For Sale By Owner – Do or Don’t?

Study: FSBOs Don’t Save Real Estate Commission

One of the main reasons why For Sale By Owners (FSBOs) don’t use a real estate agent is because they believe they will save the commission an agent charges for getting their house on the market and selling it. A new study by Collateral Analytics, however, reveals that FSBOs don’t actually save anything, and in some cases may be costing themselves more, by not listing with an agent.

In the study, they analyzed home sales in a variety of markets in 2016 and the first half of 2017. The data showed that:

“FSBOs tend to sell for lower prices than comparable home sales, and in many cases below the average differential represented by the prevailing commission rate.” (emphasis added)

Why would FSBOs net less money than if they used an agent?

The study makes several suggestions:

- “There could be systematic bias on the buyer side as well. FSBO sales might attract more strategic buyers than MLS sales, particularly buyers who rationalize lower-priced bids on with the logic that the seller is “saving” a traditional commission. Such buyers might specifically search for and target sellers who are not getting representational assistance from agents.” In other words, ‘bargain lookers’ might shop FSBOs more often.

- “Experienced agents are experts at ‘staging’ homes for sale” which could bring more money for the home.

- “Properties listed with a broker that is a member of the local MLS will be listed online with all other participating broker websites, marketing the home to a much larger buyer population. And those MLS properties generally offer compensation to agents who represent buyers, incentivizing them to show and sell the property and again potentially enlarging the buyer pool.” If more buyers see a home, the greater the chances are that there could be a bidding war for the property.

Three conclusions from the study:

- FSBOs achieve prices significantly lower than those from similar properties sold by Realtors using the MLS.

- The differential in selling prices for FSBOs when compared to MLS sales of similar properties is about 5.5%.

- The sales in 2017 suggest the average price was near 6% lower for FSBO sales of similar properties.

Bottom Line

If you are thinking of selling, FSBOing may end up costing you money instead of saving you money.

The Dynamic Duo has done it again!

Charles Nagy and Theodore Van Laar Win Second Quarter Sales Award

VERNON – (August 9, 2017) Green Team New Jersey Realty in Vernon, NJ is proud to announce that Charles Nagy and Theodore Van Laar recently won the Second Quarter Sales Leader Award.

Geoff Green puts it best… “The Dynamic Duo has done it again! Actually, this is their first Green Team Quarterly Sales Leader Award, but I just had to say that! In all seriousness, Charlie and Ted are an exceptional team within Green Team New Jersey Realty. They have a tremendous amount of experience between the two of them and they are just getting started on their road to success at Green Team New Jersey. It will be fun to watch how far they can take their business!”

To say they have a tremendous amount of experience is almost an understatement! Together, they have spent over 70 years in the real estate business.

For over 31 years, Ted Van Laar has been a trusted sales associate, specializing in resort properties. Ted and wife Rosanne were first attracted to the beauty and amenities of area resorts back in 1979. Through the years they have shared their appreciation and enjoyment of the Mountain Creek, Crystal Springs and Great Gorge resort area with their three children, friends and family. Ted has a reputation for honesty and integrity, and he enthusiastically shares his love of the Resort lifestyle with his clients, whether they’re looking for a primary residence, second home or an investment property.

Charles Nagy and wife Lynne live in Crystal Springs, where he enjoys playing golf and taking part in other activities available in the community. Charles has been involved in different aspects of the real estate business for the past 40 years. His experience includes the creation and sale of real estate tax sheltered investment offerings; real estate management of high rises and garden apartment complexes; development of raw land for construction of residential homes and, for 18 years, as a builder of residential properties. He has also obtained his certification as a Short Sale and Foreclosure Resource. For two years running (2014 and 2015), Charles was one of Sussex County’s Top Sale Producers, earning the Bronze award. His achievements continue, as shown by this award:

“We are honored to win top producers of Green Team New Jersey Realty for the second quarter of the year. The environment of the New Jersey office promotes an atmosphere of camaraderie which makes for a fun and highly productive environment. Not to mention the one-of-a-kind business model intentionally developed to enhance our client services through continual agent training and support, modern marketing and client appreciation program.”

Nancy Sardo Wins Second Quarter Sales Award

Nancy Sardo Wins Second Quarter Sales Award

WARWICK – (August 8, 2017) The Green Team Home Selling System in Warwick, NY is proud to announce that Nancy Sardo recently won the Second Quarter Sales Leader Award.

Nancy has been listing and selling homes in Orange County, New York since 2005. Dedicated to her profession, she has earned her Associate Broker’s License, Seniors Real Estate Specialist designation and is an Accredited Buyer’s Representative. Nancy devotes her time and boundless energy to making sure she does her best for each and every client, staying on top of changes and trends in the real estate market and making sure that her clients have the best possible experience as they buy, sell, rent or build their home.

In addition, Nancy is passionate about new construction and her experience working with both builders and clients has led to her becoming the listing broker for several new subdivision developments throughout Orange County. Keeping on top of new building codes and their impact, as well as keeping the client on track with both schedule and budget, help her achieve her goal of making the experience of building a home a positive one for her clients.

