Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

What’s Happening with Mortgage Rates, and Where Will They Go from Here?

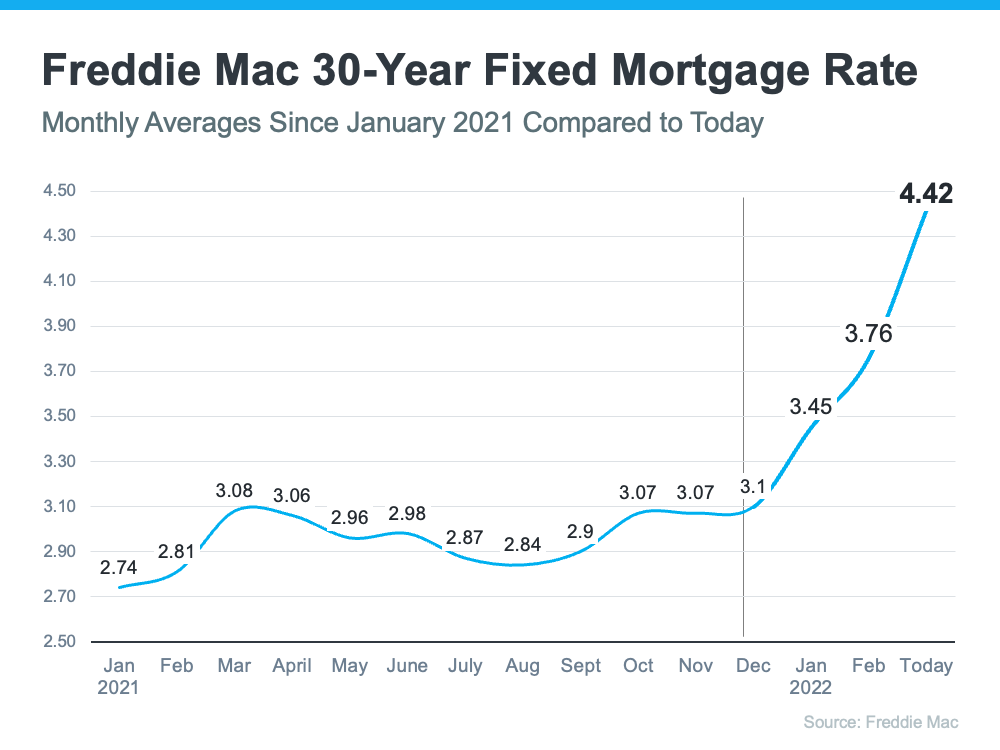

Based on the Primary Mortgage Market Survey from Freddie Mac, the average 30-year fixed-rate mortgage has increased by 1.2% (3.22% to 4.42%) since January of this year. The rate jumped by more than a quarter of a point from just a week ago. Here’s a visual to show how mortgage rate movement throughout 2021 was steady compared to the rapid increase in mortgage rates this year:

Just a few months ago, Freddie Mac projected mortgage rates would average 3.6% in 2022. Earlier this month, Fannie Mae forecast mortgage rates would average 3.8% in 2022. As the chart above shows, rates have already surpassed those projections.

Sam Khater, Chief Economist at Freddie Mac, explained in a press release last week:

“This week, the 30-year fixed-rate mortgage increased by more than a quarter of a percent as mortgage rates across all loan types continued to move up. Rising inflation, escalating geopolitical uncertainty and the Federal Reserve’s actions are driving rates higher and weakening consumers’ purchasing power.”

Where Are Mortgage Rates Going from Here?

In a recent article by Bankrate, several industry experts weighed in on where rates might be headed going forward. Here are some of their forecasts:

Greg McBride, Chief Financial Analyst, Bankrate:

“With inflation figures continuing to surprise to the upside, mortgage rates will remain above 4.0% on the 30-year fixed.”

Nadia Evangelou, Senior Economist and Director of Forecasting, National Association of Realtors (NAR):

“While higher short-term interest rates will push up mortgage rates, I expect some of this impact to be mitigated eventually through lower inflation. Thus, I expect the 30-year fixed mortgage rate to continue to rise, although we aren’t likely to see the big jumps that occurred over the past few weeks.”

Len Kiefer, Deputy Chief Economist, Freddie Mac:

“Mortgage rates are likely to continue to move higher throughout the balance of 2022, although the pace of rate increases is likely to moderate.”

