With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5% (in this example, $10,000). Experts predict that mortgage rates will be closer to 5% by this time next year.

Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

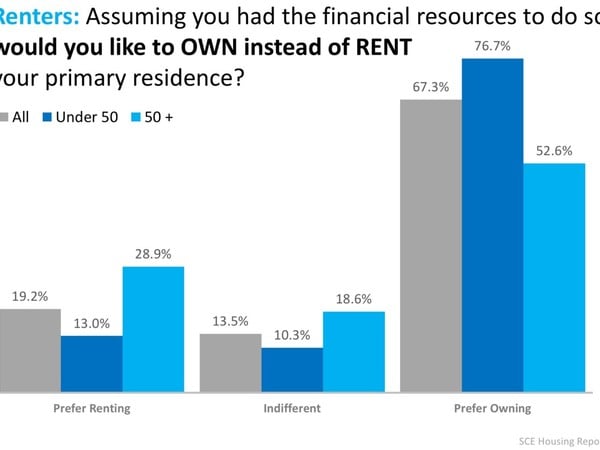

Renters Under 50 Want to Buy a Home!

Every year, the New York Federal Reserve publishes the results of their Survey of Consumer Expectations (SCE). Each survey covers a wide range of topics including inflation, labor market, household finance, credit access and housing.

One of the many questions asked in the housing section of the survey was:

Assuming you had the financial resources to do so, would you like to OWN instead of RENT your primary residence?

Over three-quarters of respondents under the age of 50 said that they would prefer to own their home, rather than rent. While only 52.6% of those over 50 would prefer to own. The full breakdown can be found in the chart below.

When renters were asked what the average probability of owning a primary residence at some point in their future was, 66.4% of those under 50 believed that they would eventually own their home, while only 23% of those over 50 did.

Bottom Line

Many had wondered if young Americans had lost their desire to own a home, but for those renting now, that dream is still alive.

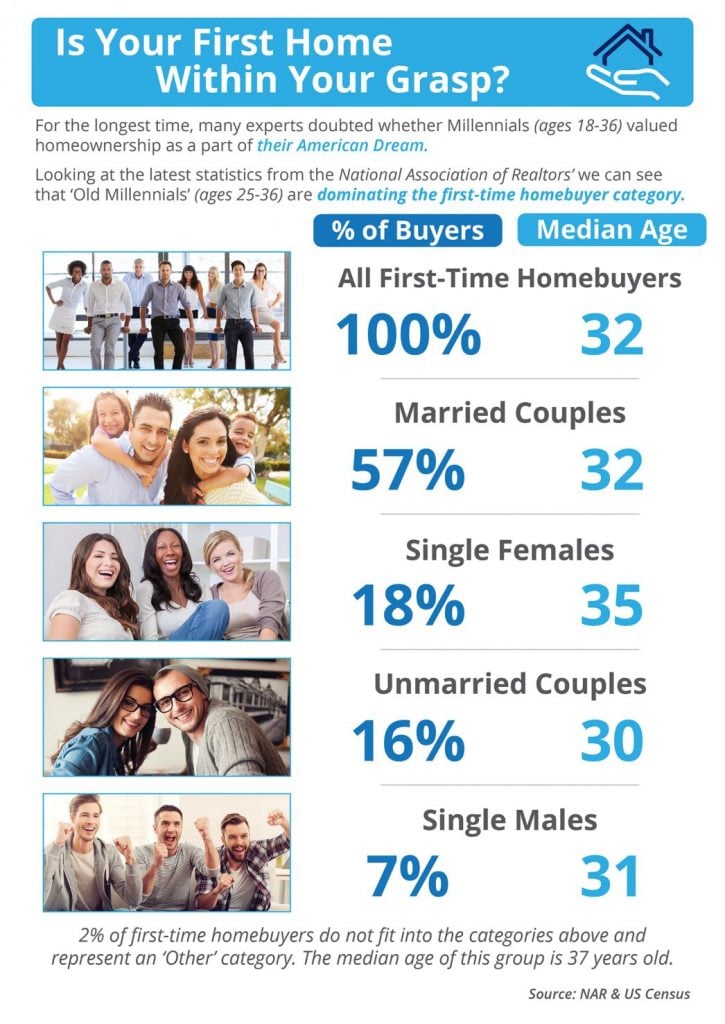

Is Your First Home Within Your Grasp Now?

Some Highlights:

- According to the US Census Bureau, ‘millennials’ are defined as 18-36-year-olds.

- According to NAR’s latest Profile of Home Buyers & Sellers, the median age of all first-time home buyers is 32.

- More and more ‘old millennials’ (25-36) are realizing that homeownership is within their grasp now!

Contact one of Our Agents today!

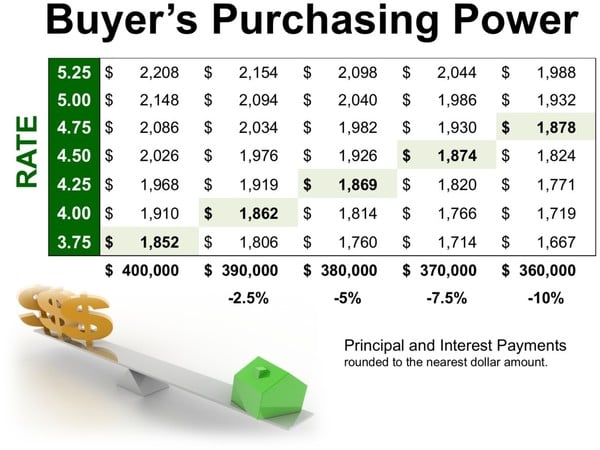

How Current Interest Rates Can Have a High Impact on Your Purchasing Power

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 4.61%, which is still near record lows in comparison to recent history!

