Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Are You Wondering if This Is the Year To Buy a Home?

Every year, many renters ask themselves the same question: Should I continue renting, or is it time to buy a home? If you’re a renter, chances are you’ve asked yourself that question at least once, and it’s likely because you’ve faced an increase in your monthly housing costs over time. After all, according to Census data, rents have risen consistently for decades.

To make an informed and powerful decision, the first step is understanding what’s happening in today’s housing market so you can determine which option is the better long-term financial decision for you.

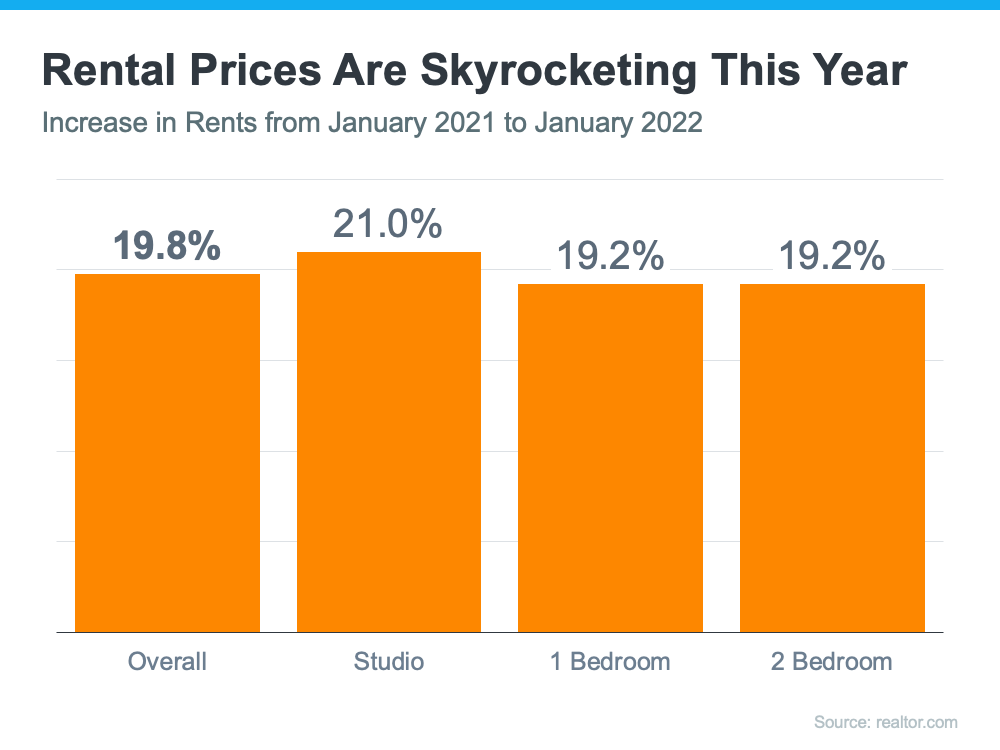

Rents Are Going Up Again This Year

Rents are skyrocketing right now. Data from realtor.com shows just how much rental prices are surging throughout the country. The graph below highlights rental unit price increases over the past year:

If you’re a renter and plan on signing a new lease, your monthly costs are likely to go up when you do. Those rising costs can have a big impact on your financial goals, including any plans you’re making to save for a home purchase.

Homeownership Offers Stable Monthly Costs

Of course, one of the key benefits of owning your home is that you’re able to lock in and stabilize your payments for the duration of your loan. That’s not the case when you rent.

While rents are already on the rise, there’s a good chance many people will see their rental costs increase even more this year. As Danielle Hale, Chief Economist at realtor.com, says:

“With rents already at a high and expected to keep going up, rental affordability will increasingly challenge many Americans in 2022. For those thinking about making the transition from renting to buying their first home, rising rents will remain a motivating factor. . . .”

So, if you’re ready to become a homeowner, waiting any longer may not make financial sense. Instead, escape the cycle of rising rents and enjoy the many benefits that come with homeownership today.

Bottom Line

Starting your journey towards homeownership can pay off significantly this year. If you’re financially ready today, let’s connect so we can discuss your options.

Don’t Get Caught Off Guard by Closing Costs

As a homebuyer, it’s important to plan and budget for the expenses you’ll encounter when you purchase a home. While most people understand the need to save for a down payment, a recent survey found 41% of homebuyers were surprised by their closing costs. Here’s some information to help you get started so you’re not caught off guard when it’s time to close on your home.

What Are Closing Costs?

