Why You Need an Expert To Determine the Right Price for Your House

If your lifestyle has changed recently and you’re ready to make a move, taking advantage of today’s sellers’ market might be just the answer for your summer plans. With homes continuing to get multiple offers, this could be your moment to get the contract you’re looking for on your house if you’re ready to sell.

And here’s the thing – you need an expert on your side to ensure you make all the right moves when you do, especially when it comes to pricing your house. Even in this competitive market, you can’t stick just any price tag on your home and get the deal you want. A key piece of the puzzle is setting the right asking price so you can help buyers notice your home (and get excited about it) from the very first time they view the listing. That’s where a real estate professional comes in.

Why Pricing Your House Right Is Important

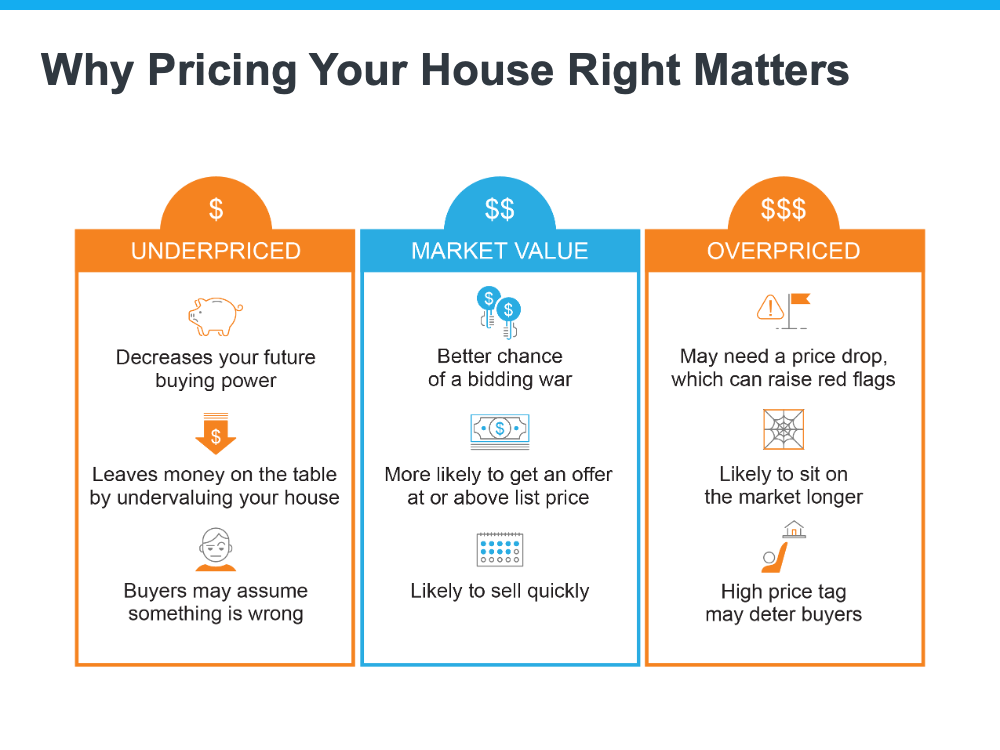

The price you set for your house sends a message to potential buyers. Price it too low and you might raise questions about your home’s condition or lead buyers to assume something is wrong with the property. Not to mention, if you undervalue your house, you could leave money on the table which decreases your future buying power.

On the other hand, price it too high, and you run the risk of deterring buyers. When that happens, you may have to do a price drop to try to re-ignite interest in your house when it sits on the market for a while. But be aware that a price drop can be seen as a red flag for some buyers who will wonder why the price was reduced and what that means about the home.

In other words, think of pricing your home as a target. Your goal is to aim directly for the center – not too high, not too low, but right at market value. Pricing your house fairly based on market conditions increases the chance you’ll have more buyers who are interested in purchasing it. That makes it more likely you’ll see multiple offers, too. And if a bidding war happens, you’ll likely get an even higher final sale price. Plus, when homes are priced right, they tend to sell quickly.

To get a look into the potential downsides of over or underpricing your house and the perks that come with pricing it at market value, see the chart below:

Lean on a Professional’s Expertise

There are several factors that go into pricing your house, and balancing them is the key. That’s why it’s important to lean on an expert real estate advisor when you’re ready to move. A local real estate advisor is knowledgeable about:

- The value of homes in your neighborhood

- The current demand for houses in today’s market

- The condition of your house and how it affects the value

A real estate professional will balance these factors to make sure the price of your house makes the best first impression and gives you the greatest return on your investment in the end.

Bottom Line

If you’re thinking about selling, pricing your house appropriately is key. Let’s connect to make sure your house is priced right for the local market, for your home’s condition, and to stand out from the competition.

Give Your Career a Boost With Green Team Realty

Why joining Green Team Realty will Benefit your Real Estate Career.

