Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

What Should You Look for In Your Real Estate Team?

How do you select the members of your team who are going to help make your dream of owning a home a reality? What should you be looking for? How do you know if you’ve found the right agent or lender?

The most important characteristic that you should be looking for in your agent is someone who is going to take the time to really educate you on the choices available to you and your ability to buy in today’s market.

As the financial guru Dave Ramsey advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Do your research. Ask your friends and family for recommendations of professionals they’ve worked with in the past and have had good experiences with.

Look for members of your team who will be honest and trustworthy; after all, you will be trusting them to help you make one of the biggest financial decisions of your life.

Whether this is your first or fifth time buying a home, you want to make sure that you have an agent who is going to have the tough conversations with you, not just the easy ones. If your offer isn’t accepted by the seller, or they think that there may be something wrong with the home that you’ve fallen in love with, you would rather know what they think than make a costly mistake.

According to the Home Buyer and Seller Generational Trends Report:

“Buyers from all generations primarily wanted their agent’s help to find the right home to purchase. Buyers were also looking for help to negotiate the terms of sale and to help with price negotiations.” Additionally, “Help understanding the purchase process was most beneficial to buyers 37 years and younger at 75 percent.”

Look for someone to invest in your family’s future with you. You want an agent who isn’t focused on the transaction but is instead focused on helping you understand the process while helping you find your dream home.

Bottom Line

In this world of Google searches, where it seems like all the answers are just a mouse-click away, you need an agent who is going to educate you and share the information that you need to know before you even know you need it.

Why You Should Get Pre-Qualified When Buying a Home

Is Mortgage Pre-Qualification Necessary?

According to the Consumer Financial Protection Bureau, Pre-Qualification and Pre-Approval in practice both refer to a letter from a lender that specifies how much the lender is willing to lend to you. While there are some legal distinctions, basically both specify a loan up to a certain amount, based on certain assumptions. These letters provide useful information. However, loan offers are not guaranteed. Rather, the letter can help you make an offer. It gives the seller confidence that you will be able to get financing to buy the home.

A buyer in today’s market needs Pre-Qualification/ Pre-Approval. This is the preliminary step to the mortgage process. Consequently, talking with a bank or mortgage lender is vital. The lender will check your credit and ask specific financial questions regarding your income, employment and financial obligations. As a result, the letter is generated based on a “snapshot “ of the financials given. It’s the first step in understanding your eligibility when ready to look at homes to buy. And it keeps you in sync with your financial budget and means.

Are You Pre-Qualified?

“Are you pre-qualified?” is an important question your realtor will ask before showing you properties. If not and you’re serious about buying a home, now is the time to start engaging in mortgage conversations with a lender. A wealth of financial resources will be shared with you to get you started. And to keep you on track understanding the loan process, your eligibility, and working within your price range. The importance of this question will determine if you’re “ABLE” to buy… Now.

Understanding Loan Types is Important

The “loan type” you’re qualified for is of equal importance for you to know and understand. Because some homes, due to their condition, may not be eligible for all loan types. Thus, your realtor will be able to navigate the market for you, finding homes that best match what you are qualified for.

The goal and success of buying a home when financing is to be Ready, Willing and “Able.” Working closely with your buyers agent and mortgage lender will help prepare you for navigating a challenging market for buyers.

My advice to buyers entering the market … understand the market you’re about to enter. Prepare yourself! Have your financing in place, regardless if purchasing with cash or a loan.

Preparation is Key!

I can help you navigate your way through the process and connect you with the right mortgage lenders. Contact Me Today.

Green Team Business Review – February 2018

The 2018 Scoreboard:

Green Team’s Warwick office had a very good start to the year. January was up over all previous years, a very positive sign. The total sales volume was $5+ million for the month, over $1 million more than last year. It’s too soon to start comparing agents’ individual numbers. However, there is a lot of enthusiasm among the team. The market continues to grow and the feeling is that the Green Team will outpace market growth. The 2018 goal for the Warwick office is $80 million in total sales volume. With this strong January start, we’ll see if the rest of the year follows suit.

The Vernon office had an increase of almost 60% over last year’s January sales. The sales team is growing, and the hope is that with even more key agents joining the highly motivated and talented New Jersey team, sales will increase. The 2018 goal is $32,000,000, but a year-end total of $40,000,000 seems possible.

Barbara Tesa wins Fourth Quarter Sales Award

Green Team New Jersey Realty in Vernon, NJ is proud to announce that Barbara Tesa is the recipient of its Fourth Quarter Sales Leader Award.