One possible reason some people are surprised by closing costs may be because they don’t know what they are or what they cover. According to U.S. News and World Report:

“Closing costs encompass a variety of expenses above your property’s purchase price. They include things like lender fees, title insurance, government processing fees, upfront tax payments and homeowners insurance.”

In other words, your closing costs are a collection of fees and payments made to a variety of individuals and organizations who are involved with your transaction. According to Freddie Mac, while they can vary by location and situation, closing costs typically include:

- Government recording costs

- Appraisal fees

- Credit report fees

- Lender origination fees

- Title services

- Tax service fees

- Survey fees

- Attorney fees

- Underwriting Fees

How Much Will You Need To Budget for Closing Costs?

Understanding what closing costs include is important, but knowing what you’ll need to budget to cover them is critical to achieving your homebuying goals. According to the Freddie Mac article mentioned above, the costs to close are typically between 2% and 5% of the total purchase price of your home. With that in mind, here’s how you can get an idea of what you’ll need to cover your closing costs.

Let’s say you find a home you want to purchase for the median price of $350,300. Based on the 2-5% Freddie Mac estimate, your closing fees could be between roughly $7,000 and $17,500.

Keep in mind, if you’re in the market for a home above or below this price range, your closing costs will be higher or lower.

What’s the Best Way To Make Sure You’re Prepared At Closing Time?

Freddie Mac provides great advice for homebuyers, saying:

“As you start your homebuying journey, take the time to get a sense of all costs involved – from your down payment to closing costs.”

The best way to understand what you’ll need at the closing table is to work with a team of trusted real estate professionals. An agent can help connect you with a lender, and together they can provide you with answers to the questions you might have.

Bottom Line

In today’s real estate market, it’s more important than ever to make sure your budget includes any fees and payments due at closing. Let’s connect so you have the knowledge you need to be confident going into the homebuying process.

This Spring Presents Sellers with a Golden Opportunity

If you’re thinking of selling your house this year, timing is crucial. After all, you’ll want to balance getting the most out of the sale of your current home and making the best investment when you buy your next one.

If that’s the case, you should know – you may be able to get the best of both worlds today. Here are four reasons why this spring may be your golden window of opportunity.

1. The Number of Homes on the Market Is Still Low

Today’s limited supply of houses for sale is putting sellers in the driver’s seat. There are far more buyers in the market today than there are homes available. That means purchasers are eagerly waiting for your house.

Listing your house now makes it the center of attention. And if you work with a real estate professional to price your house correctly, you can expect it to sell quickly and likely get multiple strong offers this season.

2. Your Equity Is Growing in Record Amounts

According to the most recent Homeowner Equity Insight report from CoreLogic, homeowners are sitting on record amounts of equity thanks to recent home price appreciation. The report finds that the average homeowner has gained $55,300 in equity over the past year.

That much equity can open doors for you to make a move. If you’ve been holding off on selling because you’re worried about how rising prices will impact your next home search, rest assured your equity can help fuel your move. It may be just what you need to cover a large portion – if not all – of the down payment on your next home.

3. Mortgage Rates Are Increasing

While it’s true mortgage rates have already been climbing this year, current mortgage rates are still below what they’ve been in recent decades. In the 2000s, the average mortgage rate was 6.27%. In the 1990s, the average rate was 8.12%.

For context, the current average 30-year fixed mortgage rate, according to Freddie Mac, is 3.85%. And while recent global uncertainty caused rates to dip slightly in the near-term, experts project rates will rise in the months ahead. Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae, says:

“For homebuyers, we believe that borrowing costs will likely rise with the increase in mortgage rates….”

When that happens, it’ll cost you more to purchase your next home. That’s why it’s important to act now if you’re ready to sell. Work with a trusted advisor to kickstart the process so you can take key steps to making your next purchase before rates climb further.

4. Home Prices Are Climbing Too

Home prices have been skyrocketing in recent years because of the imbalance of supply and demand. And as long as that imbalance continues, so will the rise in home values.

What does that mean for you? If you’re selling so you can move into the home of your dreams or downsize into something that better suits your current needs, you have an opportunity to get ahead of the curve by leveraging your growing equity and purchasing your next home before prices climb higher.

And, once you make your purchase, you can find peace of mind in knowing ongoing home price appreciation is growing the value of your new investment.

Bottom Line

If you want to win when you sell and when you buy, this spring could be your golden opportunity. Let’s connect so you have the insights you need to take advantage of today’s incredible sellers’ market.

