Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Why Home Loans Today Aren’t What They Were in the Past

In today’s housing market, many are beginning to wonder if we’re returning to the riskier lending habits and borrowing options that led to the housing crash 15 years ago. Let’s ease those concerns.

Several times a year, the Mortgage Bankers Association (MBA) releases an index titled the Mortgage Credit Availability Index (MCAI). According to their website:

“The MCAI provides the only standardized quantitative index that is solely focused on mortgage credit. The MCAI is . . . a summary measure which indicates the availability of mortgage credit at a point in time.”

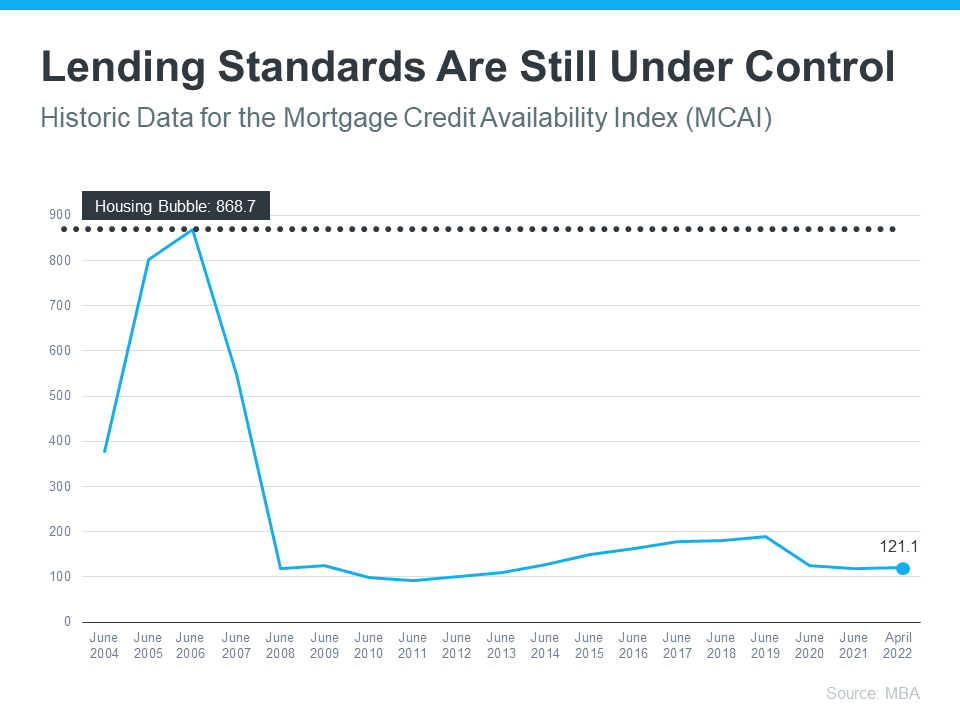

Basically, the index determines how easy it is to get a mortgage. The higher the index, the more available mortgage credit becomes. Here’s a graph of the MCAI dating back to 2004, when the data first became available:

As the graph shows, the index stood at about 400 in 2004. Mortgage credit became more available as the housing market heated up, and then the index passed 850 in 2006. When the real estate market crashed, so did the MCAI as mortgage money became almost impossible to secure. Thankfully, lending standards have eased somewhat since then, but the index is still low. In April, the index was at 121, which is about one-seventh of what it was in 2006.

As the graph shows, the index stood at about 400 in 2004. Mortgage credit became more available as the housing market heated up, and then the index passed 850 in 2006. When the real estate market crashed, so did the MCAI as mortgage money became almost impossible to secure. Thankfully, lending standards have eased somewhat since then, but the index is still low. In April, the index was at 121, which is about one-seventh of what it was in 2006.

Why Did the Index Get out of Control During the Housing Bubble?

The main reason was the availability of loans with extremely weak lending standards. To keep up with demand in 2006, many mortgage lenders offered loans that put little emphasis on the eligibility of the borrower. Lenders were approving loans without always going through a verification process to confirm if the borrower would likely be able to repay the loan.