Nancy’s philosophy is simple: “I love what I do for a living!” She goes on to say, “It takes a team to get the job done and I am proud to be part of a great team! I have the amazing opportunity to meet and work with the most wonderful clients and colleagues. Homeownership is a privilege and it is an honor to work with people who work so hard to achieve it.”

Sardo was born and raised in Queens, NY, but in 1999 she and husband Denis left the City for Warwick, where they raised their two children. A former Medical Assistant, Nancy volunteered with the Cub Scouts, as well as Meals on Wheels. Nancy made the transition to full time real estate agent 12 years ago and has never looked back.

According to Geoff Green, “This is Nancy Sardo’s first Quarterly Sales Leader award since becoming a Sales Associate here at The Green Team, and I am certain it will be the first of many. Nancy is a consummate professional hitting her stride, and it’s inspiring to watch her business grow before our eyes. I am honored that our company can assist her in all of her success.”

LACK OF LISTINGS SLOWING DOWN THE HOUSING MARKET

The real estate market is moving more and more into a complete recovery. Home values are up. Home sales are up. Distressed sales (foreclosures and short sales) have fallen dramatically. It seems that 2017 will be the year that the housing market races forward again.

However, there is one thing that may cause the industry to tap the brakes: a lack of housing inventory. While buyer demand looks like it will remain strong throughout the summer, supply is not keeping up.

Here are the thoughts of a few industry experts on the subject:

Lawrence Yun, Chief Economist at NAR

“Last quarter’s robust pace of sales was especially impressive considering the affordability sting buyers

experienced from higher prices and mortgage rates. High demand is poised to continue heading into the

summer as long as job gains continue. However, many metro areas need to see a significant rise in new

and existing inventory to meet this demand and cool down price growth.”

Tom O’Grady, Pro Teck CEO

“The lack of inventory is very real and could have a severe impact on home sales in the months to come.

Traditionally, a balanced market would have an MRI (Months Remaining Inventory) between six and 10

months.

This month, only eight metros we track have MRIs over 10, compared to 27 last year and 48 two years

ago—illustrating that this lack of inventory is not being driven by traditionally ‘hot’ markets, but is

rather a broad-based, national phenomenon.”

Ralph McLaughlin, Chief Economist at Trulia

“Nationally, housing inventory dropped to its lowest level on record in 2017 Q1. The number of homes

on the market dropped for the eighth consecutive quarter, falling 5.1% over the past year.”

Freddie Mac

“Tight housing inventory has been an important feature of the housing market at least since 2016. For-

sale housing inventory, especially of starter homes, is currently at its lowest level in over ten years. If

inventory continues to remain tight, home sales will likely decline from their 2016 levels. …all eyes are

on housing inventory and whether or not it will meet the high demand.”

Bottom Line

If you are thinking of selling, now may be the time. Demand for your house will be strongest at a time when there is very little competition. That could lead to a quick sale for a really good price.

Housing Inventory Hits 30-Year Low

Spring is traditionally the busiest season for real estate. Buyers, experiencing cabin fever all winter, emerge like flowers through the snow in search of their dream home. Homeowners, in preparation for the increased demand, are enticed to list their house for sale and move on to the home that will better fit their needs.

New data from CoreLogic shows that even though buyers came out in force, as predicted, homeowners did not make the jump to list their home in the second quarter of this year. Frank Nothaft, Chief Economist for CoreLogic had this to say,

“The growth in sales is slowing down, and this is not due to lack of affordability, but rather a lack of inventory. As of Q2 2017, the unsold inventory as a share of all households is 1.9 percent, which is the lowest Q2 reading in over 30 years.”

CoreLogic’s President & CEO, Frank Martell added,

“Home prices are marching ever higher, up almost 50 percent since the trough in March 2011.

While low mortgage rates are keeping the market affordable from a monthly payment perspective, affordability will likely become a much bigger challenge in the years ahead until the industry resolves the housing supply challenge.”

Overall inventory across the United States is down for the 25th consecutive month according to the latest report from the National Association of Realtors and now stands at a 4.3-month supply.

Real estate is local.

Market conditions in the starter and trade-up home markets are in line with the median US figures, but conditions in the luxury and premium markets are following an opposite path. Premium homes are staying on the market longer with ample inventory to suggest a buyer’s market.

What’s your home worth? Get your fast and free home value estimate now!

Bottom Line

Buyers are out in force, and there has never been a better time to move-up to a premium or luxury home. If you are considering selling your starter or trade-up home and moving up this year, let’s get together to discuss the exact conditions in our area.

Do Your Future Plans Include a Move? What’s Stopping You from Listing Now?

Are you an empty-nester? Do you want to retire where you are, or does a vacation destination sound more your style? Are you close to retirement and not ready to move yet, but living in a home that is too big in size and maintenance needs?

How can you line up your current needs with your goals and dreams for the future? The answer for many might be the equity you have in your house.

According to the latest Equity Report from CoreLogic, the average homeowner in the United States gained $14,000 in equity over the course of the last year. On the West Coast, homeowners gained twice that amount, with homeowners in Washington gaining an average of $38,000!

