On the Fence of Whether or Not To Move This Spring? Consider This.

If you’re thinking of selling your house, it may be because you’ve heard prices are rising, listings are going fast, and sellers are getting multiple offers on their homes. But why are conditions so good for sellers today? And what can you expect when you move? To help answer both of those questions, let’s turn to the data.

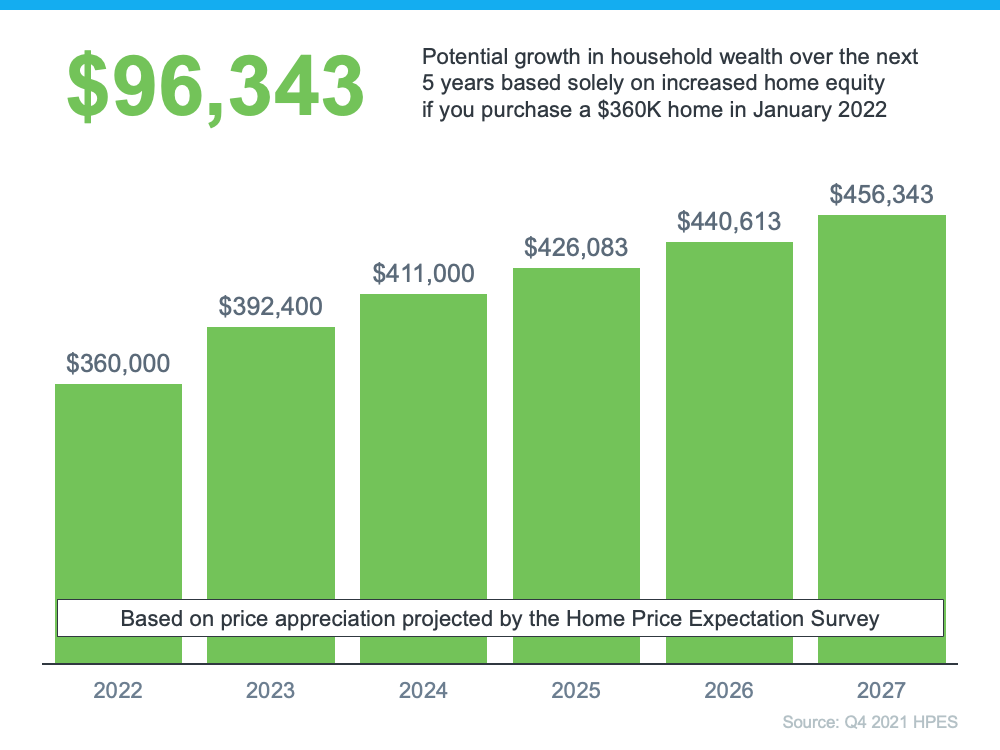

Today, there are far more buyers looking for homes than sellers listing their houses. Here are the maps of the latest buyer and seller traffic from the National Association of Realtors (NAR) to help paint the picture of what this looks like:

Notice how much darker the blues are on the left. This shows buyer traffic is strong today. In contrast, the much lighter blues on the right indicate weak or very weak seller traffic. In a nutshell, the demand for homes is significantly greater than what’s available to purchase.

What That Means for You

You have an incredible advantage when you sell your house under these conditions. Since buyer demand is so high at a time when seller traffic is so low, there’s a good chance buyers will be competing for your house.

According to NAR, in February, the average home sold got 4.8 offers. When buyers have to compete with one another like this, they’ll do everything they can to make their offer stand out. This could play to your favor and mean you’ll see things like waived contingencies, offers over asking price, earnest money deposits, and more. Selling when demand is high and supply is low sets you up for a big win.

If you’re also looking to buy a house, you may be tempted to focus more on just the seller traffic map and wonder if it means you’ll have trouble finding your next home. But remember this: perspective is key. As Danielle Hale, Chief Economist at realtor.com, says:

“The limited number of homes for sale is a lesson in perspective. This same stat that frustrates would-be homebuyers also means that today’s home sellers enjoy more limited competition than last year’s home sellers.”

If you look at the big picture, the opportunity you have as a seller today is unprecedented. Last year was a hot sellers’ market. This year, inventory is even lower, and that means an even bigger opportunity for you. Even though finding your next home in a market with low inventory can be challenging, is that concern worth passing on some of the best conditions sellers have ever seen?

As added peace of mind, remember real estate professionals have been juggling this imbalance of supply and demand for nearly two years, and they know how to help both buyers and sellers find success when they move. A skilled agent can help you capitalize on the great opportunity you have as a seller today and guide you through the buying process until you find the perfect place to call your next home.

Bottom Line

If you’re ready to move, you have an incredible opportunity in front of you today. Trust the experts. Let’s connect so you have expertise on your side that can help you win when you sell and when you buy.

