[et_pb_section fb_built=”1″ _builder_version=”3.0.47″ custom_padding=”16px|0px|0px|0px|false|false”][et_pb_row custom_padding=”22px|0px|32px|0px|false|false” _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text _builder_version=”3.0.74″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]As more people continue to identify their changing needs this year, some are turning to the upscale housing sector for more space or finer features. In their most recent Luxury Market Report, the Institute for Luxury Home Marketing (ILHM) shares:

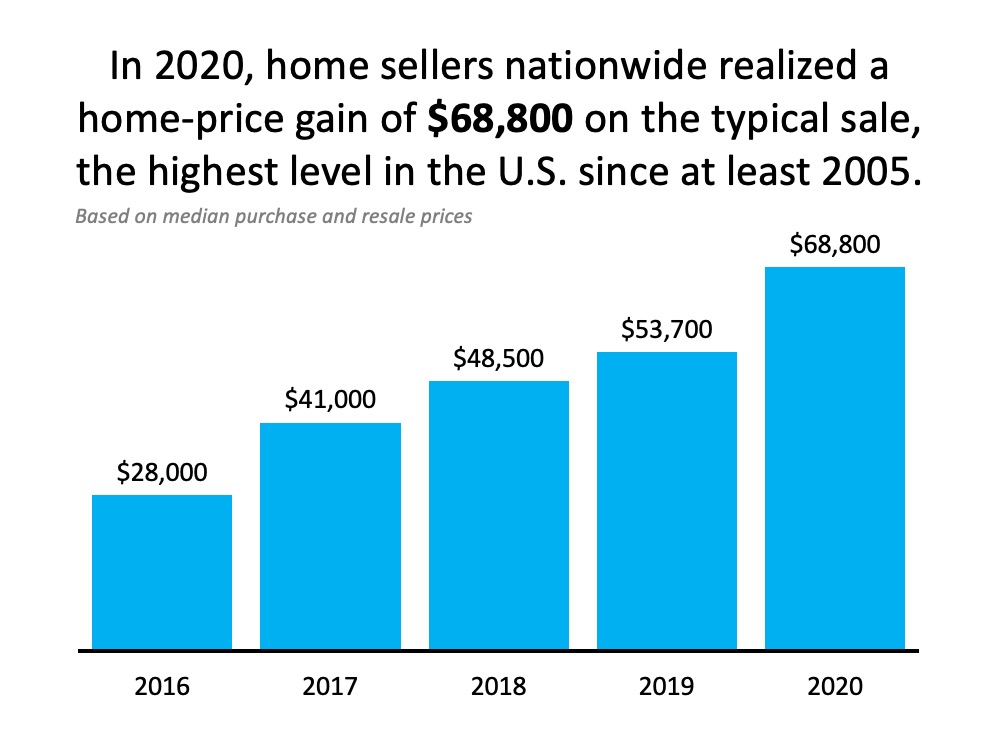

“In a snapshot of 2020, despite the devasting effects of the coronavirus pandemic, the luxury real estate market has seen one of its strongest years since 2008. In comparison to experts’ predictions in early 2020, it is remarkable how significant demands for property type, location, and amenity preferences have changed amid the pandemic.”