The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.

Purchasing power, simply put, is the amount of home you can afford to buy for the budget you have available to spend. As rates increase, the price of the house you can afford to buy will decrease if you plan to stay within a certain monthly housing budget.

The chart below shows the impact that rising interest rates would have if you planned to purchase a home within the national median price range while keeping your principal and interest payments between $1,850-$1,900 a month.

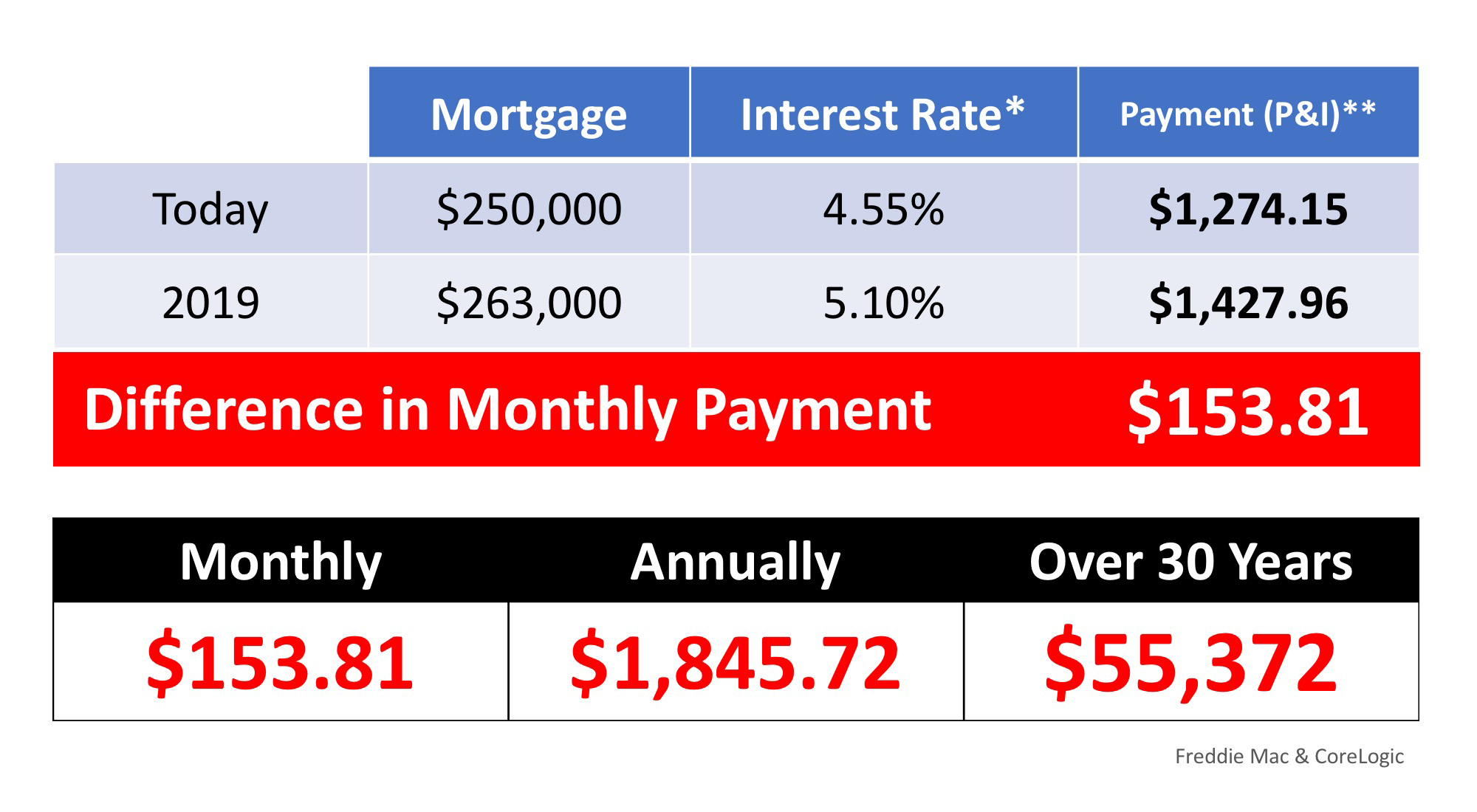

What If I Wait Until Next Year to Buy a Home?

What If I Wait Until Next Year to Buy a Home?

We recently shared that national home prices have increased by 6.7% year-over-year. Over that same time period, interest rates have remained historically low which has allowed many buyers to enter the market.

As a seller, you will likely be most concerned about ‘short-term price’ – where home values are headed over the next six months. As a buyer, however, you must not be concerned about price, but instead about the ‘long-term cost’ of the home.