In a recent realtor.com article, another expert adds to the conversation:

Danielle Hale, Chief Economist, realtor.com:

“. . . As markets digest the Fed’s updated economic projections, I anticipate a continued increase in mortgage rates over the next several months. . . .”

What Does This Mean for You if You’re Looking To Buy a Home?

With both mortgage rates and home values expected to increase throughout the year, it would be better to buy sooner rather than later if you’re able. That’s because it’ll cost you more the longer you wait. But, there is a possible silver lining to buying a home right now. While you’ll be paying a higher price and a higher mortgage rate than you would have last year, rising prices do have a long-term benefit once you buy.

If you purchase a home today valued at $400,000 and put 10% down, you would be taking out a $360,000 mortgage. According to mortgagecalculator.net, at a 4.42% fixed mortgage rate, your mortgage payment would be $1,807 a month (this does not include insurance, taxes, and other fees because those vary by location).

Now, let’s put that mortgage payment into a new perspective based on the substantial growth in equity that comes with the escalation in home prices. Every quarter, Pulsenomics surveys a panel of over 100 economists, investment strategists, and housing market analysts about their expectations for future home prices in the United States. Last week, Pulsenomics released their latest Home Price Expectation Survey. The survey reveals that the average of the experts’ forecasts calls for a 9% increase in home values in 2022.

Based on those projections, a $400,000 house you buy today could be valued at $436,000 by this time next year. If you break that down, that means the equity in your home would increase by $3,000 a month over that period. That’s greater than the estimated monthly payment above. Granted, the increase in your net worth is tied to the home, but it is one way to put the home price appreciation to use in a way that benefits you.

Bottom Line

Paying a higher price for a home and a higher mortgage rate can be a difficult pill to swallow. However, waiting will just cost you more. If you’re ready, willing, and able to buy a home, now will be a better time than a year, or even six months from now. Let’s connect to begin the process today.

A Key To Building Wealth Is Homeownership

The link between financial security and homeownership is especially important today as inflation rises. But many people may not realize just how much owning a home contributes to your overall net worth. As Leslie Rouda Smith, President of the National Association of Realtors (NAR), says:

“Homeownership is rewarding in so many ways and can serve as a vital component in achieving financial stability.”

Here are just a few reasons why, if you’re looking to increase your financial stability, homeownership is a worthwhile goal.

Owning a Home Is a Building Block for Financial Success

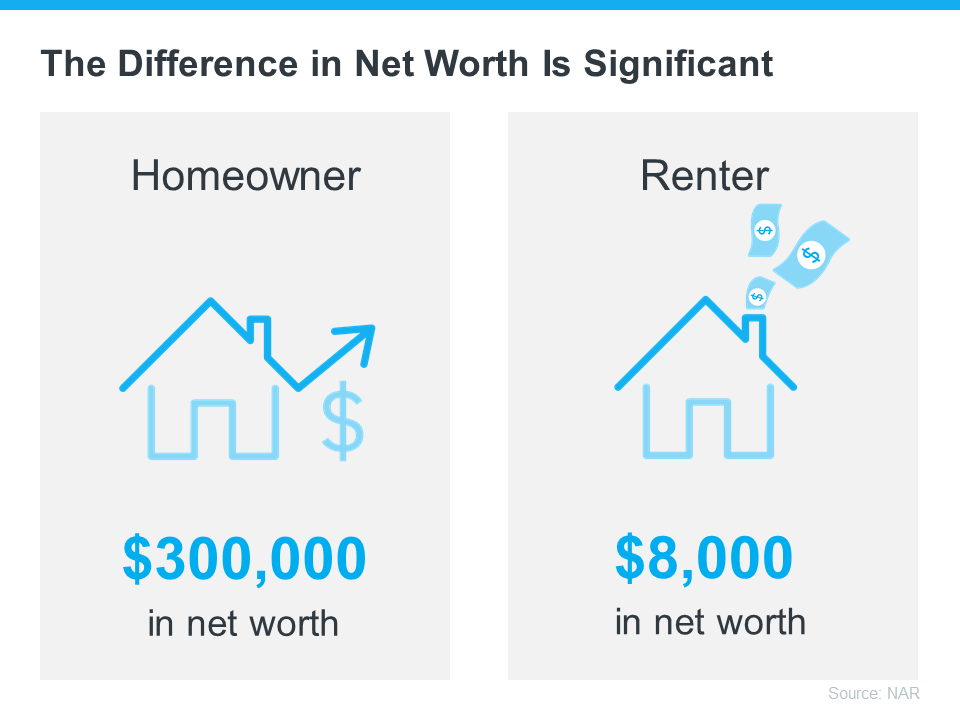

A recent NAR report details several homeownership trends and statistics, including the difference in net worth between homeowners and renters. It finds:

“. . . the net worth of a homeowner was about $300,000 while that of a renter’s was $8,000 in 2021.”