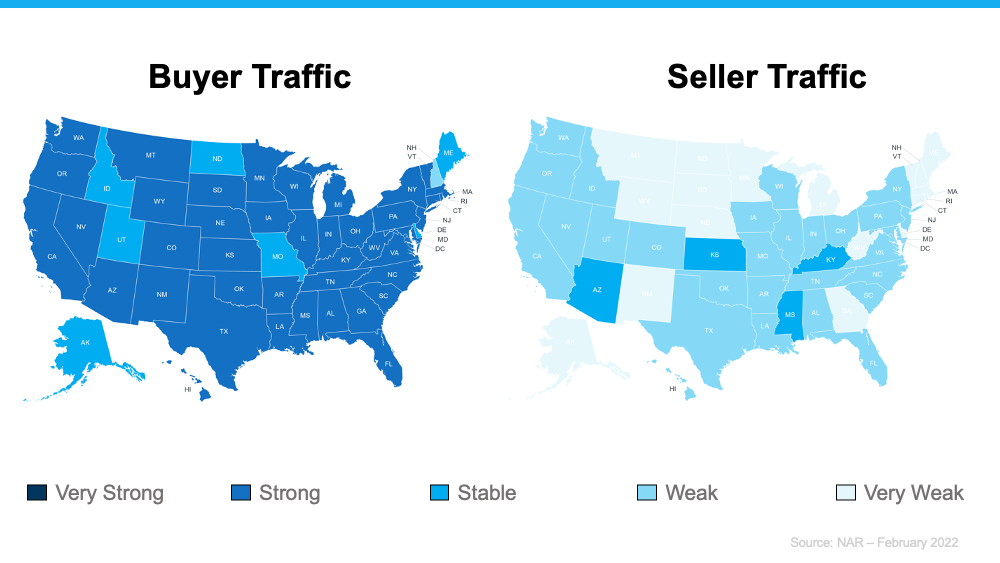

Why a Real Estate Professional Is Key When Selling Your House

With today’s real estate market moving as fast as it is, working with a real estate professional is more essential than ever. They have the skills, experience, and expertise it takes to navigate the highly detailed and involved process of selling a home. That may be why the percentage of people who list their houses on their own, known as a FSBO or For Sale By Owner, has reached its lowest point since 1985 (see graph below):

Here are five reasons why selling with a real estate professional makes more sense, even in today’s hot market:

1. They Know What Buyers Want To See

Before you decide which projects and repairs to take on, connect with a real estate professional. They have first-hand experience with today’s buyers, what they expect, and what you need to do to make sure your house shows well.

If you don’t lean on their expertise, you may spend your time and money on something that isn’t essential. That’s because, in today’s low-inventory market, buyers are willing to take on more of the renovation work themselves. A survey from Freddie Mac finds that:

“. . . nearly two-in-five potential homebuyers would consider purchasing a home requiring renovations.”

A professional can help you decide what you need to tackle. It’s not canned advice you could find online – it’s recommendations specific to your house and your area.

2. They Help Maximize Your Buyer Pool

Today, the average home is getting 4.8 offers per sale according to recent data from the National Association of Realtors (NAR), and that competition is pushing prices up. While that’s promising for you as a seller, it’s important to understand your agent’s role in bringing buyers in.

Real estate professionals have an assortment of tools at their disposal, such as social media followers, agency resources, and the MLS to ensure your house is viewed by the most buyers. According to realtor.com:

“Only licensed real estate agents can list homes on the MLS, which is a one-stop online shop of sorts for getting a house seen by thousands of agents and home buyers. . . . This is certainly one of many good reasons why the majority of home sellers decide to employ the services of a listing agent rather than going it alone.”

Without access to these tools, your buyer pool is limited. And you want more buyers to view your house since buyer competition can drive your final sales price higher.

3. They Understand the Fine Print

Today, more disclosures and regulations are mandatory when selling a house. That means the number of legal documents you’ll need to juggle is growing. That’s why Investopedia says:

“One of the biggest risks of FSBO is not having the experience or expertise to navigate all of the legal and regulatory requirements that come with selling a home.”

A real estate professional knows exactly what needs to happen, what all the paperwork means, and how to work through it efficiently. They’ll help you review the documents and avoid any costly missteps that could occur if you try to handle them on your own.

4. They’re Trained Negotiators

If you sell without a professional, you’ll also be solely responsible for all the negotiations. That means you’ll have to coordinate with:

- The buyer, who wants the best deal possible

- The buyer’s agent, who will use their expertise to advocate for the buyer

- The inspection company, which works for the buyer and will almost always find concerns with the house

- The appraiser, who assesses the property’s value to protect the lender

Instead of going toe-to-toe with all these parties alone, lean on an expert. They’ll know what levers to pull, how to address everyone’s concerns, and when you may want to get a second opinion.