Though relatively new to Green Team New Jersey Realty, Barbara is no stranger to the real estate industry – or to winning this award! She was also the recipient of the Third Quarter Sales Leader Award. When asked how she feels about winning the quarterly award for the second time, Barbara replied, “I’m certainly encouraged by my 4th Quarter sales results and I’m still smiling over that! The truth is, I love what I do and I’ve been fortunate to have met and helped really terrific clients with their real estate objectives in 2017. As I focus on 2018, while I plan to expand my marketing, those clients and their referrals will remain important to furthering my success…all of which is made easier through the continued support of the Green Team.”

Barbara has over 20 years of experience in residential and commercial real estate management and 10 years as a licensed real estate agent in New Jersey. Barbara and husband Rudi reside at Crystal Springs, where they enjoy resort living amid the natural beauty of Sussex County, and where Barbara also practices her craft. In addition to her expertise in the sale and purchase of resort homes, Barbara is a member of the Garden State Multiple Listing Service, National Association of Realtors and the Sussex County Association of Realtors.

Homeowners: Do You Know Your Home’s Value?

The latest edition of CoreLogic’s Home Price Index shows that nationally, home prices have appreciated 6.7% over the last year and 0.9% month-over-month. The release of the report included this headline,

“National Home Prices Now 50% Above March 2011 Bottom”

The real estate market has come a long way since 2011, which is great news for homeowners!

Nearly 79% of homeowners with a mortgage in the US now have significant equity in their homes (defined as over 20%), according to the latest Equity Report. The challenge is that not every homeowner knows how much their home’s value has appreciated.

Homeowners in Denver, CO lead the way with 8.7% appreciation over the last year, while owners in Washington and Utah have experienced a 3% increase in values since the start of this year!

Nationally, CoreLogic forecasts that home values will increase another 5.0% by this time next year.

Bill Banfield, VP of Capital Markets at Quicken Loans, recently explained the importance of knowing the conditions in your area,

“With home values constantly changing, and the rates of change varying across the country, this is one more way to show how important it is for homeowners to stay aware of their local housing market.”

Bottom Line

Do you know what your house is worth? Have you stayed put because you are nervous you won’t have enough equity to buy your dream home? Get started with a quick and free home evaluation – Click Here

The Internet Vs. the Real Estate Agent

The Internet Vs. the Real Estate Agent

The Internet Vs. the Real Estate Agent. It may seem like the internet provides many all the tools that can make buying your dream home seem like a breeze. You can search online, see a home you like, take a video tour. Sure, there’s an Agent attached to the house, but that seems more a formality. That’s who you call because they have the keys to the house you want to see.. You’re tech savvy, you know where you can get a mortgage online, you know how to do your research. You’ve got this under control. Or do you?

The Real Estate Agent

The Real Estate Agent is more than the holder of the keys. Buying – or selling – a home is a process, one that has many steps. The experienced Real Estate Agent is there to act as your guide through the process. From beginning to end, your Agent is there for YOU! To find out what is really important to you in a new home. Help you obtain the most beneficial financing. And to help you get the most house for your money.

The home you eventually purchase may not be the one you found on Zillow.com. But that home gave both you and your real estate Agent an idea of what you are looking for. You will most likely visit numerous homes. Some may be listed by other Agents, but YOUR Agent can and will arrange for you to see them all, and will represent you! Your Real Estate Agent’s goal is to help you find the best home at the best price, and to make the process as easy and stress free as possible.

Using the Internet as a Tool

The internet definitely has a place in your search. You can take countless house tours without ever leaving your home. It can help you define the style of house you want, the must haves you’d like to have in that house, and the things you can compromise on. You can get statistics on neighborhoods and school districts. It can definitely be fun checking out all the beautiful homes shown on the internet, but when you make that decision that it is now time to buy or sell, it’s time to let the Real Estate Agent step in.

The Real Estate Agent, the Internet, and You … the Perfect Trio

Real Estate Agents work very hard at their jobs. Their goal is to help you either get into a home that you’ll love, or sell the home that you love, so you can move on to the next. They have the training and resources to check for homes both online or through other agency offerings and their knowledge of the local market. The Agent will find comparable housing prices in specific areas. In addition, they have access to sites with information not available to home buyers and sellers. And they know the different neighborhoods in the town or city you are looking for.