Whether you are a new real estate professional or someone who has been in the business for years, choosing the right brokerage is crucial. Finding a brokerage that provides its agents with top-of-the-line technology, support, and advanced training can give you an advantage in the field and make it easier for you to create a successful business. Green Team Realty ensures that each of its sales associates receives all of those benefits and more.

Build your online presence with Green Team’s Marketing Support.

In this day and age, social media plays an important role in how a real estate agent connects with their clients. When a new agent joins the team, they receive a Welcome Blog posted to our agency’s social media platforms. Alongside the initial Welcome Blog, our agents also have the option of Meet The Agent or About Me blog. Both of these will help you build your social media presence and SEO right out of the gate.

In addition to the blog posts, Green Team continuously offers its agents a great deal of social media advertising throughout their careers, including: New/Sold Listings, Client Testimonials, Awards and Achievement blogs, designation blogs, and more. Amongst many other things

Teamwork makes the Dreamwork!

Along with a friendly atmosphere, Green Team Realty provides each agent with an extensive support system. The Agent Service Managers (ASM) and Help Desk are available every weekday to assist with any questions you may have

Green Team offers monthly social events and Small Groups which were created to allow Sales Associates an opportunity to connect with and learn from their peers.

To ensure that agents have everything they need to be successful Green Team Realty offers an extensive training program that includes:

- Sales Associate Foundation

- Video Training tutorials

- Technology Training Weekly

- Training Sessions

- Mentor Program

- Activity, Meeting & Transaction tracking

How Green Team can give you an advantage in Lead Generation and Client Management.

One of the most important parts of starting your Real Estate career is generating leads and managing your clients. At Green Team Realty, you will be provided with many opportunities to find new leads, including Lead Routing and Uptime Shifts.:

Lead Routing allows you to receive new leads sent directly to your phone. All that you would need to do is hit accept and start getting to know your new client.

Additionally, Uptime Shifts are a great way to build your clientele. Uptime shifts are in-office hours which give you the first opportunity to speak to any potential clients that may call or stop by.

Green Team believes that it is essential to give their agents everything they need to successfully manage their client base.

Examples of some of the tools offered are:

- CRM Mobile UI.

- Email Marketing

- Event Tracker

- Google Calendar Sync.

- Projects & Transactions

- Instanet – e-doc signing right through commission statement processing.

An Office built on Support and Respect

You often hear that real estate is a cutthroat business and in some cases that may be true. Green Team Realty has worked hard to create a space where its associates can develop strong bonds and learn from their peers.

If you are interested in learning more about becoming part of the Green Team please connect with us. We would be excited to get to know you and talk about how we can help you grow your Real Estate Career.

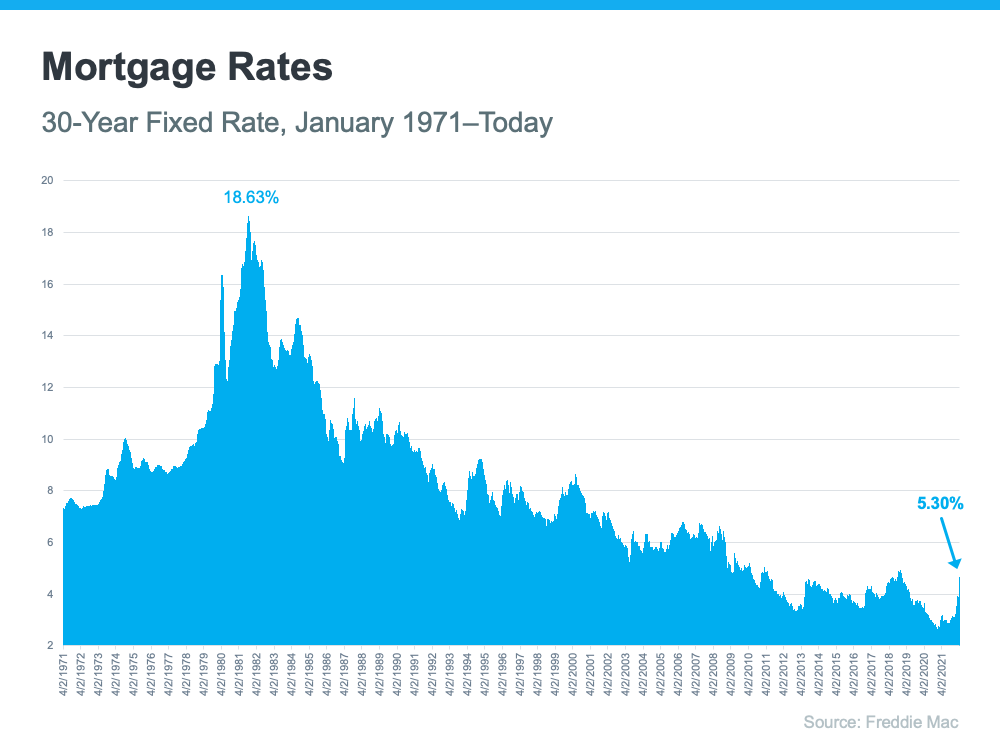

Sellers Have an Opportunity with Today’s Home Prices

As mortgage rates started to rise this year, many homeowners began to wonder if the value of their homes would fall. Here’s the good news. Historically, when mortgage rates rise by a percentage point or more, home values continue to appreciate. The latest data on home prices seems to confirm that trend.

