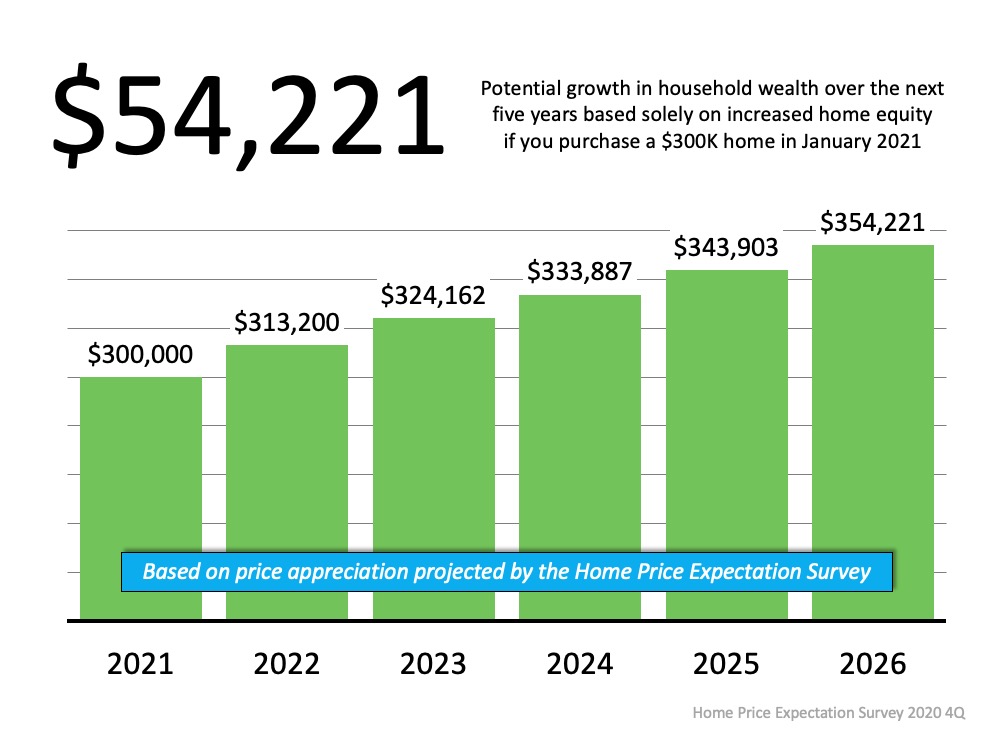

There’s still a very limited number of homes for sale for the great number of purchasers looking to buy them. As a result, the concept of “supply and demand” mandates that home values in the country will continue to appreciate. Find out what your home is worth – click here.

Why Right Now May Be the Time to Sell Your House

The housing market made an incredible recovery in 2020 and is now positioned for an even stronger year in 2021. Record-low mortgage interest rates are a driving factor in this continued momentum, with average rates hovering at historic all-time lows.

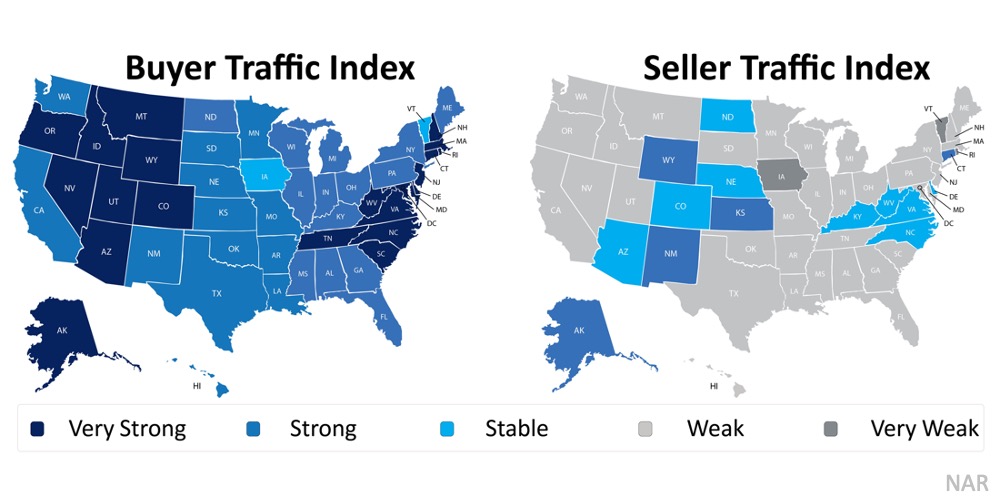

According to the latest Realtors Confidence Index Survey from the National Association of Realtors (NAR), buyer demand across the country is incredibly strong. That’s not the case, however, on the supply side. Seller traffic is simply not keeping up. Here’s a breakdown by state:

As the maps show, buyer traffic is high, but seller traffic is low. With so few homes for sale right now, record-low inventory is creating a mismatch between supply and demand.