Key Terms for Homebuyers

![Key Terms for Homebuyers [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/03/09163312/20220311-MEM-1046x2681.png)

Some Highlights

- Knowing key housing terms and how they relate to today’s market is important. For example, when mortgage rates and home prices rise, it impacts how much home you can afford.

- Terms like appraisal (what lenders rely on to validate a home’s value) and the inspection contingency (which gives buyers essential information on a home’s condition) directly impact the transaction.

- Buying a home can be intimidating if you’re not familiar with the terms used throughout the process. Let’s connect so you have an expert guide and advice for any questions that may come up.

How To Navigate a Market Where Multiple Offers Is the New Normal

If you’re thinking of buying a home today, you already know that the number of homes available for sale is low. But what does that really mean for you? As a buyer, low housing supply coupled with high buyer demand means you should be prepared to navigate a highly competitive market where homes sell fast and get multiple offers. Realtor.com has this to say:

“Homes also flew off the market at record pace as buyers put offers in the moment properties came up for sale….”

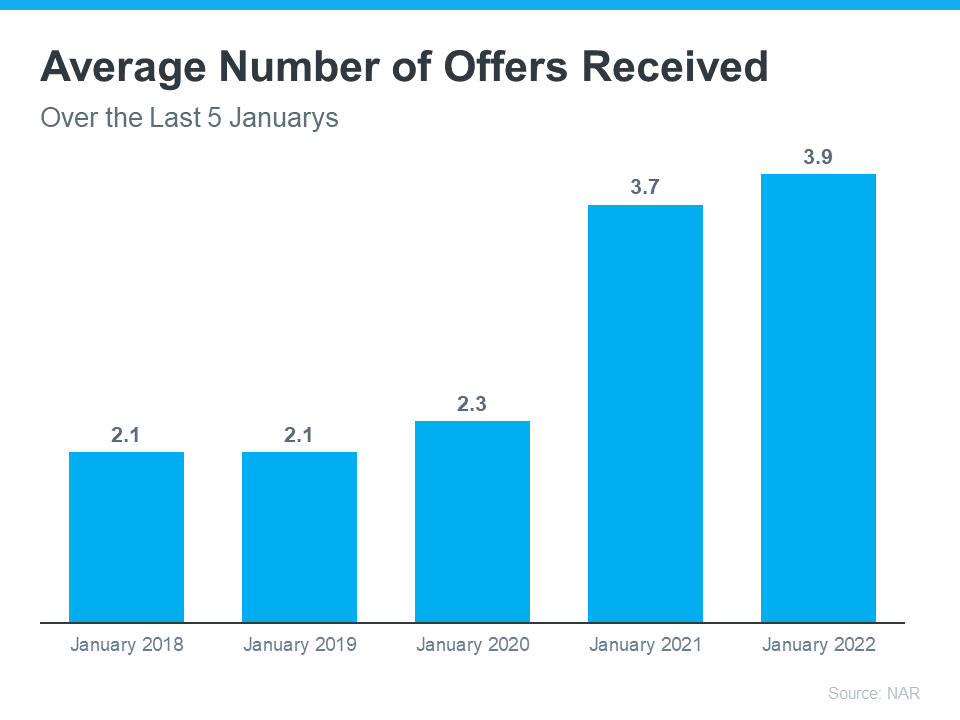

In a bidding war situation like this, doing everything you can to get ahead of the competition is a wise move. That’s because when you find a house and submit an offer, it’ll likely be up against strong offers from other buyers. According to the latest RealtorsConfidence Index from the National Association of Realtors (NAR), homes today are receiving an average of 3.9 offers. That’s the most offers we’ve seen in January for the last 5 years (see graph below):

To help you navigate bidding wars with multiple offers, an expert real estate advisor is key. They know what’s worked for other buyers, what sellers are looking for, and how to help you prepare when it comes time to make an offer. Here are three tips to keep in mind that will help you make the best offer possible.

1. Know Your Numbers

Knowing your budget and what you can afford is critical to your success as a homebuyer. The best way to understand your numbers is to work with a lender so you can get pre-approved for a loan. Pre-approval shows sellers you’re serious, which can give you a competitive edge. You should also know making an offer at the home’s asking price may not be enough. Homes today often sell for more than their listing price. An agent can help you understand the market value of the home and what other homes are selling for in your area.

2. Be Ready To Move Fast

Speed and the pace of sales are contributing factors to today’s competitive housing market. When homes are selling fast, it’s important to stay on top of the market and be ready to move quickly. Your agent will help you stay up to date on the latest listings and help you put together your best offer as soon as you find the home you want to buy.