An example of the relaxed lending standards leading up to the housing crash is the FICO® credit score associated with a loan. What’s a FICO® score? The website myFICO explains:

“A credit score tells lenders about your creditworthiness (how likely you are to pay back a loan based on your credit history). It is calculated using the information in your credit reports. FICO® Scores are the standard for credit scores—used by 90% of top lenders.”

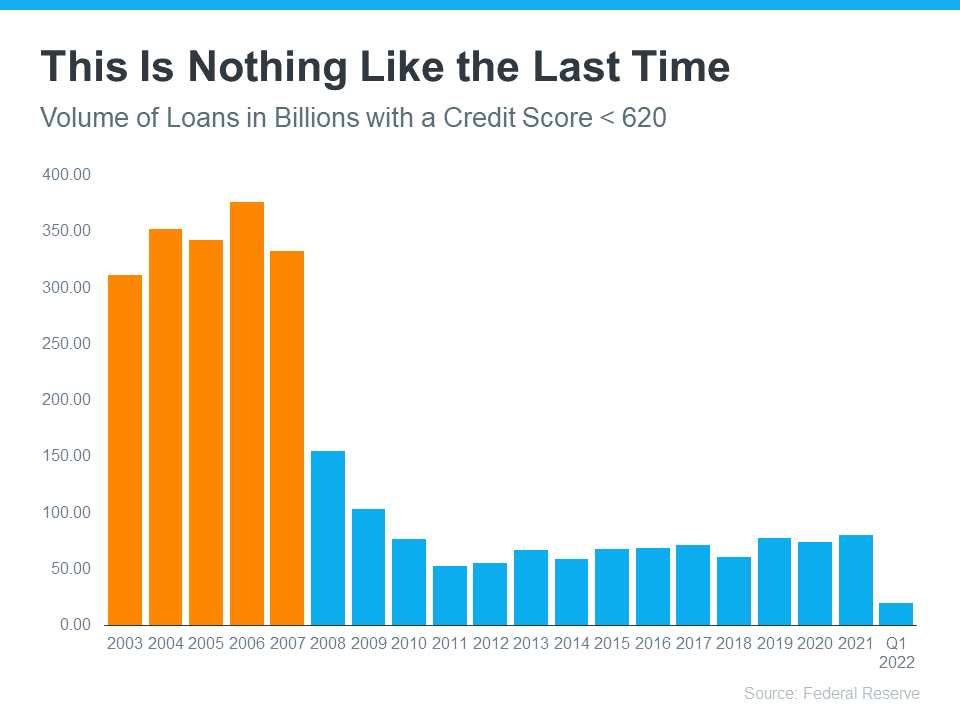

During the housing boom, many mortgages were written for borrowers with a FICO score under 620. While there are still some loan programs that allow for a 620 score, today’s lending standards are much tighter. Lending institutions overall are much more attentive about measuring risk when approving loans. According to the latest Household Debt and Credit Report from the New York Federal Reserve, the median credit score on all mortgage loans originated in the first quarter of 2022 was 776.

The graph below shows the billions of dollars in mortgage money given annually to borrowers with a credit score under 620.

In 2006, buyers with a score under 620 received $376 billion dollars in loans. In 2021, that number was only $80 billion, and it’s only $20 billion in the first quarter of 2022.

In 2006, buyers with a score under 620 received $376 billion dollars in loans. In 2021, that number was only $80 billion, and it’s only $20 billion in the first quarter of 2022.

Bottom Line

In 2006, lending standards were much more relaxed with little evaluation done to measure a borrower’s potential to repay their loan. Today, standards are tighter, and the risk is reduced for both lenders and borrowers. These are two very different housing markets, and today is nothing like the last time.

What Does the Rest of the Year Hold for the Housing Market?