If you don’t qualify for the financing to afford a home in one specific neighborhood, they can recommend an area which may just be more affordable. A knowledgeable, local real estate Agent can translate the stats you’ve seen online into real life info that can help you achieve your goals! They help you navigate the maze of forms, regulations… of making offers – and counteroffers! They’ll be by your side. From visiting properties, through making your offer. Through having it accepted, then through your home inspection. They’ll help you handle some of those challenges that can arise, ranging from merely irritating to downright nerve-wracking! They will be by your side until the closing – when YOU become the holder of the keys!

After the Sale, your Real Estate Agent is still there for you!

Once you have either moved in, or moved on to your next home, your Agent remains a valuable source of information. And, while the internet can provide you recommendations for contractors and local businesses, the recommendations from your Agent will be based on working with those individuals and businesses. That can make a big difference when selecting people to turn your new house into your new home!

So, the Internet Vs. the Real Estate Agent? While the Internet may have played a part in the overall process, there is something that it just can’t do … and that is have the human touch!

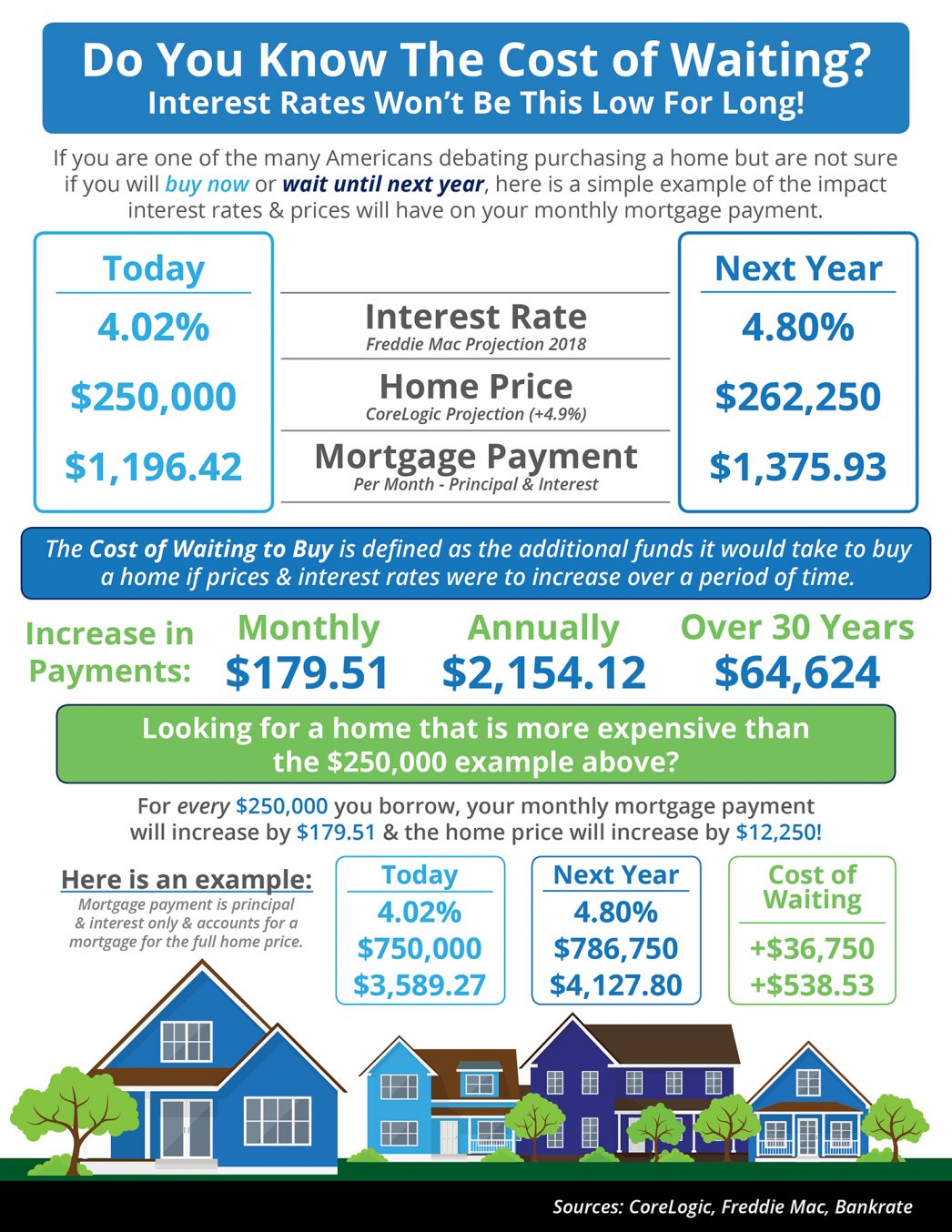

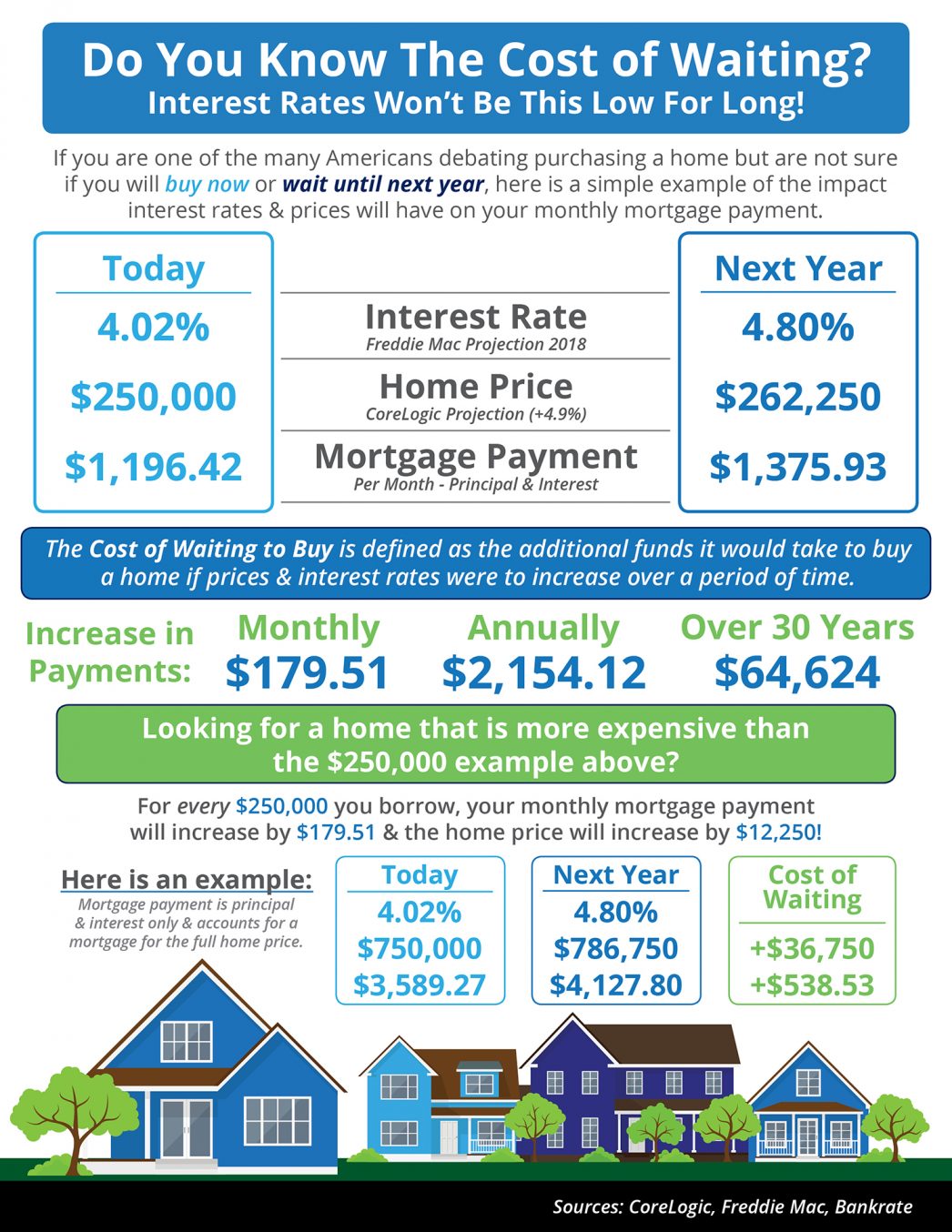

Do You Know the Cost of Waiting? [INFOGRAPHIC]

Some Highlights:

- The “Cost of Waiting to Buy” is defined as the additional funds it would take to buy a home if prices and interest rates were to increase over a period of time.

- Freddie Mac predicts that interest rates will increase to 4.8% by this time next year, while home prices are predicted to appreciate by 4.9% according to CoreLogic.

- Waiting until next year to buy could cost you thousands of dollars a year for the life of your mortgage!

Five Tips to an Accurate Credit Report

Five Tips to an Accurate Credit Report

The key to home buying obviously begins with a healthy credit report. But in this technological age, mistakes happen and in fact, it’s quite common. A minor blip on a credit report could mean the difference between getting a good interest rate and paying thousands more in interest over the life of a loan.

