Homeowners & Appraisers See the Most Eye-to-Eye on Price in 3 Years

In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. Many experts are projecting that home values could appreciate by another 5% (or more) over the next twelve months. One major challenge in such a market is the bank appraisal.

When prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the same neighborhood that recently closed) to defend the selling price when performing the appraisal for the bank.

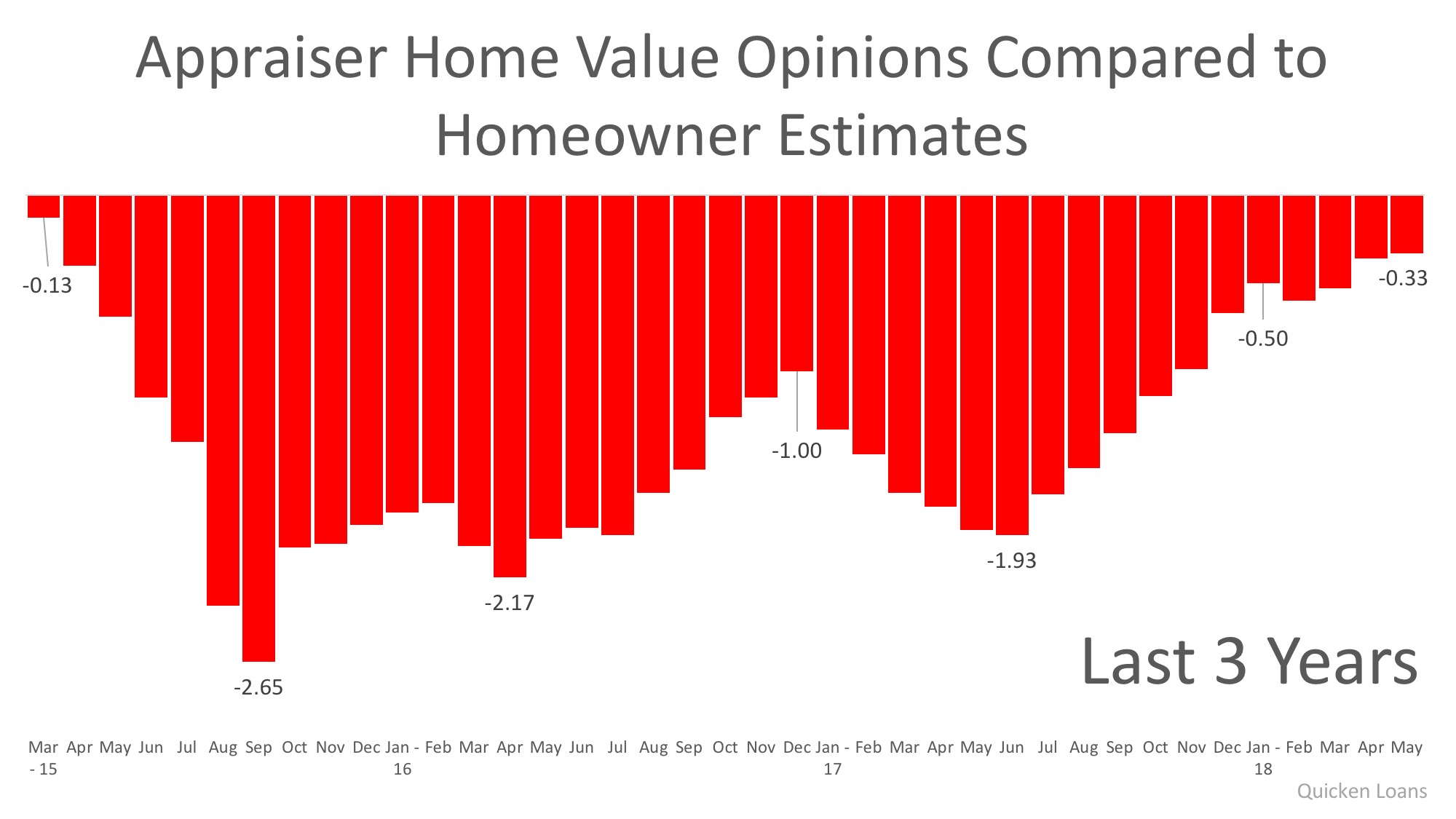

Every month in their Home Price Perception Index (HPPI), Quicken Loans measures the disparity between what a homeowner who is seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

March 2015 marked the first month of a three-year gap between what an appraiser and a homeowner believed a home was worth. That gap widened to 2.65% in September 2015 and had consistently hovered between 1.0% and 2.0% through November 2017.

