Recession? Yes. Housing Crash? No.

With over 90% of Americans now under a shelter-in-place order, many experts are warning that the American economy is heading toward a recession, if it’s not in one already. What does that mean to the residential real estate market?

What is a recession?

According to the National Bureau of Economic Research:

“A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.”

COVID-19 hit the pause button on the American economy in the middle of March. Goldman Sachs, JP Morgan, and Morgan Stanley are all calling for a deep dive in the economy in the second quarter of this year. Though we may not yet be in a recession by the technical definition of the word today, most believe history will show we were in one from April to June.

Does that mean we’re headed for another housing crash?

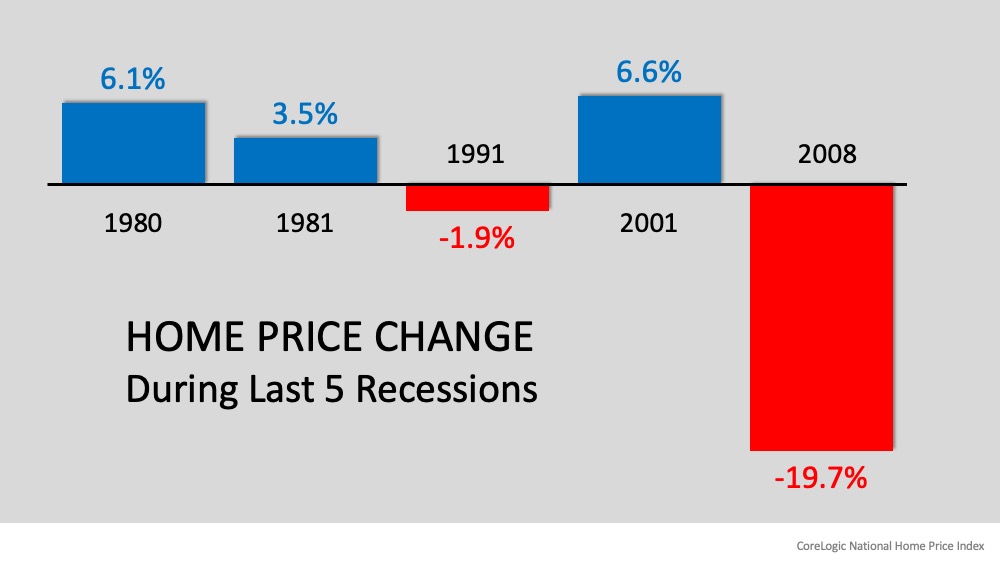

Many fear a recession will mean a repeat of the housing crash that occurred during the Great Recession of 2006-2008. The past, however, shows us that most recessions do not adversely impact home values. Doug Brien, CEO of Mynd Property Management, explains:

“With the exception of two recessions, the Great Recession from 2007-2009, & the Gulf War recession from 1990-1991, no other recessions have impacted the U.S. housing market, according to Freddie Mac Home Price Index data collected from 1975 to 2018.”

