Better Homes and Gardens Real Estate Green Team Social Media Training

When joining Better Homes and Gardens Real Estate Green Team you will receive the latest training on everything relevant including social media.

What was once an additional means of connecting and advertising, social media has become a must-have for all real estate agents. That is why we offer different forms of training to help agents establish their pages and content.

Join our Team so we can help you grow your business!

Welcome Nerette Lewis to Green Team New Jersey

The Green Team is proud to announce that Nerette Lewis has decided to join our Vernon, NJ office. We’re excited to have her on our team in both New York and New Jersey and look forward to helping her continue to grow!

Please join us in Welcoming Nerette Lewis to The Green Team New Jersey!

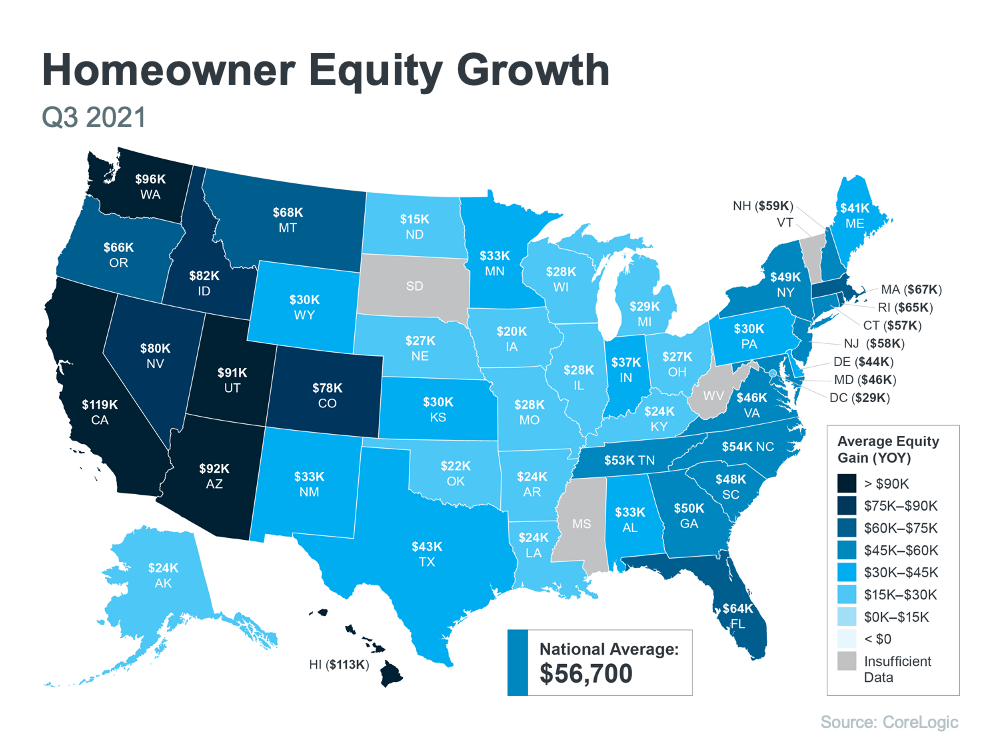

2021 Average Homeowner Gained $56k in Home Equity