3. Make a Strong but Fair Offer

When you’re up against other offers, putting your best offer forward from the start is key. Lean on your agent to write a strong offer and use their expertise on which levers you can pull to make your offer as enticing as possible. One option is to wave some of your contract contingencies (conditions you set that the seller must meet for the purchase to be finalized). Just remember there are certain contingencies you don’t want to give up, like the home inspection.

Bottom Line

No matter what, your agent is your best resource for making an offer that stands out in a competitive market. Let’s connect to talk through what you can expect as a buyer and how to kick off a successful home search.

Key Factors That Impact Affordability Today

You can’t read an article about residential real estate without the author mentioning the affordability challenges that today’s buyers face. There’s no doubt homes are less affordable today than they were over the last two years, but that doesn’t mean homes are now unaffordable.

There are three measures used to establish home affordability: home prices, mortgage rates, and wages. Let’s look closely at each of these components.

1. Home Prices

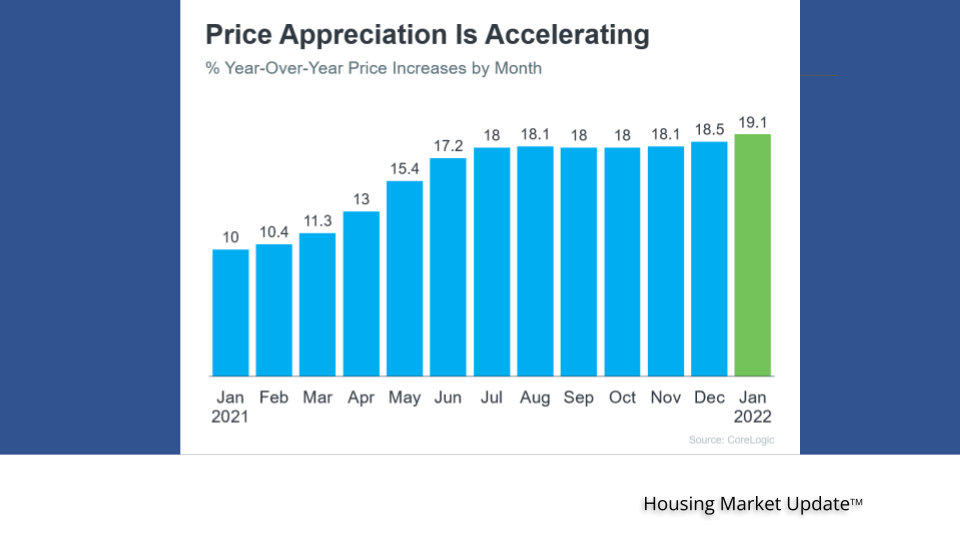

The most recent Home Price Insights report by CoreLogic shows home values have increased by 19.1% from last January to this January. That was one reason affordability declined over the past year.