To put that into perspective, the average homeowner’s net worth is roughly 40 times that of a renter (see visual below):

The results from this report show that owning a home is a key piece to the puzzle when building your overall net worth.

Equity Gains Can Substantially Boost a Homeowner’s Net Worth

The net worth gap between owners and renters exists in large part because homeowners build equity. As a homeowner, your equity grows as your home appreciates in value and you make your mortgage payments each month.

In other words, when you own your home, you have the benefit of your mortgage payment acting as a contribution to a forced savings account. And when you sell, any equity you’ve built up comes back to you. As a renter, you’ll never see a return on the money you pay out in rent every month.

To sum it up, NAR says it simply:

“Homeownership has always been an important way to build wealth.”

Bottom Line

The gap between a homeowner’s net worth and a renter’s shows how truly foundational homeownership is to wealth-building. If you’re ready to start on your journey to homeownership, let’s connect today.

What You Can Expect from the Spring Housing Market

As the spring housing market kicks off, you likely want to know what you can expect this season when it comes to buying or selling a house. While there are multiple factors causing some uncertainty, including the conflict overseas, rising inflation, and the first rate increase from the Federal Reserve in over three years — the housing market seems to be relatively immune.

Here’s a look at what experts say you can expect this spring.

1. Mortgage Rates Will Climb

Freddie Mac reports the 30-year fixed mortgage rate has increased by more than a full point in the past six months. And despite some mild fluctuation in recent weeks, experts believe rates will continue to edge up over the next 90 days. As Freddie Mac says:

“The Federal Reserve raising short-term rates and signaling further increases means mortgage rates should continue to rise over the course of the year.”

If you’re a first-time buyer or a seller thinking of moving to a home that better fits your needs, realize that waiting will likely mean you’ll pay a higher mortgage rate on your purchase. And that higher rate drives up your monthly payment and can really add up over the life of your loan.

2. Housing Inventory Will Increase

There may be some relief coming for buyers searching for a home to purchase. Realtor.com recently reported that the number of newly listed homes has grown for each of the last two months. Also, the National Association of Realtors (NAR) just announced the months’ supply of inventory increased for the first time in eight months. The inventory of existing homes usually grows every spring, and it seems, based on recent activity, the next 90 days could bring more listings to the market.

If you’re a buyer who has been frustrated with the limited supply of homes available for sale, it looks like you could find some relief this spring. However, be prepared to act quickly if you find the right home.

If you’re a seller, listing now instead of waiting for this additional competition to hit the market makes sense. Your leverage in any negotiation during the sale will be impacted as additional homes come to market.

3. Home Prices Will Rise

Prices are always determined by supply and demand. Though the number of homes entering the market is increasing, buyer demand remains very strong. As realtor.com explains in their most recent Housing Report:

“During the final two weeks of the month, more new sellers entered the market than during the same time last year. . . . However, with 5.8 million new homes missing from the market and millions of millennials at first-time buying ages, housing supply faces a long road to catching up with demand.”

What does that mean for you? With the demand for housing still outpacing supply, home prices will continue to appreciate. Many experts believe the level of appreciation will decelerate from the high double-digit levels we’ve seen over the last two years. That means prices will continue to climb, just at a more moderate pace. Most experts are predicting home prices will not depreciate.

Won’t Increasing Mortgage Rates Cause Home Prices To Fall?

While some people may believe a 1% increase in mortgage rates will impact demand so dramatically that home prices will have to fall, experts say otherwise. Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae, says:

“What I will caution against is making the inference that interest rates have a direct impact on house prices. That is not true.”