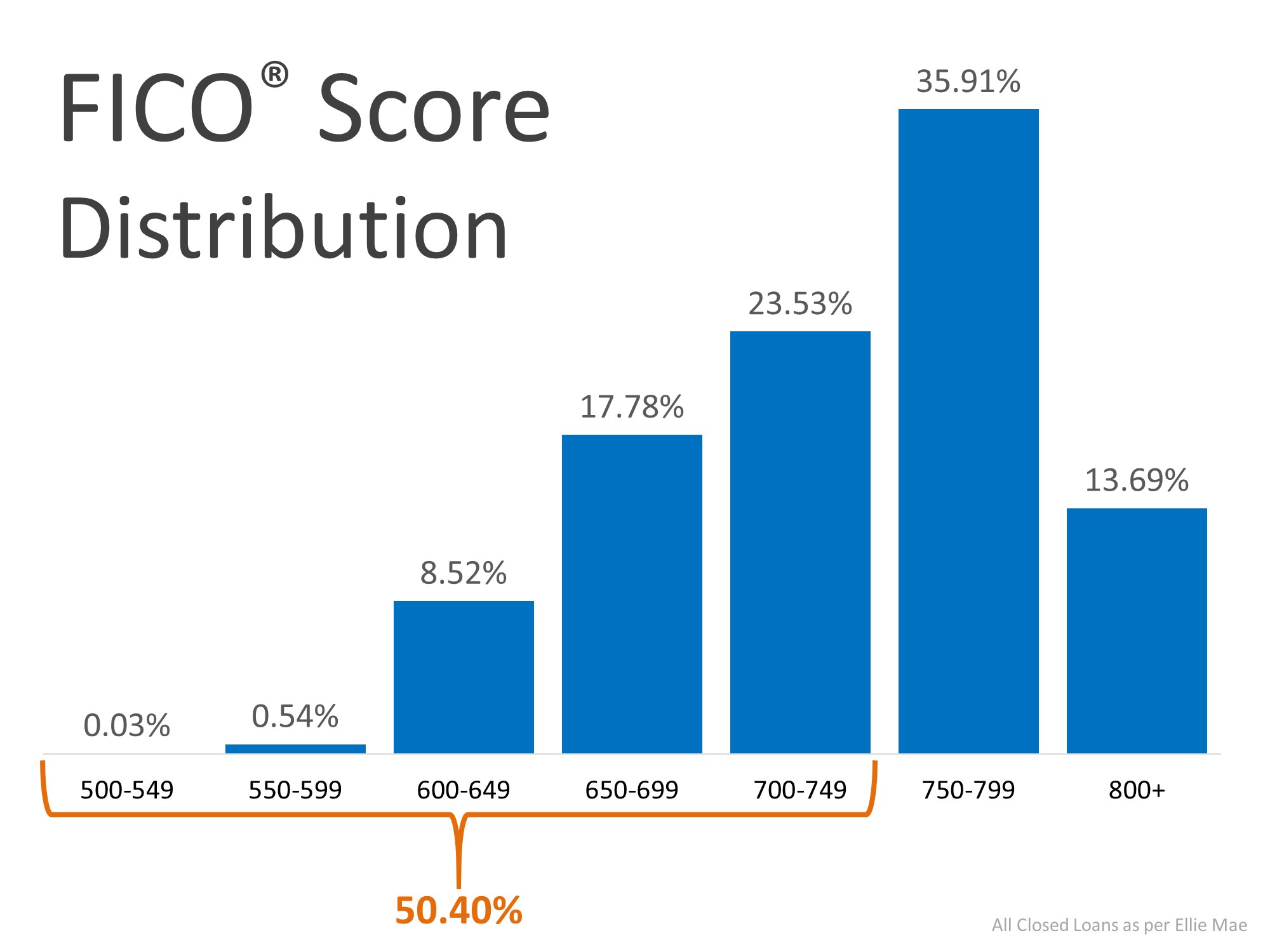

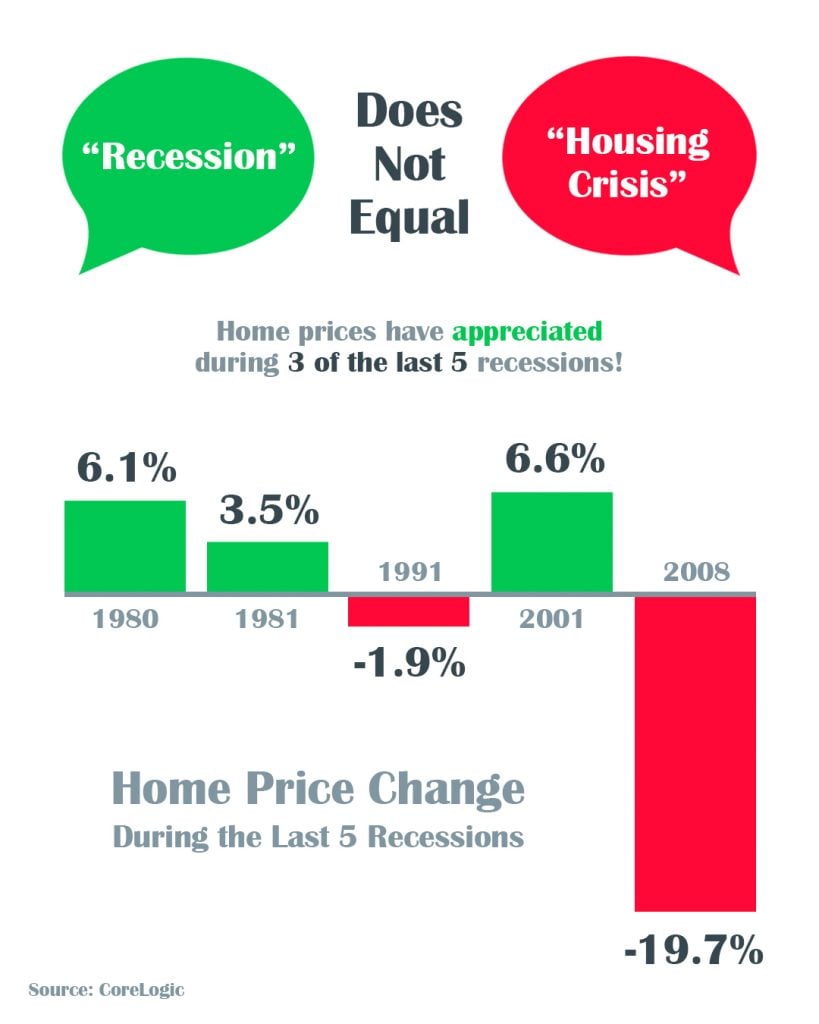

CoreLogic, in a second study of the last five recessions, found the same. Here’s a graph of their findings:

What are the experts saying this time?