If you’re thinking of buying or selling a house, you’re at an exciting decision point. And anytime you make a big decision like that, one thing you should always consider is timing. So, what does the rest of the year hold for the housing market? Here’s what experts have to say.

The Number of Homes Available for Sale Is Likely To Grow

There are early signs housing inventory is starting to grow and experts say that should continue in the months ahead. According to Danielle Hale, Chief Economist at realtor.com:

“The gap between this year’s homes for sale and last year’s is one-fifth the size that it was at the beginning of the year. The catch up is likely to continue, . . . This growth will mean more options for shoppers than they’ve had in a while, even though inventory continues to lag pre-pandemic normal.”

- As a buyer, having more options is welcome news. Just remember, housing supply is still low, so be ready to act fast and put in your best offer up front.

- As a seller, your house may soon face more competition when other sellers list their homes. But the good news is, if you’re also buying your next home, having more options to choose from should make that move-up process easier.

Mortgage Rates Will Likely Continue To Respond to Inflationary Pressures

Experts also agree inflation should continue to drive up mortgage rates, albeit more moderately. Odeta Kushi, Deputy Chief Economist at First American, says:

“… ongoing inflationary pressure remains likely to push mortgage rates even higher in the months to come.”

- As a buyer, work with trusted real estate professionals, including your lender, so you can learn how rising mortgage rate environments impact your purchasing power. It may make sense to buy now before it costs more to do so, if you’re ready.

- As a seller, rising mortgage rates are motivating some homeowners to make a move up sooner rather than later. If you’re planning to buy your next home, talk to a trusted real estate advisor to decide how to time your move.

Home Prices Are Projected To Continue To Climb

Home prices are forecast to keep appreciating because there are still fewer homes for sale than there are buyers in the market. That said, experts agree the pace of that appreciation should moderate – but home prices won’t fall. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Prices throughout the country have surged for the better part of two years, including in the first quarter of 2022. . . Given the extremely low inventory, we’re unlikely to see price declines, but appreciation should slow in the coming months.”

- As a buyer, continued home price appreciation means it’ll cost you more to buy the longer you wait. But it also gives you peace of mind that, once you do buy a home, it will likely grow in value. That makes it historically a good investment and a strong hedge against inflation.

- As a seller, price appreciation is great news for the value of your home. Again, lean on a professional to strike the right balance of the best conditions possible for both selling your house and buying your next one.

Bottom Line

Whether you’re a homebuyer or seller, you need to know what’s happening in the housing market, so you can make the most informed decision possible. Let’s connect to discuss your goals and what lies ahead, so you can pick your best time to make a move.

Bright Days Are Ahead When You Move Up This Summer [INFOGRAPHIC]

![Bright Days Are Ahead When You Move Up This Summer INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/05/26132018/20220527-MEM-1046x1913.png)

Some Highlights

- Warmer weather and longer days mean summer is almost here. Celebrate by upgrading to the home of your dreams so you can enjoy all the season has to offer.

- When you list your house, you can capitalize on today’s sellers’ market to fuel your upgrade. Then, you can move to a home with the features you want, like space to entertain or rooms for work and play.

- If you’re ready to upgrade to a home that matches your changing needs, let’s connect.

Why Summer Is a Great Time To Buy a Vacation Home

You may be someone who looks forward to summer each year because it gives you an opportunity to rest, unwind, and enjoy more quality time with your loved ones. Now that summer is just around the corner, it’s worthwhile to start thinking about your plans and where you want to spend your vacations this year. Here are a few reasons a vacation home could be right for you.

Why You May Want To Consider a Vacation Home Today

Over the past two years, a lot has changed. You may be one of many people who now work from home and have added flexibility in where you live. You may also be someone who delayed trips for personal or health reasons. If either is true for you, there could be a unique opportunity to use the flexibility that comes with remote work or the money saved while not traveling to invest in your future by buying a vacation home.

Bankrate explains why a second home, or a vacation home, may be something worth considering:

“For those who are able, buying a second home is suddenly more appealing, as remote working became the norm for many professionals during the pandemic. Why not work from the place where you like to vacation — the place where you want to live?