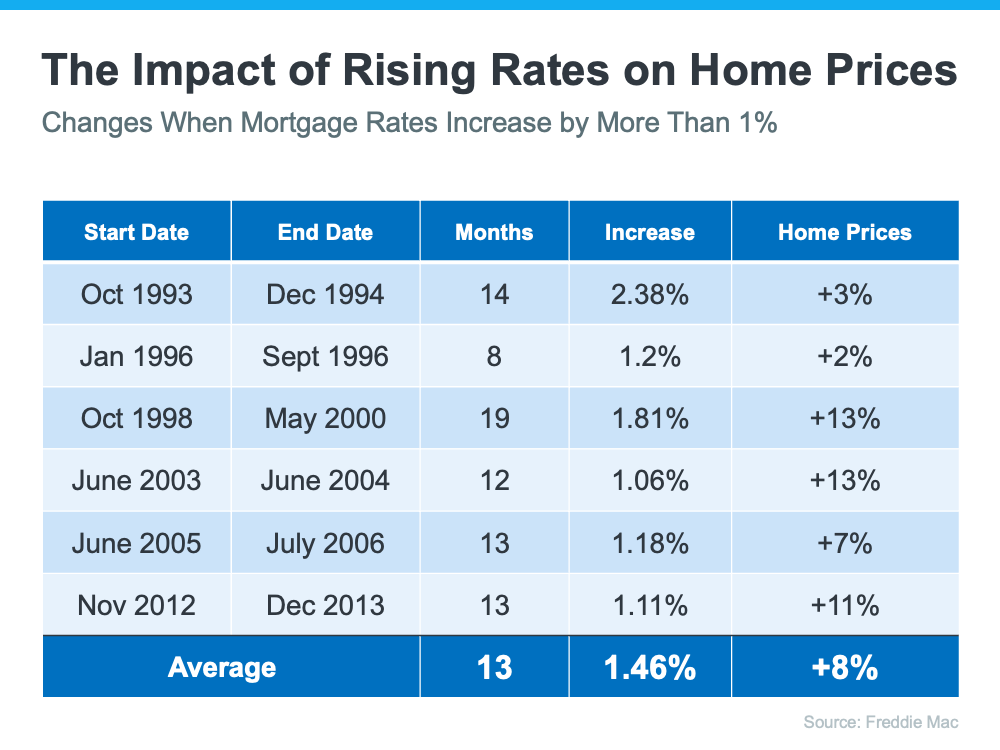

Freddie Mac studied the impact that mortgage rates increasing by at least 1% has had on home prices in the past. Here are the results of that study:

As the chart shows, mortgage rates jumped by at least 1% six times in the last thirty years. In each case, home values increased.

So again, if you’re a first-time buyer or a repeat buyer, waiting to buy likely means you’ll pay more for a home later in the year (as compared to its current value).

Bottom Line

There are three things that seem certain going into the spring housing market:

- Mortgage rates will continue to rise

- The selection of homes available for sale will modestly improve

- Home prices will continue to appreciate, just at a slightly slower pace

If you’re thinking of buying, act now before mortgage rates and home prices increase further. If you’re thinking of selling, your best bet may be to sell soon so you can beat the increase in competition that’s about to come to market.

What You Need To Know if You’re Thinking About Building a Home

If you’re ready to move up, you may be trying to decide whether you want to buy a home that’s already on the market or build a new one. And since the supply of homes available for sale today is low, you’re willing to consider either avenue. While home builders are doing everything they can to construct more houses and help narrow the supply shortage, they’re also facing delays due to factors outside of their control.

Here’s the latest on some of the key challenges homebuilders are experiencing today and how they could impact your plans to move up. When you know what’s happening in the industry, you can make an informed decision on whether to look for a newly built or an existing home in your home search.

Supply Chain Issues

The first hurdle builders are dealing with is the lack of supply of various building materials. According to a recent article from HousingWire:

“. . . Nearly everything needed in the homebuilding process is facing some sort of delay and subsequent price increase.”

The supply issue isn’t just with lumber, even though that’s what’s covered most in the news. The article explains many other supplies are impacted too, including roofing materials, windows, garage doors, siding, and gypsum (which is used in drywall).

The difficulty in getting these items is dragging out timelines for new homes as builders wait on what they need to finish construction. And since materials are in short supply, even when they do get the product, the principle of supply and demand is driving prices up for those goods. HousingWire explains it like this:

“When supplies are low, charges inevitably go up, . . . Meanwhile, a lack of availability is causing huge delays, meaning builders are struggling to stay on schedule.”