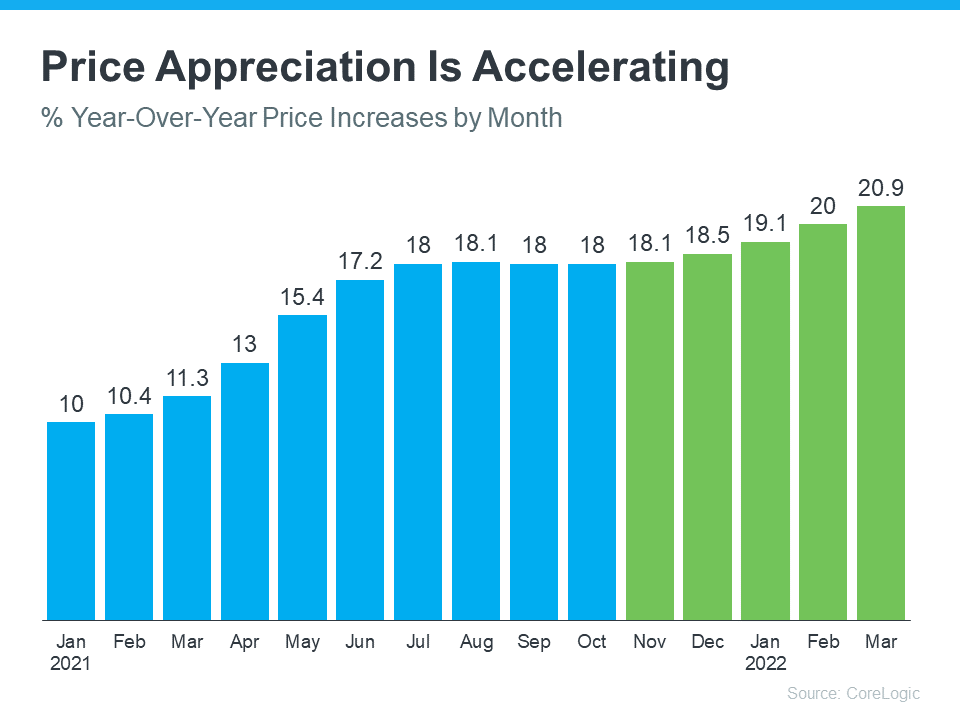

According to data from CoreLogic, home price appreciation has been re-accelerating since November. The graph below shows this increase in home price appreciation in green:

This is largely due to an ongoing imbalance in supply and demand. Specifically, housing supply is still low, and demand is high. As mortgage rates started to rise this year, many homebuyers rushed to make their purchases before those rates could climb higher. The increased competition drove home prices up even more. Selma Hepp, Deputy Chief Economist at CoreLogic, explains:

This is largely due to an ongoing imbalance in supply and demand. Specifically, housing supply is still low, and demand is high. As mortgage rates started to rise this year, many homebuyers rushed to make their purchases before those rates could climb higher. The increased competition drove home prices up even more. Selma Hepp, Deputy Chief Economist at CoreLogic, explains:

“Home price growth continued to gain speed in early spring, as eager buyers tried to get in front of the mortgage rate surge.”

And experts say prices are forecast to continue appreciating, just at a more moderate pace moving forward. A recent article from Fortune says:

“. . . the swift move up in mortgage rates . . . doesn’t mean home prices are about to crash. In fact, every major real estate firm with a publicly released forecast model . . . still predicts home prices will climb further this year.”

What This Means for You

If you’re thinking about selling your house, you should know you have a great opportunity to list your home and capitalize on today’s home price appreciation. As prices rise, so does the value of your home, which gives your equity a big boost.

When you sell, you can use that equity toward the purchase of your next home. And at today’s record-level of appreciation, that equity may be enough to cover some (if not all) of your down payment.

Bottom Line

History shows rising mortgage rates have not had a negative impact on home prices. Now is still a great time to sell your house thanks to ongoing price appreciation. When you’re ready to find out how much equity you have in your current home and what’s happening with home prices in your local area, let’s connect.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![History Proves Recession Doesn’t Equal a Housing Crisis [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/06/02165354/20220603-MEM-2-1046x1949.png)

![Don’t Let Rising Inflation Delay Your Homeownership Plans INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/05/18153723/20220520-MEM-1046x2334.png)