The Mortgage Bankers Association (MBA), Freddie Mac, and Fannie Mae all project that mortgage interest rates will increase by this time next year. According to CoreLogic’s most recent Home Price Index Report, home prices will appreciate by 5.2% over the next 12 months.

What Does This Mean as a Buyer?

If home prices appreciate by 5.2% over the next twelve months as predicted by CoreLogic,here is a simple demonstration of the impact that an increase in interest rate would have on the mortgage payment of a home selling for approximately $250,000 today:

Bottom Line

If buying a home is in your plan for this year, doing it sooner rather than later could save you thousands of dollars over the terms of your loan.

Get the latest news and updates on your local housing market – Sign up for our Monthly Housing Updates

[gravityform id=”16″ title=”false” description=”true”]

5 Ways Tax Reform Has Impacted the 2018 Housing Market

5 Ways Tax Reform Has Impacted the 2018 Housing Market

Starting late last year, some predicted that the 2018 tax changes would cripple the housing market. Headlines warned of the potential for double-digit price depreciation and suggested that buyer demand could drop like a rock. There was even sentiment that homeownership could lose its coveted status as a major component of the American Dream.

Now that the first quarter numbers are in, we can begin to decipher the actual that impact tax reform has had on the real estate market.

1. Has tax reform killed off home buyer demand? The answer is “NO.”

According to the Showing Time Index which “tracks the average number of buyer showings on active residential properties on a monthly basis” and is a “highly reliable leading indicator of current and future demand trends,” buyer demand has increased each month over the last three months and is HIGHER than it was for the same months last year. Buyer demand is not down. It is up.

2. Have the tax changes affected America’s belief in real estate as a long-term investment? The answer is “NO.”

Two weeks ago, Gallup released its annual survey which asks Americans which asset they believed to be the best long-term investment. The survey revealed:

“More Americans name real estate over several other vehicles for growing wealth as the best long-term investment for the fifth year in a row. Just over a third cite real estate for this, while roughly a quarter name stocks or mutual funds.”

The survey also showed that the percentage of Americans who believe real estate is the best long-term investment was unchanged from a year ago.

3. Has the homeownership rate been negatively impacted by the tax changes? The answer is “NO.”

Not only did the homeownership rate not crash, it increased when compared to the first quarter of last year according to data released by the Census Bureau.

In her latest “Z Report,” Ivy Zelman explains that tax reform didn’t hurt the homeownership rate, but instead, enhanced it:

“We have been of the opinion that homeownership is most highly correlated with income and the net effect of tax reform would be a positive, rather than negative catalyst for the homeownership rate. While still in the early innings of tax changes, this has proven to be the case.”

4. Has the upper-end market been crushed by new State and Local Taxes (SALT) limitations? The answer is “NO.”

In the National Association of Realtors latest Existing Home Sales Report it was revealed that:

* Sales between $500,000 and $750,000 were up 4.5% year-over-year

* Sales between $750,000 and $1M were up 15.1% year-over-year

* Sales over $1M were up 17.3% year-over-year

5. Will the reforms in the tax code cause home prices to tumble over the next twelve months? The answer is “NO.”

According to CoreLogic’s latest Home Price Insights Report, home prices will appreciate in each of the 50 states over the next twelve months. Appreciation is projected to be anywhere from 1.9% to 10.3% with the national average being 4.7%.

Bottom Line

The doomsday scenarios that some predicted based on tax reform fears seem to have already blown over based on the early housing industry numbers being reported.

Get the latest News and Advice on your local market – Sign up for our Monthly Market Updates Today

[gravityform id=”16″ title=”true” description=”true”]

Sussex County Real Estate Market Report for April 2018

Green Team Business Review – April 2018

There has been a lot of excitement at the Green Team lately. Much of it was generated by the Launch Competition, which was a tremendous success this year. You can read about this annual contest, its goals, the winners, and the prizes here. In addition, Joyce Rogers was named the recipient of the First Quarter Sales Leader Award for the Vernon office.

Making Market Updates More Informative and More Accessible

While it seems that would be enough to report, there’s more. The Green Team strives to bring its agents and its clients up-to-date market information as well as insights into the mortgage market, events that impact interest rates, and more. To provide all this information in an expanded, far-reaching format, the Green Team is going Live on Facebook!

Sussex County, NJ Real Estate Market Report – March 2018 Results

We are pleased to share with you the Housing Market Report for March 2018. We break down local real estate activities and provide you with stats, graphs, and analysis of our local and regional real estate markets. The April Market Update was held Tuesday, April 17 on Facebook Live. It was moderated by Geoff Green, the Broker/Manager of Green Team Home Selling System. Panelists included sales agents Barbara Tesa and Keren Gonen. In addition, Jeremy Miller of First Home Bank provided insights on mortgage and housing industry stats. Dan Habib, of MBS Highway, a firm that provides insight and analytics to industries, discussed where interest rates are headed and the topic of affordability. Watch the video on our Facebook page to hear what these experts had to share.

Also, you can sign up on the Green Team website to receive monthly updates by email.