5. They Know How To Set the Right Price for Your House

If you sell your house on your own, you may over or undershoot your asking price. That could mean you’ll leave money on the table because you priced it too low or your house will sit on the market because you priced it too high. Pricing a house requires expertise. Investopedia explains it like this:

“. . . There is no easy or universal way to determine market value for real estate.”

Real estate professionals know the ins and outs of how to price your house accurately and competitively. To do so, they compare your house to recently sold homes in your area and factor in the current condition of your house. These factors are key to making sure it’s priced to move quickly while still getting you the highest possible final sale price.

Bottom Line

There’s a lot that goes into selling your house. Instead of tackling it alone, let’s connect so you have an expert on your side throughout the entire process.

Green Team’s 2021 Awards Ceremony

A night to remember after a year we won’t forget!

Green Team’s 2021 Awards Ceremony was held on Friday evening, April 1, at Crystal Springs Resort in Vernon. Celebrating together was especially meaningful, after two years of virtual events. COVID-19 created challenges, however, it also created opportunities. Green Team Sales Associates worked non-stop throughout the pandemic. Furthermore, they had to adhere and adjust to ever-changing COVID regulations while meeting the demands of the market; in so doing, many Green Team Associates achieved their personal best in sales. Thus, new categories of Sales Volume Levels were created. For all categories, Green Team New York/ New Jersey Realty recognizes the dedication, determination, and excellent client service that resulted in these sales volumes. These sales volumes resulted in Green Team New York Realty being #1 In Warwick NY. And Green Team New Jersey Realty #1 in Vernon NJ.

Geoff Green, President, Green Team Realty, with the Top Three Producers of 2021: (From l to r) Jennifer DiCostanzo, Keren Gonen, and Tiffany Megna.

And the Sapphire and GTNJR Yearly Sales Leader Awards go to… Keren Gonen

The Green Team New Jersey Realty 2021 Yearly Sales Leader has been in this category several times before. Not only is Keren Gonen the 2021 Yearly Sales Leader, but with over $22 Million in sales, Keren is the first Sales Associate to reach the Sapphire level. This new level was created to recognize those with a sales volume of $20 to 30 Million. It is no surprise that Keren has earned this recognition.

Keren works hard, and it shows. She has been the sales leader at GTNJR for the past 8 quarters. In fact, Keren was the Yearly Sales Leader when she joined Green Team New Jersey Realty in 2017. Then, in 2020 she joined the MVP Circle with over $10 Million in sales volume. In addition, Keren received the 2021 NJ Realtors® Gold Circle of Excellence Award. Not surprisingly, she is in the top 20 agents in Sussex County.

Keren has been featured in Top Agent Magazine and recognized in a National Honors Program by Broker★Agent Advisor.

And the Diamond, GTNYR Yearly Sales Leader, and Momentum Builder Awards go to… Jennifer DiCostanzo

Jennifer DiCostanzo has been the yearly sales leader every year since joining Green Team New York Realty in 2016. In addition, she became the first Green Team Sales Associate to receive the MVP award for over $10 million in sales. In fact, Jen has achieved MVP status three times to date. She even surpassed these achievements with a sales volume, for the 3rd Quarter of 2021, of over $10 Million; she is now the first to achieve the Diamond level, for a sales volume of $15 to $20 Million.

Jen is among the top 20 selling agents in Orange County for 2021, which puts her in the top 1%. She is a Sales Representative Specialist and Accredited Buyer’s Representative. In addition, she has achieved Pricing Strategy Advisor and Seniors Real Estate Specialist designations. Jen has been featured in Top Agent Magazine. Furthermore, Jen has been named a Real Estate All-Star by Hudson Valley Magazine for the past two years.

In addition, Jen received the Momentum Builder Award, which reads:

” In recognition of her ability to create the most positive and consistent momentum in her professional career while maintaining the same impetus reflected in many aspects of her personal life.”

Platinum Awards for $10 to $15 Million in Sales were presented to:

Tiffany Megna, Green Team New York Realty, was Green Team Realty’s 3rd Top Producer of 2021. Kristi Anderson, Green Team New Jersey Realty, was the 4th Top Producer. And Nancy Sardo, Green Team New York Realty, was Top Producer #5.

Gold Awards for $5 to $10 Million in Sales were presented to:

Tammy Scotto (GTNYR); Charles Nagy (GTNJR), Theodore Van Laar (GTNJR); Carol Buchanan (GTNYR); Kimberly Lasalandra (GTNYR/GTNJR); Karen Gauvin (GTNYR); Kristine Many (GTNYR); Tom Folino (GTNYR); Vikki Garby (GTNYR); Pip Klein (GTNYR); Pam Zachowski (GTNJR); Angela Murphy (GTNYR); and Barbara Tesa (GTNJR).