This is what three economic leaders are saying about the housing connection to this recession:

Robert Dietz, Chief Economist with NAHB

“The housing sector enters this recession underbuilt rather than overbuilt…That means as the economy rebounds – which it will at some stage – housing is set to help lead the way out.”

Ali Wolf, Chief Economist with Meyers Research

“Last time housing led the recession…This time it’s poised to bring us out. This is the Great Recession for leisure, hospitality, trade and transportation in that this recession will feel as bad as the Great Recession did to housing.”

John Burns, founder of John Burns Consulting, also revealed that his firm’s research concluded that recessions caused by a pandemic usually do not significantly impact home values:

“Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices).”

Bottom Line

If we’re not in a recession yet, we’re about to be in one. This time, however, housing will be the sector that leads the economic recovery.

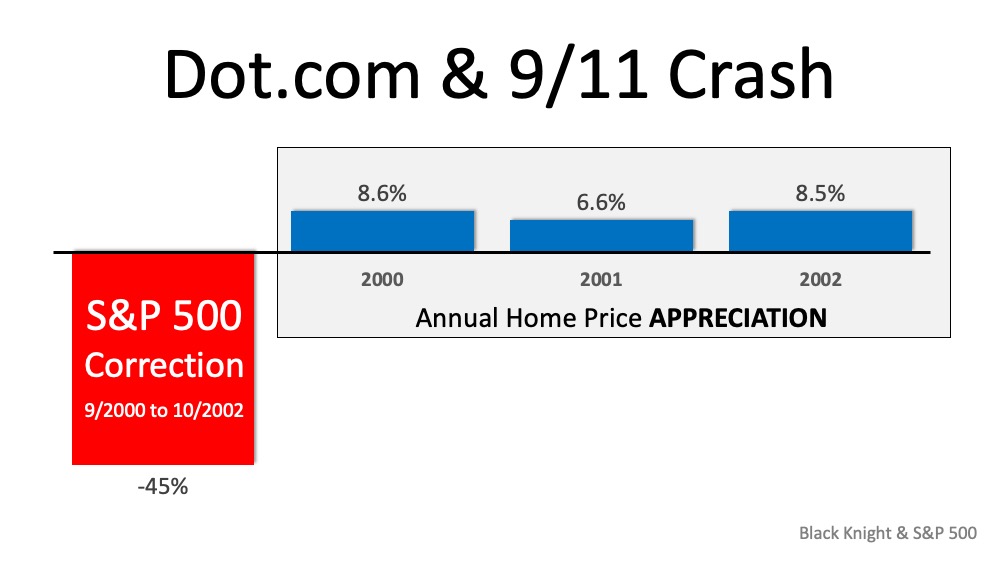

Why the Stock Market Correction Probably Won’t Impact Home Values

With the housing crash of 2006-2008 still visible in the rear-view mirror, many are concerned the current correction in the stock market is a sign that home values are also about to tumble. What’s taking place today, however, is nothing like what happened the last time. The S&P 500 did fall by over fifty percent from October 2007 to March 2009, and home values did depreciate in 2007, 2008, and 2009 – but that was because that economic slowdown was mainly caused by a collapsing real estate market and a meltdown in the mortgage market.

This time, the stock market correction is being caused by an outside event (the coronavirus) with no connection to the housing industry. Many experts are saying the current situation is much more reminiscent of the challenges we had when the dot.com crash was immediately followed by 9/11. As an example, David Rosenberg, Chief Economist with Gluskin Sheff + Associates Inc., recently explained:

“What 9/11 has in common with what is happening today is that this shock has also generated fear, angst and anxiety among the general public. People avoided crowds then as they believed another terrorist attack was coming and are acting the same today to avoid getting sick. The same parts of the economy are under pressure ─ airlines, leisure, hospitality, restaurants, entertainment ─ consumer discretionary services in general.”

Since the current situation resembles the stock market correction in the early 2000s, let’s review what happened to home values during that time. The S&P dropped 45% between September 2000 and October 2002. Home prices, on the other hand, appreciated nicely at the same time. That stock market correction proved not to have any negative impact on home values.