2. Mortgage Rates

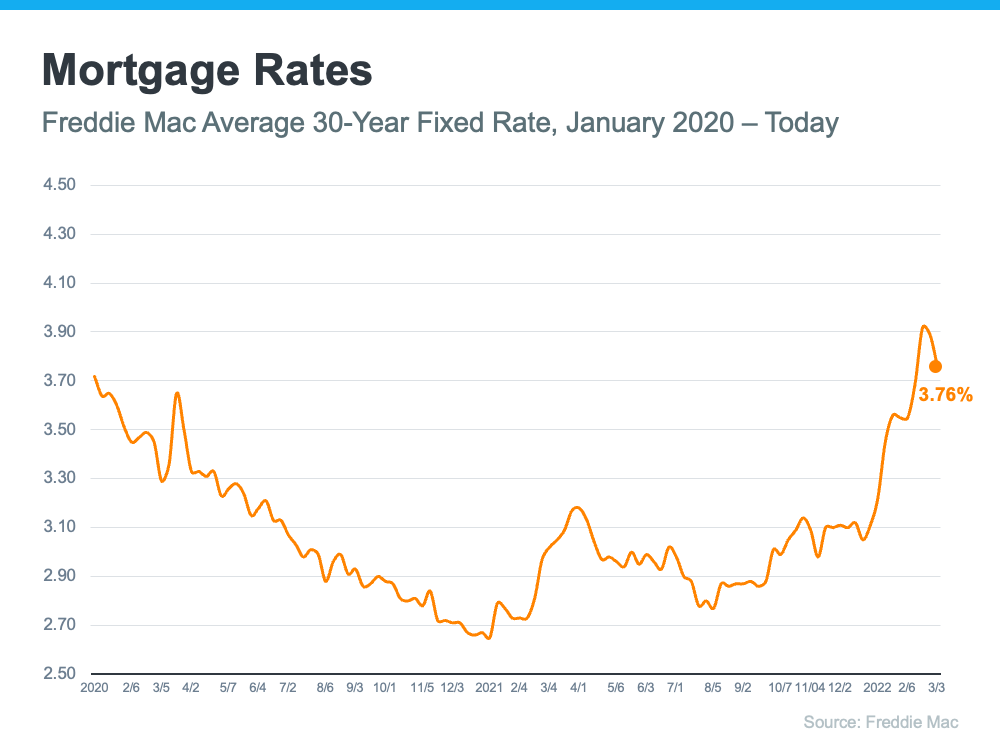

While the current global uncertainty makes it difficult to project mortgage rates, we do know current rates are almost one full percentage point higher than they were last year. According to Freddie Mac, the average monthly rate for last February was 2.81%. This February it was 3.76%. That increase in the mortgage rate also contributes to homes being less affordable than they were last year.

3. Wages

The one big, positive component in the affordability equation is an increase in American wages. In a recent article by RealtyTrac, Peter Miller addresses that point:

“Prices are up, but what about wages? ADP reports that job holder incomes increased 5.9% last year but rose 8.0% for those who switched employers. In effect, some of the higher cost to buy a home has been offset by more cash income.”

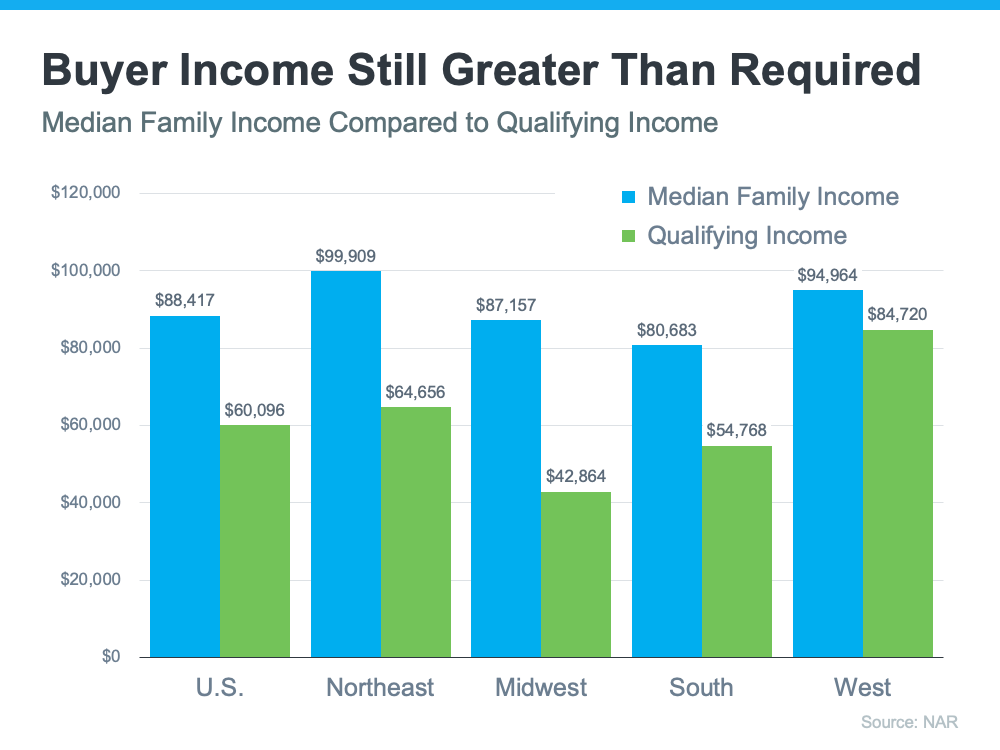

The National Association of Realtors (NAR) also recently released information that looks at income and affordability. The NAR data provides a comparison of the current median family income versus the qualifying income for a median-priced home in each region of the country. Here’s a graph of their findings:

As the graph shows, the median family income (shown in blue on the graph) is greater than the qualifying income needed to buy a median-priced home (shown in green on the graph) in all four regions of the country. While those figures may vary in certain locations within each region, it’s important to note that, in most of the country, homes are still affordable.