The National Association of Home Builders (NAHB) agrees:

“Builders are grappling with supply-chain issues that are extending construction times and increasing costs.”

Skilled Labor Shortage

But that’s not the only challenge with new home construction today. Builders are also having a hard time finding skilled labor, which means they’re short-handed, further dragging out their timelines. Odeta Kushi, Deputy Chief Economist at First American, says this is an ongoing challenge for the industry:

“The skilled labor shortage in the construction industry is not new – it’s been an issue for more than a decade now.”

But there is good news. The February jobs report shows employment gains in the construction industry. Kushi puts this encouraging news into perspective in the article mentioned above:

“Overall this was a good report, . . . The supply of workers continues to fall short of demand, but the underlying momentum of the labor market recovery is strong, and falling COVID case counts provide further forward momentum.”

That means, while finding workers continues to be a challenge for builders, there are signs of positive momentum moving forward.

How This Impacts You

HousingWire explains how these things can impact move-up buyers today:

“The residential construction industry is facing a crisis as builders manage the critical shortage of building materials and labor. Explosive supply and labor costs are forcing long delays. . . .”

So, when you weigh your options and try to decide between building a home or buying an existing one, factor the potential delay in new home construction into your decision. While it doesn’t mean you should cross newly built homes off your list, it does mean you should consider your timeline and if you’re willing to wait while your home is being constructed.

Bottom Line

When planning your next move, understanding the latest market conditions is key to making the best decision possible. To make sure you have all the information you need, let’s connect. Together we can make sure you know what’s happening in our local market so you can confidently decide what’s right for you, your priorities, and your timeline.

The Many Benefits of Homeownership

The past two years have taught us the true value of homeownership, especially the stability and the feeling of accomplishment it can provide. But homeownership has so much more to offer. Here’s a look at a few of the non-financial and financial benefits of owning a home. If you’re looking to buy a home today, think about all the ways homeownership can impact your life.

Homeownership Has Impactful Personal and Emotional Benefits

Owning your home gives you a significant sense of pride because it’s a space that is truly yours. And as a homeowner, you can customize your home to your heart’s desire. Having a space you’ve put your stamp on enhances the pride and sense of ownership you may feel.

And that sense of ownership can extend beyond your shelter to help create social, community, and civic benefits as well. That’s because the average homeowner stays in their home for longer than just a few years. That means you’ll naturally feel a stronger connection to the community around you the longer you live there. This can help you experience a greater sense of belonging and a greater stake in your community as a whole. As the National Association of Realtors (NAR) says:

“Living in one place for a longer amount of time creates an obvious sense of community pride, which may lead to more investment in said community.”

Owning a Home Is a Significant Step Toward Financial Stability

In a financial sense, homeowners benefit from home price appreciation, equity gains, and having a shield against some of the effects of inflation. These benefits can have a big impact on your life. As you gain equity through home price appreciation and paying down your mortgage, you build your net worth. And in times of inflation, your 30-year fixed-rate mortgage can help you stabilize one of your largest monthly expenses for the duration of your loan.

Lawrence Yun, Chief Economist for NAR, explains how you can start to see these lasting effects of homeownership as soon as you make your purchase:

“Owning a home continues to be a proven method for building long-term wealth. . . . Home values generally grow over time, so homeowners begin the wealth-building process as soon as they make a down payment and move to pay down their mortgage.”

Knowing you’ve made a good investment soon after your purchase is powerful. And that may give you confidence in your decision to buy a home.

Bottom Line

The benefits of owning a home are foundational. As a homeowner, you can feel proud of the space you call home and know you’ve made a sound financial investment. To learn how homeownership can help you, let’s connect to start the conversation today.

The Perks of Owning More Than One Home

Many things have changed over the past couple of years, and real estate is no exception. One impact is an increased desire to own more than one home. According to the recent Luxury Market Report from Luxury Home Marketing:

“As trends such as remote working and flexi-hours took hold in 2021, so too did the flexibility of relocating as well as the growth of second homeownership.”

This may be because the pandemic has altered how we think about our homes. Where we live has become, more than ever, our safe space and our getaway. And with the rise in remote work, more people are reconsidering where they want to live and buying second homes to give them greater flexibility. If you fall in that category, here are just a few of the perks you’ll enjoy, and how owning a second home may be a great decision for your lifestyle and your future.