NAR also just reported that the actual number of homes currently for sale stands at 1.28 million, down 22% from one year ago (1.64 million). Additionally, inventory is at an all-time low with 2.3 months supply available at the current sales pace. In a normal market, that number would be 6.0 months of inventory – significantly higher than it is today.

What does this mean for buyers and sellers?

Buyers need to remain patient in the search process. At the same time, they must be ready to act immediately once they find the right home since bidding wars are more common when so few houses are available for sale.

Sellers may not want to wait until spring to put their houses on the market, though. With such high buyer demand and such a low supply, now is the perfect time to sell a house on optimal terms.

Bottom Line

The real estate market is entering the year like a lion. There’s no indication it will lose that roar, assuming inventory continues to come to market.

Contact one of Our Agents today!

See out Complete Inventory of Available Properties!

Will Forbearance Plans Lead to a Tsunami of Foreclosures?

At the onset of the economic disruptions caused by the COVID pandemic, the government quickly put into place forbearance plans to allow homeowners to remain in their homes without making their monthly mortgage payments. Today, almost three million households are actively in a forbearance plan. Though 29.4% of those in forbearance have continued to stay current on their payments, many have not.

Yanling Mayer, Principal Economist at CoreLogic, recently revealed:

“A distributional analysis of forborne loans’ payment status reveals that more than one third (39.1%) of all forborne loans are now 150+ days behind payment, while as many as 1-in-4 (25.5%) are 180+ days past due.”

These homeowners have been given permission to not make their payments, but the question now is: how many of them will be able to catch up after their forbearance program ends? There’s speculation that a forthcoming wave of foreclosures could be the result, and that could lead to another crash in home values like we saw a decade ago.