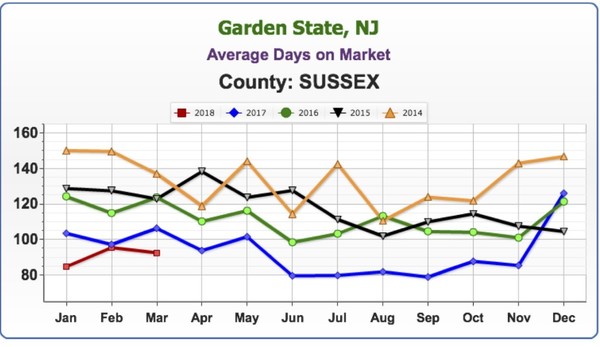

Average Days on the Market

The faster homes are selling, the hotter the market. Look for the lowest number on the graph, as opposed to the highest.

We take a snapshot of the past 5 years and see how the current market compares. The average number of days on the market is the lowest it’s been for March since 2014, coming in at 92.51 days. This is great news for sellers, but not such good news for buyers.

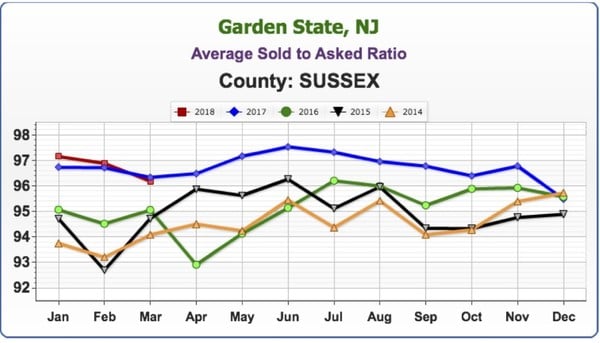

Average Sold to Asked Ratio

The percentage a house sold for under or over the last asking price (not the original price).

The Average Sold to Asked Ratio has been closely tracking 2017 numbers and is above the prior three years.

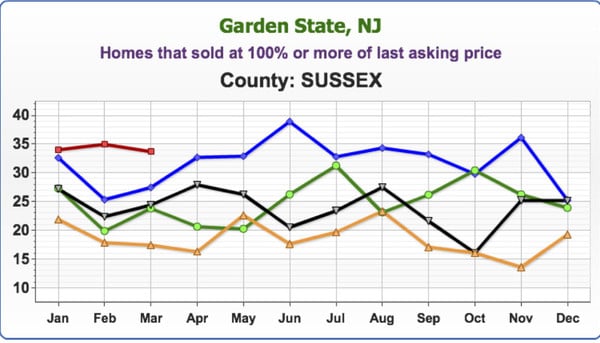

Homes that sold at 100% or more of last asking price

The first 3 months of 2018 have consistently been higher than the previous four years. In March almost 35 percent of homes sold at 100% or more of their last asking price..

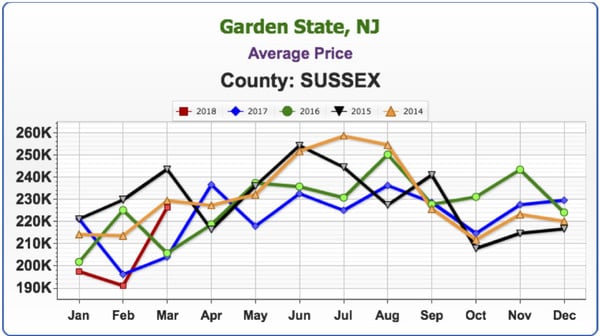

Average Price

There have been some interesting stats on average price. February 2018 was the lowest month in 5 years, but the March numbers are climbing up, higher than March 2016 and 2017, closing in on 2014, and and trying to close the gap with 2015’s numbers.

Barbara stated that so many homes are at or below the $200,000 mark that they’re dragging down the County average. There are also foreclosures below $100,000 that need so much work they’re just tear downs. Add the underwater inventory, short sales or foreclosures into the mix and that further brings down the average. According to Keren, banks are getting smarter, spending $20,000 to paint, put in new kitchen, flooring, or trying to make a house a little more acceptable. However, more often than not, the house is not in good enough condition for new buyers.. Buyers are willing to pay more, but don’t want to pay more when they see mold, etc. Banks are putting houses up at prices too high for flippers to purchase, flip and make a profit on. When a foreclosure does come up that is in good condition, intense bidding wars ensue.

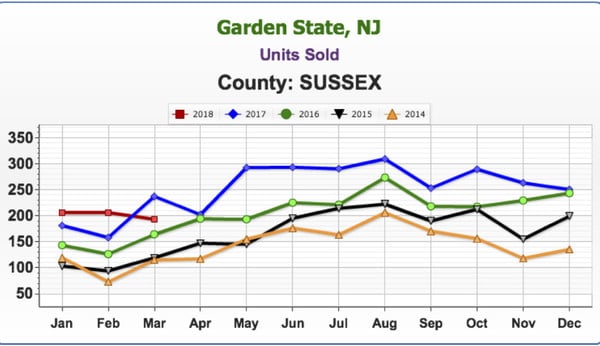

Units Sold

March dipped below the number of units sold in 2017, though it remained higher than the previous three years.

Keren stated that the banks have been holding on to inventory, waiting to release foreclosures in the spring market for a higher return on their investment. They’re thinking things are bad right now, so let’s just hold on and wait for the spring market. Keren Goren has experience in real estate investment, flipping homes, etc., so she brings a valuable perspective to the conversation.

