Vikki Garby is Green Team New York Realty’s 2019 2nd Quarter Sales Leader

[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”3.0.47″][et_pb_row admin_label=”row” _builder_version=”3.0.48″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”][et_pb_column type=”4_4″ _builder_version=”3.0.47″ parallax=”off” parallax_method=”on”][et_pb_text admin_label=”Text” _builder_version=”3.18.2″ background_size=”initial” background_position=”top_left” background_repeat=”repeat”]Vikki Garby is having a great year. She was 1st Quarter Sales Leader for 2019, And now Green Team New York Realty is very proud to announce that Vikki is 2nd Quarter Sales Leader. According to Geoff Green, President of Green Team New York,

“Vikki Garby is a smart, focused Real Estate professional. Furthermore, the analytical abilities developed during her time as an investment banker and real estate investor contribute to her success in both Residential and Commercial Real Estate. It’s exciting watching Vikki grow her Real Estate Business. Green Team New York Realty is extremely blessed to have her as part of our Agency.”

More about Vikki…

As mentioned above, Vikki was an investment banker for a major bank in New York City. During that time she reviewed and negotiated complex contracts on a regular basis. And it was also during that time that Vikki became a real estate investor, negotiating on her own behalf as a buyer.

Her love of real estate and skill at navigating its many transactional parts lead her to obtain her license so that she could help others achieve their real estate goals. Furthering her education and skills, Vikki obtained her Commercial and Investment Properties Real Estate Certification (“CIREC”) last summer.

Vikki had this to say about her recent achievements:

“I have been blessed with a great year working with wonderful and supportive clients. Their loyalty has allowed me to grow my business each year. It has been an extremely rewarding and fulfilling year so far. The great team I have at Green Team New York Realty helps tremendously.”

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

Whether You Rent or Buy, Either Way You’re Paying a Mortgage!

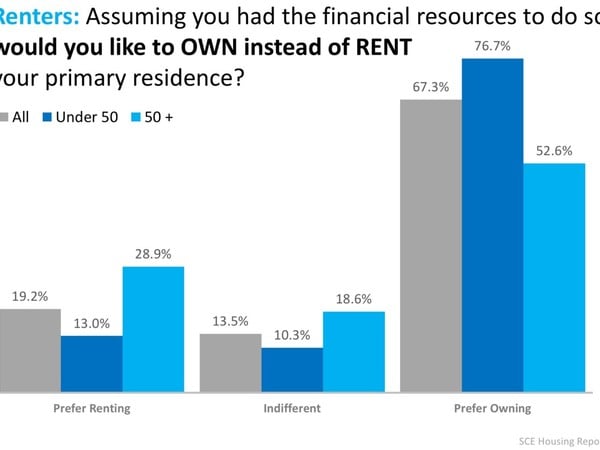

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize, however, that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business explained in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

Christina Boyle, Senior Vice President and head of the Single-Family Sales & Relationship Management organization at Freddie Mac, explains another benefit of securing a mortgage as opposed to paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person building that equity.

How much house can you afford?

Interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 4.22% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.

News and Advice

[frontpage_news widget=”6588″ name=”Housing Market News & Updates”]

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link