Do you know how much your home has appreciated over the last year?

Many homeowners would be able to easily sell their current house and use the profits from that sale to purchase a condo nearby in order to continue working while eliminating some of the daily maintenance of owning a house (ex. lawn care, snow removal).

With the additional cash gained from the sale of the home, you could put down a sizeable down payment on a vacation/retirement home in the location that you would like to eventually retire to. While you will not yet be able to live there full-time, you can rent out your property during peak vacation times and pay off your mortgage faster.

Purchasing your retirement home now will allow you to take full advantage of today’s seller’s market, allow you to cash in on the equity you have already built, and take comfort in knowing that a plan is in place for a smooth transition into retirement.

Bottom Line

There are many reasons to relocate in retirement, including a change in climate, proximity to family & grandchildren, and so much more. What are the reasons you want to move? Are the reasons to stay more important? Let’s get together to discuss your current equity situation and the options available for you, today!

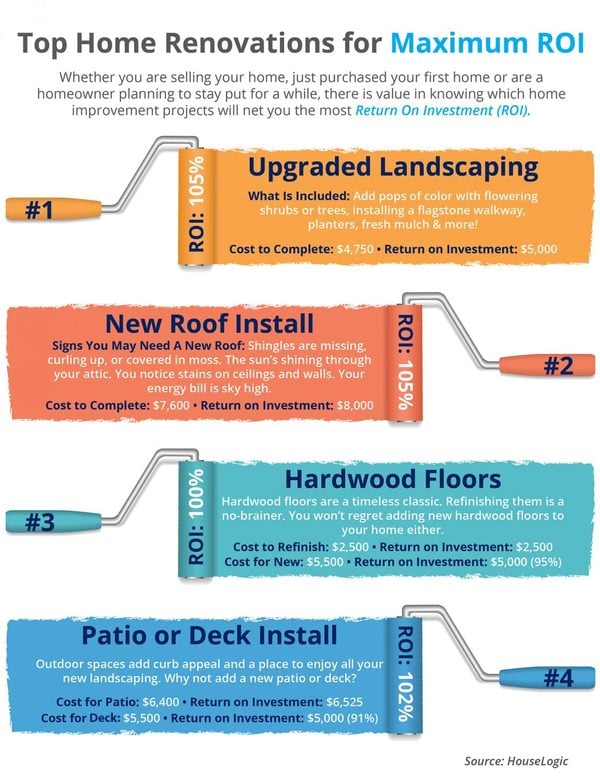

Top Home Renovations for Maximum ROI [INFOGRAPHIC]

Some Highlights:

-

Whether you are selling your home, just purchased your first home, or are a homeowner planning to stay put for a while, there is value in knowing which home improvement projects will net you the most Return On Investment (ROI).

-

While big projects like adding a bathroom or a complete kitchen remodel are popular ways to increase a home’s value, something as simple as updating landscaping and curb appeal can have a quick impact on a home’s value.

-

For more information about top renovation projects that net you the most ROI, you can check out the complete list here.

Do You Know How Much Equity You Have in Your Home?

CoreLogic’s latest Equity Report revealed that 91,000 properties regained equity in the first quarter of 2017. This is great news for the country, as 48.2 million of all mortgaged properties are now in a positive equity situation.

Price Appreciation = Good News for Homeowners

Frank Nothaft, CoreLogic’s Chief Economist, explains:

“One million borrowers achieved positive equity over the last year, which means risk continues to steadily decline as a result of increasing home prices.”

Frank Martell, President and CEO of CoreLogic, believes this is a great sign for the market in 2017 as well, as he had this to say:

“Homeowner equity increased by $766 billion over the last year, the largest increase since Q2 2014. The rising cushion of home equity is one of the main drivers of improved mortgage performance. Since home equity is the largest source of homeowner wealth, the increase in home equity also supports consumer balance sheets, spending and the broader economy.”

This is great news for homeowners! But, do they realize that their equity position has changed?

According to the Fannie Mae’s Home Purchase Sentiment Index (HPSI), more homeowners are beginning to realize that they may have more equity than they first thought.

“This is only the second time in the survey’s history that the net share of those saying it’s a good time to sell surpassed the net share of those saying it’s a good time to buy.”

78.8% of homeowners have significant equity (more than 20%) in their homes today!

This means that many Americans with a mortgage have an opportunity to take advantage of today’s seller’s market. With a sizeable equity position, many homeowners could easily move into a housing situation that better meets their current needs (moving to a larger home or downsizing).

Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae spoke out on this issue:

“High home prices have led many consumers to give us the first clear indication we’ve seen in the National Housing Survey’s seven-year history that they think it’s now a seller’s market. However, we continue to see a lack of housing supply as many potential sellers are unwilling or unable to put their homes on the market…”

Bottom Line

If you are one of the many Americans who is unsure of how much equity you have built in your home, don’t let that be the reason you fail to move on to your dream home in 2017! Check your homes worth – click here

Let’s get together to evaluate your situation!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

share of fees.

share of fees.