Next Market Update

Mark your calendars and join us on Tuesday, May 8 at 9:15 a.m. for our next Facebook Live Market Update. Our special guests will be Michael Giannetto of Residential Home Financing, who will be offering substantive updates on the mortgage market and Ken Ford of Warwick Valley Financial Advisors, who will discuss other economic factors impacting the housing market. If you can’t make it at 9:15, be sure to watch the video later!

Orange County Real Estate Market Report for April 2018

Green Team Business Review – April 2018

There has been a lot of excitement at the Green Team lately. Much of it was generated by the Launch Competition, which was a tremendous success this year. You can read about this annual contest, its goals, the winners and the prizes here. Then Lucyann Tinnirello was selected as the new Broker Manager of the Warwick office. In addition, Nancy Sardo was named the recipient of the First Quarter Sales Leader Award in Warwick.

Making Market Updates More Informative and More Accessible

While it seems that would be enough to report, there’s more. The Green Team strives to bring its agents and its clients up-to-date market information as well as insight into the mortgage market, events that impact interest rates, and more. To provide all this information in an expanded, far-reaching format, the Green Team is going Live on Facebook.

Orange County, NY Real Estate Market Report – March 2018 Results

We are pleased to share with you the Housing Market Report for March 2018. We break down local real estate activities and provide you with stats, graphs, and analysis of our local and regional real estate market. The April Market Update was held Tuesday, April 17 on Facebook Live. It was moderated by Geoff Green, the Broker/Manager of Green Team Home Selling System. Panelists included sales agents Vikki Garby and Jacqueline Kraszewski. In addition, Jeremy Miller of First Home Bank provided insights on mortgage and housing industry stats. Dan Habib, of MBS Highway, a firm that provides insight and analytics to industries, discussed where interest rates are headed and the topic of affordability. Watch the video on our Facebook page to hear what these experts had to share.

Also, you can sign up on the Green Team website to receive a monthly update by email.

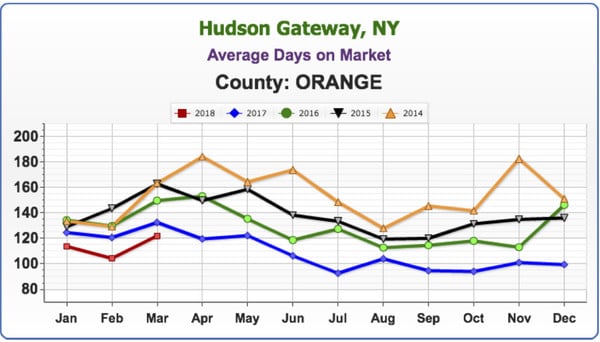

Average Days on the Market

The faster homes are selling, the hotter the market. Look for the lowest number on the graph, as opposed to the highest. The calculation in New York State is from the List Date to the Contract Date.

We take a snapshot of the past 5 years and see how the current market compares. The average number of days on the market is the lowest it’s been for March since 2014. This shows a stronger market for sellers. However, it’s not the best news for buyers.

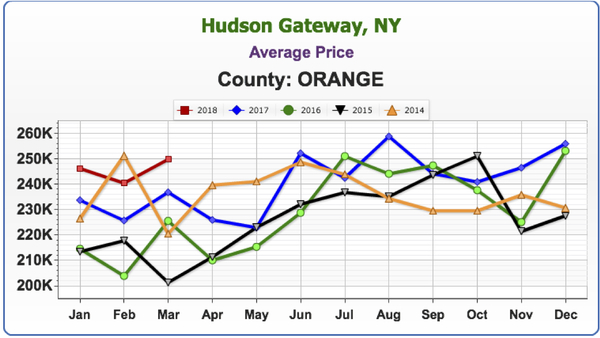

Average Price

Prices have not been on the comeback for some time, but last June they started to rise and are now coming out of the gate significantly higher. According to Geoff, inventory continues to be a big problem. He thinks that one of the issues is that some sellers still can’t get out of their homes based on refinancing they did ten years ago. They just can’t sell until prices rise, and he believes that will be the key to unlocking inventory.

Jacqueline stated there are just not enough houses out there to show. The average length of time that most people stay in a house is ten years, and ten years ago was when the market really crashed. Some people are still underwater and either can’t get out, or don’t want to just break even; they’d like to make a profit.

Vikki added that this year some things are helping. Last year appraisals were hurting the market. This year they seem to be getting more realistic based on what is actually happening in the market. There is very little supply for the demand. Market traffic was higher in February 2018 than it was in May of 2017. Sellers are feeling their strength and power in this market. Even banks are seeing the market potential and wanting to get in on the act, raising prices on properties they would have sold at much lower prices in previous markets. Vikki has experience in real estate investing, flipping homes, etc., so she brings a valuable perspective to the conversation.

Geoff mentioned that some banks are even holding their position in inventory and renting out units, something which is highly unusual. Banks generally unload inventory. For them to hold and rent is almost unheard of.