The S&P dropped 45% between September 2000 and October 2002. Home prices, on the other hand, appreciated nicely at the same time. That stock market correction proved not to have any negative impact on home values.

Bottom Line

If the current situation is more like the markets in the early 2000s versus the markets during the Great Recession, home values should be minimally affected, if at all.

Economic Slowdown: What the Experts Are Saying

More and more economists are predicting a recession is imminent as the result of the pullback in the economy caused by COVID-19. According to the National Bureau of Economic Research:

“A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.”

Bill McBride, the founder of Calculated Risk, believes we are already in a recession:

“With the sudden economic stop, and with many states shutting down by closing down schools, bars and restaurants…my view is the US economy is now in a recession (started in March 2020), and GDP will decline sharply in Q2. The length of the recession will depend on the course of the pandemic.”

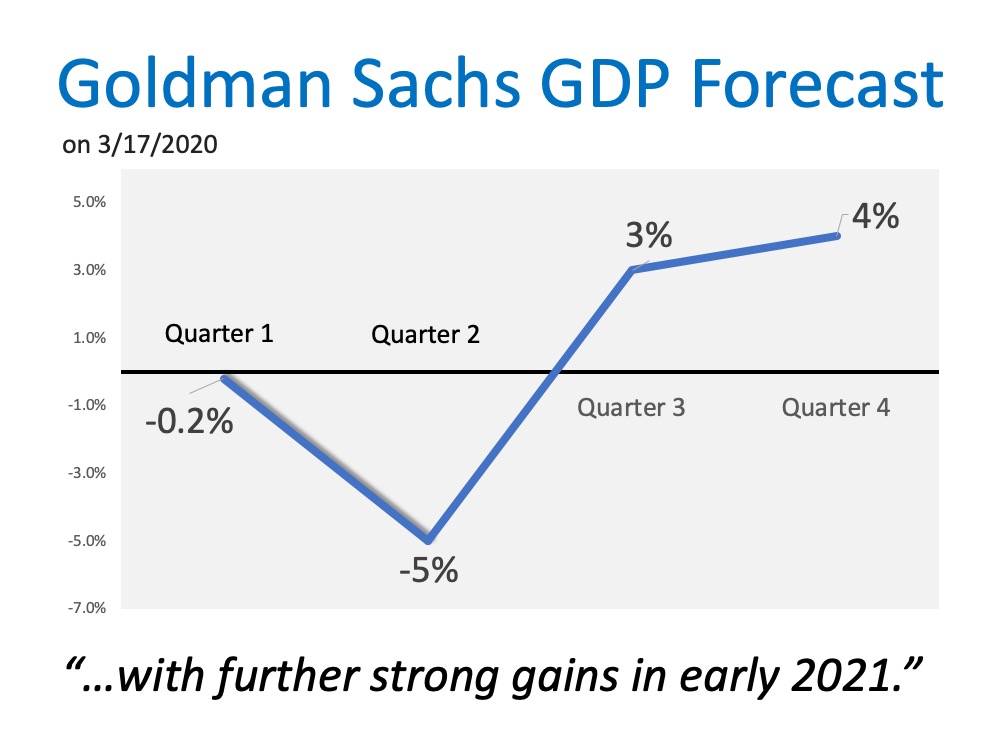

How deep will it go?

No one knows for sure. It depends on how long it takes to beat this virus. Goldman Sachsanticipates we will see a difficult first half of the year, but the economy will recover in the second half (see below): Goldman also projects we’ll have “further strong gains in early 2021.”

Goldman also projects we’ll have “further strong gains in early 2021.”

This aligns with the projection from Wells Fargo Investment Institute:

“Once the virus infection rate peaks, we expect a recovery to gain momentum into the final quarter of the year and especially into 2021.”

Again, no one knows for sure how long the pandemic will last. The hope is that it will resolve sometime over the next several months. Most agree that when it does, the economy will regain its strength quickly.

*QUARTER 1 DATA FROM GOLDMAN SACHS WAS UPDATED FROM 0% TO -0.2% ON 3/17/20 AFTER THE INITIAL RELEASE.

Bottom Line

This virus is not only impacting the physical health of Americans, but also the financial health of the nation. The sooner we beat it, the sooner our lives will return to normal.

A Recession Does Not Equal a Housing Crisis [INFOGRAPHIC]

Some Highlights

- The COVID-19 pandemic is causing an economic slowdown.

- The good news is, home values actually increased in 3 of the last 5 U.S. recessions and decreased by less than 2% in the 4th.