If you don’t work remotely, a vacation home could still be at the top of your wish list if you have a favorite getaway spot that you visit often. It beats staying in a tiny hotel room or worrying about rental rates each time you want to take a trip.”

How a Professional Can Help You Find the Right One

So, if you’re looking for an oasis, you may be able to make it a second home rather than just the destination for a trip. If you could see yourself soaking up the sun in a vacation home, you may want to start your search. Summer is a popular time to buy vacation homes. By beginning the process now, you could get ahead of the competition.

The first step is working with a local real estate advisor who can help you find a home in your desired location. A professional has the knowledge and resources to help you understand the market, what homes are available and at what price points, and more. They can also walk you through all the perks of owning a second home and how it can benefit you.

A recent article from the National Association of Realtors (NAR), mentions some of the top reasons buyers today are looking into purchasing a second, or a vacation, home:

“According to Google’s data, the top reasons that homeowners cited for purchasing a second home were to diversify their investments, earn money renting, and use as a vacation home.”

If any of the reasons covered here resonate with you, connect with a real estate professional to learn more. They can give you expert advice based on what you need, your goals, and what you’re hoping to get out of your second home.

Bottom Line

Owning a vacation home is an investment in your future and your lifestyle. If this is one of your goals this year, you still have time to buy and enjoy spending the summer in your vacation home. When you’re ready to get started, let’s connect.

How Buying or Selling a Home Benefits the Economy and Your Community

If you’re thinking of buying or selling a home, chances are you’re focusing on the many extraordinary ways it’ll change your life. But do you know it has a large impact on your community too?