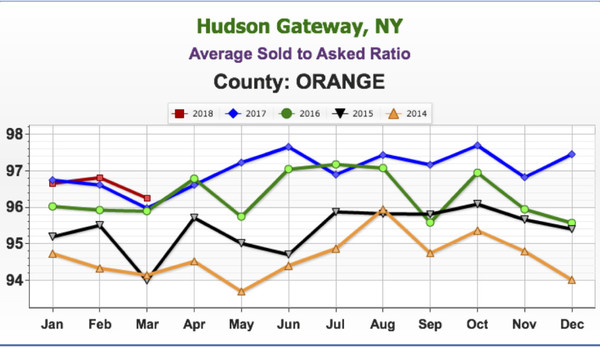

Average Sold to Asked Ratio

The percentage a house sold for under or over the last asking price (not the original price).

The higher the percentage, the hotter the market. Again, March 2018 is outpacing the last 4 years, with sellers negotiating approximately 3.5 points off their last asking price. It’s important to remember that this is an average of all Orange County; in some areas the percentage will be higher and in others, lower.

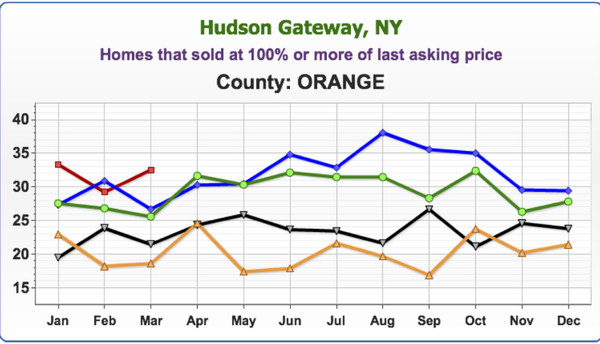

Homes that sold at 100% or more of last asking price

Again, the numbers continue to rise. March 2018 is the highest it’s been since 2014, with almost 35% of homes going for 100% or more of the last asking price. In other words, expect bidding wars!

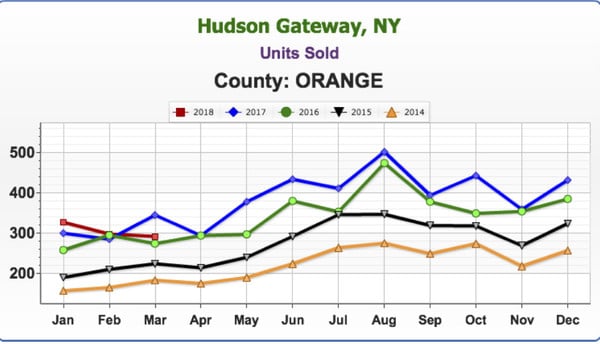

Units Sold

There hasn’t been a dip from the previous year in many years. However less homes were sold in March than in previous years. Vikki felt that people closing in March were closing on those deals made in December and January, when inventory was way down.

Jacque stated that the market is hard on people starting out, those buyers in the under $300,000 range. There is not much available at that price point, and if there is something, it’s usually a total handyman special, which people don’t want!

Geoff agreed that currently, couples are usually both employed and don’t have the time, expertise or inclination to start making repairs and remodels to the home they purchase. They would rather pay top dollar for a move-in-ready home. His advice for sellers: spend time renovating your home before putting in on the market. Bathrooms, kitchens, windows all need to be in good shape. Paint, new siding, fixing up the landscaping, and replacing the roof if necessary, will bring a good return on your investment. Buyers are willing to pay top dollar!

Next Market Update

Mark your calendars and join us on Tuesday, May 8 at 9:15 a.m. for our next Facebook Live Market Update. Our special guests will be Michael Giannetto of Residential Home Financing, who will be offering substantive updates on the mortgage market and Ken Ford of Warwick Valley Financial Advisors, who will discuss other economic factors impacting the housing market. If you can’t make it at 9:15, be sure to watch it later!