So, when you think about affordability, remember that the picture includes more than just home prices and mortgage rates. When prices rise and rates rise, it does impact affordability, and experts project both of those things will climb in the months ahead. That’s why it’s less affordable to buy a home than it was over the past two years when prices and rates were lower than they are today. But wages need to be factored into affordability as well. Because wages have been rising, they’re a big reason that, while less affordable, homes are not unaffordable today.

Bottom Line

To find out more about affordability in our local area, let’s discuss where home prices are locally, what’s happening with mortgage rates, and get you in contact with a lender so you can make an informed financial decision. Remember, while less affordable, homes are not unaffordable, which still gives you an opportunity to buy today.

How Global Uncertainty Is Impacting Mortgage Rates

If you’re thinking about buying or selling a home, you’ll want to keep a pulse on what’s happening with mortgage rates. Rates have been climbing in recent months, especially since January of this year. And just a few weeks ago, the 30-year fixed mortgage rate from Freddie Mac approached 4% for the first time since May of 2019. But that climb has dropped slightly over the past few weeks (see graph below):

The recent decline in mortgage rates is primarily due to growing uncertainty around geopolitical tensions surrounding Russia and Ukraine. But experts say it’s to be expected.

Here’s a look at how industry leaders are explaining the impact global uncertainty has on mortgage rates:

Odeta Kushi, Deputy Chief Economist at First American, says:

“While mortgage rates trended upward in 2022, one unintended side effect of global uncertainty is that it often results in downward pressure on mortgage rates.”

In another interview, Kushi adds:

“Geopolitical events play an important role in impacting the long end of the yield curve and mortgage rates. For example, in the weeks following the ‘Brexit’ vote in 2016, the U.S. Treasury bond yield declined and led to a corresponding decline in mortgage rates.”

Kushi’s insights are a reminder that, historically, economic uncertainty can impact the 10-year treasury yield – which has a long-standing relationship with mortgage rates and is often considered a leading indicator of where rates are headed. Basically, events overseas can have an impact on mortgage rates here, and that’s what we’re seeing today.

Will Mortgage Rates Stay Down?

While no one has a crystal ball to predict exactly what will happen with rates in the future, experts agree this slight decline is temporary. Sam Khater, Chief Economist at Freddie Mac, echoes Kushi’s sentiment, but adds that the decline in rates won’t last:

“Geopolitical tensions caused U.S. Treasury yields to recede this week . . . leading to a drop in mortgage rates. While inflationary pressures remain, the cascading impacts of the war in Ukraine have created market uncertainty. Consequently, rates are expected to stay low in the short-term but will likely increase in the coming months.”

Rates will likely fluctuate in the short-term based on what’s happening globally. But before long, experts project rates will renew their climb. If you’re in the market to buy a home, doing so before rates start to rise again may be your most affordable option.

Bottom Line

Mortgage rates are an important piece of the puzzle because they help determine how much you’ll owe on your monthly mortgage payment in your next home. Let’s connect so you have up-to-date information on rates and trusted advice on how to time your next move.

March 2022 Housing Market Update

Welcome to the March 2022 Housing Market Update. Geoff Green, President of Green Team Realty and Co-Founder and CEO of NuOp, is the host of the March 15 webinar. If you missed it, the video of the webinar is available below.

Price appreciation

As shown here, there is an acceleration again in price appreciation. For a while, we were talking about it decelerating (not depreciating). According to Geoff, inventory is just so low that pricing has nowhere to go but up.

In addition. the major forecasting agencies show an average of 6.1% increase for 2022. The average annual home price forecast has usually been around 4% per year.

