Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Weekly Market Update for Week Ending 7/28/2023

by Better Homes and Gardens Green Team

| Weekly Market Update from Cross Country Mortgage for the Week Ending 7/28/2023

Helping you navigate the market |

Fed Hikes Rates

|

|

|

|

|

|

| If the goal of Fed officials was to avoid any surprises at the meeting on Wednesday, they succeeded, completely sticking to the expected script. |

|

|

|

| They raised the federal funds rate by 25 basis points to a target range of 5.25% – 5.50%, the highest since 2001, and the statement was essentially unchanged from the one released after the prior meeting. Officials simply repeated that they will continue to make future policy decisions based on incoming economic data and provided no precise guidance of any sort. According to Chair Powell, significant progress has been made in bringing down inflation, but there is still a long way to go and the labor market remains very tight. Investors are split about whether there will be another 25 basis point rate hike later this year.

While there were no surprises from the Fed meeting and inflation was in line with expectations, most of the other economic data continued to exceed the forecasts of economists. As a result, mortgage rates ended the week higher.

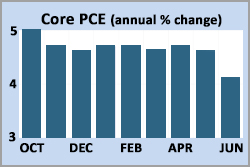

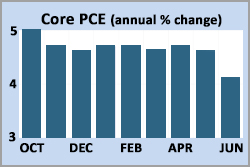

The PCE price index is the inflation indicator favored by the Fed. In June, Core PCE, which excludes food and energy to reduce volatility, was up 4.1% from a year ago, matching the consensus forecast. This was down sharply from an annual rate of 4.6% last month and the smallest since September 2021. Costs of services continued to increase more than prices for goods.

Gross Domestic Product (GDP) is the broadest measure of economic activity. During the second quarter, GDP rose at an annualized rate of just 2.4%, above the consensus forecast and up from 2.0% during the first quarter of 2023. Strength was seen in consumer and government spending, business investment, and inventory growth. Despite tighter monetary policy, the economy has remained surprisingly resilient and has shown few signs that it will enter a recession. |

Week ahead

|

| Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. For economic reports, the JOLTS report, measuring job openings and labor turnover rates, will be released on Tuesday. The ISM national manufacturing index also will come out on Tuesday and the ISM national services sector index on Thursday. The key Employment report will be released on Friday, and these figures on the number of jobs, the unemployment rate, and wage inflation will be some of the most highly anticipated economic data of the month. |

|

|

|

|

|

| Tue |

8/1 |

ISM Manufacturing |

| Tue |

8/1 |

JOLTS |

| Thu |

8/3 |

ISM Services |

| Fri |

8/4 |

Employment |

|

|

|

|

| Mortgage Rates |

Rose |

0.15% |

| Dow |

Rose |

200 |

| NASDAQ |

Rose |

200 |

|

| We would like to thank our partner, MBSQuoteline for their insightful information.

All material Copyright © Ress No. 1, LTD (DBA MBSQuoteline) and may not be reproduced without permission. |

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link