The chart below illustrates the changes in home price estimates over the last three years:

In the latest release, the disparity was the narrowest it has been since March 2015, as the gap between appraisers and homeowners was only -0.33%. This is important for homeowners to note as even a .33% difference in appraisal could equate to thousands of dollars that a buyer or seller has to come up with at closing (depending on the price of the home).

Bill Banfield, Executive VP of Capital Markets at Quicken Loans urges homeowners to find out how their local markets have been impacted by supply and demand:

“The appraisal is one of the most important, although sometimes least predictable, parts of the mortgage process. The Home Price Perception Index is a way to illustrate the differences of opinion, and these differences affect everything from the type of mortgage a borrower can get to the expectations a seller has about the proceeds available upon sale of their home.”

Bottom Line

Every house on the market must be sold twice; once to a prospective buyer and then again to the bank (through the bank’s appraisal). With escalating prices, the second sale may be even more difficult than the first. If you are planning on entering the housing market this year, let’s get together to discuss this and any other obstacles that may arise.

What’s Your Home’s Value? – Click Here

The Green Team Welcomes James House, Chris and Megan Kimiecik and Kristine Many

The Green Team welcomes James House, Megan Kimiecek and Kristine Many to the company. Each brings unique skills and experience to the Green Team family.

James House

James House became interested in pursuing a career in real estate while helping a family member sell his home and finding that he enjoyed the whole process. He also found that his background in sales, construction and social media marketing enhanced his ability to provide exceptional service to his clients.

James House became interested in pursuing a career in real estate while helping a family member sell his home and finding that he enjoyed the whole process. He also found that his background in sales, construction and social media marketing enhanced his ability to provide exceptional service to his clients.

Born and raised here, James knows not only Warwick but Orange and Sussex Counties. Besides his hands-on experience remodeling homes, he has also developed a network of contractors that he can recommend to buyers who may want to make improvements to their new home, or sellers who want to do some renovations prior to putting their home on the market.

Chris and Megan Kimiecik

Chris and Megan Kimiecik are a team. Married for 11 years, they spent the past 9 years buying and rehabbing properties throughout Orange County, while raising their three daughters, aged 3, 5 and 8. And now, as licensed real estate sales associates, they continue to work together.

Chris and Megan Kimiecik are a team. Married for 11 years, they spent the past 9 years buying and rehabbing properties throughout Orange County, while raising their three daughters, aged 3, 5 and 8. And now, as licensed real estate sales associates, they continue to work together.

Megan is a nurse working per diem in the Warwick Valley School District and Chris runs a busy landscaping business. But, no matter how busy their lives are, this team provides exceptional service to their real estate clients.

Kristine Many

Kristine (“Krissy”) Many sees herself as a Real Estate Consultant, not selling, not pushing. She is there to answer her clients’ questions and help them through the process. Krissy realizes that every transaction, every client is individual, no two the same. Sometimes she is called upon to act as life coach, or mom, or confidant or teacher. Each client is her #1 client, and her clients often become friends.

Kristine (“Krissy”) Many sees herself as a Real Estate Consultant, not selling, not pushing. She is there to answer her clients’ questions and help them through the process. Krissy realizes that every transaction, every client is individual, no two the same. Sometimes she is called upon to act as life coach, or mom, or confidant or teacher. Each client is her #1 client, and her clients often become friends.

Krissy has some very important advise for sellers. Whether they want to move or have to move, it’s an emotional time. They need to disconnect and remember… sell the house, buy the home. She also has a word of caution for buyers. Never discuss important issues in the house. A bad experience with a nanny cam when she was looking at homes in Oklahoma taught her that the hard way.