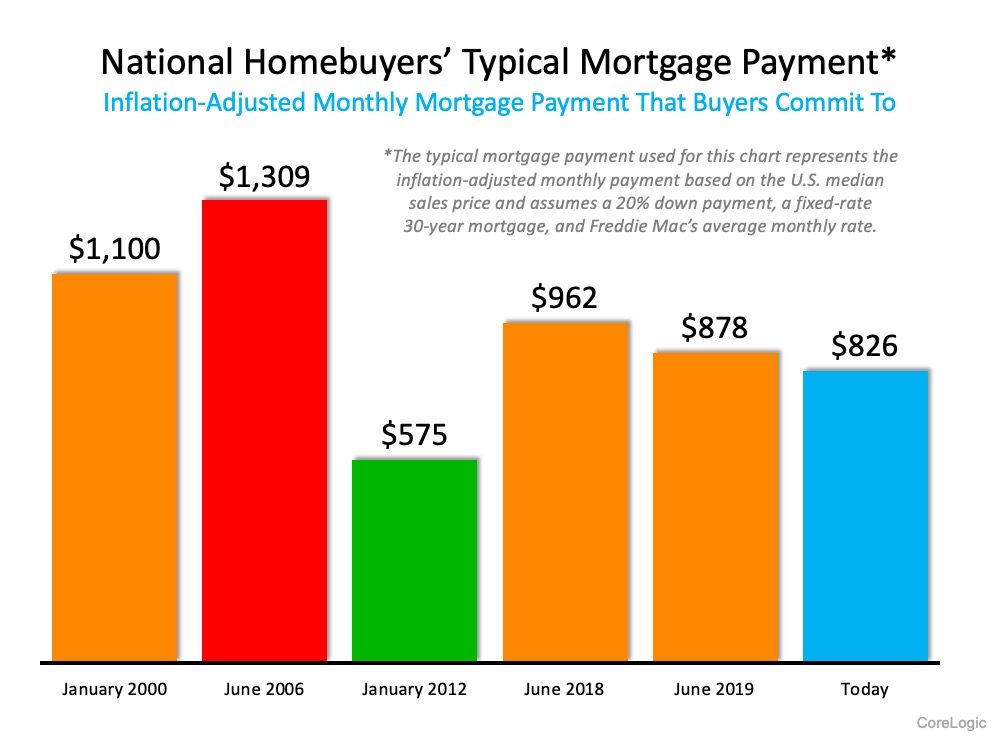

With more opportunities to work from home and a growing interest in having extra space for things like virtual school, working out, and cooking more meals, the desire to own a home that can meet these needs continues to increase. Additionally, record-low mortgage rates are creating opportunities for homebuyers to stretch their legs into higher price points or even expand their real estate portfolios. The ILHM report continues to say:

“Experts believe that the demand for exclusive residential properties outside the metropolitan areas will continue well into 2021; even with the introduction of vaccines, the pandemic is far from over.

For those who have moved to the suburbs and beyond, moving back to the city full time is unlikely while the work from home trend remains. Many of these affluent homeowners are now making their secondary properties their primary residences for the foreseeable future.”

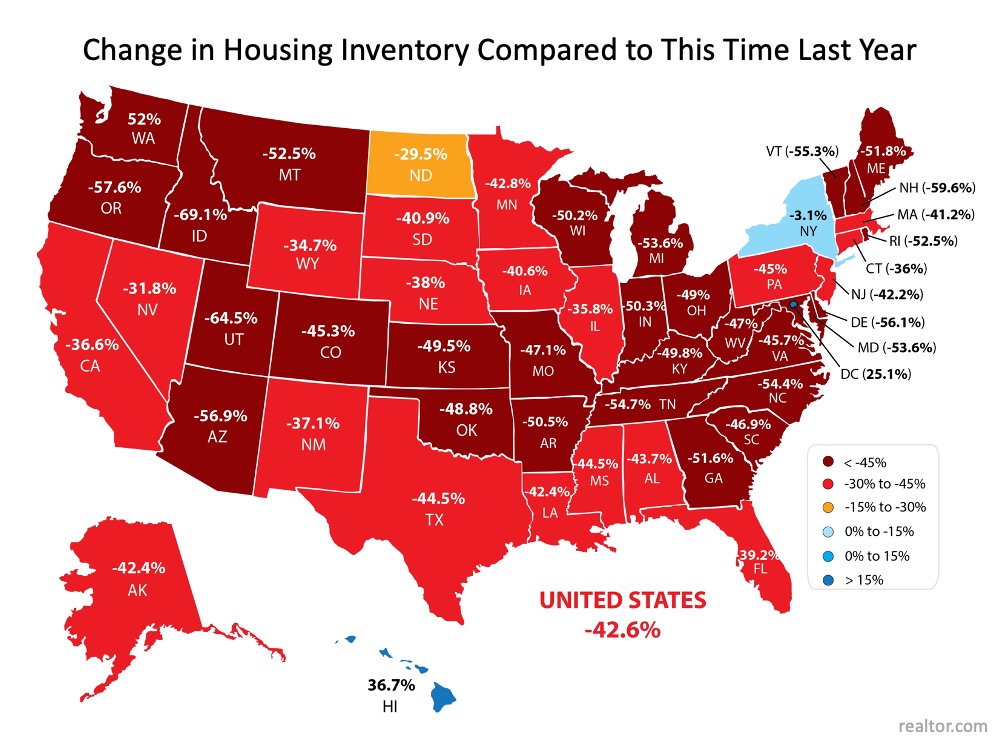

If you’re interested in buying a home this year, it appears that some higher-priced markets may have more homes to choose from than those at lower price points. Javier Vivas, Director of Economic Research at realtor.com, notes:

“Interestingly, markets, where new supply is improving the fastest, tend to be higher priced than those that have yet to see improvement, suggesting sellers are more active in the more expensive markets.”

Bottom Line

If you’re hoping to buy the home of your dreams, this could be the year to achieve that goal. Let’s connect today to explore your possibilities.

Contact one of Our Agents today!

See our Complete Inventory of Available Properties!

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”3.18.2″][et_pb_row _builder_version=”3.18.2″][et_pb_column type=”4_4″ _builder_version=”3.18.2″ parallax=”off” parallax_method=”on”][et_pb_blog fullwidth=”off” posts_number=”3″ include_categories=”43″ show_author=”off” show_date=”off” show_categories=”off” _builder_version=”3.18.2″ header_level=”h5″ header_font=”||||||||” body_font=”||||||||” border_radii=”on|12px|12px|12px|12px” text_orientation=”center”][/et_pb_blog][/et_pb_column][/et_pb_row][/et_pb_section]

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Is Right Now the Right Time to Sell? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/01/29150937/20210129-MEM-FINAL-1046x1262.png)