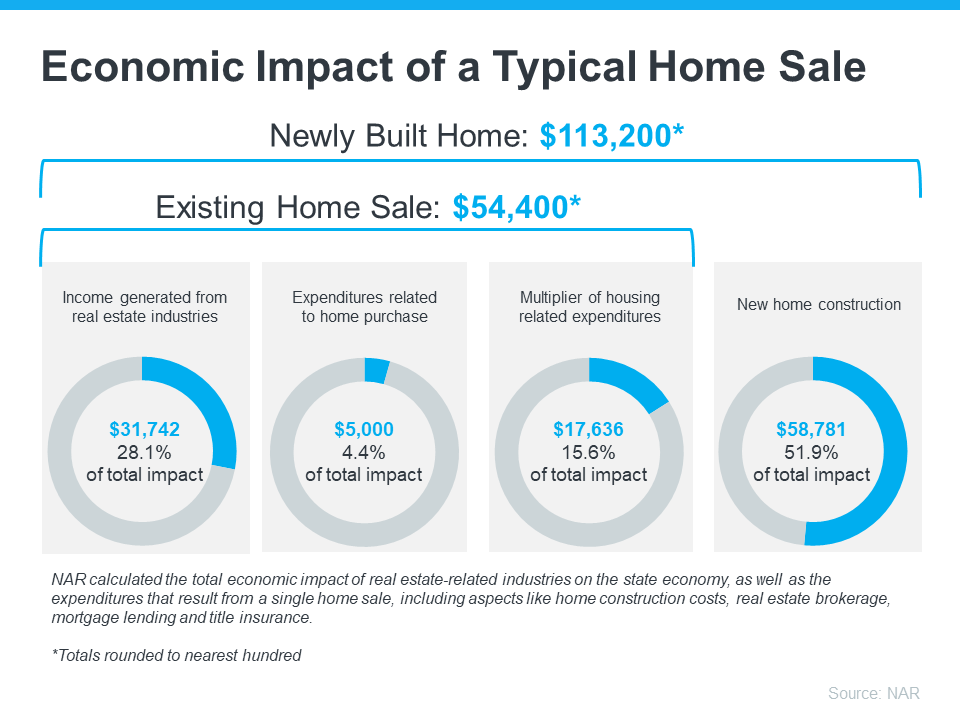

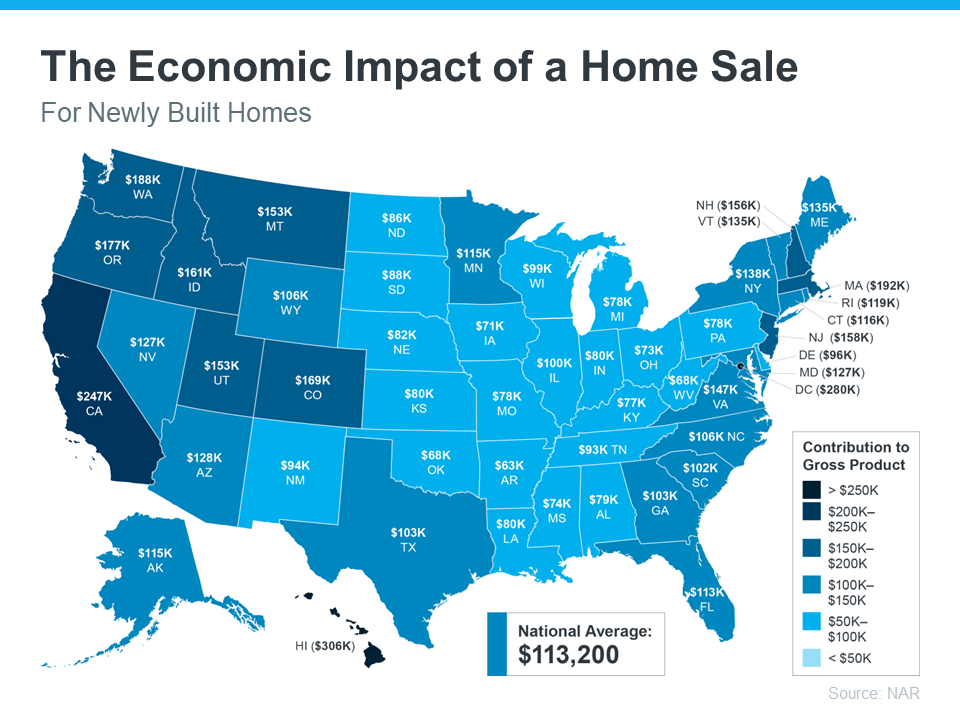

To measure that impact, the National Association of Realtors (NAR) releases a report each year to highlight just how much economic activity a home sale generates. The chart below shows how the sale of both a newly built home and an existing home impact the economy:

As the visual shows, a single home sale can have a significant effect on the overall economy. To dive a level deeper, NAR also provides a detailed look at how that varies state-by-state for newly built homes (see map below):

As the visual shows, a single home sale can have a significant effect on the overall economy. To dive a level deeper, NAR also provides a detailed look at how that varies state-by-state for newly built homes (see map below):

You may be wondering: how can a single home sale have such a major effect on the economy?

You may be wondering: how can a single home sale have such a major effect on the economy?

For starters, there are multiple industries that play a role in the process. Numerous contractors, specialists, lawyers, town and city officials, and so many other professionals are all necessary at various stages during the transaction. Every individual you work with, like your trusted real estate advisor, has a team of professionals involved behind the scenes.

That means when you buy or sell a home, you’re leaving a lasting impression on the community at large. Let the knowledge that you’re contributing to those around you while also meeting your own needs help you feel even more empowered when you decide to make your move this year.

Bottom Line

Homebuyers and sellers are economic drivers in their community and beyond. Let’s connect so you have a trusted real estate advisor on your side if you’re ready to get started. It won’t just change your life; it’ll make a powerful impact on your entire community.

Work With a Real Estate Professional if You Want the Best Advice

Because buying or selling a home is such a big decision in our lives, the need for clear, trustworthy information and guidance is crucial. And while no one can give you perfect advice, when you align yourself with an expert, you’ll get the best advice for your situation.