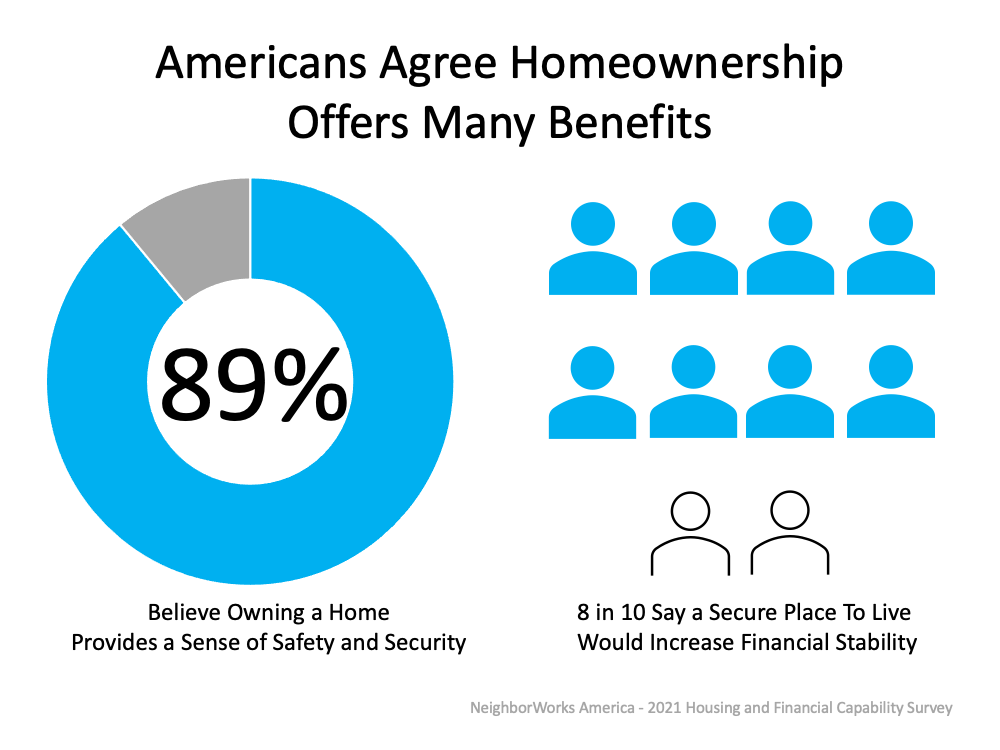

When you think of homeownership, what’s the first thing that comes to mind? Chances are you might focus on the non-financial benefits, like the security or stability a home provides. But what about equity? While it can be overlooked, a homeowner’s equity helps build long-term wealth over time. Here’s a look at what home equity is and why it matters.

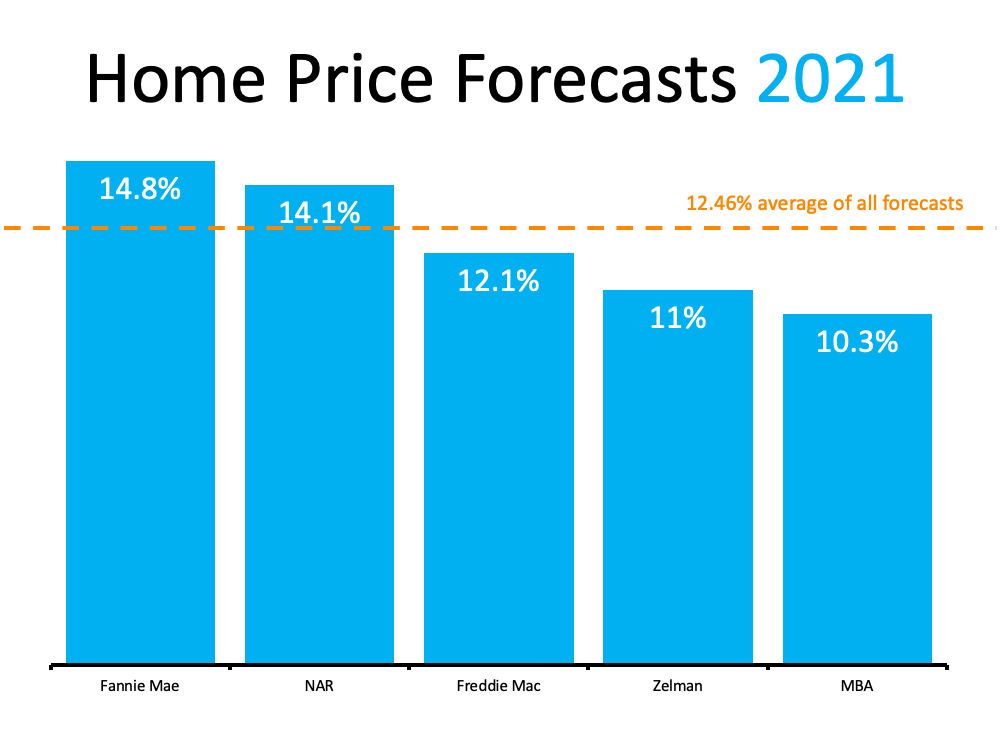

For a homeowner, your equity is the current value of your home minus what you owe on the loan. So, as home values climb, your equity does too. That’s exactly what’s happening today. There aren’t enough homes on the market to meet buyer demand, so bidding wars and multiple offers are driving prices up. That’s because people are willing to pay more to buy a home. Right now, this low supply and high demand are giving current homeowners a significant equity boost.

