agents are committed to educating the consumer so they can feel confident when buying or selling a home.

Bottom Line

What agents are posting online will help you determine who meets the criteria Dave Ramsey suggested you look for: someone with the heart of a teacher. Let’s connect today, so you can work with a true trusted real estate professional. To find a realtor with Green Team click here.

Meet Cara Dumond

For Cara Dumond, education was the starting point

Meet Cara Dumond, an accomplished MBA Graduate. She comes to Green Team New York Realty with a proven record of success. Cara is a motivated, dynamic and innovative business professional. And she is equipped with articulate communication and presentation skills. She loves being around people. Furthermore, her ability to spark a conversation is a definite assets to her real estate business.

Cara graduated from Monroe-Woodbury High School. She went on to major in Business Administration at Marist Business School at Marist College. With a minor in Fashion Merchandising, Cara achieved her Bachelor of Science Degree. She then went on to receive her Masters of Business Administration with a concentration in Marketing, with high honors.

From Masters degree to project support manager to management/retail positions

For over 10 years Cara was a project support manager for a manufacturing consulting company. They deployed tailored training, implantation and consulting services that helped customers create an organizational culture of continuous sustainable improvement.

For the last 5 years she worked in management/retail positions for Ann Taylor (Loft), Levis Strauss and Company, and Lafayette 148. While at Lafayette 148, she became a top achiever in commission sales in the first 5 months. Through email, personal outreach and social media, Cara developed hundreds of personal relationships with clientele. Her networking and sales abilities are additional assets for a real estate professional.

The transition to real estate and family time

When Cara and her husband Eric built their home in Greenville, New York 15 years ago, she was involved in every step of the process and loved it. She was selling her town home at the same time. While it was extremely stressful and overwhelming, she loved the excitement and challenges. And, she began to see the potential for a career as a real estate professional.

Cara loves working with people. And she wanted a more flexible schedule to fit her family’s lifestyle. Further, she wanted to get away from the hustle and bustle of the corporate world. As a people person who enjoys being out in the world, Cara delights in meeting new people and helping them find their dream home. Born and raised in Orange County, she loves the area and shares her local knowledge with her clients. For Cara, the entire business is exciting and fascinating. From helping a client navigate the purchase of their first home, to finding a distressed property and seeing its potential to be brought back to life or high-end luxury, she loves it all. But beyond that, she is all about putting her clients needs, wants and desires first and forefront.

Real Estate, family and community

Cara and Eric have twins, a boy and a girl, and a Yorkie named Gucci. The twins attend Minisink High School and are active in sports. They play basketball, football, wrestling, lacrosse and snowboarding. Naturally, Cara enjoys watching them play. And she volunteers when needed.

Cara enjoys home decorating and has a passion for home staging, She also enjoys yoga, reading and trying out different restaurants in the Hudson Valley. Cara also volunteers at Mini Wellness Retreats. The company is based in the local community. It offers events that help attendees feel a renewed sense of prioritization for their health and wellness. Additionally, Cara loves being able to support a cause that has such a positive impact on her community.

Cara’s unique skill set and experience combine to make her a wonderful addition to the Green Team family.

Meet Kathryn (Kate) Vega

Green Team New York Realty would like you to meet Kathryn (Kate) Vega. Before entering the world of real estate, Kate Vega earned an Associates Degree in Business. She was a corporate Administrative/Executive Administrative Assistant for 12 years, working with many professionals of all levels, Kate was (and is) detail oriented with a focus on financials, analytics and accounting.

Kate Vega finds her passion for real estate

Her interest in real estate began when she helped her husband, John, sell his condo (off the market). She then assisted in the purchasing of their first home. After that she was hands on in selling that first home And purchasing their current home in Warwick. Kate’s ability to identify and highlight pros and cons of various homes had her becoming a resource for several friends working through their first home purchases.

Interest may actually be too mild a word to describe Kate’s feelings about real estate. In her own words, “I felt that buying, selling and remodeling my homes were the most emotional and exciting times of my life (besides marriage and having babies).” She even admits that she was distracted during her honeymoon with the construction of their first house. And then, while in the hospital having her second child, she requested photos of work being done on the house!

Kate feels that home ownership is a huge component of most people’s portfolios. In addition, it’s vital for the health of a community. She has always been interested in finances, and real estate is one of the largest and most crucial aspects of the economy. Furthermore, she’s conscious of the ups and downs that come with the biggest transactions of most people’s lives. And Kate knows she’ll be able to offer the support her clients need during the process and be sensitive to their needs.

It’s all about family

Kate and John have three children: Johnny, Tommy and Lexie. The family attends Warwick Reformed Church. The children attend Warwick schools. And they’re involved in sports: football, baseball, basketball, wrestling and soccer! John is on the football board, and Kate is the PTA Treasurer for Sanfordville Elementary School.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![How Technology is Helping Buyers Navigate the Home Search Process [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/04/16133213/20200417-MEM-Eng-1046x1308.png)