Enjoy a Change in Scenery (or Weather)

When you have two homes, you can alternate between them as the weather changes or as you crave different scenery. Do you want to live in an area with a particular season? Would alternating between a resort and a suburban setting be ideal? With two homes, you have those options. Being able to move between homes based on which location best suits you at the time gives you added flexibility and variety that can help increase your happiness.

Build Your Wealth Faster

You may have heard that home equity is skyrocketing, thanks to ongoing home price appreciation. CoreLogic reports that the average homeowner gained $56,700 in equity over the last year. With home prices projected to continue rising, if you purchase a second home, you could benefit from rising equity on both properties to build your wealth (and your net worth) even faster.

Be Closer to Loved Ones

The pandemic has also reignited the importance of being near our loved ones. One option worth exploring is whether you want your second home to be near the people who matter most in your life. This makes it easier to see your loved ones but still gives you your own dedicated, private space so you can be nearby for major life events or longer visits.

Lock in Your Expenses

Buying a second home today and locking in your mortgage rate may be a good option if you’re looking to stabilize your housing costs for the long haul. If you’re approaching retirement or are looking to use your second home as your permanent residence in the future, buying that house now with today’s rate and price may be a good financial decision. That way, no matter what happens with rates and prices in years ahead, your monthly payment is locked in for the next 15-30 years.

Bottom Line

Having multiple homes has considerable benefits. If owning a second home is something you’re interested in, let’s connect to explore your options, discuss the benefits, and take the next step to start your home search.

The Difference Between Renting and Owning

![The Difference Between Renting and Owning [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/02/24130106/20220225-MEM-1046x2279.png)

Some Highlights

- If you’re deciding whether to rent or buy, consider the many financial benefits that come with owning a home.

- As a renter, you build your landlord’s wealth and face rising costs. As a homeowner, you build your own net worth and can lock in your monthly payments for the length of your loan.

- If you’re weighing your options, remember that owning a home is a decision that has considerable financial perks. If you want to learn more, let’s connect to talk about the perks of homeownership.

Supply and Demand in Today’s Market

![Supply and Demand in Today’s Market [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/03/03164955/20220304-MEM-1046x2586.png)

Some Highlights

- Today’s housing market is the direct result of low supply and high buyer demand. Here’s what that means for you and your plans to buy or sell.

- For buyers, expect competition, be ready to move fast, and be prepared to submit your strongest offer. For sellers, know your house will be the center of attention and that it’ll likely sell quickly and get multiple offers.

- If you’re ready to move, let’s connect to talk about our local area and how you can take advantage of today’s unprecedented housing market.

Millennials: Do You Need a Home with More Space?

If you’re a millennial, homebuying might be top of mind for you. Your generation is the largest group of homebuyers in the market today and has been since 2014, according to the National Association of Realtors (NAR). And while other millennials are looking to buy for the first time, you may be one of the many who are now discovering you’ve outgrown your home.

If that’s the case, you’re not alone. The past two years brought about significant changes for many people, and today, homeowners are reevaluating what they truly need in a home. As a recent report from the Wall Street Journal states:

“They say the pandemic and the emergence of remote work accelerated millennial home-buying trends already under way. . . . Millennials who already owned homes traded up for more space.”

So, if you’re working remotely now or simply have a growing need for additional space, it may be time to move. And even if you purchased your current home sometime over the last few years, you can still move into a different one that has the space and features you’re looking for. That’s because there’s a good chance you have more equity than you realize. As Diana Olick, Real Estate Correspondent for CNBC, notes:

“The stunning jump in home values over the course of the Covid-19 pandemic has given U.S. homeowners record amounts of housing wealth. . . . Even homeowners who weren’t listing their properties for sale were gaining equity. About 42% of homeowners were considered equity-rich at the end of last year, meaning their mortgages were half or less than half the value of their home.”

Growing equity can be the key you need to fuel your next move, especially if you’re looking to purchase a larger home. When you sell your current house, the equity that comes back to you in the sale can be used toward the down payment on your next home.

In other words, your purchasing power may be greater than you realize, making a move to a larger home a realistic option. That, plus your changing needs, might make moving now more desirable than ever.