An Expert Will Give You the Best Advice Possible

Let’s say you need an attorney, so you seek out an expert in the type of law required for your case. When you go to their office, they won’t immediately tell you how the case is going to end or how the judge or jury will rule. What a good attorney can do, though, is discuss the most effective strategies you can take. They may recommend one or two approaches they believe will work well for your case.

Then, they’ll leave you to make the decision on which option you want to pursue. Once you decide, they can help you put a plan together based on the facts at hand. They’ll use their expert knowledge to work toward the resolution you want and make whatever modifications in the strategy necessary to try and achieve that outcome.

Similarly, the job of a trusted real estate professional is to give you the best advice for your situation. Just like you can’t find a lawyer to give you perfect advice, you won’t find a real estate professional who can either. They can’t because it’s impossible to know exactly what’s going to happen throughout your transaction. They also can’t predict exactly what will happen with conditions in today’s housing market.

But an expert real estate advisor is knowledgeable about market trends and the ins and outs of the homebuying and selling process. With that knowledge, they can anticipate what could happen based on your situation and help you put together a solid plan. And they’ll guide you through the process, helping you make decisions along the way.

That’s the very definition of getting the best – not perfect – advice. And that’s the power of working with an expert real estate advisor.

Bottom Line

If you want trustworthy advice when buying or selling a home, let’s connect so you have an expert real estate advisor on your side.

Lucyann Tinnirello steps down as Broker Manager of GTNYR

[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”3.0.47″][et_pb_row admin_label=”row” _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text admin_label=”Text” _builder_version=”3.18.2″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]

Lucyann Tinnirello may be stepping down as Broker Manager of GTNYR, but that is by no means the end of her Green Team story. In fact, that story began in 1984, when Lucyann started her career with Geoff Green’s father at ERA Joseph Green Real Estate. From there, Lucyann worked at several other agencies, including co-owning her own firm. When she joined Green Team in 2008, she felt as though she had come full circle. In 2018, Lucyann was elected broker manager of [what was formerly known as] Green Team Home Selling System. Now, she is looking forward to working full-time with her clients.

A message from Geoff Green…

“LucyAnn has been an asset to our office as Broker Manager since she stepped into the role in 2018. Her experience in real estate made her the perfect candidate to not only handle the details of management but also to solve problems and help agents succeed. Additionally, Lucyann always exceeded our expectations in terms of caring for everyone in our Agency. Lucyann will always take the shirt off her back to help those around her, and she did just that for many of our Agents through the years. And, now that Lucyann has decided to step down as Broker Manager she will be re-focusing her time and energy on her own real estate sales, remaining as one of our beloved Agents.”

Lucyann’s Words of Wisdom

Lucyann lives by her credo, “It’s nice to be important but it’s more important to be nice.” It’s no surprise, then, that she is much-loved by fellow agents. When Lucyann comes across a quote that inspires her, she embraces and shares it. For instance, Lucyann has another quote, with a story behind it. She considers herself lucky to have attended a motivational workshop by the legendary former Notre Dame Football Coach, Lou Holtz. And, Lucyann took to heart his words: ‘WIN – What’s Important Now!” She’ll tell you the importance of staying in the moment,

Jennifer DiCostanzo

“Kindness and compassion are Lucyann’s trademarks. She supports agents with both personal and professional growth.”

Tiffany Megna

Tiffany Megna shared some of Lucyann’s quotes. For instance, instead of saying goodbye, Lucyann says, “Be safe!” The agents have trust in LucyAnn: if someone came to her with a problem, they knew their conversation would be kept confidential. She would always conclude the discussions with ” It’s your story to tell” letting them know that it would be safe in the Lucyann vault. Tiffany and Lucyann also created their own saying, by shortening “Hello, Lucyann,” to “HiLu!” This is now a regular greeting.