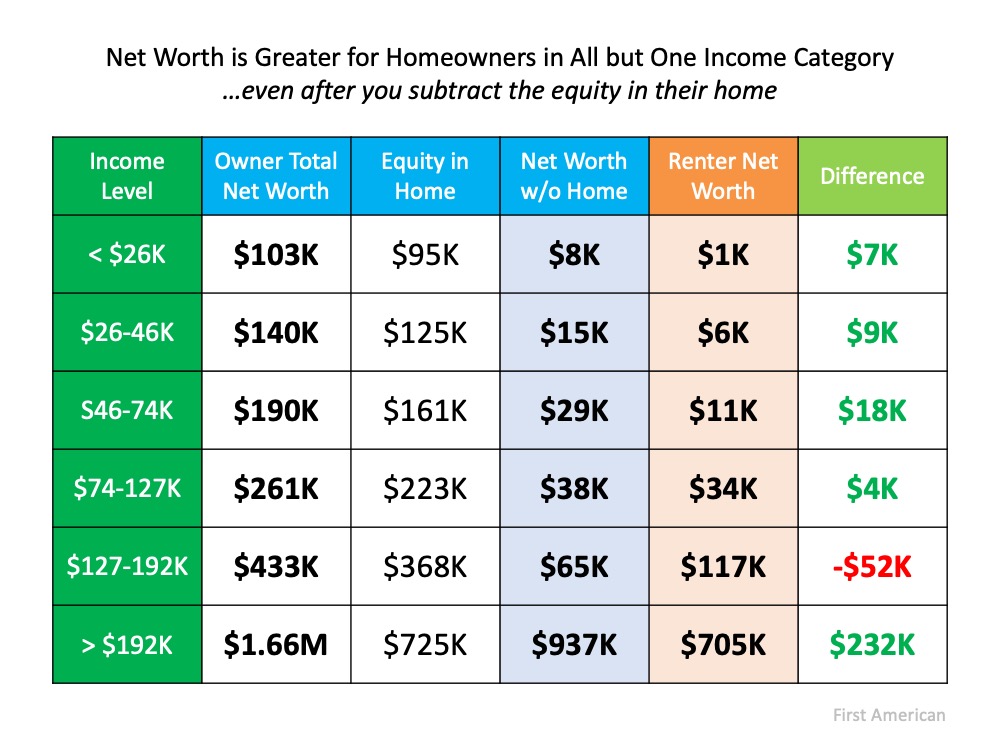

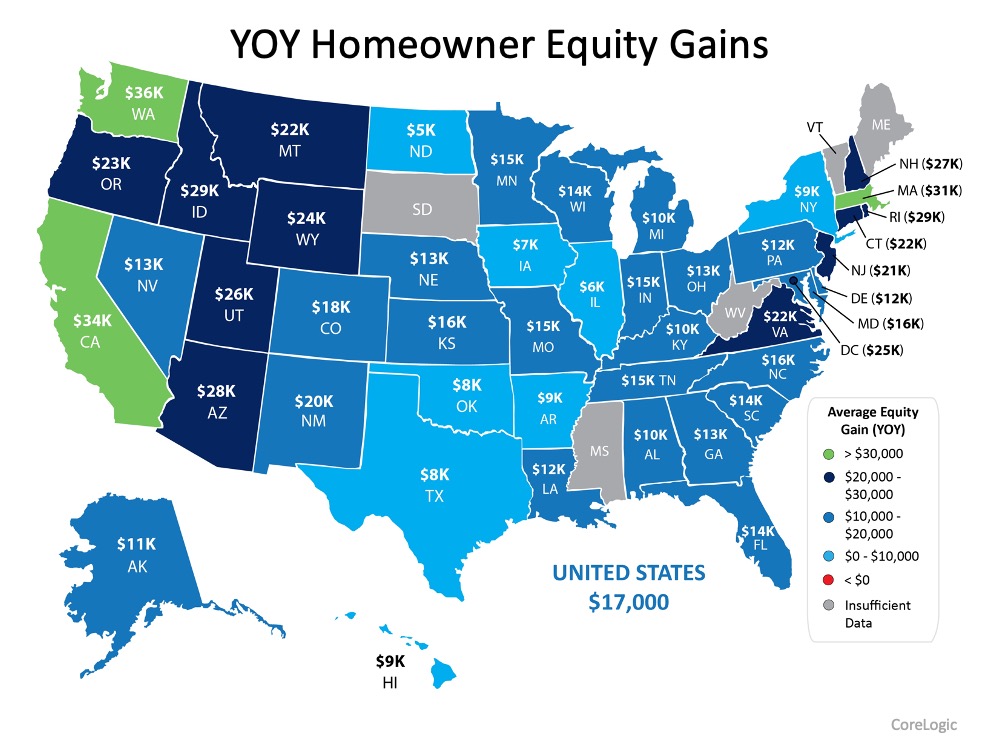

However, today’s situation is different than the 2006-2008 housing crisis as many homeowners have tremendous amounts of equity in their homes.

What are the experts saying?

Over the last 30 days, several industry experts have weighed in on this subject.

Michael Sklarz, President at Collateral Analytics:

“We may very well see a meaningful increase in the number of homes listed for sale as these borrowers choose to sell at what is arguably an intermediate top in the market and downsize to more affordable homes rather than face foreclosure.”

Odeta Kushi, Deputy Chief Economist at First American:

“The foreclosure process is based on two steps. First, the homeowner suffers an adverse economic shock…leading to the homeowner becoming delinquent on their mortgage. However, delinquency by itself is not enough to send a mortgage into foreclosure. With enough equity, a homeowner has the option of selling their home, or tapping into their equity through a refinance, to help weather the economic shock. It is a lack of sufficient equity, the second component of the dual trigger, that causes a serious delinquency to become a foreclosure.”

Don Layton, Senior Industry Fellow at the Joint Center for Housing Studies of Harvard University:

“With a greater cushion of equity, troubled homeowners have dramatically improved options: a greater ability to access funding (e.g. home equity lines) to keep paying monthly expenses until family finances might recover, improved ability to qualify for and support a loan modification, and, if push comes to shove, the ability to sell the home and monetize their increased net worth while reducing monthly payment obligations. So, what should lenders and servicers expect: a large number of foreclosures or only a modest increase? I believe the latter.”

With today’s positive equity situation, many homeowners will be able to use a loan modification or refinance to stay in their homes. If not, some will go to foreclosure, but most will be able to sell and walk away with their equity.

Won’t the additional homes on the market impact prices?

Distressed properties (foreclosures and short sales) sell at a significant discount. If homeowners sell instead of going into foreclosure, the impact on the housing market will be much less severe.

We must also realize there is currently an unprecedented lack of inventory on the market. Just last week, realtor.com explained:

“Nationally, the number of homes for sale was down 39.6%, amounting to 449,000 fewer homes for sale than last December.”

It’s important to remember that there weren’t enough homes for sale even then, and inventory has only continued to decline.

The market has the potential to absorb half a million homes this year without it causing home values to depreciate.