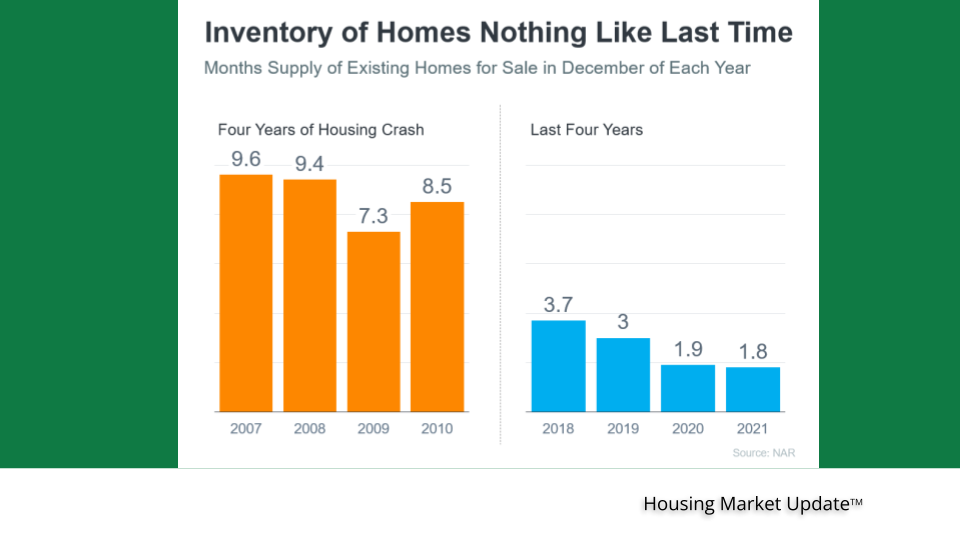

Supply and Demand

Basically, inventory is a subject that the Housing Market Update has discussed for several years. A Sellers’ Market is defined as having less than 6 months’ inventory. Home prices will appreciate. A neutral market, during which prices appreciate with inflation, is 6-7 months inventory. A Buyers’ Market, with over 7 months of inventory, will see home prices depreciating.

In addition, worries of a housing bubble persist among 77% of consumers and 44% of agents. However, there is a big difference in factors, including inventory supply as shown below.

Keeping an eye on other factors…

According to Mark Zandi, Moody’s Analytics Chief Economist,

“Recession risks later this year and into next are now uncomfortably high.” “The odds that the Fed missteps and tightens too aggressively are material and rising. Landing the economic plane on the tarmac was already going to be difficult for the Fed because of the pandemic and high inflation, but Russia’s invasion makes it more likely the economic plane hits the tarmac hard or even crashes.”

The Housing Market Update will continue to keep an eye on this. However, Geoff reminded viewers that a recession does not necessarily lead to a bad housing market.

Meet the Panel

Joining Geoff for this March 2022 Housing Market Update are Keren Gonen, Green Team New Jersey Realty, and Peter Mallon, Americana Mortgage Group, Inc. The panel discussed the issues and data presented by Geoff as it relates to what they are experiencing in their own businesses. To watch the webinar and view the panel discussion, click here. You’ll find contact information for the panelists below:

“Housekeeping” Items

Why It’s Critical To Price Your House Right

When you make a move, you want to sell your house for the highest price possible. That might be why many homeowners are eager to list in today’s sellers’ market. After all, with record-low inventory and high buyer demand, many homes are selling for more than asking price. Data from the National Association of Realtors (NAR) shows 46% of homes are selling above list price today.

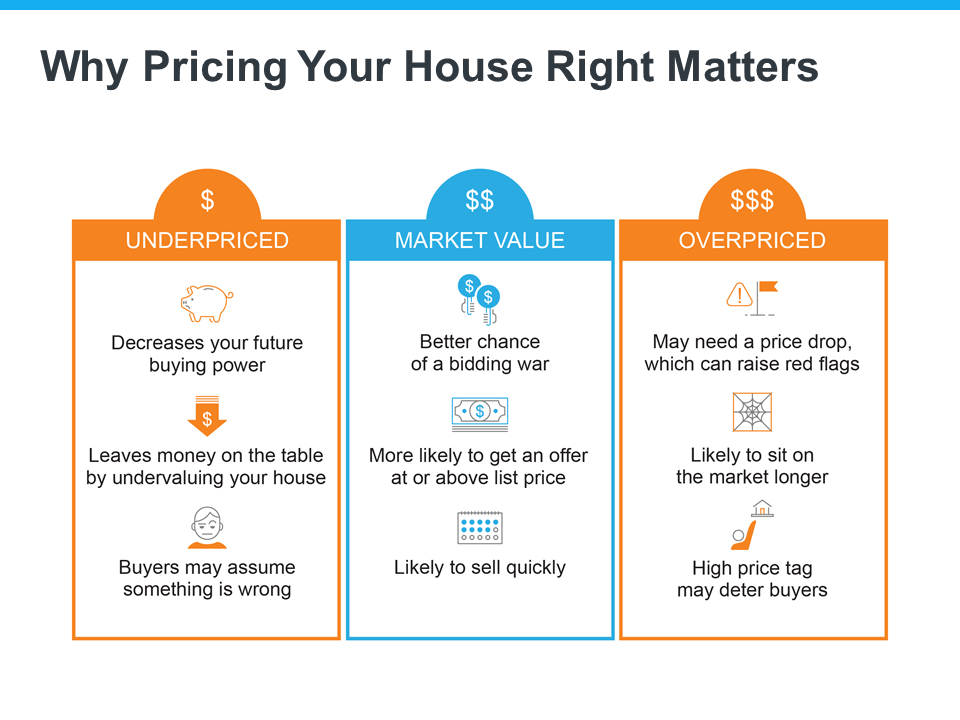

But even in a market like we have now, working with an agent to set the right asking price is critical, as pricing it too high or too low could have a negative impact on your final sale. Here’s why.