Krissy Many

“When I reflect back on the time she served; I am most appreciative for her making herself available and her undying support of her agents. She always had our backs ( and if needed; told us privately what we did wrong). Lucyann was a defender! She was “Switzerland.” I appreciated her wisdom and sense of humor, and look forward to enjoying her company in the office as she has an abundance of both!! She is thoughtful and often surprised us at our breakfast meetings with tokens of love and kindness. That is just who she is…. Thoughtful, kind, funny, and supportive. I will never hear the phrases “Be Safe” and “It is nice to be important but more important to be nice!” and not think of Lucyann. Thanks to Lucyann her for her support and service. I wish her the very best in the next chapter of her business”.

Nancy Sardo

“Lucyann has a genuine, unconditional love for people. She can be defined by her ability to do her very best to make things go as smoothly as possible in this crazy world of real estate, she will be missed as our Broker Manager. However, I am sure she is going to welcome the extra time with her beautiful family and grandchildren. Be Safe Lou–Love”

Morgan Beattie

“Ever since starting at Green Team, Lucyann has welcomed me with open arms. She is the person you can go to for anything. It can be a real estate question or even life advice, Lu will always be there for you no matter what.”

A celebration to say Thank You, Lucyann!

And what better way to celebrate than Happy Hour at Warwick Thai! A group of Green Team Sales Associates gathered to say thank you on Lucyann’s last day as broker manager. Stepping up to that position is Carol Buchanan, who will be featured in an upcoming post. Lucyann proudly held up a card, which reads: “I’m not old – I’m Vintage!”

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

Don’t Let Rising Inflation Delay Your Homeownership Plans [INFOGRAPHIC]

![Don’t Let Rising Inflation Delay Your Homeownership Plans INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/05/18153723/20220520-MEM-1046x2334.png)

Some Highlights

- If recent headlines about rising inflation are making you wonder if it’s still a good time to buy, here’s what experts have to say.

- Housing is an asset that typically grows in value. Plus, your mortgage helps stabilize your monthly housing costs, and buying protects you from rising rents.

- Experts say owning a home is historically a good hedge against inflation. Let’s connect if you’re ready to start the homebuying process today.

The Largest Green to Green Residential Sale

Congratulations to Jennifer DiCostanzo as the listing agent for 30 Cardinal Lane. This magnificent home sold for $1,490,000, the largest residential Green Team to Green Team listing sale to date. Tiffany Megna represented the buyers.

Jennifer DiCostanzo

Listing and showing high-end luxury homes requires a real estate professional who understands the quintessential details the property offers, aligning to the buyer’s specific criteria. Jennifer has expertise in marketing such homes, as was the case with 30 Cardinal Lane. This magnificent home was built to provide sustainability, privacy, and luxury living, both indoors and out. By customizing marketing approaches for her selling clients, Jennifer understands the uniqueness of each property. She intuitively captures buyers’ interest with strategic strategies emphasizing the lifestyle and story these prestigious homes offer to prospective buyers- case in point 30 Cardinal Lane.

Tiffany Megna

Tiffany Megna works hard, with her goal to be better every year. A former teacher, Tiffany understands the importance of listening and understanding her clients’ needs. She has achieved designations as a Pricing Strategy Advisor, Accredited Buyer Representative, and an At Home with Diversity certification. Furthermore, she has her Seller Representative Specialist and Short Sales and Foreclosure Resource certifications. With each designation, she feels she has more to offer her clients.

A dynamic Team

The real estate market has been booming since the pandemic affected the way we live and our ideas of what a home should be. Jennifer has been working non-stop and for the 6th straight year, is GTNYR Yearly Sales Leader, as well as the Q1 Sales Leader for 2022. Tiffany, also working non-stop, is ranked 2nd in Green Team New York Realty sales for 2021.

Now take a video tour of this magnificent home and property…

For many homebuyers, the beauty of Orange County, NY, and its picturesque villages and towns provide the perfect lifestyle balance with all the recreational amenities they desire. Ultimately, this property showcases some of the best that Orange County has to offer.