Bottom Line

If you’re a millennial thinking about moving this year, you’re not alone. Let’s connect today to discuss the equity you have in your current home and the opportunities it can create. Contact Green Team Realty

The Average Homeowner Gained More Than $55K in Equity over the Past Year

If you’re a current homeowner, you should know your net worth just got a big boost. It comes in the form of rising home equity. Equity is the current value of your home minus what you owe on the loan. Today, you’re building that equity far faster than you may expect – and this gain is great news for you.

Here’s how it happened. Home values are on the rise thanks to low housing supply and high buyer demand. Basically, there aren’t enough homes available to meet this high buyer interest, so bidding wars are driving home prices up. When you own a home, the rising prices mean your home is worth more in today’s market. And as home values climb, your equity does too. As Dr. Frank Nothaft, Chief Economist at CoreLogic, explains:

“Home prices rose 18% during 2021 in the CoreLogic Home Price Index, the largest annual gain recorded in its 45-year history, generating a big increase in home equity wealth.”

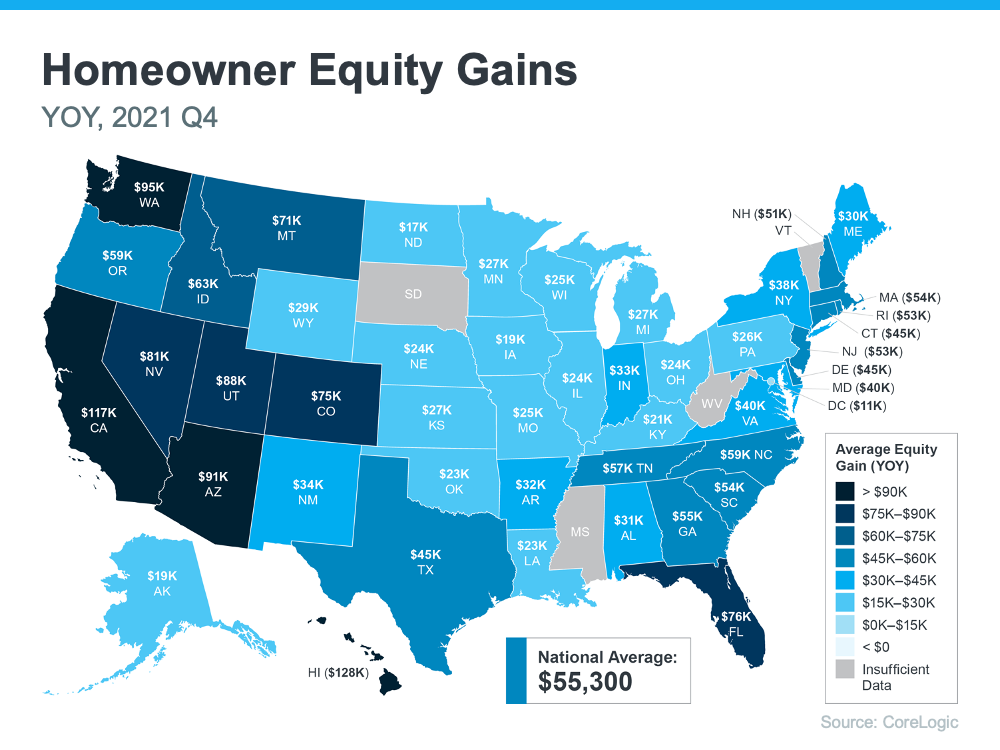

The latest Homeowner Equity Insights from CoreLogic shed light on just how much rising home values have boosted homeowner equity. According to that report, the average homeowner’s equity has grown by $55,300 over the last 12 months.

Want to know what’s happening in your area? Here’s a breakdown of the average year-over-year equity growth for each state based on that data.

How Rising Equity Impacts You

In addition to building your overall net worth, equity can also help you achieve other goals like buying your next home. It works like this: when you sell your house, the equity you built up comes back to you in the sale.

In a market where you’re gaining so much equity, it may be just what you need to cover a large portion – if not all – of the down payment on your next home. So, if you’ve been holding off on selling and worried about being priced out of your next home because of today’s home price appreciation, rest assured your equity can help fuel your move.

Bottom Line

Equity can be a real game-changer if you’re planning to make a move. To find out just how much equity you have in your home and how you can use it to fuel your next purchase, let’s connect so you can get a professional equity assessment report on your house.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link