Dr. Frank Nothaft, Chief Economist at CoreLogic, explains it like this:

“Home price growth is the principal driver of home equity creation. The CoreLogic Home Price Index reported home prices were up 17.7% for the past 12 months ending September, spurring the record gains in home equity wealth.”

To find out just how much rising home values have impacted equity, we turn to the latest Homeowner Equity Insights from CoreLogic.According to that report, the average homeowner’s equity has grown by $56,700 over the last 12 months.

Curious how your state stacks up? Check out the map below to find out the average equity gain for your area.

How Rising Equity Impacts You

If you’re already a homeowner, equity not only builds your wealth, it also opens doors for you to achieve your goals. It works like this: when you sell your house, the equity you built up comes back to you in the sale. You can use those proceeds to fuel your next move, especially if you’ve decided your needs have changed and you’re looking for something new.

If you’re thinking about becoming a homeowner, understanding the importance of equity can help you realize why homeownership is a worthwhile goal. It builds your wealth and gives you peace of mind that your investment is a wise one, not just from a lifestyle perspective, but from a financial one too.

Bottom Line

Whether you’re a current homeowner or you’re ready to become one, it’s important to know how equity works and why it matters.

Find out what your home is worth with our quick and easy Home Value Estimate Tool.

Congrats to Kristine (Krissy) Many For Reaching the Cap!

Congratulations From Geoffrey Green, President Of Green Team Realty, To Kristine (Krissy) Many for reaching the commission cap for Company Dollar Contribution in 2021!

“Krissy is a rising star in the Orange County NY real estate market. Her rise has been very consistent and I fully expect her to keep on her deliberate pace as she rises through the ranks. Krissy has a tremendous work ethic, is very intelligent, and truly goes above and beyond for her clients. Her “can do” attitude is what keeps her clients very satisfied with her service. Congrats Krissy on reaching the cap, and enjoy the fruits of your labor for the balance of 2021!”

Kristine (Krissy) Many dedication to her clients and hard work has allowed her to reach the cap on her commission with Green Team Realty. This is an outstanding accomplishment and means Kristine (Krissy) Many will now receive a 100% commission split on any deal he closes during 2021.

Kristine (Krissy) Many thoughts on hitting the cap:

“I am blessed and so very grateful to have reached CAP at Green Team NY Realty!

One of my goals for 2021 was to reach this milestone by June 30th; goals are such an important aspect to make sure you are running your business efficiently and to your potential.

I missed the mark by 1 month; but that is OK! Without goals and metrics; I would not have a way to gauge my professional and business growth.There are other brokers in our area that offer a CAP program; but not all are created equal. I feel the CAP & commission structure at Green Team to be superior. Not only does Green Team offer an obtainable CAP, but they offer company leads, Inside Sales and a referral app called NuOp that has allowed me to send and receive referrals across the country! All of these funnels have helped grow my business. The support & encouragement I receive year round from my broker and the support staff are invaluable to me.

I am a problem solver by nature and love what I do. I wouldn’t be able to support my family in this challenging, 100% commission, profession if it wasn’t for the wonderful clients I work with! It is because of their trust and investment in me, that I am able to serve them in obtaining their real estate goals. Nothing is better than being a part of the process that makes my client’s dreams come true. So to all of my clients; past, present and future; thank you, I am honored and look forward to continuing to serve you & your referrals.”

Green Team Realty’s commission structure is, no doubt, one of the finest in the industry, but it doesn’t end there. Our lead generation platform, certified sales assistant program, and dynamic training systems are just a few other things worth mentioning.

To learn more about Green Team Realty and why you should join our team click here.

Congratulations, Kristine (Krissy) Many!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

“I am blessed and so very grateful to have reached CAP at Green Team NY Realty!

“I am blessed and so very grateful to have reached CAP at Green Team NY Realty!