Silver Awards for $3 to $5 Million in Sales were presented to:

Lucyann Tinnirello (GTNYR); Toni Vogel (GTNYR); Walter Ross (GTNYR); Toni Kreusch (GTNJR/GNYR), and Kasey Decker (GTNYR)

Bronze Awards for $1.5 to $3 Million in Sales were presented to:

From Green Team New York Realty, Linda Vandeweert; Rebecca Hundley; Cara Dumond; Guillermina “Gidget” Tavares; Chris Kimiecik; Robert Valentine; Ed Sattler; Kim Lesley, and, from Green Team New Jersey Realty, Jaime Dalton.

Team Players, Mentor of the Year, and Citizens of the Year:

Team Players are chosen by their peers, “in recognition of their reliability, positivity, and dependability, while exhibiting dedication and devotion to the agency and team.” The sales associates of Green Team New York Realty selected Britanni Gaucher as their Team Player and Green Team New Jersey Realty sales associates selected Charles Nagy as theirs!

Tammy Scotto earned her award for Mentor of the Year “in recognition of her dedication, dependability, and devotion to Her mentees.”

Finally, Citizens of the Year are selected in recognition of their valuable contributions and outstanding support to our community. This is a very special award, in that each winner will have $500 from Green Team Realty to be donated to the charity of their choice. Green Team New York Realty selected Wayne Patterson as their Citizen of the Year. Kristi Anderson was selected by Green Team New Jersey Realty as their Citizen of the Year.

Thank you to our sponsors!

We could not have held such a fantastic awards event without our wonderful sponsors!

First of all, a special thank you to Amy Green, Guaranteed Rate, our Diamond Sponsor. Next, thanks to our Platinum Sponsors! They are Michael Giannetto, CrossCountry Mortgage; Douglas Stage, Stage Law Firm; Gregory Romaine, Homestead Funding Corp., and Daniel Bounds, Chase Bank. Our thanks go to Gold Sponsors Chad Barris, Family First Funding; William Askin, Askin & Hooker LLC; Gary S. Goldstein, Esq., and Micaela Gandarinho, Seely & Durland Insurance. Finally, we thank our Silver Sponsor, George Tsakanias, VHT Studios.

Wait! There are more acknowledgments…

Inside Sales Associates

The Inside Sales Associates play an integral part in providing leads to sales associates. The Green Team ISA Team is Giovanni Lasalandra, Director of Business Development; Kevin Many, Sandra Medina, and Jimmy Cosenza.

In addition, Kevin Many received an award in recognition of great achievement for exchange opportunities for the NuOp platform, with over 500 Ops exchanged in 2021.

And where would we be without our phenomenal support staff…

Behind-the-scenes support is essential to providing our sales associates with the resources, training, tools, and services they need to best conduct their businesses. Geoff Green acknowledged the hardworking Green Team HQ support staff: Broker Managers Lucyann Tinnirello, Carol Buchanan, and Kim Lasalandra; Lora Chandra, Director of Operations; Andy Clough, Digital Marketing Support; Diana Clough, Controller; Nicole McCormick, Director of Marketing. In addition, we have Morgan Beattie and Natalee DiMichele, Agent Service Managers; Linda Vandeweert, Sign Installation Manager; Susan Wynn, Copywriter; Jane Tuomala, Marketing Assistant; and Brittani Gaucher, Agent Service Representative.

Team Up for Hope

Geoff asked the Board of Team Up for Hope, a non-profit organization he co-founded and chairs, to talk about what the organization has accomplished. Team Up for Hope is made up of an all-volunteer group of Green Team sales associates and staff. Locally, the organization addresses the challenges of mental health, drug use, and suicide by raising money for non-profit volunteer organizations at the forefront of addressing these issues. Team Up for Hope also produces webinars that bring in experts and advocates to provide knowledge, resources, and answer questions on these issues.

Globally, as the invasion of Ukraine began, Team Up for Hope began raising money for a relief organization in Poland assisting the refugees and will continue to do so. A webinar is planned with that organization so that we can all see the many needs that exist. Please visit the Team Up for Hope website and Facebook page for updates, to learn more about our organization, how you can help, and how to donate.

After the award presentations, the party got started…

DJ Chris Paul got the party started and kept it going as Green Teamers hit the dance floor. After a year of challenges, hard work, and dedication, it was wonderful to be able to celebrate with friends.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![What Is Multigenerational Housing? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/04/14144240/20220415-MEM-1046x2456.png)

![Do You Know How Much Equity You Have in Your Home? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/04/05162315/20220408-MEM-1046x2334.png)