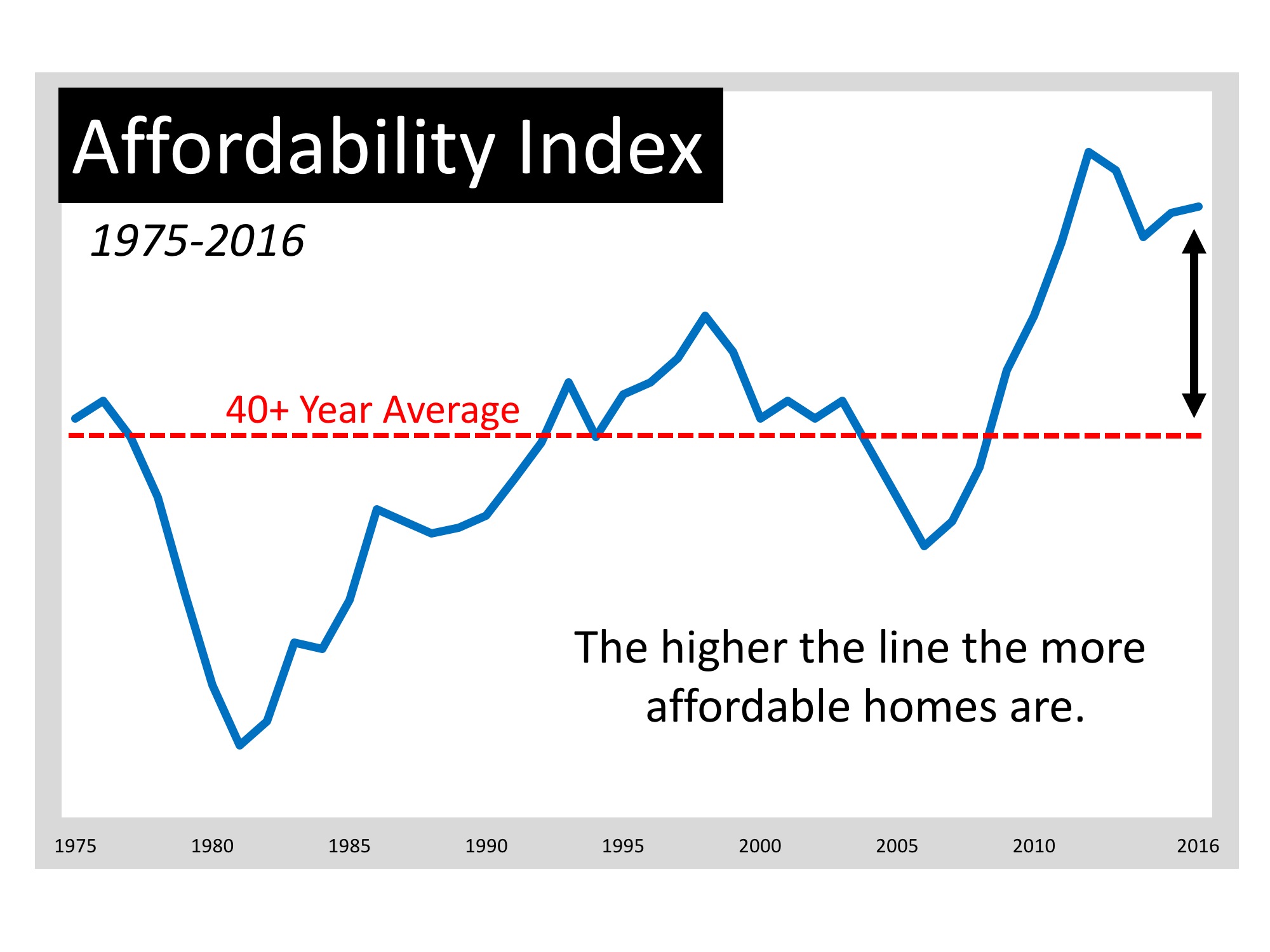

Moving up Is MORE Affordable Now Than Almost Any Other Time in 40 Years

If you are considering selling your current home, to either move up to a larger home or into a home in an area that better suits your current family needs, great news was just revealed.

Last week, Trulia posted a blog, Not Your Father’s Housing Market, which examined home affordability over the last 40+ years (1975-2016). Their research revealed that:

“Nationally, homes are just about the most affordable they’ve been in the last 40 years… the median household could afford a home 1.5 times more expensive than the median home price. In 1980, the median household could only afford about 3/4 of the median home price.

Despite relatively stagnant incomes, affordability has grown due to the sharp drop in mortgage rates over the last 30 years – from a high of over 16% in the 1980s to under 4% by 2016.

Of the nation’s 100 largest metros, only Miami became unaffordable between 1990 and 2016. Meanwhile, 22 metros have flipped from being unaffordable to becoming affordable in that same time frame.”

Here is a graph showing the Affordability Index compared to the 40-year average:

The graph shows that housing affordability is better now than at any other time in the last forty years, except during the housing crash last decade.

(Remember that during the crash you could purchase distressed properties – foreclosures and short sales – at 20-50% discounts.)

There is no doubt that with home prices and mortgage rates on the rise, the affordability index will continue to fall. That is why if you are thinking of moving up, you probably shouldn’t wait.

Bottom Line

If you have held off on moving up to your family’s dream home because you were hoping to time the market, that time has come.