Bottom Line

The pandemic has led to both personal and economic hardships for many American households. The overall residential real estate market, however, has weathered the storm and will continue to do so in 2021.

Contact one of Our Agents today!

3 Must-Do’s When Selling Your House This Year

It’s exciting to put a house on the market and to think about making new memories in new spaces. However, despite the anticipation of what’s to come, we can still have deep sentimental attachments to the home we’re leaving behind. Growing emotions can help or hinder a sale depending on how we manage them.

When it comes to the bottom line, homeowners need to know what it takes to avoid costly mistakes when it’s time to move. Being mindful and prepared for the process can help you stay on the right track when selling your house this year.

1. Price Your Home Right

When inventory is low, like it is in the current market, it’s common to think buyers will pay whatever we ask when setting a listing price. Believe it or not, that’s not always true. Don’t forget that the buyer’s bank will send an appraiser to determine the fair value for your house. The bank will not lend more than what the house is worth, so be aware that you might need to renegotiate the price after the appraisal. A real estate professional will help you set the true value of your home.

2. Keep Your Emotions in Check

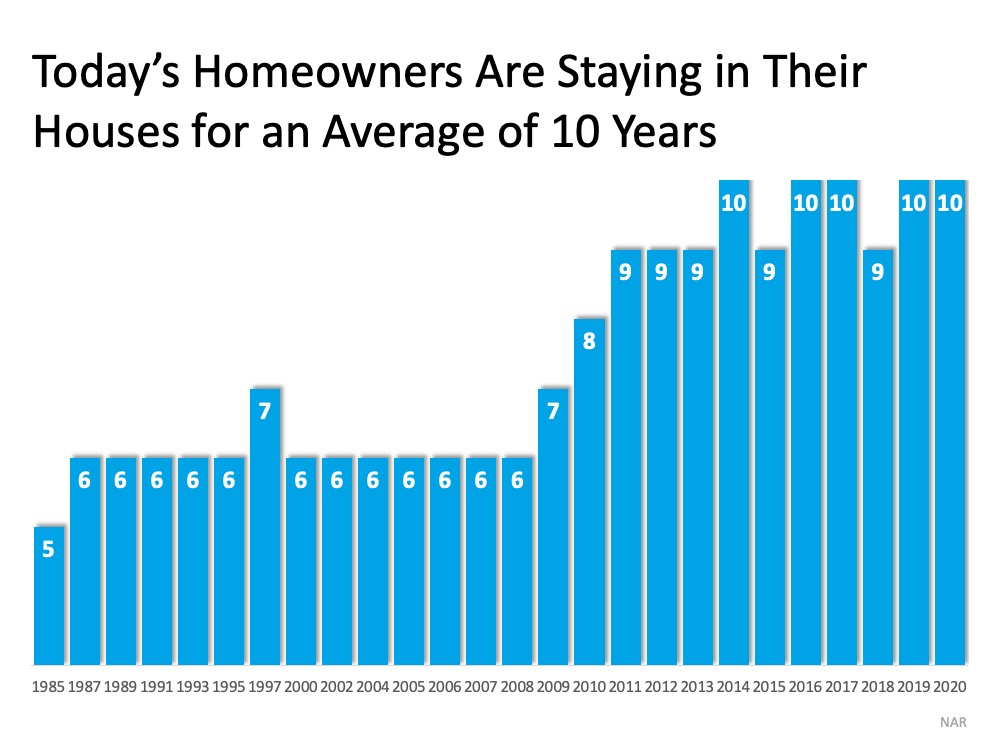

Today, homeowners are living in their houses for a longer period of time. Since 1985, the average tenure, or the time a homeowner has owned their home, has increased from 5 to 10 years (as shown in the graph below):

This is several years longer than what used to be the historical norm. The side effect, however, is when you stay in one place for so long, you may get even more emotionally attached to your space. If it’s the first home you bought or the house where your children grew up, it very likely means something extra special to you. Every room has memories, and it’s hard to detach from the sentimental value.

For some homeowners, that makes it even harder to negotiate and separate the emotional value of the house from the fair market price. That’s why you need a real estate professional to help you with the negotiations along the way.

3. Stage Your Home Properly

We’re generally quite proud of our décor and how we’ve customized our houses to make them our own unique homes, but not all buyers will feel the same way about your design. That’s why it’s so important to make sure you stage your house with the buyer in mind.

Buyers want to envision themselves in the space so it truly feels like it could be their own. They need to see themselves inside with their furniture and keepsakes – not your pictures and decorations. Stage and declutter so they can visualize their own dreams as they walk down the hall. A real estate professional can help you with tips to get your home ready to stage and sell.