- All things considered, an economic slowdown does not equal a housing crisis, and this will not be a repeat of 2008.

Are We About to See a New Wave of Foreclosures?

With all of the havoc being caused by COVID-19, many are concerned we may see a new wave of foreclosures. Restaurants, airlines, hotels, and many other industries are furloughing workers or dramatically cutting their hours. Without a job, many homeowners are wondering how they’ll be able to afford their mortgage payments.

In spite of this, there are actually many reasons we won’t see a surge in the number of foreclosures like we did during the housing crash over ten years ago. Here are just a few of those reasons:

The Government Learned its Lesson the Last Time

During the previous housing crash, the government was slow to recognize the challenges homeowners were having and waited too long to grant relief. Today, action is being taken swiftly. Just this week:

- The Federal Housing Administration indicated it is enacting an “immediate foreclosure and eviction moratorium for single family homeowners with FHA-insured mortgages” for the next 60 days.

- The Federal Housing Finance Agency announced it is directing Fannie Mae and Freddie Macto suspend foreclosures and evictions for “at least 60 days.”

Homeowners Learned their Lesson the Last Time

When the housing market was going strong in the early 2000s, homeowners gained a tremendous amount of equity in their homes. Many began to tap into that equity. Some started to use their homes as ATM machines to purchase luxury items like cars, jet-skis, and lavish vacations. When prices dipped, many found themselves in a negative equity situation (where the mortgage was greater than the value of their homes). Some just walked away, leaving the banks with no other option but to foreclose on their properties.

Today, the home equity situation in America is vastly different. From 2005-2007, homeowners cashed out $824 billion worth of home equity by refinancing. In the last three years, they cashed out only $232 billion, less than one-third of that amount. That has led to:

- 37% of homes in America having no mortgage at all

- Of the remaining 63%, more than 1 in 4 having over 50% equity

Even if prices dip (and most experts are not predicting that they will), most homeowners will still have vast amounts of value in their homes and will not walk away from that money.

There Will Be Help Available to Individuals and Small Businesses

The government is aware of the financial pain this virus has caused and will continue to cause. Yesterday, the Associated Press reported:

“In a memorandum, Treasury proposed two $250 billion cash infusions to individuals: A first set of checks issued starting April 6, with a second wave in mid-May. The amounts would depend on income and family size.”

The plan also recommends $300 billion for small businesses.

Bottom Line

These are not going to be easy times. However, the lessons learned from the last crisis have Americans better prepared to weather the financial storm. For those who can’t, help is on the way.

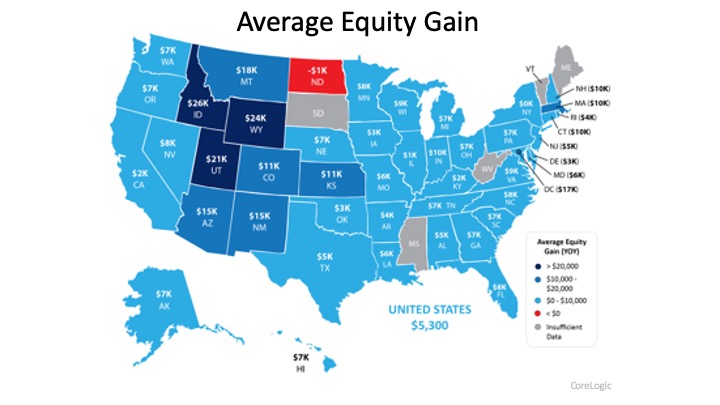

Equity Gain Growing in Nearly Every State

Rising home prices have been in the news a lot lately, and much of the focus is on whether they’re accelerating too quickly and how sustainable the growth in prices really is. One of the often-overlooked benefits of rising prices, however, is the impact they have on a homeowner’s equity position.

Home equity is defined as the difference between a home’s fair market value and the outstanding balance of all liens on the property. While homeowners pay down their mortgages, the amount of equity they have in their homes climbs each time the value increases.

Today, the number of homeowners that currently have significant equity in their homes is growing. According to the Census Bureau, 38% of all homes in the country are mortgage-free. In a home equity study, ATTOM Data Solutions revealed that of the 54.5 million homes with a mortgage, 26.7% of them have at least 50% equity. That number has been increasing over the last eight years.

CoreLogic also notes:

“…the average homeowner gained approximately $5,300 in equity during the past year.”

The map below shows a breakdown of the increasing equity gain across the country, painting a clear picture that home equity is growing in nearly every state.

Bottom Line

This may be the year to take advantage of your home equity by applying it forward, either as you downsize or as you move up to a new home.

Want to see what your home is worth? Use our quick and easy Home Value Estimator.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link