Krissy loves the satisfaction of matchmaking people with what they need. She loves problem solving and making things happen. Learn more about Krissy on her webpage.

Excitement is building at Green Team New Jersey Realty

Excitement is building at Green Team New Jersey Realty, which launched in September of 2016. In less than two years it has become one of the top 20 real estate agencies in all of Sussex County. Furthermore, it is now one of the top 5 agencies in Vernon. Its formula for success is simple. Follow the systems and training set up by Geoffrey Green, founder of the Green Team Home Selling System in Warwick, New York and a partner in the New Jersey Office. Then put together a dynamic team of realtors who take to heart the Green Team’s commitment to exceed client expectations.

JOYCE ROGERS – FIRST QUARTER SALES LEADER, GOING FOR BROKE(R)

For Joyce Rogers, the first quarter of 2018 has shown what can be accomplished when someone sets a goal and keeps going until it’s achieved.

For Joyce Rogers, the first quarter of 2018 has shown what can be accomplished when someone sets a goal and keeps going until it’s achieved.

Joyce became the Sales Leader at Green Team New Jersey Realty for the first quarter of 2018. For Joyce, there is a great deal of personal satisfaction in joining the ranks of those who taught her. And, in this case, surpassing their sales. It has meant a lot of hard work, something Joyce is used to. She makes herself available to her clients whenever they need her. She appreciates the ability the Green Team affords to be able to work from wherever you are. She’s even closed a deal in Shoprite’s parking lot. Joyce feels she is hitting her stride and, while this is her first time achieving this goal, it is most likely not her last.

What makes Joyce’s achievement even more laudable is that she was going for her broker’s license at the same time. She began in December 2017, taking classes twice a week and studying hard and in March got her broker’s license on her first try!

Geoff Green describes Joyce as “driven,” and as someone he knows can make happen whatever she wants. Joyce appreciates Geoff’s support and his vision of the telecommuting model, as well as the camaraderie that sales associates have with each other. They work well together and help each other. And we applaud and congratulate Joyce on her double achievement, looking forward to seeing what comes in the future.

Meet Jared Kunish

Every new sales associate who joins the Green Team brings a unique background and skill set. And Jared Kunish is no exception. With his background as a hedge fund trading manager, Jared’s professional knowledge of  interest rates and housing market trends was a definite plus. But Jared was looking for more than the fast-paced, stress-filled life he’d been living in the financial world. Rather, he was looking for a quality driven life. One to share with his three children. He began following his passions, expanding his knowledge base. Woodworking, making furniture with his own hands, helped ground him. So did being an amateur chef.

interest rates and housing market trends was a definite plus. But Jared was looking for more than the fast-paced, stress-filled life he’d been living in the financial world. Rather, he was looking for a quality driven life. One to share with his three children. He began following his passions, expanding his knowledge base. Woodworking, making furniture with his own hands, helped ground him. So did being an amateur chef.

Becoming a real estate sales agent in Sussex County and a resident of Crystal Springs seems like a natural progression to Jared. He’s far away from the rat race. And he enjoys working with people, helping them find the place that will bring them happiness. Jared enjoys making things as easy as he can for his clients

Don’t Wait to Sell Your House! Buyers Are Out Now

Recently released data from the National Association of Realtors (NAR) suggests that now is a great time to sell your home. The concept of ‘supply & demand’ reveals that the best price for an item is realized when the supply of that item is low and the demand for that item is high.

Let’s see how this applies to the current residential real estate market.

SUPPLY

It is no secret that the supply of homes for sale has been far below the number needed to sustain a normal market for over a year at this point. A normal market requires six months of housing inventory to meet the demand. The latest report from NAR revealed that there is currently only a 3.6-month supply of houses on the market.

Supply is currently very low!

DEMAND

A report that was just released tells us that demand is very strong. The most recent Foot Traffic Report (which sheds light on the number of buyers who are actually out looking at homes) disclosed that “foot traffic grew 10.5 points to 52.4 in March as the new season approaches.”

Demand is currently very high!

Bottom Line

Waiting to sell will only increase the competition between you and all of the other sellers putting their houses on the market later this summer. If you are debating whether or not to list your home, let’s get together to discuss the conditions in our market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link