Pricing Your House Right Is Crucial Even in a Sellers’ Market

The price you set for your house sends a message to potential buyers. Price it too low and you might raise questions about your home’s condition or lead buyers to assume something is wrong with the property. Not to mention, you could leave money on the table, which decreases your future buying power if you undervalue your house.

On the other hand, price it too high and you run the risk of deterring buyers. When that happens, you may have to do a price drop to try to re-ignite interest in your house when it sits on the market for a while. But be aware that a price drop can be seen as a red flag for some buyers who will wonder why the price was reduced and what that means about the home.

In other words, think of pricing your home as a target. Your goal is to aim directly for the center – not too high, not too low, but right at market value. Pricing your house fairly based on market conditions increases the chance you’ll have more buyers who are interested in purchasing it. That makes it more likely you’ll see a bidding war, too. And when a bidding war happens, you’ll likely get an even higher final sale price. Plus, when homes are priced right, they tend to sell quickly.

To get a look into the potential downsides of over or underpricing your house and the perks that come with pricing it at market value, see the chart below:

Lean on a Professional’s Expertise To Price Your House Right

There are several factors that go into pricing your house and balancing them is the key. That’s why it’s important to lean on an expert real estate advisor when you’re ready to move. A local real estate advisor is knowledgeable about:

- The value of homes in your neighborhood

- The current demand for houses in today’s market

- The condition of your house and how it affects the value

A real estate professional will balance these factors to make sure the price of your house makes the best first impression and gives you the greatest return on your investment in the end.

Bottom Line

Even in a sellers’ market, pricing your house right is critical. Don’t rely on guesswork. Let’s connect to make sure your house is perfectly priced.

An Expert Advisor Will Give You the Best Advice in Today’s Market

Having an experienced guide coaching you through the process of buying or selling a home is important in a normal market – but today’s market is far from normal. As a result, an expert real estate advisor isn’t just good to have by your side, they’re essential.

Today’s housing market is full of extremes. Experts project mortgage rates will continue to rise this year, and that’s driving significant demand for homes as buyers want to make their purchases before rates climb even higher. At the same time, an absence of sellers is leading to record-low housing inventory. This imbalance in supply and demand is creating bidding wars and driving home price appreciation as well as considerable gains in home equity.

These market conditions can feel overwhelming, but you don’t have to go at it alone. Having a trusted expert to coach you through the process of buying or selling a home gives you clarity and confidence through each step.

Here are just a few of the ways a real estate expert is invaluable:

Contracts – Agents help with the disclosures and contracts necessary in today’s heavily regulated environment.

Experience – In an unprecedented market, experience is crucial. Real estate professionals know the entire sales process, including how it’s changed over the past two years.

Negotiations – Your real estate advisor acts as a buffer in negotiations with all parties throughout the entire transaction and advocates for your best interests.

Education – Knowledge is power in today’s market, and your advisor will simply and effectively explain market conditions and translate what they mean for you.

Pricing – Finally, a real estate professional understands today’s real estate values when setting the price of your home or helping you make an offer to purchase one.

A real estate agent is a crucial guide through this unprecedented market, but not all agents are created equal. A true expert can carefully walk you through the whole real estate process, look out for your unique needs, and advise you on the best ways to achieve success. Finding an expert real estate advisor – not just any agent – should be your top priority when you’re ready to buy or sell a home.

What’s the key to choosing the right expert?

It starts with trust. You’ll want to know you can trust the advice they’re giving you, so you need to make sure you’re connected with a true professional. No one can provide perfect advice because it’s impossible to know exactly what’s going to happen at every turn – especially in today’s unique market. But a true professional can give you the best possible advice based on the information and situation at hand. They’ll help you make the necessary adjustments along the way, advocate for you throughout the process, and coach you on the essential knowledge you need to make confident decisions. That’s exactly what you want and deserve.

Bottom Line

It’s critical to have an expert on your side who’s well versed in navigating today’s rapidly changing market. If you’re planning to buy or sell a home this year, let’s connect so you have a real estate professional on your side to give you the best advice and guide you along the way.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link