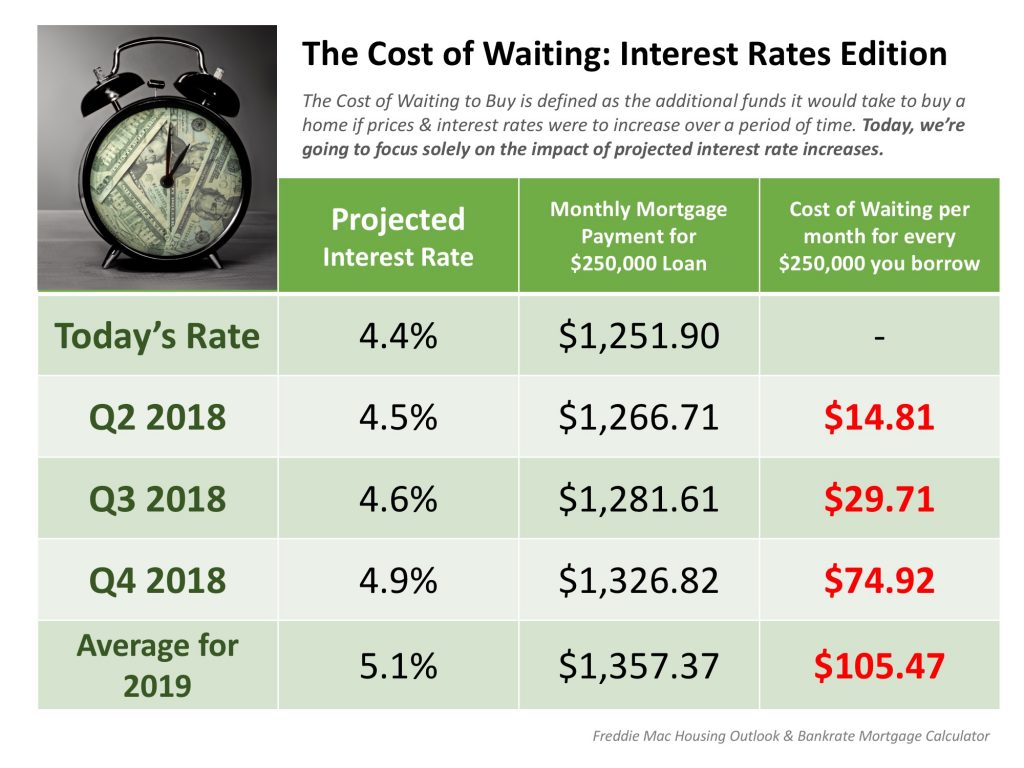

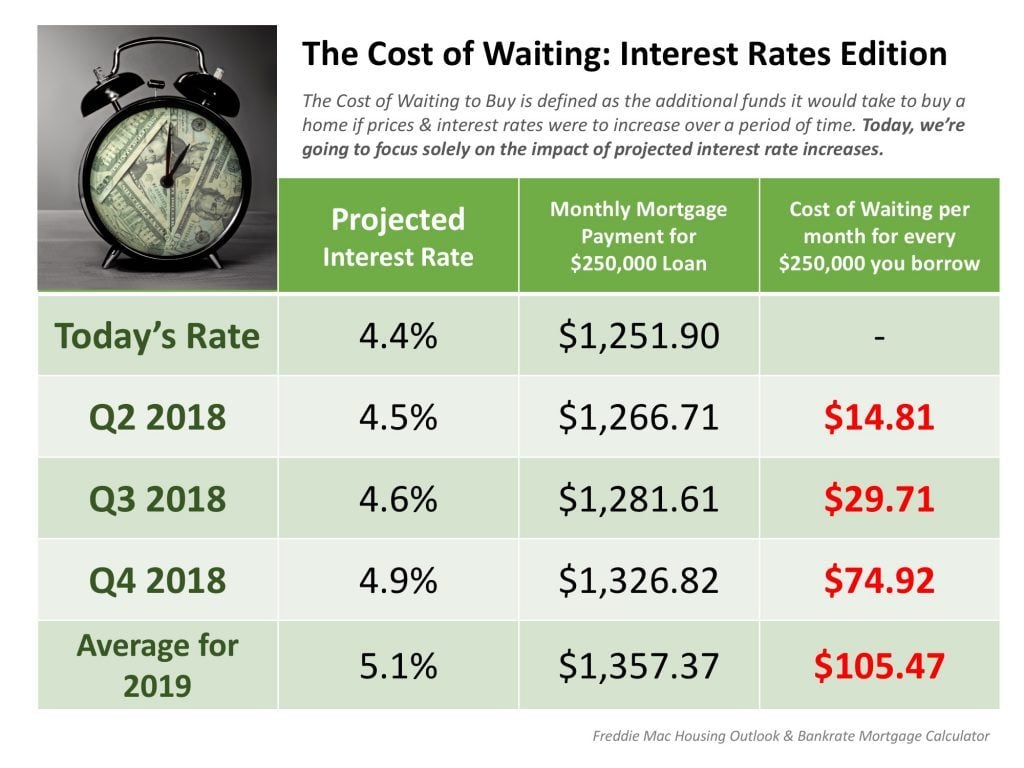

The Cost of Waiting: Interest Rates Edition [INFOGRAPHIC]

Some Highlights:

- Interest rates are projected to increase steadily heading into 2019.

- The higher your interest rate, the more money you end up paying for your home and the higher your monthly payment will be.

- Rates are still low right now. Don’t wait until rates hit 5% to start searching for your dream home!

99% of Experts Agree: Home Prices Will Increase

Some believe that the combined effects of the new tax code and rising mortgage rates will have an adverse impact on residential real estate prices in 2018. However, the clear majority of recently surveyed housing experts believe that home values will continue to rise this year.

What is the Home Price Expectation Survey?

Each quarter, Pulsenomics surveys a nationwide panel of economists, real estate experts and investment & market strategists. Those surveyed include experts such as:

- Daniel Bachman, Senior Manager, U.S. Economics at Deloitte Services, LP

- Kathy Bostjancic, Head of U.S. Macro Investors Service at Oxford Economics

- David Downs, Real Estate Finance Professor at VCU

- Edward Pinto, Resident Fellow at American Enterprise Institute

- Albert Saiz, Director at MIT Center for Real Estate

Where do these experts see home values headed in 2018?

Here is a breakdown of where they see home values twelve months from now:

- 21.6% believe prices will appreciate by 6% or more

- 71.6% believe prices will appreciate between 3 and 5.99%

- 5.7% believe prices will appreciate between 0 and 2.99%

- Only 1.1% believe prices will depreciate

Bottom Line

Almost ninety-nine percent of the top experts studying residential real estate believe that prices will appreciate this year, and over 93% believe home values will appreciate by at least 3%.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link