While some homeowners may be tempted to hold off until spring to list their houses, you should know – homebuyers aren’t waiting. Demand is high today as more people are trying to beat rising mortgage rates. As a result, eager buyers are entering the market or moving their plans up so they can make their purchases as soon as possible.

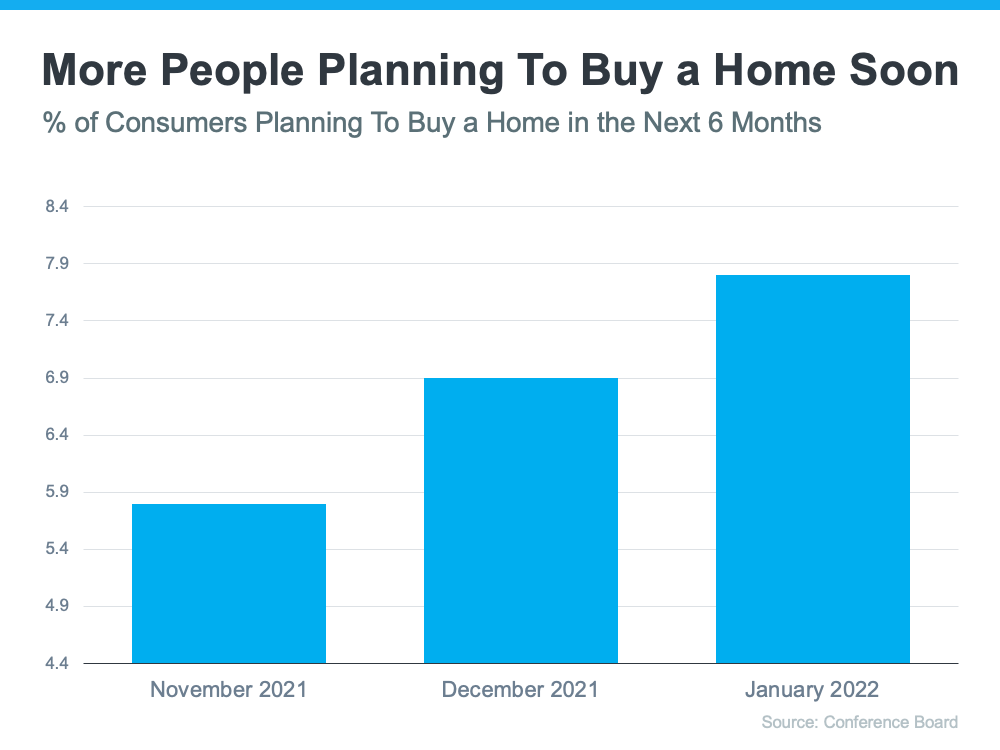

The most recent Consumer Confidence Survey finds that, of those surveyed, the percentage of people planning to buy over the next six months has increased substantially since last fall (see graph below):

As the graph shows, the number of consumers fast-tracking their plans to purchase a home has crept up over the past three months. That indicates many buyers are evaluating their strategy and realizing they should act sooner rather than later. And for homeowners planning to sell, it’s a signal that now may be the time to list.

While more people are moving their plans up, others are actively putting theirs in motion. Time on the market is a great indication that homebuyers are motivated and moving quickly. According to a recent realtor.com report, the average home sold faster this January than any January on record.

Danielle Hale, Chief Economist at realtor.com, notes:

“Homes sold at a record-fast January pace, suggesting that buyers are more active than usual for this time of year.”

What Does That Mean for You?

Homebuyers are rethinking their strategies and moving their plans forward. Others are making their moves today. That means demand for your house isn’t just increasing – it’s high right now.

And because there are so few homes available for determined purchasers to choose from, if you’re planning to sell your house this year, doing so sooner means you can take advantage of high buyer demand before more houses are listed in your neighborhood. Why is this important? Because as more houses are put up for sale, buyers will have more options. But until then, your house will be in the spotlight.

Bottom Line

With so many buyers eager to make a purchase, you could benefit by listing your house soon. To understand how strong buyer demand is in our area, let’s connect so you can start making your plans. Contact Green Team Realty today!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![How To Win as a Buyer in a Sellers’ Market [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/02/10091346/20220211-MEM-1046x2408.png)