We at The Green Team Home Selling System always encourage homebuyers to get a copy of their credit report the moment they’ve decided to begin shopping for a home, in order to fix any problems that may not be of their own doing.

We suggest enrolling in freecreditscore.com, where subscribers receive unlimited access to their credit report and score, and the chance to get credit score alerts, identity protection alerts and fraud resolution support. Additionally, a mobile app allows users to monitor their credit on the go, and monthly reports and statements can help you stay on top of your credit and be aware of changes quickly.

Tips:

1. That’s Not Me

Make sure every listing actually belongs to you. Check name spelling, addresses, names you’ve never used, etc. You’d be surprised at how often something’s on your credit report that’s not yours – especially if you have somewhat of a common name. And identity fraud could also be the culprit.

2. These Aren’t My Accounts

An unrecognized account ALSO may be a sign of fraud that requires immediate action. Just another reason to be diligent in monitoring your credit report with regularity.

3. But I Paid That On Time

Late payments hurt credit scores more than anything else. If an account is reported as late but you made the payment on time, contact the credit reporting agency immediately to help get the information updated.

4. These Aren’t My Public Records

Like No. 1 above, others can show up on your credit report for civil judgments, tax liens, and bankruptcy public records. We’ve seen it happen many times, but fortunately, it can be easily corrected by contacting the credit reporting agency.

5. I Didn’t Make That Inquiry

Your credit report contains a list of creditors who have asked for it. Each entry on the list is called an inquiry. If you see inquiries you don’t recognize, it could be a sign of fraud.

It’s estimated that close to half of all credit reports have errors, Half! Be among the other half that does not have any errors by taking action. It’s not as hard or as stressful as you think. Fortunately, the federal Fair Credit Reporting Act requires credit reporting agencies to notify lenders when you believe something is being reported incorrectly.

So get on it, then start looking for that dream home with peace of mind!

$100k Piece of Advice – Think Multifamily

Every time I meet with a new person or new couple to speak about their first home purchase I give them what seems to many as “wild and crazy” advice. The advice I give is that, if they are truly interested in building wealth over the long term, then they should make their first purchase a multifamily property. Not a single family property.

Now, I know many people reading this may be thinking, “what bad advice, I couldn’t stand being a landlord”, or “when I had a rental property the tenants ripped me off”, or most commonly, “I want nothing to do with being a landlord”.

While I hear these comments loud and clear, I beg to differ. In fact I am myself a landlord as I own and manage many rental units. I will address being a landlord below, but first let me elaborate on why purchasing a multifamily first before a single family home is a great wealth building strategy.

Five wealth building reasons to purchase a multifamily first:

- Have you ever noticed that most of the rich people you know own more real estate then just their home? In fact most rich people own lots of real estate. I don’t have any firm stats on this, but just think about the rich people that you know and I think you will find this to be true.

- Real estate investment is all about the long term. No matter what you hear from these “guru’s” on T.V. or the radio it’s simply not a get rich type of plan. It takes time, so the sooner you get in the game the more likely you are to become wealthy from it over the long term.

- Most first time buyers are already living in a rental unit. They haven’t purchased the dining room set just yet, or the super sized TV, or the formal living room furniture. They know how to live minimally, so why not take these very important minimalist skills and use them to get rich? Living beneath one’s means is a universally acceptable concept. Getting rich takes a mentality of frugality.

- How else will you get started in Real Estate investing? That is a serious question you should ask yourself? If you are not going to do it this way, then what is your plan? The fact is most people don’t give this a single thought and this is why most people do not ever own any real estate other then their home.

-

This multifamily that you now own becomes part of your investment “portfolio”. You never sell this property unless you have the opportunity to sell this one to get into a bigger and better deal. Einstein said that compounding interest is the 8th wonder of the world. Income from Real Estate Investments provide the same compounding effect.

So here is the bottom line. If you are ambitious and seek to build lots of wealth over your lifetime make your first Real Estate purchase a multifamily. Live in one of the units while renting out the rest. You will be forced to learn the extremely valuable skill of how to manage real estate income properties. Over time you will save enough money to purchase your single family home. By that time you will have so much valuable information in your brain on how to manage real estate investment properties you will have no problem managing your single family home in addition to your multifamily. Finally, if you do a good job with your first multifamily you will naturally go looking for more. This is where the wealth building “rubber” hits the road.

So there it is. A minimum of $100,000 equity in your pocket. Now all that you need to do is execute it. Don’t know where to start? Call us. We have many Realtors in our firm who are very well versed in Real Estate investing because many of us are Investors ourselves.

Happy Investing!!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link