Bottom Line

Today’s sellers’ market might be your best chance to make a move. If you’re considering selling your house, let’s connect so you have the help need to navigate through the process while prioritizing these must-do’s.

Contact one of our Agents today!

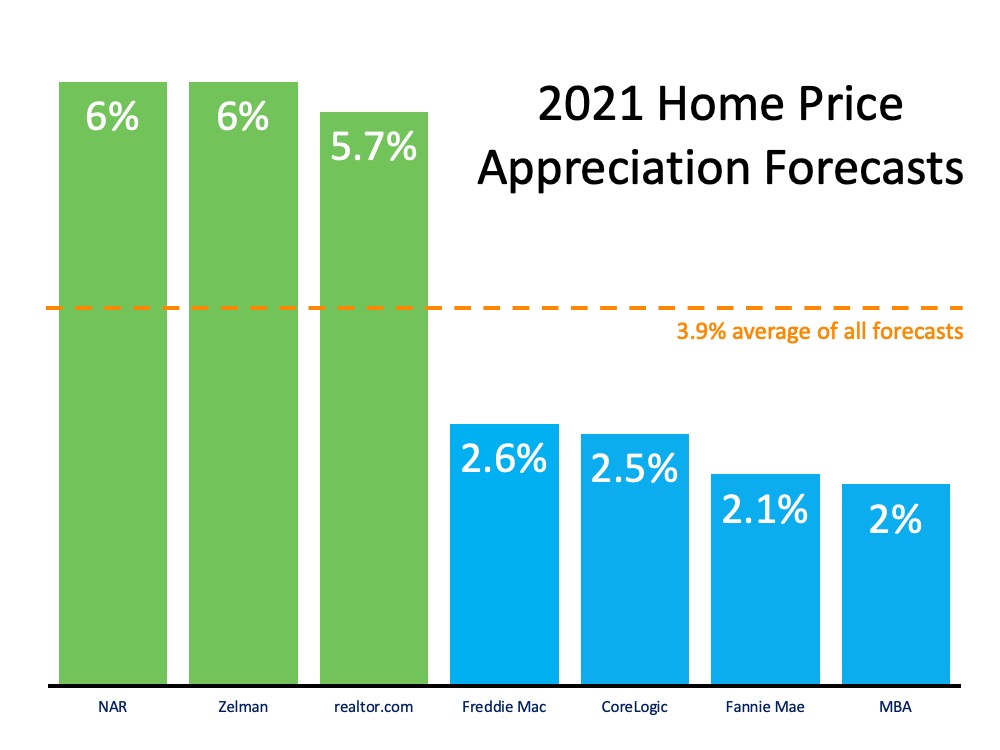

Four Expert Views on the 2021 Housing Market

The housing market was a shining star in 2020, fueling the economic turnaround throughout the country. As we look forward to 2021, can we expect real estate to continue showing such promise? Here’s what four experts have to say about the year ahead.

Lawrence Yun, Chief Economist, National Association of Realtors (NAR)

“In 2021, I think rates will be similar or modestly higher, maybe 3%…So, mortgage rates will continue to be historically favorable.”

Danielle Hale, Chief Economist, realtor.com

“We expect sales to grow 7 percent and prices to rise another 5.7 percent on top of 2020’s already high levels.”

Robert Dietz, Senior Vice President and Chief Economist, National Association of Home Builders (NAHB)

“With home builder confidence near record highs, we expect continued gains for single-family construction, albeit at a lower growth rate than in 2019. Some slowing of new home sales growth will occur due to the fact that a growing share of sales has come from homes that have not started construction. Nonetheless, buyer traffic will remain strong given favorable demographics, a shifting geography of housing demand to lower-density markets and historically low interest rates.”

Mark Fleming, Chief Economist, First American

“Mortgage rates are expected to remain low for the foreseeable future and millennials will continue forming households, keeping demand robust, even if income growth moderates. Despite the best intentions of home builders to provide more housing supply, the big short in housing supply will continue into 2021 and likely keep house price appreciation flying high.”

Bottom Line

Whether you’re ready to buy or sell a home in 2021, if you’re planning to take advantage of the market this winter, let’s connect to talk about the opportunities available in our local market.

Contact a Real Estate Professional Today!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Things to Avoid after Applying for a Mortgage [INFOGRAPHIC]](https://files.mykcm.com/2021/01/14132936/20210115-MEM-1046x1762.png)

![Reasons to Hire a Real Estate Professional [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/01/07152500/20210108-MEM-1046x1665.png)