[

The One Thing Every Homeowner Needs To Know About a Recession

A recession does not equal a housing crisis. That’s the one thing that every homeowner today needs to know. Everywhere you look, experts are warning we could be heading toward a recession, and if true, an economic slowdown doesn’t mean homes will lose value.

The National Bureau of Economic Research (NBER) defines a recession this way:

“A recession is a significant decline in economic activity spread across the economy, normally visible in production, employment, and other indicators. A recession begins when the economy reaches a peak of economic activity and ends when the economy reaches its trough. Between trough and peak, the economy is in an expansion.”

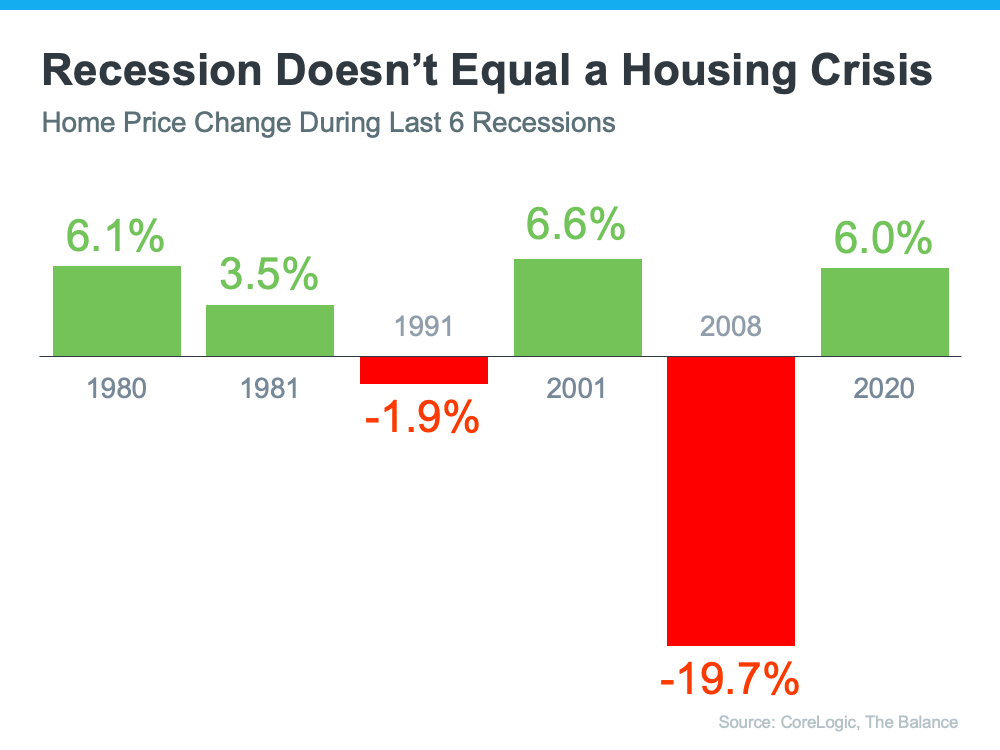

To help show that home prices don’t fall every time there’s a recession, take a look at the historical data. There have been six recessions in this country over the past four decades. As the graph below shows, looking at the recessions going all the way back to the 1980s, home prices appreciated four times and depreciated only two times. So, historically, there’s proof that when the economy slows down, it doesn’t mean home values will fall or depreciate.

The first occasion on the graph when home values depreciated was in the early 1990s when home prices dropped by less than 2%. It happened again during the housing crisis in 2008 when home values declined by almost 20%. Most people vividly remember the housing crisis in 2008 and think if we were to fall into a recession that we’d repeat what happened then. But this housing market isn’t a bubble that’s about to burst. The fundamentals are very different today than they were in 2008. So, we shouldn’t assume we’re heading down the same path.

Bottom Line

We’re not in a recession in this country, but if one is coming, it doesn’t mean homes will lose value. History proves a recession doesn’t equal a housing crisis.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link